|

市場調查報告書

商品編碼

1886133

汽車光達專利趨勢分析(2025)LiDAR for Automotive Patent Landscape Analysis 2025 |

|||||||

全球範圍內的智慧財產權爭奪戰日趨激烈。哪些是關鍵參與者?哪些技術將塑造汽車光達的未來?

主要特點:

- 包含超過 160 張投影片的 PDF 檔案

- Excel 文件(超過 36,200 個專利族)

- 全球專利趨勢(例如,專利公開趨勢隨時間的變化、按申請國家劃分的分佈)

- 各細分領域的主要專利持有人和智慧財產權領域的新進入者

- 主要進入者的智慧財產權地位和專利組合的相對實力

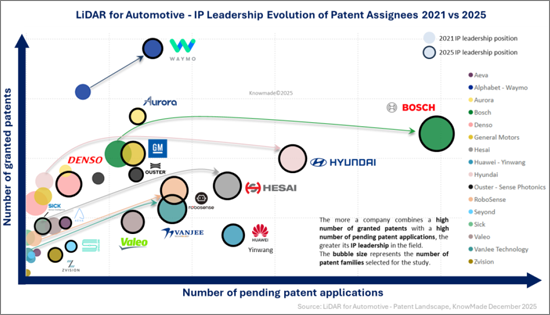

- 專利持有人知識產權領導地位的演變(2021 年與 2025 年比較)

- 智慧財產權生態系統,包括共同擁有的專利,包括集團內部和與外部各方的共同申請

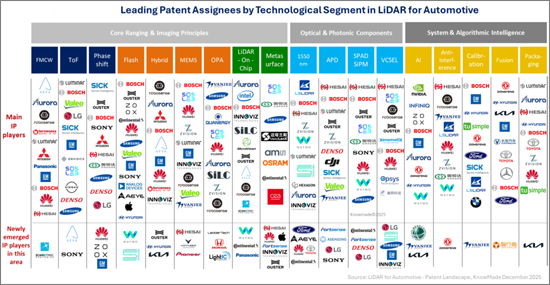

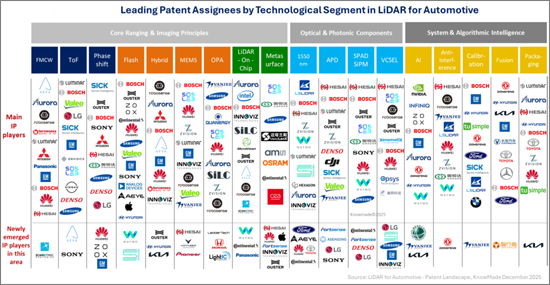

- 以 18 個技術領域分類的專利(飛行時間、FMCW、相移、MEMS、混合、OPA、快閃記憶體、超表面、晶片上雷射雷達、1550 奈米、VCSEL、 SPAD/SiPM、APD、封裝、校準、抗干擾、人工智慧、融合技術)

- 30家領先公司的智慧財產權概況(包括專利組合概述、技術覆蓋範圍、地域覆蓋範圍以及已授權和待授權的重要專利)

- 本報告分析的所有專利的Excel資料庫(包含專利分類和指向最新線上資料庫的超連結)

