|

市場調查報告書

商品編碼

1802921

全球醫療設備契約製造市場(按設備類型、設備等級和服務)—預測至 2030 年Medical Device Contract Manufacturing Market by Device Type (IVD, Cardiovascular, Orthopedic, Dental), Class of Device (Class I, II, III), Service (Device Development & Manufacturing, Packaging & Assembly, Quality Management) - Global Forecast to 2030 |

||||||

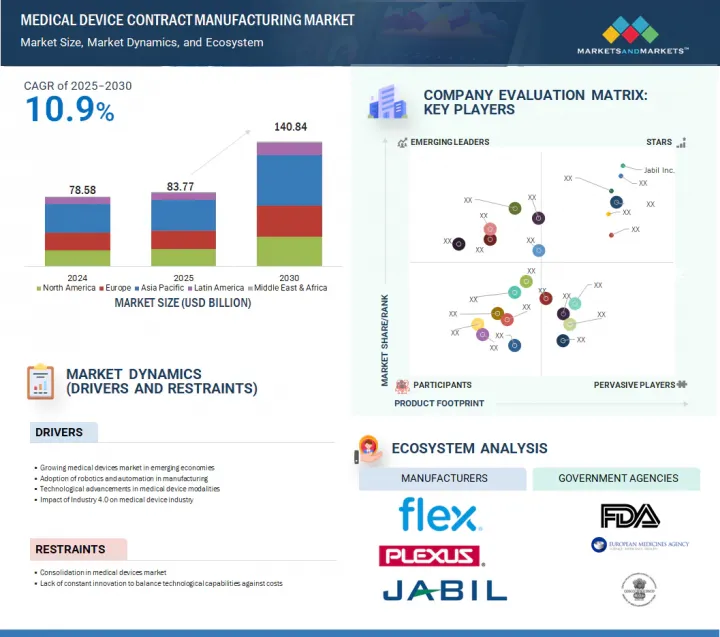

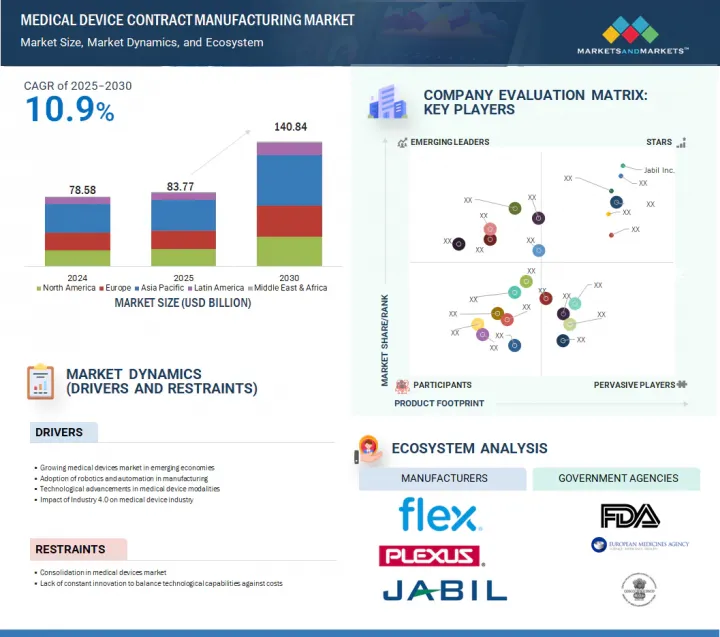

全球醫療設備契約製造市場預計將從 2025 年的 837.7 億美元成長到 2030 年的 1,408.4 億美元,2025 年至 2030 年的複合年成長率為 10.9%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2024-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 10億美元 |

| 部分 | 設備類型、服務類型、服務供應商、合約類型、最終用戶、地區 |

| 目標區域 | 北美、歐洲、亞太地區、拉丁美洲、中東和非洲 |

預計市場將受到醫療設備技術進步和老齡人口成長的推動。機器人技術和微創手術、醫療設備器材人工智慧、遠端醫療和遠端患者監護等醫療領域的持續發展預計將推動市場成長。人口老化推動了醫療診斷需求的增加,進一步促進了市場成長。然而,嚴格的監管合規和複雜的供應鏈管理預計將在一定程度上限制市場成長。

“根據設備類型,藥物傳輸設備領域預計將在醫療設備契約製造市場中實現最高的複合年成長率。”

預計2025年至2030年期間,給藥裝置領域將在醫療設備契約製造市場中實現最高的複合年成長率。這一成長主要源於對精準、高效且以患者為中心的給藥系統日益成長的需求。糖尿病、癌症和呼吸系統疾病等慢性疾病的發生率不斷上升,導致吸入器、胰島素筆、自動注射器和植入式幫浦等設備的使用量顯著增加。製藥公司擴大將這些複雜工程設備的生產外包給契約製造製造商,利用其專業技術力來最佳化生產成本。此外,生技藥品的進步和個人化醫療的轉變正在推動對創新給藥機制的需求,從而在整個預測期內增強該領域的成長。

“到2024年,設備開發和製造服務領域將佔據服務市場的最大佔有率。”

設備開發和製造服務部門在醫療設備契約製造領域佔有最大的市場佔有率,這主要是因為其在將概念轉化為可行的醫療設備發揮著至關重要的作用。中小型公司經常外包這些服務,以降低成本、加快產品時間表,並利用專業知識和先進的製造技術。這一領域對於新創公司和新興企業都至關重要,因為它涵蓋了整個產品開發生命週期,從初始設計和原型製作到大規模商業化。此外,對微創手術設備和穿戴式健康監測技術等複雜和高精度醫療設備的需求不斷成長,大大推動了對全面製造夥伴關係關係的需求,鞏固了這一領域在市場上的主導地位。

“2024年亞太地區將佔據最大的市場佔有率。”

亞太地區對醫療設備契約製造服務的需求因多種因素而蓬勃發展。首先,該地區許多國家的人口快速成長推動了對先進醫療解決方案的需求。此外,醫療服務提供者和患者對現代醫療設備的優勢和功能的認知不斷提高,進一步推動了需求。隨著越來越多的消費者獲得醫療保健服務和產品,亞太國家不斷成長的中產階級也助長了這個趨勢。由於這些趨勢,醫療設備契約製造領域的全球領導者正在積極推出和擴展其在亞太市場的業務。這些公司正在引進尖端醫療設備、創新軟體解決方案和各種生物相容性材料,以滿足各種醫療環境的需求。中國在亞太醫療設備契約製造市場佔據主導地位,預計到 2024 年將佔最大佔有率。這種成長可以歸因於公眾和醫療機構對醫療設備的效用和有效性的認知不斷提高,以及人群中慢性病盛行率的不斷上升。因此,在這些相互關聯的趨勢和不斷發展的醫療保健格局的推動下,亞太地區佔據了整體市場的最大佔有率。

