|

市場調查報告書

商品編碼

1871104

智慧紡織品(含整合式電子元件)市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Smart Textiles with Integrated Electronics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

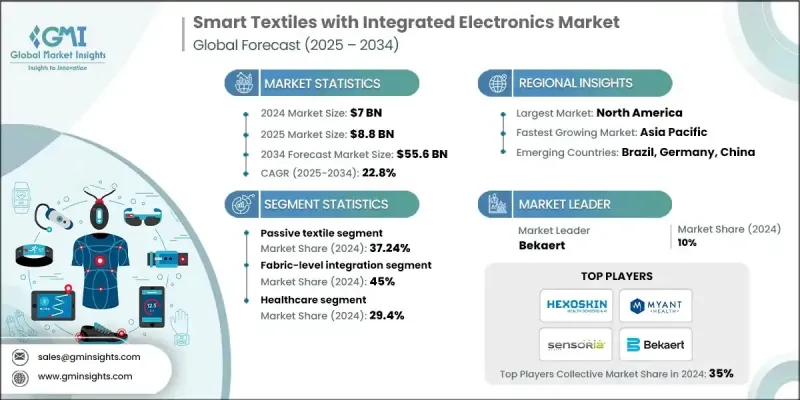

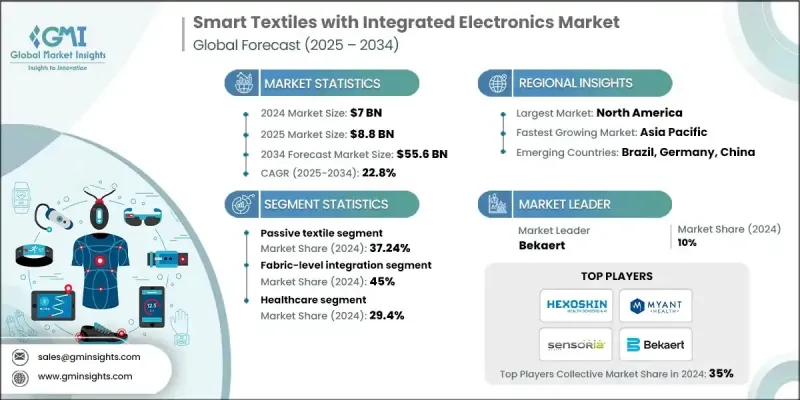

2024 年全球整合電子智慧紡織品市場價值為 70 億美元,預計到 2034 年將以 22.8% 的複合年成長率成長至 556 億美元。

智慧紡織品的快速發展表明,將電子功能直接嵌入織物具有巨大的潛力。軟性電子、先進感測器系統和能量收集技術的持續創新正在重新定義傳統紡織品的功能。醫療保健產業仍然是主要驅動力,因為智慧紡織品能夠實現即時健康監測、疾病早期檢測和個人化醫療。整合生物感測器、溫度感測器和運動感測器的應用正在改變患者護理方式。紡織製造技術的進步,包括導電材料和軟性電路整合,在降低生產成本的同時,提高了耐用性和性能。可洗滌且耐用的電子織物的出現克服了早期的局限性,推動了更廣泛的商業應用。研發投入的增加以及科技公司和紡織品生產商之間的合作關係進一步促進了這一成長。政府推動工業4.0和智慧製造的措施也為智慧紡織品在工業和消費領域的應用拓展創造了有利環境。隨著先進感測技術嵌入織物,智慧紡織品能夠主動檢測並響應物理或環境變化,從而實現對心率、呼吸和血糖水平等關鍵生理資料的精確監測。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 70億美元 |

| 預測值 | 556億美元 |

| 複合年成長率 | 22.8% |

到2024年,被動式智慧紡織品市場佔有率將達到37.24%。這類布料能夠辨識濕度、壓力和溫度等環境條件的變化,但自身無法做出相應調整或適應。其市場主導地位凸顯了被動式感測技術的成熟、穩定性和廣泛應用,為使用者提供了一種高效且無需電源的感測解決方案,從而提升了使用者的舒適度和可靠性。

