|

市場調查報告書

商品編碼

1808089

全球網路 API 市場(按 API 類型、應用程式和產業分類)- 預測至 2030 年Network API Market by API Type (Device Status, Identity, Location, Network Performance), Application (IoT, Priority Communication, Anti-fraud, Entertainment & Content Distribution, Enterprise IT, Autonomous Vehicles), Vertical - Global Forecast to 2030 |

||||||

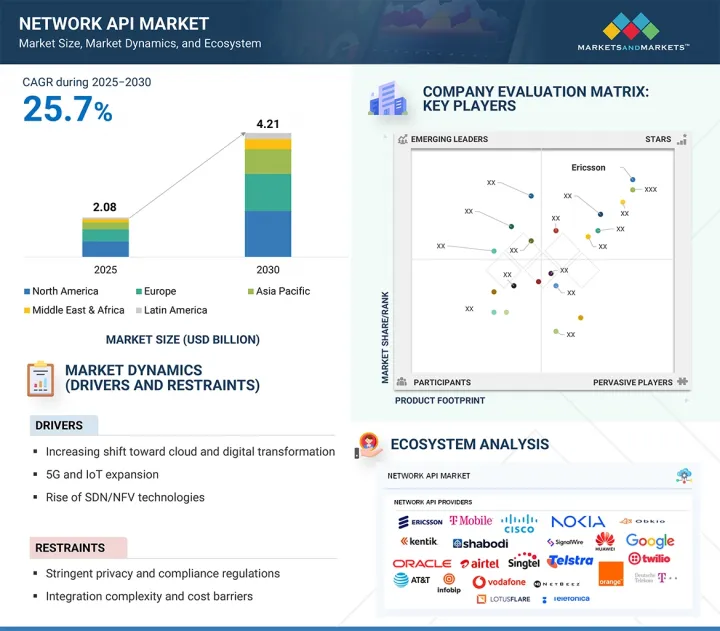

預計 2025 年全球網路 API 市值將達到 19.6 億美元,到 2030 年將達到 61.3 億美元,2025 年至 2030 年的複合年成長率為 25.7%。

在可程式化、隨選連線的推動下,市場正迅速從實驗階段走向商業化。與傳統的整合模式不同,網路 API 以標準化、開發者友善的格式提供設備狀態、位置、邊緣運算和策略控制等即時功能。這種轉變使企業能夠像使用雲端基礎設施一樣輕鬆地使用網路服務,從而降低複雜性,並解鎖物聯網、自主移動旅行、延展實境 (XR) 和安全數位交易等新用例。

| 調查範圍 | |

|---|---|

| 調查年份 | 2025-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 百萬/十億美元 |

| 部分 | API類型、應用程式、產業、地區 |

| 目標區域 | 北美、歐洲、亞太地區、中東和非洲、拉丁美洲 |

CAMARA 和開放式閘道器等計畫的興起確保了營運商之間的互通性,使企業能夠實現全球可程式性,而不是孤立的部署。隨著網路日益軟體定義化,API 正在從可選的附加元件演變為必不可少的業務賦能器。未來五年的成長將由企業對敏捷性的需求、新的營運商收益模式以及人工智慧驅動的自動化與網路可程式化的融合所推動。

儘管網路 API 市場成長潛力巨大,但它仍面臨著許多限制因素,例如整合複雜度、營運商標準化程度有限以及高昂的實施成本。企業往往難以應對難以輕鬆使用 API 的舊有系統,而對 API 安全性、延遲保證和收益模式的擔憂也阻礙了 API 的廣泛應用。

根據應用,預計物聯網領域將在預測期內佔據最大的市場規模。

物聯網是網路 API 市場最大的應用,企業需要為數十億台設備提供可擴展、安全、即時的連接。用於設備狀態、策略控制和分析的 API 使公司能夠以無與倫比的精度管理其物聯網生態系統。 2024 年 11 月,NTT Docomo 將符合 CAMARA 標準的 API 整合到其位於日本的 5G 物聯網平台中,取得了突破性進展,使企業能夠動態監控設備效能並在大規模物聯網部署中實施網路策略。這對於智慧製造、物流和公共產業等行業至關重要,因為這些行業的延遲和可靠性會直接影響營運。透過將 API 整合到物聯網解決方案中,營運商正在開闢新的收益途徑,企業也正在獲得大規模的控制力和可視性。

根據 API 類型,邊緣部分預計在預測期內實現最快的成長率。

邊緣 API 正在成為網路 API 市場的關鍵戰場,使企業能夠提供需要超低延遲和本地運算能力的體驗。邊緣 API 使開發人員能夠無縫利用分散式基礎架構、編配工作負載並最佳化效能,而無需深厚的通訊專業知識。 2024 年 10 月,新加坡電信 (Singtel) 和 Bridge Alliance 合作,在亞太地區擴展 API Exchange,為企業和開發人員提供標準化的邊緣 API。此次擴展使智慧城市和物流應用供應商能夠直接存取邊緣基礎架構,以實現對延遲敏感的用例,例如自主無人機和交通管理。透過抽象網路資源的複雜性,此部署使邊緣功能可編程且可擴展。隨著企業將工作負載推向邊緣,API 將成為從交通到娛樂等各個領域實現收益、效率和創新的關鍵。

