|

市場調查報告書

商品編碼

1683477

汽車LiDAR:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Automotive LiDAR - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

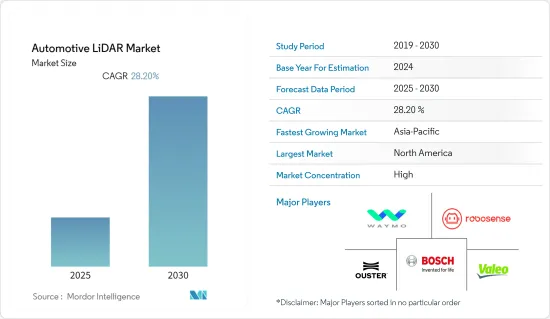

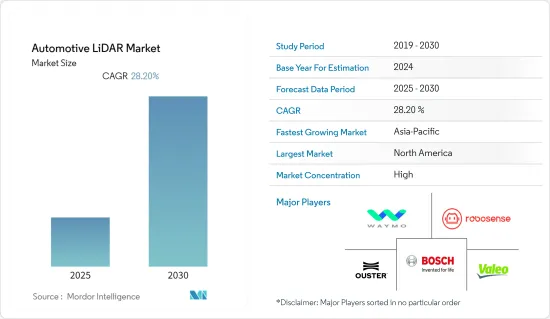

預測期內,汽車LiDAR市場預計將以 28.2% 的複合年成長率成長。

中國工業協會修改了2020年汽車銷售的預測,預計受冠狀病毒疫情影響,上半年汽車銷售將下降10%,全年銷售量將下降5%。據 SMMT 稱,由於新冠疫情導致英國所有主要工廠關閉,2020 年汽車產量將下降 18%。

主要亮點

- 整個汽車產業都依賴自動駕駛汽車和輔助技術。汽車公司正在利用新型且價格實惠的感測器為 ADAS(高級駕駛輔助系統)引入創新技術。對於全面的車輛安全解決方案,ADAS 系統不能僅依賴視覺或基於 RADAR 的系統。

- 汽車產業向自動駕駛和電動車發展的趨勢預計將成為LiDAR新應用的主要驅動力。自動駕駛汽車擴大使用 LiDAR 感測器來產生 360° 視野的巨大 3D 地圖,並提供精確的資訊來協助自動導航和物件偵測。

- LiDAR 技術的出現為 Leddartech、Quantum Spatial、Geodigital、Topcon Positioning Systems 和 Innoviz Technologies 等眾多公司開闢了巨大的成長潛力,這些公司正在不懈地努力在商業領域引入新穎的創新。例如,知名汽車零件製造商大陸集團近期宣布對機器人視覺和感測先驅 AEye 進行大規模投資,以擴大其 LiDAR 技術組合。

- AEye 的 LiDAR 技術能夠在僅 160 公尺的距離內透過多個測量點追蹤小型、低反射物體。這對於商用車和乘用車的自動駕駛至關重要。

- 這項投資將使大陸集團拓寬其LiDAR技術的範圍,並實現感測器的工業化,以生產完整的汽車級產品。

- 此外,2021 年 4 月,Velodyne 和 Ansys 宣布他們正在開發下一代汽車雷射雷達感測器的軟體模型,以便為高度先進的自動駕駛汽車提供顯著改進的危險識別能力。此次合作將把 Velodyne 的LiDAR設計融入 Ansys 的虛擬感測器套件,加速汽車製造商將 Velodyne 的感測器整合到自動駕駛汽車中。

汽車LiDAR市場趨勢

ADAS 預計將佔據很大佔有率

- ADAS 有五個自動化級別,其中 0 級完全依賴人工輸入,5 級完全自主。 3、4 和 5 級自動駕駛汽車被認為是最有效的,這些車輛將繼續採用雷射雷達。

- LiDAR主要用於汽車ADAS(高級駕駛輔助系統),以提高駕駛員的便利性,並透過人機介面實現安全引導和平穩操作。汽車的自動駕駛特性需要高度的精確度和輔助,以偵測和避開障礙物並在道路上安全行駛。