本報告研究了全球醫療設備契約製造市場,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 醫療設備契約製造市場概覽

- 亞太醫療設備契約製造市場(按應用和國家分類)

- 醫療設備契約製造市場:新興經濟體與已開發國家

- 醫療設備契約製造市場:地理成長機會

- 醫療設備契約製造市場:區域細分

第5章市場概述

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 產業趨勢

- 原始設備製造商和契約製造之間的整合日益加強

- 私募股權對醫療設備契約製造的興趣不斷上升

- 醫療設備契約製造服務外包

- 工業 5.0

- 技術分析

- 主要技術

- 鄰近技術

- 互補技術

- 波特五力分析

- 主要相關利益者和採購標準

- 監管格局

- 法規結構

- 監管機構、政府機構和其他組織

- 定價分析

- 主要企業平均銷售價格趨勢(2022-2024 年)

- 各地區平均售價趨勢(2022-2024)

- 價值鏈分析

- 大型會議和活動(2025-2026年)

- 專利分析

- 供應鏈分析

- 生態系分析

- 貿易分析

- HS 編碼 9018 的進口資料(2020-2024 年)

- HS編碼9018出口資料(2020-2024年)

- 醫療設備契約製造鄰近市場

- 醫療設備契約製造市場中未滿足的需求/最終用戶的期望

- 產生人工智慧對醫療設備契約製造市場的影響

- 案例研究分析

- 案例研究1:JABIL INC. 與 HEARTWARE INTERNATIONAL 合作開發先進的心臟衰竭療法

- 案例研究2:FLEX LTD.與MEDTRONIC合作開發下一代胰島素幫浦

- 案例研究3:PLEXUS與Start-Ups合作開發創新胰島素幫浦

- 投資金籌措場景

- 2025年美國關稅的影響-醫療設備契約製造市場

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對國家的影響

- 對終端產業的影響

第6章醫療設備契約製造市場(按設備)

- 介紹

- 體外診斷設備

- 診斷影像設備

- 心血管設備

- 藥物輸送裝置

- 整形外科設備

- 呼吸照護設備

- 眼科設備

- 手術設備

- 糖尿病護理設備

- 牙科設備

- 內視鏡和腹腔鏡設備

- 婦科/泌尿系統設備

- 個人護理設備

- 神經科設備

- 病患監測設備

- 病人援助設備

- 其他設備

第7章醫療設備契約製造市場(依設備類別)

- 介紹

- 第二類醫療設備

- 第一類醫療設備

- 第三類醫療設備

第8章醫療設備契約製造市場(按服務)

- 介紹

- 裝備開發及製造服務

- 品管服務

- 包裝和組裝服務

- 其他服務

第9章醫療設備契約製造市場(按地區)

- 介紹

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 印度

- 日本

- 馬來西亞

- 泰國

- 韓國

- 澳洲

- 菲律賓

- 新加坡

- 紐西蘭

- 其他亞太地區

- 歐洲

- 歐洲宏觀經濟展望

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲國家

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 拉丁美洲

- 拉丁美洲宏觀經濟展望

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東和非洲

- 中東和非洲的宏觀經濟展望

- 海灣合作理事會國家

- 其他中東和非洲地區

第10章 競爭格局

- 概述

- 收益分析(2020-2024)

- 市場佔有率分析(2024年)

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣,Start-Ups/中小企業(2024 年)

- 公司估值及財務指標

- 品牌/產品比較分析

- 主要企業研發評估

- 競爭場景

第11章 公司簡介

- 主要企業

- JABIL INC.

- FLEX LTD.

- PLEXUS CORP.

- SANMINA CORPORATION

- INTEGER HOLDINGS CORPORATION

- TE CONNECTIVITY LTD.

- NIPRO CORPORATION

- CELESTICA INC.

- WEST PHARMACEUTICAL SERVICES, INC.

- BENCHMARK ELECTRONICS INC.

- RECIPHARM AB

- GERRESHEIMER AG

- KIMBALL ELECTRONICS, INC.

- NORTECH SYSTEMS, INC.

- CARCLO PLC

- NOLATO GW, INC. (A PART OF NOLATO AB)

- 其他公司

- NEMERA

- VIANT MEDICAL HOLDINGS, INC.

- TECOMET, INC.

- SMC LTD.

- PHILLIPS-MEDISIZE CORPORATION

- TESSY PLASTICS CORP.

- MEHOW

- TEKNI-PLEX

- PETER'S TECHNOLOGY

第12章 附錄

The global medical device contract manufacturing market is projected to reach USD 140.84 billion in 2030 from USD 83.77 billion in 2025, at a CAGR of 10.9% between 2025 and 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Device Type, Service Type, Service Provider, Contract Type, End User, and Region |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa |

Rising technological advancements in medical devices, along with an increasing geriatric population, are expected to drive the market. The market is anticipated to grow due to continuous developments in medical fields such as robotics and minimally invasive surgery, artificial intelligence (AI) in medical devices, telemedicine, and remote patient monitoring. The aging population with a rising need for medical diagnostics further contributes to market growth. However, strict regulatory compliance and complexities in supply chain management are expected to limit market growth to some extent.

"By device type, the drug delivery devices segment is expected to witness the highest CAGR in the medical device contract manufacturing market."

The drug delivery devices segment is anticipated to experience the highest CAGR in the medical device contract manufacturing market from 2025 to 2030. This growth is primarily driven by the escalating demand for targeted, efficient, and patient-centric drug delivery systems. The rising incidence of chronic conditions such as diabetes, cancer, and respiratory diseases has significantly increased the utilization of devices, including inhalers, insulin pens, auto-injectors, and implantable pumps. Pharmaceutical companies are increasingly outsourcing the manufacturing of these intricately designed devices to contract manufacturers, capitalizing on their specialized technical capabilities and optimizing production costs. Furthermore, the ongoing advancements in biologics and the shift toward personalized medicine are propelling the demand for innovative drug delivery mechanisms, thereby intensifying growth in this sector throughout the projected period.

"The device development & manufacturing services segment has accounted for the largest share in the market in 2024, by services."

The device development and manufacturing services segment commands the largest market share within the medical device contract manufacturing sector, primarily due to its integral role in transforming concepts into viable medical devices. Smaller enterprises and mid-sized firms often outsource these services to mitigate costs, accelerate their product timelines, and leverage specialized knowledge and advanced manufacturing techniques. This segment encompasses the entire lifecycle of product development, from initial design and prototyping to large-scale commercialization, rendering it crucial for both emerging and established companies. Furthermore, the escalating demand for sophisticated, high-precision medical instruments-such as minimally invasive surgical devices and wearable health monitoring technologies-has significantly heightened the need for comprehensive manufacturing partnerships, thereby solidifying the preeminence of this segment in the market.