全球雷射雷達智慧財產權(IP)快速成長趨勢

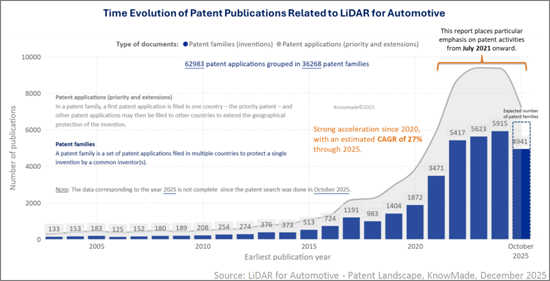

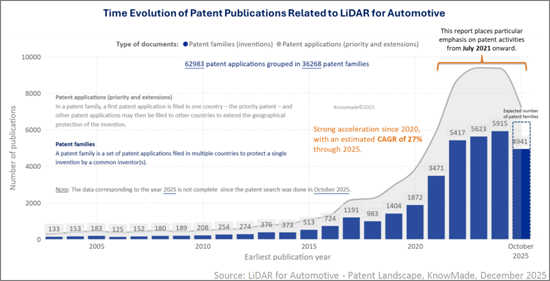

憑藉著厘米級的精度和在各種光照條件下的穩健性能,雷射雷達正迅速成為ADAS、L2-L4級自動駕駛、無人出租車以及日益增長的機器人和基礎設施應用的核心感測技術。反映這項技術變革的是,與雷射雷達相關的專利活動正在迅速增長,使其從一項實驗性技術轉變為先進出行領域最具競爭力的智慧財產權環境中的主導感知感測器。截至2025年10月,全球汽車應用雷射雷達專利領域已擁有超過36,200個專利族和超過62,900項單一專利,展現出調頻連續波雷射雷達、固態架構、光子整合、先進光束控制和人工智慧驅動感知技術等領域的顯著增長。僅自2021年7月以來,就已提交超過24,300個專利族,是KnowMade先前數據集的三倍,標誌著該領域正從早期研究階段邁向全面產業化。 2020年至2025年,雷射雷達相關專利申請的複合年增長率預計將達到27%,凸顯了該領域創新的爆炸性成長。

全球智慧財產權趨勢及策略參與者

雷射雷達專利環境的一個關鍵結構性變化是,中國迅速且持續地崛起為全球最大的雷射雷達相關智慧財產權來源國。預計到2025年,中國光達專利公開數量將佔全球總量的約40%,無論在數量或成長率方面都將超過美國。這一趨勢伴隨著參與者的廣泛多元化,包括光達純技術公司、一級供應商、汽車製造商、自動駕駛開發商、半導體公司和研究機構。這些參與者的智慧財產權活動總體上反映了雷射雷達技術的日益成熟,以及專利組合與長期技術路線圖之間策略契合度的不斷提高。

包括合賽電子、RoboSense、華為銀網、VanJee、Zvision、Benewake 和雷神智能在內的中國企業在雷射雷達的關鍵技術領域表現活躍,展現出2021年至2025年間的強勁發展勢頭。同時,美國在通用汽車、Alphabet-Waymo、Aurora、Ouster、Seyond 和 Aeva 等公司的推動下,繼續保持核心地位。在歐洲,博世、大陸集團和法雷奧等汽車和光子學公司集群積極參與其中,多家原始設備製造商 (OEM) 專注於零件、封裝、校準和車用級雷射雷達整合。日本和韓國則透過索尼、電裝、豐田、三星、Infoworks 和現代起亞等公司持續做出穩定貢獻,展現出全球分散的創新努力。