本報告研究了全球網路 API 市場,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 網路 API 市場為企業帶來誘人機會

- 北美網路 API 市場(按 API 類型和國家分類)

- 按 API 類型分類的網路 API 市場

- 按行業分類的網路 API 市場

- 網路 API 市場(按應用)

第5章市場概況與產業趨勢(具有定量意義的策略促進因素)

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 價值鏈分析

- 生態系分析

- 案例研究

- 諾基亞和德國電信 (DT) 利用 NETWORK AS CODE 的 5G 功能突破無人機操作的界限

- 中國電信透過QOD API和CNOS架構賦能企業

- ORANGE 透過 CAMARA API 消除對 DIDIT 的 OTP 依賴並增強數位身分安全

- 波特五力分析

- 主要相關利益者和採購標準

- 專利分析

- 影響客戶業務的趨勢/中斷

- 定價分析

- 各 API 類型主要企業平均銷售價格(2024 年)

- 主要企業參考價格分析(2024年)

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 監管格局

- 監管機構、政府機構和其他組織

- 主要法規

- 大型會議和活動(2025-2026年)

- 網路API市場技術藍圖

- 短期藍圖(2025-2026)

- 中期藍圖(2027-2028)

- 長期藍圖(2028-2030)

- 網路 API 市場的最佳實踐

- 採用 JSON 進行資料交換

- 不要在 URL 中使用動詞

- 實作 API 版本控制

- 安全身份驗證和核准實施

- 所有資料傳輸均經過加密

- 速率限制和節流

- 日誌記錄、監控和審核

- 定期進行安全測試

- GSMA開放閘道器和CAMARA計劃

- 當前和新興的經營模式經營模式

- 網路 API 市場中使用的工具、框架和技術

- 投資金籌措場景

- 人工智慧/生成式人工智慧對網路 API 市場的影響

- 2025年美國關稅的影響 - 網路API市場

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對國家的影響

- 對終端產業的影響

第6章:按 API 類型分類的網路 API 市場(市場規模與預測,到 2030 年)

- 介紹

- 設備狀態

- 邊緣

- 鑑別

- 位置

- 網路效能

- 其他 API 類型

第7章 網路 API 市場應用(市場規模與預測,到 2030 年)

- 介紹

- IoT

- 優先通訊

- 自動駕駛汽車

- 預防詐欺

- 娛樂和內容傳送

- 企業IT

- 其他用途

第 8 章 按行業分類的網路 API 市場(市場規模和預測,到 2030 年)

- 介紹

- BFSI

- 資訊科技/資訊科技服務

- 通訊

- 政府/公共部門

- 製造業

- 醫學與生命科學

- 零售與電子商務

- 媒體與娛樂

- 其他行業

第9章 網路 API 市場(按地區分類) (市場規模和預測,到 2030 年)

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 歐洲宏觀經濟展望

- 英國

- 德國

- 法國

- 西班牙

- 俄羅斯

- 義大利

- 北歐國家

- 其他歐洲國家

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 韓國

- 東南亞

- 其他亞太地區

- 中東和非洲

- 中東和非洲的宏觀經濟展望

- 中東

- 非洲

- 拉丁美洲

- 拉丁美洲宏觀經濟展望

- 巴西

- 墨西哥

- 其他拉丁美洲

第10章 競爭格局

- 介紹

- 主要參與企業的策略/優勢(2023-2025)

- 市場佔有率分析(2024年)

- 收益分析(2024年)

- 品牌/產品比較

- 公司估值及財務指標

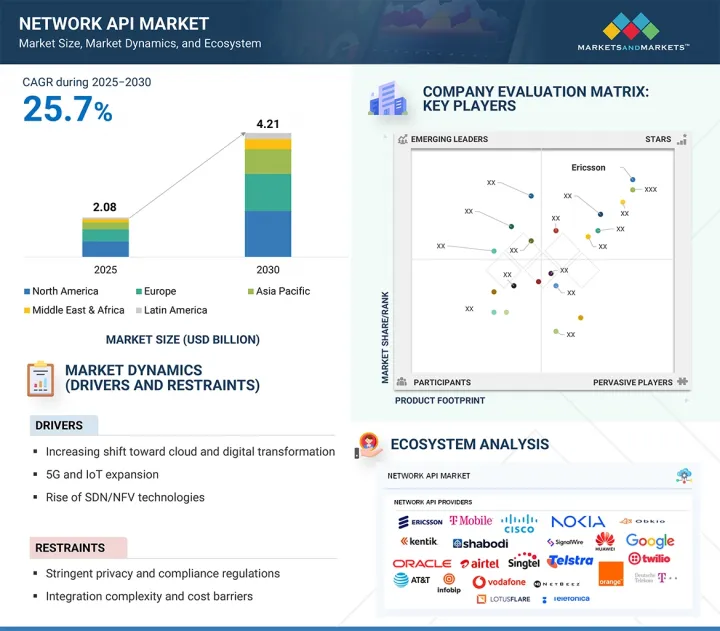

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 競爭場景

第11章:公司簡介

- 主要企業

- ERICSSON

- CISCO

- NOKIA

- MICROSOFT

- T-MOBILE

- AT&T

- ORANGE

- DEUTSCHE TELEKOM

- VODAFONE

- TELEFONICA

- 其他公司

- SINGTEL

- TELSTRA

- BHARTI AIRTEL

- HUAWEI

- ORACLE

- INFOBIP

- Start-Ups/中小型企業

- KENTIK

- OBKIO

- NETBEEZ

- GRAPHIANT

- ALKIRA

- SHABODI

- LOTUSFLARE

- PHOENIXNAP

第 12 章:相鄰/相關市場

- 介紹

- API管理市場

- 市場定義

- 市場概覽

- API 管理市場:按產品

- API 管理市場(按平台)

