|

市場調查報告書

商品編碼

1919560

共封裝光學元件 (CPO) 與光互連專利格局分析 (2026)Co-Packaged Optics & Optical Interconnects Patent Landscape Analysis 2026 |

|||||||

主要特點

- 包含 80 多張投影片的 PDF 文件

- Excel 文件(包含 1300 多個專利族)

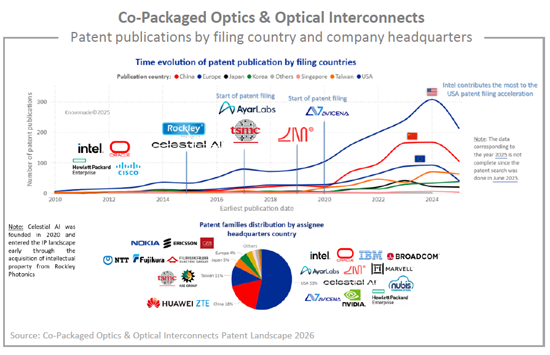

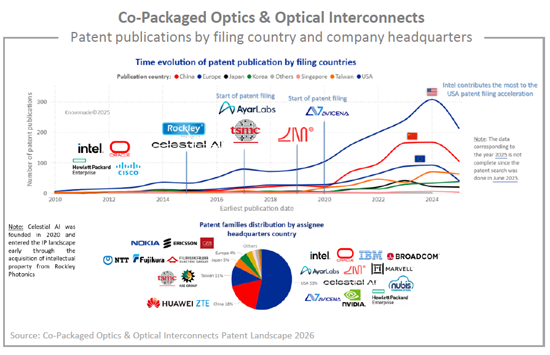

- 全球專利趨勢,包括專利揭露趨勢隨時間的變化以及申請國家/地區

- 知識產權領域的主要專利持有人和新進入者

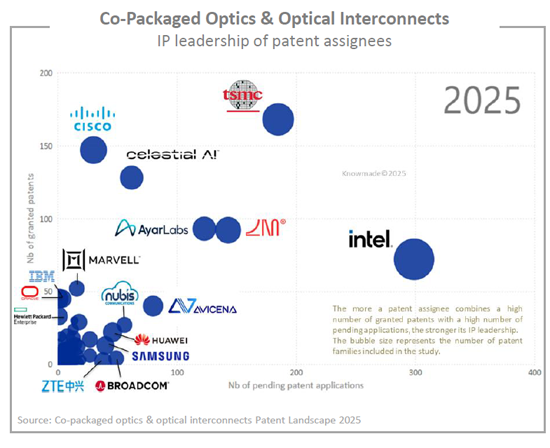

- 主要進入者的智慧財產權地位和專利組合的相對實力

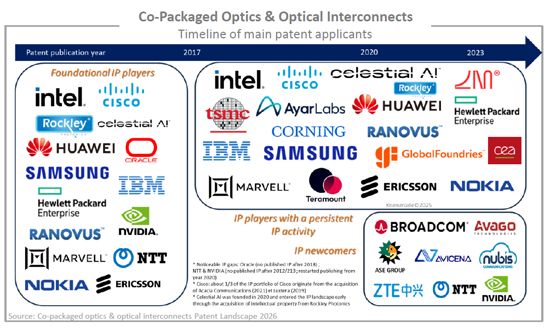

- 自 2020 年以來專利持有人智慧財產權領導地位的變化

- 主要進入者的智慧財產權概況(專利組合概述、技術覆蓋範圍、地理覆蓋範圍、重要專利和近期智慧財產權活動)

- 包含本報告分析的所有專利的 Excel 資料庫(帶有指向更新後的線上資料庫的超連結)。

共封裝光元件 (CPO) 是新一代電子產品的關鍵基礎技術。

人工智慧 (AI) 正在重塑產業格局,推動前所未有的數據成長,並加速對節能運算的需求。資料量的指數級成長需要硬體創新,特別是透過重新思考資料中心架構,以實現更快的運算速度、更低的功耗、更高的效能和更低的延遲。在此背景下,矽光子技術已成為取代傳統銅互連、實現高速光資料傳輸的關鍵技術。隨著對數據密集型計算的需求持續增長,半導體行業已構建了龐大的專利組合,旨在將光子系統和電子系統整合到封裝層級。這些發明共同凸顯了產業從傳統電互連向光輸入/輸出 (I/O) 架構的轉型,從而在運算和網路平台上實現更高的頻寬、更低的延遲和更高的能源效率。其中一項最重要的進展是共封裝光學元件 (CPO),這是一種創新的封裝技術,它將光學元件直接放置在電子設備內部或附近,從而最大限度地提高效率和可擴展性。

