|

市場調查報告書

商品編碼

1699263

高效能活性藥物成分市場機會、成長動力、產業趨勢分析及 2025-2034 年預測High Potency Active Pharmaceutical Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

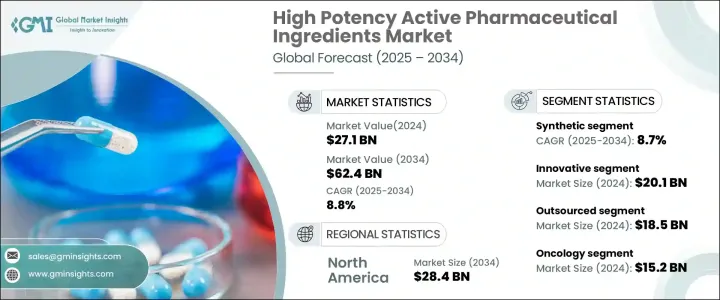

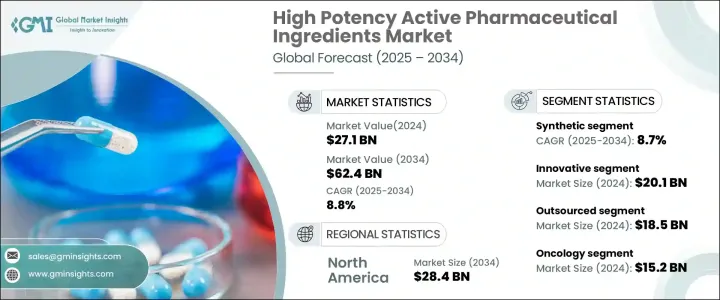

2024 年全球高效活性藥物成分市場價值為 271 億美元,預計 2025 年至 2034 年的複合年成長率為 8.8%。 HPAPI 是一種特殊的藥物化合物,以最小劑量產生強大的生物效應,由於其效力,需要嚴格的處理和製造過程。這些成分在現代標靶治療,特別是癌症治療中發揮著至關重要的作用,因為它們能夠更有效地傳遞藥物,同時降低全身毒性。隨著精準醫療需求的不斷成長,製藥公司正專注於擴大 HPAPI 的生產能力,以滿足日益成長的先進療法需求。

市場分為合成和生物技術 HPAPI,其中合成部分在 2024 年將創造 180 億美元的收入,預計複合年成長率為 8.7%。合成 HPAPI 因其可擴展的製造流程而受到廣泛青睞,使其更適合大規模生產。與需要細胞培養和發酵等複雜過程的生物技術 HPAPI 不同,合成替代品是使用完善的化學程序生產的,從而加快了藥物開發時間表。隨著全球慢性病盛行率的不斷上升,合成HPAPI因其能夠透過精確的劑量控制提供有針對性的治療效果而繼續佔據市場主導地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 271億美元 |

| 預測值 | 624億美元 |

| 複合年成長率 | 8.8% |

根據藥物類型,HPAPI 市場分為創新藥和學名藥。到 2024 年,創新領域的規模將達到 201 億美元,佔市場佔有率的 74.3%。對癌症、自體免疫疾病和其他複雜疾病的先進治療的需求不斷成長,導致對高效 HPAPI 的投資增加。遏制系統和連續製造流程的持續技術進步正在簡化生產流程,同時確保遵守嚴格的監管要求。此外,採用永續製造技術可降低生產成本並提高 HPAPI 開發的安全性。

市場還根據製造商類型進行細分,包括內部生產和外包生產。外包部分在 2024 年以 185 億美元的收入領先市場。與專門的密封設施相關的高成本迫使許多製藥公司依賴合約製造組織 (CMO) 來生產 HPAPI。這使得製藥公司能夠專注於藥物研究、開發和商業化,同時利用 CMO 的專業知識來滿足嚴格的行業標準。因此,外包已成為提高生產效率和維持成本效益的策略措施。

在應用方面,腫瘤學仍然是主導領域,2024 年貢獻了 152 億美元的收入。 HPAPI 在癌症治療中發揮著至關重要的作用,特別是在化療和標靶治療中,因為它們能夠攻擊癌細胞,同時對健康組織的影響最小。它們在抗體-藥物偶聯物和免疫療法等先進藥物製劑中的應用進一步推動了市場需求。

從地理上看,北美在 2024 年的收入為 124 億美元,預計到 2034 年將達到 284 億美元。美國以 113 億美元的收入領先該地區,這得益於癌症病例的增加和支持高效藥物開發的嚴格監管要求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 癌症發生率上升

- 標靶治療的採用日益增多

- 高效活性藥物成分的應用日益廣泛

- 產業陷阱與挑戰

- 開發和製造成本高

- 嚴格的監管要求

- 成長動力

- 成長潛力分析

- 差距分析

- 專利分析

- 未來市場趨勢

- 監管格局

- 技術格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 合成的

- 生物技術

第6章:市場估計與預測:依藥物類型,2021 年至 2034 年

- 主要趨勢

- 創新的

- 通用的

第7章:市場估計與預測:按製造商類型,2021 年至 2034 年

- 主要趨勢

- 內部

- 外包

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 腫瘤學

- 荷爾蒙失調

- 青光眼

- 其他應用

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Albany Molecular Research

- Agilent Technologies

- Axplora

- BASF

- Boehringer Ingelheim International

- Bristol-Myers Squibb Company

- CARBOGEN AMCIS

- Cipla

- CordenPharma

- Dr. Reddy's Laboratories

- F. Hoffmann-La Roche

- Lonza

- Merck & Co.

