|

市場調查報告書

商品編碼

1807087

全球創新管理市場(按產品、功能和產業分類)- 2030 年預測Innovation Management Market by Offering (Solutions (Idea Management, Portfolio & Project Management, Collaboration Platform) and Services (Professional Services, Managed Services)), Function, Vertical - Global Forecast to 2030 |

||||||

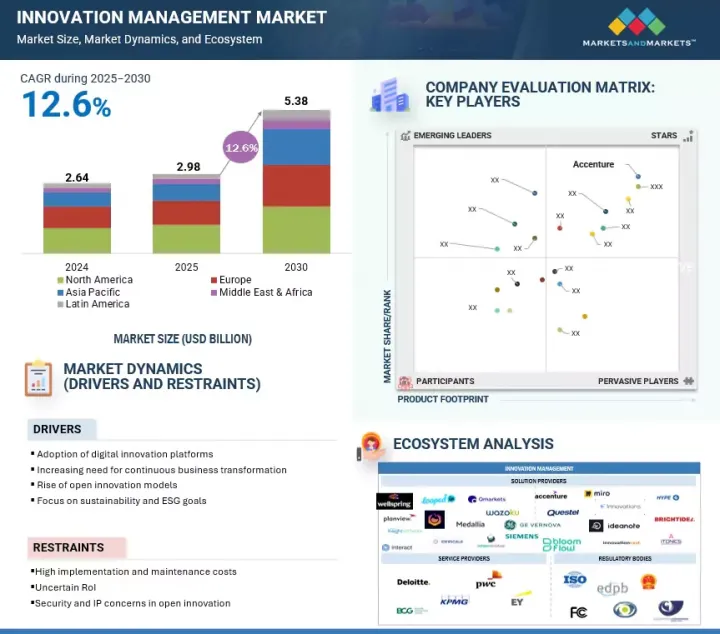

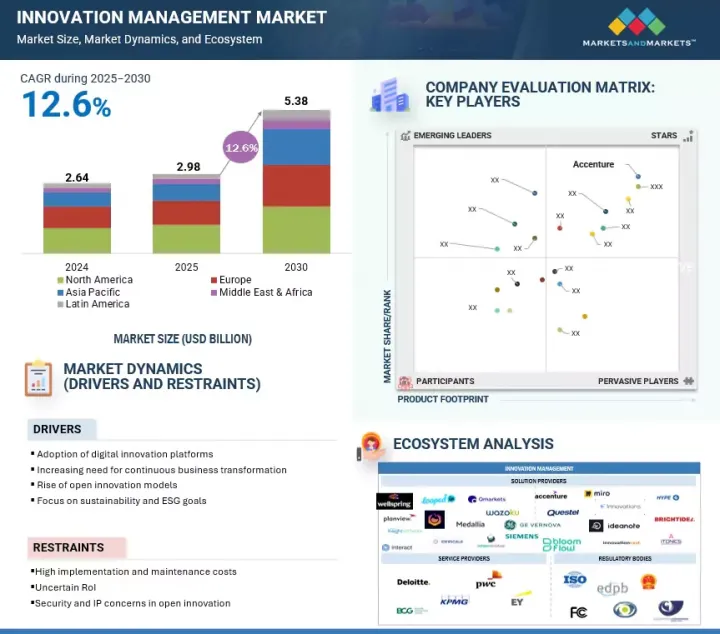

預計到 2025 年全球創新管理市場規模將達到 29.8 億美元,到 2030 年將達到 53.8 億美元,2025 年至 2030 年的複合年成長率為 12.6%。

組織範圍內的創新管理對於確保創造力和新想法被系統地捕捉、評估並轉化為實際的業務成果至關重要。

| 調查範圍 | |

|---|---|

| 調查年份 | 2019-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 百萬/十億美元 |

| 部分 | 產品、功能、產業、地區 |

| 目標區域 | 北美、歐洲、亞太地區、中東和非洲、拉丁美洲 |

創新管理提供了一個結構化的框架,使創新與組織目標保持一致,並促進效率、適應性和長期成長。在領導層面,它推動創新的願景、投資重點和管治模式。在員工層面,它透過創意共用平台、Hackathon和內部創業專案促進員工參與。跨職能協作至關重要,因為創新通常需要研發、行銷、IT 和業務的共同投入。

越來越多的組織採用數位創新平台來管理創意管道、追蹤投資報酬率 (ROI) 並整合群眾外包回饋。創新管理也強調以客戶為中心,並確保解決方案能夠滿足不斷變化的市場需求。關鍵趨勢包括將人工智慧、自動化和資料分析納入創新生命週期,並與Start-Ups、大學和生態系統公司建立夥伴關係。許多組織正在將開放式創新模式與內部專案結合,以加速突破。永續性也是優先事項,企業將綠色創新納入其流程,以實現環境、社會和治理 (ESG) 目標。最終,全組織範圍的創新管理使組織能夠平衡短期效率與長期轉型,確保在顛覆性市場中的韌性和競爭力。

創新管理常面臨諸多限制因素,阻礙其有效性和推廣應用。主要障礙是高昂的成本和資源需求,這使得持續創新變得困難,尤其對於中小企業而言。文化對變革的抵制和僵化的組織結構阻礙了協作和創新理念的採納。衡量創新的投資報酬率和實際成果仍然困難,導致人們不願意進行長期投資。此外,新技術人才短缺、與舊有系統整合的挑戰以及醫療和金融等領域的監管限制也限制了創新實驗的發展。在許多地區,基礎設施不足和資金匱乏進一步抑制了創新工作。總而言之,這些挑戰凸顯了對更敏捷、更開放、更規範的創新管理框架的需求。

按功能分類,產品創新管理部門將在預測期內貢獻最大的市場規模。

產品創新管理對企業至關重要,因為它可以幫助企業系統性地創造、改進和擴展產品,以應對不斷變化的客戶需求和競爭壓力。產品創新管理提供了一個結構化的框架,用於管理從構思到原型設計、市場發布和持續升級的端到端產品生命週期。透過整合客戶洞察、設計思維和新技術,企業可以最大限度地降低風險並加速創新。它還能促進研發、產品團隊和行銷之間的跨職能協作,以確保業務協調一致。

本報告對全球創新管理市場進行了分析,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 創新管理市場為企業帶來誘人機會

- 創新管理市場(按產品)

- 創新管理市場:按解決方案

- 專業服務創新管理市場

- 創新管理市場(按功能)

- 創新管理市場(按產業)

- 北美創新管理市場(按行業和地區)