- API 管理市場:依組織規模

- 按開發類型分類的 API 管理市場

- API 管理市場:按行業

- API 管理市場:按地區

- iPaaS(整合平台即服務)市場

- 市場定義

- 市場概覽

- iPaaS(整合平台即服務)市場(依服務類型)

- iPaaS(整合平台即服務)市場(依部署模式)

- iPaaS(整合平台即服務)市場:依組織規模

- iPaaS(整合平台即服務)市場(按行業)

- iPaaS(整合平台即服務)市場(按地區)

第13章 附錄

The network API market is estimated to be USD 1.96 billion in 2025 and is projected to reach USD 6.13 billion by 2030, at a CAGR of 25.7% from 2025 to 2030. The market is rapidly moving from experimentation to commercialization, driven by the push for programmable, on-demand connectivity across industries. Unlike traditional integration models, network APIs expose real-time capabilities such as device status, location, edge computing, and policy control in a standardized, developer-friendly format. This shift is enabling enterprises to consume network services as easily as cloud infrastructure, reducing complexity while unlocking new applications in IoT, autonomous mobility, extended reality, and secure digital transactions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | API type, application, vertical, and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The rise of initiatives like CAMARA and Open Gateway is ensuring interoperability across operators, giving enterprises global-scale programmability instead of siloed deployments. As networks become increasingly software-defined, APIs are evolving from optional add-ons to essential business enablers. Over the next five years, growth will be fueled by enterprise demand for agility, new monetization models for operators, and the convergence of AI-driven automation with network programmability.

Despite strong growth potential, the network API market faces constraints such as integration complexity, limited standardization across operators, and high implementation costs. Enterprises often struggle with legacy systems that cannot easily consume APIs, while concerns around API security, latency guarantees, and monetization models slow adoption at scale.

By application, the IoT segment is estimated to account for the largest market size during the forecast period

The Internet of Things (IoT) is the largest application of the network API market, as enterprises demand scalable, secure, and real-time connectivity for billions of devices. APIs for device status, policy control, and analytics are enabling enterprises to manage IoT ecosystems with unmatched precision. A breakthrough came in November 2024, when NTT Docomo integrated CAMARA-compliant APIs into its 5G IoT platform in Japan, allowing enterprises to dynamically monitor device performance and enforce network policies across massive IoT deployments. This is critical for industries like smart manufacturing, logistics, and utilities, where latency and reliability directly impact operations. By embedding APIs into IoT solutions, operators are unlocking new monetization pathways while enterprises gain control and visibility at scale.

By API type, the edge segment is expected to register the fastest growth rate during the forecast period

The edge API is emerging as a critical battleground in the network API market, enabling enterprises to deliver experiences that demand ultra-low latency and local compute power. Edge APIs allow developers to seamlessly tap into distributed infrastructure, orchestrate workloads, and optimize performance without needing deep telecom expertise. In October 2024, Singtel and Bridge Alliance partnered to expand their API Exchange across the Asia Pacific, providing standardized edge APIs to enterprises and developers. This expansion gave application providers in smart cities and logistics direct access to edge infrastructure for latency-sensitive use cases such as autonomous drones and traffic management. By abstracting the complexity of network resources, this rollout makes edge capabilities programmable and consumable at scale. As enterprises push workloads to the edge, APIs will be the key to unlocking monetization, efficiency, and innovation across sectors from transportation to entertainment.

North America leads in market share, while Asia Pacific is expected to be the fastest-growing regional market during the forecast period

The Network API market in North America and the Asia Pacific is dynamically shaping the global digital landscape through rapid adoption, innovation, and infrastructure advancements. North America, with its mature telecommunications ecosystem and extensive 5G rollout, spearheads enterprise adoption of programmable networks, enabling scalable IoT, edge computing, and secure API integration across industries such as healthcare, finance, and smart cities. At the same time, Asia Pacific stands out as the fastest-growing market, driven by aggressive government initiatives, massive 5G deployments, and expanding private network ecosystems. The Asia Pacific region leverages network APIs extensively across manufacturing, autonomous vehicles, and smart urban infrastructure, fueling digital transformation at an unprecedented pace. Together, these regions exemplify a complementary growth narrative: North America leads in technological maturity and use case diversity, while Asia Pacific delivers scale and acceleration through innovative, large-scale deployments. This synergistic growth positions both markets as critical pillars in the worldwide expansion of network API ecosystems, setting a robust foundation for next-generation connectivity and digital services.