"The Asia Pacific accounted for the largest market share in 2024."

The Asia Pacific (APAC) region is experiencing a significant surge in demand for medical device contract manufacturing services, driven by several key factors. Firstly, the rapid population growth in many countries within this region is creating an increased need for advanced medical solutions. Additionally, there is a growing awareness among healthcare providers and patients about the benefits and functionalities of modern medical devices, which further fuels this demand. The expanding middle class in various Asia Pacific nations is also contributing to this trend, as more consumers gain access to healthcare services and products. As a result of these dynamics, global leaders in the medical device contract manufacturing sector are actively establishing and expanding their operations in the Asia Pacific market. These companies are introducing a variety of cutting-edge medical devices, innovative software solutions, and a diverse range of biocompatible materials tailored to meet the needs of different healthcare settings. In particular, China is set to dominate the APAC medical device contract manufacturing market, and it is projected to capture the largest share in 2024. This growth can be attributed to the increasing prevalence of chronic diseases within the population, alongside greater public and institutional awareness regarding the availability and efficacy of medical devices. As a result, the overall market in the Asia Pacific region has accounted for the largest share in the market, driven by these interconnected trends and the continued evolution of the healthcare landscape.

A breakdown of the primary participants (supply-side) for the medical device contract manufacturing market referred to in this report is provided below:

- By Company Type: Tier 1-45%, Tier 2-20%, and Tier 3-35%

- By Designation: C-level Executives-35%, Directors-25%, and Others-40%

- By Region: North America-40%, Europe-25%, Asia Pacific-20%, Latin America- 10%, Middle East & Africa-5%.

The prominent players in the medical device contract manufacturing market include include Jabil Inc. (US), Flex Ltd. (Singapore), Plexus Corp. (US), Sanmina Corporation (US), Integer Holdings Corporation (US), TE Connectivity Ltd. (Switzerland), Nipro Corporation (Japan), Celestica Inc. (Canada), West Pharmaceutical Services, Inc. (US), Benchmark Electronics Inc. (US), Recipharm AB (Sweden), Gerresheimer AG (Germany), Kimball Electronics Inc. (US), Nortech Systems, Inc. (US), Carclo Plc (UK), Nolato GW, Inc. (US), and the other players are Nemera. (France), Viant Medical Holdings, Inc. (US), Tecomet, Inc. (US), SMC Ltd. (US), Phillips-Medisize Corporation (US), Tessy Plastics Corp. (US), MeHow (China), Tekni-Plex (US), and Peter's Technology (China).

Research Coverage:

The report examines the medical device contract manufacturing market and aims to estimate the market size and future growth potential across various segments, including device type, device class, service, and region. It also features a competitive analysis of major players in the market, highlighting their company profiles, product and service offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall medical device contract manufacturing market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

- Analysis of key drivers (growth in medical devices market in developing countries, adoption of robotics and automation in manufacturing, technological advancements in medical device modalities, impact of industry 4.0 on the medical device industry), restraints (consolidation in medical devices market), opportunities (increasing healthcare expenditure, infrastructure, and awareness in developing economies, rising geriatric population and its associated diseases) and challenges (lack of constant innovation to balance technological capabilities against costs)

- Market Penetration: It includes extensive information on product portfolios offered by the major players in the global medical device contract manufacturing market. The report includes various segments in market device type, class of device, service, and region

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global medical device contract manufacturing market.

- Market Development: Thorough knowledge and analysis of the profitable rising markets by device type, class of device, service, and region

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global medical device contract manufacturing market.

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings of products and services, and capacities of the major competitors in the global medical device contract manufacturing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY SOURCES

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY SOURCES

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET OVERVIEW

- 4.2 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY APPLICATION AND COUNTRY

- 4.3 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: EMERGING ECONOMIES VS. DEVELOPED MARKETS

- 4.4 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.5 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: REGIONAL MIX

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing medical devices market in developing countries

- 5.2.1.2 Adoption of robotics and automation in manufacturing

- 5.2.1.3 Technological advancements in medical device modalities

- 5.2.1.4 Impact of industry 4.0 on medical device industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Consolidation in medical devices market

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing healthcare expenditure, infrastructure, and awareness in developing economies

- 5.2.3.2 Rising geriatric population and increasing incidence of associated diseases

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of constant innovation to balance technological capabilities against costs

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 INCREASING CONSOLIDATION OF OEMS AND CONTRACT MANUFACTURERS

- 5.3.2 GROWING INTEREST OF PRIVATE EQUITY FIRMS IN MEDICAL DEVICE CONTRACT MANUFACTURING

- 5.3.3 OUTSOURCING OF MEDICAL DEVICE CONTRACT MANUFACTURING SERVICES

- 5.3.4 INDUSTRY 5.0

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Digital transformation

- 5.4.1.2 Robotics and automation

- 5.4.2 ADJACENT TECHNOLOGIES

- 5.4.2.1 Artificial Intelligence

- 5.4.2.2 Big data

- 5.4.3 COMPLEMENTARY TECHNOLOGIES

- 5.4.3.1 5G

- 5.4.1 KEY TECHNOLOGIES

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF SUPPLIERS

- 5.5.4 BARGAINING POWER OF BUYERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 BUYING CRITERIA

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATORY FRAMEWORK

- 5.7.1.1 North America

- 5.7.1.1.1 US

- 5.7.1.1.2 Canada

- 5.7.1.2 Europe

- 5.7.1.3 Asia Pacific

- 5.7.1.3.1 Japan

- 5.7.1.3.2 China

- 5.7.1.3.3 India

- 5.7.1.1 North America

- 5.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.1 REGULATORY FRAMEWORK

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER, 2022-2024

- 5.8.2 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 5.9 VALUE CHAIN ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS IN 2025-2026