第5章市場概述

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 創新管理簡史

- 1900-1940

- 1940-1970

- 1970-2000

- 2000-2010

- 生態系分析

- 案例研究分析

- 案例研究1:思科利用 Brightidea 的創新計畫軟體取得數百萬美元的創新成果

- 案例研究2:嘉吉部署 PLANVIEW ADAPTIVEWORK 以簡化投資組合管理流程

- 案例研究3:一家醫療保健公司利用 PLANVIEW IDEAPLACE 進行創新,讓約 60,000 名員工參與創意挑戰

- 案例研究4:畢馬威利用 ITONICS 的 ILLUMINATE 平台,利用生成式人工智慧加速全球創新

- 案例研究5:Paul Bunyan 利用 Ideawake 推動參與和創意

- 價值鏈分析

- 創意生成

- 開發和原型製作

- 測試

- 實施和商業化

- 監管格局

- 監管機構、政府機構和其他組織

- 主要法規

- 定價分析

- 主要企業按價格類別分類的平均銷售價格

- 主要企業解決方案參考價格分析

- 技術分析

- 主要技術

- 鄰近技術

- 互補技術

- 專利分析

- 波特五力分析

- 主要相關利益者和採購標準

- 影響客戶業務的趨勢/中斷

- 大型會議和活動(2025-2026年)

- 創新管理市場最佳實踐

- 當前和新興的經營模式經營模式

- 基於訂閱的模式

- 諮詢服務模式

- 基於結果的模型

- 開放式創新模式

- 創新管理工具、框架與技術

- 創新管理市場的未來

- 短期藍圖(2025-2027)

- 中期藍圖(2028-2030)

- 長期藍圖(2031-2035)

- 人工智慧/生成人工智慧對創新管理市場的影響

- 2025年美國關稅的影響 - 創新管理市場

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對該地區的影響

- 對終端產業的影響

- 投資金籌措場景

第6章:創新管理市場(按產品)

- 介紹

- 解決方案

- 創意管理解決方案

- 投資組合和計劃管理解決方案

- 技術趨勢偵察解決方案

- 協作平台

- 持續改進工具

- 永續發展管理平台

- 數位雙胞胎仿真平台

- 創新管治、風險與合規(GRC)工具

- 客戶回饋管理工具

- 其他解決方案

- 服務

- 專業服務

- 託管服務

第7章:創新管理市場(按功能)

- 介紹

- 產品創新管理

- 流程創新管理

- 經營模式創新管理

- 其他功能

第 8 章:按產業分類的創新管理市場

- 介紹

- 資訊科技/資訊科技服務

- 通訊

- BFSI

- 醫學與生命科學

- 航太/國防

- 零售與電子商務

- 能源與公共產業

- 製造業

- 運輸和物流

- 政府/公共部門

- 其他行業

第9章:按地區分類的創新管理市場

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 歐洲

- 歐洲宏觀經濟展望

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 印度

- 日本

- 其他亞太地區

- 中東和非洲

- 中東和非洲的宏觀經濟展望

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 拉丁美洲

- 拉丁美洲宏觀經濟展望

- 巴西

- 墨西哥

- 其他拉丁美洲

第10章 競爭格局

- 介紹

- 主要參與企業的策略/優勢(2022-2025)

- 收益分析(2020-2024)

- 市場佔有率分析(2024年)

- 品牌/產品比較

- ACCENTURE INNOVATION STRATEGY & CONSULTING

- DELOITTE - DOBLIN

- SAP - INNOVATION MANAGEMENT SOLUTION

- PWC - INNOVATION MANAGEMENT SERVICES

- EY - COGNISTREAMER

- 公司估值及財務指標

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 競爭場景

第11章:公司簡介

- 主要企業

- ACCENTURE

- DELOITTE

- SAP

- PRICEWATERHOUSECOOPERS (PWC)

- ERNST & YOUNG

- BOSTON CONSULTING GROUP

- KPMG

- SIEMENS AG

- PLANVIEW

- QUESTEL

- MEDALLIA

- INSIGHTSOFTWARE

- GE VERNOVA

- MIRO

- Start-Ups/中小型企業

- WELLSPRING

- QMARKETS

- BRIGHTIDEA

- HYPE INNOVATION

- PLUS INNOVATIONS

- IDEASCALE

- INNOVATIONCAST

- BLOOMFLOW

- WAZOKU

- ITONICS

- INDUCT

- INTERACT SOFTWARE

- YAMBLA

- IDEAWAKE

- LOOPEDIN

- IDEANOTE

第12章:相鄰市場與相關市場

- 介紹

- 決策智慧市場

- 市場定義

- 市場概覽

- 決策智慧市場(按產品)

- 決策智慧市場類型

- 按業務功能分類的決策智慧市場

- 決策智慧市場(按產業垂直分類)

- 決策智慧市場(按地區)

- 應用程式生命週期管理市場

- 市場定義

- 應用程式生命週期管理市場(按產品)

- 按平台分類的應用程式生命週期管理市場

- 按組織規模分類的應用程式生命週期管理市場

- 按部署方法分類的應用程式生命週期管理市場

- 按行業分類的應用程式生命週期管理市場

- 應用程式生命週期管理市場(按區域)

第13章 附錄

The innovation management market is estimated to be USD 2.98 billion in 2025 and reach USD 5.38 billion in 2030 at a CAGR of 12.6%, from 2025 to 2030. Innovation management across organizations is vital for ensuring that creativity and new ideas are systematically captured, evaluated, and transformed into tangible business outcomes.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | Offering, function, vertical, and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

It provides a structured framework that aligns innovation with organizational goals, fostering efficiency, adaptability, and long-term growth. At the leadership level, it drives vision-setting, investment priorities, and governance models for innovation. At the employee level, it encourages participation through idea-sharing platforms, hackathons, and intrapreneurship programs. Cross-functional collaboration is central, as innovation often requires input from R&D, marketing, IT, and operations.

Organizations are increasingly adopting digital innovation platforms to manage idea pipelines, track ROI, and integrate crowdsourced feedback. Innovation management also emphasizes customer-centricity, ensuring solutions address evolving market needs. Key trends include embedding AI, automation, and data analytics into the innovation lifecycle, as well as forming partnerships with startups, universities, and ecosystem players. Many organizations now combine open innovation models with internal programs to accelerate breakthroughs. Sustainability is another growing priority, with firms embedding green innovation into their processes to meet ESG goals. Ultimately, innovation management across organizations enables them to balance short-term efficiency with long-term transformation, ensuring resilience and competitiveness in disruptive markets.

Innovation management often faces constraints that slow its effectiveness and adoption. A major barrier is the high cost and resource requirement, which makes sustained innovation challenging, especially for smaller firms. Cultural resistance to change and rigid organizational silos hinder collaboration and idea adoption. Measuring ROI and tangible outcomes from innovation remains difficult, leading to hesitancy in long-term investments. Additionally, talent shortages in emerging technologies, integration challenges with legacy systems, and regulatory restrictions in sectors like healthcare and finance limit experimentation. In many regions, inadequate infrastructure and funding gaps further constrain innovation efforts. Collectively, these challenges highlight the need for more agile, open, and well-governed innovation management frameworks.

