|

市場調查報告書

商品編碼

1811731

全球人工智慧檢測器市場(按產品、檢測方式、應用、最終用戶和地區分類)- 預測至 2030 年AI Detector Market by Offering (Platform, API/SDKs), Detection Modality (AI Generated Text, Image, Video, Voice, Code), Application (Academic Integrity, Plagiarism Detection, Deepfake Detection, Content Authenticity Assessment) - Global Forecast to 2030 |

||||||

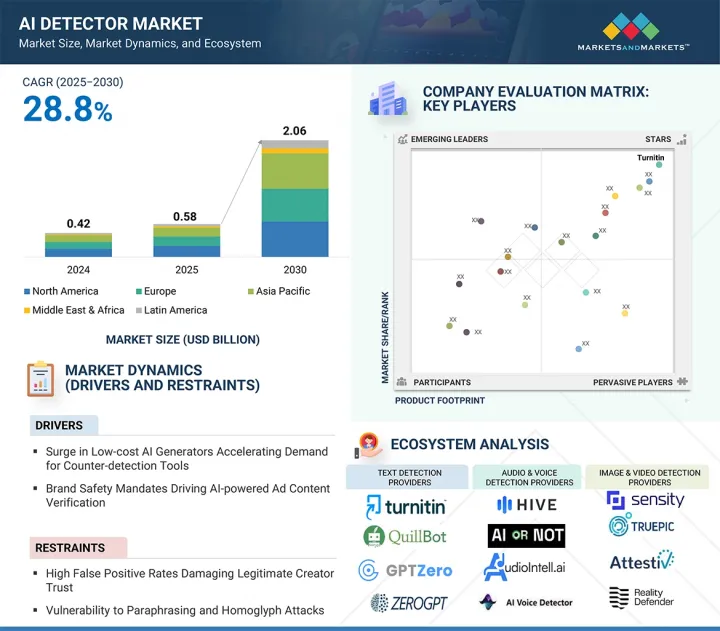

AI檢測器市場規模預計將從2025年的約5.8億美元成長到2030年的20.6億美元,預測期間的年複合成長率(CAGR)為28.8%。

生成式人工智慧在教育、媒體和企業領域的廣泛應用是人工智慧檢測器市場的主要驅動力,機構和企業越來越需要工具來確保其數位輸出的原創性、保持真實性和完整性。

| 調查範圍 | |

|---|---|

| 調查年份 | 2020-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 對價單位 | 美元(百萬美元) |

| 部分 | 按產品、按檢測方式、按應用、按最終用戶、按地區 |

| 目標區域 | 北美、歐洲、亞太地區、中東和非洲、拉丁美洲 |

同時,深度造假、虛假資訊和合成詐騙的風險日益增加,迫切需要可靠的檢測技術來維護通訊信任、維護品牌聲譽並支持遵守日益嚴格的法規。然而,儘管發展勢頭強勁,市場仍面臨一個重大限制:檢測供應商之間的基準測試標準有限。缺乏普遍認可的績效指標和評估框架,使得買家難以比較解決方案、評估準確性並衡量長期可靠性,從而減緩了企業範圍內的採用速度,並為採購決策帶來了不確定性。

在產品細分市場中,平台子細分市場預計將在 2025 年佔據最大的市場佔有率,這得益於人們越來越偏好將多種檢測功能整合到單一介面的端到端解決方案。與獨立的 API 和 SDK 相比,平台使企業、教育機構和報導機構能夠更有效地管理大規模檢測工作流程,而獨立的 API 和 SDK 通常需要額外的整合和客製化。許多供應商正在透過多模態檢測、效能追蹤和報告儀表板等功能增強其平台,使其對尋求解決合規性和簡化管治的組織更具吸引力。平台能夠支援各種使用案例,從學術誠信到品牌安全和錯誤訊息監控,這使它們成為大規模部署的核心產品。隨著受監管行業和大容量內容生態系統中平台的採用率不斷提高,平台為相關人員提供了更大的營運控制權、更輕鬆的審核和更快的實施,從而加強了他們在該領域的領導地位。

在應用領域中,學術誠信子領域預計將在 2025 年佔據最大的市場佔有率,這得益於學校、大學和線上學習平台中人工智慧檢測工具的日益整合。隨著學生產生的人工智慧的迅速普及,教育機構正在優先考慮能夠識別人工智慧輔助挑戰、維護評估公平性和保護證書完整性的解決方案。學習管理系統和數位評估平台正在整合檢測功能,以大規模解決這些問題,大學也在正式製定學術政策,強制使用此類工具。供應商也擴大提供與機構要求直接相關的功能,例如抄襲檢測、風格分析和即時內容檢驗。遠距和混合學習的持續擴展進一步刺激了需求,越來越依賴可靠的檢驗方法來維護對數位教育生態系統的信任。這種強勁而持續的需求使學術誠信成為人工智慧檢測器市場的關鍵應用領域。

全球人工智慧檢測器市場發展勢頭強勁,預計到 2025 年北美將佔據最大市場佔有率,而 2030 年亞太地區預計將實現最快成長。北美的領先地位得益於成熟的數位基礎設施、早期採用的人工智慧管治框架,以及在教育、媒體和金融服務等領域提供企業級解決方案的知名供應商。美國和加拿大的大學和企業用戶擴大將人工智慧檢測工具納入其學術、編輯和合規工作流程中,從而形成了永續的需求基礎。同時,隨著中國、印度、日本和韓國等國家加速數位轉型並加強對人工智慧使用的法律規範,亞太地區正成為一個快速成長的市場。該地區教育科技生態系統的興起,加上對虛假資訊、合成媒體和選舉安全日益成長的擔憂,正促使機構和企業尋求可擴展的檢測平台。此外,中國和日本政府主導的人工智慧內容監管舉措,以及印度和東南亞地區新興企業的快速擴張,為新的發展創造了肥沃的土壤。這些動態共同凸顯了北美作為全球市場收益中心的地位,以及亞太地區作為未來成長潛力最大的地區的地位,使得這兩個地區在塑造供應商的競爭策略方面都至關重要。

