|

市場調查報告書

商品編碼

1793325

全球智慧紡織品市場(至 2030 年)按類型(被動/主動)、形式(穿戴式/不穿戴式)、織物類型(棉/尼龍和聚酯/羊毛和絲綢)、織物(棉/尼龍/羊毛/石墨烯/導電)和應用(感測/能源採集)分類Smart Textiles Market by Type (Passive, Active), Form (Wearable, Non-wearable), Fabric Type (Cotton, Nylon & Polyester, Wool & Silk), Fabric (Cotton, Nylon, Wool, Graphene, Conductive), Application (Sensing, Energy Harvesting) - Global Forecast to 2030 |

||||||

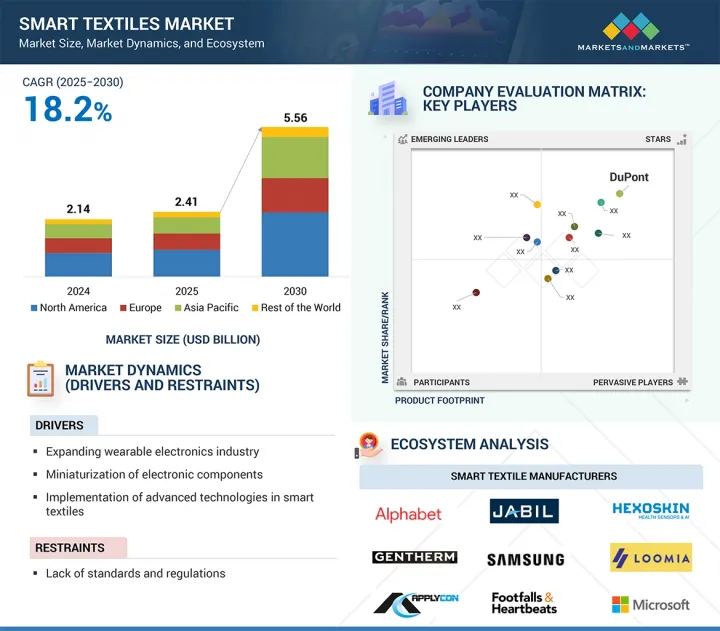

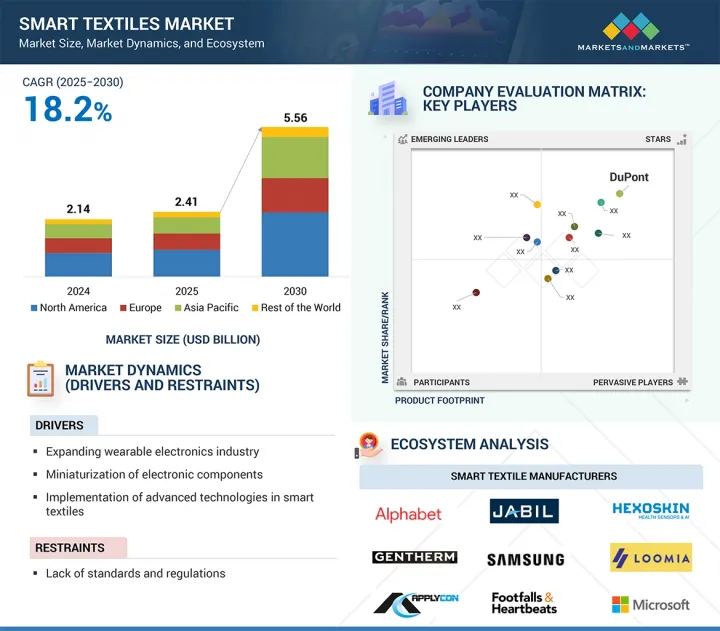

智慧紡織品市場預計將從 2025 年的 24.1 億美元成長到 2030 年的 55.6 億美元,預測期內的複合年成長率為 18.2%。

穿戴式健康監測設備的需求不斷成長,為智慧紡織品市場帶來了巨大的機會。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 金額(美元) |

| 按細分市場 | 按類型、用途、行業和地區 |

| 目標區域 | 北美、歐洲、亞太地區及其他地區 |

隨著醫療保健系統向遠端患者監護和慢性病預防管理邁進,整合生物感測器的智慧織物正成為關鍵工具。這些織物能夠持續測量心率、呼吸、體溫和水分等生命徵象,提供即時健康洞察。將其整合到服裝中,可實現無縫、非侵入式監測,使其成為醫院、居家照護和運動表現監測的理想選擇。此外,全球人口老化正在加速這些解決方案在老年護理和健康監測領域的應用。

根據最終用戶垂直行業,時尚和娛樂領域預計在預測期內實現顯著的複合年成長率。

這一趨勢的驅動力源自於消費者對互動性、表現力和科技融合型服裝日益成長的興趣。隨著科技與生活方式之間的界線逐漸模糊,設計師和科技公司正攜手合作,打造不僅兼具美感,更能提供身臨其境型體驗的服裝。該領域的智慧紡織品可以變色、發光、響應音樂,並根據環境刺激或用戶互動顯示動態視覺效果,使其成為音樂會、時裝秀、主題活動、Cosplay等活動的理想選擇。穿戴式LED、軟性電路和形狀記憶材料的日益普及,使得時尚品牌能夠將電子產品直接融入布料中,同時又不犧牲舒適度。此外,社群媒體和網紅文化正在推動對視覺衝擊力強的高科技服裝的需求,這些服裝能夠提升個人品牌形象和娛樂價值。此外,AR/VR服裝和元宇宙時尚的興起,為數位原民人群開闢了新的收益途徑。智慧紡織品也被融入奢華品牌和高級訂製系列,為其增添了一絲獨特性和創新性。隨著消費者追求新穎性、個人化和數位化表達,預計該行業將在創造性創新和市場成熟的推動下經歷強勁成長。