Breakdown of Primary Interviews

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The breakdown of the primary interviews is as follows:

- By Company Type: Tier 1 - 39%, Tier 2 - 26%, and Tier 3 - 35%

- By Designation: C-level - 27%, Directors - 39%, and Others - 34%

- By Region: North America - 39%, Europe - 25%, Asia Pacific - 19%, Rest of the World - 17%

The major players in the network API market are Ericsson (Sweden), Nokia (Finland), Cisco (US), Microsoft (US), T-Mobile (US), AT&T (US), Orange (France), Deutsche Telekom (Germany), Vodafone (UK), Telefonica (Spain), Singtel (Singapore), Telstra (Australia), Huawei (China), Oracle (US), Bharti Airtel (India), and Infobip (Croatia). These players have adopted various growth strategies, such as partnerships, agreements, collaborations, product launches, product enhancements, and acquisitions, to expand their footprint in the network API market.

Research Coverage

The market study covers the network API market size and the growth potential across different segments, including API Type (Device Status, Edge, Identity, Location, Network Performance, Other API Types), Application (IoT, Priority Communication, Autonomous Vehicles, Anti-fraud, Entertainment & Content Distribution, Enterprise IT, Other Applications), Vertical (BFSI, IT & ITeS, Telecom, Government & Public Sector, Manufacturing, Healthcare & Life Sciences, Retail & E-commerce, Media & Entertainment, Other Verticals), and Region. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global network API market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (increasing shift toward cloud and digital transformation, 5G and IoT expansion, rise of SDN/NFV technologies), restraints (stringent privacy and compliance regulations, integration complexity and cost barriers), opportunities (growing demand for real-time data and services, monetization of network-as-a-service), challenges (scalability and SLA assurance, rising complexity of API security and cyber threats).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the network API market

- Market Development: Comprehensive information about lucrative markets - analyzing the network API market across various regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the network API market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Ericsson (Sweden), Nokia (Finland), Cisco (US), Microsoft (US), T-Mobile (US), AT&T (US), Orange (France), Deutsche Telekom (Germany), Vodafone (UK), Telefonica (Spain), Singtel (Singapore), Telstra (Australia), Huawei (China), Oracle (US), Bharti Airtel (India), and Infobip (Croatia).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Primary sources

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NETWORK API MARKET

- 4.2 NORTH AMERICA: NETWORK API MARKET, BY API TYPE AND COUNTRY

- 4.3 NETWORK API MARKET, BY API TYPE

- 4.4 NETWORK API MARKET, BY VERTICAL

- 4.5 NETWORK API MARKET, BY APPLICATION

5 MARKET OVERVIEW AND INDUSTRY TRENDS (STRATEGIC DRIVERS WITH QUANTITATIVE IMPLICATIONS)

Unpacking the Forces Shaping network API Adoption & Future Growth Opportunities

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing shift toward cloud and digital transformation

- 5.2.1.2 5G and IoT expansion

- 5.2.1.3 Rise of SDN/NFV technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent privacy and compliance regulations

- 5.2.2.2 Integration complexity and cost barriers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for real-time data and services

- 5.2.3.2 Monetization of Network-as-a-Service

- 5.2.4 CHALLENGES

- 5.2.4.1 Scalability & SLA assurance

- 5.2.4.2 Rising complexity of API security and cyber threats

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 CASE STUDIES

- 5.5.1 NOKIA AND DEUTSCHE TELEKOM (DT) PUSH BOUNDARIES OF DRONE OPERATIONS USING NETWORK AS CODE'S 5G CAPABILITIES

- 5.5.2 CHINA TELECOM EMPOWERS ENTERPRISES WITH QOD APIS AND CNOS ARCHITECTURE

- 5.5.3 ORANGE ENABLES DIDIT ELIMINATE OTP DEPENDENCY AND STRENGTHEN DIGITAL IDENTITY SECURITY VIA CAMARA APIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF BUYERS

- 5.6.4 BARGAINING POWER OF SUPPLIERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.7.2 BUYING CRITERIA

- 5.8 PATENT ANALYSIS

- 5.8.1 METHODOLOGY

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY API TYPE, 2024

- 5.10.2 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, 2024

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 OpenAPI/Swagger

- 5.11.1.2 gRPC with Protocol Buffers

- 5.11.1.3 NETCONF/RESTCONF

- 5.11.1.4 YANG data models

- 5.11.1.5 gNMI (gRPC network management interface)

- 5.11.1.6 API gateways (e.g., Kong, Apigee Edge)

- 5.11.1.7 OAuth 2.0/OpenID Connect

- 5.11.1.8 Event-driven Webhooks/Kafka Topics

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Service mesh (Istio, Linkerd)

- 5.11.2.2 API lifecycle management platforms

- 5.11.2.3 Network function virtualization (NFV) orchestration

- 5.11.2.4 SDN controllers (OpenDaylight, ONOS)

- 5.11.2.5 Telemetry analytics engines (Prometheus, InfluxDB)

- 5.11.2.6 Policy-control engines (PCRF/PCF)

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 OSS/BSS integration platforms

- 5.11.3.2 Edge orchestration frameworks (KubeEdge, OpenNESS)