- LiDAR感測器連續旋轉,每秒產生數千個雷射脈衝。這些來自雷射雷達的高速雷射光束會連續 360 度投射到車輛周圍,並被障礙物反射。使用複雜的機器學習演算法,透過此活動接收的資料會轉換成即時 3D 圖形,通常顯示為周圍物體的 3D 影像或 3D 地圖。

- 隨著汽車主動式車距維持定速系統(ACC) 系統的出現,自動駕駛汽車將發展為無人駕駛系統。該裝置安裝在車輛前部,監測相鄰車輛之間的距離,並根據相鄰車輛之間的距離和速度的變化做出相應反應。

- 各公司正專注於開發更安全、更可靠的自動駕駛汽車,為客戶提供先進的 ADAS 功能,包括行人和騎車人避讓、車道維持輔助 (LKA)、自動緊急煞車 (AEB)、自適應主動式車距維持定速系統(ACC)、交通堵塞輔助 (TJA) 等。主要目標是確保安全、降低成本並使運輸更安全,這導致公司對雷射雷達技術及其實施進行大量投資。為了降低成本,最終目標是實現固態雷射雷達等其他技術的開發,以取代傳統的機械旋轉。

- 2021年,Innoviz 宣布與韓國 Vueron Technology夥伴關係,實現僅基於 LiDAR 的自動駕駛。此次合作將是一次強大的組合,將 Innoviz 的高解析度 LiDAR 與 Vueron 的感知軟體結合在一起,為該行業帶來重大進步。 Vueron 車輛從首都首爾行駛了 414 公里到南部港口城市釜山,完全自動化並僅由雷射雷達驅動,最高時速為 100 公里。在這次歷史性駕駛的整個五個小時的旅程中,沒有一位安全駕駛員在駕駛。

- 沃爾沃在尋求一種經濟高效的雷射雷達解決方案時,同樣資助了 Luminar 的技術,而該公司也憑藉其產品成為了一個奇蹟。 Luminar 以其創新和成本效益而聞名,並推出了售價低於 1,000 美元的基於 LiDAR 的解決方案。該公司與豐田、奧迪和大眾等品牌密切合作,為自動駕駛汽車提供雷射雷達解決方案。

預計北美將佔很大佔有率

- 以美國、加拿大為代表的北美是全球技術最先進的市場。該地區市場的成長歸因於 LiDAR 在環境、走廊測繪、氣象學和城市規劃等應用領域的日益廣泛使用。此外,無人駕駛汽車和 ADAS 中 LiDAR 的使用日益增多也促進了市場的成長,預計未來幾年將實現顯著成長。

- 此外,Faro Technologies 和 Velodyne Lidar Inc. 等知名供應商也在該地區設有業務。 2020 年 8 月,Velodyne Lidar Inc. 宣布加入美國智慧交通協會 (ITS America),以宣傳自動駕駛汽車 (AV) 和智慧交通基礎設施的優勢。

- 自動駕駛汽車已經在美國加利福尼亞州、德克薩斯州、亞利桑那州、華盛頓州、賓夕法尼亞州和密西根州等州和國家上路行駛。但目前,這種行動僅限於某些測試區域和駕駛條件。

- 此外,隨著Google、特斯拉和寶馬等大公司已經推出原型車型,自動駕駛汽車可能很快就會成為現實。該地區在本地和國際市場上的夥伴關係和投資正在不斷增加,這有助於該地區雷射雷達的發展。加拿大汽車零件供應商麥格納與以色列LiDAR技術開發商Innoviz將合作為BMW提供創新的感測器和系統。它提供高解析度 LiDAR 技術,可在所有天氣條件下產生車輛周圍環境的即時 3D 點雲資料。

- 此外,沃爾沃汽車還投資了美國雷射雷達感測器新興企業Luminar,該公司利用紅外頻譜的不同部分,為其汽車帶來感測技術。 LiDAR 可以將汽車變成一台敏銳的感知機器,幫助產生汽車周圍一切事物的精確 3D 簡介。沃爾沃計劃於 2022 年開始生產配備 LiDAR 和感知堆疊的汽車。