根據應用,預計能源採集和熱電領域在預測期內將佔據相當大的佔有率。

能源採集與熱電領域預計將佔據顯著的市場佔有率,因為它能夠為穿戴式裝置和嵌入式電子設備提供自主型供電解決方案。醫療監測、軍事裝備、健身服裝和消費性電子產品等領域的日益普及,推動了對持續、無電池電源的需求。能源採集紡織品將體熱(熱電)、運動(壓電)和環境光轉化為電能,為傳統的電池供電系統提供了永續的替代方案。這使得穿戴式裝置無需充電即可長時間運作,從而提高了便利性、易用性和環境永續性。例如,在醫療領域,熱電紡織品可以為生物感測器供電,用於即時病患監測,運作依賴外部能源來源。在軍事領域,自給自足的紡織品可以使士兵的通訊和情境察覺工具不間斷運作。此外,材料科學家、電子產品製造商和紡織品製造商之間的研發與合作正在推動成本降低和效率提升,從而提高商業可行性。隨著全球對環保和自主供電穿戴裝置的趨勢不斷成長,預計該領域將在預測期內在智慧紡織品市場中發揮重要作用。

本報告調查了全球智慧紡織品市場,並提供了市場概況、影響市場成長的各種因素分析、技術和專利趨勢、法律制度、案例研究、市場規模趨勢和預測、各個細分市場、地區/主要國家的詳細分析、競爭格局和主要企業的概況。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章重要考察

第5章市場概述

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

- 供應鏈分析

- 波特五力分析

- 主要相關利益者和採購標準

- 貿易分析

- 生態系分析

- 影響客戶業務的趨勢/中斷

- 定價分析

- 案例研究分析

- 專利分析

- 技術分析

- 人工智慧/生成式人工智慧對智慧紡織品市場的影響

- 2025-2026年重要會議和活動

- 監管狀況

- 2025年美國關稅的影響 - 智慧紡織品市場

第6章:依布料類型分類的智慧紡織品市場

- 棉基智慧紡織品

- 尼龍和聚酯纖維

- 羊毛和絲綢

- 石墨烯相容織物

- 導電聚合物纖維

- 混合佈料(混紡)

第7章 智慧紡織品市場(按類型)

- 穿戴式智慧紡織品

- 非穿戴式智慧紡織品

第 8 章:按類型分類的智慧紡織品市場

- 被動智慧紡織品

- 活性/超智慧紡織品

第9章智慧紡織品市場(按應用)

- 感測

- 能源採集與熱電

- 發光與美學元素

- 其他

第 10 章:按最終用戶產業分類的智慧紡織品市場

- 軍事/國防

- 衛生保健

- 運動與健身

- 時尚與娛樂

- 車

- 其他

第 11 章:按地區分類的智慧紡織品市場

- 北美洲

- 北美:宏觀經濟展望

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 歐洲:宏觀經濟展望

- 英國

- 德國

- 法國

- 義大利

- 其他

- 亞太地區

- 亞太地區:宏觀經濟展望

- 中國

- 日本

- 韓國

- 印度

- 其他

- 世界其他地區

- 世界其他地區:宏觀經濟展望

- 南美洲

- 中東

- 非洲

第12章競爭格局

- 概述

- 主要企業採取的策略概述

- 收益分析

- 市場佔有率分析

- 公司評估矩陣:主要企業

- 公司估值矩陣:Start-Ups/中小型企業

- 競爭場景

第13章:公司簡介

- 主要企業

- DUPONT

- JABIL INC.

- GENTHERM INCORPORATED

- AIQ SMART CLOTHING

- SENSORIA

- ALPHABET

- INTERACTIVE WEAR

- OUTLAST TECHNOLOGIES GMBH

- ADIDAS

- HEXOSKIN

- 其他公司

- CLIM8 SAS

- NIKE

- SENSING TEX

- APPLYCON, SRO

- FOOTFALLS SMARTEX LIMITED

- VOLT AI LLC.

- SAMSUNG

- MICROSOFT

- LIFESENSE GROUP

- NANOLEQ AG

- EMBRO

- LOOMIA

- NEXTILES, INC.

- AMOHR TECHNISCHE TEXTILIEN GMBH

- PRIMO1D

第14章 附錄

The smart textiles market is projected to grow from USD 2.41 billion in 2025 to USD 5.56 billion by 2030, at a CAGR of 18.2%. The increasing demand for wearable health monitoring devices is significantly driving opportunities in the smart textiles market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By type, application, vertical, and region |

| Regions covered | North America, Europe, APAC, RoW |

As healthcare systems shift toward remote patient monitoring and proactive chronic disease management, smart fabrics embedded with biosensors are emerging as vital tools. These textiles can continuously track vital signs such as heart rate, respiration, body temperature, and hydration levels, enabling real-time health insights. Their integration into garments offers a seamless, non-intrusive monitoring solution, making them ideal for hospital settings, home-based care, and athletic performance tracking. Additionally, the aging global population is accelerating the adoption of such solutions for elderly care and wellness monitoring.