本報告研究了全球人工智慧檢測器市場,並根據產品、檢測方式、應用、最終用戶、區域趨勢和參與市場的公司概況對其進行細分。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章市場概況及產業趨勢

- 介紹

- 市場動態

- AI檢測器市場的演變

- 供應鏈分析

- 生態系分析

- 投資狀況及資金籌措情景

- 案例研究分析

- 技術分析

- 監管狀況

- 專利分析

- 定價分析

- 大型會議及活動

- 波特五力分析

- 主要相關人員和採購標準

- 影響客戶業務的趨勢/中斷

6. 人工智慧檢測器市場(依產品分類)

- 介紹

- 平台

- API/SDK

7. AI檢測器市場(依檢測方式)

- 介紹

- 人工智慧生成的文本

- 人工智慧生成的圖像和影片

- 人工智慧生成的音訊和語音

- AI產生的程式碼

- 多模態

第 8 章:AI檢測器市場(按應用)

- 介紹

- 學術誠信

- 內容可信度評估

- 抄襲檢測

- 深度造假和合成媒體偵測

- 程式碼真實性檢查

- 檢測錯誤訊息和虛假訊息

- 其他

第 9 章 AI檢測器市場(按最終用戶分類)

- 介紹

- BFSI

- 醫療保健和生命科學

- 媒體與娛樂

- 教育

- 法律

- 軟體和技術供應商

- 政府和國防

- 消費者

- 其他

第10章 AI檢測器市場(按地區)

- 介紹

- 北美洲

- 北美:人工智慧檢測器市場促進因素

- 北美:宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 歐洲:人工智慧檢測器市場促進因素

- 歐洲:宏觀經濟展望

- 英國

- 德國

- 法國

- 其他

- 亞太地區

- 亞太地區:人工智慧檢測器市場促進因素

- 亞太地區:宏觀經濟展望

- 中國

- 印度

- 日本

- 其他

- 中東和非洲

- 中東和非洲:人工智慧檢測器市場促進因素

- 中東與非洲:宏觀經濟展望

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他

- 拉丁美洲

- 拉丁美洲:人工智慧檢測器市場促進因素

- 拉丁美洲:宏觀經濟展望

- 巴西

- 墨西哥

- 其他

第11章 競爭格局

- 概述

- 主要參與企業的策略/優勢,2022-2025

- 2024年市場佔有率分析

- 產品比較分析

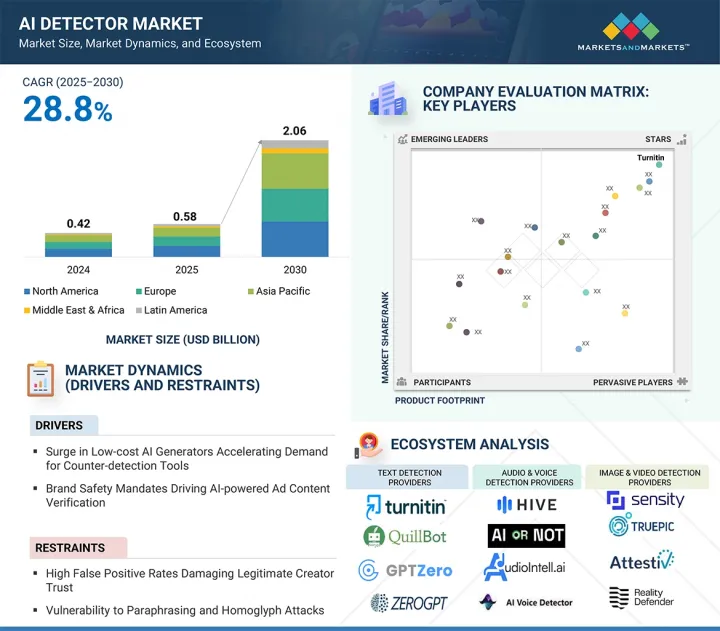

- 公司估值矩陣:2024 年關鍵參與企業

- 公司估值矩陣:其他公司,2024 年

- 競爭場景

第12章:公司簡介

- 介紹

- 主要參與企業

- TURNITIN

- GRAMMARLY

- HIVE MODERATION

- COPYLEAKS

- QUILLBOT

- REALITY DEFENDER

- ATTESTIV

- GPTZERO

- TRUEPIC

- BRANDWELL AI

- COMPILATIO

- QUETEXT

- SENSITY

- DUCKDUCKGOOSE

- PINDROP

- SCRIBBR

- RESEMBLE AI

- BLACKBIRD.AI

- 其他公司

- ORIGINALITY.AI

- SIGHTENGINE

- WRITER.COM

- PERFIOS

- AI OR NOT

- AI DETECTOR PRO(AIDP)

- SMODIN

- SURFER

- SCALENUT

- WINSTON AI

- ILLUMINARTY

- CROSSPLAG

- ZEROGPT

- SAPLING.AI

- PANGRAM LABS

- TRACEGPT(PLAGIARISMCHECKER)

- FACIA.AI

第13章:相鄰市場與相關市場

第14章 附錄

The AI detector market is anticipated to grow at a compound annual growth rate (CAGR) of 28.8% during the forecast period, from an estimated USD 0.58 billion in 2025 to USD 2.06 billion by 2030. The proliferation of generative AI across education, media, and enterprise sectors is a key driver of the AI detector market, as institutions and businesses increasingly require tools to ensure originality, maintain credibility, and uphold integrity in digital outputs.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Million) |

| Segments | Offering, Detection Modality, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

At the same time, the escalating risk of deepfakes, disinformation, and synthetic fraud is creating urgent demand for reliable detection technologies to safeguard trust in communication, protect brand reputation, and support compliance with tightening regulations. However, despite this strong momentum, the market faces a significant restraint in the form of limited benchmark standards across detection vendors. The absence of universally accepted performance metrics and evaluation frameworks makes it difficult for buyers to compare solutions, assess accuracy, and measure long-term reliability, slowing down enterprise-scale adoption and creating uncertainty in procurement decisions.

