|

市場調查報告書

商品編碼

1811760

全球實機雲端市場按服務模式、應用、組織規模、部署類型、垂直領域和地區分類 - 預測至 2030 年Bare Metal Cloud Market by Service Model (Bare Metal Servers, Instances, Managed Services), Application (HPC, AI/ML & Data Analytics, Gaming & Media, General-purpose Infrastructure), Deployment Type (Public, Private, Hybrid) - Global Forecast to 2030 |

||||||

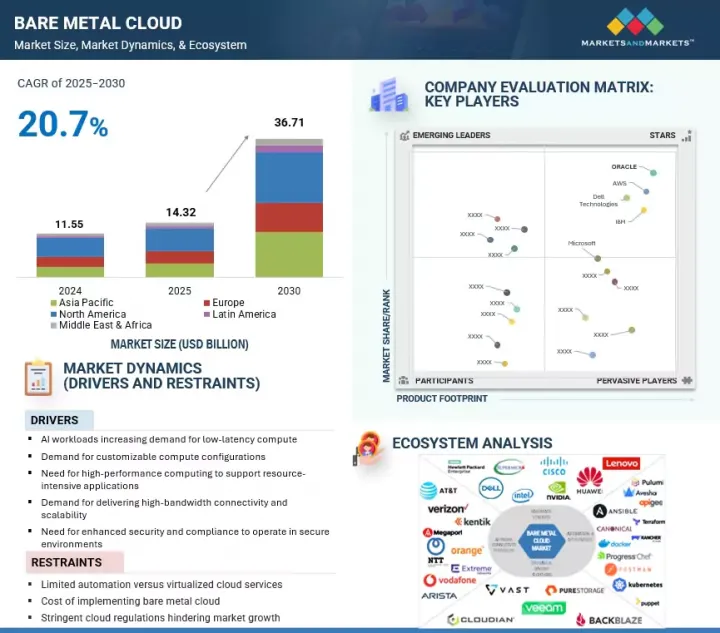

全球實機雲端市場預計將從 2025 年的 143.2 億美元成長到 2030 年的 367.1 億美元,複合年成長率為 20.7%。

這一市場由日益成長的低延遲運算需求驅動,用於處理即時處理效能至關重要的人工智慧工作負載。企業需要高度可自訂的運算配置來滿足其特定的工作負載需求。這一趨勢源自於高效能運算日益廣泛的應用,用於支援科學模擬、財務建模和進階分析等資源彙整密集型應用。

| 調查範圍 | |

|---|---|

| 調查年份 | 2020-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 對價單位 | 10億美元 |

| 部分 | 依服務模式、用途、組織規模、部署類型、產業和地區 |

| 目標區域 | 北美、歐洲、亞太地區、中東和非洲、拉丁美洲 |

此外,提供高頻寬連接和可擴展基礎設施對於滿足不斷變化的業務需求至關重要,而增強的安全性和合規性功能使其能夠在法規環境和敏感的環境中運作。

然而,與虛擬雲端服務相比,自動化有其局限性,這可能會影響營運效率。此外,部署實機雲端基礎設施的高昂前期和持續成本,使得預算有限的企業難以採用,從而限制了市場的成長。

混合實機雲端透過結合公有和私有裸機基礎設施,實現工作負載的無縫遷移,同時保持專用伺服器的效能,為供應商和解決方案供應商提供了一條重要的成長途徑。混合實機雲端滿足了企業對彈性容量擴展、災難復原和成本最佳化的需求,敏感工作負載在私有環境中得到安全保護,而突發需求則在公共基礎架構上得到管理。 2024年7月,Rackspace Technology宣布推出混合式裸機即服務平台,提供公共雲端和私有裸機環境的統一管理,並簡化工作負載遷移。

為了進一步推動混合雲的採用,Google Cloud 於 2025 年 4 月與 Nutanix 合作,在 Google 的裸機 Z3 實例上啟用 Nutanix Cloud Clusters (NC2),支援在混合環境中無縫編配Kubernetes 和 AI 工作負載。這些進步為供應商和解決方案提供者提供了一個機會,讓他們能夠提供一個統一的平台,將雲端的彈性與裸機的專用性能相結合。混合裸機在全球營運、遊戲和物聯網主導的製造業中越來越受歡迎,這些領域對低延遲、敏捷性和合規性至關重要。透過提供能夠使延遲敏感型工作負載更貼近最終用戶運行,同時保持營運一致性的產品,提供者可以避免供應商鎖定,並滿足對靈活、高效能基礎架構日益成長的需求。

軟體和 IT 服務產業越來越依賴實機雲端來交付高效能、安全、全球分佈的應用程式,這為供應商和解決方案供應商提供了巨大的機會。 Salesforce 等 SaaS 供應商利用裸機伺服器為其全球用戶提供低延遲和高可用性。這種方法消除了虛擬開銷,從而加快了資料處理速度並實現了即時服務交付。 2024 年 1 月,Equinix 在印度孟買推出了實機雲端服務 Equinix Metal,為需要專用低延遲基礎架構的 SaaS 和 IT 服務公司提供支援。該服務專注於與 Equinix Fabric 整合的裸機伺服器的自動配置,為全球軟體交付提供一致的運算能力和網路可靠性。

像 CrowdStrike 這樣的網路安全供應商正在利用裸機環境提供專用運算能力來處理各種威脅情報工作負載,從而實現更快的偵測和事件回應。這一領域為供應商和解決方案提供者提供了一個建立客製化解決方案的機會,以滿足日益成長的資料密集型運算、嚴格的安全性和客製化基礎架構的需求。透過滿足 SaaS 平台、IT 服務和網路安全公司的效能和合規性需求,供應商可以將實機雲端定位為安全、可擴展和高效能數位生態系統的根本推動者。

受企業對高效能運算、專用基礎設施和安全雲端原生環境日益成長的需求推動,北美預計將主導實機雲端市場。這為提供者和供應商提供了一個重要機遇,使他們能夠提供可擴展的平台,支援BFSI、遊戲、醫療保健和生命科學以及大規模分析等產業。該地區先進的資料中心生態系統以及人工智慧和數位轉型舉措的快速應用,正在加速從傳統本地系統向裸機部署的過渡,從而對專用且合規的基礎設施產生強勁需求。

預計亞太地區將在實機雲端市場預測期內保持最高的複合年成長率,因為由於人工智慧的加速採用、政府支持的數位化以及對下一代運算基礎設施的投資,該地區正迅速成為實機雲端的核心成長區域。

策略夥伴關係,包括與超大規模企業和企業的合作,凸顯了實機雲端如何提升營運效率和工作負載效能。透過進軍這些新興市場,供應商可以滿足不斷變化的企業需求,解決延遲和合規性問題,並在快速應用和創新的行業中建立強大的市場地位。