By function, the product innovation management segment contributed to the largest market size during the forecast period

Product innovation management is essential for enterprises as it helps them systematically create, refine, and scale products that address changing customer needs and competitive pressures. It provides a structured framework for managing the end-to-end product lifecycle, from ideation and prototyping to market launch and continuous upgrades. By embedding customer insights, design thinking, and emerging technologies, enterprises can minimize risks and accelerate innovation. It also drives cross-functional collaboration between R&D, product teams, and marketing to ensure business alignment. For instance, Samsung applies product innovation management to stay ahead in the electronics market, consistently introducing innovations in smartphones, foldable displays, and home appliances while integrating AI and IoT for smarter user experiences. Another case is Procter & Gamble (P&G), which uses a structured innovation model called Connect + Develop, combining internal R&D with external partnerships to create successful products like Swiffer and Tide Pods, transforming household care. Increasingly, enterprises are leveraging AI, digital twins, and advanced analytics to test product designs virtually and predict customer adoption. With growing emphasis on sustainability, companies are also innovating to create eco-friendly packaging and greener products. Overall, product innovation management ensures enterprises can differentiate, sustain growth, and remain competitive in dynamic markets.

The sustainability management segment among solutions is expected to register the fastest growth rate during the forecast period

Sustainability management solutions are becoming a cornerstone of innovation management, as enterprises increasingly face pressure from regulators, investors, and customers to operate responsibly while driving growth. These solutions integrate environmental, social, and governance (ESG) goals into the innovation pipeline, ensuring that new products, services, and processes are both competitive and sustainable. By embedding carbon tracking, energy efficiency, and circular economy principles into innovation management platforms, organizations can align business transformation with climate commitments. For instance, Siemens' Xcelerator ecosystem enables companies to co-create sustainable industrial solutions, while SAP's Sustainability Control Tower empowers enterprises to measure and reduce emissions in real time. Sustainability-driven innovation management also helps businesses unlock new markets, attract green financing, and build trust with stakeholders. Across geographies, North America is focusing on ESG-linked reporting and compliance, Europe leads with stringent regulatory frameworks and green innovation initiatives, and Asia Pacific is showing strong momentum in renewable energy adoption and sustainable manufacturing. These solutions not only future-proof operations but also foster resilience against resource scarcity, rising costs, and environmental risks. Ultimately, sustainability management within innovation management ensures that growth is inclusive, ethical, and aligned with long-term planetary needs, turning sustainability from a compliance mandate into a source of competitive advantage.

North America leads in market share, while Asia Pacific emerges as the fastest-growing region during the forecast period

In North America, innovation management is highly advanced, driven by strong R&D investments, world-class universities, and vibrant startup ecosystems. The region's enterprises and governments leverage structured innovation programs, corporate labs, accelerators, and open innovation platforms to maintain global leadership. Technology, healthcare, and BFSI are leading adopters, with companies like IBM, Google, and Johnson & Johnson embedding AI, digital platforms, and customer-centric design into their innovation strategies. Sustainability and green innovation are also gaining momentum, making innovation management a board-level priority. In contrast, Asia Pacific is experiencing the fastest growth in innovation management, fueled by rapid digitalization, government initiatives, and an expanding startup base. Countries like China, India, Japan, South Korea, and Singapore are investing heavily in smart cities, fintech, Industry 4.0, and healthcare innovation. For instance, Huawei and Alibaba in China drive large-scale AI and cloud-led innovation ecosystems, while Infosys and TCS in India co-create solutions with clients through digital innovation labs. Japan's Society 5.0 initiative and South Korea's Digital New Deal further highlight government-backed innovation momentum. Collectively, North America leads in maturity and ecosystem depth, while Asia Pacific outpaces others in adoption speed and market expansion, making both regions central to global innovation management growth.

Breakdown of Primary Interviews

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The breakdown of the primary interviews is as follows:

- By Company Type: Tier 1 - 39%, Tier 2 - 26%, and Tier 3 - 35%

- By Designation: C-level - 27%, Directors - 39%, and Others - 34%

- By Region: North America - 39%, Europe - 25%, Asia Pacific - 19%, Rest of the World - 17%

The major players in the innovation management market are Accenture (Ireland), Deloitte (UK), SAP (Germany), PwC (UK), EY (UK), Boston Consulting Group (US), KPMG (Netherlands), Siemens (Germany), Planview (US), Questel (France), Medallia (US), insightsoftware (US), GE Vernova (US), Miro (US), and Wellspring (US). These players have adopted various growth strategies, such as partnerships, agreements, collaborations, product launches, product enhancements, and acquisitions, to expand their footprint in the innovation management market.

Research Coverage

The market study covers the innovation management market size and the growth potential across different segments, including Offering (Solutions [Idea Management Solutions, Portfolio & Project Management Solutions, Technology & Trend Scouting Solutions, Collaboration platforms, Continuous Improvement Tools, Sustainability Management Platforms, Digital Twin & Simulation Platforms, Innovation Governance, Risk, & Compliance Tools, Customer Feedback Management Tools, Other Solutions], Services [Professional Services (Consulting, Implementation, Training, Support & Maintenance), Managed Services]), Function (Product Innovation Management, Process Innovation Management, Business Model Innovation Management, and Other Functions), Vertical (IT & ITeS, Telecom, Banking, Financial Services, & Insurance, Healthcare & Life Sciences, Aerospace & Defense, Retail & E-commerce, Energy & Utilities, Manufacturing, Transportation & Logistics, Government & Public Sector, and Other Verticals), and Region. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the innovation management market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (digital innovation, business transformation, open innovation models, sustainability and ESG goals), restraints (implementation and maintenance costs, uncertain RoI, security and IP concerns), opportunities (SME and emerging market adoption, sustainability-driven product innovation, AI-driven predictive innovation), challenges (aligning innovation with business strategy, cross-functional coordination, talent shortage).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the innovation management market

- Market Development: Comprehensive information about lucrative markets - analyzing the innovation management market across various regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the innovation management market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Accenture (Ireland), Deloitte (UK), SAP (Germany), PwC (UK), EY (UK), Boston Consulting Group (US), KPMG (Netherlands), Siemens (Germany), Planview (US), Questel (France), Medallia (US), insightsoftware (US), GE Vernova (US), Miro (US), and Wellspring (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.3 INNOVATION MANAGEMENT MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INNOVATION MANAGEMENT MARKET

- 4.2 INNOVATION MANAGEMENT MARKET, BY OFFERING

- 4.3 INNOVATION MANAGEMENT MARKET, BY SOLUTION

- 4.4 INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE

- 4.5 INNOVATION MANAGEMENT MARKET, BY FUNCTION

- 4.6 INNOVATION MANAGEMENT MARKET, BY VERTICAL

- 4.7 NORTH AMERICA: INNOVATION MANAGEMENT MARKET, BY VERTICAL AND REGION

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- 5.1.1 DRIVERS

- 5.1.1.1 Adoption of digital innovation platforms

- 5.1.1.2 Increasing need for continuous business transformation

- 5.1.1.3 Rise of open innovation models

- 5.1.1.4 Focus on sustainability and ESG goals

- 5.1.2 RESTRAINTS

- 5.1.2.1 High implementation and maintenance costs

- 5.1.2.2 Inefficiency of enterprises to track reliable RoI

- 5.1.2.3 Security and IP concerns in open innovation

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 SME and emerging market adoption