這種地域格局的重新平衡凸顯了專利環境的轉變,即從傳統上由美國和歐洲主導的環境,轉向由中國不斷發展的光子學和半導體生態系統塑造的環境。

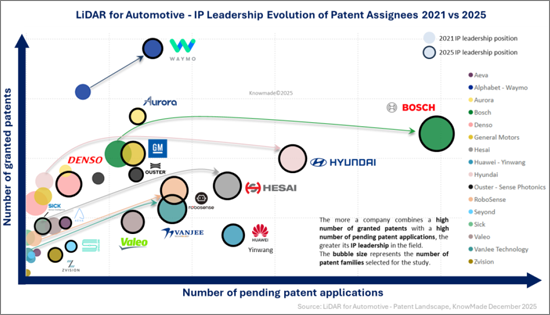

智慧財產權領導地位的轉變:2021 年與 2025 年

從 2021 年到 2025 年,隨著跨技術、跨地區和跨行業領域的競爭日益激烈,雷射雷達 (LiDAR) 智慧財產權的領導地位發生了顯著變化。該生態系統由四大類組成:純光達公司、一級供應商、汽車製造商和自動駕駛公司。本報告對每一類公司進行了更深入、更詳細的分析,揭示了隨著競爭加劇,2021 年至 2025 年間領導地位、技術能力和智慧財產權組合的變化。尤其值得注意的是,在過去幾年裡,專注於雷射雷達(LiDAR)領域的公司在智慧財產權(IP)活動方面明顯加速發展,許多公司在2021年以前所未有的速度強化了其智慧財產權組合。詳細分析顯示,儘管一級供應商在2021年擁有更具競爭力和更成熟的智慧財產權組合,但市場格局正在改變。到2025年,一些專注於光達領域的新興企業將展現出必要的規模、品質和技術深度,從而在多個高成長的雷射雷達細分市場中確立其新興智慧財產權領導者的地位。該報告還揭示了知識產權領域新進入者數量的不斷增長,其中包括快速增長的專注於雷射雷達領域的新興企業、自動駕駛公司和汽車製造商。這些公司快速擴張其智慧財產權組合,顯示其策略影響力日益增強。這些變化預示著雷射雷達生態系統領導地位的重新分配,從而打造出先進感測領域最具活力和競爭性的智慧財產權環境之一。

雷射雷達技術創新差異化顯著

本報告揭示了雷射雷達關鍵技術層面的強勁創新活動。專利主要集中在以下五個領域:

- 核心測距和成像原理:脈衝飛行時間 (ToF)、調頻連續波 (FMCW) 和相移測距,以及微機電系統 (MEMS)、混合掃描、光參量放大器 (OPA) 和閃光光束控制結構。先進的光束控制技術,例如超表面和奈米光子學,以及光子整合雷射雷達。

- 光學與光子元件:1550 nm 雷射光源、垂直腔面發射雷射 (VCSEL) 陣列、單光子雪崩二極體/矽光電倍增管 (SPAD/SiPM) 偵測器和雪崩光電二極體 (APD)。

- 系統與演算法智慧: 固態封裝、校準、幹擾抑制、人工智慧、多感測器融合。

依關鍵產業細分領域劃分的詳細智慧財產權概況

本報告對30家具有影響力的雷射雷達專利持有者進行了系統、數據驅動的智慧財產權概況分析。這些持有者是根據其在智慧財產權領域的領先地位以及2021年至2025年期間的最新動態而遴選出來的。分析對象包括純雷射雷達公司(Hesai、RoboSense、Ouster/Sense Photonics、VanJee、Seyond、Zvision、Aeva、Leishen Intelligent、Sick、Benewake、SOSLAB、Oradar、Luminar、SiLC Technologies、Innoviz、MicroVision、Ibeo Automotive、Mobiltech、Infoworks、Blickfeld、OLEI、LiangDao、Aeye)、一級供應商(Bosch、華為銀王、Valeo)、自動駕駛公司(Aurora、Alphabet-Waymo)以及汽車製造商(現代、通用汽車)。該報告針對每家公司,提供一致的智慧財產權領導力演變、組合趨勢、地理擴張、技術領域分析以及近期專利活動評估。

實用Excel專利資料庫

本報告包含一個內容豐富的Excel資料庫,其中包含本研究分析的超過36,200個專利族(發明),以及過去四年新增的超過24,300個相關專利族。該資料庫包含專利資訊(公開號、所有者、日期、標題、摘要等)、指向更新的在線資料庫(來源資料、法律狀態等)的超鏈接,以及按技術領域(飛行時間、調頻連續波、相移、微機電系統、混合、光參量放大器、快閃記憶體、超表面、片上雷射雷達、1550奈米、垂直腔面發射雷射、單光子雪崩二極體/矽光電倍增管、雪崩光電二極體、封裝、校準、抗干擾、人工智慧、融合)進行的結構化分類。該專利資料庫支援高級多條件搜索,並提供對更新記錄的直接存取。這使用戶能夠對其投資組合進行基準測試、監控競爭對手、識別潛在合作夥伴或收購目標,並評估執業自由的限制。

