|

市場調查報告書

商品編碼

1794018

全球智慧工廠市場(按組件和解決方案)預測(至 2030 年)Smart Factory Market by Component (Industrial Sensors, Industrial Robots, Industrial 3D Printing, Machine Vision Systems), Solution (SCADA, Manufacturing Execution Systems (MES), Plant Asset Management (PAM), Industrial Safety) - Global Forecast to 2030 |

||||||

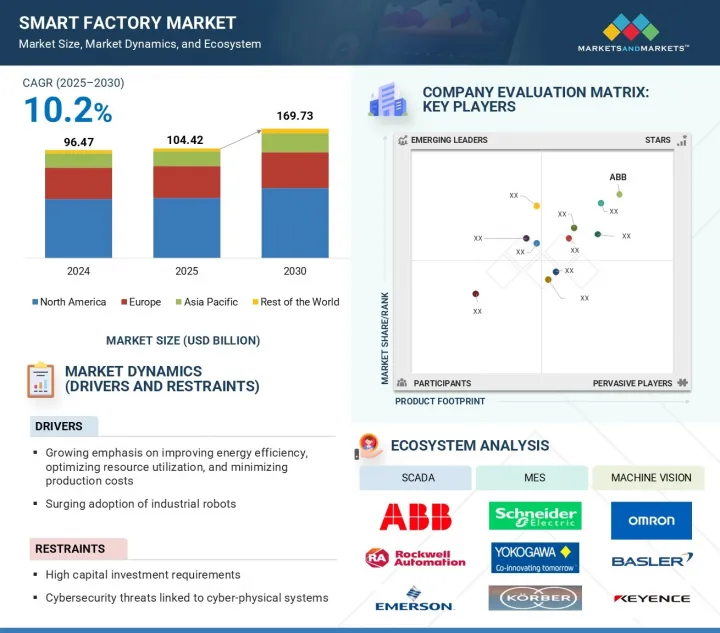

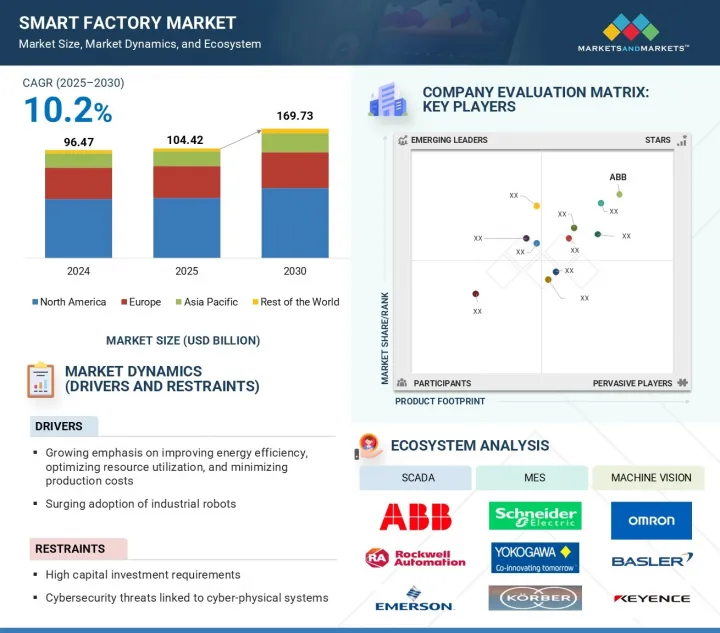

全球智慧工廠市場規模預計將從 2025 年的 1,044.2 億美元成長到 2030 年的 1,697.3 億美元,複合年成長率為 10.2%。

市場成長的驅動力在於工業 4.0 技術的日益普及、為提高生產力而不斷成長的自動化需求,以及對能源效率和資源最佳化的重視。各行各業正在投資智慧製造解決方案,例如工業感測器、機器人、3D 列印和機器視覺系統,以提高業務效率並減少停機時間。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 10億美元 |

| 部分 | 組件、解決方案、產業、地區 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

MES、SCADA 和 PAM 系統的進步也支持著工廠的數位轉型。政府措施和不斷上漲的人事費用也在推動企業實現製造業務現代化。這些因素共同推動了汽車、電子、食品飲料和製藥等產業對智慧工廠解決方案的需求。

“預計到 2024 年,MES 領域將佔據智慧工廠市場的最大佔有率。”

製造執行系統 (MES) 對於建構智慧工廠至關重要,預計將在市場佔有率方面佔據市場領先地位。這些系統連接企業級規劃和現場營運,實現對製造活動的即時追蹤、監控和控制。 MES 的廣泛採用源自於提高生產效率、減少停機時間和確保品質合規的需求。 MES 解決方案透過提供對效能、庫存和工作流程的可視性,支援數據主導的決策。它們還支援與 ERP 和自動化系統無縫整合,使其成為管理複雜製造環境的理想選擇。隨著企業努力採用工業 4.0,MES 在數位轉型中扮演的角色日益重要。此外,MES 解決方案憑藉其擴充性和適應性,在汽車、電子和製藥等行業中越來越受歡迎。隨著對營運透明度、生產可追溯性和即時分析的日益關注,MES 平台正成為智慧互聯工廠發展的重要工具。

“預測期內,半導體和電子行業將實現顯著的複合年成長率。”

預計在預測期內,智慧工廠市場將在半導體和電子領域見證強勁成長。這主要是由於晶片和電子元件製造對先進自動化、即時監控和精密製造的需求不斷成長。半導體製造對極高精度、無塵室操作和高效材料利用的需求使其成為採用智慧工廠技術(如物聯網感測器、機器人、數位雙胞胎和人工智慧驅動的分析)的理想領域。這些工具有助於減少缺陷、提高產量比率並確保一致的質量,這在電子產品生產中至關重要。此外,對更短生產週期、更高客製化和更快上市時間的需求,正推動半導體和電子公司使用智慧工廠解決方案升級舊有系統。設備連接和邊緣運算的不斷進步正在進一步推動這一轉變。隨著製造商致力於提高生產力和能源效率,智慧工廠方法正在獲得發展勢頭。預計這些趨勢將在預測期內顯著推動該領域的高複合年成長率。

“到2030年,北美將佔據智慧工廠市場的大部分佔有率。”

預計到2030年,北美智慧工廠市場將保持強勁地位,這得益於工業自動化、先進製造技術和強大數位基礎設施的廣泛應用。美國是智慧工廠市場的主要貢獻者,這得益於其對工業4.0的早期投資、強大的技術提供者實力以及對提高生產力和降低營運成本的重視。汽車、航太、電子和食品加工等行業的需求正在成長,這些產業都在積極整合物聯網、機器人技術、機器學習和雲端基礎方案,以實現業務現代化。

本報告研究了全球智慧工廠市場,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 智慧工廠市場為企業帶來誘人機會

- 智慧工廠市場(按組件)

- 智慧工廠市場(按解決方案)

- 智慧工廠市場:依流程工業

- 智慧工廠市場:按離散製造業分類

- 北美智慧工廠市場(按解決方案和國家分類)

- 各國智慧工廠市場

第5章市場概述

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 價值鏈分析

- 生態系分析

- 投資金籌措場景

- 定價分析

- MES定價分析

- 工業機器人平均銷售價格

- SCADA平均售價

- 機器視覺組件的平均售價

- 參考價格:主要企業及各組成部分(2024年)

- 工業感測器的平均售價

- 影響客戶業務的趨勢/中斷

- 波特五力分析

- 案例研究分析

- ELOPAK 安裝配備堅固的 EMERSON AVENTICS 氣動系統的全無菌山形蓋頂包裝填充機

- MP Equipment 與羅克韋爾自動化安全顧問合作,重新評估蛋白質分裝機設計

- MOLLART ENGINEERING 為寶潔智慧工具機安裝封閉式防護裝置

- 主要汽車供應商利用富士膠片的 4D 高解析度機器視覺鏡頭提高偵測效率

- SIDENOR 鋼廠利用 3D 機器視覺實現先進的尺寸和品管

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 主要相關利益者和採購標準

- 貿易分析

- 進口情形(HS 編碼 847950)