- 5.11 PATENT ANALYSIS

- 5.11.1 LIST OF MAJOR PATENTS, 2022-2025

- 5.12 SUPPLY CHAIN ANALYSIS

- 5.13 ECOSYSTEM ANALYSIS

- 5.14 TRADE ANALYSIS

- 5.14.1 IMPORT DATA FOR HS CODE 9018, 2020-2024

- 5.14.2 EXPORT DATA FOR HS CODE 9018, 2020-2024

- 5.15 ADJACENT MARKETS FOR MEDICAL DEVICE CONTRACT MANUFACTURING

- 5.16 UNMET NEEDS/END-USER EXPECTATIONS IN MEDICAL DEVICE CONTRACT MANUFACTURING MARKET

- 5.17 IMPACT OF GEN AI IN MEDICAL DEVICE CONTRACT MANUFACTURING MARKET

- 5.18 CASE STUDY ANALYSIS

- 5.18.1 CASE STUDY 1: JABIL INC. AND HEARTWARE INTERNATIONAL PARTNER TO DEVELOP ADVANCED HEART FAILURE TREATMENT

- 5.18.2 CASE STUDY 2: FLEX LTD. AND MEDTRONIC COLLABORATE TO DEVELOP THE NEXT-GENERATION INSULIN PUMP

- 5.18.3 CASE STUDY 3: PLEXUS PARTNERED WITH A START-UP TO DEVELOP A REVOLUTIONARY INSULIN PUMP

- 5.19 INVESTMENT AND FUNDING SCENARIO

- 5.20 IMPACT OF 2025 US TARIFFS-MEDICAL DEVICE CONTRACT MANUFACTURING MARKET

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRIES/REGIONS

- 5.20.4.1 US

- 5.20.4.2 Europe

- 5.20.4.3 APAC

- 5.20.5 IMPACT ON END-USE INDUSTRIES

- 5.20.5.1 Diagnostic & Imaging Equipment

- 5.20.5.2 Surgical Instruments & Implants

- 5.20.5.3 Point-of-Care & Diagnostic Kits

6 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE

- 6.1 INTRODUCTION

- 6.2 IVD DEVICES

- 6.2.1 IVD CONSUMABLES

- 6.2.1.1 Increasing demand for reagents & kits to drive market

- 6.2.2 IVD EQUIPMENT

- 6.2.2.1 Advances in life sciences research to support market

- 6.2.1 IVD CONSUMABLES

- 6.3 DIAGNOSTIC IMAGING DEVICES

- 6.3.1 ADOPTION OF NEW AND ADVANCED DIAGNOSTIC IMAGING SYSTEMS IN DEVELOPING COUNTRIES TO AUGMENT MARKET

- 6.4 CARDIOVASCULAR DEVICES

- 6.4.1 RISING PREVALENCE OF CVDS TO PROPEL MARKET

- 6.5 DRUG DELIVERY DEVICES

- 6.5.1 INFUSION DEVICES & ADMINISTRATION SETS

- 6.5.1.1 Rising incidence of chronic diseases and number of surgical procedures to fuel market

- 6.5.2 SYRINGES

- 6.5.2.1 High cost of safety syringes and increasing incidence of needlestick injuries to hinder market

- 6.5.3 INHALERS

- 6.5.3.1 High prevalence of asthma, COPD, and cystic fibrosis to aid market growth

- 6.5.4 AUTOINJECTORS

- 6.5.4.1 Rising number of regulatory approvals for new drug therapies and advancements to drive market

- 6.5.5 PEN INJECTORS

- 6.5.5.1 Rising prevalence of chronic diseases and growing pipeline of biologics and biosimilars to boost market growth

- 6.5.6 OTHER DRUG DELIVERY DEVICES

- 6.5.1 INFUSION DEVICES & ADMINISTRATION SETS

- 6.6 ORTHOPEDIC DEVICES

- 6.6.1 HIGH PREVALENCE OF ORTHOPEDIC CONDITIONS TO DRIVE MARKET

- 6.7 RESPIRATORY CARE DEVICES

- 6.7.1 GROWING PREVALENCE OF RESPIRATORY INFECTIONS TO DRIVE MARKET

- 6.8 OPHTHALMOLOGY DEVICES

- 6.8.1 INCREASING PREVALENCE OF OPHTHALMIC DISEASES TO DRIVE MARKET

- 6.9 SURGICAL DEVICES

- 6.9.1 INCREASE IN SURGICAL PROCEDURES TO FUEL MARKET

- 6.10 DIABETES CARE DEVICES

- 6.10.1 RISING PREVALENCE OF DIABETES TO PROPEL MARKET

- 6.11 DENTAL DEVICES

- 6.11.1 RISING INCIDENCE OF DENTAL DISEASES TO DRIVE MARKET

- 6.12 ENDOSCOPY & LAPAROSCOPY DEVICES

- 6.12.1 RISING PATIENT PREFERENCE FOR MINIMALLY INVASIVE PROCEDURES TO AUGMENT MARKET

- 6.13 GYNECOLOGY/UROLOGY DEVICES

- 6.13.1 GROWING AWARENESS AND PREVENTIVE CHECK-UPS FOR LATE-PHASE DIAGNOSIS OF STDS TO PROPEL MARKET

- 6.14 PERSONAL CARE DEVICES

- 6.14.1 SHIFT IN CONSUMPTION PATTERN TOWARD PREMIUM PERSONAL CARE PRODUCTS TO FUEL MARKET

- 6.15 NEUROLOGY DEVICES

- 6.15.1 RISING GLOBAL BURDEN OF NEUROLOGICAL DISEASES TO DRIVE MARKET

- 6.16 PATIENT MONITORING DEVICES

- 6.16.1 GROWING AVAILABILITY OF INTEGRATED MONITORING TECHNOLOGY TO AID MARKET

- 6.17 PATIENT ASSISTIVE DEVICES

- 6.17.1 RISING GERIATRIC POPULATION TO PROPEL MARKET

- 6.18 OTHER DEVICES

7 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS

- 7.1 INTRODUCTION

- 7.2 CLASS II MEDICAL DEVICES

- 7.2.1 HIGH-VOLUME UTILIZATION OF CLASS II MEDICAL DEVICES TO SUPPORT MARKET

- 7.3 CLASS I MEDICAL DEVICES

- 7.3.1 CLASS I DEVICES HOLD LARGEST SHARE OF ALL APPROVED MEDICAL DEVICES

- 7.4 CLASS III MEDICAL DEVICES

- 7.4.1 HIGHEST LEVEL OF HEALTH RISKS NECESSITATES STRINGENT OVERSIGHT

8 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE

- 8.1 INTRODUCTION

- 8.2 DEVICE DEVELOPMENT & MANUFACTURING SERVICES

- 8.2.1 DEVICE & COMPONENT MANUFACTURING SERVICES

- 8.2.1.1 New aspects, such as robotics and personalized medicine, to necessitate specialized device manufacturing capabilities

- 8.2.2 PROCESS DEVELOPMENT SERVICES

- 8.2.2.1 Increased R&D spending and innovation and growing demand for complex products to drive market

- 8.2.3 DEVICE ENGINEERING SERVICES

- 8.2.3.1 Complexity of device engineering services to propel segment

- 8.2.1 DEVICE & COMPONENT MANUFACTURING SERVICES

- 8.3 QUALITY MANAGEMENT SERVICES

- 8.3.1 PACKAGING VALIDATION SERVICES

- 8.3.1.1 Increasing product safety concerns for medical devices to aid market

- 8.3.2 INSPECTION & TESTING SERVICES

- 8.3.2.1 Availability of technological expertise in testing services to eliminate large capital and overhead investments