- 5.1.3.2 Sustainability-driven product innovation

- 5.1.3.3 AI-driven predictive innovation

- 5.1.4 CHALLENGES

- 5.1.4.1 Aligning innovation with business strategy

- 5.1.4.2 Cross-functional coordination

- 5.1.4.3 Talent shortage

- 5.1.1 DRIVERS

- 5.2 BRIEF HISTORY OF INNOVATION MANAGEMENT

- 5.2.1 1900-1940

- 5.2.2 1940-1970

- 5.2.3 1970-2000

- 5.2.4 2000-2010

- 5.3 ECOSYSTEM ANALYSIS

- 5.4 CASE STUDY ANALYSIS

- 5.4.1 CASE STUDY 1: CISCO ACHIEVED MILLIONS IN INNOVATION OUTCOMES USING BRIGHTIDEA'S INNOVATION PROGRAM SOFTWARE

- 5.4.2 CASE STUDY 2: CARGILL DEPLOYED PLANVIEW ADAPTIVEWORK TO STREAMLINE ITS PORTFOLIO MANAGEMENT PROCESS

- 5.4.3 CASE STUDY 3: HEALTHCARE CORPORATION INNOVATED BY ENGAGING NEARLY 60,000 EMPLOYEES IN IDEA CHALLENGES USING PLANVIEW IDEAPLACE

- 5.4.4 CASE STUDY 4: KPMG SUPERCHARGES GLOBAL INNOVATION WITH GENERATIVE AI VIA ITONICS' ILLUMINATE PLATFORM

- 5.4.5 CASE STUDY 5: PAUL BUNYAN BOOSTS ENGAGEMENT & IDEAS WITH IDEAWAKE

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 IDEATION

- 5.5.2 DEVELOPMENT AND PROTOTYPING

- 5.5.3 TESTING

- 5.5.4 IMPLEMENTATION AND COMMERCIALIZATION

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.2 KEY REGULATIONS

- 5.6.2.1 North America

- 5.6.2.1.1 US

- 5.6.2.1.2 Canada

- 5.6.2.2 Europe

- 5.6.2.2.1 UK

- 5.6.2.2.2 Germany

- 5.6.2.3 Asia Pacific

- 5.6.2.3.1 China

- 5.6.2.3.2 India

- 5.6.2.3.3 Japan

- 5.6.2.4 Middle East & Africa

- 5.6.2.4.1 UAE

- 5.6.2.4.2 South Africa

- 5.6.2.5 Latin America

- 5.6.2.5.1 Brazil

- 5.6.2.1 North America

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRICING CATEGORY

- 5.7.2 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY SOLUTION

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Gamification frameworks

- 5.8.1.2 Data visualization & dashboards

- 5.8.1.3 Blockchain for intellectual property protection

- 5.8.1.4 Big data analytics

- 5.8.1.5 Artificial intelligence (AI) & machine learning (ML)

- 5.8.2 ADJACENT TECHNOLOGIES

- 5.8.2.1 Knowledge management systems

- 5.8.2.2 Digital twin technology

- 5.8.2.3 Product lifecycle management (PLM) systems

- 5.8.2.4 Robotic process automation (RPA)

- 5.8.3 COMPLEMENTARY TECHNOLOGIES

- 5.8.3.1 Customer experience management (CEM) tools

- 5.8.3.2 Cybersecurity solutions

- 5.8.3.3 Marketing automation platforms

- 5.8.3.4 Patent search & IP management tools

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.9.1 METHODOLOGY

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 BARGAINING POWER OF SUPPLIERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 BEST PRACTICES OF INNOVATION MANAGEMENT MARKET

- 5.15 CURRENT AND EMERGING BUSINESS MODELS

- 5.15.1 SUBSCRIPTION-BASED MODEL

- 5.15.2 CONSULTING SERVICES MODEL

- 5.15.3 OUTCOME-BASED MODEL

- 5.15.4 OPEN INNOVATION MODEL

- 5.16 INNOVATION MANAGEMENT TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.17 FUTURE LANDSCAPE OF INNOVATION MANAGEMENT MARKET

- 5.17.1 SHORT-TERM ROADMAP (2025-2027)

- 5.17.2 MID-TERM ROADMAP (2028-2030)

- 5.17.3 LONG-TERM ROADMAP (2031-2035)

- 5.18 IMPACT OF AI/GEN AI ON INNOVATION MANAGEMENT MARKET

- 5.19 IMPACT OF 2025 US TARIFF - INNOVATION MANAGEMENT MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON REGION

- 5.19.4.1 North America

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.4.4 Rest of the World

- 5.19.5 IMPACT ON END-USE INDUSTRIES

- 5.19.5.1 BFSI (banking, financial services, & insurance)

- 5.19.5.2 Manufacturing

- 5.19.5.3 Retail & e-commerce

- 5.19.5.4 Healthcare

- 5.19.5.5 Telecom & ISPs

- 5.19.5.6 Energy & utilities

- 5.20 INVESTMENT AND FUNDING SCENARIO

6 INNOVATION MANAGEMENT MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: INNOVATION MANAGEMENT MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 IDEA MANAGEMENT SOLUTIONS

- 6.2.1.1 Accelerating transformation of raw ideas into actionable innovations

- 6.2.2 PORTFOLIO & PROJECT MANAGEMENT SOLUTIONS

- 6.2.2.1 Need for organizations to plan, prioritize, and oversee innovation initiatives effectively

- 6.2.3 TECHNOLOGY & TREND SCOUTING SOLUTIONS

- 6.2.3.1 Providing actionable intelligence for strategic decision-making

- 6.2.4 COLLABORATION PLATFORMS

- 6.2.4.1 Creating unified space for co-creation, brainstorming, and innovation project execution

- 6.2.5 CONTINUOUS IMPROVEMENT TOOLS

- 6.2.5.1 Systematically capturing feedback, implementing improvements, and measuring outcomes

- 6.2.6 SUSTAINABILITY MANAGEMENT PLATFORMS

- 6.2.6.1 Helping organizations track carbon footprints and manage resources efficiently

- 6.2.7 DIGITAL TWIN & SIMULATION PLATFORMS

- 6.2.7.1 Allowing organizations to model prototypes, simulate scenarios, and reduce costly trial-and-error experiments

- 6.2.8 INNOVATION GOVERNANCE, RISK, & COMPLIANCE (GRC) TOOLS

- 6.2.8.1 Ensuring innovation initiatives comply with industry regulations, risk policies, and ethical standards

- 6.2.9 CUSTOMER FEEDBACK MANAGEMENT TOOLS

- 6.2.9.1 Gathering feedback from surveys, social media, product reviews, and direct interactions

- 6.2.10 OTHER SOLUTIONS

- 6.2.1 IDEA MANAGEMENT SOLUTIONS

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Consulting

- 6.3.1.1.1 Maximizing information availability, increasing business flexibility, and extracting valuable insights from business data