"The fashion and Entertainment smart textile segment is expected to record a significant CAGR in the smart textiles market from 2025 to 2030."

The fashion and entertainment segment of the smart textiles market is projected to record a significant CAGR from 2025 to 2030, driven by growing consumer interest in interactive, expressive, and tech-integrated apparel as the lines between technology and lifestyle blur, designers and technology firms are collaborating to create garments that not only serve aesthetic purposes but also deliver immersive experiences. Smart textiles in this segment can change color, emit light, react to music, or display dynamic visuals based on user interaction or environmental stimuli, making them ideal for concerts, fashion shows, themed events, and cosplay. With the increasing adoption of wearable LEDs, flexible circuits, and shape-memory fabrics, fashion houses are integrating electronics directly into fabric without compromising comfort. Social media and influencer culture are also fueling demand for visually striking, tech-enhanced outfits that enhance personal branding and entertainment value. Furthermore, the emergence of AR/VR-enabled clothing and metaverse fashion is unlocking new monetization avenues for digital-native audiences. Smart textiles are also being used in luxury and haute couture, providing exclusivity and innovation to premium segments. As consumers seek novelty, personalization, and digital expression, the fashion and entertainment smart textile segment is poised for robust growth, supported by both creative innovation and rising market readiness.

"Energy harvesting & thermo-electricity segment is expected to contribute a recognizable share in the smart textiles market from 2025 to 2030."

The Energy Harvesting & Thermo-Electricity segment is anticipated to contribute a significant share to the smart textiles market from 2025 to 2030 due to its ability to provide self-sustaining power solutions for wearable and embedded electronics. As the adoption of smart textiles in applications like healthcare monitoring, military gear, fitness apparel, and consumer electronics increases, the demand for continuous, battery-free energy supply is becoming critical. Energy harvesting textiles, which convert body heat (thermoelectricity), motion (piezoelectricity), or ambient light into electrical energy, offer a sustainable alternative to traditional battery-powered systems. These fabrics enable wearables to operate longer without recharging, enhancing convenience, usability, and environmental sustainability. In healthcare, for example, thermo-electric fabrics can power biosensors for real-time patient monitoring without relying on external energy sources. In defense, self-powered textiles ensure uninterrupted communication and situational awareness tools for soldiers in the field. Furthermore, ongoing R&D and collaborations among material scientists, electronics companies, and textile manufacturers are driving down costs and improving efficiency, making these technologies commercially viable. The push for eco-friendly, power-autonomous wearables-aligned with global sustainability trends-further positions this segment as a key contributor to the smart textiles market during the forecast period.

"North America dominated the market in 2024."

North America is expected to have contributed the largest share to the smart textiles market in 2024, driven by early technology adoption, strong presence of key industry players, and growing demand across diverse application areas. The region, particularly the US, leads in wearable technology innovation, with robust R&D activities and significant investments from both public and private sectors. Healthcare applications are a major contributor, as smart textiles are increasingly used for patient monitoring, chronic disease management, and post-operative recovery. The well-established medical infrastructure and rising demand for personalized healthcare solutions are accelerating adoption. Additionally, the military and defense sector in the US is actively deploying smart uniforms with embedded sensors for health tracking, situational awareness, and thermal management, further boosting market revenue. The sports and fitness industry is another growth driver, with consumers showing a high preference for performance-enhancing wearable garments. Collaborations between tech firms, fashion brands, and textile manufacturers are leading to commercially viable smart apparel that combines comfort with functionality. Moreover, North America benefits from strong intellectual property protections and favorable regulatory frameworks that support innovation in the smart textiles domain. These factors, combined with high consumer awareness and purchasing power, position North America as the leading region in the global smart textiles market in 2024.

- By Company Type: Tier 1 - 38%, Tier 2 - 28%, and Tier 3 - 34%

- By Designation: C-level Executives - 40%, Managers -30%, and Others - 30%

- By Region: North America -45%, Europe - 22%, Asia Pacific- 22%, and RoW - 11%

Prominent players profiled in this report include DuPont (US), Jabil Inc. (US), Gentherm (US), AiQ Smart Clothing (Taiwan), and Sensoria (US).

Report Coverage

The report defines, describes, and forecasts the smart textiles market based on type (Passive, Active/Ultra smart textiles), application (Sensing, Energy Harvesting and Thermo-electricity, Luminescence & Aesthetics, Others), vertical (Military & Protection, Healthcare, Sports & Fitness, Fashion & Entertainment, Automotive, Others), and region (North America, Europe, Asia Pacific, and RoW). It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth. It also analyzes competitive developments such as acquisitions, product launches, expansions, and actions carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue for the overall smart textiles market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key drivers, restraints, opportunities, and challenges.