- 8.3.3 STERILIZATION SERVICES

- 8.3.3.1 Rising complexity of sterility standards to augment market

- 8.3.1 PACKAGING VALIDATION SERVICES

- 8.4 PACKAGING & ASSEMBLY SERVICES

- 8.4.1 PRIMARY & SECONDARY PACKAGING SERVICES

- 8.4.1.1 Growing concerns for patient safety to aid segment

- 8.4.2 LABELING SERVICES

- 8.4.2.1 Export bans and product recalls due to improper labeling to support market

- 8.4.3 OTHER PACKAGING & ASSEMBLY SERVICES

- 8.4.1 PRIMARY & SECONDARY PACKAGING SERVICES

- 8.5 OTHER SERVICES

9 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.2.2 CHINA

- 9.2.2.1 Low labor costs and rapidly changing healthcare infrastructure to drive market

- 9.2.3 INDIA

- 9.2.3.1 Rising contract manufacturing capabilities to support market growth

- 9.2.4 JAPAN

- 9.2.4.1 Universal healthcare reimbursement policies to propel market

- 9.2.5 MALAYSIA

- 9.2.5.1 Increasing R&D activities and investments by established players to augment market growth

- 9.2.6 THAILAND

- 9.2.6.1 Government-supported industrial clustering and export competitiveness to propel market

- 9.2.7 SOUTH KOREA

- 9.2.7.1 High-value imports from other countries to offer growth opportunities

- 9.2.8 AUSTRALIA

- 9.2.8.1 Government-backed investment in sovereign capability to drive medtech manufacturing growth

- 9.2.9 PHILIPPINES

- 9.2.9.1 Skilled labor force and IT-enabled support to drive market growth

- 9.2.10 SINGAPORE

- 9.2.10.1 Strong government support and global investments to drive market

- 9.2.11 NEW ZEALAND

- 9.2.11.1 Deregulation of therapeutic products unlocking expedited access and export potential

- 9.2.12 REST OF ASIA PACIFIC

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Presence of major device manufacturers and high healthcare expenditure to support market growth

- 9.3.3 UK

- 9.3.3.1 Rising number of accredited clinical laboratories and hospital laboratories to propel market

- 9.3.4 FRANCE

- 9.3.4.1 Increasing government pressure for healthcare cost reduction and budgetary constraints to support market growth

- 9.3.5 SPAIN

- 9.3.5.1 Increasing adoption of home-based medical devices to drive market

- 9.3.6 ITALY

- 9.3.6.1 Healthcare coverage for all citizens and foreign residents to increase demand for medical devices

- 9.3.7 REST OF EUROPE

- 9.4 NORTH AMERICA

- 9.4.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.4.2 US

- 9.4.2.1 Presence of stringent government regulations to drive market

- 9.4.3 CANADA

- 9.4.3.1 Strong presence of key contract manufacturing companies to augment market

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Favorable government initiatives and willingness to pay for better healthcare to boost market

- 9.5.3 MEXICO

- 9.5.3.1 Proximity to US and other LATAM countries to strengthen Mexico's relevance as a contract manufacturing hub

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Increasing healthcare infrastructure development to support market growth

- 9.6.2.2 Kingdom of Saudi Arabia (KSA)

- 9.6.2.2.1 Focus on healthcare localization and Vision 2030 to drive investment

- 9.6.2.3 United Arab Emirates (UAE)

- 9.6.2.3.1 Advanced infrastructure and regulatory efficiency to attract global medtech contract manufacturers

- 9.6.2.4 Rest of GCC Countries

- 9.6.3 REST OF MIDDLE EAST AND AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.1.1 KEY STRATEGIES ADOPTED BY PLAYERS IN MEDICAL DEVICE CONTRACT MANUFACTURING MARKET

- 10.2 REVENUE ANALYSIS, 2020-2024

- 10.3 MARKET SHARE ANALYSIS, 2024

- 10.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.4.1 STARS

- 10.4.2 EMERGING LEADERS

- 10.4.3 PERVASIVE PLAYERS

- 10.4.4 PARTICIPANTS

- 10.4.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.4.5.1 Company footprint

- 10.4.5.2 Region footprint

- 10.4.5.3 Device footprint

- 10.4.5.4 Device class footprint

- 10.4.5.5 Service footprint

- 10.5 COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- 10.5.1 PROGRESSIVE COMPANIES

- 10.5.2 RESPONSIVE COMPANIES

- 10.5.3 DYNAMIC COMPANIES

- 10.5.4 STARTING BLOCKS

- 10.5.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.5.5.1 Detailed list of key startups/SMEs

- 10.5.5.2 Competitive benchmarking of key startups/SMEs

- 10.6 COMPANY VALUATION & FINANCIAL METRICS

- 10.6.1 FINANCIAL METRICS

- 10.6.2 COMPANY VALUATION

- 10.7 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.8 R&D ASSESSMENT OF KEY PLAYERS

- 10.9 COMPETITIVE SCENARIO

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 JABIL INC.

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Services/Solutions offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product approvals

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices made

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 FLEX LTD.

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Services/Solutions offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 Expansions

- 11.1.2.5 MnM view

- 11.1.2.5.1 Right to win

- 11.1.2.5.2 Strategic choices made

- 11.1.2.5.3 Weaknesses and competitive threats

- 11.1.3 PLEXUS CORP.

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Services/Solutions offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices made

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 SANMINA CORPORATION

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Services/Solutions offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices made

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 INTEGER HOLDINGS CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Services/Solutions offered

- 11.1.5.3 Recent developments

- 11.1.5.4 Deals

- 11.1.5.5 MnM view

- 11.1.5.5.1 Right to win

- 11.1.5.5.2 Strategic choices made

- 11.1.5.5.3 Weaknesses and competitive threats

- 11.1.6 TE CONNECTIVITY LTD.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Services/Solutions offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.4 Deals

- 11.1.7 NIPRO CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Services/Solutions offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Expansions

- 11.1.8 CELESTICA INC.

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Services/Solutions offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Expansions

- 11.1.8.3.2 Other developments

- 11.1.9 WEST PHARMACEUTICAL SERVICES, INC.

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Services/Solutions offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.9.3.2 Deals

- 11.1.10 BENCHMARK ELECTRONICS INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Services/Solutions offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.10.3.2 Expansions

- 11.1.11 RECIPHARM AB

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Services/Solutions offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.11.4 Other developments

- 11.1.12 GERRESHEIMER AG

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Services/Solutions offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Deals

- 11.1.13 KIMBALL ELECTRONICS, INC.