本報告中提及的公司(節錄):

|

|

等等。

目錄

引言

摘要整理

專利概覽

- 專利公開歷史

- 主要專利受讓人

- 知識產權公司時間線

- 專利受讓人知識產權領導地位的演變:2021 年和 2025 年

- 主要專利的地域覆蓋範圍

- 有影響力的專利受讓人

- 主要共同擁有的智慧財產權

專利細分

- 測距與成像的核心原理:測距:脈衝飛行時間 (ToF)、調頻連續波 (FMCW)、相移

- 光束控制:微機電系統 (MEMS)、混合掃描、光參量放大器 (OPA)、閃光法

- 高階光束控制:晶片級光達、超表面

- 光學與光子元件:1550 nm、VCSEL、SPAD/SiPM、APD

- 系統和演算法智慧:人工智慧、幹擾抑制、封裝和整合、相機和雷達融合、校準

- 各細分領域簡介:

- 細分領域定義

- 專利組合概覽

- 主要專利受讓人

- 重要專利

專利受讓人智慧財產權概況

- 純光達廠商:

- 專利受讓人知識產權領導地位的演變:2021 年和 2025 年

- 2025 年專利受讓人智慧財產權領導地位展望

- 7 家雷射雷達廠商的專利組合概覽、分析和近期專利活動專用雷射雷達製造商(Hesai、RoboSense、Ouster-Sense Photonics、VanJee Technology、Seyond、Zvision、Aeva)

- 16 家專用雷射雷達製造商的專利組合概況:Leishen Intelligent、Sick、Benewake、SOSLAB、Oradar、Luminar、SiLC Technologies、Innoviz、MicroVision、Ibeo Automotive、Mobiltech、Infoworks、Blickfeld、OLEI、LiangDao、Aeye

- 一級供應商:

- 專利受讓人知識產權領導地位的演變:2021 年和 2025 年

- 一級供應商專利組合概況、分析與近期專利活動說明(3):Bosch、華為-銀王、Valeo

- 自動駕駛/汽車公司:

- 專利受讓人知識產權領導地位的演變: 2021 年和 2025 年

- 自動駕駛/車輛公司專利組合概覽、分析及近期專利活動說明(2):Aurora、Alphabet、Waymo

- 汽車製造商:

- 專利受讓人的智慧財產權領導地位演變:2021 年和 2025 年

- 汽車製造商專利組合概況、分析及近期專利活動說明(2):現代、通用汽車

專利訴訟

附錄

KNOWMADE 簡報

The global IP battlefield is heating up: who are the key players, and which technologies will shape the future of LiDAR for automotive?

Key Features:

- PDF with > 160 slides

- Excel file > 36,200 patent families

- Global patenting trends, including time evolution of patent publications, countries of patent filings, etc.

- Main patent assignees and IP newcomers in the different segments

- Key players' IP position and the relative strength of their patent portfolio

- IP leadership evolution of patent assignees 2021 vs 2025

- IP ecosystems including co-owned patents including group-internal and external collaboration, etc.

- Patents categorized by 18 technological segments (ToF, FMCW, phase-shift, MEMS, hybrid, OPA, flash, metasurface, LiDAR-On-Chip, 1550 nm, VCSEL, SPAD/SiPM, APD, packaging, calibration, Anti-interference, AI, fusion)

- IP profile of 30 key players (patent portfolio overview, technical coverage, geographical coverage, notable granted and pending patents, etc.)

- Excel database containing all patents analyzed in the report, including patent segmentations and hyperlinks to an updated online database

A Rapidly Expanding Global LiDAR IP Landscape

With centimeter-level accuracy and consistent performance across varied lighting conditions, LiDAR is becoming a core sensing modality for ADAS, L2-L4 autonomous driving, robotaxis and a growing range of robotics and infrastructure applications. Its rapidly expanding patent activity reflects this shift, marking LiDAR's transition from an experimental technology to a primary perception sensor in one of the most competitive IP landscapes in advanced mobility. As of October 2025, the global LiDAR patent landscape for automotive applications includes more than 36,200 patent families and over 62,900 individual patents, with strong growth across FMCW LiDAR, solid-state architectures, photonic integration, advanced beam steering and AI-driven perception. Over 24,300 patent families were filed since July 2021 alone, tripling KnowMade's previous dataset and signalling the move from early research to full-scale industrialization. Between 2020 and 2025, LiDAR-related patenting increased at an estimated CAGR of 27%, highlighting the explosive pace of innovation across the sector.