- 6.3.1.2 Implementation

- 6.3.1.2.1 Need to deploy innovation management software and integrate existing enterprise systems

- 6.3.1.3 Training, support, & maintenance

- 6.3.1.3.1 Comprehending operation and implementation of innovation management solutions

- 6.3.1.1 Consulting

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Enhancing and optimizing outsourced functions to drive efficiency and cost-effectiveness

- 6.3.1 PROFESSIONAL SERVICES

7 INNOVATION MANAGEMENT MARKET, BY FUNCTION

- 7.1 INTRODUCTION

- 7.1.1 FUNCTION: INNOVATION MANAGEMENT MARKET DRIVERS

- 7.2 PRODUCT INNOVATION MANAGEMENT

- 7.2.1 LEVERAGING CUSTOMER INSIGHTS, MARKET RESEARCH, AND EMERGING TECHNOLOGIES TO ENSURE RELEVANCE AND COMPETITIVENESS

- 7.3 PROCESS INNOVATION MANAGEMENT

- 7.3.1 REDUCING COSTS, MINIMIZING WASTE, AND INCREASING PRODUCTIVITY WHILE MAINTAINING QUALITY

- 7.4 BUSINESS MODEL INNOVATION MANAGEMENT

- 7.4.1 ENABLING COMPANIES TO DIFFERENTIATE AND EXPAND INTO UNTAPPED MARKETS

- 7.5 OTHER FUNCTIONS

8 INNOVATION MANAGEMENT MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.1.1 VERTICAL: INNOVATION MANAGEMENT MARKET DRIVERS

- 8.2 IT & ITES

- 8.2.1 INNOVATION MANAGEMENT TO DETECT THREATS AND OFFER INCIDENT RESPONSE IDEAS

- 8.2.2 USE CASES

- 8.2.2.1 Cybersecurity

- 8.2.2.2 Remote work solutions

- 8.3 TELECOM

- 8.3.1 INNOVATION MANAGEMENT TO DRIVE IOT NETWORK EXPANSION FOR SEAMLESS CONNECTIVITY AND EFFICIENT DATA HANDLING

- 8.3.2 USE CASES

- 8.3.2.1 IoT expansion

- 8.3.2.2 5G optimization

- 8.4 BFSI

- 8.4.1 INNOVATION MANAGEMENT TO DESIGN INNOVATIVE INSURANCE PRODUCTS AND HELP IDENTIFY EMERGING RISKS AND FRAUD PATTERNS

- 8.4.2 USE CASES

- 8.4.2.1 Insurance management

- 8.4.2.2 Fraud detection

- 8.5 HEALTHCARE & LIFE SCIENCES

- 8.5.1 INNOVATION MANAGEMENT TO EXPEDITE DRUG DISCOVERY BY GATHERING INSIGHTS FROM RESEARCH TEAMS

- 8.5.2 USE CASES

- 8.5.2.1 Drug discovery and development

- 8.5.2.2 Patient-centric care solutions

- 8.6 AEROSPACE & DEFENSE

- 8.6.1 INNOVATION MANAGEMENT TO ENHANCE AIRCRAFT DESIGN PROCESS AND COLLECT INSIGHTS FROM EXPERTS

- 8.6.2 USE CASES

- 8.6.2.1 Aircraft design and development

- 8.6.2.2 Defense technology developments

- 8.7 RETAIL & E-COMMERCE

- 8.7.1 INNOVATION MANAGEMENT TO HELP IN PAYMENT PROCESSING AND ENABLE RETAILERS TO EXPLORE FRESH SALES CHANNELS

- 8.7.2 USE CASES

- 8.7.2.1 Payment solutions

- 8.7.2.2 Alternative sales channels

- 8.8 ENERGY & UTILITIES

- 8.8.1 INNOVATION MANAGEMENT TO HELP SMOOTHLY INTEGRATE RENEWABLE ENERGY SOURCES INTO CURRENT ENERGY INFRASTRUCTURE

- 8.8.2 USE CASES

- 8.8.2.1 Renewable energy integration

- 8.8.2.2 Advanced metering infrastructure

- 8.9 MANUFACTURING

- 8.9.1 INNOVATION MANAGEMENT TO ENHANCE QUALITY CONTROL PROCESSES AND PRODUCT DESIGN & DEVELOPMENT

- 8.9.2 USE CASES

- 8.9.2.1 Quality control

- 8.9.2.2 Product design & development

- 8.10 TRANSPORTATION & LOGISTICS

- 8.10.1 INNOVATION MANAGEMENT TO FACILITATE DELIVERY SOLUTIONS AND ROUTE OPTIMIZATION

- 8.10.2 USE CASES

- 8.10.2.1 Delivery solutions

- 8.10.2.2 Route optimization

- 8.11 GOVERNMENT & PUBLIC SECTOR

- 8.11.1 FOCUS ON SUSTAINABILITY, DIGITAL TRANSFORMATION, AND RESILIENT PUBLIC INFRASTRUCTURE TO ACCELERATE ADOPTION

- 8.11.2 USE CASES

- 8.11.2.1 Crisis response and pandemic management

- 8.11.2.2 Smart city development and governance

- 8.12 OTHER VERTICALS

- 8.12.1 USE CASES

- 8.12.1.1 eLearning platform enhancements

- 8.12.1.2 VR and AR experience

- 8.12.1 USE CASES

9 INNOVATION MANAGEMENT MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Strong focus on technology, cross-industry innovation, and dynamic startup ecosystem to drive market

- 9.2.3 CANADA

- 9.2.3.1 Dynamic tech and research ecosystem and government initiatives to support startups to propel market

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 UK

- 9.3.2.1 Need to create innovative products and improve business processes to drive market

- 9.3.3 GERMANY

- 9.3.3.1 Rising opportunities in business analytics space and technological advancement to drive market

- 9.3.4 FRANCE

- 9.3.4.1 Thriving industrial sector to present significant growth opportunities for innovation management

- 9.3.5 ITALY

- 9.3.5.1 Emergence of vibrant startup ecosystem and focus on R&D to fuel demand for innovation management

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Rapid adoption and investment in latest technologies to boost demand for innovation management

- 9.4.3 INDIA

- 9.4.3.1 Rising startup ecosystem, focus on digital transformation, and adoption of innovative technologies to propel market

- 9.4.4 JAPAN

- 9.4.4.1 METI's support for innovation through ASCA TechLab initiative to drive market

- 9.4.5 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 UAE

- 9.5.2.1 Government initiatives supporting innovation, startups, and entrepreneurs to drive market

- 9.5.3 KSA

- 9.5.3.1 Implementation of innovation centers and collaborations to fuel demand for innovation management

- 9.5.4 SOUTH AFRICA

- 9.5.4.1 Establishment of regional hubs and vibrant startup ecosystem to drive market

- 9.5.5 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Increasing IT spending and investment in innovation management solutions to drive market