- 5.11.3.3 IoT device management platforms

- 5.11.3.4 Zero-trust network access (ZTNA) gateways

- 5.11.3.5 Intent-based networking engines

- 5.11.3.6 Network assurance & digital twin tools

- 5.11.1 KEY TECHNOLOGIES

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 KEY REGULATIONS

- 5.12.2.1 North America

- 5.12.2.1.1 US

- 5.12.2.2 Europe

- 5.12.2.3 Asia Pacific

- 5.12.2.3.1 India

- 5.12.2.4 Middle East & Africa

- 5.12.2.4.1 UAE

- 5.12.2.5 Latin America

- 5.12.2.5.1 Brazil

- 5.12.2.5.2 Mexico

- 5.12.2.1 North America

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 TECHNOLOGY ROADMAP FOR NETWORK API MARKET

- 5.14.1 SHORT-TERM ROADMAP (2025-2026)

- 5.14.2 MID-TERM ROADMAP (2027-2028)

- 5.14.3 LONG-TERM ROADMAP (2028-2030)

- 5.15 BEST PRACTICES IN NETWORK API MARKET

- 5.15.1 ADOPT JSON FOR DATA EXCHANGE

- 5.15.2 AVOID VERBS IN URLS

- 5.15.3 IMPLEMENT API VERSIONING

- 5.15.4 ENFORCE SECURE AUTHENTICATION AND AUTHORIZATION

- 5.15.5 ENCRYPT ALL DATA TRANSMISSION

- 5.15.6 RATE LIMITING AND THROTTLING

- 5.15.7 LOGGING, MONITORING, AND AUDITING

- 5.15.8 CONDUCT REGULAR SECURITY TESTING

- 5.16 GSMA OPEN GATEWAY AND CAMARA INITIATIVES

- 5.17 CURRENT AND EMERGING BUSINESS MODELS

- 5.18 TOOLS, FRAMEWORKS, AND TECHNIQUES USED IN NETWORK API MARKET

- 5.19 INVESTMENT AND FUNDING SCENARIO

- 5.20 IMPACT OF AI/GENERATIVE AI ON NETWORK API MARKET

- 5.20.1 IMPACT OF GENERATIVE AI IN NETWORK API

- 5.21 IMPACT OF 2025 US TARIFF - NETWORK API MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON COUNTRY/REGION

- 5.21.4.1 US

- 5.21.4.2 Europe

- 5.21.4.3 Asia Pacific

- 5.21.5 IMPACT ON END-USE INDUSTRIES

6 NETWORK API MARKET, BY API TYPE (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across network API device status, edge, identity, location, network performance, other API types

- 6.1 INTRODUCTION

- 6.1.1 API TYPE: MARKET DRIVERS

- 6.2 DEVICE STATUS

- 6.2.1 NEED FOR REAL-TIME VISIBILITY AND MANAGEMENT CAPABILITIES TO DRIVE DEMAND

- 6.3 EDGE

- 6.3.1 ULTRA-LOW LATENCY WORKFLOWS TO SPUR EDGE API ADOPTION

- 6.4 IDENTITY

- 6.4.1 INTEGRATION OF REAL-TIME NUMBER VERIFICATION TO DRIVE DEMAND FOR IDENTITY APIS

- 6.5 LOCATION

- 6.5.1 NETWORK-BASED GEOFENCING TO DRIVE DEMAND

- 6.6 NETWORK PERFORMANCE

- 6.6.1 ON-DEMAND QUALITY OF SERVICE TO INCREASE ADOPTION

- 6.7 OTHER API TYPES

7 NETWORK API MARKET, BY APPLICATION (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across network API applications