- Novartis

- Pfizer

- Sanofi

- Sun Pharmaceutical Industries

- Teva Pharmaceutical Industries

The Global High Potency Active Pharmaceutical Ingredients Market was valued at USD 27.1 billion in 2024 and is projected to grow at a CAGR of 8.8% from 2025 to 2034. HPAPIs are specialized pharmaceutical compounds that produce strong biological effects at minimal doses, necessitating strict handling and manufacturing processes due to their potency. These ingredients play a crucial role in modern targeted therapies, particularly cancer treatments, as they enable more effective drug delivery while reducing systemic toxicity. With the rising demand for precision medicine, pharmaceutical companies are focusing on expanding HPAPI production capabilities to cater to the growing need for advanced therapies.

The market is divided into synthetic and biotech HPAPIs, with the synthetic segment generating USD 18 billion in revenue in 2024 and expected to grow at a CAGR of 8.7%. Synthetic HPAPIs are widely preferred due to their scalable manufacturing processes, making them more efficient for large-scale production. Unlike biotech HPAPIs, which require complex processes like cell culture and fermentation, synthetic alternatives are produced using well-established chemical procedures, accelerating drug development timelines. With an increasing global prevalence of chronic diseases, synthetic HPAPIs continue to dominate the market due to their ability to deliver targeted therapeutic effects with precise dosage control.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27.1 Billion |

| Forecast Value | $62.4 Billion |

| CAGR | 8.8% |

Based on drug type, the HPAPI market is categorized into innovative and generic drugs. The innovative segment accounted for USD 20.1 billion in 2024, representing 74.3% of the market. The growing demand for advanced treatments for cancer, autoimmune diseases, and other complex conditions has led to increased investment in high-efficacy HPAPIs. Ongoing technological advancements in containment systems and continuous manufacturing processes are streamlining production while ensuring compliance with stringent regulatory requirements. Additionally, the adoption of sustainable manufacturing techniques is reducing production costs and enhancing safety in HPAPI development.

The market is also segmented by manufacturer type, with in-house and outsourced production. The outsourced segment led the market with USD 18.5 billion in revenue in 2024. The high costs associated with specialized containment facilities have driven many pharmaceutical companies to rely on contract manufacturing organizations (CMOs) for HPAPI production. This allows pharmaceutical firms to focus on drug research, development, and commercialization while leveraging the expertise of CMOs to meet stringent industry standards. As a result, outsourcing has become a strategic move to enhance production efficiency and maintain cost-effectiveness.

In terms of applications, oncology remained the dominant segment, contributing USD 15.2 billion in revenue in 2024. HPAPIs play a vital role in cancer treatments, particularly in chemotherapy and targeted therapies, due to their ability to attack cancer cells with minimal impact on healthy tissues. Their application in advanced drug formulations, including antibody-drug conjugates and immunotherapy, is further driving market demand.

Geographically, North America accounted for USD 12.4 billion in 2024 and is projected to reach USD 28.4 billion by 2034. The U.S. led the region with USD 11.3 billion in revenue, driven by increasing cancer cases and stringent regulatory requirements that support the development of high-potency pharmaceuticals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of cancer

- 3.2.1.2 Growing adoption of targeted therapies

- 3.2.1.3 Growing application of high potency active pharmaceutical ingredients

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and manufacturing cost

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Gap analysis

- 3.5 Patent analysis

- 3.6 Future market trends

- 3.7 Regulatory landscape

- 3.8 Technological landscape

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Synthetic

- 5.3 Biotech

Chapter 6 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Innovative

- 6.3 Generic

Chapter 7 Market Estimates and Forecast, By Manufacturer Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 In-house

- 7.3 Outsourced

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oncology

- 8.3 Hormonal imbalance

- 8.4 Glaucoma

- 8.5 Other applications

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Albany Molecular Research

- 10.2 Agilent Technologies

- 10.3 Axplora

- 10.4 BASF

- 10.5 Boehringer Ingelheim International

- 10.6 Bristol-Myers Squibb Company

- 10.7 CARBOGEN AMCIS

- 10.8 Cipla

- 10.9 CordenPharma

- 10.10 Dr. Reddy’s Laboratories

- 10.11 F. Hoffmann-La Roche

- 10.12 Lonza

- 10.13 Merck & Co.

- 10.14 Novartis

- 10.15 Pfizer

- 10.16 Sanofi

- 10.17 Sun Pharmaceutical Industries

- 10.18 Teva Pharmaceutical Industries