- 9.6.3 MEXICO

- 9.6.3.1 National Innovation Strategy to transform different sectors to drive market

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.5.1 ACCENTURE INNOVATION STRATEGY & CONSULTING

- 10.5.2 DELOITTE - DOBLIN

- 10.5.3 SAP - INNOVATION MANAGEMENT SOLUTION

- 10.5.4 PWC - INNOVATION MANAGEMENT SERVICES

- 10.5.5 EY - COGNISTREAMER

- 10.6 COMPANY VALUATION AND FINANCIAL METRICS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Offering footprint

- 10.7.5.4 Vertical footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

- 10.9.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 ACCENTURE

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.3.2 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 DELOITTE

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 SAP

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches and enhancements

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 PRICEWATERHOUSECOOPERS (PWC)

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 ERNST & YOUNG

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches and enhancements

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 BOSTON CONSULTING GROUP

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.6.3.2 Expansions

- 11.1.6.4 MnM view

- 11.1.6.4.1 Right to win

- 11.1.6.4.2 Strategic choices

- 11.1.6.4.3 Weaknesses and competitive threats

- 11.1.7 KPMG

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches and enhancements

- 11.1.8 SIEMENS AG

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches and enhancements

- 11.1.8.3.2 Deals

- 11.1.9 PLANVIEW

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches and enhancements

- 11.1.9.3.2 Deals

- 11.1.10 QUESTEL

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 MEDALLIA

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches and enhancements

- 11.1.12 INSIGHTSOFTWARE

- 11.1.13 GE VERNOVA

- 11.1.14 MIRO

- 11.1.1 ACCENTURE

- 11.2 STARTUPS/SMES

- 11.2.1 WELLSPRING

- 11.2.2 QMARKETS

- 11.2.3 BRIGHTIDEA

- 11.2.4 HYPE INNOVATION

- 11.2.5 PLUS INNOVATIONS

- 11.2.6 IDEASCALE

- 11.2.7 INNOVATIONCAST

- 11.2.8 BLOOMFLOW

- 11.2.9 WAZOKU

- 11.2.10 ITONICS

- 11.2.11 INDUCT

- 11.2.12 INTERACT SOFTWARE

- 11.2.13 YAMBLA

- 11.2.14 IDEAWAKE

- 11.2.15 LOOPEDIN

- 11.2.16 IDEANOTE

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 DECISION INTELLIGENCE MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 DECISION INTELLIGENCE MARKET, BY OFFERING

- 12.2.4 DECISION INTELLIGENCE MARKET, BY TYPE

- 12.2.5 DECISION INTELLIGENCE MARKET, BY BUSINESS FUNCTION

- 12.2.6 DECISION INTELLIGENCE MARKET, BY VERTICAL

- 12.2.7 DECISION INTELLIGENCE MARKET, BY REGION

- 12.3 APPLICATION LIFECYCLE MANAGEMENT MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING

- 12.3.3 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM

- 12.3.4 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 12.3.5 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE

- 12.3.6 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL

- 12.3.7 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRICING CATEGORY, 2024