- 出口情形(HS 編碼 847950)

- 專利分析

- 大型會議和活動(2025-2026年)

- 監管格局

- 監管機構、政府機構和其他組織

- 標準

- 人工智慧/生成人工智慧對智慧工廠市場的影響

- 介紹

- 人工智慧/生成式人工智慧對關鍵終端產業的影響

- 用例

- 智慧工廠生態系統中人工智慧/生成式人工智慧的未來

- 2025年美國關稅的影響—概述

- 介紹

- 主要關稅稅率

- 價格影響分析

- 對國家和地區的影響

- 對終端產業的影響

第6章 智慧工廠市場(按組件)

- 介紹

- 工業感測器

- 工業機器人

- 工業3D列印

- 機器視覺

第7章 智慧工廠市場(按解決方案)

- 介紹

- 製造執行系統(MES)

- 監控和數據採集(SCADA)

- 工廠資產管理(PAM)

- 工業安全

第8章 智慧工廠市場(按行業)

- 介紹

- 流程工業

- 離散製造業

第9章:按地區分類的智慧工廠市場

- 介紹

- 北美洲

- 北美宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 歐洲宏觀經濟展望

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 波蘭

- 北歐的

- 其他歐洲國家

- 亞太地區

- 亞太宏觀經濟展望

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 泰國

- 越南

- 其他亞太地區

- 其他地區

- 其他地區的宏觀經濟展望

- 中東

- 南美洲

- 非洲

第10章 競爭格局

- 介紹

- 主要參與企業的策略/優勢,2021 年 1 月至 2025 年 6 月

- 收益分析(2020-2024)

- 前五大公司市場佔有率分析(2024年)

- 公司估值及財務指標

- 比較產品

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 競爭場景

第11章:公司簡介

- 主要企業

- ABB

- EMERSON ELECTRIC CO.

- SIEMENS

- SCHNEIDER ELECTRIC

- ROCKWELL AUTOMATION, INC.

- HONEYWELL INTERNATIONAL INC.

- MITSUBISHI ELECTRIC CORPORATION

- GE VERNOVA

- YOKOGAWA ELECTRIC CORPORATION

- OMRON CORPORATION

- ENDRESS+HAUSER GROUP SERVICES AG

- FANUC CORPORATION

- WIKA ALEXANDER WIEGAND SE & CO. KG

- DWYER INSTRUMENTS, LLC

- STRATASYS

- 3D SYSTEMS, INC.

- COGNEX CORPORATION

- BASLER AG

- 其他主要企業

- FUJI ELECTRIC CO., LTD.

- HITACHI, LTD.

- KROHNE MESSTECHNIK GMBH

- AZBIL CORPORATION

- VEGA GRIESHABER KG

- DANFOSS

- KUKA AG

- 其他中小企業

- TRIDITIVE

- ROBOZE

- ZIVID

- INXPECT SPA

- INUITIVE

- FUELICS

- ULTIMAKER

- NANO DIMENSION

- PICK-IT NV

- ONROBOT A/S

第12章 附錄

The global smart factory market is projected to grow from USD 104.42 billion in 2025 to USD 169.73 billion by 2030, growing at a CAGR of 10.2%. The market growth is driven by the increasing adoption of Industry 4.0 technologies, rising demand for automation to improve productivity, and growing emphasis on energy efficiency and resource optimization. Industries are investing in smart manufacturing solutions such as industrial sensors, robots, 3D printing, and machine vision systems to improve operational efficiency and reduce downtime.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Component, Solution, Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Advancements in MES, SCADA, and PAM systems are also supporting the digital transformation of factories. Government initiatives and rising labor costs also encourage companies to modernize their manufacturing operations. These factors collectively boost the demand for smart factory solutions across sectors such as automotive, electronics, food & beverages, and pharmaceuticals.

"MES segment accounted for largest share of smart factory market in 2024"

Manufacturing execution systems (MES) are crucial in smart factory setups and are expected to lead the market in terms of share. These systems bridge enterprise-level planning and shop-floor operations, enabling real-time tracking, monitoring, and control of manufacturing activities. Their widespread adoption is driven by the need to improve production efficiency, reduce downtime, and ensure quality compliance. MES solutions help manufacturers make data-driven decisions by offering visibility into performance, inventory, and workflows. They also support seamless integration with ERP and automation systems, making them ideal for managing complex manufacturing environments. As companies aim to adopt Industry 4.0 practices, the role of MES in digital transformation becomes even more critical. Additionally, MES solutions are gaining popularity for their scalability and adaptability across industries such as automotive, electronics, and pharmaceuticals. With increasing focus on operational transparency, production traceability, and real-time analytics, MES platforms are becoming essential tools in evolving smart, connected factories.

"Semiconductor & electronics segment to record a significant CAGR during forecast period"

During the forecast period, the smart factory market is expected to experience strong growth in the semiconductor & electronics segment. This is mainly due to rising demand for advanced automation, real-time monitoring, and precision manufacturing in chip and electronic component production. Semiconductor manufacturing requires extremely high accuracy, cleanroom operations, and efficient use of materials, making it an ideal sector for adopting smart factory technologies such as IoT sensors, robotics, digital twins, and AI-driven analytics. These tools help reduce defects, improve yield, and ensure consistent quality, which is critical in electronics production. Additionally, the need for shorter production cycles, greater customization, and faster time-to-market pushes semiconductor and electronics companies to upgrade legacy systems with smart factory solutions. Ongoing advancements in equipment connectivity and edge computing further support this transition. The smart factory approach is gaining momentum as manufacturers aim for better productivity and energy efficiency. These trends are expected to significantly drive the segment's high CAGR during the forecast period.

"North America to hold a significant share in smart factory market by 2030"

The smart factory market in North America is anticipated to maintain a strong position through 2030, supported by widespread adoption of industrial automation, advanced manufacturing technologies, and strong digital infrastructure. The US is a key contributor, driven by its early investment in Industry 4.0 practices, strong presence of technology providers, and a focus on boosting productivity and reducing operational costs. Demand is growing across sectors such as automotive, aerospace, electronics, and food processing, all actively integrating IoT, robotics, machine learning, and cloud-based solutions to modernize operations. The region also benefits from supportive government initiatives promoting smart manufacturing and digital transformation, including funding programs and industry partnerships. Prominent players such as Rockwell Automation (US), Honeywell International Inc. (US), Emerson Electric Co. (US), and GE Vernova (US) continuously innovate and offer scalable smart factory solutions. Moreover, the increasing emphasis on real-time monitoring, predictive maintenance, and energy efficiency aligns well with North American manufacturers' goals. With a strong foundation in technology adoption and a clear focus on competitiveness, North America is expected to capture a significant share of the smart factory market during the forecast period.

Extensive primary interviews were conducted with key industry experts in the smart factory market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation - Directors - 48%, C- level Executives - 33%, and Others - 19%

- By Region - Asia Pacific - 40%, Europe - 18%, North America - 35%, and RoW - 7%

The smart factory market is dominated by a few globally established players, such as ABB (Switzerland), Emerson Electric Co.(US), Siemens (Germany), Schneider Electric (France), Mitsubishi Electric Corporation (Japan), GE Vernova (US), Rockwell Automation (US), Honeywell International Inc. (US), Yokogawa Electric Corporation (Japan), OMRON Corporation (Japan), WIKA Alexander Wiegand SE & Co. KG (Germany), Endress+Hauser Group Services AG (Switzerland), and FANUC CORPORATION (Japan).