本報告研究了全球實機雲端市場,並總結了服務模式、用例、組織規模、部署類型、行業垂直和地區的趨勢,以及參與市場的公司概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章市場概況與產業趨勢(具有定量意義的策略促進因素)

- 介紹

- 市場動態

- 案例研究分析

- 生態系分析

- 供應鏈分析

- 技術分析

- 波特五力分析

- 定價分析

- 專利分析

- 監管狀況

- 影響客戶業務的趨勢和中斷

- 主要相關人員和採購標準

- 2025-2026年主要會議和活動

- 生成式人工智慧對實機雲端市場的影響

- 經營模式

- 投資金籌措場景

- 2025年美國關稅的影響

第6章實機雲端市場,按服務模式分類(市場規模和預測到 2030 年 - 價值)

- 介紹

- 裸機伺服器

- 裸機實例

- 託管服務

第 7 章實機雲端市場,按應用分類(市場規模和預測到 2030 年 - 價值)

- 介紹

- 高效能運算

- 人工智慧/機器學習和數據分析

- 遊戲和媒體

- 通用基礎設施

第 8 章實機雲端市場,按組織規模分類(市場規模和預測到 2030 年 - 價值)

- 介紹

- 主要企業

- 小型企業

第 9 章實機雲端市場,按部署類型分類(市場規模和預測到 2030 年 - 價值)

- 介紹

- 公有實機雲端

- 私有實機雲端

- 混合實機雲端

第 10 章實機雲端市場,按行業分類(市場規模和預測到 2030 年 - 價值)

- 介紹

- 軟體和IT服務

- 銀行、金融服務和保險

- 製造業

- 醫療保健和生命科學

- 電訊

- 媒體與娛樂

- 零售和消費品

- 政府/公共部門

- 其他

第 11 章實機雲端市場,按地區分類(市場規模和預測到 2030 年 - 價值)

- 介紹

- 北美洲

- 北美:實機雲端市場促進因素

- 北美:宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 歐洲:實機雲端市場促進因素

- 歐洲:宏觀經濟展望

- 英國

- 德國

- 法國

- 義大利

- 其他

- 亞太地區

- 亞太地區:實機雲端市場促進因素

- 亞太地區:宏觀經濟展望

- 中國

- 日本

- 印度

- 其他

- 中東和非洲

- 中東和非洲:實機雲端市場促進因素

- 中東與非洲:宏觀經濟展望

- 波灣合作理事會

- 南非

- 其他

- 拉丁美洲

- 拉丁美洲:實機雲端市場促進因素

- 拉丁美洲:宏觀經濟展望

- 巴西

- 墨西哥

- 其他

第12章 競爭格局

- 介紹

- 主要參與企業的策略/優勢

- 2020-2024年收益分析

- 2024年市佔率分析

- 產品/品牌比較

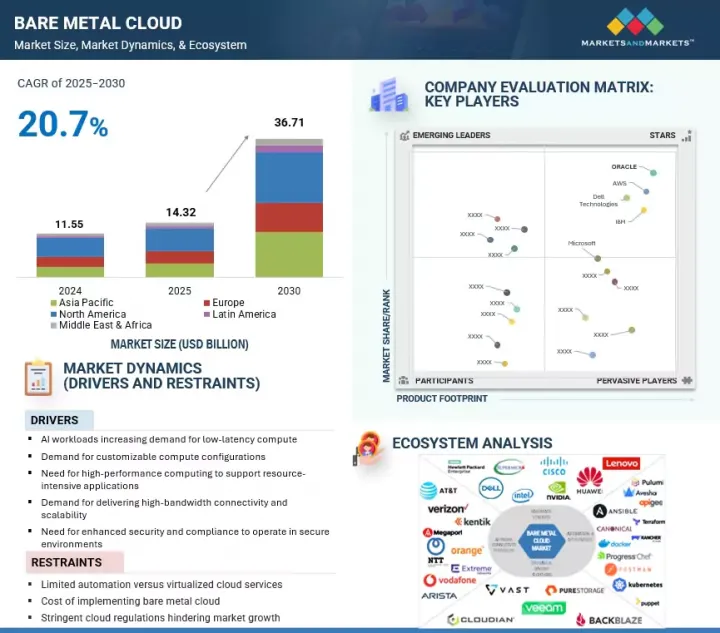

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:Start-Ups/中小企業,2024 年

- 主要供應商的估值和財務指標

- 競爭情境和趨勢

第13章:公司簡介

- 主要參與企業

- ORACLE

- AWS

- IBM

- MICROSOFT

- DELL TECHNOLOGIES

- ALIBABA CLOUD

- RACKSPACE TECHNOLOGY

- LUMEN TECHNOLOGIES

- HUAWEI CLOUD

- VULTR

- 其他公司

- DIGITALOCEAN, LLC.

- IONOS CLOUD INC.

- HIVELOCITY, INC

- CHERRY SERVERS

- PURE STORAGE

- HETZNER

- PHOENIXNAP

- LIMESTONE NETWORKS

- OVHCLOUD

- HPE

- JOYENT

- SCALEWAY

- HOSTINGRAJA

- REDSWITCHES

- ZENLAYER

- GCORE

- OMAN DATA PARK

- BIGSTEP

- DARTPOINTS

- OPENMETAL.IO

- CLOUDONE DIGITAL

第14章:相鄰市場與相關市場

第15章 附錄

The global bare metal cloud market is projected to grow from USD 14.32 billion in 2025 to USD 36.71 billion by 2030, featuring a CAGR of 20.7%. The market is driven by the increasing demand for low-latency compute to handle AI workloads, where real-time processing is critical for performance. Businesses need highly customizable computing configurations to meet their specific workload requirements. This trend is accompanied by the growing use of high-performance computing to support resource-intensive applications, including scientific simulations, financial modeling, and advanced analytics.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD Billion |

| Segments | Service Model, Application, Deployment Mode, Organization Size, Vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Furthermore, the need for delivering high-bandwidth connectivity and scalable infrastructure is becoming essential to meet fluctuating business demands, while enhanced security and compliance capabilities enable operations in regulated or sensitive environments.

In contrast, the market faces limited automation compared to virtualized cloud services, which can impact operational efficiency. The significant upfront and ongoing costs associated with deploying bare metal cloud infrastructure also make adoption challenging for budget-constrained organizations, thus restraining market growth.