過去十年,CPO 和光學 I/O 技術已成為先進半導體封裝的關鍵基礎技術,導致專利申請活動激增,並顯著改變了智慧財產權 (IP) 的競爭格局。雖然主要專利持有者已在美國、中國和歐洲鞏固了其智慧財產權地位,但純粹的專利持有者也已進入專利領域。現在,對於在半導體先進封裝行業運營的公司而言,從智慧財產權的角度仔細審視技術和競爭格局至關重要。

為此,KnowMade 發布了一份新的專利格局報告,該報告以可視化的方式呈現了塑造這一快速發展領域的專利活動和競爭動態。報告從 1300 多個專利族(發明)中選取了 4000 多項獨立專利。本報告旨在深入分析當前的智慧財產權活動、主要智慧財產權參與者的地位、其專利涵蓋的應用領域,以及專利組合如何支持其市場策略。

了解關鍵趨勢及主要智慧財產權參與者的智慧財產權地位及策略

透過專利分析,我們闡明了智慧財產權參與者的地位,並闡明了其智慧財產權組合增強策略。我們重點關注競爭對手的專利申請活動及其限制自由實施 (FTO) 的能力,識別有潛力的新進入者,並預測未來的智慧財產權領導者。智慧財產權競爭分析應反映參與者對先進半導體封裝市場進入和業務發展策略的願景。

本報告全面概述了與 CPO 和光 I/O 技術相關的競爭格局和最新技術趨勢。本報告涵蓋智慧財產權 (IP) 趨勢和關鍵發展,包括專利申請、專利持有人、申請國、專利技術和目標應用。報告中還列出了知識產權領域的領導企業和最活躍的專利申請者,並重點介紹了該領域中知名度較低的公司和新晉企業。此外,該報告還列出了 270 多項在關鍵技術市場中地域覆蓋範圍最廣的關鍵發明。

動態的智慧財產權環境:主要參與者的地位與純專利廠商的演變

台積電和英特爾引領專利格局,不斷增加專利申請活動,並在關鍵國家擴大發明保護範圍。身為先驅者,英特爾正採取積極的策略來維護其專利權益。隨後,台積電和其他專注於智慧財產權領域的公司(Lightmatter、Celestial AI、Ayar Labs 和 Avicena Tech)也加入了智慧財產權領域,並建立了策略性專利組合。

近年來,越來越多的智慧財產權企業進入智慧財產權領域,包括 OSAT(半導體封裝測試外包)公司和材料供應商。

本報告概述了智慧財產權領域主要新興企業的智慧財產權組合,並介紹了相關的發明和技術。

實用 Excel 專利資料庫

本報告附帶一個內容豐富的 Excel 資料庫,其中包含本研究分析的所有專利。它包含專利資訊(編號、日期、所有者、標題、摘要、法律狀態等)以及指向更新的線上資料庫(來源文件、法律狀態等)的超連結。

本報告中提及的公司(節錄)

英特爾、台積電、華為、博通、思科、Lightmatter、Avicena、Celestial AI、Rockley Photonics、Ayar Labs、Ranovus、三星集團、英偉達、Teramount、中興通訊、Resonac、Marvell、諾基亞、甲骨文、美光、Senkobet、VTT Technologies、銳捷網路、Eliyan、三菱電機、LIPAC、RTX Corporation、惠普(惠普發展)、紫光集團(UnilC)、揚州新力積體電路、瞻博網路、蘇州奇點光子智慧科技、華工科技、NCAP、CEA、ASTAR、住友電工、江電科技、蘋果、GlobalFoundries、日木、Nuble Technology、Lightelligence、浙江凌鑫光電科技、康寧、中山美索科技、Nano Photonics、廣本威科技、無錫互連技術研究院、李宏電子、永江實驗室、中芯國際、清華大學、天天半導體、Elphic、Lightip Technology、NTT -日本電報電話公司、群創光電、上海希智科技、聯合測試組裝中心、科克大學學院、Lumentum、漢陽大學、古河電氣、瑞泰科技、杭州廣智源科技、東莞立訊精密、PICadvanced、SPIL、武漢光谷資訊光電創新中心、MACOM Technology Solutions、Ciena、MaxLine AI、Browave、迅雲電子科技、Xperi/Adeia、香港科技大學、工研院

目錄

引言

執行摘要

專利概覽

- 知識產權動態

- 依公司部門劃分的專利揭露趨勢

- 主要專利受讓人(一般專利、核心發明、動態)