The study includes an in-depth competitive analysis of these key players in the smart factory market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the smart factory market and forecasts its size by component (industrial sensors, industrial robots, industrial 3D printers, machine vision systems), by solution (SCADA, MES, industrial safety, PAM), and by industry [process industries (oil & gas, chemicals, pulp & paper, pharmaceuticals, metals & mining, food & beverages, energy & power, other process industries), discrete industries (automotive, aerospace & defense, semiconductor & electronics, machine manufacturing, medical devices, other discrete industries)]. It also discusses the market's drivers, restraints, opportunities, and challenges. It provides a detailed market analysis across four key regions (North America, Europe, Asia Pacific, and RoW). The report includes a review of the supply chain and competitive landscape of key players operating in the smart factory ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (growing emphasis on improving energy efficiency, optimizing resource utilization, and minimizing production costs; increasing adoption of industrial robots; surging use of IoT and AI technologies across industrial settings), restraints (high capital investment requirements, rising security concerns related to cyber-physical systems), opportunities (adoption of 5G in next-generation smart factories, advancements in wireless sensor technologies and their integration into intelligent manufacturing), challenges (bridging the gap between (IT) and (OT) systems, exposure to cyber threats)

- Service Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the smart factory market

- Market Development: Comprehensive information about lucrative markets by analyzing the smart factory market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the smart factory market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as ABB (Switzerland), Emerson Electric Co. (US), Honeywell International Inc. (US), Rockwell Automation (US), and Schneider Electric (France).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of interviews with experts

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis

- 2.2.2 TOP DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SMART FACTORY MARKET

- 4.2 SMART FACTORY MARKET, BY COMPONENT

- 4.3 SMART FACTORY MARKET, BY SOLUTION

- 4.4 SMART FACTORY MARKET, BY PROCESS INDUSTRIES

- 4.5 SMART FACTORY MARKET, BY DISCRETE INDUSTRIES

- 4.6 SMART FACTORY MARKET IN NORTH AMERICA, BY SOLUTION AND COUNTRY

- 4.7 SMART FACTORY MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing emphasis on improving energy efficiency, optimizing resource utilization, and minimizing production costs

- 5.2.1.2 Growing adoption of industrial robots

- 5.2.1.3 Rising interest in technologies like IoT and AI across industrial settings

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital investment requirements

- 5.2.2.2 Cybersecurity threats linked to cyber-physical systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of 5G in next-generation smart factories

- 5.2.3.2 Advancements in wireless sensor technologies and their integration into intelligent manufacturing

- 5.2.4 CHALLENGES

- 5.2.4.1 Bridging the gap between IT and OT systems

- 5.2.4.2 Exposure to cyber threats

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 PRICING ANALYSIS

- 5.6.1 PRICING ANALYSIS OF MES

- 5.6.1.1 Indicative pricing of MES software subscription, by key players, 2024

- 5.6.1.2 Average selling price trend of MES software subscriptions, 2021-2024

- 5.6.1.3 Average selling price trend of MES software subscriptions, by region, 2021-2024

- 5.6.2 AVERAGE SELLING PRICE OF INDUSTRIAL ROBOTS, 2024 (USD)

- 5.6.3 AVERAGE SELLING PRICE FOR SCADA, BY RTUS, 2024 (USD)

- 5.6.4 AVERAGE SELLING PRICE FOR MACHINE VISION COMPONENTS, 2024 (USD)

- 5.6.5 INDICATIVE PRICING OF KEY PLAYERS, BY COMPONENT, 2024

- 5.6.6 AVERAGE SELLING PRICE FOR INDUSTRIAL SENSORS, 2024 (USD)

- 5.6.1 PRICING ANALYSIS OF MES

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 ELOPAK INSTALLS FULLY ASEPTIC FILLING MACHINE FOR GABLE TOP PACKAGING WITH ROBUST PNEUMATICS FROM EMERSON AVENTICS

- 5.9.2 MP EQUIPMENT JOINS HANDS WITH ROCKWELL AUTOMATION SAFETY CONSULTANTS TO RE-EVALUATE DESIGN OF PROTEIN PORTIONING MACHINE

- 5.9.3 MOLLART ENGINEERING SELECTS PROCTER SMART FACTORY'S ENCLOSED GUARDS TO INSTALL IN ITS MACHINE TOOLS

- 5.9.4 LEADING AUTOMOTIVE SUPPLIER IMPROVES INSPECTION EFFICIENCY WITH FUJIFILM'S 4D HIGH RESOLUTION MACHINE VISION LENSES

- 5.9.5 ADVANCED DIMENSIONAL AND QUALITY CONTROL WITH 3D MACHINE VISION AT SIDENOR STEEL MILL

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Artificial intelligence

- 5.10.1.2 Augmented reality

- 5.10.1.3 IoT

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 5G

- 5.10.2.2 Digital twin

- 5.10.2.3 Predictive maintenance

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Blockchain

- 5.10.3.2 Smart energy management

- 5.10.3.3 Edge computing

- 5.10.3.4 Predictive supply chain

- 5.10.3.5 Cybersecurity

- 5.10.1 KEY TECHNOLOGIES

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 847950)

- 5.12.2 EXPORT SCENARIO (HS CODE 847950)

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 STANDARDS

- 5.16 IMPACT OF AI/GEN AI ON SMART FACTORY MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 IMPACT OF AI/GEN AI ON KEY END-USE INDUSTRIES

- 5.16.2.1 Electronics & semiconductors

- 5.16.2.2 Automotive

- 5.16.3 USE CASES

- 5.16.4 FUTURE OF AI/GEN AI IN SMART FACTORY ECOSYSTEM

- 5.17 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 SMART FACTORY MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.2 INDUSTRIAL SENSORS

- 6.2.1 LEVEL SENSORS

- 6.2.1.1 Requirement to measure liquid, bulk solid, and other fluid levels to drive market

- 6.2.2 TEMPERATURE SENSORS

- 6.2.2.1 Adoption of lean manufacturing and process control technologies to drive market

- 6.2.3 FLOW SENSORS

- 6.2.3.1 Wide use in monitoring flow of various chemicals to foster market growth

- 6.2.4 POSITION SENSORS

- 6.2.4.1 Increasing demand from several applications to drive market

- 6.2.5 PRESSURE SENSORS

- 6.2.5.1 Replacement of pressure transducers with cost-efficient pressure transmitters to drive market

- 6.2.6 FORCE SENSORS

- 6.2.6.1 Demand for force control to improve safety and comfort in robot-human interactions to drive market

- 6.2.7 HUMIDITY & MOISTURE SENSORS

- 6.2.7.1 Extensive use in chemicals, pharmaceuticals, oil & gas, and food & beverage industries to drive demand

- 6.2.8 IMAGE SENSORS

- 6.2.8.1 Wide usage in imaging devices to foster market growth

- 6.2.9 GAS SENSORS

- 6.2.9.1 Rising demand from various end-use industries to drive market

- 6.2.1 LEVEL SENSORS

- 6.3 INDUSTRIAL ROBOTS

- 6.3.1 TRADITIONAL INDUSTRIAL ROBOTS

- 6.3.1.1 Adoption of automated manufacturing techniques to drive market growth

- 6.3.1.2 Articulated robots

- 6.3.1.2.1 Demand for assembly, welding, and machine load and unloads to drive market

- 6.3.1.3 Cartesian robots

- 6.3.1.3.1 Provision of accurate and quick solutions for material handling applications to drive market

- 6.3.1.4 Selective compliance assembly robot arm

- 6.3.1.4.1 Ability to offer precise and flexible horizontal motions while being fixed vertically to drive adoption