"Hybrid bare metal cloud to account for the fastest growth rate during the forecast period"

Hybrid bare metal cloud presents a significant growth avenue for vendors and solution providers by combining public and private bare metal infrastructure, enabling seamless workload mobility while preserving dedicated server performance. The type addresses the needs of enterprises for flexible capacity scaling, disaster recovery, and cost optimization, ensuring that sensitive workloads are secured in private environments while burst demand is managed through public infrastructure. In July 2024, Rackspace Technology launched its Hybrid Bare Metal as a Service platform, offering unified management and simplified workload migration across public cloud and private bare metal environments.

Further advancing hybrid adoption, Google Cloud partnered with Nutanix in April 2025 to enable Nutanix Cloud Clusters (NC2) on Google's bare metal Z3 instances, supporting seamless orchestration of Kubernetes and AI workloads across hybrid environments. For vendors and solution providers, these advancements highlight the opportunity to deliver integrated platforms that blend cloud elasticity with bare metal's dedicated performance. Hybrid bare metal is gaining momentum across global operations, gaming, and IoT-driven manufacturing, where low latency, agility, and compliance are critical. By positioning offerings that enable enterprises to run latency-sensitive workloads closer to end users while maintaining operational consistency, providers can capitalize on the growing demand for flexible, high-performance infrastructure that avoids vendor lock-in.

"Software & IT Services segment to hold the largest market share during the forecast period"

The Software & IT Services sector offers strong potential for vendors and solution providers as it increasingly depends on bare metal cloud to deliver high-performance, secure, and globally distributed applications. SaaS providers such as Salesforce utilize bare metal servers to ensure low latency and high availability for users around the world. This approach eliminates virtualization overhead, which leads to faster data processing and real-time service delivery. In January 2024, Equinix introduced its Equinix Metal bare metal cloud service in Mumbai, India, designed to support SaaS and IT services firms requiring dedicated, low-latency infrastructure. The launch emphasized automated provisioning of bare metal servers integrated with Equinix Fabric, delivering consistent compute power and network reliability for global software delivery.

Cybersecurity vendors such as CrowdStrike rely on bare metal environments to process extensive threat intelligence workloads with dedicated compute capacity, enabling rapid detection and incident response. For vendors and solution providers, this sector highlights the opportunity to create customized solutions that meet the increasing demand for data-intensive computing, stringent security, and tailored infrastructure. By addressing the performance and compliance needs of SaaS platforms, IT services, and cybersecurity firms, providers can position bare metal cloud as a fundamental enabler of secure, scalable, and high-performing digital ecosystems.

"North America is expected to hold the largest share, while Asia Pacific will be the fastest-growing region during the forecast period"

North America is expected to dominate the bare metal cloud market, driven by rising enterprise demand for high-performance computing, dedicated infrastructure, and secure cloud-native environments. For providers and vendors, this presents significant opportunities to deliver scalable platforms that support industries such as BFSI, gaming, healthcare & life sciences, and large-scale analytics. The region's advanced data center ecosystem and rapid adoption of AI and digital transformation initiatives accelerate the shift from traditional on-premises systems to bare metal deployments, creating strong demand for dedicated, compliant infrastructure.

Asia Pacific is expected to hold the highest CAGR during the bare metal cloud market forecast period. The region is rapidly emerging as a core growth region for bare metal cloud driven by accelerated AI adoption, government-backed digitalization, and investments in next-generation computing infrastructure.

Strategic partnerships, including collaborations with hyperscalers and enterprises, highlight how bare metal cloud enhances operational efficiency and workload performance. Capitalizing on these developments enables vendors to meet evolving enterprise requirements, address latency and compliance needs, and establish resilient market positions in an industry marked by rapid adoption and innovation.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the bare metal cloud market.

- By Company: Tier I - 38%, Tier II - 42%, and Tier III - 20%

- By Designation: C-Level Executives - 40%, D-Level Executives - 35%, and others - 25%

- By Region: North America - 35%, Europe - 40%, Asia Pacific - 15%, and Rest of the world - 10%

The report includes a study of key players offering bare metal cloud services. It profiles major vendors in the bare metal cloud market. The major market players include Oracle (US), AWS (US), IBM (US), Dell Technologies (US), Microsoft (US), Google (US), Cherry Servers (Lithuania), HostingRaja (India), Red Switches (Singapore), Vultr (US), Zenlayer (US), Gcore (Luxembourg), Oman Data Park (Oman), Bigstep (UK), DartPoints (US), Pure Storage (US), Huawei Cloud (China), Hetzner (Germany), pheonixNAP (US), Limestone Networks (US), OVHcloud (France), HPE (US), Joyent (US), Scaleway (France), Alibaba Cloud (China), and Liquid Web (US).

Research Coverage

This research report categorizes the bare metal cloud market based on service model (bare metal servers (dedicated servers, custom-built physical servers, high-performance servers, other bare metal servers), bare metal instances (standard bare metal instances, GPU-accelerated instances, high-memory instances, storage-optimized instances, network-optimized instances, other bare metal instances) and managed services (provisioning & deployment services, monitoring & analytics, support & maintenance, orchestration integration, API & portal-based management and other managed services)), application (high-performance computing (scientific computing, engineering simulations, weather and climate modeling, and others), AI/ML & Data Analytics (real-time data processing, distributed computing frameworks, data warehousing & lakes, and others), gaming & media (cloud gaming platforms, video transcoding & streaming, content delivery optimization, AR/VR applications, and others), general purpose infrastructure (financial modeling (algorithmic trading platforms, risk management simulations, financial forecasting, and others), database applications (in-memory databases, OLTP systems, NoSQL & NewSQL workloads, and others), enterprise applications (virtual desktop infrastructure (VDI), ERP & CRM Platforms, Enterprise Dev/Test Environments, and others))), deployment type (public bare metal, private bare metal, hybrid bare metal), organization size (large enterprises, small & medium sized enterprises), vertical (BFSI, healthcare & life sciences, manufacturing/automotive, software & IT services, media & entertainment, government & public sector, telecommunications, retail & consumer goods, and other verticals (energy & utilities, education, transportation & logistics, and travel & hospitality )), and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the bare metal cloud market. A detailed analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, and mergers and acquisitions; and recent developments associated with the bare metal cloud market. This report also covers the competitive analysis of upcoming startups in the bare metal cloud market ecosystem.