"Platforms segment leads growth in 2025"

Within the offering segment, the platform subsegment is expected to hold the largest market share in 2025, driven by the rising preference for end-to-end solutions that consolidate multiple detection capabilities in a single interface. Platforms allow enterprises, educational institutions, and media organizations to manage large-scale detection workflows more efficiently compared to standalone APIs or SDKs, which often require additional integration and customization. Many vendors are enhancing their platforms with features such as multimodal detection, provenance tracking, and reporting dashboards, making them more attractive for organizations seeking compliance readiness and streamlined governance. The ability of platforms to support varied use cases, from academic integrity to brand safety and misinformation monitoring, positions them as the core offering for large-scale deployments. As adoption expands across regulated industries and high-volume content ecosystems, platforms provide stakeholders with greater operational control, easier auditability, and faster implementation, reinforcing their leadership within the offering segment.

"Academic integrity becomes the anchor of AI detector demand"

Within the application segment, the academic integrity subsegment is projected to hold the largest market share in 2025, supported by the growing integration of AI detection tools across schools, universities, and online learning platforms. With the rapid adoption of generative AI by students, institutions are prioritizing solutions that can identify AI-assisted assignments, maintain fairness in assessments, and protect the credibility of qualifications. Learning management systems and digital assessment platforms are embedding detection capabilities to address these concerns at scale, while universities are formalizing academic policies that mandate the use of such tools. Vendors are also tailoring their offerings with plagiarism detection, writing style analysis, and real-time content verification, which align directly with institutional requirements. The continued expansion of remote and hybrid learning further amplifies demand, as academic environments increasingly depend on reliable verification methods to uphold trust in digital education ecosystems. This strong and recurring demand positions academic integrity as the leading application area in the AI detector market.

"Asia Pacific to witness rapid AI detector growth fueled by innovation and emerging technologies, while North America leads in market size"

The AI detector market is experiencing strong global momentum, with North America expected to hold the largest market share in 2025, while Asia Pacific is projected to register the fastest growth through 2030. North America's lead is supported by a combination of mature digital infrastructure, early adoption of AI governance frameworks, and the presence of established vendors offering enterprise-grade solutions across sectors such as education, media, and financial services. Universities and corporate users across the US and Canada are increasingly embedding AI detection tools into academic, editorial, and compliance workflows, creating a sustained demand base. Meanwhile, Asia Pacific is emerging as the fastest-growing market as countries including China, India, Japan, and South Korea accelerate digital transformation initiatives and tighten regulatory oversight on AI usage. The rise of edtech ecosystems in the region, coupled with growing concerns around disinformation, synthetic media, and election security, is driving institutions and enterprises to seek scalable detection platforms. Additionally, government-backed initiatives in China and Japan to regulate AI-generated content and the rapid expansion of start-ups across India and Southeast Asia are creating fertile ground for new deployments. Together, these dynamics highlight North America as the anchor for global market revenues and Asia Pacific as the most promising region for future expansion, making both regions critical in shaping competitive strategies for vendors.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the AI detector market.

- By Company: Tier I - 30%, Tier II - 45%, and Tier III - 25%

- By Designation: C Level - 32%, Director Level - 25%, and others - 43%

- By Region: North America - 40%, Europe - 21%, Asia Pacific - 26%, Middle East & Africa - 8%, and Latin America - 5%

The report includes the study of key players offering AI detector solutions. It profiles major vendors in the AI detector market. The major players in the AI detector market include GPTZero (US), Originality.AI (Canada), Copyleaks (US), Turnitin (US), Writer.com (US), Smodin (US), Hive Moderation (US), Truepic (US), BrandWell AI (US), QuillBot (US), Scribbr (Netherlands), Grammarly (US), Surfer (Poland), Winston AI (Canada), AI Detector Pro (AIDP) (US), Illuminarty (US), DuckDuckGoose (Netherlands), Crossplag (US), ZeroGPT (US), Sapling.ai (US), TraceGPT (PlagiarismCheck.org) (UK), Pangram Labs (US), Compilatio (France), Scalenut (US), Quetext (US), Sightengine (France), Sensity (Netherlands), Reality Defender (US), Attestiv (US), AI or Not (US), Facia.ai (UK), Resemble AI (US), Pindrop (US), Blackbrid.AI (US), and Perfios (India).

Research coverage

This research report covers the AI detector market, which has been segmented based on Offering (Platforms, API/SDKs). The Detection Modality segment consists of AI-generated Text, AI-generated Image & video, AI-generated Audio & voice, AI-generated Code, and Multimodal. The application segment includes Academic Integrity, Content Authenticity Assessment, Plagiarism Detection, Deepfake and Synthetic Media Detection, Code Authenticity Checking, Misinformation and Disinformation Detection, and Other Applications. The End User segment consists of BFSI, Healthcare & Life Sciences, Media & Entertainment, Education, Legal, Software & Technology Providers, Government & Defense, Consumers, and Other End Users. The regional analysis of the AI detector market covers North America, Europe, Asia Pacific, the Middle East & Africa (MEA), and Latin America.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall AI detector market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

Analysis of key drivers (Cross-platform Content Dissemination Fueling Multi-format AI Detection Adoption, Surge in Low-cost AI Generators Accelerating Demand for Counter-detection Tools, Brand Safety Mandates Driving AI-powered Ad Content Verification, and Advertiser-led Misinformation Control on Social Platforms Boosting Detector Deployment), restraints (High False Positive Rates Damaging Legitimate Creator Trust, and Vulnerability to Paraphrasing and Homoglyph Attacks), opportunities (Expansion into Real-time API Integrations for Chatbots and Collaboration Tools, Radioactive Data Tracing for Enhanced AI Output Attribution, and Integration with Blockchain-based Content Authenticity Ledgers), and challenges (Limited Explainability of Content Flagging Decisions, and Competitive Disadvantage of Small Vendors Against Rapidly Advancing Big Tech AI Capabilities).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the AI detector market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the AI detector market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the AI detector market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and offerings of leading players like GPTZero (US), Originality.AI (Canada), Copyleaks (US), Turnitin (US), Writer.com (US), Smodin (US), Hive Moderation (US), Truepic (US), BrandWell AI (US), QuillBot (US), Scribbr (Netherlands), Grammarly (US), Surfer (Poland), Winston AI (Canada), AI Detector Pro (AIDP) (US), Illuminarty (US), DuckDuckGoose (Netherlands), Crossplag (US), ZeroGPT (US), Sapling.ai (US), TraceGPT (PlagiarismCheck.org) (UK), Pangram Labs (US), Compilatio (France), Scalenut (US), Quetext (US), Sightengine (France), Sensity (Netherlands), Reality Defender (US), Attestiv (US), AI or Not (US), Facia.ai (UK), Resemble AI (US), Pindrop (US), Blackbrid.AI (US), and Perfios (India) among others in the AI detector market. The report also helps stakeholders understand the pulse of the AI detector market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN AI DETECTOR MARKET