- TABLE 8 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY SOLUTION

- TABLE 9 LIST OF PATENTS IN INNOVATION MANAGEMENT MARKET, 2024-2025

- TABLE 10 IMPACT OF EACH FORCE ON INNOVATION MANAGEMENT MARKET

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 13 INNOVATION MANAGEMENT MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 15 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 16 INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 17 INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 18 SOLUTIONS: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 19 SOLUTIONS: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 20 SOLUTIONS: INNOVATION MANAGEMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 21 SOLUTIONS: INNOVATION MANAGEMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 22 IDEA MANAGEMENT SOLUTIONS: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 23 IDEA MANAGEMENT SOLUTIONS: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 PORTFOLIO & PROJECT MANAGEMENT SOLUTIONS: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 25 PORTFOLIO & PROJECT MANAGEMENT SOLUTIONS: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 TECHNOLOGY & TREND SCOUTING SOLUTIONS: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 27 TECHNOLOGY & TREND SCOUTING SOLUTIONS: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 COLLABORATION PLATFORMS: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 29 COLLABORATION PLATFORMS: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 CONTINUOUS IMPROVEMENT TOOLS: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 31 CONTINUOUS IMPROVEMENT TOOLS: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 SUSTAINABILITY MANAGEMENT PLATFORMS: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 33 SUSTAINABILITY MANAGEMENT PLATFORMS: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 DIGITAL TWIN & SIMULATION PLATFORMS: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 35 DIGITAL TWIN & SIMULATION PLATFORMS: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 INNOVATION GOVERNANCE, RISK, & COMPLIANCE (GRC) TOOLS: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 37 INNOVATION GOVERNANCE, RISK, & COMPLIANCE (GRC) TOOLS: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 CUSTOMER FEEDBACK MANAGEMENT TOOLS: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 39 CUSTOMER FEEDBACK MANAGEMENT TOOLS: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 OTHER SOLUTIONS: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 41 OTHER SOLUTIONS: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 SERVICES: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 43 SERVICES: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 SERVICES: INNOVATION MANAGEMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 45 SERVICES: INNOVATION MANAGEMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 46 PROFESSIONAL SERVICES: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 47 PROFESSIONAL SERVICES: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 PROFESSIONAL SERVICES: INNOVATION MANAGEMENT MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 49 PROFESSIONAL SERVICES: INNOVATION MANAGEMENT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 50 CONSULTING: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 51 CONSULTING: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 IMPLEMENTATION: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 53 IMPLEMENTATION: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 TRAINING, SUPPORT, & MAINTENANCE: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 55 TRAINING, SUPPORT, & MAINTENANCE: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 MANAGED SERVICES: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 57 MANAGED SERVICES: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 59 INNOVATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 60 PRODUCT INNOVATION MANAGEMENT: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 61 PRODUCT INNOVATION MANAGEMENT: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 PROCESS INNOVATION MANAGEMENT: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 63 PROCESS INNOVATION MANAGEMENT: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 BUSINESS MODEL INNOVATION MANAGEMENT: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 65 BUSINESS MODEL INNOVATION MANAGEMENT: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 OTHER FUNCTIONS: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 67 OTHER FUNCTIONS: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 69 INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 70 IT & ITES: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 71 IT & ITES: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 TELECOM: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 73 TELECOM: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 BFSI: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 75 BFSI: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 HEALTHCARE & LIFE SCIENCES: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 77 HEALTHCARE & LIFE SCIENCES: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 AEROSPACE & DEFENSE: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 79 AEROSPACE & DEFENSE: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 RETAIL & E-COMMERCE: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 81 RETAIL & E-COMMERCE: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 ENERGY & UTILITIES: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 83 ENERGY & UTILITIES: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 MANUFACTURING: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 85 MANUFACTURING: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 TRANSPORTATION & LOGISTICS: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 87 TRANSPORTATION & LOGISTICS: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 GOVERNMENT & PUBLIC SECTOR: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 89 GOVERNMENT & PUBLIC SECTOR: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 OTHER VERTICALS: INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 91 OTHER VERTICALS: INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 INNOVATION MANAGEMENT MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 93 INNOVATION MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 103 NORTH AMERICA: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 104 NORTH AMERICA: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 105 NORTH AMERICA: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 106 NORTH AMERICA: INNOVATION MANAGEMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 107 NORTH AMERICA: INNOVATION MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 108 US: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 109 US: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 110 US: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 111 US: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 112 US: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 113 US: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 114 US: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 115 US: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 116 US: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 117 US: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 118 US: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 119 US: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 120 CANADA: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 121 CANADA: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 122 CANADA: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 123 CANADA: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 124 CANADA: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 125 CANADA: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 126 CANADA: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 127 CANADA: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 128 CANADA: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 129 CANADA: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 130 CANADA: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 131 CANADA: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 132 EUROPE: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 133 EUROPE: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 135 EUROPE: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 137 EUROPE: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 138 EUROPE: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 139 EUROPE: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 140 EUROPE: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 141 EUROPE: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 142 EUROPE: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 143 EUROPE: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 144 EUROPE: INNOVATION MANAGEMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 145 EUROPE: INNOVATION MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 146 UK: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 147 UK: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 148 UK: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 149 UK: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 150 UK: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 151 UK: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 152 UK: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 153 UK: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 154 UK: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 155 UK: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 156 UK: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 157 UK: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 158 GERMANY: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 159 GERMANY: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 160 GERMANY: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 161 GERMANY: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 162 GERMANY: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 163 GERMANY: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 164 GERMANY: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 165 GERMANY: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 166 GERMANY: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 167 GERMANY: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 168 GERMANY: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 169 GERMANY: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 170 FRANCE: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 171 FRANCE: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 172 FRANCE: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 173 FRANCE: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 174 FRANCE: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 175 FRANCE: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 176 FRANCE: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 177 FRANCE: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 178 FRANCE: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 179 FRANCE: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 180 FRANCE: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 181 FRANCE: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 182 ITALY: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 183 ITALY: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 184 ITALY: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 185 ITALY: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 186 ITALY: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 187 ITALY: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 188 ITALY: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 189 ITALY: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 190 ITALY: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 191 ITALY: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 192 ITALY: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 193 ITALY: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 194 ASIA PACIFIC: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 195 ASIA PACIFIC: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 196 ASIA PACIFIC: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 197 ASIA PACIFIC: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 198 ASIA PACIFIC: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 199 ASIA PACIFIC: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 200 ASIA PACIFIC: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 201 ASIA PACIFIC: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 202 ASIA PACIFIC: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 203 ASIA PACIFIC: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 204 ASIA PACIFIC: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 205 ASIA PACIFIC: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 206 ASIA PACIFIC: INNOVATION MANAGEMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 207 ASIA PACIFIC: INNOVATION MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 208 CHINA: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 209 CHINA: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 210 CHINA: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 211 CHINA: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 212 CHINA: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 213 CHINA: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 214 CHINA: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 215 CHINA: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 216 CHINA: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 217 CHINA: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 218 CHINA: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 219 CHINA: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 220 INDIA: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 221 INDIA: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 222 INDIA: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 223 INDIA: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 224 INDIA: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 225 INDIA: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 226 INDIA: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 227 INDIA: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 228 INDIA: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 229 INDIA: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 230 INDIA: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 231 INDIA: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 232 JAPAN: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 233 JAPAN: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 234 JAPAN: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 235 JAPAN: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 236 JAPAN: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 237 JAPAN: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 238 JAPAN: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 239 JAPAN: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 240 JAPAN: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 241 JAPAN: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 242 JAPAN: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 243 JAPAN: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 246 MIDDLE EAST & AFRICA: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 251 MIDDLE EAST & AFRICA: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 252 MIDDLE EAST & AFRICA: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 253 MIDDLE EAST & AFRICA: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 254 MIDDLE EAST & AFRICA: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 256 MIDDLE EAST & AFRICA: INNOVATION MANAGEMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: INNOVATION MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 258 UAE: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 259 UAE: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 260 UAE: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 261 UAE: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 262 UAE: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 263 UAE: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 264 UAE: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 265 UAE: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 266 UAE: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 267 UAE: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 268 UAE: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 269 UAE: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 270 KSA: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 271 KSA: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 272 KSA: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 273 KSA: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 274 KSA: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 275 KSA: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 276 KSA: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 277 KSA: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 278 KSA: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 279 KSA: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 280 KSA: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 281 KSA: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 282 SOUTH AFRICA: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 283 SOUTH AFRICA: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 284 SOUTH AFRICA: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 285 SOUTH AFRICA: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 286 SOUTH AFRICA: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 287 SOUTH AFRICA: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 288 SOUTH AFRICA: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 289 SOUTH AFRICA: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 290 SOUTH AFRICA: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 291 SOUTH AFRICA: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 292 SOUTH AFRICA: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 293 SOUTH AFRICA: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 294 LATIN AMERICA: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 295 LATIN AMERICA: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 296 LATIN AMERICA: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 297 LATIN AMERICA: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 298 LATIN AMERICA: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 299 LATIN AMERICA: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 300 LATIN AMERICA: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 301 LATIN AMERICA: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 302 LATIN AMERICA: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 303 LATIN AMERICA: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 304 LATIN AMERICA: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 305 LATIN AMERICA: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 306 LATIN AMERICA: INNOVATION MANAGEMENT MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 307 LATIN AMERICA: INNOVATION MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 308 BRAZIL: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 309 BRAZIL: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 310 BRAZIL: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 311 BRAZIL: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 312 BRAZIL: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 313 BRAZIL: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 314 BRAZIL: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 315 BRAZIL: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 316 BRAZIL: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 317 BRAZIL: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 318 BRAZIL: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 319 BRAZIL: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 320 MEXICO: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 321 MEXICO: INNOVATION MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 322 MEXICO: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 323 MEXICO: INNOVATION MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 324 MEXICO: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 325 MEXICO: INNOVATION MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 326 MEXICO: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 327 MEXICO: INNOVATION MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 328 MEXICO: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2019-2024 (USD MILLION)

- TABLE 329 MEXICO: INNOVATION MANAGEMENT MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 330 MEXICO: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 331 MEXICO: INNOVATION MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 332 OVERVIEW OF STRATEGIES ADOPTED BY KEY INNOVATION MANAGEMENT MARKET PLAYERS, 2022-2025

- TABLE 333 INNOVATION MANAGEMENT MARKET: DEGREE OF COMPETITION

- TABLE 334 INNOVATION MANAGEMENT MARKET: REGION FOOTPRINT

- TABLE 335 INNOVATION MANAGEMENT MARKET: OFFERING FOOTPRINT

- TABLE 336 INNOVATION MANAGEMENT MARKET: VERTICAL FOOTPRINT

- TABLE 337 INNOVATION MANAGEMENT MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 338 INNOVATION MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 339 INNOVATION MANAGEMENT MARKET: PRODUCT LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 340 INNOVATION MANAGEMENT MARKET: DEALS, JANUARY 2022-JULY 2025