Reasons to buy this Report

The report would provide market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall bare metal cloud market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (AI workloads increasing demand for low-latency compute, Demand for customizable compute configurations, Need for high-performance computing to support resource-intensive applications, Demand for delivering high-bandwidth connectivity and scalability, Need for enhanced security and compliance to operate in secure environments, Absence of noisy neighbor concerns and hypervisor tax), restraints (Limited Automation versus virtualized cloud services, Cost of implementation of bare metal cloud, Stringent cloud regulations are hindering the market growth ), opportunities (Expansion of GPU-backed bare metal offerings, Growing adoption of edge computing infrastructure for real-time data processing, Growing adoption of big data and DevOps applications, Emergence of AI and ML applications), and challenges (Inability to scale infrastructure instantly under variable load, Lack of isolation in multi-tenant environments, Integration with virtualized environments)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the bare metal cloud market

- Market Development: Comprehensive information about lucrative markets - the report analyses the bare metal cloud market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the bare metal cloud market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such Oracle (US), AWS (US), IBM (US), Dell Technologies (US), Microsoft (US), Google (US), Cherry Servers (Lithuania), HostingRaja (India), Red Switches (Singapore), Vultr (US), Zenlayer (US), Gcore (Luxembourg), Oman Data Park (Oman), Bigstep (UK), DartPoints (US), Pure Storage (US), Huawei Cloud (China), Hetzner (Germany), pheonixNAP (US), Limestone Networks (US), OVHcloud (France), HPE (US), Joyent (US), Scaleway (France), Alibaba Cloud (China) and Liquid Web (US). The report also helps stakeholders understand the bare metal cloud market's pulse and provides information on key market drivers, restraints, challenges, and opportunities

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BARE METAL CLOUD MARKET

- 4.2 BARE METAL CLOUD MARKET, BY SERVICE MODEL

- 4.3 BARE METAL CLOUD MARKET, BY APPLICATION

- 4.4 BARE METAL CLOUD MARKET, BY DEPLOYMENT TYPE

- 4.5 BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE

- 4.6 BARE METAL CLOUD MARKET, BY VERTICAL

- 4.7 BARE METAL CLOUD MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS (STRATEGIC DRIVERS WITH QUANTITATIVE IMPLICATIONS)

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for low-latency computing

- 5.2.1.2 Surging need for customizable compute configurations

- 5.2.1.3 Rising need to support resource-intensive applications

- 5.2.1.4 Delivering high-bandwidth connectivity and scalability

- 5.2.1.5 Rising need for enhanced security and compliance to operate in secure environments

- 5.2.1.6 Implications associated with hypervisor taxation

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited automation versus virtualized cloud services

- 5.2.2.2 High implementation costs

- 5.2.2.3 Stringent cloud regulations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of GPU-backed bare metal offerings

- 5.2.3.2 Adoption of edge computing infrastructure for real-time data processing

- 5.2.3.3 Rising implementation of big data and DevOps applications

- 5.2.3.4 Emergence of AI and ML applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Inability to scale infrastructure instantly under variable load

- 5.2.4.2 Lack of isolation in multi-tenant environments

- 5.2.4.3 Integration with virtualized environments

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 STRAKER TRANSLATIONS LEVERAGES IBM CLOUD TO POWER SCALABLE ONLINE TRANSLATION SERVICES

- 5.3.2 ALTAIR ENHANCES HPC AND SIMULATION WORKLOADS WITH ORACLE BARE METAL CLOUD INFRASTRUCTURE

- 5.3.3 CYCLE.IO SIMPLIFIES HYBRID CLOUD MANAGEMENT WITH VULTR BARE METAL CLOUD

- 5.3.4 NITRADO EXPANDS GLOBAL GAMING FOOTPRINT WITH GCORE BARE METAL INFRASTRUCTURE IN JAPAN AND BRAZIL

- 5.3.5 FOSSHUB SCALES GLOBAL SOFTWARE DELIVERY WITH PHOENIXNAP'S BARE METAL CLOUD INFRASTRUCTURE

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 BARE METAL CLOUD NETWORK PROVIDERS

- 5.5.2 BARE METAL CLOUD HARDWARE PROVIDERS

- 5.5.3 DATA CENTER SERVICE PROVIDERS

- 5.5.4 VERTICALS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Hardware Root of Trust (RoT)

- 5.6.1.2 Single-tenant Physical Servers

- 5.6.1.3 Provisioning Automation Platforms

- 5.6.1.4 Out-of-Band (OOB) Management Interfaces

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Data Encryption at Rest and in Transit

- 5.6.2.2 Infrastructure Monitoring and Telemetry

- 5.6.2.3 Storage Virtualization

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Edge Data Centers

- 5.6.3.2 Kubernetes and Bare Metal Containerization

- 5.6.3.3 Private 5G Integration

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE OFFERED BY KEY PLAYERS, BY REGION, 2025

- 5.8.2 INDICATIVE PRICING ANALYSIS OF BARE METAL CLOUD SOLUTIONS, 2025

- 5.9 PATENT ANALYSIS

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATIONS, BY REGION

- 5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 IMPACT OF GENERATIVE AI ON BARE METAL CLOUD MARKET

- 5.14.1 TOP USE CASES & MARKET POTENTIAL

- 5.14.2 KEY USE CASES

- 5.14.3 CASE STUDY

- 5.14.3.1 Veriswitch deploys Vultr bare metal cloud to power AI-driven telecom fraud prevention

- 5.14.4 VENDOR INITIATIVE

- 5.14.4.1 Gcore

- 5.15 BUSINESS MODELS

- 5.15.1 BARE METAL CLOUD BUSINESS MODELS

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 IMPACT OF 2025 US TARIFF

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

- 5.17.5.1 Banking, Financial Services, & Insurance (BFSI)