- 4.2 AI DETECTOR MARKET: TOP THREE APPLICATIONS

- 4.3 NORTH AMERICA: AI DETECTOR MARKET, BY OFFERING AND DETECTION MODALITY

- 4.4 AI DETECTOR MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Cross-platform Content Dissemination Fueling Multi-format AI Detection Adoption

- 5.2.1.2 Surge in Low-cost AI Generators Accelerating Demand for Counter-detection Tools

- 5.2.1.3 Brand Safety Mandates Driving AI-powered Ad Content Verification

- 5.2.1.4 Advertiser-led Misinformation Control on Social Platforms Boosting Detector Deployment

- 5.2.2 RESTRAINTS

- 5.2.2.1 High False Positive Rates Damaging Legitimate Creator Trust

- 5.2.2.2 Vulnerability to Paraphrasing and Homoglyph Attacks

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion into Real-time API Integrations for Chatbots and Collaboration Tools

- 5.2.3.2 Radioactive Data Tracing for Enhanced AI Output Attribution

- 5.2.3.3 Integration with Blockchain-based Content Authenticity Ledgers

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited Explainability of Content Flagging Decisions

- 5.2.4.2 Competitive Disadvantage of Small Vendors Against Rapidly Advancing Big Tech AI Capabilities

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF AI DETECTOR MARKET

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 TEXT DETECTION PROVIDERS

- 5.5.2 AUDIO AND VOICE DETECTION PROVIDERS

- 5.5.3 CODE DETECTION PROVIDERS

- 5.5.4 IMAGE AND VIDEO DETECTION PROVIDERS

- 5.5.5 MULTIMODAL DETECTION PROVIDERS

- 5.6 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 IZZ2IZZ'S CONTENT PROTECTION UPGRADED TO ENTERPRISE LEVEL THROUGH COPYLEAKS

- 5.7.2 VERIFIEDHUMAN PARTNERED WITH ORIGINALITY.AI TO EMPOWER EDUCATORS IN AUTHENTICITY VERIFICATION

- 5.7.3 HIGHRISE PARTNERED WITH HIVE MODERATION TO SAFEGUARD AND SCALE ITS VIRTUAL COMMUNITY

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Natural Language Processing (NLP)

- 5.8.1.2 Computer Vision

- 5.8.1.3 Machine Learning

- 5.8.1.4 Neural Text & Image Embeddings

- 5.8.1.5 Perplexity & Entropy Calculation Engines

- 5.8.1.6 Sequence Modeling

- 5.8.1.7 Audio Forensics

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Metadata Extraction & Forensics

- 5.8.2.2 Cloud Computing

- 5.8.2.3 Digital Watermarking

- 5.8.2.4 Data Labeling & Annotation Systems

- 5.8.2.5 Blockchain

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Generative AI

- 5.8.3.2 Synthetic Media Generation

- 5.8.3.3 Plagiarism Detection Engines

- 5.8.3.4 Digital Identity Verification

- 5.8.3.5 Content Moderation Systems

- 5.8.1 KEY TECHNOLOGIES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 REGULATIONS

- 5.9.2.1 North America

- 5.9.2.1.1 TAKE IT DOWN Act (2025)

- 5.9.2.1.2 Personal Information Protection and Electronic Documents Act (PIPEDA)

- 5.9.2.1.3 National Artificial Intelligence Initiative Act (NAIIA) (US)

- 5.9.2.1.4 Artificial Intelligence and Data Act (AIDA) (Canada)

- 5.9.2.2 Europe

- 5.9.2.2.1 European Union (EU) - Artificial Intelligence Act (AIA)

- 5.9.2.2.2 General Data Protection Regulation (Europe)

- 5.9.2.2.3 Online Safety Act 2023

- 5.9.2.3 Asia Pacific

- 5.9.2.3.1 Provisions on Deep Synthesis Internet Information Services (2023)

- 5.9.2.3.2 Act on the Protection of Personal Information (APPI)

- 5.9.2.3.3 Interim Administrative Measures for Generative Artificial Intelligence Services (China)

- 5.9.2.3.4 National AI Strategy (Singapore)

- 5.9.2.3.5 Hiroshima AI Process Comprehensive Policy Framework (Japan)

- 5.9.2.4 Middle East & Africa

- 5.9.2.4.1 Federal Decree-Law No. 45 of 2021 (UAE PDPL)

- 5.9.2.4.2 National Strategy for Artificial Intelligence (UAE)

- 5.9.2.4.3 National Artificial Intelligence Strategy (Qatar)

- 5.9.2.4.4 AI Ethics Principles and Guidelines (Dubai)

- 5.9.2.5 Latin America

- 5.9.2.5.1 Santiago Declaration (Chile)

- 5.9.2.5.2 Brazilian Artificial Intelligence Strategy (EBIA)

- 5.9.2.1 North America

- 5.10 PATENT ANALYSIS

- 5.10.1 METHODOLOGY

- 5.10.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.10.3 INNOVATIONS AND PATENT APPLICATIONS

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE OF OFFERING, BY KEY PLAYER, 2025

- 5.11.2 AVERAGE SELLING PRICE, BY DETECTION MODALITY, 2025

- 5.12 KEY CONFERENCES AND EVENTS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.15.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