- TABLE 341 INNOVATION MANAGEMENT MARKET: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 342 INNOVATION MANAGEMENT MARKET: OTHER DEVELOPMENTS, JANUARY 2022-JULY 2025

- TABLE 343 ACCENTURE: COMPANY OVERVIEW

- TABLE 344 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 345 ACCENTURE: DEALS

- TABLE 346 ACCENTURE: OTHER DEVELOPMENTS

- TABLE 347 DELOITTE: COMPANY OVERVIEW

- TABLE 348 DELOITTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 349 DELOITTE: DEALS

- TABLE 350 DELOITTE: EXPANSIONS

- TABLE 351 SAP: COMPANY OVERVIEW

- TABLE 352 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 353 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 354 SAP: DEALS

- TABLE 355 PRICEWATERHOUSECOOPERS (PWC): COMPANY OVERVIEW

- TABLE 356 PRICEWATERHOUSECOOPERS (PWC): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 357 PRICEWATERHOUSECOOPERS (PWC): DEALS

- TABLE 358 ERNST & YOUNG: COMPANY OVERVIEW

- TABLE 359 ERNST & YOUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 360 ERNST & YOUNG: PRODUCT LAUNCHES

- TABLE 361 BOSTON CONSULTING GROUP: COMPANY OVERVIEW

- TABLE 362 BOSTON CONSULTING GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 363 BOSTON CONSULTING GROUP: DEALS

- TABLE 364 BOSTON CONSULTING GROUP: EXPANSIONS

- TABLE 365 KPMG: COMPANY OVERVIEW

- TABLE 366 KPMG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 367 KPMG: PRODUCT LAUNCHES

- TABLE 368 SIEMENS AG: COMPANY OVERVIEW

- TABLE 369 SIEMENS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 370 SIEMENS AG: PRODUCT LAUNCHES

- TABLE 371 SIEMENS AG: DEALS

- TABLE 372 PLANVIEW: COMPANY OVERVIEW

- TABLE 373 PLANVIEW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 374 PLANVIEW: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 375 PLANVIEW: DEALS

- TABLE 376 QUESTEL: COMPANY OVERVIEW

- TABLE 377 QUESTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 378 QUESTEL: DEALS

- TABLE 379 MEDALLIA: COMPANY OVERVIEW

- TABLE 380 MEDALLIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 381 MEDALLIA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 382 DECISION INTELLIGENCE MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 383 DECISION INTELLIGENCE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 384 DECISION INTELLIGENCE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 385 DECISION INTELLIGENCE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 386 DECISION INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2019-2023 (USD MILLION)

- TABLE 387 DECISION INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2024-2030 (USD MILLION)

- TABLE 388 DECISION INTELLIGENCE MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 389 DECISION INTELLIGENCE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 390 DECISION INTELLIGENCE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 391 DECISION INTELLIGENCE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 392 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 393 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 394 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2018-2023 (USD MILLION)

- TABLE 395 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 396 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 397 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 398 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 399 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 400 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 401 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 402 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 403 APPLICATION LIFECYCLE MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 INNOVATION MANAGEMENT MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 INNOVATION MANAGEMENT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY SIDE): REVENUE OF VENDORS IN INNOVATION MANAGEMENT MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (DEMAND SIDE): INNOVATION MANAGEMENT MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH

- FIGURE 8 INNOVATION MANAGEMENT MARKET: DATA TRIANGULATION

- FIGURE 9 INNOVATION MANAGEMENT MARKET, 2023-2030 (USD MILLION)

- FIGURE 10 INNOVATION MANAGEMENT MARKET, REGIONAL AND COUNTRY-WISE SHARE, 2025

- FIGURE 11 INCREASING DEMAND FOR IDEA MANAGEMENT PLATFORMS AMONG ENTERPRISES TO DRIVE MARKET

- FIGURE 12 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SHARE THAN SERVICES SEGMENT IN 2025

- FIGURE 13 IDEA MANAGEMENT SOLUTIONS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 14 CONSULTING SEGMENT TO LEAD MARKET IN 2025

- FIGURE 15 PRODUCT INNOVATION MANAGEMENT SEGMENT TO LEAD MARKET IN 2025

- FIGURE 16 BFSI SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 BFSI SEGMENT AND US TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2025

- FIGURE 18 INNOVATION MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 BRIEF HISTORY OF INNOVATION MANAGEMENT

- FIGURE 20 INNOVATION MANAGEMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 21 INNOVATION MANAGEMENT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRICING CATEGORY, 2024

- FIGURE 23 KEY PATENTS APPLIED AND GRANTED, 2015-2025

- FIGURE 24 INNOVATION MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 INNOVATION MANAGEMENT MARKET: TOOLS, FRAMEWORKS, AND TECHNIQUES

- FIGURE 29 IMPACT OF GENERATIVE AI ON INNOVATION MANAGEMENT MARKET

- FIGURE 30 INNOVATION MANAGEMENT MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 31 SERVICES SEGMENT TO REGISTER HIGHER CAGR THAN SOLUTIONS SEGMENT DURING FORECAST PERIOD

- FIGURE 32 SUSTAINABILITY MANAGEMENT PLATFORMS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 MANAGED SERVICES SEGMENT TO REGISTER HIGHER CAGR THAN PROFESSIONAL SERVICES SEGMENT DURING FORECAST PERIOD

- FIGURE 34 TRAINING, SUPPORT, & MAINTENANCE SERVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 BUSINESS MODEL INNOVATION MANAGEMENT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 HEALTHCARE & LIFE SCIENCES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 39 REVENUE ANALYSIS OF KEY PLAYERS IN INNOVATION MANAGEMENT MARKET, 2020-2024 (USD BILLION)

- FIGURE 40 SHARES OF LEADING COMPANIES IN INNOVATION MANAGEMENT MARKET, 2024

- FIGURE 41 INNOVATION MANAGEMENT MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 42 COMPANY VALUATION OF KEY VENDORS, 2025

- FIGURE 43 FINANCIAL METRICS OF KEY VENDORS, 2025

- FIGURE 44 INNOVATION MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 INNOVATION MANAGEMENT MARKET: COMPANY FOOTPRINT

- FIGURE 46 INNOVATION MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 ACCENTURE: COMPANY SNAPSHOT

- FIGURE 48 DELOITTE: COMPANY SNAPSHOT

- FIGURE 49 SAP: COMPANY SNAPSHOT

- FIGURE 50 PRICEWATERHOUSECOOPERS (PWC): COMPANY SNAPSHOT

- FIGURE 51 ERNST & YOUNG: COMPANY SNAPSHOT

- FIGURE 52 BOSTON CONSULTING GROUP: COMPANY SNAPSHOT

- FIGURE 53 KPMG: COMPANY SNAPSHOT

- FIGURE 54 SIEMENS AG: COMPANY SNAPSHOT