2024年,織物級整合市場佔據45%的市場佔有率,預計2025年至2034年間將以24.9%的複合年成長率成長。這種整合技術將電子元件直接整合到紡織品生產過程中,確保電子功能嵌入織物,同時不影響織物的自然觸感和外觀。該工藝涉及將感測器和電子電路分佈在紡織品結構中,以增強其耐用性、柔韌性和功能性。這種整合技術支援智慧服裝和自適應布料等應用,可顯著提高其耐洗性、回彈性和性能穩定性。

北美智慧紡織品整合電子市場預計在2024年佔據33.5%的市場佔有率,這主要得益於其先進的研發生態系統、對創新的大量投入以及早期技術應用。該地區的擴張主要由美國推動,這得益於主要科技公司、研究機構和國防部門之間的緊密合作。有利的智慧財產權框架、充裕的創投以及產學研合作,進一步鞏固了該地區在智慧紡織品開發和商業化領域的領先地位。

全球智慧紡織品整合電子市場的主要參與者包括Myant Inc.、AiQ Smart Clothing Inc.、Sensoria Inc.、Clothing+、Intelligent Textiles Ltd.、Vista Medical Ltd.、Xenoma Inc.、Ohmatex A/S、Gentherm Inc.、Textronics、Internet Wear AG、Hexx A/S、Sextm Inc.、Textronics、Interrem Wear AG、Hex Technologies Technologiesal Technologies)。智慧紡織品整合電子市場中各公司採取的關鍵策略圍繞著創新、合作和永續製造。領先企業正大力投資研發,以開發導電性更高、舒適度更強、感測器精度更高,同時又能保持穿著舒適性和耐用性的紡織品。許多企業正在與技術開發商和醫療保健提供者建立策略合作夥伴關係,共同開發先進的智慧布料系統。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 對穿戴式科技的需求日益成長

- 軟性電子和材料領域的進展

- 醫療保健和醫療應用領域的成長

- 產業陷阱與挑戰

- 高昂的製造成本和材料成本

- 耐用性和耐洗性問題

- 機會

- 健康意識和健身意識的提高

- 與物聯網和聯網設備的整合

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 被動式智慧紡織品

- 主動式智慧紡織品

- 超智慧紡織品

第6章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 光纖級整合

- 紗線級整合

- 表面處理

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 醫療保健

- 運動與健身

- 時尚與生活風格

- 軍事與國防

- 汽車

- 工業的

- 其他

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- AiQ Smart Clothing Inc.

- Clothing+

- Gentherm Inc.

- Hexoskin (Carre Technologies)

- Interactive Wear AG

- Intelligent Textiles Ltd.

- Loomia Technologies

- Myant Inc.

- Nextiles Inc.

- Ohmatex A/S

- Schoeller Textiles AG

- Sensoria Inc.

- Textronics

- Vista Medical Ltd.

- Xenoma Inc.

The Global Smart Textiles with Integrated Electronics Market was valued at USD 7 Billion in 2024 and is estimated to grow at a CAGR of 22.8% to reach USD 55.6 Billion by 2034.

The sharp expansion indicates a strong potential for electronic functionality to be embedded directly into fabrics. Continuous innovations in flexible electronics, advanced sensor systems, and energy-harvesting technologies are redefining the capabilities of traditional textiles. The healthcare industry remains the primary driver, as intelligent fabrics are enabling real-time health monitoring, early disease detection, and personalized medical treatment. The use of integrated biosensors, temperature sensors, and motion sensors is transforming patient care. Progress in textile manufacturing, including conductive materials and flexible circuit integration, is lowering production costs while improving durability and performance. The availability of washable and resilient electronic fabrics has addressed earlier limitations, fueling broader commercial adoption. This growth is further supported by increased R&D funding and collaborative partnerships between technology companies and textile producers. Government initiatives promoting Industry 4.0 and smart manufacturing have also provided a favorable environment for expanding smart textile applications across industrial and consumer sectors. With advanced sensing technologies now embedded in fabrics, smart textiles can actively detect and respond to physical or environmental changes, enabling accurate monitoring of key physiological data such as heart rate, respiration, and glucose levels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7 Billion |