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Services/Solutions offered

- 11.1.14 NORTECH SYSTEMS, INC.

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Services/Solutions offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product approvals

- 11.1.15 CARCLO PLC

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Services/Solutions offered

- 11.1.16 NOLATO GW, INC. (A PART OF NOLATO AB)

- 11.1.16.1 Business overview

- 11.1.16.2 Products/Services/Solutions offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Deals

- 11.1.1 JABIL INC.

- 11.2 OTHER PLAYERS

- 11.2.1 NEMERA

- 11.2.2 VIANT MEDICAL HOLDINGS, INC.

- 11.2.3 TECOMET, INC.

- 11.2.4 SMC LTD.

- 11.2.5 PHILLIPS-MEDISIZE CORPORATION

- 11.2.6 TESSY PLASTICS CORP.

- 11.2.7 MEHOW

- 11.2.8 TEKNI-PLEX

- 11.2.9 PETER'S TECHNOLOGY

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 STANDARD CURRENCY CONVERSION RATES (UNIT OF USD)

- TABLE 2 RISK ASSESSMENT: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET

- TABLE 3 KEY ACQUISITIONS IN MEDICAL DEVICE INDUSTRY

- TABLE 4 ESTIMATED INCREASE IN GERIATRIC POPULATION, BY REGION, 2019 VS. 2050

- TABLE 5 AVERAGE LIFE EXPECTANCY, 2023

- TABLE 6 KEY EXAMPLES OF OEM CONSOLIDATION

- TABLE 7 KEY EXAMPLES OF CMO CONSOLIDATION

- TABLE 8 KEY INVESTMENTS BY PRIVATE EQUITY FIRMS

- TABLE 9 EXAMPLES OF KEY COLLABORATIONS AND AGREEMENTS

- TABLE 10 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MEDICAL DEVICES

- TABLE 12 KEY BUYING CRITERIA FOR MEDICAL DEVICES

- TABLE 13 US: CLASSIFICATION OF MEDICAL EQUIPMENT

- TABLE 14 US: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 15 CANADA: RISK, TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 16 EUROPE: RISK, TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 17 JAPAN: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 18 CHINA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 AVERAGE SELLING PRICE TREND OF MEDICAL DEVICE CONTRACT MANUFACTURING SERVICES, BY DEVICE, 2022-2024 (USD)

- TABLE 25 AVERAGE SELLING PRICE TREND OF MEDICAL DEVICE CONTRACT MANUFACTURING SERVICES, BY REGION, 2022-2024 (USD)

- TABLE 26 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 27 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: LIST OF MAJOR PATENTS, JANUARY 2022-JUNE 2025

- TABLE 28 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: ROLE IN ECOSYSTEM, 2024

- TABLE 29 IMPORT DATA FOR HS CODE 9018, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 30 EXPORT DATA FOR HS CODE 9018, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 31 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 32 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 33 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 34 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 IVD CONSUMABLES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 IVD EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DIAGNOSTIC IMAGING DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 PREVALENCE OF CVDS, 2015-2035

- TABLE 39 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR CARDIOVASCULAR DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 41 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 INFUSION DEVICES & ADMINISTRATION SETS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 SYRINGES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 INHALERS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 RECENT APPROVALS FOR AUTOINJECTORS AND PEN INJECTORS GLOBALLY

- TABLE 46 AUTOINJECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 PEN INJECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 OTHER DRUG DELIVERY DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR ORTHOPEDIC DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR RESPIRATORY CARE DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR OPHTHALMOLOGY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR SURGICAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 TOP FIVE COUNTRIES WITH HIGHEST NUMBER OF DIABETIC PATIENTS (20-79 YRS) (2024 V/S 2050)

- TABLE 55 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DIABETES CARE DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DENTAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR ENDOSCOPY & LAPAROSCOPY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR GYNECOLOGY/UROLOGY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR PERSONAL CARE DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR NEUROLOGY DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR PATIENT MONITORING DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR PATIENT ASSISTIVE DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR OTHER DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 69 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR CLASS II MEDICAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR CLASS I MEDICAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR CLASS III MEDICAL DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 74 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DEVICE DEVELOPMENT & MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 75 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DEVICE DEVELOPMENT & MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 DEVICE & COMPONENT MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 PROCESS DEVELOPMENT SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 DEVICE ENGINEERING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR QUALITY MANAGEMENT SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 81 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR QUALITY MANAGEMENT SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 82 PACKAGING VALIDATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 INSPECTION & TESTING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 MEDICAL DEVICE STERILIZATION PATENTS PUBLISHED BY MAJOR COMPANIES WORLDWIDE

- TABLE 85 STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR PACKAGING & ASSEMBLY SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 87 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR PACKAGING & ASSEMBLY SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 PRIMARY & SECONDARY PACKAGING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 89 LABELING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 OTHER PACKAGING & ASSEMBLY SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 92 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 99 ASIA PACIFIC: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 100 ASIA PACIFIC: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 102 CHINA: KEY MACROINDICATORS

- TABLE 103 CHINA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 104 CHINA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 CHINA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 CHINA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 107 CHINA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 108 CHINA: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 CHINA: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 110 CHINA: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 INDIA: KEY MACROINDICATORS

- TABLE 113 INDIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 114 INDIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 INDIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 INDIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 117 INDIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 118 INDIA: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 INDIA: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 INDIA: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 JAPAN: KEY MACROINDICATORS

- TABLE 122 JAPAN: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 123 JAPAN: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 JAPAN: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 JAPAN: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 126 JAPAN: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 127 JAPAN: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 JAPAN: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 129 JAPAN: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 130 MALAYSIA: KEY MACROINDICATORS

- TABLE 131 MALAYSIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 132 MALAYSIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 MALAYSIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 MALAYSIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 135 MALAYSIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 136 MALAYSIA: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 137 MALAYSIA: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 MALAYSIA: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 THAILAND: KEY MACROINDICATORS

- TABLE 141 THAILAND: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 142 THAILAND: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 143 THAILAND: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 THAILAND: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 145 THAILAND: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 146 THAILAND: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 THAILAND: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 THAILAND: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 151 SOUTH KOREA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 152 SOUTH KOREA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 SOUTH KOREA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 SOUTH KOREA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 156 SOUTH KOREA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 157 SOUTH KOREA: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 SOUTH KOREA: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 SOUTH KOREA: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 AUSTRALIA: KEY MACROINDICATORS

- TABLE 161 AUSTRALIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 162 AUSTRALIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 AUSTRALIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 AUSTRALIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 165 AUSTRALIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 166 AUSTRALIA: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 167 AUSTRALIA: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 AUSTRALIA: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 PHILIPPINES: KEY MACROINDICATORS