The report will provide insights into the following points:

- Analysis of key drivers (Expanding wearable electronics industry, Miniaturization of electronic components, Implementation of advanced technologies in smart textiles, Proliferation of low-cost smart wireless sensor networks), restraints (Lack of standards and regulations), opportunities (Development of flexible electronics, Development of multi-featured and hybrid smart textiles), and challenges (Technical difficulties related to integration of electronics and textiles, Product protection and thermal consideration, High cost of smart textiles and products developed using smart textiles) of the smart textiles market

- Product development /Innovation: Detailed insights into upcoming technologies, research & development activities, and new product launches in the smart textiles market

- Market Development: Comprehensive information about lucrative markets; the report analyses the smart textiles market across various regions

- Market Diversification: Exhaustive information about new products launched, untapped geographies, recent developments, and investments in the smart textiles market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and offering of leading players, including DuPont (US), Jabil Inc. (US), Gentherm (US), AiQ Smart Clothing (Taiwan), Sensoria (US), Alphabet (US), Interactive Wear (Germany), Outlast Technologies GmbH (Germany), Adidas (Germany), Hexoskin (Canada) in the smart textiles market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 SUMMARY OF CHANGES

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Major secondary sources

- 2.1.2.2 Secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primaries

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Estimating market size using a bottom-up approach (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 ASSUMPTIONS

- 2.5 LIMITATIONS

- 2.5.1 SCOPE-RELATED LIMITATIONS

- 2.5.2 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN SMART TEXTILES MARKET

- 4.2 SMART TEXTILES MARKET, BY TYPE

- 4.3 SMART TEXTILES MARKET, BY APPLICATION

- 4.4 SMART TEXTILES MARKET, BY END-USER INDUSTRY

- 4.5 SMART TEXTILES MARKET IN NORTH AMERICA, BY COUNTRY AND END-USER INDUSTRY

- 4.6 SMART TEXTILES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- 5.1.1 DRIVERS

- 5.1.1.1 Expanding wearable electronics industry

- 5.1.1.2 Miniaturization of electronic components

- 5.1.1.3 Implementation of advanced technologies in smart textiles

- 5.1.1.4 Proliferation of low-cost smart wireless sensor networks

- 5.1.2 RESTRAINTS

- 5.1.2.1 Lack of standards and regulations

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Development of flexible electronics

- 5.1.3.2 Development of multi-featured and hybrid smart textiles

- 5.1.4 CHALLENGES

- 5.1.4.1 Technical difficulties related to integration of electronics and textiles

- 5.1.4.2 Product protection and thermal consideration

- 5.1.4.3 High cost of smart textiles and products developed using smart textiles

- 5.1.1 DRIVERS

- 5.2 SUPPLY CHAIN ANALYSIS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 TRADE ANALYSIS

- 5.5.1 IMPORT DATA FOR HS CODE 591131

- 5.5.2 EXPORT DATA FOR HS CODE 591131

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 5.8.2 AVERAGE SELLING PRICE TREND OF ACTIVE SMART TEXTILES, BY REGION

- 5.8.3 AVERAGE SELLING PRICE TREND OF PASSIVE SMART TEXTILES, BY REGION

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 CASE STUDY 1: SMART TEXTILE BIO-SENSOR DEVELOPMENT AND INTEGRATION IN AUTOMOTIVE INDUSTRY

- 5.9.2 CASE STUDY 2: DEVELOPMENT OF FABRIC-BASED WEARABLE SYSTEM FOR STROKE REHABILITATION

- 5.9.3 CASE STUDY 3: DEVELOPMENT OF FABRIC-BASED WEARABLE SYSTEM FOR JOINT PAIN RELIEF

- 5.10 PATENT ANALYSIS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Integrating AI and IoT in smart textiles

- 5.11.1.2 Embedded Electronics (Sensors, ICs, PCBs)

- 5.11.1.3 Printed Electronics on Fabric

- 5.11.1.4 Shape Memory Alloys (SMA)-infused Textiles

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Digital textile printing ink

- 5.11.2.2 Coated/Layered Functionalization

- 5.11.2.3 Knitted Smart Textiles

- 5.11.2.4 Woven Smart Textiles

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 Biotextile-based smart textiles for healthcare industry

- 5.11.1 KEY TECHNOLOGIES

- 5.12 IMPACT OF AI/GEN AI ON SMART TEXTILES MARKET

- 5.12.1 TOP USE CASES AND MARKET POTENTIAL

- 5.12.1.1 Personalized Health Monitoring

- 5.12.1.2 Adaptive Fitness & Sportswear

- 5.12.1.3 Predictive Maintenance in Smart Fabrics

- 5.12.1.4 Smart Uniforms for Workforce Safety

- 5.12.1.5 Thermal & Climate-Adaptive Clothing

- 5.12.1 TOP USE CASES AND MARKET POTENTIAL

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 REGULATORY FRAMEWORK

- 5.14.2.1 US

- 5.14.2.2 Europe

- 5.14.2.3 India

- 5.15 IMPACT OF 2025 US TARIFFS-SMART TEXTILES MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.15.3 PRICE IMPACT ANALYSIS

- 5.15.4 IMPACT ON COUNTRIES/REGIONS

- 5.15.4.1 US

- 5.15.4.2 Europe

- 5.15.4.3 Asia Pacific

- 5.15.5 IMPACT ON END-USE INDUSTRIES

6 SMART TEXTILES MARKET, BY FABRIC TYPE

- 6.1 INTRODUCTION

- 6.2 COTTON-BASED SMART TEXTILES

- 6.3 NYLON & POLYESTER

- 6.4 WOOL & SILK

- 6.5 GRAPHENE-ENABLED FABRICS

- 6.6 CONDUCTIVE POLYMER FIBERS

- 6.7 HYBRID FABRICS (BLENDS)