6 AI DETECTOR MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 DRIVERS: AI DETECTOR MARKET, BY OFFERING

- 6.2 PLATFORMS

- 6.2.1 UNIFIED HUBS FOR END-TO-END AI DETECTION

- 6.3 API/SDKS

- 6.3.1 AGILE DETECTION EMBEDDED INTO DIGITAL ECOSYSTEMS

7 AI DETECTOR MARKET, BY DETECTION MODALITY

- 7.1 INTRODUCTION

- 7.1.1 DRIVERS: AI DETECTOR MARKET, BY DETECTION MODALITY

- 7.2 AI-GENERATED TEXT

- 7.2.1 SAFEGUARDING WRITTEN INTEGRITY TO PRESERVE TRUST, AUTHENTICITY, AND ACCOUNTABILITY

- 7.3 AI-GENERATED IMAGE & VIDEO

- 7.3.1 PRESERVING VISUAL TRUTH TO COMBAT MANIPULATED IMAGERY AND DEEPFAKES

- 7.4 AI-GENERATED AUDIO & VOICE

- 7.4.1 DEFENDING SONIC AUTHENTICITY AGAINST VOICE CLONING, IMPERSONATION, AND AUDIO-DRIVEN MISINFORMATION

- 7.5 AI-GENERATED CODE

- 7.5.1 SECURING SOFTWARE SUPPLY CHAIN BY DETECTING AI-GENERATED CODE RISKS

- 7.6 MULTIMODAL

- 7.6.1 TRUST ASSURANCE THROUGH MULTIMODAL DETECTION ACROSS TEXT, VISUALS, AUDIO, VIDEO, AND CODE

8 AI DETECTOR MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 DRIVERS: AI DETECTOR MARKET, BY APPLICATION

- 8.2 ACADEMIC INTEGRITY

- 8.2.1 SAFEGUARDING ACADEMIC INTEGRITY IN AGE OF AI

- 8.3 CONTENT AUTHENTICITY ASSESSMENT

- 8.3.1 ESTABLISHING CONTENT AUTHENTICITY AS NEW TRUST CURRENCY

- 8.4 PLAGIARISM DETECTION

- 8.4.1 REDEFINING PLAGIARISM DETECTION FOR AI ERA

- 8.5 DEEPFAKE AND SYNTHETIC MEDIA DETECTION

- 8.5.1 COMBATING SYNTHETIC MEDIA WITH PRECISION DEEPFAKE DETECTION

- 8.6 CODE AUTHENTICITY CHECKING

- 8.6.1 ENSURING TRUST IN SOFTWARE THROUGH CODE AUTHENTICITY CHECKING

- 8.7 MISINFORMATION AND DISINFORMATION DETECTION

- 8.7.1 COUNTERING FALSE NARRATIVES WITH MISINFORMATION AND DISINFORMATION DETECTION

- 8.8 OTHER APPLICATIONS

9 AI DETECTOR MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.1.1 DRIVERS: AI DETECTOR MARKET, BY END USER

- 9.2 BFSI

- 9.2.1 SAFEGUARDING TRUST IN FINANCIAL COMMUNICATION

- 9.3 HEALTHCARE & LIFE SCIENCES

- 9.3.1 PROTECTING PATIENT DATA AND CLINICAL ACCURACY

- 9.4 MEDIA & ENTERTAINMENT

- 9.4.1 MAINTAINING BRAND INTEGRITY IN DIGITAL STORYTELLING

- 9.5 EDUCATION

- 9.5.1 REINFORCING ETHICAL STANDARDS IN ACADEMIA

- 9.6 LEGAL

- 9.6.1 STRENGTHENING EVIDENCE AND DOCUMENTATION IN LEGAL PRACTICE

- 9.7 SOFTWARE & TECHNOLOGY PROVIDERS

- 9.7.1 ENHANCING PRODUCT INTEGRITY FOR SOFTWARE INNOVATORS

- 9.8 GOVERNMENT & DEFENSE

- 9.8.1 SAFEGUARDING PUBLIC TRUST IN GOVERNANCE AND DEFENSE

- 9.9 CONSUMERS

- 9.9.1 EMPOWERING INDIVIDUAL USERS WITH DIGITAL CONFIDENCE

- 9.10 OTHER END USERS

10 AI DETECTOR MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: AI DETECTOR MARKET DRIVERS

- 10.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.3 US

- 10.2.4 CANADA

- 10.3 EUROPE

- 10.3.1 EUROPE: AI DETECTOR MARKET DRIVERS

- 10.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.3 UK

- 10.3.4 GERMANY

- 10.3.5 FRANCE

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: AI DETECTOR MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.3 CHINA

- 10.4.4 INDIA

- 10.4.5 JAPAN

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: AI DETECTOR MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.3 SAUDI ARABIA

- 10.5.4 UAE

- 10.5.5 SOUTH AFRICA

- 10.5.6 REST OF MIDDLE EAST & AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: AI DETECTOR MARKET DRIVERS

- 10.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.3 BRAZIL

- 10.6.4 MEXICO

- 10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.3.1 MARKET RANKING ANALYSIS

- 11.4 PRODUCT COMPARATIVE ANALYSIS

- 11.4.1 PRODUCT COMPARATIVE ANALYSIS, BY AI CONTENT DETECTOR PROVIDER

- 11.4.2 PRODUCT COMPARATIVE ANALYSIS, BY DEEPFAKE DETECTION PROVIDER

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company Footprint

- 11.5.5.2 Regional Footprint

- 11.5.5.3 Detection Modality Footprint

- 11.5.5.4 Application Footprint

- 11.5.5.5 End User Footprint

- 11.6 COMPANY EVALUATION MATRIX: OTHER PLAYERS, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: OTHER PLAYERS, 2024

- 11.6.5.1 Detailed List of Other Players

- 11.6.5.2 Competitive Benchmarking of Other Players

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 11.7.2 DEALS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 TURNITIN