Global IP Trends and Strategic Players

A major structural shift in the LiDAR patent landscape is the rapid and sustained rise of China as the world's largest source of LiDAR-related intellectual property. By 2025, China accounts for around 40% of global LiDAR patent publications, surpassing the United States in both volume and growth rate. This trend is accompanied by a broad diversification of contributors, including LiDAR pure players, Tier-1 suppliers, automotive OEMs, autonomous-driving developers, semiconductor companies and research institutes. Their collective IP activity reflects the growing maturity of LiDAR technologies and the increasingly strategic alignment between patent portfolios and long-term technology roadmaps.

Chinese companies such as Hesai, RoboSense, Huawei Yinwang, VanJee, Zvision, Benewake and Leishen Intelligent are active across all major LiDAR technology domains and demonstrate significant momentum from 2021 to 2025. In parallel, the United States maintains a central role driven by General Motors, Alphabet-Waymo, Aurora, Ouster, Seyond and Aeva, while Europe contributes substantial activity through its automotive and photonics sectors, led by Bosch, Continental, Valeo and several OEMs focusing on components, packaging, calibration and vehicle-grade LiDAR integration. Japan and South Korea remain steady contributors through Sony, Denso, Toyota, Samsung, Infoworks and Hyundai-Kia, illustrating the global distribution of innovation efforts.

This geographic rebalancing highlights the shift from a historically U.S.- and Europe-led patent landscape toward one increasingly shaped by China's expanding photonics and semiconductor ecosystem.

Evolution of IP Leadership 2021 vs 2025

Between 2021 and 2025, LiDAR IP leadership evolved significantly as competition intensified across technologies, regions and industry segments. While the ecosystem is structured around four major categories: LiDAR pure players, Tier-1 suppliers, car makers and autonomous-driving companies, the report provides a deeper, fine-grained examination within each group, revealing how leadership positions, technology strengths and IP portfolios have shifted between 2021 and 2025 as competition intensified. In particular, LiDAR pure players show a clear acceleration in IP activity over the past few years, with many strengthening their portfolios at a pace unmatched in 2021. Detailed analysis reveals that although Tier-1 suppliers held more competitive and mature portfolios in 2021, the landscape has shifted: by 2025, multiple pure players demonstrate the scale, quality and technological depth required to position themselves as emerging IP leaders in several high-growth LiDAR domains. The report also identifies a growing cohort of IP newcomers including fast-moving pure players, autonomous-driving companies and car makers who's rapidly expanding portfolios signal their rising strategic influence. Together, these shifts illustrate how leadership is being redistributed across the LiDAR ecosystem, making this one of the most dynamic and contested IP environments in advanced sensing.

Clear Segmentation of Innovation Across LiDAR Technologies

The report reveals strong innovation activity across all major LiDAR technology layers. Patents are concentrated in five key areas:

- Core Ranging & Imaging Principles: Pulsed ToF, FMCW and phase-shift ranging, along with MEMS, hybrid scanning, OPA and flash beam-steering architectures; advanced beam steering technologies as metasurface and nanophotonic approaches, as well as photonic-integrated LiDAR.

- Optical & Photonic Components: 1550 nm laser sources, VCSEL arrays, SPAD/SiPM detectors and APDs.

- System & Algorithmic Intelligence: Solid-state packaging, calibration, interference mitigation, AI and multi-sensor fusion.