7 SMART TEXTILES MARKET, BY FORM

- 7.1 INTRODUCTION

- 7.2 WEARABLE SMART TEXTILES

- 7.3 NON-WEARABLE SMART TEXTILES

8 SMART TEXTILES MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 PASSIVE SMART TEXTILES

- 8.2.1 PASSIVE SMART TEXTILES ARE MAINLY USED IN MILITARY & PROTECTION

- 8.3 ACTIVE/ULTRA-SMART TEXTILES

- 8.3.1 ACTIVE SMART TEXTILES CAN SENSE ENVIRONMENTAL STIMULI AND REACT ACCORDINGLY

9 SMART TEXTILES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 SENSING

- 9.2.1 SENSING APPLICATIONS DOMINATE SMART TEXTILES MARKET

- 9.3 ENERGY HARVESTING AND THERMOELECTRICITY

- 9.3.1 RISING FOCUS ON INTEGRATION OF ENERGY HARVESTING CAPABILITIES

- 9.4 LUMINESCENCE & AESTHETICS

- 9.4.1 RISING INTEREST IN DISPLAY-EMBEDDED CLOTHING TO DRIVE MARKET

- 9.5 OTHER APPLICATIONS

10 SMART TEXTILES MARKET, BY END-USER INDUSTRY

- 10.1 INTRODUCTION

- 10.2 MILITARY & PROTECTION

- 10.2.1 SMART TEXTILES PLAY ESSENTIAL ROLE IN PROTECTING SOLDIERS DURING WARFARE BY PROVIDING ADDITIONAL PROTECTION

- 10.2.1.1 Health monitoring uniforms

- 10.2.1.2 Ballistic protection

- 10.2.1.3 Chemical & biological threat detection

- 10.2.1.4 Wearable navigation & communication textiles

- 10.2.1.5 Temperature-regulating combat gear

- 10.2.1 SMART TEXTILES PLAY ESSENTIAL ROLE IN PROTECTING SOLDIERS DURING WARFARE BY PROVIDING ADDITIONAL PROTECTION

- 10.3 HEALTHCARE

- 10.3.1 SMART TEXTILES IN HEALTHCARE ARE GAINING POPULARITY FOR TRACKING PATIENT DATA

- 10.3.1.1 Remote patient monitoring garments

- 10.3.1.2 Post-surgical rehabilitation garments

- 10.3.1.3 Diabetic socks (temperature/pressure sensing)

- 10.3.1.4 Smart bandages for wound healing

- 10.3.1.5 Bio-signal monitoring shirts for elderly care

- 10.3.1 SMART TEXTILES IN HEALTHCARE ARE GAINING POPULARITY FOR TRACKING PATIENT DATA

- 10.4 SPORTS & FITNESS

- 10.4.1 SMART TEXTILES HELP ATHLETES IMPROVE PERFORMANCE AND COMFORT

- 10.4.1.1 Fitness tracking shirts

- 10.4.1.2 Compression garments with motion sensors

- 10.4.1.3 Posture monitoring apparel

- 10.4.1.4 Smart insoles for gait analysis

- 10.4.1 SMART TEXTILES HELP ATHLETES IMPROVE PERFORMANCE AND COMFORT

- 10.5 FASHION & ENTERTAINMENT

- 10.5.1 INCREASING APPLICATION OF SMART TEXTILES IN MANUFACTURING STAGE COSTUMES AND HAPTIC GAMING SUITS

- 10.5.1.1 Light-emitting (LED) clothing

- 10.5.1.2 Interactive clothing

- 10.5.1.3 Color-changing fabrics

- 10.5.1.4 Garments with integrated sound or haptic feedback

- 10.5.1 INCREASING APPLICATION OF SMART TEXTILES IN MANUFACTURING STAGE COSTUMES AND HAPTIC GAMING SUITS

- 10.6 AUTOMOTIVE

- 10.6.1 INTEGRATION OF SMART TEXTILES INTO VEHICLES ENHANCES EXPERIENCE OF DRIVING

- 10.6.1.1 Seat upholstery with occupancy/pressure sensors

- 10.6.1.2 Sound-absorbing smart textiles

- 10.6.1.3 Thermo-regulating upholstery

- 10.6.1.4 Ambient lighting-integrated textiles

- 10.6.1 INTEGRATION OF SMART TEXTILES INTO VEHICLES ENHANCES EXPERIENCE OF DRIVING

- 10.7 OTHER END-USER INDUSTRIES

11 SMART TEXTILES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.2 US

- 11.2.2.1 High internet penetration and disposable income to drive growth of US market

- 11.2.3 CANADA

- 11.2.3.1 Innovative applications and government support drive growth in Canada

- 11.2.4 MEXICO

- 11.2.4.1 Smart textiles market in Mexico gains traction through industrial growth and cross-border innovation

- 11.3 EUROPE

- 11.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.2 UK

- 11.3.2.1 UK's smart textiles market advances with innovation, defense demand, and sustainability focus

- 11.3.3 GERMANY

- 11.3.3.1 Germany's smart textiles market thrives on industrial innovation, technical textiles, and research leadership

- 11.3.4 FRANCE

- 11.3.4.1 Collaborations between various small smart textiles producers to positively impact market

- 11.3.5 ITALY

- 11.3.5.1 Growing integration of smart textiles in fashion, automotive, and medical sectors

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.2 CHINA

- 11.4.2.1 Expansion of Chinese economy to drive market growth

- 11.4.3 JAPAN

- 11.4.3.1 Japan's technological prowess driving smart textiles innovation and commercialization