- 7.1 INTRODUCTION

- 7.1.1 APPLICATION: MARKET DRIVERS

- 7.2 IOT

- 7.2.1 AUTOMATING SIM ACTIVATION AND CONFIGURATION VIA SINGLE API ACCELERATES LARGE-SCALE IOT ROLLOUTS

- 7.3 PRIORITY COMMUNICATION

- 7.3.1 EMBEDDING AUTOMATED PRIORITY-CHANNEL RESERVATION TO DRIVE DEMAND FOR PRIORITY COMMUNICATION

- 7.4 AUTONOMOUS VEHICLES

- 7.4.1 ON-THE-FLY ALLOCATION OF DEDICATED NETWORK SLICES VIA API ENABLES RELIABLE TELEOPERATION AND REMOTE CONTROL

- 7.5 ANTI-FRAUD

- 7.5.1 INCORPORATING NETWORK-SIDE IDENTITY VALIDATION INTO TRANSACTION FLOWS VIA API DRAMATICALLY CUTS FRAUD RATES

- 7.6 ENTERTAINMENT & CONTENT DISTRIBUTION

- 7.6.1 EDGE-POWERED ADAPTIVE STREAMING TO DRIVE MARKET

- 7.7 ENTERPRISE IT

- 7.7.1 SINGLE API GATEWAY TO UNIFY MULTI-NETWORK CONNECTIVITY

- 7.8 OTHER APPLICATIONS

8 NETWORK API MARKET, BY VERTICAL (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across network API vertical

- 8.1 INTRODUCTION

- 8.1.1 VERTICAL: MARKET DRIVERS

- 8.2 BFSI

- 8.2.1 MANDATORY API-DRIVEN TRANSACTION AUTHENTICATION TO DRIVE MARKET

- 8.3 IT & ITES

- 8.3.1 ACCELERATION OF APP-TO-NETWORK INTEGRATION TO DRIVE DEMAND

- 8.4 TELECOM

- 8.4.1 MONETIZED NETWORK SLICES THROUGH SELF-SERVICE APIS TO SPUR MARKET

- 8.5 GOVERNMENT & PUBLIC SECTOR

- 8.5.1 STANDARDIZATION OF APIS TO DRIVE MARKET

- 8.6 MANUFACTURING

- 8.6.1 INTEGRATION OF PRECISION INDOOR POSITIONING APIS TO DRIVE SEGMENT

- 8.7 HEALTHCARE & LIFESCIENCES

- 8.7.1 DEMAND FOR NETWORK PERFORMANCE APIS IN TELEHEALTH APPLICATIONS TO DRIVE MARKET

- 8.8 RETAIL & E-COMMERCE

- 8.8.1 DEMAND FOR REAL-TIME LOCATION-BASED PERSONALIZATION TO DRIVE MARKET

- 8.9 MEDIA & ENTERTAINMENT

- 8.9.1 NEED FOR SEAMLESS STREAMING EXPERIENCES TO INCREASE NETWORK API ADOPTION

- 8.10 OTHER VERTICALS

9 NETWORK API MARKET, BY REGION (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Regional market sizing, forecasts, and regulatory landscapes

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Increasing focus on 5G-driven API innovation to drive market

- 9.2.3 CANADA

- 9.2.3.1 Accelerating IoT and digital transformation to drive market

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 UK

- 9.3.2.1 Focus on network API leadership with developer-centric innovation to drive market

- 9.3.3 GERMANY

- 9.3.3.1 Open Gateway to fuel market with identity & QoS APIs

- 9.3.4 FRANCE

- 9.3.4.1 GSMA Open Gateway initiative and Aduna alliance to expand network API ecosystem

- 9.3.5 SPAIN

- 9.3.5.1 Focus on smart city innovations via API integration to drive market

- 9.3.6 RUSSIA

- 9.3.6.1 Emergence of network API landscape with gradual 5G expansion to drive market

- 9.3.7 ITALY

- 9.3.7.1 Advancements in 5G infrastructure and government-led digitization programs to drive market

- 9.3.8 NORDIC COUNTRIES

- 9.3.8.1 Maturing 5G infrastructure to enable API-driven smart applications

- 9.3.9 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Focus on OTP API commercialization for digital security to drive market

- 9.4.3 JAPAN

- 9.4.3.1 Accelerating network API revolution with Aduna partnerships

- 9.4.4 INDIA

- 9.4.4.1 Widespread 4G/5G adoption and initiatives by Reliance Jio and Bharti Airtel to drive market

- 9.4.5 AUSTRALIA AND NEW ZEALAND

- 9.4.5.1 High smartphone penetration and thriving digital economy to fuel market

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Proactive involvement in global collaborations for unified open API framework to drive market

- 9.4.7 SOUTHEAST ASIA

- 9.4.7.1 Advancements in digital infrastructure to accelerate network API integration

- 9.4.8 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 MIDDLE EAST

- 9.5.2.1 KSA

- 9.5.2.1.1 Vision 2030 to spur leadership in network API innovation

- 9.5.2.2 UAE

- 9.5.2.2.1 Global standards adoption to fuel API-driven innovation

- 9.5.2.3 KUWAIT

- 9.5.2.3.1 Expanding digital services to accelerate API adoption

- 9.5.2.4 BAHRAIN

- 9.5.2.4.1 Progressive digital agenda and rising demand for enterprise-grade connectivity to drive market

- 9.5.2.5 Rest of Middle East

- 9.5.2.1 KSA

- 9.5.3 AFRICA

- 9.5.3.1 Increasing focus on fintech and e-health to drive market

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Strong market momentum to drive network API innovations

- 9.6.3 MEXICO

- 9.6.3.1 Growing digital economy and global collaborations to drive market

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

Strategic Profiles of Leading Players & Their Playbooks for Market Dominance

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 10.3 MARKET SHARE ANALYSIS, 2024

- 10.4 REVENUE ANALYSIS, 2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.6 COMPANY VALUATION AND FINANCIAL METRICS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 API type footprint

- 10.7.5.4 Application footprint

- 10.7.5.5 Vertical footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 10.9.2 DEALS

11 COMPANY PROFILES

In-depth look at their Strengths, Weaknesses, Product Portfolios, Recent Developments, and Strategic Moves

- 11.1 KEY PLAYERS

- 11.1.1 ERICSSON

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches and enhancements

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 CISCO

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches and enhancements

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 NOKIA

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches and enhancements

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 MICROSOFT

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches and enhancements

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 T-MOBILE

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches and enhancements

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 AT&T

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches and enhancements

- 11.1.7 ORANGE

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches and enhancements

- 11.1.7.3.2 Deals

- 11.1.8 DEUTSCHE TELEKOM

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches and enhancements

- 11.1.8.3.2 Deals

- 11.1.9 VODAFONE

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.10 TELEFONICA

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.1 ERICSSON

- 11.2 OTHER PLAYERS

- 11.2.1 SINGTEL

- 11.2.2 TELSTRA

- 11.2.3 BHARTI AIRTEL

- 11.2.4 HUAWEI

- 11.2.5 ORACLE

- 11.2.6 INFOBIP

- 11.3 STARTUPS/SMES

- 11.3.1 KENTIK

- 11.3.2 OBKIO

- 11.3.3 NETBEEZ

- 11.3.4 GRAPHIANT

- 11.3.5 ALKIRA

- 11.3.6 SHABODI

- 11.3.7 LOTUSFLARE

- 11.3.8 PHOENIXNAP

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 API MANAGEMENT MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 API MANAGEMENT MARKET, BY OFFERING