- 6.3.1.5 Cylindrical robots

- 6.3.1.5.1 Deployment in various robotic applications to drive market

- 6.3.1.6 Other robots

- 6.3.2 COLLABORATIVE ROBOTS

- 6.3.2.1 High production efficiency through human-robot collaboration to drive market

- 6.3.1 TRADITIONAL INDUSTRIAL ROBOTS

- 6.4 INDUSTRIAL 3D PRINTING

- 6.4.1 ELIMINATION OF ASSEMBLY LINE AND REDUCTION OF LABOR COSTS TO DRIVE MARKET

- 6.4.2 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET, BY OFFERING

- 6.4.2.1 Printers

- 6.4.2.1.1 Primary hardware component used in industrial additive manufacturing

- 6.4.2.2 Material

- 6.4.2.2.1 Investments in R&D for developing new materials for 3D printing to support market growth

- 6.4.2.3 Software

- 6.4.2.3.1 Software programs essential for developing and processing 3D digital models

- 6.4.2.4 Services

- 6.4.2.4.1 Advancements in 3D printing technology increasing demand for services

- 6.4.2.1 Printers

- 6.5 MACHINE VISION

- 6.5.1 INCREASING DEMAND FOR QUALITY FROM MANUFACTURERS AND CUSTOMERS TO DRIVE MARKET

- 6.5.2 MACHINE VISION: SMART FACTORY MARKET, BY COMPONENT

- 6.5.2.1 Cameras

- 6.5.2.1.1 Demand for high-quality images, image processing, and compactness to drive market

- 6.5.2.2 Frame grabbers

- 6.5.2.2.1 Increasing adoption in high-speed and large-scale machine vision systems to drive market

- 6.5.2.3 LED lighting

- 6.5.2.3.1 Increasing adoption of structured lighting solutions to fuel demand

- 6.5.2.4 Optics

- 6.5.2.4.1 Growing integration with camera bodies for object image capture to fuel demand

- 6.5.2.5 Processors

- 6.5.2.5.1 Adoption of advanced vision systems fueling demand for high-performance processors

- 6.5.2.6 Other hardware components

- 6.5.2.6.1 Optimized hardware components to boost system reliability and performance

- 6.5.2.7 Software

- 6.5.2.7.1 AI-based machine vision software

- 6.5.2.1 Cameras

7 SMART FACTORY MARKET, BY SOLUTION

- 7.1 INTRODUCTION

- 7.2 MANUFACTURING EXECUTION SYSTEM (MES)

- 7.2.1 INCREASING PRODUCTIVITY, REDUCING SHIPPING TIME, AND PROCESSING DATA TO DRIVE MARKET

- 7.2.2 MANUFACTURING EXECUTION SYSTEM: SMART FACTORY MARKET, BY DEPLOYMENT MODE

- 7.2.2.1 On-premises

- 7.2.2.1.1 Emphasis on enhancing security control through in-house configurations to fuel segmental growth

- 7.2.2.2 Cloud

- 7.2.2.2.1 Cost-efficiency and reliability in terms of data recovery to drive market

- 7.2.2.3 Hybrid

- 7.2.2.3.1 Enhanced operational efficiency through integrated infrastructure to foster segmental growth

- 7.2.2.1 On-premises

- 7.2.3 MANUFACTURING EXECUTION SYSTEM: SMART FACTORY MARKET, BY OFFERING

- 7.2.3.1 Software

- 7.2.3.1.1 Ability to limit manual work and reduce errors to accelerate segmental growth

- 7.2.3.2 Services

- 7.2.3.2.1 Need for routine business maintenance and upgradation to contribute to segmental growth

- 7.2.3.1 Software

- 7.2.4 IMPLEMENTATION

- 7.2.5 UPGRADATION

- 7.2.6 TRAINING

- 7.2.7 MAINTENANCE

- 7.3 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

- 7.3.1 CONTROL AND ACQUISITION OF DATA FROM REMOTE DEVICES TO DRIVE MARKET

- 7.3.2 SCADA: SMART FACTORY MARKET, BY OFFERING

- 7.3.2.1 Hardware

- 7.3.2.2 Programmable logic controller

- 7.3.2.2.1 Adoption of PLCs for safe and efficient plant operations to accelerate segment expansion

- 7.3.2.3 Remote terminal unit

- 7.3.2.3.1 Rising demand for real-time data acquisition and remote monitoring to drive segment growth

- 7.3.2.4 Human-machine interface

- 7.3.2.4.1 Growing need for clear graphical representation of critical data to support timely decision-making

- 7.3.2.4.2 Communication systems

- 7.3.2.4.3 Wired communication systems

- 7.3.2.4.4 Wireless communication systems

- 7.3.2.5 Other components

- 7.3.2.6 software

- 7.3.2.6.1 Software deployment modes

- 7.3.2.6.2 On-premises deployment

- 7.3.2.6.3 Cloud deployment

- 7.3.2.7 Services

- 7.3.2.7.1 Professional services

- 7.3.2.7.2 Managed services

- 7.4 PLANT ASSET MANAGEMENT (PAM)

- 7.4.1 REDUCED UNPLANNED DOWNTIME AND OPTIMIZED ASSET UTILIZATION TO FOSTER MARKET GROWTH

- 7.5 INDUSTRIAL SAFETY

- 7.5.1 RISK MITIGATION IN SENSORS, LOGIC CONTROLS, AND ACTING ELEMENTS TO DRIVE MARKET

- 7.5.2 INDUSTRIAL SAFETY: SMART FACTORY MARKET, BY TYPE

- 7.5.2.1 Machine safety

- 7.5.2.1.1 Machine safety systems enable safety of plant assets and personnel

- 7.5.2.2 Worker safety

- 7.5.2.2.1 Smart worker safety solutions to drive industrial worker safety market

- 7.5.2.1 Machine safety

8 SMART FACTORY MARKET, BY INDUSTRY

- 8.1 INTRODUCTION

- 8.2 PROCESS INDUSTRIES

- 8.2.1 NEED TO DELIVER SUPERIOR PRODUCTS AT COMPETITIVE COSTS TO DRIVE MARKET

- 8.2.2 OIL & GAS

- 8.2.2.1 Reliability in large-scale production, product quality, and accelerated decision-making to drive market

- 8.2.3 CHEMICALS

- 8.2.3.1 Enhancement of production efficiencies and operational excellence in processes to drive market

- 8.2.4 PULP & PAPER

- 8.2.4.1 Workflow management and process optimization to boost market

- 8.2.5 PHARMACEUTICALS

- 8.2.5.1 Need to standardize workflows and enable regulatory compliance to fuel market

- 8.2.6 METALS & MINING

- 8.2.6.1 Cost containment, supply chain visibility, and risk management to drive market

- 8.2.7 FOOD & BEVERAGE

- 8.2.7.1 Cost-efficient and streamlined production processes to foster growth

- 8.2.8 ENERGY & POWER

- 8.2.8.1 Improved plant performance and flexibility in electricity production to drive market

- 8.2.9 OTHER PROCESS INDUSTRIES

- 8.3 DISCRETE INDUSTRIES

- 8.3.1 OPTIMIZATION OF SUPPLY CHAIN MANAGEMENT TO DRIVE MARKET

- 8.3.2 AUTOMOTIVE

- 8.3.2.1 Development and production of high-quality automobiles to drive market

- 8.3.3 AEROSPACE

- 8.3.3.1 Real-time visibility of production processes, equipment conditions, and process defects to drive market

- 8.3.4 SEMICONDUCTOR & ELECTRONICS

- 8.3.4.1 Need to achieve accuracy in designing complex products to drive market

- 8.3.5 MACHINE MANUFACTURING

- 8.3.5.1 Prevention of machine breakdown and unplanned downtime to drive market

- 8.3.6 MEDICAL DEVICES

- 8.3.6.1 Pressing need for manufacturing precision and high profitability to boost demand