- TABLE 170 PHILIPPINES: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 171 PHILIPPINES: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 PHILIPPINES: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 173 PHILIPPINES: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 174 PHILIPPINES: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 175 PHILIPPINES: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 PHILIPPINES: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 PHILIPPINES: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 178 SINGAPORE: KEY MACROINDICATORS

- TABLE 179 SINGAPORE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 180 SINGAPORE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 SINGAPORE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 SINGAPORE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 183 SINGAPORE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 184 SINGAPORE: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 185 SINGAPORE: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 SINGAPORE: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 NEW ZEALAND: KEY MACROINDICATORS

- TABLE 188 NEW ZEALAND: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 189 NEW ZEALAND: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 NEW ZEALAND: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 NEW ZEALAND: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 192 NEW ZEALAND: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 193 NEW ZEALAND: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 NEW ZEALAND: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 NEW ZEALAND: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 REST OF ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 197 REST OF ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 199 REST OF ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 200 REST OF ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 201 REST OF ASIA PACIFIC: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 REST OF ASIA PACIFIC: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 204 EUROPE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 205 EUROPE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 206 EUROPE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 EUROPE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 EUROPE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 209 EUROPE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 210 EUROPE: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 EUROPE: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 EUROPE: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 GERMANY: KEY MACROINDICATORS

- TABLE 214 GERMANY: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 215 GERMANY: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 216 GERMANY: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 217 GERMANY: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 218 GERMANY: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 219 GERMANY: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 GERMANY: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 GERMANY: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 UK: KEY MACROINDICATORS

- TABLE 223 UK: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 224 UK: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 225 UK: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 226 UK: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 227 UK: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 228 UK: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 229 UK: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 UK: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 231 FRANCE: KEY MACROINDICATORS

- TABLE 232 FRANCE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 233 FRANCE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 234 FRANCE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 235 FRANCE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 236 FRANCE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 237 FRANCE: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 238 FRANCE: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 239 FRANCE: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 240 SPAIN: KEY MACROINDICATORS

- TABLE 241 SPAIN: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 242 SPAIN: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 243 SPAIN: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 244 SPAIN: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 245 SPAIN: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 246 SPAIN: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 247 SPAIN: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 248 SPAIN: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 249 ITALY: KEY MACROINDICATORS

- TABLE 250 ITALY: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 251 ITALY: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 252 ITALY: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 253 ITALY: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 254 ITALY: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 255 ITALY: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 ITALY: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 257 ITALY: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 258 REST OF EUROPE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 259 REST OF EUROPE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 260 REST OF EUROPE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 261 REST OF EUROPE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 262 REST OF EUROPE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 263 REST OF EUROPE: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 264 REST OF EUROPE: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 265 REST OF EUROPE: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 266 NORTH AMERICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 267 NORTH AMERICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 268 NORTH AMERICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 269 NORTH AMERICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 270 NORTH AMERICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 271 NORTH AMERICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 272 NORTH AMERICA: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 273 NORTH AMERICA: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 274 NORTH AMERICA: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 275 US: KEY MACROINDICATORS

- TABLE 276 US: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 277 US: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 278 US: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 279 US: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 280 US: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 281 US: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 282 US: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 283 US: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 284 CANADA: KEY MACROINDICATORS

- TABLE 285 CANADA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 286 CANADA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 287 CANADA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 288 CANADA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 289 CANADA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 290 CANADA: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 291 CANADA: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 292 CANADA: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 293 LATIN AMERICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 294 LATIN AMERICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 295 LATIN AMERICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 296 LATIN AMERICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 297 LATIN AMERICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 298 LATIN AMERICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 299 LATIN AMERICA: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 300 LATIN AMERICA: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 301 LATIN AMERICA: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 302 BRAZIL: KEY MACROINDICATORS

- TABLE 303 BRAZIL: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 304 BRAZIL: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 305 BRAZIL: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 306 BRAZIL: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 307 BRAZIL: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 308 BRAZIL: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 309 BRAZIL: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 310 BRAZIL: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 311 MEXICO: KEY MACROINDICATORS

- TABLE 312 MEXICO: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 313 MEXICO: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 314 MEXICO: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 315 MEXICO: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 316 MEXICO: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 317 MEXICO: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 318 MEXICO: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 319 MEXICO: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 320 REST OF LATIN AMERICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 321 REST OF LATIN AMERICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 322 REST OF LATIN AMERICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 323 REST OF LATIN AMERICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 324 REST OF LATIN AMERICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 325 REST OF LATIN AMERICA: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 326 REST OF LATIN AMERICA: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 327 REST OF LATIN AMERICA: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 328 MIDDLE EAST & AFRICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 329 MIDDLE EAST & AFRICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 330 MIDDLE EAST & AFRICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 331 MIDDLE EAST & AFRICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 332 MIDDLE EAST & AFRICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 333 MIDDLE EAST & AFRICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 334 MIDDLE EAST & AFRICA: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 335 MIDDLE EAST & AFRICA: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 336 MIDDLE EAST & AFRICA: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 337 GCC COUNTRIES: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 338 GCC COUNTRIES: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 339 GCC COUNTRIES: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 340 GCC COUNTRIES: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 341 GCC COUNTRIES: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 342 GCC COUNTRIES: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 343 GCC COUNTRIES: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 344 GCC COUNTRIES: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 345 GCC COUNTRIES: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 346 KSA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 347 KSA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 348 KSA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 349 KSA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 350 KSA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 351 KSA: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 352 KSA: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 353 KSA: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 354 UAE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 355 UAE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 356 UAE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 357 UAE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 358 UAE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 359 UAE: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 360 UAE: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 361 UAE: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 362 REST OF GCC COUNTRIES: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 363 REST OF GCC COUNTRIES: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 364 REST OF GCC COUNTRIES: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 365 REST OF GCC COUNTRIES: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 366 REST OF GCC COUNTRIES: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 367 REST OF GCC COUNTRIES: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 368 REST OF GCC COUNTRIES: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 369 REST OF GCC COUNTRIES: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 370 REST OF MIDDLE EAST & AFRICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2023-2030 (USD MILLION)

- TABLE 371 REST OF MIDDLE EAST & AFRICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 372 REST OF MIDDLE EAST & AFRICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 373 REST OF MIDDLE EAST & AFRICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE CLASS, 2023-2030 (USD MILLION)