| Forecast Value | $55.6 Billion |

| CAGR | 22.8% |

The passive smart textiles segment held a 37.24% share in 2024. These fabrics can identify variations in environmental conditions such as humidity, pressure, and temperature, but cannot alter or adapt themselves in response. Their dominance highlights the maturity, stability, and widespread adoption of passive sensing technologies across multiple applications, offering an efficient and power-free sensing solution that enhances user comfort and reliability.

The fabric-level integration segment held a 45% share in 2024 and is projected to reach a CAGR of 24.9% between 2025 and 2034. This integration technique incorporates electronic components directly during textile production, ensuring that electronic functionality is embedded without compromising the natural feel or appearance of the fabric. The process involves distributing sensors and electronic circuits within the textile structure to enhance durability, flexibility, and functionality. Such integration supports applications like connected garments and adaptive fabrics with improved washability, resilience, and performance consistency over time.

North America Smart Textiles with Integrated Electronics Market held 33.5% share in 2024 owing to its advanced R&D ecosystem, significant investment in innovation, and early technology adoption. The region's expansion is largely supported by the United States, driven by strong collaboration between major technology firms, research institutions, and defense sectors. Favorable intellectual property frameworks, abundant venture capital, and robust partnerships between industry and academia are further reinforcing the region's leadership in the development and commercialization of smart textiles.

The major players in the Global Smart Textiles with Integrated Electronics Market include Myant Inc., AiQ Smart Clothing Inc., Sensoria Inc., Clothing+, Intelligent Textiles Ltd., Vista Medical Ltd., Xenoma Inc., Ohmatex A/S, Gentherm Inc., Textronics, Interactive Wear AG, Hexoskin (Carre Technologies), Nextiles Inc., Loomia Technologies, and Schoeller Textiles AG. Key strategies adopted by companies in the Smart Textiles with Integrated Electronics Market center on innovation, collaboration, and sustainable manufacturing. Leading players are heavily investing in R&D to create textiles with higher conductivity, comfort, and sensor accuracy while maintaining wearability and durability. Many are forming strategic partnerships with technology developers and healthcare providers to co-develop advanced smart fabric systems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Technology

- 2.2.4 Application

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for wearable technology

- 3.2.1.2 Advancements in flexible electronics and materials

- 3.2.1.3 Growth in healthcare and medical applications

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High manufacturing and material costs

- 3.2.2.2 Durability and washability issues

- 3.2.3 Opportunities

- 3.2.3.1 Rising health and fitness awareness

- 3.2.3.2 Integration with IoT and connected devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Type

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Bn, Thousand Units)

- 5.1 Key trends

- 5.2 Passive smart textiles

- 5.3 Active smart textiles

- 5.4 Ultra-smart textiles

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Thousand Units)

- 6.1 Key trends

- 6.2 Fiber-level integration

- 6.3 Yarn-level integration

- 6.4 Surface treatment

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Thousand Units)

- 7.1 Key trends

- 7.2 Healthcare & medical

- 7.3 Sports & fitness

- 7.4 Fashion & lifestyle

- 7.5 Military & defense

- 7.6 Automotive

- 7.7 Industrial

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 AiQ Smart Clothing Inc.

- 9.2 Clothing+

- 9.3 Gentherm Inc.

- 9.4 Hexoskin (Carre Technologies)

- 9.5 Interactive Wear AG

- 9.6 Intelligent Textiles Ltd.

- 9.7 Loomia Technologies

- 9.8 Myant Inc.

- 9.9 Nextiles Inc.

- 9.10 Ohmatex A/S

- 9.11 Schoeller Textiles AG

- 9.12 Sensoria Inc.

- 9.13 Textronics

- 9.14 Vista Medical Ltd.

- 9.15 Xenoma Inc.