- 一些地區(例如美國)的政府強制使用 AEB 和其他使用雷達、感測器、雷射雷達和其他技術的安全系統,這些系統可以單獨或結合使用。這些法規鼓勵汽車製造商使用 LiDAR 系統作為 ADAS 的一部分,到目前為止,該系統僅在豪華車輛中提供。儘管不斷做出努力和採取了措施,但包括特斯拉在內的許多公司和組織仍然不願加入LiDAR的行列。例如,包括成本效益高的紅外線輻射熱計在內的替代方案可以將成本降低到幾美元,而雷射雷達則需要數千美元。

- 特斯拉和伊隆馬斯克也曾提過這樣的問題:LiDAR只能偵測移動物體,而無法分辨物體是如何移動的,甚至無法判斷物體是什麼。此外,將LiDAR系統適應神經網路系統並非易事,這也是特斯拉競爭對手一直堅持的。

汽車LiDAR產業概覽

該行業競爭對手之間的競爭主要依靠透過創新來獲得永續的競爭優勢。該技術的市場滲透速度較慢,許多產業正在探索該技術的潛力。這為企業佔領新市場提供了機會並增強了競爭力。該行業行銷和廣告水平較高,集中度適中,且正在不斷成長。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 市場促進因素

- LiDAR 的技術優勢

- 汽車安全法規不斷加強,OEM擴大採用 ADA 技術

- 市場挑戰

- LiDAR高成本,推高了車輛整體成本

- LiDAR 生態系統(光電探測器、積體電路、LiDAR 系統、雷射光源、光學元件)

- ADAS 車輛中的 LiDAR 整合(車輛不同區域的優點和挑戰)

- 汽車LiDAR技術藍圖(2018 年 vs. 2020 年 vs. 2025 年)

- 汽車LiDAR技術平均成本的變化(雷射測距感測器、高解析度旋轉雷射雷達測繪、用於位置檢測的旋轉和固態雷射雷達、用於測繪的雷射雷達)

第 4 章 市場細分

- 按應用

- 機器人車輛

- ADAS

- ADAS 2+ 級和 2++ 級

- ADAS 3 級和 4 級

- ADAS 5 級

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第5章 競爭訊息

- 供應商排名分析

- 公司簡介

- Ouster Inc.

- Robert Bosch GmbH

- Valeo

- Insight LiDAR

- Velodyne LiDAR Inc.

- Leddar Tech

- Waymo LLC

- RoboSense

第6章投資分析

第7章 LiDAR 市場的未來機會

The Automotive LiDAR Market is expected to register a CAGR of 28.2% during the forecast period.

The China Association of Automobile Manufacturers revised its predictions for 2020, forecasting a 10% drop in sales for the first half of the year and 5% for the full year, on account of the coronavirus outbreak According to the SMMT, car output would fall by 18% in 2020 as a result of COVID-19 closing all major UK plants.

Key Highlights

- The entire automotive industry is looking forward to autonomous vehicles and assisted technologies. Automotive companies are coming up with innovative technologies in Advanced Driver Assistance Systems, using new and affordable sensors. For inclusive vehicle safety solutions, ADAS systems cannot be dependent on just vision and RADAR based systems; they require more efficient systems capable of providing highly accurate data for improved driver assistance.

- The growing trends in the automotive industry toward self-driving cars and electric vehicles are expected to be the critical drivers for newer applications of LiDAR. Self-driving cars increasingly use LiDAR sensors for generating huge 3D maps for 360° vision and for accurate information to assist in self-navigation and object detection.

- The emergence of LiDAR technology has provided an enormous growth potential to a wide range of enterprises, including Leddartech, Quantum Spatial, Geodigital, Topcon Positioning Systems, and Innoviz Technologies, among others, who have been relentlessly working toward introducing novel innovations in the business space. For example, Continental AG, a prominent name in automotive part manufacturing, announced expanding its LiDAR technology portfolio by investing a massive share in robotic vision and sensing pioneer- AEye.

- The latter's LiDAR technology boasts of the ability to trace small, low-reflective objects at a distance of mere 160 meters with multiple measuring points. It is suited to be vital for automated driving in both commercial and passenger vehicles.

- This investment would allow Continental to make extensive use of this LiDAR technology and industrialize the sensor to produce a fully automotive grade product, which stands as the major need of the hour across the automotive industry and autonomous vehicles.