- 8.3.7 OTHER DISCRETE INDUSTRIES

9 SMART FACTORY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Operational efficiency, improved product quality, and optimal use of resources to drive market

- 9.2.3 CANADA

- 9.2.3.1 Increasing government support for adopting advanced manufacturing technologies to drive market

- 9.2.4 MEXICO

- 9.2.4.1 Increasing investments and expansions by global market players to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 UK

- 9.3.2.1 Increasing adoption of smart factory solutions in automotive industry to drive market

- 9.3.3 GERMANY

- 9.3.3.1 Industry 4.0 initiative to automate operations to drive market

- 9.3.4 FRANCE

- 9.3.4.1 Growth of industrial sector to drive market

- 9.3.5 ITALY

- 9.3.5.1 Focus on boosting manufacturing output to drive market

- 9.3.6 SPAIN

- 9.3.6.1 Focus on modernizing manufacturing infrastructure to support smart factory growth

- 9.3.7 POLAND

- 9.3.7.1 Industry 4.0 strategies and EU funding supporting smart factory development

- 9.3.8 NORDICS

- 9.3.8.1 Sustainability-led smart factory adoption across advanced industries

- 9.3.9 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Increasing adoption of automation solutions due to rising labor costs to drive market

- 9.4.3 JAPAN

- 9.4.3.1 Ongoing developments in smart manufacturing processes to drive market

- 9.4.4 INDIA

- 9.4.4.1 Rapid industrialization, recovering economy, growing government support, and increasing foreign investments to drive market

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Government-led initiatives and technology leadership driving adoption

- 9.4.6 AUSTRALIA

- 9.4.6.1 Focus on reshoring and digital manufacturing to build industrial resilience

- 9.4.7 INDONESIA

- 9.4.7.1 Rising industrialization and government push for Industry 4.0 to fuel demand

- 9.4.8 MALAYSIA

- 9.4.8.1 Government support and smart manufacturing initiatives driving growth

- 9.4.9 THAILAND

- 9.4.9.1 National strategies and foreign investments accelerating smart factory adoption

- 9.4.10 VIETNAM

- 9.4.10.1 Industrial modernization and export-oriented growth fostering smart factory uptake

- 9.4.11 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD (ROW)

- 9.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Bahrain

- 9.5.2.1.1 Digital-first approach in dynamic industrial landscape to support market growth

- 9.5.2.2 Kuwait

- 9.5.2.2.1 Industrial diversification driving digital transformation

- 9.5.2.3 Oman

- 9.5.2.3.1 Strategic investment in industrial modernization and smart production to drive market

- 9.5.2.4 Qatar

- 9.5.2.4.1 Adoption of smart factory increasing to build resilient manufacturing capabilities

- 9.5.2.5 Saudi Arabia

- 9.5.2.5.1 Vision 2030 fueling industrial automation and digital transformation

- 9.5.2.6 UAE

- 9.5.2.6.1 Leading digital industrial transformation through strategic initiatives

- 9.5.2.7 Rest of Middle East

- 9.5.2.1 Bahrain

- 9.5.3 SOUTH AMERICA

- 9.5.3.1 Brazil

- 9.5.3.1.1 Focus on industrial modernization and digital adoption to fuel market

- 9.5.3.2 Argentina

- 9.5.3.2.1 Emerging focus on efficiency and technology upgrades supporting market growth

- 9.5.3.3 Other South American countries

- 9.5.3.1 Brazil

- 9.5.4 AFRICA

- 9.5.4.1 South Africa

- 9.5.4.1.1 Government-backed digitization to enhance industrial competitiveness

- 9.5.4.2 Other African countries

- 9.5.4.1 South Africa

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2021-JUNE 2025

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS OF KEY FIVE PLAYERS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 MACHINE VISION MARKET: COMPANY FOOTPRINT, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Machine vision market: Region footprint

- 10.7.5.3 Machine vision market: System type footprint

- 10.7.5.4 Machine vision market: Component footprint

- 10.7.5.5 Machine vision market: Industry footprint

- 10.7.6 SCADA MARKET: COMPANY FOOTPRINT, 2024

- 10.7.6.1 SCADA market: Overall footprint

- 10.7.6.2 SCADA market: Region footprint

- 10.7.6.3 SCADA market: Offering footprint

- 10.7.6.4 SCADA market: End user footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

- 10.9.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 ABB

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 EMERSON ELECTRIC CO.

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & developments

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 SIEMENS

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 SCHNEIDER ELECTRIC

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Expansions

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 ROCKWELL AUTOMATION, INC.

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches & developments

- 11.1.5.3.2 Deals

- 11.1.5.3.3 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 HONEYWELL INTERNATIONAL INC.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches & developments

- 11.1.6.3.2 Deals

- 11.1.6.4 MnM view

- 11.1.6.4.1 Right to win

- 11.1.6.4.2 Strategic choices

- 11.1.6.4.3 Weaknesses and competitive threats

- 11.1.7 MITSUBISHI ELECTRIC CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.7.3.2 Expansions

- 11.1.7.3.3 Other developments

- 11.1.8 GE VERNOVA

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches & developments

- 11.1.9 YOKOGAWA ELECTRIC CORPORATION

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches & developments

- 11.1.9.3.2 Deals

- 11.1.9.3.3 Other developments

- 11.1.10 OMRON CORPORATION

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.3.2 Deals

- 11.1.11 ENDRESS+HAUSER GROUP SERVICES AG

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches & developments

- 11.1.11.3.2 Deals

- 11.1.11.3.3 Expansions

- 11.1.12 FANUC CORPORATION

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product launches & developments

- 11.1.13 WIKA ALEXANDER WIEGAND SE & CO. KG

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Product launches

- 11.1.13.3.2 Expansions

- 11.1.14 DWYER INSTRUMENTS, LLC

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product launches & developments

- 11.1.15 STRATASYS

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions/Services offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Product launches & developments

- 11.1.15.3.2 Deals

- 11.1.16 3D SYSTEMS, INC.

- 11.1.16.1 Business overview

- 11.1.16.2 Products/Solutions/Services offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Product launches & developments

- 11.1.16.3.2 Deals

- 11.1.17 COGNEX CORPORATION

- 11.1.17.1 Business overview

- 11.1.17.2 Products/Solutions/Services offered

- 11.1.17.3 Recent developments

- 11.1.17.3.1 Product launches

- 11.1.18 BASLER AG

- 11.1.18.1 Business overview

- 11.1.18.2 Products/Solutions/Services offered

- 11.1.18.3 Recent developments

- 11.1.18.3.1 Product launches

- 11.1.18.3.2 Deals

- 11.1.1 ABB

- 11.2 OTHER KEY PLAYERS

- 11.2.1 FUJI ELECTRIC CO., LTD.

- 11.2.2 HITACHI, LTD.

- 11.2.3 KROHNE MESSTECHNIK GMBH

- 11.2.4 AZBIL CORPORATION

- 11.2.5 VEGA GRIESHABER KG

- 11.2.6 DANFOSS

- 11.2.7 KUKA AG

- 11.3 OTHER SMALL AND MEDIUM-SIZED ENTERPRISES

- 11.3.1 TRIDITIVE

- 11.3.2 ROBOZE

- 11.3.3 ZIVID

- 11.3.4 INXPECT S.P.A.

- 11.3.5 INUITIVE

- 11.3.6 FUELICS

- 11.3.7 ULTIMAKER

- 11.3.8 NANO DIMENSION

- 11.3.9 PICK-IT N.V.