- TABLE 374 REST OF MIDDLE EAST & AFRICA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 375 REST OF MIDDLE EAST & AFRICA: DEVICE DEVELOPMENT & MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 376 REST OF MIDDLE EAST & AFRICA: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 377 REST OF MIDDLE EAST & AFRICA: PACKAGING & ASSEMBLY SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 378 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN MEDICAL DEVICE CONTRACT MARKET

- TABLE 379 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: DEGREE OF COMPETITION

- TABLE 380 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: REGION FOOTPRINT

- TABLE 381 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: DEVICE FOOTPRINT (1/2)

- TABLE 382 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: DEVICE FOOTPRINT (2/2)

- TABLE 383 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: DEVICE CLASS FOOTPRINT

- TABLE 384 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: SERVICE FOOTPRINT

- TABLE 385 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 386 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 387 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 388 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: DEALS, JANUARY 2022-JUNE 2025

- TABLE 389 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 390 JABIL INC.: COMPANY OVERVIEW

- TABLE 391 JABIL INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 392 JABIL INC: PRODUCT APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 393 JABIL INC: DEALS, JANUARY 2022-JUNE 2025

- TABLE 394 FLEX LTD.: COMPANY OVERVIEW

- TABLE 395 FLEX LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 396 FLEX LTD.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 397 FLEX LTD.: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 398 PLEXUS CORP.: COMPANY OVERVIEW

- TABLE 399 PLEXUS CORP.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 400 PLEXUS CORP: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 401 SANMINA CORPORATION: COMPANY OVERVIEW

- TABLE 402 SANMINA CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 403 SANMINA CORPORATION: DEALS, JANUARY 2022-JUNE 2025

- TABLE 404 INTEGER HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 405 INTEGER HOLDINGS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 406 INTEGER HOLDINGS CORPORATION: DEALS, JANUARY 2022-JUNE 2025

- TABLE 407 TE CONNECTIVITY LTD.: COMPANY OVERVIEW

- TABLE 408 TE CONNECTIVITY LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 409 TE CONNECTIVITY LTD: PRODUCT LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 410 TE CONNECTIVITY LTD: DEALS, JANUARY 2022-JUNE 2025

- TABLE 411 NIPRO CORPORATION: COMPANY OVERVIEW

- TABLE 412 NIPRO CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 413 NIPRO CORPORATION: EXPANSIONS: JANUARY 2022-JUNE 2025

- TABLE 414 CELESTICA INC.: COMPANY OVERVIEW

- TABLE 415 CELESTICA INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 416 CELESTICA INC.: EXPANSIONS: JANUARY 2022-JUNE 2025

- TABLE 417 CELESTICA INC.: OTHER DEVELOPMENTS, JANUARY 2022- JUNE 2025

- TABLE 418 WEST PHARMACEUTICALS SERVICES, INC.: COMPANY OVERVIEW

- TABLE 419 WEST PHARMACEUTICAL SERVICES, INC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 420 WEST PHARMACEUTICAL SERVICES, INC: PRODUCT LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 421 WEST PHARMACEUTICAL SERVICES, INC: DEALS, JANUARY 2022-JUNE 2025

- TABLE 422 BENCHMARK ELECTRONICS INC.: COMPANY OVERVIEW

- TABLE 423 BENCHMARK ELECTRONICS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 424 BENCHMARK ELECTRONICS INC.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 425 BENCHMARK ELECTRONICS INC.: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 426 RECIPHARM AB: COMPANY OVERVIEW

- TABLE 427 RECIPHARM AB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 428 RECIPHARM AB: DEALS, JANUARY 2022-JUNE 2025

- TABLE 429 RECIPHARM AB: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 430 GERRESHEIMER AG: COMPANY OVERVIEW

- TABLE 431 GERRESHEIMER AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 432 GERRESHEIMER AG: DEALS, JANUARY 2022-JUNE 2025

- TABLE 433 KIMBALL ELECTRONICS, INC.: COMPANY OVERVIEW

- TABLE 434 KIMBALL ELECTRONICS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 435 NORTECH SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 436 NORTECH SYSTEMS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 437 NORTECH SYSTEMS, INC.: PRODUCT APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 438 CARCLO PLC: COMPANY OVERVIEW

- TABLE 439 CARCLO PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 440 NOLATO GW, INC.: COMPANY OVERVIEW

- TABLE 441 NOLATO GW, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 442 NOLATO GW, INC.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 443 NEMERA: COMPANY OVERVIEW

- TABLE 444 VIANT MEDICAL HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 445 TECOMET, INC.: COMPANY OVERVIEW

- TABLE 446 SMC LTD.: COMPANY OVERVIEW

- TABLE 447 PHILLIPS-MEDISIZE CORPORATION: COMPANY OVERVIEW

- TABLE 448 TESSY PLASTICS CORP.: COMPANY OVERVIEW

- TABLE 449 MEHOW: COMPANY OVERVIEW

- TABLE 450 TEKNI-PLEX: COMPANY OVERVIEW

- TABLE 451 PETER'S TECHNOLOGY: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: MARKETS & REGIONS COVERED

- FIGURE 2 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 7 SUPPLY SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: FLEX, LTD.

- FIGURE 9 SUPPLY SIDE ANALYSIS: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET (2024)

- FIGURE 10 DEMAND-SIDE ESTIMATION FOR MEDICAL DEVICE CONTRACT MANUFACTURING MARKET

- FIGURE 11 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2025-2030)

- FIGURE 12 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

- FIGURE 13 TOP-DOWN APPROACH

- FIGURE 14 MARKET DATA TRIANGULATION METHODOLOGY

- FIGURE 15 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY CLASS OF DEVICE, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 GEOGRAPHICAL SNAPSHOT OF MEDICAL DEVICE CONTRACT MANUFACTURING MARKET

- FIGURE 19 TECHNOLOGICAL ADVANCEMENTS IN MEDICAL DEVICE MODALITIES TO DRIVE MARKET

- FIGURE 20 CHINA AND CLASS I SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2024

- FIGURE 21 EMERGING ECONOMIES SHOW HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 22 ASIA PACIFIC COUNTRIES TO EMERGE AS GROWTH HOTSPOTS

- FIGURE 23 ASIA PACIFIC TO DOMINATE MARKET IN 2030

- FIGURE 24 MARKET DYNAMICS: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET

- FIGURE 25 GDP GROWTH FORECAST: COMPARISON OF INDIA, CHINA, US, AND GERMANY, 2022 VS. 2030 (FORECAST)

- FIGURE 26 FACTORS DRIVING DEMAND FOR CONTRACT MANUFACTURING

- FIGURE 27 HEALTHCARE EXPENDITURE (%), BY COUNTRY (2010 TO 2022)

- FIGURE 28 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MEDICAL DEVICES

- FIGURE 30 KEY BUYING CRITERIA FOR MEDICAL DEVICES