- 5.17.5.2 Healthcare & Life Sciences

- 5.17.5.3 Manufacturing

- 5.17.5.4 Software & IT Services

- 5.17.5.5 Media & Entertainment

- 5.17.5.6 Government & Public Sector

6 BARE METAL CLOUD MARKET, BY SERVICE MODEL (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD MILLION))

- 6.1 INTRODUCTION

- 6.1.1 SERVICE MODEL: BARE METAL CLOUD MARKET DRIVERS

- 6.2 BARE METAL SERVERS

- 6.2.1 DELIVERING SCALABLE, SECURE BARE METAL SERVERS TO EMPOWER ENTERPRISE WORKLOADS AND DIGITAL TRANSFORMATION

- 6.2.2 DEDICATED SERVERS

- 6.2.3 CUSTOM-BUILT PHYSICAL SERVERS

- 6.2.4 HIGH-PERFORMANCE SERVERS

- 6.2.5 OTHER BARE METAL SERVERS

- 6.3 BARE METAL INSTANCES

- 6.3.1 EMPOWERING ENTERPRISES WITH SCALABLE, HIGH-PERFORMANCE BARE METAL INSTANCES FOR MISSION-CRITICAL WORKLOADS

- 6.3.2 STANDARD BARE METAL INSTANCES

- 6.3.3 GPU-ACCELERATED INSTANCES

- 6.3.4 HIGH-MEMORY INSTANCES

- 6.3.5 STORAGE-OPTIMIZED INSTANCES

- 6.3.6 NETWORK-OPTIMIZED INSTANCES

- 6.3.7 OTHER BARE METAL INSTANCES

- 6.4 MANAGED SERVICES

- 6.4.1 MANAGING BARE METAL SERVICES TO STREAMLINE OPERATIONS AND ACCELERATE SECURE, FLEXIBLE CLOUD GROWTH

- 6.4.2 PROVISIONING & DEPLOYMENT SERVICES

- 6.4.3 MONITORING & ANALYTICS

- 6.4.4 SUPPORT & MAINTENANCE

- 6.4.5 ORCHESTRATION INTEGRATION

- 6.4.6 API & PORTAL-BASED MANAGEMENT

- 6.4.7 OTHER MANAGED SERVICES

7 BARE METAL CLOUD MARKET, BY APPLICATION (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD MILLION))

- 7.1 INTRODUCTION

- 7.1.1 APPLICATION: BARE METAL CLOUD MARKET DRIVERS

- 7.2 HIGH-PERFORMANCE COMPUTING

- 7.2.1 ENABLING DIFFERENTIATED HPC SERVICES BY LEVERAGING GPU-ACCELERATED BARE METAL INFRASTRUCTURE

- 7.2.2 SCIENTIFIC COMPUTING

- 7.2.3 ENGINEERING SIMULATIONS

- 7.2.4 WEATHER & CLIMATE MODELING

- 7.2.5 OTHERS

- 7.3 AI/ML & DATA ANALYTICS

- 7.3.1 BARE METAL CLOUD TO ENABLE HIGH-PRECISION, ENTERPRISE-GRADE AI AND ANALYTICS SOLUTIONS

- 7.3.2 REAL-TIME DATA PROCESSING

- 7.3.3 DISTRIBUTED COMPUTING FRAMEWORKS

- 7.3.4 DATA WAREHOUSING & LAKES

- 7.3.5 OTHERS

- 7.4 GAMING & MEDIA

- 7.4.1 RISING DEMAND FOR LOW-LATENCY GAMING AND ULTRA-HIGH-DEFINITION STREAMING TO MEET SCALABILITY REQUIREMENTS

- 7.4.2 CLOUD GAMING PLATFORMS

- 7.4.3 VIDEO TRANSCODING & STREAMING

- 7.4.4 CONTENT DELIVERY & OPTIMIZATION

- 7.4.5 AR/VR APPLICATIONS

- 7.4.6 OTHERS

- 7.5 GENERAL PURPOSE INFRASTRUCTURE

- 7.5.1 STRENGTHENING ENTERPRISE BACKBONE WITH HIGH-PERFORMANCE, VIRTUALIZATION-FREE INFRASTRUCTURE

- 7.5.2 FINANCIAL MODELING

- 7.5.2.1 Algorithmic Trading Platforms

- 7.5.2.2 Risk Management Simulations

- 7.5.2.3 Financial Forecasting & Analytics

- 7.5.2.4 Others

- 7.5.3 DATABASE APPLICATIONS

- 7.5.3.1 In-memory Databases

- 7.5.3.2 OLTP Systems

- 7.5.3.3 No SQL & New SQL Workloads

- 7.5.3.4 Others

- 7.5.4 ENTERPRISE APPLICATIONS

- 7.5.4.1 Virtual Desktop Infrastructure

- 7.5.4.2 ERP & CRM Platforms

- 7.5.4.3 Enterprise Dev/Test Environments

- 7.5.4.4 Others

8 BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD MILLION))

- 8.1 INTRODUCTION

- 8.1.1 ORGANIZATION SIZES: BARE METAL CLOUD MARKET DRIVERS

- 8.2 LARGE ENTERPRISES

- 8.2.1 ACCELERATING DIGITAL TRANSFORMATION WITH HIGH-PERFORMANCE BARE METAL DEPLOYMENTS

- 8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- 8.3.1 UNLOCKING ENTERPRISE-GRADE CAPABILITIES THROUGH COST-EFFICIENT BARE METAL CLOUD SOLUTIONS