- 11.3.10 ONROBOT A/S

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 SMART FACTORY MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 SMART FACTORY MARKET: RISK ANALYSIS

- TABLE 3 SMART FACTORY MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 INDICATING PRICING OF MES SOFTWARE SUBSCRIPTIONS PER MONTH OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF MES SOFTWARE SUBSCRIPTIONS PER MONTH, 2021-2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF MES SOFTWARE SUBSCRIPTIONS PER MONTH, BY REGION, 2021-2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE OF INDUSTRIAL ROBOTS, BY PAYLOAD CAPACITY, 2024

- TABLE 8 AVERAGE SELLING PRICE OF RTUS

- TABLE 9 INDICATING PRICING OF MACHINE VISION COMPONENTS OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 10 AVERAGE SELLING PRICE (ASP) OF DIGITAL TEMPERATURE SENSORS OFFERED BY MAJOR PLAYERS

- TABLE 11 IMPACT OF PORTER'S FIVE FORCES: SMART FACTORY MARKET

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN TOP THREE INDUSTRIES

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 14 IMPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 15 EXPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 16 LIST OF MAJOR PATENTS, 2022-2024

- TABLE 17 REGION-WISE LIST OF KEY CONFERENCES AND EVENTS

- TABLE 18 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 MAJOR COMMUNICATION STANDARDS FOR SCADA SYSTEMS

- TABLE 23 INDUSTRIAL SAFETY STANDARDS

- TABLE 24 MACHINE VISION STANDARDS

- TABLE 25 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 26 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR SMART FACTORY

- TABLE 27 SMART FACTORY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 28 SMART FACTORY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 29 COMPONENT: SMART FACTORY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 COMPONENT: SMART FACTORY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 INDUSTRIAL SENSORS: SMART FACTORY MARKET, BY SENSOR TYPE, 2021-2024 (USD MILLION)

- TABLE 32 INDUSTRIAL SENSORS: SMART FACTORY MARKET, BY SENSOR TYPE, 2025-2030 (USD MILLION)

- TABLE 33 INDUSTRIAL SENSORS: SMART FACTORY MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 34 INDUSTRIAL SENSORS: SMART FACTORY MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 35 INDUSTRIAL SENSORS: SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 36 INDUSTRIAL SENSORS: SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 37 INDUSTRIAL SENSORS: SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 38 INDUSTRIAL SENSORS: SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 39 INDUSTRIAL SENSORS: SMART FACTORY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 INDUSTRIAL SENSORS: SMART FACTORY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 INDUSTRIAL SENSORS: SMART FACTORY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 42 INDUSTRIAL SENSORS: SMART FACTORY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 43 INDUSTRIAL SENSORS: SMART FACTORY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 44 INDUSTRIAL SENSORS: SMART FACTORY MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 45 INDUSTRIAL SENSORS: SMART FACTORY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 46 INDUSTRIAL SENSORS: SMART FACTORY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 47 INDUSTRIAL SENSORS: SMART FACTORY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 INDUSTRIAL SENSORS: SMART FACTORY MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 50 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 51 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 52 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 53 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 54 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 55 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 56 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 57 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 INDUSTRIAL ROBOTS: SMART FACTORY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 60 INDUSTRIAL ROBOTS: SMART FACTORY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 INDUSTRIAL ROBOTS: SMART FACTORY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 62 INDUSTRIAL ROBOTS: SMART FACTORY MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 63 INDUSTRIAL ROBOTS: SMART FACTORY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 64 INDUSTRIAL ROBOTS: SMART FACTORY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 65 INDUSTRIAL ROBOTS: SMART FACTORY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 INDUSTRIAL ROBOTS: SMART FACTORY MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, TRADITIONAL ROBOTS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 68 INDUSTRIAL ROBOTS: SMART FACTORY MARKET, TRADITIONAL ROBOTS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 69 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 70 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 71 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 72 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 73 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 74 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 75 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 86 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 87 MACHINE VISION: SMART FACTORY MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 88 MACHINE VISION: SMART FACTORY MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 89 MACHINE VISION: SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 90 MACHINE VISION: SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 91 MACHINE VISION: SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 92 MACHINE VISION: SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 93 MACHINE VISION: SMART FACTORY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 MACHINE VISION: SMART FACTORY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 MACHINE VISION: SMART FACTORY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 96 MACHINE VISION: SMART FACTORY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 MACHINE VISION: SMART FACTORY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 98 MACHINE VISION: SMART FACTORY MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99 MACHINE VISION: SMART FACTORY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 100 MACHINE VISION: SMART FACTORY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 101 MACHINE VISION: SMART FACTORY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 MACHINE VISION: SMART FACTORY MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 MACHINE VISION: SMART FACTORY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 104 MACHINE VISION: SMART FACTORY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 105 MACHINE VISION: SMART FACTORY MARKET, BY COMPONENT, 2021-2024 (MILLION UNITS)

- TABLE 106 MACHINE VISION: SMART FACTORY MARKET, BY COMPONENT, 2025-2030 (MILLION UNITS)

- TABLE 107 SMART FACTORY MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 108 SMART FACTORY MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 109 SOLUTION: SMART FACTORY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 SOLUTION: SMART FACTORY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 MES: SMART FACTORY MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 112 MES: SMART FACTORY MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 113 MES: SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 114 MES: SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 115 MES: SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 116 MES: SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 117 MES: SMART FACTORY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 MES: SMART FACTORY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 MES: SMART FACTORY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 120 MES: SMART FACTORY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 MES: SMART FACTORY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 122 MES: SMART FACTORY MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 123 MES: SMART FACTORY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 124 MES: SMART FACTORY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 125 MES: SMART FACTORY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 126 MES: SMART FACTORY MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127 MES: SMART FACTORY MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 128 MES: SMART FACTORY MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 129 MES: SMART FACTORY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 130 MES: SMART FACTORY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 131 SCADA: SMART FACTORY MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 132 SCADA: SMART FACTORY MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 SCADA: SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 134 SCADA: SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 135 SCADA: SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 136 SCADA: SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 137 SCADA: SMART FACTORY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 138 SCADA: SMART FACTORY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 139 SCADA: SMART FACTORY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 SCADA: SMART FACTORY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 SCADA: SMART FACTORY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 142 SCADA: SMART FACTORY MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 143 SCADA: SMART FACTORY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 144 SCADA: SMART FACTORY MARKET, ASIA PACIFIC BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 SCADA: SMART FACTORY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 146 SCADA: SMART FACTORY MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 147 SCADA: SMART FACTORY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 148 SCADA: SMART FACTORY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 149 SCADA: SMART FACTORY MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 150 SCADA: SMART FACTORY MARKET, BY HARDWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 151 ADVANTAGES AND DISADVANTAGES OF WIRED COMMUNICATION SYSTEMS

- TABLE 152 ADVANTAGES AND DISADVANTAGES OF WIRELESS COMMUNICATION SYSTEMS

- TABLE 153 SCADA: SMART FACTORY MARKET, BY SOFTWARE, 2021-2024 (USD MILLION)

- TABLE 154 SCADA: SMART FACTORY MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 155 SCADA: SMART FACTORY MARKET, BY SERVICES, 2021-2024 (USD MILLION)