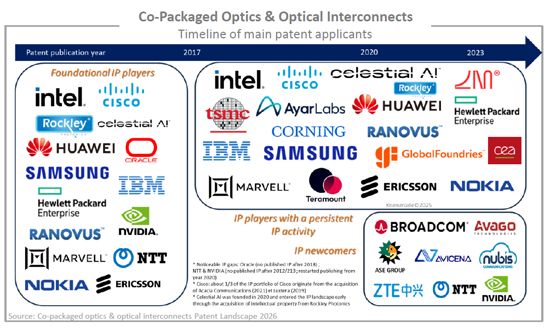

- 主要知識產權參與者時間軸

- 主要智慧財產權所有者及其目前法律地位

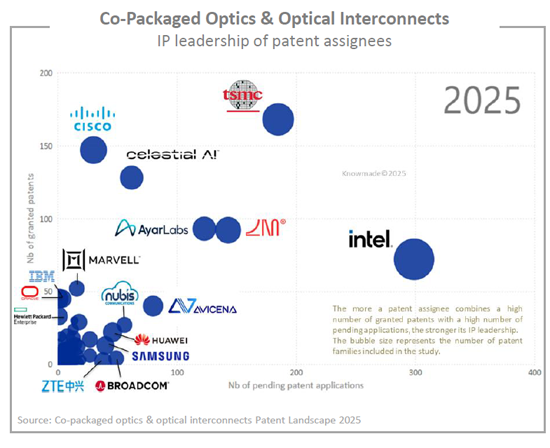

- 智慧財產權領導地位(2020 年及 2025 年一般專利、2025 年核心發明)

- 有效專利(1. 專利的地域範圍(一般發明、核心發明))

- 國內與全球智慧財產權策略(全球智慧財產權與核心發明)

- 具有策略地域範圍的專利族

用於選擇專利受讓人的智慧財產權概況

關於每位參與者:

- 專利組合概覽(知識產權動態、細分、法律地位、地理範圍等)

- 重要專利描述

- Inte

- TSMC

- Avicena

- Samsun

- Cisco

- ASE Group

- Broadcom (Avago)

- Ayar Labs

- Celestial AI

- Lightmatter

附錄

- 專利檢索、選擇與分析研究方法

- 術語表

KNOWMADE 簡報

Key Features

- PDF with > 80 slides

- Excel file > 1,300 patent families

- Global patenting trends, including time evolution of patent publications, countries of patent filings, etc.

- Main patent assignees and IP newcomers

- Key players' IP position and the relative strength of their patent portfolio

- IP leadership evolution of patent assignees since 2020

- IP profile of key players (patent portfolio overview, technical coverage, geographical coverage, notable patents, recent IP activity)

- Excel database containing all patents analyzed in the report, including hyperlinks to an updated online database.

Co-packaged optics is now a key enabler of next-gen electronics

Artificial intelligence (AI) is reshaping industries at their core, fueling unprecedented data growth and accelerating the demand for energy-efficient computing. As data volumes surge, hardware innovation has become essential, particularly in rethinking data center architectures to deliver faster computation, lower power consumption, higher performance, and reduced latency. In this context, silicon photonics has emerged as a pivotal technology, replacing traditional copper interconnects with high-speed, light-based data transmission. As demand for data-intensive computing continues to rise, the semiconductor industry has built a substantial portfolio of patents aimed at integrating photonic and electronic systems at the package level. Together, these inventions highlight the industry's transition from conventional electrical interconnects to optical input/output (I/O) architectures that unlock higher bandwidth, lower latency, and improved energy efficiency across compute and networking platforms. Among the most significant advances is Co-Packaged Optics (CPO), an innovative packaging approach that brings optical components directly into or near electronic devices to maximize efficiency and scalability.

Over the past 10 years, CPO and optical I/O technologies has become a key enabler of advanced semiconductor packaging, leading to a strong increase in patenting activity and a significant evolution of the competitive intellectual property (IP) landscape. Major patent owners have strengthened their IP positions in the US, China, and Europe, while pure players have entered the patent landscape. It is now crucial for companies operating in the semiconductor advanced packaging industry to closely examine the technology and competitive landscape from an IP perspective.

In this context, KnowMade is releasing a new patent landscape report to map the patent activity and competitive dynamics shaping this rapidly evolving field. Over 4,000 individual patents from more than 1,300 patent families (inventions) have been selected. This report aims to provide insights into current IP activities, the positions of key IP players, the applications they target in their patents, and how their patent portfolios can support their market strategies.