- 12.2.4 API MANAGEMENT MARKET, BY PLATFORM

- 12.2.5 API MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 12.2.6 API MANAGEMENT MARKET, BY DEVELOPMENT TYPE

- 12.2.7 API MANAGEMENT MARKET, BY VERTICAL

- 12.2.8 API MANAGEMENT MARKET, BY REGION

- 12.3 INTEGRATION PLATFORM AS A SERVICE MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 INTEGRATION PLATFORM AS A SERVICE MARKET, BY SERVICE TYPE

- 12.3.4 INTEGRATION PLATFORM AS A SERVICE MARKET, BY DEPLOYMENT MODEL

- 12.3.5 INTEGRATION PLATFORM AS A SERVICE MARKET, BY ORGANIZATION SIZE

- 12.3.6 INTEGRATION PLATFORM AS A SERVICE MARKET, BY VERTICAL

- 12.3.7 INTEGRATION PLATFORM AS A SERVICE MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 NETWORK API MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 IMPACT OF PORTER'S FIVE FORCES ON NETWORK API MARKET

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 7 LIST OF PATENTS IN NETWORK API MARKET, 2023-2025

- TABLE 8 AVERAGE SELLING PRICE OF KEY PLAYERS, BY API TYPE, 2024

- TABLE 9 INDICATIVE PRICING ANALYSIS, BY API TYPE, 2024

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NETWORK API MARKET: KEY CONFERENCES AND EVENTS, 2025

- TABLE 15 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 16 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKETS DUE TO TARIFF IMPACT

- TABLE 17 NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 18 DEVICE STATUS: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 19 EDGE: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 20 IDENTITY: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 21 LOCATION: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 22 NETWORK PERFORMANCE: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23 OTHER API TYPES: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 25 IOT: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 PRIORITY COMMUNICATION: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 AUTONOMOUS VEHICLES: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 ANTI-FRAUD: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 ENTERTAINMENT & CONTENT DISTRIBUTION: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 ENTERPRISE IT: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 OTHER APPLICATIONS: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 33 BFSI: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 IT & ITES: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 TELECOM: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 GOVERNMENT & PUBLIC SECTOR: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 MANUFACTURING: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 HEALTHCARE & LIFESCIENCES: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 RETAIL & E-COMMERCE: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 MEDIA & ENTERTAINMENT: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 OTHER VERTICALS: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 NORTH AMERICA: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 44 NORTH AMERICA: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: NETWORK API MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 47 US: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 48 US: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 49 US: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 50 EUROPE: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 51 EUROPE: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 52 EUROPE: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 53 EUROPE: NETWORK API MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 54 UK: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 55 UK: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 56 UK: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 57 GERMANY: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 58 GERMANY: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 59 GERMANY: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 60 FRANCE: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 61 FRANCE: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 62 FRANCE: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 63 SPAIN: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 64 SPAIN: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 65 SPAIN: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 66 RUSSIA: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 67 RUSSIA: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 68 RUSSIA: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 69 ASIA PACIFIC: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 70 ASIA PACIFIC: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 71 ASIA PACIFIC: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 72 ASIA PACIFIC: NETWORK API MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 CHINA: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 74 CHINA: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 75 CHINA: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 76 JAPAN: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 77 JAPAN: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 78 JAPAN: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 79 INDIA: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 80 INDIA: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 81 INDIA: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 82 MIDDLE EAST & AFRICA: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 83 MIDDLE EAST & AFRICA: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 84 MIDDLE EAST & AFRICA: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 85 MIDDLE EAST & AFRICA: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 MIDDLE EAST: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 87 MIDDLE EAST: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 88 MIDDLE EAST: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 89 MIDDLE EAST: NETWORK API MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 LATIN AMERICA: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 91 LATIN AMERICA: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 92 LATIN AMERICA: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 93 LATIN AMERICA: NETWORK API MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 94 BRAZIL: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 95 BRAZIL: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 96 BRAZIL: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 97 OVERVIEW OF STRATEGIES DEPLOYED BY KEY NETWORK API MARKET PLAYERS, 2023-APRIL 2025

- TABLE 98 NETWORK API MARKET: DEGREE OF COMPETITION

- TABLE 99 NETWORK API MARKET: REGION FOOTPRINT

- TABLE 100 NETWORK API MARKET: API TYPE FOOTPRINT

- TABLE 101 NETWORK API MARKET: APPLICATION FOOTPRINT

- TABLE 102 NETWORK API MARKET: VERTICAL FOOTPRINT

- TABLE 103 NETWORK API MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 104 NETWORK API MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 105 NETWORK API MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, FEBRUAY 2023-JULY 2025

- TABLE 106 NETWORK API MARKET: DEALS, 2023-JULY 2025

- TABLE 107 ERICSSON: COMPANY OVERVIEW

- TABLE 108 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 109 ERICSSON: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 110 ERICSSON: DEALS