9 BARE METAL CLOUD MARKET, BY DEPLOYMENT TYPE (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD MILLION))

- 9.1 INTRODUCTION

- 9.1.1 DEPLOYMENT TYPE: BARE METAL CLOUD MARKET DRIVERS

- 9.2 PUBLIC BARE METAL CLOUD

- 9.2.1 DRIVING HIGH-PERFORMANCE, MULTI-TENANT INFRASTRUCTURE AT CLOUD SCALE

- 9.3 PRIVATE BARE METAL CLOUD

- 9.3.1 ENABLING SECURE, SINGLE-TENANT ENVIRONMENTS FOR MISSION-CRITICAL WORKLOADS

- 9.4 HYBRID BARE METAL CLOUD

- 9.4.1 DELIVERING FLEXIBLE, SCALABLE INFRASTRUCTURE WITH OPTIMIZED WORKLOAD PLACEMENT

10 BARE METAL CLOUD MARKET, BY VERTICAL (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD MILLION))

- 10.1 INTRODUCTION

- 10.1.1 VERTICALS: BARE METAL CLOUD MARKET DRIVERS

- 10.2 SOFTWARE & IT SERVICES

- 10.2.1 USING BARE METAL CLOUD TO DELIVER SECURE, HIGH-PERFORMANCE DIGITAL SERVICES

- 10.2.2 SOFTWARE & IT SERVICES: USE CASES

- 10.2.2.1 Application Hosting

- 10.2.2.2 Application Development & Testing

- 10.2.2.3 API Platforms

- 10.2.2.4 Other Use Cases

- 10.3 BANKING, FINANCIAL SERVICES, & INSURANCE

- 10.3.1 DEMAND FOR HIGH PERFORMANCE, SECURITY, AND COMPLIANCE

- 10.3.2 BFSI: USE CASES

- 10.3.2.1 High Frequency Trading

- 10.3.2.2 Risk Management

- 10.3.2.3 Fraud Detection

- 10.3.2.4 Other Use Cases

- 10.4 MANUFACTURING

- 10.4.1 DIGITALIZATION AND AUTOMATION IN DRIVING EFFICIENCY, REDUCING COST, AND ENHANCING PERFORMANCE

- 10.4.2 MANUFACTURING: USE CASES

- 10.4.2.1 Computer-aided Design

- 10.4.2.2 Digital Twins

- 10.4.2.3 Predictive Maintenance

- 10.4.2.4 Other Use Cases

- 10.5 HEALTHCARE & LIFE SCIENCES

- 10.5.1 TECHNOLOGICAL ADOPTION FOR ENHANCED PATIENT CARE

- 10.5.2 HEALTHCARE & LIFE SCIENCES: USE CASES

- 10.5.2.1 Medical Imaging

- 10.5.2.2 Drug Discovery

- 10.5.2.3 Electronic Health Records

- 10.5.2.4 Other Use Cases

- 10.6 TELECOMMUNICATIONS

- 10.6.1 GREATER NEED FOR ENHANCING PERFORMANCE AND RELIABILITY

- 10.6.2 TELECOMMUNICATIONS: USE CASES

- 10.6.2.1 Network Optimization

- 10.6.2.2 IOT Platforms

- 10.6.2.3 Customer Experience Management

- 10.6.2.4 Other Use Cases

- 10.7 MEDIA & ENTERTAINMENT

- 10.7.1 RISING DEMAND FOR HIGH-PERFORMANCE SERVERS FOR CONTENT DELIVERY AND STREAMING

- 10.7.2 MEDIA & ENTERTAINMENT: USE CASES

- 10.7.2.1 Video Rendering

- 10.7.2.2 Content Transcoding

- 10.7.2.3 Virtual Production

- 10.7.2.4 Other Use Cases

- 10.8 RETAIL & CONSUMER GOODS

- 10.8.1 SUBSTANTIAL UPTAKE OF BARE METAL CLOUD TECHNOLOGY TO ENHANCE CUSTOMER EXPERIENCE

- 10.8.2 RETAIL & CONSUMER GOODS: USE CASES

- 10.8.2.1 Personalization Engines

- 10.8.2.2 Inventory Management

- 10.8.2.3 Marketing Automation

- 10.8.2.4 Other Use Cases

- 10.9 GOVERNMENT & PUBLIC SECTOR

- 10.9.1 NECESSITY FOR ENHANCED SECURITY, PERFORMANCE, AND CONTROL

- 10.9.2 GOVERNMENT & PUBLIC SECTOR: USE CASES

- 10.9.2.1 Smart Cities

- 10.9.2.2 Emergency Response

- 10.9.2.3 Regulatory Compliance

- 10.9.2.4 Other Use Cases

- 10.10 OTHER VERTICALS

11 BARE METAL CLOUD MARKET, BY REGION (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD MILLION))

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: BARE METAL CLOUD MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.3.1 Targeted infrastructure upgrades and regional expansions to drive market

- 11.2.4 CANADA

- 11.2.4.1 Boost in AI and sovereign infrastructure investments to drive market

- 11.3 EUROPE

- 11.3.1 EUROPE: BARE METAL CLOUD MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 Push for digital sovereignty and AI readiness to boost demand for localized bare metal cloud infrastructure

- 11.3.4 GERMANY

- 11.3.4.1 Advancements in AI infrastructure, sovereign computing, and industrial innovation to drive market

- 11.3.5 FRANCE

- 11.3.5.1 Aligning digital sovereignty goals with trusted compute platforms to boost demand

- 11.3.6 ITALY

- 11.3.6.1 Adoption of AI-ready digital infrastructure with targeted bare metal cloud to drive market

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: BARE METAL CLOUD MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 Fostering robust digital economy and attracting substantial investments to drive market

- 11.4.4 JAPAN

- 11.4.4.1 Strengthening bare metal cloud landscape with AI supercomputing and sovereign infrastructure to boost demand

- 11.4.5 INDIA

- 11.4.5.1 Strategic investments to boost sovereign cloud imperatives and accelerate demand for AI and high-performance computing

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: BARE METAL CLOUD MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 GULF COOPERATION COUNCIL

- 11.5.3.1 Saudi Arabia

- 11.5.3.1.1 Accelerating hyperscale and bare metal adoption to power Vision 2030 goals

- 11.5.3.2 UAE

- 11.5.3.2.1 Advancing AI-driven cloud and bare metal deployments to boost market

- 11.5.3.3 Rest of GCC

- 11.5.3.1 Saudi Arabia

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Strengthening sovereign Cloud and bare metal infrastructure for Sub-Saharan digital growth to drive market

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: BARE METAL CLOUD MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 Hyperscale cloud and bare metal infrastructure expansion to boost demand for cloud services

- 11.6.4 MEXICO

- 11.6.4.1 Strategic cloud investments and enterprise-grade bare metal adoption to drive market

- 11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 PRODUCT/BRAND COMPARISON

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Service model footprint

- 12.6.5.4 Application footprint

- 12.6.5.5 Vertical footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of startups/SMEs

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 12.8.1 FINANCIAL METRICS OF KEY VENDORS

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ORACLE

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 AWS

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 IBM

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 MICROSOFT

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 DELL TECHNOLOGIES

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 GOOGLE

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.7 ALIBABA CLOUD

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.3.2 Deals

- 13.1.8 RACKSPACE TECHNOLOGY

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.9 LUMEN TECHNOLOGIES

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.10 HUAWEI CLOUD

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.11 VULTR

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches

- 13.1.11.3.2 Deals

- 13.1.11.3.3 Others

- 13.1.1 ORACLE

- 13.2 OTHER PLAYERS

- 13.2.1 DIGITALOCEAN, LLC.

- 13.2.2 IONOS CLOUD INC.

- 13.2.3 HIVELOCITY, INC

- 13.2.4 CHERRY SERVERS

- 13.2.5 PURE STORAGE

- 13.2.6 HETZNER

- 13.2.7 PHOENIXNAP

- 13.2.8 LIMESTONE NETWORKS

- 13.2.9 OVHCLOUD

- 13.2.10 HPE

- 13.2.11 JOYENT

- 13.2.12 SCALEWAY

- 13.2.13 HOSTINGRAJA

- 13.2.14 REDSWITCHES

- 13.2.15 ZENLAYER

- 13.2.16 GCORE

- 13.2.17 OMAN DATA PARK

- 13.2.18 BIGSTEP

- 13.2.19 DARTPOINTS

- 13.2.20 OPENMETAL.IO

- 13.2.21 CLOUDONE DIGITAL

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.1.1 RELATED MARKETS

- 14.1.2 LIMITATIONS

- 14.2 CLOUD COMPUTING MARKET

- 14.3 CLOUD STORAGE MARKET

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 BARE METAL CLOUD MARKET SIZE AND GROWTH, 2020-2024 (USD MILLION, YOY GROWTH% %)

- TABLE 4 BARE METAL CLOUD MARKET SIZE AND GROWTH, 2025-2030 (USD MILLION, YOY GROWTH% %)

- TABLE 5 BARE METAL CLOUD MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 6 IMPACT OF PORTER'S FIVE FORCES

- TABLE 7 AVERAGE SELLING PRICE OFFERED BY KEY PLAYERS, BY REGION, 2025

- TABLE 8 INDICATIVE PRICING ANALYSIS OF BARE METAL CLOUD SOLUTIONS, BY KEY PLAYERS, 2025

- TABLE 9 PATENTS GRANTED TO VENDORS IN BARE METAL CLOUD MARKET

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES AND REGULATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES AND REGULATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES AND REGULATIONS