- TABLE 156 SCADA: SMART FACTORY MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 157 PAM: SMART FACTORY MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 158 PAM: SMART FACTORY MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 159 PAM: SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 160 PAM: SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 161 PAM: SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 162 PAM: SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 163 PAM: SMART FACTORY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 164 PAM: SMART FACTORY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 165 PAM: SMART FACTORY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 166 PAM: SMART FACTORY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 167 PAM: SMART FACTORY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 168 PAM: SMART FACTORY MARKET IN EUROPE BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 169 PAM: SMART FACTORY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 170 PAM: SMART FACTORY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 171 PAM: SMART FACTORY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 172 PAM: SMART FACTORY MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 173 INDUSTRIAL SAFETY: SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 174 INDUSTRIAL SAFETY: SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 175 INDUSTRIAL SAFETY: SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 176 INDUSTRIAL SAFETY: SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 177 INDUSTRIAL SAFETY: SMART FACTORY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 178 INDUSTRIAL SAFETY: SMART FACTORY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 179 INDUSTRIAL SAFETY: SMART FACTORY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 180 INDUSTRIAL SAFETY: SMART FACTORY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 181 INDUSTRIAL SAFETY: SMART FACTORY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 182 INDUSTRIAL SAFETY: SMART FACTORY MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 183 INDUSTRIAL SAFETY: SMART FACTORY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 184 INDUSTRIAL SAFETY: SMART FACTORY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 185 INDUSTRIAL SAFETY: SMART FACTORY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 186 INDUSTRIAL SAFETY: SMART FACTORY MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 187 INDUSTRIAL SAFETY: SMART FACTORY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 188 INDUSTRIAL SAFETY: SMART FACTORY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 189 SMART FACTORY MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 190 SMART FACTORY MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 191 SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 192 SMART FACTORY MARKET, BY PROCESS INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 193 SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2021-2024 (USD MILLION)

- TABLE 194 SMART FACTORY MARKET, BY DISCRETE INDUSTRIES, 2025-2030 (USD MILLION)

- TABLE 195 SMART FACTORY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 196 SMART FACTORY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 197 NORTH AMERICA: SMART FACTORY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 198 NORTH AMERICA: SMART FACTORY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 199 NORTH AMERICA: SMART FACTORY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 200 NORTH AMERICA: SMART FACTORY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 201 NORTH AMERICA: SMART FACTORY MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 202 NORTH AMERICA: SMART FACTORY MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 203 EUROPE: SMART FACTORY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 204 EUROPE: SMART FACTORY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 205 EUROPE: SMART FACTORY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 206 EUROPE: SMART FACTORY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 207 EUROPE: SMART FACTORY MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 208 EUROPE: SMART FACTORY MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 209 ASIA PACIFIC: SMART FACTORY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 210 ASIA PACIFIC: SMART FACTORY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 211 ASIA PACIFIC: SMART FACTORY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 212 ASIA PACIFIC: SMART FACTORY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 213 ASIA PACIFIC: SMART FACTORY MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 214 ASIA PACIFIC: SMART FACTORY MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 215 REST OF THE WORLD: SMART FACTORY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 216 REST OF THE WORLD: SMART FACTORY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 217 REST OF THE WORLD: SMART FACTORY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 218 REST OF THE WORLD: SMART FACTORY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 219 REST OF THE WORLD: SMART FACTORY MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 220 REST OF THE WORLD: SMART FACTORY MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 221 MIDDLE EAST: SMART FACTORY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 222 AFRICA: SMART FACTORY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 223 SOUTH AMERICA: SMART FACTORY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 224 AFRICA: SMART FACTORY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 225 AFRICA: SMART FACTORY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 226 AFRICA: SMART FACTORY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 227 SMART FACTORY MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-JUNE 2025

- TABLE 228 MACHINE VISION MARKET: DEGREE OF COMPETITION

- TABLE 229 INDUSTRIAL ROBOTS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 230 MANUFACTURING EXECUTION SYSTEMS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 231 SCADA MARKET: DEGREE OF COMPETITION, 2024

- TABLE 232 MACHINE VISION MARKET: COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 233 MACHINE VISION MARKET: REGION FOOTPRINT

- TABLE 234 MACHINE VISION MARKET: SYSTEM TYPE FOOTPRINT

- TABLE 235 MACHINE VISION MARKET: COMPONENT FOOTPRINT

- TABLE 236 MACHINE VISION MARKET: INDUSTRY FOOTPRINT

- TABLE 237 SCADA MARKET: REGION FOOTPRINT

- TABLE 238 SCADA MARKET: OFFERING FOOTPRINT

- TABLE 239 SCADA MARKET: END USER FOOTPRINT

- TABLE 240 SMART FACTORY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 241 SMART FACTORY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 242 SMART FACTORY MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 243 SMART FACTORY MARKET: DEALS, JANUARY 2021-JUNE 2025

- TABLE 244 SMART FACTORY MARKET: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 245 SMART FACTORY MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 246 ABB: COMPANY OVERVIEW

- TABLE 247 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 ABB: PRODUCT LAUNCHES

- TABLE 249 ABB: DEALS

- TABLE 250 ABB: EXPANSIONS

- TABLE 251 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 252 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 254 EMERSON ELECTRIC CO.: DEALS

- TABLE 255 SIEMENS: COMPANY OVERVIEW

- TABLE 256 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 SIEMENS: PRODUCT LAUNCHES

- TABLE 258 SIEMENS: DEALS

- TABLE 259 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 260 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 262 SCHNEIDER ELECTRIC: EXPANSIONS

- TABLE 263 SCHNEIDER ELECTRIC: DEALS

- TABLE 264 ROCKWELL AUTOMATION, INC.: COMPANY OVERVIEW

- TABLE 265 ROCKWELL AUTOMATION, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 ROCKWELL AUTOMATION, INC.: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 267 ROCKWELL AUTOMATION, INC.: DEALS

- TABLE 268 ROCKWELL AUTOMATION, INC.: EXPANSIONS

- TABLE 269 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 270 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 272 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 273 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 274 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 275 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 276 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 277 MITSUBISHI ELECTRIC CORPORATION: EXPANSIONS

- TABLE 278 MITSUBISHI ELECTRIC CORPORATION: OTHER DEVELOPMENTS

- TABLE 279 GE VERNOVA: COMPANY OVERVIEW

- TABLE 280 GE VERNOVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 GE VERNOVA: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 282 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 283 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 284 YOKOGAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 285 YOKOGAWA ELECTRIC CORPORATION: DEALS

- TABLE 286 YOKOGAWA ELECTRIC CORPORATION: OTHER DEVELOPMENTS

- TABLE 287 OMRON CORPORATION: COMPANY OVERVIEW

- TABLE 288 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 OMRON CORPORATION: PRODUCT LAUNCHES

- TABLE 290 OMRON CORPORATION: DEALS

- TABLE 291 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY OVERVIEW

- TABLE 292 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 293 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 294 ENDRESS+HAUSER GROUP SERVICES AG: DEALS

- TABLE 295 ENDRESS+HAUSER GROUP SERVICES AG: EXPANSIONS

- TABLE 296 FANUC CORPORATION: COMPANY OVERVIEW

- TABLE 297 FANUC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 FANUC CORPORATION: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 299 WIKA ALEXANDER WIEGAND SE & CO. KG: COMPANY OVERVIEW

- TABLE 300 WIKA ALEXANDER WIEGAND SE & CO. KG: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 301 WIKA ALEXANDER WIEGAND SE & CO. KG: PRODUCT LAUNCHES

- TABLE 302 WIKA ALEXANDER WIEGAND SE & CO. KG: EXPANSIONS

- TABLE 303 DWYER INSTRUMENTS, LLC: COMPANY OVERVIEW

- TABLE 304 DWYER INSTRUMENTS, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 DWYER INSTRUMENTS, LLC: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 306 STRATASYS: COMPANY OVERVIEW

- TABLE 307 STRATASYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 STRATASYS: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 309 STRATASYS: DEALS

- TABLE 310 3D SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 311 3D SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 312 3D SYSTEMS, INC.: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 313 3D SYSTEMS, INC.: DEALS

- TABLE 314 COGNEX CORPORATION: COMPANY OVERVIEW

- TABLE 315 COGNEX CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 316 COGNEX CORPORATION: PRODUCT LAUNCHES

- TABLE 317 BASLER AG: COMPANY OVERVIEW

- TABLE 318 BASLER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 319 BASLER AG: PRODUCT LAUNCHES