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses and competitive threats

- 12.2.2 GRAMMARLY

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.4 MnM view

- 12.2.2.4.1 Key strengths

- 12.2.2.4.2 Strategic choices

- 12.2.2.4.3 Weaknesses and competitive threats

- 12.2.3 HIVE MODERATION

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.4 MnM view

- 12.2.3.4.1 Key strengths

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses and competitive threats

- 12.2.4 COPYLEAKS

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 Recent developments

- 12.2.4.4 MnM view

- 12.2.4.4.1 Key strengths

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses and competitive threats

- 12.2.5 QUILLBOT

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 Recent developments

- 12.2.5.4 MnM view

- 12.2.5.4.1 Key strengths

- 12.2.5.4.2 Strategic choices

- 12.2.5.4.3 Weaknesses and competitive threats

- 12.2.6 REALITY DEFENDER

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Solutions/Services offered

- 12.2.6.3 Recent developments

- 12.2.6.3.1 Deals

- 12.2.7 ATTESTIV

- 12.2.7.1 Business overview

- 12.2.7.2 Products/Solutions/Services offered

- 12.2.7.3 Recent developments

- 12.2.8 GPTZERO

- 12.2.8.1 Business overview

- 12.2.8.2 Products/Solutions/Services offered

- 12.2.8.3 Recent developments

- 12.2.9 TRUEPIC

- 12.2.10 BRANDWELL AI

- 12.2.11 COMPILATIO

- 12.2.12 QUETEXT

- 12.2.13 SENSITY

- 12.2.14 DUCKDUCKGOOSE

- 12.2.15 PINDROP

- 12.2.16 SCRIBBR

- 12.2.17 RESEMBLE AI

- 12.2.18 BLACKBIRD.AI

- 12.2.1 TURNITIN

- 12.3 OTHER PLAYERS

- 12.3.1 ORIGINALITY.AI

- 12.3.1.1 Business overview

- 12.3.1.2 Products/Solutions/Services offered

- 12.3.1.3 Recent developments

- 12.3.2 SIGHTENGINE

- 12.3.2.1 Business overview

- 12.3.2.2 Products/Solutions/Services offered

- 12.3.2.3 Recent developments

- 12.3.3 WRITER.COM

- 12.3.4 PERFIOS

- 12.3.5 AI OR NOT

- 12.3.6 AI DETECTOR PRO (AIDP)

- 12.3.7 SMODIN

- 12.3.8 SURFER

- 12.3.9 SCALENUT

- 12.3.10 WINSTON AI

- 12.3.11 ILLUMINARTY

- 12.3.12 CROSSPLAG

- 12.3.13 ZEROGPT

- 12.3.14 SAPLING.AI

- 12.3.15 PANGRAM LABS

- 12.3.16 TRACEGPT (PLAGIARISMCHECKER)

- 12.3.17 FACIA.AI

- 12.3.1 ORIGINALITY.AI

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 DEEPFAKE AI MARKET - GLOBAL FORECAST TO 2031

- 13.2.1 MARKET DEFINITION

- 13.2.2 MARKET OVERVIEW

- 13.2.2.1 Deepfake AI market, by offering

- 13.2.2.2 Deepfake AI market, by technology

- 13.2.2.3 Deepfake AI market, by vertical

- 13.2.2.4 Deepfake AI market, by region

- 13.3 ARTIFICIAL INTELLIGENCE MARKET - GLOBAL FORECAST TO 2032

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.2.1 Artificial intelligence (AI) market, by end user

- 13.3.2.2 Artificial intelligence (AI) market, by region

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2020-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 GLOBAL AI DETECTOR MARKET SIZE AND GROWTH RATE, 2020-2024 (USD MILLION, Y-O-Y %)

- TABLE 4 GLOBAL AI DETECTOR MARKET SIZE AND GROWTH RATE, 2025-2030 (USD MILLION, Y-O-Y %)

- TABLE 5 AI DETECTOR MARKET: ECOSYSTEM

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 PATENTS FILED, 2016-2025

- TABLE 12 LIST OF FEW PATENTS IN AI DETECTOR MARKET, 2024-2025

- TABLE 13 AVERAGE SELLING PRICE OF OFFERING, BY KEY PLAYER, 2025

- TABLE 14 AVERAGE SELLING PRICE, BY DETECTION MODALITY, 2025

- TABLE 15 AI DETECTOR MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 PORTER'S FIVE FORCES' IMPACT ON AI DETECTOR MARKET

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 19 AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 20 AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 21 PLATFORMS: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 22 PLATFORMS: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23 API/SDKS: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 24 API/SDKS: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD MILLION)

- TABLE 26 AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD MILLION)

- TABLE 27 AI-GENERATED TEXT: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 AI-GENERATED TEXT: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 AI-GENERATED IMAGE & VIDEO: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 AI-GENERATED IMAGE & VIDEO: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 AI-GENERATED AUDIO & VOICE: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 AI-GENERATED AUDIO & VOICE: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 AI-GENERATED CODE: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 AI-GENERATED CODE: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 MULTIMODAL: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 MULTIMODAL: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 38 AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 39 ACADEMIC INTEGRITY: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 ACADEMIC INTEGRITY: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 CONTENT AUTHENTICITY ASSESSMENT: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 CONTENT AUTHENTICITY ASSESSMENT: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 PLAGIARISM DETECTION: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 PLAGIARISM DETECTION: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 DEEPFAKE AND SYNTHETIC MEDIA DETECTION: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 DEEPFAKE AND SYNTHETIC MEDIA DETECTION: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 CODE AUTHENTICITY CHECKING: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 CODE AUTHENTICITY CHECKING: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 MISINFORMATION AND DISINFORMATION DETECTION: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 MISINFORMATION AND DISINFORMATION DETECTION: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 OTHER APPLICATIONS: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 OTHER APPLICATIONS: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 AI DETECTOR MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 54 AI DETECTOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 55 BFSI: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 BFSI: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 HEALTHCARE & LIFE SCIENCES: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 HEALTHCARE & LIFE SCIENCES: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 MEDIA & ENTERTAINMENT: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 MEDIA & ENTERTAINMENT: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 EDUCATION: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 EDUCATION: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 LEGAL: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 LEGAL: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 SOFTWARE & TECHNOLOGY PROVIDERS: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 SOFTWARE & TECHNOLOGY PROVIDERS: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 GOVERNMENT & DEFENSE: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 GOVERNMENT & DEFENSE: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 CONSUMERS: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 CONSUMERS: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 OTHER END USERS: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 72 OTHER END USERS: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 74 AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 76 NORTH AMERICA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 80 NORTH AMERICA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 82 NORTH AMERICA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: AI DETECTOR MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 84 NORTH AMERICA: AI DETECTOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 85 US: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 86 US: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 87 US: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 88 US: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 89 US: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 90 US: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 91 US: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 92 US: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 93 CANADA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 94 CANADA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 95 CANADA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 96 CANADA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 97 CANADA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 98 CANADA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 99 CANADA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 100 CANADA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 101 EUROPE: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 102 EUROPE: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 103 EUROPE: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD MILLION)