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Technological advancements and innovation driving growth

- 11.4.5 INDIA

- 11.4.5.1 Availability of raw materials, low labor cost, and modernized production facilities to drive market growth in India

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 REST OF THE WORLD

- 11.5.1 REST OF THE WORLD: MACROECONOMIC OUTLOOK

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Growing textile innovation, sports adoption, and healthcare digitization driving smart textile growth

- 11.5.3 MIDDLE EAST

- 11.5.3.1 Rising adoption of smart textiles in healthcare, defense, and sports sectors

- 11.5.4 AFRICA

- 11.5.4.1 Gradual market entry through medical, wearable, and academic initiatives

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.4.1 KEY PLAYERS IN SMART TEXTILES MARKET, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Type footprint

- 12.5.5.4 Application footprint

- 12.5.5.5 End-user industry footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.4.1 Competitive benchmarking of key startups/SMEs

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 DEALS

- 12.7.2 PRODUCT LAUNCHES

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 DUPONT

- 13.1.1.1 Business overview

- 13.1.1.2 Products/solutions/services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices made

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 JABIL INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/solutions/services offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Key strengths/Right to win

- 13.1.2.3.2 Strategic choices made

- 13.1.2.3.3 Weaknesses and competitive threats

- 13.1.3 GENTHERM INCORPORATED

- 13.1.3.1 Business overview

- 13.1.3.2 Products/solutions/services offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths/Right to win

- 13.1.3.3.2 Strategic choices made

- 13.1.3.3.3 Weaknesses and competitive threats

- 13.1.4 AIQ SMART CLOTHING

- 13.1.4.1 Business overview

- 13.1.4.2 Products/solutions/services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths/Right to win

- 13.1.4.3.2 Strategic choices made

- 13.1.4.3.3 Weaknesses and competitive threats

- 13.1.5 SENSORIA

- 13.1.5.1 Business overview

- 13.1.5.2 Products/solutions/services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths/Right to win

- 13.1.5.3.2 Strategic choices made

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 ALPHABET

- 13.1.6.1 Business overview

- 13.1.6.2 Products/solutions/services offered

- 13.1.7 INTERACTIVE WEAR

- 13.1.7.1 Business overview

- 13.1.7.2 Products/solutions/services offered

- 13.1.8 OUTLAST TECHNOLOGIES GMBH

- 13.1.8.1 Business overview

- 13.1.8.2 Products/solutions/services offered

- 13.1.9 ADIDAS

- 13.1.9.1 Business overview

- 13.1.9.2 Products/solutions/services offered

- 13.1.10 HEXOSKIN

- 13.1.10.1 Business overview

- 13.1.10.2 Products/solutions/services offered

- 13.1.1 DUPONT

- 13.2 OTHER PLAYERS

- 13.2.1 CLIM8 SAS

- 13.2.2 NIKE

- 13.2.3 SENSING TEX

- 13.2.4 APPLYCON, S. R. O.

- 13.2.5 FOOTFALLS SMARTEX LIMITED

- 13.2.6 VOLT AI LLC.

- 13.2.7 SAMSUNG

- 13.2.8 MICROSOFT

- 13.2.9 LIFESENSE GROUP

- 13.2.10 NANOLEQ AG

- 13.2.11 EMBRO

- 13.2.12 LOOMIA

- 13.2.13 NEXTILES, INC.

- 13.2.14 AMOHR TECHNISCHE TEXTILIEN GMBH

- 13.2.15 PRIMO1D

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

List of Tables

- TABLE 1 SMART TEXTILES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 3 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

- TABLE 4 GLOBAL IMPORT DATA FOR HS CODE 591131, 2020-2024 (USD MILLION)

- TABLE 5 GLOBAL EXPORT DATA FOR HS CODE 591131, 2020-2024 (USD MILLION)

- TABLE 6 SMART TEXTILES MARKET: ECOSYSTEM

- TABLE 7 PRICING RANGE OF SMART TEXTILES, BY KEY PLAYER, 2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE OF ACTIVE SMART TEXTILES, BY REGION, 2021-2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE OF PASSIVE SMART TEXTILES, BY REGION, 2021-2024 (USD)

- TABLE 10 SMART TEXTILES MARKET: KEY PATENTS

- TABLE 11 SMART TEXTILES MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 17 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFFS

- TABLE 18 SMART TEXTILES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 19 SMART TEXTILES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 20 SMART TEXTILES MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 21 SMART TEXTILES MARKET, BY TYPE, 2025-2030 (MILLION UNITS)