Understanding the main trends, the key players' IP position and IP strategy

Through patent analysis, we describe the position of IP players, unveil their strategies to strengthen their IP portfolio, highlight their capability to limit the patenting activity and freedom-to-operate of other firms, identify promising new players, and forecast what would be the future IP leaders. IP competition analysis should reflect the vision of players with a strategy to enter and develop their business in the advanced semiconductor packaging market.

In this report, we provide a comprehensive overview of the competitive IP landscape and latest technological developments related to CPO and optical I/O technology. The report covers IP dynamics and key trends in terms of patents applications, patent assignees, filing countries, patented technologies, and targeted applications. It also identifies the IP leaders, most active patent applicants, and sheds light on under-the-radar companies and new players in this field. Besides, we have identified over 270 key inventions that are most critical in terms of geographic coverage in key technology markets.

A dynamic IP landscape: evolution of leading players' positions and pure players

TSMC and Intel are leading the patent landscape, increasing patenting activity, and expanding invention protection in key countries. As pioneer Intel has adopted an aggressive strategy to assert its patents. Later TSMC and pure players (Lightmatter, Celestial AI, Ayar Labs, Avicena Tech) joined the IP landscape and developed strategic portfolios.

In recent years, more IP players have become involved in the IP landscape, and OSATs and materials suppliers have entered the IP arena.

In this report, we provide an overview of the IP portfolios held by the key players emerging from the IP landscape and describe the related inventions and technologies.

Useful Excel patent database

This report includes an extensive Excel database with all patents analyzed in this study, including patent information (numbers, dates, assignees, title, abstract, legal status, etc.) and hyperlinks to an updated online database (original documents, legal status, etc.).

Companies mentioned in the report (non-exhaustive)

Intel, TSMC, Huawei, Broadcom, Cisco, Lightmatter, Avicena, Celestial AI, Rockley Photonics, Ayar Labs, Ranovus, Samsung Group, NVIDIA, Teramount, ZTE, Resonac, Marvell, Nokia, Oracle, Micron, Senko Group, VTT, Alphabet, Accelink Technologies, Ruijie Networks, Eliyan, Mitsubishi Electric, LIPAC, RTX Corporation, HP - Hewlett Packard Development, UnilC (Tsinghua Unigroup), Yangzhou Xinli Integrated Circuit, Juniper, Suzhou Singularity Photon Intelligent Technology, Huagong Tech, NCAP, CEA, ASTAR, Sumitomo Electric, JCET Group, Apple, GlobalFoundries, ASE Group, Nubis communications, Amkor Technology, Lightelligence, Zhejiang Lingxin Optoelectronics Technology, Corning, Zhongshan Meisu Technology, Nano Photonics, Guangbenwei Technology, Wuxi institute of interconnect technology, Li Hong Electronic, Yongjiang Laboratory, SMIC, Tsinghua University, Sky Semiconductor, Elphic, Lightip Technologie, NTT - Nippon Telegraph & Telephone, Innolux, Shanghai Xizhi Technology, United Test and Assembly Center, University College Cork, Lumentum, Hanyang University, Furukawa Electric, Raytek, Hangzhou Guangzhiyuan Technology, Dongguan Luxshare Technology, PICadvanced, SPIL, Wuhan Optics Valley Information Optoelectronics Innovation Center, MACOM Technology Solutions, Ciena, MaxLinear, AIP - Advanced Integrated Photonics, Lyte AI, Browave, Xunyun Electronic Technology, Xperi/Adeia, HKUST - Hong Kong University of Science And Technology, ITRI - Industrial Technology Research Institute.

TABLE OF CONTENTS

INTRODUCTION

- Context and objectives of the report

- Scope of the report

- Definitions

- Reading guide

- Excel database

EXECUTIVE SUMMARY

PATENT LANDSCAPE OVERVIEW

- IP dynamics

- Time evolution of patent publications by company HQ

- Main patent assignees (general, core inventions, dynamics)

- Timeline of main IP players

- Main IP players and current legal status of their patents

- IP leadership (general 2020 & 2025, 2025 core inventions)

- Geographic coverage of active patents (general, core inventions)

- Domestic vs. Global IP strategies (global IP and core inventions)

- Patent families with a strategic geographic coverage

IP PROFILE OF A SELECTION OF PATENT ASSIGNEE

For each player:

- Patent portfolio overview (IP dynamics, segments, legal status, geographic coverage, etc.)

- Description of notable patents

- Inte

- TSMC

- Avicena

- Samsun

- Cisco

- ASE Group

- Broadcom (Avago)

- Ayar Labs

- Celestial AI

- Lightmatter

ANNEX

- Methodology for patent search, selection and analysis

- Terminology