- TABLE 104 EUROPE: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 106 EUROPE: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 107 EUROPE: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 108 EUROPE: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 109 EUROPE: AI DETECTOR MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 110 EUROPE: AI DETECTOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 UK: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 112 UK: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 113 UK: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 114 UK: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 115 UK: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 116 UK: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 117 UK: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 118 UK: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 119 GERMANY: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 120 GERMANY: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 121 GERMANY: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 122 GERMANY: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 123 GERMANY: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 124 GERMANY: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 125 GERMANY: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 126 GERMANY: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 127 FRANCE: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 128 FRANCE: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 129 FRANCE: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 130 FRANCE: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 131 FRANCE: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 132 FRANCE: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 133 FRANCE: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 134 FRANCE: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 135 REST OF EUROPE: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 136 REST OF EUROPE: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 137 REST OF EUROPE: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 138 REST OF EUROPE: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 139 REST OF EUROPE: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 140 REST OF EUROPE: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 141 REST OF EUROPE: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 142 REST OF EUROPE: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 143 ASIA PACIFIC: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 148 ASIA PACIFIC: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 150 ASIA PACIFIC: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: AI DETECTOR MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 152 ASIA PACIFIC: AI DETECTOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 153 CHINA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 154 CHINA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 155 CHINA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 156 CHINA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 157 CHINA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 158 CHINA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 159 CHINA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 160 CHINA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 161 INDIA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 162 INDIA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 163 INDIA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 164 INDIA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 165 INDIA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 166 INDIA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 167 INDIA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 168 INDIA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 169 JAPAN: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 170 JAPAN: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 171 JAPAN: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 172 JAPAN: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 173 JAPAN: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 174 JAPAN: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 175 JAPAN: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 176 JAPAN: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 177 REST OF ASIA PACIFIC: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 178 REST OF ASIA PACIFIC: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 179 REST OF ASIA PACIFIC: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 180 REST OF ASIA PACIFIC: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 181 REST OF ASIA PACIFIC: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 182 REST OF ASIA PACIFIC: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 183 REST OF ASIA PACIFIC: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 184 REST OF ASIA PACIFIC: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 185 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 195 SAUDI ARABIA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 196 SAUDI ARABIA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 197 SAUDI ARABIA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 198 SAUDI ARABIA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 199 SAUDI ARABIA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 200 SAUDI ARABIA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 201 SAUDI ARABIA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 202 SAUDI ARABIA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 203 UAE: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 204 UAE: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 205 UAE: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 206 UAE: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 207 UAE: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 208 UAE: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 209 UAE: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 210 UAE: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 211 SOUTH AFRICA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 212 SOUTH AFRICA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 213 SOUTH AFRICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 214 SOUTH AFRICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 215 SOUTH AFRICA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 216 SOUTH AFRICA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 217 SOUTH AFRICA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 218 SOUTH AFRICA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 219 REST OF MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 220 REST OF MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 221 REST OF MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 222 REST OF MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 223 REST OF MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 224 REST OF MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 225 REST OF MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 226 REST OF MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 227 LATIN AMERICA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 228 LATIN AMERICA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 229 LATIN AMERICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD MILLION)

- TABLE 230 LATIN AMERICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD MILLION)

- TABLE 231 LATIN AMERICA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 232 LATIN AMERICA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 233 LATIN AMERICA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 234 LATIN AMERICA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 235 LATIN AMERICA: AI DETECTOR MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 236 LATIN AMERICA: AI DETECTOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 237 BRAZIL: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 238 BRAZIL: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 239 BRAZIL: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 240 BRAZIL: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 241 BRAZIL: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 242 BRAZIL: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 243 BRAZIL: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 244 BRAZIL: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 245 MEXICO: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 246 MEXICO: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 247 MEXICO: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 248 MEXICO: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 249 MEXICO: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 250 MEXICO: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 251 MEXICO: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 252 MEXICO: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 253 REST OF LATIN AMERICA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 254 REST OF LATIN AMERICA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 255 REST OF LATIN AMERICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 256 REST OF LATIN AMERICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 257 REST OF LATIN AMERICA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 258 REST OF LATIN AMERICA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 259 REST OF LATIN AMERICA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 260 REST OF LATIN AMERICA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 261 OVERVIEW OF STRATEGIES ADOPTED BY KEY AI DETECTOR VENDORS, 2022-2025

- TABLE 262 AI DETECTOR MARKET: DEGREE OF COMPETITION

- TABLE 263 REGIONAL FOOTPRINT (18 COMPANIES), 2024

- TABLE 264 DETECTION MODALITY FOOTPRINT (18 COMPANIES), 2024

- TABLE 265 APPLICATION FOOTPRINT (18 COMPANIES), 2024

- TABLE 266 END USER FOOTPRINT (18 COMPANIES), 2024

- TABLE 267 AI DETECTOR MARKET: OTHER PLAYERS, 2024

- TABLE 268 AI DETECTOR MARKET: COMPETITIVE BENCHMARKING OF OTHER PLAYERS

- TABLE 269 AI DETECTOR MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2022-2025