- TABLE 22 PASSIVE SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 23 PASSIVE SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 24 ACTIVE/ULTRA-SMART TEXTILES MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 25 ACTIVE/ULTRA-SMART TEXTILES MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 26 SMART TEXTILES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 27 SMART TEXTILES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 28 SENSING: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 29 SENSING: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 30 ENERGY HARVESTING & THERMOELECTRICITY: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 31 ENERGY HARVESTING & THERMOELECTRICITY: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 32 LUMINESCENCE & AESTHETICS: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 33 LUMINESCENCE & AESTHETICS: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 34 OTHER APPLICATIONS: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 35 OTHER APPLICATIONS: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 36 SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 37 SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 38 SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 39 SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 40 SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 41 SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 42 SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 NORTH AMERICA: SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 45 NORTH AMERICA: SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 46 EUROPE: SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 47 EUROPE: SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 48 ASIA PACIFIC: SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 49 ASIA PACIFIC: SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 50 REST OF THE WORLD: SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 REST OF THE WORLD: SMART TEXTILES MARKET FOR MILITARY & PROTECTION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 SMART TEXTILES MARKET FOR HEALTHCARE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 53 SMART TEXTILES MARKET FOR HEALTHCARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 54 SMART TEXTILES MARKET FOR HEALTHCARE, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 55 SMART TEXTILES MARKET FOR HEALTHCARE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 56 SMART TEXTILES MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 SMART TEXTILES MARKET FOR HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: SMART TEXTILES MARKET FOR HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 59 NORTH AMERICA: SMART TEXTILES MARKET FOR HEALTHCARE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 60 EUROPE: SMART TEXTILES MARKET FOR HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 61 EUROPE: SMART TEXTILES MARKET FOR HEALTHCARE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 62 ASIA PACIFIC: SMART TEXTILES MARKET FOR HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 63 ASIA PACIFIC: SMART TEXTILES MARKET FOR HEALTHCARE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 64 REST OF THE WORLD: SMART TEXTILES MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 REST OF THE WORLD: SMART TEXTILES MARKET FOR HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 67 SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 68 SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 69 SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 70 SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 74 EUROPE: SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 75 EUROPE: SPORTS & FITNESS: SMART TEXTILES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 76 ASIA PACIFIC: SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 77 ASIA PACIFIC: SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 78 REST OF THE WORLD: SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 REST OF THE WORLD: SMART TEXTILES MARKET FOR SPORTS & FITNESS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 81 SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 82 SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 83 SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 84 SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 87 NORTH AMERICA: SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 88 EUROPE: SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 89 EUROPE: SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 91 ASIA PACIFIC: SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 92 REST OF THE WORLD: SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 93 REST OF THE WORLD: SMART TEXTILES MARKET FOR FASHION & ENTERTAINMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 SMART TEXTILES MARKET FOR AUTOMOTIVE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 95 SMART TEXTILES MARKET FOR AUTOMOTIVE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 96 SMART TEXTILES MARKET FOR AUTOMOTIVE, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 97 SMART TEXTILES MARKET FOR AUTOMOTIVE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 98 SMART TEXTILES MARKET FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 99 SMART TEXTILES MARKET FOR AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: SMART TEXTILES MARKET FOR AUTOMOTIVE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: SMART TEXTILES MARKET FOR AUTOMOTIVE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 102 EUROPE: SMART TEXTILES MARKET FOR AUTOMOTIVE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 103 EUROPE: SMART TEXTILES MARKET FOR AUTOMOTIVE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 104 ASIA PACIFIC: SMART TEXTILES MARKET FOR AUTOMOTIVE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 105 ASIA PACIFIC: SMART TEXTILES MARKET FOR AUTOMOTIVE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 106 REST OF THE WORLD: SMART TEXTILES MARKET FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 107 REST OF THE WORLD: SMART TEXTILES MARKET FOR AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 109 SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 110 SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 111 SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 112 SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 115 NORTH AMERICA: SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 116 EUROPE: SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 117 EUROPE: SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 119 ASIA PACIFIC: SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 120 REST OF THE WORLD: SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 121 REST OF THE WORLD: SMART TEXTILES MARKET FOR OTHER END-USER INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 122 SMART TEXTILES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 123 SMART TEXTILES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 124 NORTH AMERICA: SMART TEXTILES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 125 NORTH AMERICA: SMART TEXTILES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 127 NORTH AMERICA: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 128 EUROPE: SMART TEXTILES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 129 EUROPE: SMART TEXTILES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 131 EUROPE: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: SMART TEXTILES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 133 ASIA PACIFIC: SMART TEXTILES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 135 ASIA PACIFIC: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 136 REST OF THE WORLD: SMART TEXTILES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 137 REST OF THE WORLD: SMART TEXTILES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 138 REST OF THE WORLD: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 139 REST OF THE WORLD: SMART TEXTILES MARKET, BY END-USER INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 140 OVERVIEW OF STRATEGIES FOLLOWED BY KEY PLAYERS IN SMART TEXTILES MARKET

- TABLE 141 SMART TEXTILES MARKET: DEGREE OF COMPETITION

- TABLE 142 SMART TEXTILES MARKET: REGION FOOTPRINT

- TABLE 143 SMART TEXTILES MARKET: TYPE FOOTPRINT

- TABLE 144 SMART TEXTILES MARKET: APPLICATION FOOTPRINT

- TABLE 145 SMART TEXTILES MARKET: END-USER INDUSTRY FOOTPRINT

- TABLE 146 SMART TEXTILE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 147 SMART TEXTILES MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (2/2)

- TABLE 148 SMART TEXTILES MARKET: DEALS, 2021-2025

- TABLE 149 SMART TEXTILES MARKET: PRODUCT LAUNCHES, 2021-2025

- TABLE 150 DUPONT: BUSINESS OVERVIEW

- TABLE 151 DUPONT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 DUPONT: PRODUCT LAUNCHES