- TABLE 17 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES AND REGULATIONS

- TABLE 18 LATIN AMERICA: LIST OF REGULATORY BODIES AND REGULATIONS

- TABLE 19 IMPACT OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 20 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 21 BARE METAL CLOUD MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 22 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 23 BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 24 BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 25 BARE METAL SERVERS: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 26 BARE METAL SERVERS: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 BARE METAL INSTANCES: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 BARE METAL INSTANCES: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 MANAGED SERVICES: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 MANAGED SERVICES: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 BARE METAL CLOUD MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 32 BARE METAL CLOUD MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 33 HIGH-PERFORMANCE COMPUTING: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 HIGH-PERFORMANCE COMPUTING: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 AI/ML & DATA ANALYTICS: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 AI/ML & DATA ANALYTICS: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 GAMING & MEDIA: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 GAMING & MEDIA: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 GENERAL PURPOSE INFRASTRUCTURE: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 GENERAL PURPOSE INFRASTRUCTURE: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 42 BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 43 LARGE ENTERPRISES: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 LARGE ENTERPRISES: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 SMES: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 SMES: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 BARE METAL CLOUD MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 48 BARE METAL CLOUD MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 49 PUBLIC BARE METAL CLOUD: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 PUBLIC BARE METAL CLOUD: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 PRIVATE BARE METAL CLOUD: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 PRIVATE BARE METAL CLOUD: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 HYBRID BARE METAL CLOUD: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 HYBRID BARE METAL CLOUD: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 BARE METAL CLOUD MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 56 BARE METAL CLOUD MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 57 SOFTWARE & IT SERVICES: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 SOFTWARE & IT SERVICES: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 BFSI: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 BFSI: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 MANUFACTURING: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 MANUFACTURING: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 HEALTHCARE & LIFE SCIENCES: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 HEALTHCARE & LIFE SCIENCES: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 TELECOMMUNICATIONS: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 TELECOMMUNICATIONS: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 MEDIA & ENTERTAINMENT: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 MEDIA & ENTERTAINMENT: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 RETAIL & CONSUMER GOODS: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 RETAIL & CONSUMER GOODS: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 GOVERNMENT & PUBLIC SECTOR: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 72 GOVERNMENT & PUBLIC SECTOR: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 OTHER VERTICALS: BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 74 OTHER VERTICALS: BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 BARE METAL CLOUD MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 BARE METAL CLOUD MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: BARE METAL CLOUD MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 80 NORTH AMERICA: BARE METAL CLOUD MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 82 NORTH AMERICA: BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: BARE METAL CLOUD MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 84 NORTH AMERICA: BARE METAL CLOUD MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: BARE METAL CLOUD MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 86 NORTH AMERICA: BARE METAL CLOUD MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: BARE METAL CLOUD MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 88 NORTH AMERICA: BARE METAL CLOUD MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 89 US: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 90 US: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 91 CANADA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 92 CANADA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 93 EUROPE: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 94 EUROPE: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 95 EUROPE: BARE METAL CLOUD MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 96 EUROPE: BARE METAL CLOUD MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 97 EUROPE: BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 98 EUROPE: BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 99 EUROPE: BARE METAL CLOUD MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 100 EUROPE: BARE METAL CLOUD MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 101 EUROPE: BARE METAL CLOUD MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 102 EUROPE: BARE METAL CLOUD MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 103 EUROPE: BARE METAL CLOUD MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 104 EUROPE: BARE METAL CLOUD MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 UK: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 106 UK: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 107 GERMANY: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 108 GERMANY: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 109 FRANCE: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 110 FRANCE: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 111 ITALY: BARE METAL CLOUD MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 112 ITALY: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 113 REST OF EUROPE: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 114 REST OF EUROPE: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 116 ASIA PACIFIC: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: BARE METAL CLOUD MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 118 ASIA PACIFIC: BARE METAL CLOUD MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 120 ASIA PACIFIC: BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: BARE METAL CLOUD MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 122 ASIA PACIFIC: BARE METAL CLOUD MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: BARE METAL CLOUD MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 124 ASIA PACIFIC: BARE METAL CLOUD MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: BARE METAL CLOUD MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 126 ASIA PACIFIC: BARE METAL CLOUD MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 127 CHINA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 128 CHINA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 129 JAPAN: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 130 JAPAN: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 131 INDIA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 132 INDIA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: BARE METAL CLOUD MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: BARE METAL CLOUD MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: BARE METAL CLOUD MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: BARE METAL CLOUD MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: BARE METAL CLOUD MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: BARE METAL CLOUD MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: BARE METAL CLOUD MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: BARE METAL CLOUD MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 147 GULF COOPERATION COUNCIL: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 148 GULF COOPERATION COUNCIL: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 149 GULF COOPERATION COUNCIL: BARE METAL CLOUD MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 150 GULF COOPERATION COUNCIL: BARE METAL CLOUD MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 151 SAUDI ARABIA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 152 SAUDI ARABIA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 153 UAE: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 154 UAE: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 155 REST OF GCC: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 156 REST OF GCC: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 157 SOUTH AFRICA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 158 SOUTH AFRICA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 159 REST OF MIDDLE EAST & AFRICA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 160 REST OF MIDDLE EAST & AFRICA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 161 LATIN AMERICA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 162 LATIN AMERICA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 163 LATIN AMERICA: BARE METAL CLOUD MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 164 LATIN AMERICA: BARE METAL CLOUD MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 165 LATIN AMERICA: BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 166 LATIN AMERICA: BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 167 LATIN AMERICA: BARE METAL CLOUD MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 168 LATIN AMERICA: BARE METAL CLOUD MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 169 LATIN AMERICA: BARE METAL CLOUD MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 170 LATIN AMERICA: BARE METAL CLOUD MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 171 LATIN AMERICA: BARE METAL CLOUD MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 172 LATIN AMERICA: BARE METAL CLOUD MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 173 BRAZIL: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 174 BRAZIL: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 175 MEXICO: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 176 MEXICO: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 177 REST OF LATIN AMERICA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2020-2024 (USD MILLION)

- TABLE 178 REST OF LATIN AMERICA: BARE METAL CLOUD MARKET, BY SERVICE MODEL, 2025-2030 (USD MILLION)