- TABLE 270 AI DETECTOR MARKET: DEALS, 2022-2025

- TABLE 271 TURNITIN: COMPANY OVERVIEW

- TABLE 272 TURNITIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 TURNITIN: PRODUCT LAUNCHES

- TABLE 274 TURNITIN: DEALS

- TABLE 275 GRAMMARLY: COMPANY OVERVIEW

- TABLE 276 GRAMMARLY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 GRAMMARLY: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 278 GRAMMARLY: DEALS

- TABLE 279 HIVE MODERATION: COMPANY OVERVIEW

- TABLE 280 HIVE MODERATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 HIVE MODERATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 282 HIVE MODERATION: DEALS

- TABLE 283 COPYLEAKS: COMPANY OVERVIEW

- TABLE 284 COPYLEAKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 COPYLEAKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 286 COPYLEAKS: DEALS

- TABLE 287 QUILLBOT: COMPANY OVERVIEW

- TABLE 288 QUILLBOT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 QUILLBOT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 290 REALITY DEFENDER: COMPANY OVERVIEW

- TABLE 291 REALITY DEFENDER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 REALITY DEFENDER: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 293 REALITY DEFENDER: DEALS

- TABLE 294 ATTESTIV: COMPANY OVERVIEW

- TABLE 295 ATTESTIV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 ATTESTIV: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 297 ATTESTIV: DEALS

- TABLE 298 GPTZERO: COMPANY OVERVIEW

- TABLE 299 GPTZERO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 GPTZERO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 301 GPTZERO: DEALS

- TABLE 302 ORIGINALITY.AI: COMPANY OVERVIEW

- TABLE 303 ORIGINALITY.AI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 ORIGINALITY.AI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 305 ORIGINALITY.AI: DEALS

- TABLE 306 SIGHTENGINE: COMPANY OVERVIEW

- TABLE 307 SIGHTENGINE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 SIGHTENGINE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 309 SIGHTENGINE: DEALS

- TABLE 310 DEEPFAKE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 311 DEEPFAKE AI MARKET, BY OFFERING, 2025-2031 (USD MILLION)

- TABLE 312 DEEPFAKE AI MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 313 DEEPFAKE AI MARKET, BY TECHNOLOGY, 2025-2031 (USD MILLION)

- TABLE 314 DEEPFAKE AI MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 315 DEEPFAKE AI MARKET, BY VERTICAL, 2025-2031 (USD MILLION)

- TABLE 316 DEEPFAKE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 317 DEEPFAKE AI MARKET, BY REGION, 2025-2031 (USD MILLION)

- TABLE 318 ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2020-2024 (USD BILLION)

- TABLE 319 ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2025-2032 (USD BILLION)

- TABLE 320 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 321 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025-2032 (USD BILLION)

List of Figures

- FIGURE 1 AI DETECTOR MARKET: RESEARCH DESIGN

- FIGURE 2 AI DETECTOR MARKET: DATA TRIANGULATION

- FIGURE 3 AI DETECTOR MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1, BOTTOM-UP (SUPPLY-SIDE): REVENUE FROM PLATFORMS AND API/SDKS IN AI DETECTOR MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM KEY COMPANIES IN AI DETECTOR MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM BUSINESS UNITS (BU) OF KEY VENDORS IN AI DETECTOR MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF AI DETECTOR THROUGH OVERALL IT SPENDING ON AI DETECTOR SOLUTIONS

- FIGURE 8 PLATFORMS SEGMENT TO HOLD LARGEST MARKET SIZE IN 2025

- FIGURE 9 AI-GENERATED TEXT SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 10 ACADEMIC INTEGRITY SEGMENT TO HOLD LARGEST MARKET SIZE IN 2025

- FIGURE 11 HEALTHCARE & LIFE SCIENCES TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO REGISTER FASTEST GROWTH BETWEEN 2025 AND 2030

- FIGURE 13 RAPID AI & COMPUTER-VISION ADVANCEMENTS AND EXPANSIVE DEPLOYMENT ACROSS INDUSTRIES IN ASIA PACIFIC TO DRIVE AI DETECTOR MARKET GROWTH

- FIGURE 14 DEEPFAKE AND SYNTHETIC MEDIA DETECTION SEGMENT TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 15 PLATFORMS AND AI-GENERATED TEXT TO BE LARGEST SHAREHOLDERS IN NORTH AMERICAN AI DETECTOR MARKET IN 2025

- FIGURE 16 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 17 AI DETECTOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 EVOLUTION OF AI DETECTORS

- FIGURE 19 AI DETECTOR MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 20 KEY PLAYERS IN AI DETECTOR MARKET ECOSYSTEM

- FIGURE 21 AI DETECTOR MARKET: INVESTMENT LANDSCAPE AND FUNDING SCENARIO (USD MILLION AND NUMBER OF FUNDING ROUNDS)

- FIGURE 22 NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2016-2025

- FIGURE 23 REGIONAL ANALYSIS OF PATENTS GRANTED, 2016-2025

- FIGURE 24 AI DETECTOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 28 API/SDKS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 29 AI-GENERATED AUDIO & VOICE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 DEEPFAKE AND SYNTHETIC MEDIA DETECTION SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 HEALTHCARE & LIFE SCIENCES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 INDIA TO REGISTER HIGHEST GROWTH RATE IN AI DETECTOR MARKET DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: AI DETECTOR MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: AI DETECTOR MARKET SNAPSHOT

- FIGURE 36 SHARE OF LEADING COMPANIES IN AI DETECTOR MARKET, 2024

- FIGURE 37 PRODUCT COMPARATIVE ANALYSIS, BY AI CONTENT DETECTOR PROVIDER

- FIGURE 38 PRODUCT COMPARATIVE ANALYSIS, BY DEEPFAKE DETECTION ASSISTANT PROVIDER

- FIGURE 39 AI DETECTOR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 40 COMPANY FOOTPRINT (18 COMPANIES), 2024

- FIGURE 41 AI DETECTOR MARKET: COMPANY EVALUATION MATRIX (OTHER PLAYERS), 2024