In-Depth IP Profiles Across Key Industry Segments

This report delivers a structured and data-driven IP profile analysis of 30 influential LiDAR patent assignees, selected based on their IP leadership and recent activity from 2021 to 2025. The analysis covers the full spectrum of ecosystem actors, including LiDAR pure players (Hesai, RoboSense, Ouster/Sense Photonics, VanJee, Seyond, Zvision, Aeva, Leishen Intelligent, Sick, Benewake, SOSLAB, Oradar, Luminar, SiLC Technologies, Innoviz, MicroVision, Ibeo Automotive, Mobiltech, Infoworks, Blickfeld, OLEI, LiangDao, Aeye), Tier-1 suppliers (Bosch, Huawei-Yinwang, Valeo), autonomous-driving companies (Aurora, Alphabet-Waymo) and car makers (Hyundai, General Motors). For each company, the report provides a consistent assessment of IP leadership evolution, portfolio dynamics, geographic footprint, technical segmentation and recent patent activities.

Useful Excel patent database

This report includes an extensive Excel database with the 36,200+ patent families (inventions) analyzed in this study and a focus set of 24,300+ families added in the last four years, including patent information (publication numbers, assignees, dates, title, abstract, etc.), hyperlinks to an updated online database (original documents, legal status, etc.), and structured classification by technological segments (ToF, FMCW, phase-shift, MEMS, hybrid, OPA, flash, metasurface, LiDAR-On-Chip, 1550 nm, VCSEL, SPAD/SiPM, APD, packaging, calibration, Anti- interference, AI, fusion). This patent database supports advanced multi-criteria searches and provides direct access to updated records, enabling users to benchmark portfolios, monitor competitors, identify potential partners or acquisition targets and evaluate freedom-to-operate constraints.

Companies mentioned in the report (non-exhaustive):

|

|

and more.

TABLE OF CONTENTS

INTRODUCTION

- Context of the report

- Scope and objectives of the report

- Reading guide

- Excel database

EXECUTIVE SUMMARY

PATENT LANDSCAPE OVERVIEW

- Time evolution of patent publications

- Main patent assignees

- Timeline of IP players

- IP leadership of patent assignees evolution 2021 vs 2025

- Geographical coverage of main players' patents

- High-impact patent assignees

- Main co-owned IP

PATENT SEGMENTATION

- Core Ranging & Imaging Principles:Ranging: Pulsed ToF, FMCW, Phase Shift

- Beam Steering: MEMS, Hybrid Scanning, OPA, Flash

- Advanced beam steering: LiDAR-On-Chip, Metasurface

- Optical & Photonic Components: 1550 nm, VCSEL, SPAD / SiPM, APD

- System & Algorithmic Intelligence: AI, Anti-Interference, Packaging & Integration, Fusion with Camera and Radar, Calibration

- For each segment:

- Segment definition

- Patent portfolio overview

- Main patent assignees

- Notable patents

IP PROFILE OF A SELECTION OF PATENT ASSIGNEES

- LiDAR pure player:

- IP leadership of patent assignees evolution 2021 vs 2025

- IP leadership of patent assignees 2025

- Patent portfolio overview, analysis and description of recent patent activities for LiDAR pure players (7) : Hesai, RoboSense, Ouster -Sense Photonics, VanJee Technology, Seyond, Zvision, Aeva

- Patent portfolio overview for LiDAR pure players (16) : Leishen Intelligent, Sick, Benewake, SOSLAB, Oradar, Luminar, SiLC Technologies, Innoviz, MicroVision, Ibeo Automotive, Mobiltech, Infoworks, Blickfeld, OLEI, LiangDao, Aeye

- Tier one suppliers:

- IP leadership of patent assignees evolution 2021 vs 2025

- Patent portfolio overview, analysis and description of recent patent activities for Tier one suppliers (3) : Bosch, Huawei -Yinwang, Valeo

- Autonomous driving/vehicle players:

- IP leadership of patent assignees evolution 2021 vs 2025

- Patent portfolio overview, analysis and description of recent patent activities for Autonomous driving/vehicle players (2) : Aurora, Alphabet -Waymo

- Car makers:

- IP leadership of patent assignees evolution 2021 vs 2025

- Patent portfolio overview, analysis and description of recent patent activities for Car makers (2) : Hyundai, General Motors

PATENT LITIGATION

ANNEX

- Methodology for patent search, selection and analysis

- Terminology