- TABLE 179 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

- TABLE 180 MARKET SHARE OF KEY VENDORS, 2024

- TABLE 181 BARE METAL CLOUD MARKET: REGION FOOTPRINT

- TABLE 182 BARE METAL CLOUD MARKET: SERVICE MODEL FOOTPRINT

- TABLE 183 BARE METAL CLOUD MARKET: APPLICATION FOOTPRINT

- TABLE 184 BARE METAL CLOUD MARKET: VERTICAL FOOTPRINT

- TABLE 185 BARE METAL CLOUD MARKET: KEY STARTUPS/SMES

- TABLE 186 BARE METAL CLOUD MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 187 BARE METAL CLOUD MARKET: PRODUCT LAUNCHES, FEBRUARY 2022-JULY 2025

- TABLE 188 BARE METAL CLOUD MARKET: DEALS, FEBRUARY 2022-JULY 2025

- TABLE 189 BARE METAL CLOUD MARKET: EXPANSIONS, FEBRUARY 2022-JULY 2025

- TABLE 190 ORACLE: COMPANY OVERVIEW

- TABLE 191 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 ORACLE: PRODUCT LAUNCHES

- TABLE 193 ORACLE: DEALS

- TABLE 194 AWS: COMPANY OVERVIEW

- TABLE 195 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 AWS: PRODUCT LAUNCHES

- TABLE 197 AWS: DEALS

- TABLE 198 AWS: EXPANSIONS

- TABLE 199 IBM: COMPANY OVERVIEW

- TABLE 200 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 IBM: PRODUCT LAUNCHES

- TABLE 202 IBM: DEALS

- TABLE 203 IBM: EXPANSIONS

- TABLE 204 MICROSOFT: COMPANY OVERVIEW

- TABLE 205 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 MICROSOFT: PRODUCT LAUNCHES

- TABLE 207 MICROSOFT: DEALS

- TABLE 208 DELL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 209 DELL TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 DELL TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 211 DELL TECHNOLOGIES: DEALS

- TABLE 212 GOOGLE: COMPANY OVERVIEW

- TABLE 213 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 GOOGLE: PRODUCT LAUNCHES

- TABLE 215 GOOGLE: DEALS

- TABLE 216 ALIBABA CLOUD: COMPANY OVERVIEW

- TABLE 217 ALIBABA CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 ALIBABA CLOUD: PRODUCT LAUNCHES

- TABLE 219 ALIBABA CLOUD: DEALS

- TABLE 220 RACKSPACE TECHNOLOGY: COMPANY OVERVIEW

- TABLE 221 RACKSPACE TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 RACKSPACE TECHNOLOGY: PRODUCT LAUNCHES

- TABLE 223 LUMEN TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 224 LUMEN TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 LUMEN TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 226 LUMEN TECHNOLOGIES: DEALS

- TABLE 227 HUAWEI CLOUD: COMPANY OVERVIEW

- TABLE 228 HUAWEI CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 HUAWEI CLOUD: PRODUCT LAUNCHES

- TABLE 230 HUAWEI CLOUD: DEALS

- TABLE 231 VULTR: COMPANY OVERVIEW

- TABLE 232 VULTR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 VULTR: PRODUCT LAUNCHES

- TABLE 234 VULTR: DEALS

- TABLE 235 VULTR: OTHERS

- TABLE 236 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2024 (USD BILLION)

- TABLE 237 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2025-2030 (USD BILLION)

- TABLE 238 CLOUD STORAGE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 239 CLOUD STORAGE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 BARE METAL CLOUD MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 BARE METAL CLOUD MARKET: DATA TRIANGULATION

- FIGURE 4 BARE METAL CLOUD MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF BARE METAL CLOUD VENDORS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM OFFERINGS

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): BARE METAL CLOUD MARKET

- FIGURE 10 GLOBAL BARE METAL CLOUD MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 11 FASTEST-GROWING SEGMENTS IN BARE METAL CLOUD MARKET, 2025-2030

- FIGURE 12 BARE METAL CLOUD MARKET: REGIONAL SNAPSHOT

- FIGURE 13 RISING DIGITAL INFRASTRUCTURE DEMANDS AND AI WORKLOADS TO ACCELERATE MARKET GROWTH

- FIGURE 14 BARE METAL INSTANCES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 AI/ML & DATA ANALYTICS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 PUBLIC BARE METAL CLOUD TO HOLD SIGNIFICANT SHARE DURING FORECAST PERIOD

- FIGURE 17 LARGE ENTERPRISES TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 SOFTWARE & IT SERVICES SEGMENT TO HOLD MAJOR SHARE DURING FORECAST PERIOD

- FIGURE 19 NORTH AMERICA TO EMERGE AS LARGEST MARKET FOR NEXT FIVE YEARS

- FIGURE 20 BARE METAL CLOUD MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 ORGANIZATION FUNCTIONS IMPACTED BY IOT AND EDGE SOLUTIONS, 2023

- FIGURE 22 BARE METAL CLOUD ECOSYSTEM

- FIGURE 23 BARE METAL CLOUD MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 BARE METAL CLOUD MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 AVERAGE SELLING PRICE TREND, BY REGION, 2025

- FIGURE 26 NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2015-2025

- FIGURE 27 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN BARE METAL CLOUD MARKET

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 30 MARKET POTENTIAL OF GENERATIVE AI IN ENHANCING BARE METAL CLOUD ACROSS KEY USE CASES

- FIGURE 31 BARE METAL CLOUD MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 32 BARE METAL INSTANCES MODEL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 AI/ML & DATA ANALYTICS SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 34 LARGE ENTERPRISES SEGMENT TO LEAD MARKET BY 2030

- FIGURE 35 PUBLIC BARE METAL CLOUD SEGMENT TO LEAD MARKET BY 2030

- FIGURE 36 SOFTWARE & IT SERVICES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 39 EUROPE: MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 41 MIDDLE EAST & AFRICA: MARKET SNAPSHOT

- FIGURE 42 LATIN AMERICA: MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF KEY VENDORS, 2020-2024

- FIGURE 44 BARE METAL CLOUD MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 45 BARE METAL CLOUD MARKET: VENDOR PRODUCT/BRAND COMPARISON

- FIGURE 46 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 47 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 48 BARE METAL CLOUD MARKET: COMPANY FOOTPRINT

- FIGURE 49 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 50 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- FIGURE 51 COMPANY VALUATION OF KEY VENDORS

- FIGURE 52 EV/EBITDA ANALYSIS OF KEY VENDORS

- FIGURE 53 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 54 ORACLE: COMPANY SNAPSHOT

- FIGURE 55 AWS: COMPANY SNAPSHOT

- FIGURE 56 IBM: COMPANY SNAPSHOT

- FIGURE 57 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 58 DELL TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 59 GOOGLE: COMPANY SNAPSHOT

- FIGURE 60 ALIBABA CLOUD: COMPANY SNAPSHOT

- FIGURE 61 RACKSPACE TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 62 LUMEN TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 63 HUAWEI CLOUD: COMPANY SNAPSHOT