- TABLE 320 BASLER AG: DEALS

- TABLE 321 FUJI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 322 HITACHI, LTD.: COMPANY OVERVIEW

- TABLE 323 KROHNE MESSTECHNIK GMBH: COMPANY OVERVIEW

- TABLE 324 AZBIL CORPORATION: COMPANY OVERVIEW

- TABLE 325 VEGA GRIESHABER KG: COMPANY OVERVIEW

- TABLE 326 DANFOSS: COMPANY OVERVIEW

- TABLE 327 KUKA AG: COMPANY OVERVIEW

- TABLE 328 TRIDITIVE: COMPANY OVERVIEW

- TABLE 329 ROBOZE: COMPANY OVERVIEW

- TABLE 330 ZIVID: COMPANY OVERVIEW

- TABLE 331 INXPECT S.P.A.: COMPANY OVERVIEW

- TABLE 332 INUITIVE: COMPANY OVERVIEW

- TABLE 333 FUELICS: COMPANY OVERVIEW

- TABLE 334 ULTIMAKER: COMPANY OVERVIEW

- TABLE 335 NANO DIMENSION: COMPANY OVERVIEW

- TABLE 336 PICK-IT N.V.: COMPANY OVERVIEW

- TABLE 337 ONROBOT A/S: COMPANY OVERVIEW

List of Figures

- FIGURE 1 SMART FACTORY MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SMART FACTORY MARKET: RESEARCH DESIGN

- FIGURE 3 SMART FACTORY MARKET: RESEARCH APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 MACHINE VISION MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 7 MANUFACTURING EXECUTION SYSTEMS MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 8 SCADA MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 9 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 10 SMART FACTORY MARKET SIZE, 2021-2030

- FIGURE 11 INDUSTRIAL 3D PRINTING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 PAM SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 PHARMACEUTICAL INDUSTRY TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 14 MEDICAL DEVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 16 INCREASING USE OF AUTOMATION IN MANUFACTURING TO BOOST ADOPTION OF SMART FACTORY SOLUTIONS

- FIGURE 17 INDUSTRIAL SENSORS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 MES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 OIL & GAS INDUSTRY TO BE LARGEST END USER IN 2025

- FIGURE 20 AUTOMOTIVE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 21 MES DOMINATED NORTH AMERICAN SMART FACTORY MARKET IN 2024

- FIGURE 22 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 23 SMART FACTORY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 HISTORICAL AND PROJECTED ANNUAL INSTALLATION OF INDUSTRIAL ROBOTS, 2021-2027

- FIGURE 25 SMART FACTORY MARKET DRIVERS AND THEIR IMPACT

- FIGURE 26 SMART FACTORY MARKET RESTRAINTS AND THEIR IMPACT

- FIGURE 27 SMART FACTORY MARKET OPPORTUNITIES AND THEIR IMPACT

- FIGURE 28 SMART FACTORY MARKET CHALLENGES AND THEIR IMPACT

- FIGURE 29 SMART FACTORY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 SMART FACTORY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 32 AVERAGE SELLING PRICE TREND OF MES SOFTWARE SUBSCRIPTIONS PER MONTH, 2021-2024

- FIGURE 33 AVERAGE SELLING PRICE TREND OF MES SOFTWARE SUBSCRIPTIONS PER MONTH, BY REGION, 2021-2024

- FIGURE 34 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 35 SMART FACTORY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN TOP THREE INDUSTRIES

- FIGURE 37 BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 38 IMPORT SCENARIO FOR HS CODE 847950-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 39 EXPORT SCENARIO FOR HS CODE 847950-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 40 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 41 AI USE CASES IN SMART FACTORY

- FIGURE 42 SMART FACTORY MARKET, BY COMPONENT

- FIGURE 43 INDUSTRIAL SENSORS SEGMENT TO LEAD SMART FACTORY MARKET DURING FORECAST PERIOD

- FIGURE 44 INDUSTRIAL 3D PRINTING: SMART FACTORY MARKET, BY OFFERING

- FIGURE 45 MACHINE VISION: SMART FACTORY MARKET, BY COMPONENT

- FIGURE 46 SMART FACTORY MARKET, BY SOLUTION

- FIGURE 47 MES SEGMENT TO LEAD SMART FACTORY MARKET FROM 2025 TO 2030

- FIGURE 48 MANUFACTURING EXECUTION SYSTEM: SMART FACTORY MARKET, BY DEPLOYMENT MODE

- FIGURE 49 MANUFACTURING EXECUTION SYSTEM: SMART FACTORY MARKET, BY OFFERING

- FIGURE 50 SCADA: SMART FACTORY MARKET, BY OFFERING

- FIGURE 51 HARDWARE COMPONENTS OF SCADA SYSTEM

- FIGURE 52 PLC HARDWARE SYSTEM

- FIGURE 53 OPERATING CYCLE OF PLC

- FIGURE 54 BENEFITS OF PLC

- FIGURE 55 ARCHITECTURE OF RTU

- FIGURE 56 ADVANTAGES OF SOFTWARE-INTEGRATED SCADA SYSTEMS

- FIGURE 57 SOFTWARE DEPLOYMENT MODES

- FIGURE 58 LIMITATIONS OF ON-PREMISES SCADA SYSTEMS

- FIGURE 59 ADVANTAGES OF CLOUD-BASED SCADA SYSTEMS

- FIGURE 60 ADVANTAGES OF SCADA SYSTEM SERVICES

- FIGURE 61 SMART FACTORY MARKET, BY INDUSTRY

- FIGURE 62 PHARMACEUTICALS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 63 AUTOMOTIVE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 64 SMART FACTORY MARKET, BY REGION

- FIGURE 65 CHINA TO EXHIBIT HIGHEST CAGR IN GLOBAL SMART FACTORY MARKET DURING FORECAST PERIOD

- FIGURE 66 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN SMART FACTORY MARKET DURING FORECAST PERIOD

- FIGURE 67 NORTH AMERICA: SMART FACTORY MARKET SNAPSHOT

- FIGURE 68 EUROPE: SMART FACTORY MARKET SNAPSHOT

- FIGURE 69 ASIA PACIFIC: SMART FACTORY MARKET SNAPSHOT

- FIGURE 70 REST OF THE WORLD: SMART FACTORY MARKET SNAPSHOT

- FIGURE 71 SMART FACTORY MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 72 MACHINE VISION MARKET SHARE ANALYSIS, 2024

- FIGURE 73 COMPANY VALUATION, 2025

- FIGURE 74 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 75 PRODUCT COMPARISON

- FIGURE 76 MACHINE VISION MARKET: COMPANY EVALUATION MATRIX, 2024

- FIGURE 77 SCADA MARKET: COMPANY EVALUATION MATRIX, 2024

- FIGURE 78 SCADA MARKET: COMPANY OVERALL FOOTPRINT

- FIGURE 79 MACHINE VISION MARKET: STARTUPS/SMES EVALUATION MATRIX, 2024

- FIGURE 80 SCADA MARKET: STARTUPS/SMES EVALUATION MATRIX, 2024

- FIGURE 81 ABB: COMPANY SNAPSHOT

- FIGURE 82 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 83 SIEMENS: COMPANY SNAPSHOT

- FIGURE 84 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 85 ROCKWELL AUTOMATION, INC.: COMPANY SNAPSHOT

- FIGURE 86 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 87 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 88 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 89 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 90 OMRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 91 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY SNAPSHOT

- FIGURE 92 FANUC CORPORATION: COMPANY SNAPSHOT

- FIGURE 93 STRATASYS: COMPANY SNAPSHOT

- FIGURE 94 3D SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 95 COGNEX CORPORATION: COMPANY SNAPSHOT

- FIGURE 96 BASLER AG: COMPANY SNAPSHOT