- Furthermore, in April 2021, Velodyne and Ansys announced that they are developing software models of next-generation automotive lidar sensors to provide substantially improved hazard identification capabilities for highly advanced AVs. The collaboration incorporates Velodyne's lidar design into Ansys' virtual sensor suite and expedites automakers' integration of Velodyne's sensor into AVs - delivering industry-leading driving safety and a drastically faster path to market.

Automotive LiDAR Market Trends

ADAS is Expected to Hold Major Share

- The ADAS has 5 different levels of automation with Level 0 being completely reliant on human input ot level 5 being complete autonomy . Autonomous cars with level 3, 4 and 5 are considered the most effective and LIDARs are continuously implemented in these vehicles,

- LiDAR is primarily used for the advanced driver assistance systems (ADAS) in the automobiles for the convenience of the driver, with human-machine interface for the safe guidance and smooth operation. The autonomous nature of the vehicle needs a considerably high accuracy and assistance for the obstacle detection for avoidance and the safe navigation through the roadways.

- LIDAR Sensors continuously rotate and generate thousands of laser pulses per second. These high-speed laser beams from LIDAR are continuously emitted in the 360-degree surroundings of the vehicle and are reflected by the objects in the way. With use of complex machine learning algorithms, the data received through this activity is converted into real-time 3D graphics, which are often displayed as 3D images or 3D maps of the surrounding objects.

- With the creation of the adaptive cruise control (ACC) systems for the automobiles, the autonomous vehicles will evolve into an automated system. The devices are mounted in the front of the vehicle to monitor the distance between successive cars, to react according to the varying distance and speeds between the successive vehicles.

- Companies are focusing on developing safer and reliable autonomous cars to allow customers to unlock advanced capabilities for ADAS features including pedestrian and bicycle avoidance, Lane Keep Assistance (LKA), Automatic Emergency Braking (AEB), Adaptive Cruise Control (ACC), Traffic Jam Assist (TJA), and more. The primary aim is to ensure safety, reduce costs and make transportation safer and this has enabled companies to make significant investments in to LIDAR technologies and their implementation . To reduce costs , the ultimate goal was to achieve development of other technologies like Soldi State LIDARs to replace the traditional mechanical rotation.

- This Innoviz in 2021 announced a partnership Vueron Technology from South Korea for LiDAR-Only Autonomous Driving . The cooperation will be a powerful combination - together, Innoviz's high-resolution LiDARs and Vueron's perception software will bring significant progress to the industry.. Vueron executed a 414-kilometer, fully automated, LIDAR-only drive from the capital city of Seoul to the southern port city of Busan, at a maximum speed of 100 km/hr. The mandated safety driver on board did not hold the steering wheel at any time during the full five hours of the historic drive.

- Volvo has similarly funded Luminar technologies in their advent of finding cost effective means of LIDAR solutions and the company has been a revelation in its products ever since.. Luminar is renowned for its innovation and cost effective measures and announced LiDAR-based solutions for under USD 1,000. The company is closely working with brands such as Toyota, Audi, and VW on LiDAR solutions for self-driving cars.

North America is Expected to Hold Major Share

- North America, led by the United States and Canada, is the most technologically superior market in the world. The growth of the market in the region is attributed to the increasing use of LiDAR in applications like environment, corridor mapping, meteorology, and urban planning. The market is also witnessing growth due to the increasing use of LiDAR in driverless cars and ADAS, which is expected to grow significantly in the coming years.

- Moreover, prominent vendors like Faro Technologies and Velodyne Lidar Inc. are present in the region. In August 2020, Velodyne Lidar Inc. announced that it had joined the Intelligent Transportation Society of America (ITS America) to promote the benefits of autonomous vehicles (AVs) and intelligent transportation infrastructure.

- Self-driving cars have already hit the roads of California, Texas, Arizona, Washington, Pennsylvania, Michigan and other US states and countries. Though, as of now, their mobility is restricted to specific test areas and driving conditions.