- TABLE 153 DUPONT: DEALS

- TABLE 154 JABIL INC.: BUSINESS OVERVIEW

- TABLE 155 JABIL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 GENTHERM INCORPORATED: BUSINESS OVERVIEW

- TABLE 157 GENTHERM INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 AIQ SMART CLOTHING: BUSINESS OVERVIEW

- TABLE 159 AIQ SMART CLOTHING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 SENSORIA: BUSINESS OVERVIEW

- TABLE 161 SENSORIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 ALPHABET: BUSINESS OVERVIEW

- TABLE 163 ALPHABET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 INTERACTIVE WEAR: BUSINESS OVERVIEW

- TABLE 165 INTERACTIVE WEAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 OUTLAST TECHNOLOGIES GMBH: BUSINESS OVERVIEW

- TABLE 167 OUTLAST TECHNOLOGIES GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 ADIDAS: BUSINESS OVERVIEW

- TABLE 169 ADIDAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 HEXOSKIN: BUSINESS OVERVIEW

- TABLE 171 HEXOSKIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 SMART TEXTILES MARKET SEGMENTATION

- FIGURE 2 SMART TEXTILES MARKET: RESEARCH DESIGN

- FIGURE 3 PROCESS FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 SMART TEXTILES MARKET: BOTTOM-UP APPROACH

- FIGURE 5 SMART TEXTILES MARKET: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH (SUPPLY SIDE)-REVENUE GENERATED FROM SALES OF SMART TEXTILE PRODUCTS

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ACTIVE/ULTRA-SMART TEXTILES SEGMENT TO HOLD MAJOR MARKET SHARE TILL 2030

- FIGURE 9 SENSING SEGMENT TO ACCOUNT FOR LARGEST SHARE OF APPLICATIONS MARKET

- FIGURE 10 MILITARY & PROTECTION SEGMENT TO CONTINUE AS DOMINANT END-USER INDUSTRY TILL 2030

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING REGIONAL MARKET DURING FORECAST PERIOD

- FIGURE 12 INCREASING ADOPTION OF SMART TEXTILES IN ASIA PACIFIC TO DRIVE MARKET GROWTH

- FIGURE 13 ACTIVE/ULTRA-SMART TEXTILES SEGMENT TO REGISTER HIGHEST CAGR

- FIGURE 14 ENERGY HARVESTING & THERMOELECTRICITY TO GROW AT HIGHEST RATE

- FIGURE 15 SPORTS & FITNESS TO REGISTER HIGHEST CAGR TILL 2030

- FIGURE 16 US AND MILITARY & DEFENSE APPLICATIONS TO HOLD LARGEST SHARES OF NORTH AMERICAN MARKET IN 2024

- FIGURE 17 CHINA TO REGISTER HIGHEST CAGR IN SMART TEXTILES MARKET DURING FORECAST PERIOD

- FIGURE 18 SMART TEXTILES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 GLOBAL IOT CONNECTIONS, 2019-2030

- FIGURE 20 IMPACT ANALYSIS: DRIVERS

- FIGURE 21 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 22 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 23 IMPACT ANALYSIS: CHALLENGES

- FIGURE 24 SUPPLY CHAIN ANALYSIS: SMART TEXTILES MARKET

- FIGURE 25 SMART TEXTILES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 27 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

- FIGURE 28 GLOBAL IMPORT DATA FOR KEY COUNTRIES UNDER HS CODE 591131, 2020-2024 (USD MILLION)

- FIGURE 29 GLOBAL EXPORT DATA FOR KEY COUNTRIES UNDER HS CODE 591131, 2020-2024 (USD MILLION)

- FIGURE 30 SMART TEXTILES MARKET: ECOSYSTEM

- FIGURE 31 SMART TEXTILES MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 32 AVERAGE SELLING PRICE OF SMART TEXTILES, BY KEY PLAYER, 2024 (USD)

- FIGURE 33 AVERAGE SELLING PRICE TREND OF ACTIVE SMART TEXTILES, BY REGION, 2021-2024 (USD)

- FIGURE 34 AVERAGE SELLING PRICE OF PASSIVE SMART TEXTILES, BY REGION, 2021-2024 (USD)

- FIGURE 35 NUMBER OF PATENTS GRANTED FOR SMART TEXTILES, 2016-2025

- FIGURE 36 IMPACT OF AI/GEN AI ON SMART TEXTILES MARKET

- FIGURE 37 ACTIVE/ULTRA-SMART TEXTILES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 SENSING APPLICATIONS TO HOLD LARGEST MARKET SHARE

- FIGURE 39 SPORTS & FITNESS TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: SMART TEXTILES MARKET SNAPSHOT

- FIGURE 42 EUROPE: SMART TEXTILES MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC SMART TEXTILES MARKET: SNAPSHOT

- FIGURE 44 REST OF THE WORLD: SMART TEXTILES MARKET SNAPSHOT

- FIGURE 45 SMART TEXTILES MARKET: REVENUE ANALYSIS (USD MILLION), 2020-2024

- FIGURE 46 SMART TEXTILES MARKET: MARKET SHARE ANALYSIS (2024)

- FIGURE 47 SMART TEXTILES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 SMART TEXTILES MARKET: COMPANY FOOTPRINT

- FIGURE 49 SMART TEXTILES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 50 DUPONT: COMPANY SNAPSHOT

- FIGURE 51 JABIL INC.: COMPANY SNAPSHOT

- FIGURE 52 GENTHERM INCORPORATED: COMPANY SNAPSHOT

- FIGURE 53 ALPHABET: COMPANY SNAPSHOT

- FIGURE 54 ADIDAS: COMPANY SNAPSHOT