- TABLE 111 CISCO: COMPANY OVERVIEW

- TABLE 112 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 113 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 114 NOKIA: COMPANY OVERVIEW

- TABLE 115 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 116 NOKIA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 117 NOKIA: DEALS

- TABLE 118 MICROSOFT: COMPANY OVERVIEW

- TABLE 119 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 120 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 121 T-MOBILE: COMPANY OVERVIEW

- TABLE 122 T-MOBILE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 123 T-MOBILE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 124 AT&T: COMPANY OVERVIEW

- TABLE 125 AT&T: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 AT&T: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 127 ORANGE: COMPANY OVERVIEW

- TABLE 128 ORANGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 ORANGE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 130 ORANGE: DEALS

- TABLE 131 DEUTSCHE TELEKOM: COMPANY OVERVIEW

- TABLE 132 DEUTSCHE TELEKOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 DEUTSCHE TELEKOM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 134 DEUTSCHE TELEKOM: DEALS

- TABLE 135 VODAFONE: COMPANY OVERVIEW

- TABLE 136 VODAFONE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 VODAFONE: DEALS

- TABLE 138 TELEFONICA: COMPANY OVERVIEW

- TABLE 139 TELEFONICA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 API MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 141 API MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 142 API MANAGEMENT PLATFORMS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 143 API MANAGEMENT PLATFORMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 144 API MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 145 API MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 146 API MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 147 API MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 148 API MANAGEMENT MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 149 API MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 150 API MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 151 API MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 152 INTEGRATION PLATFORM AS A SERVICE MARKET, BY SERVICE TYPE, 2016-2020 (USD MILLION)

- TABLE 153 INTEGRATION PLATFORM AS A SERVICE MARKET, BY SERVICE TYPE, 2021-2026 (USD MILLION)

- TABLE 154 INTEGRATION PLATFORM AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2016-2020 (USD MILLION)

- TABLE 155 INTEGRATION PLATFORM AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2021-2026 (USD MILLION)

- TABLE 156 INTEGRATION PLATFORM AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 157 INTEGRATION PLATFORM AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- TABLE 158 INTEGRATION PLATFORM AS A SERVICE MARKET, BY VERTICAL, 2016-2020 (USD MILLION)

- TABLE 159 INTEGRATION PLATFORM AS A SERVICE MARKET, BY VERTICAL, 2021-2026 (USD MILLION)

- TABLE 160 INTEGRATION PLATFORM AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 161 INTEGRATION PLATFORM AS A SERVICE MARKET, BY REGION, 2021-2026 (USD MILLION)

List of Figures

- FIGURE 1 NETWORK API MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): NETWORK API MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (DEMAND-SIDE): NETWORK API MARKET

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 NETWORK API MARKET, 2025-2030 (USD MILLION)

- FIGURE 8 NETWORK API MARKET, REGIONAL SHARE, 2025

- FIGURE 9 RISE OF SDN/NFV TECHNOLOGIES TO DRIVE MARKET

- FIGURE 10 IDENTITY SEGMENT AND US TO LEAD MARKET IN NORTH AMERICA IN 2025

- FIGURE 11 IDENTITY SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 12 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 13 IOT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 14 NETWORK API MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 NETWORK API MARKET: VALUE CHAIN ANALYSIS

- FIGURE 16 NETWORK API MARKET: ECOSYSTEM ANALYSIS

- FIGURE 17 NETWORK API MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 19 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 20 MAJOR PATENTS APPLIED AND GRANTED FOR NETWORK API, 2015-2024

- FIGURE 21 NETWORK API MARKET: TREND/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 22 AVERAGE SELLING PRICE OF KEY PLAYERS, BY API TYPE, 2024

- FIGURE 23 TOOLS, FRAMEWORKS, AND TECHNIQUES USED IN NETWORK API MARKET

- FIGURE 24 INVESTMENT AND FUNDING SCENARIO

- FIGURE 25 IMPACT OF GENERATIVE AI IN NETWORK API

- FIGURE 26 EDGE SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 27 AUTONOMOUS VEHICLES SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 MEDIA & ENTERTAINMENT SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 31 SHARES OF LEADING COMPANIES IN NETWORK API MARKET, 2024

- FIGURE 32 REVENUE ANALYSIS OF KEY PLAYERS IN NETWORK API MARKET, 2024 (USD MILLION)

- FIGURE 33 NETWORK API MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 34 COMPANY VALUATION, 2025

- FIGURE 35 FINANCIAL METRICS OF KEY VENDORS, 2025

- FIGURE 36 NETWORK API MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 37 NETWORK API MARKET: COMPANY FOOTPRINT

- FIGURE 38 NETWORK API MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 39 ERICSSON: COMPANY SNAPSHOT

- FIGURE 40 CISCO: COMPANY SNAPSHOT

- FIGURE 41 NOKIA: COMPANY SNAPSHOT

- FIGURE 42 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 43 T-MOBILE: COMPANY SNAPSHOT

- FIGURE 44 AT&T: COMPANY SNAPSHOT

- FIGURE 45 ORANGE: COMPANY SNAPSHOT

- FIGURE 46 DEUTSCHE TELEKOM: COMPANY SNAPSHOT

- FIGURE 47 VODAFONE: COMPANY SNAPSHOT

- FIGURE 48 TELEFONICA: COMPANY SNAPSHOT