- Moreover, self-driving and autonomous cars are becoming a reality soon with major giants, such as Google, Tesla, and BMW, already releasing their prototype models. The region is witnessing increased partnerships and investments in domestic as well as international market which is contributing towards the growth of LiDAR in the region. The Canadian car components supplier, Magna, and an Israeli LiDAR technology developer, Innoviz cooperated, will provide BMW with its innovative sensor and system. It offered high-resolution LiDAR technology, which generates a 3D point cloud in real-time of the vehicle's surroundings under all kinds of weather conditions.

- Moreover, to implement sensing technologies on its cars, Volvo Cars invested in an American LiDAR sensor startup, Luminar, which utilizes a different part of the infrared light spectrum. This is because LiDAR can turn cars into machines keenly aware of their surroundings, where it helps in generating accurate 3D snapshots of every object surrounding the vehicle. Volvo is expected to start producing vehicles in 2022 that are equipped with LiDAR and Perception Stack.

- Regional governments, like the United States, have mandated the use of AEBs and other safety systems, which use technologies like RADAR, sensors, and LiDAR in combination or used alone. Such regulations prompt the automakers to use LiDAR systems a part of their ADAS, which has been by far incorporated only in the luxury cars. Despite these continual efforts and measures, many companies notably Tesla and many organizations are still hesitant to jump on the LIDAR wagon. The main issue corelates with the cost as alternatives including the cost effective Infrared Bolometers for instance can reduce costs as they ost upto few dollars in comparisons with the thousands for LIDARs.

- Also Tesla and Elon Musk has mentioned the issue of LIDARs while detecting moving objects as to not be able to detect how they are moving or even what these objects are. Also adaptation has been a key issue for LIDAR systems to the neural network system and the competitors of Tesla have maintained this problem consistently.

Automotive LiDAR Industry Overview

The competitive rivalry in this industry is primarily dependent on sustainable competitive advantage through innovation. The market penetration of this technology is moderate, with many industries exploring the potential of this technology. This is providing an opportunity for companies to attract new markets, thus driving the competition. The levels of marketing and advertising in this industry are high, while the firm concentration ratio is moderate and growing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 MARKET INSIGHTS

- 3.1 Market Overview

- 3.2 Industry Attractiveness - Porter's Five Forces Analysis

- 3.2.1 Threat of New Entrants

- 3.2.2 Bargaining Power of Buyers

- 3.2.3 Bargaining Power of Suppliers

- 3.2.4 Threat of Substitutes

- 3.2.5 Intensity of Competitive Rivalry

- 3.3 Market Drivers

- 3.3.1 Technological Superiority of LiDAR

- 3.3.2 Increasing Vehicle Safety Regulations and Growing Adoption of Adas Technology By OEM's

- 3.4 Market Challenges

- 3.4.1 High Cost of LiDAR Raises Overall Vehicle Cost

- 3.5 LiDAR Ecosystem (Photodetectors, IC, LiDAR Systems, Laser sources and Optical Components)

- 3.6 Integration of LiDAR in ADAS Vehicles (Advantages and Pain Points at Different Areas in the Vehicle)

- 3.7 Automotive LiDAR Technology Roadmap (2018 vs 2020 vs 2025)

- 3.8 Change in the Average Cost of LiDAR Technology in Automotive (Laser Ranging Sensor, High Resolution Spinning LiDAR mapping, Spinning & Solid State LiDAR for Positioning and Detection, and LiDAR for Mapping)

4 MARKET SEGMENTATION

- 4.1 By Application

- 4.1.1 Robotic Vehicles

- 4.1.2 ADAS

- 4.1.2.1 ADAS Level 2+ and 2++

- 4.1.2.2 ADAS Level 3 and Level 4

- 4.1.2.3 ADAS Level 5

- 4.2 By Geography

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia-Pacific

- 4.2.4 Rest of World

5 COMPETITIVE INTELLIGENCE

- 5.1 Vendor Ranking Analysis

- 5.2 Company Profile

- 5.2.1 Ouster Inc.

- 5.2.2 Robert Bosch GmbH

- 5.2.3 Valeo

- 5.2.4 Insight LiDAR

- 5.2.5 Velodyne LiDAR Inc.

- 5.2.6 Leddar Tech

- 5.2.7 Waymo LLC

- 5.2.8 RoboSense