|

市場調查報告書

商品編碼

1904934

全球合成潤滑油市場:市場分析與機會Global Synthetic Lubricants: Market Analysis and Opportunities |

||||||

價格

如有價格方面的疑問請按下「詢問」鍵來信查詢

簡介目錄

本報告分析了全球合成潤滑油市場,提供了主要成長國家的商機、各細分市場的需求驅動因素以及主要供應商的競爭格局等資訊。

影響全球合成潤滑油產業的關鍵主題

商品化與高階化

- 對所有汽車/工業產品類型進行排名和評分,以評估其商品化和高端化程度,以及值得關注的關鍵驅動因素和趨勢。

- 評估了這兩個細分市場的成長機會。

電氣化、效率、技術與法規

- 分析重點但不限於工業油和流體,以及合成油滲透潛力最大的產業/產品類別。

- 根據工業4.0、物聯網、機器人和合成油的潛在溢出效應進行排名和評分。

- 評估在這些領域具有成功潛力或能力的供應商,並了解其原因。

OEM 的影響

- 了解 OEM 的影響、技術和建議(出廠和售後服務),以及它們對供應鏈和最終用戶決策過程的影響。

通路/細分市場動態

- 考察合成樹脂在各個渠道/細分市場的當前和未來滲透率。

- 分析並評估成長機會和潛在的顛覆性因素/趨勢。

競爭活動與壓力

- 評估定價、品牌、產品特性與優勢、通路、原物料採購及長期成功等因素所面臨的競爭活動與壓力。

供應商定位 - 市佔率

- 比較全球領先的汽車和工業合成材料供應商、區域供應商、獨立供應商、自有品牌供應商、OEM 原廠供應商和特種供應商的產品組合,分析 PCMO/HDMO 的分級(經濟型、旗艦型、高端型)、定價、功效、價值主張、策略和長期成功。

簡介目錄

Product Code: Y634I

Global Synthetic Lubricants: Market Analysis and Opportunities

- Provides a comprehensive analysis of trends in synthetic lubricants, along with opportunities, challenges and trends in select countries across consumer, commercial and industrial segments.

- Synthetics outperform other categories providing opportunities for suppliers to grow both volume and value.

This report will deliver to subscribers:

- Business opportunities in synthetic lubricants for key growth country markets around the world

- Demand drivers and outlook for synthetic and semi-synthetic lubricants by product, segment and country

- Competitive landscape by key suppliers with estimated market shares and marketing activities by segment

Regional coverage: Global -with focus on 9key country markets across the world

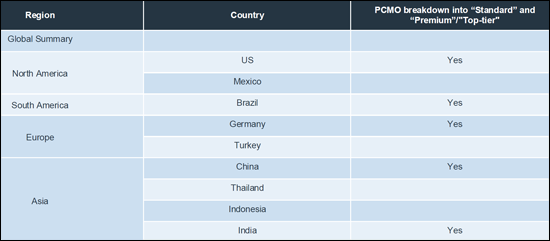

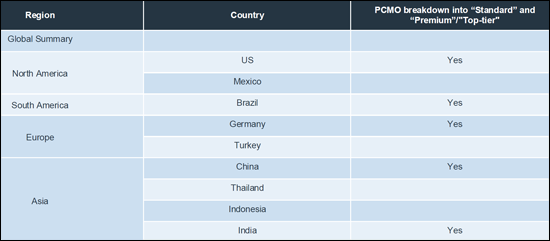

New - more granular market view: Full synthetic PCMO will be split into "Flagship" (Standard) and "Premium" in 5 key markets to evaluate different trends and opportunities for those market segments

Leading themes to be covered that are shaping the Global Synthetic Lubricants industry

Commoditization and Premiumization

- Rank and rate all automotive and industrial product types to assess levels of commoditization and premiumization and what are the driving forces and trends to monitor?

- Assess opportunities in both spaces for growth

Electrification, Efficiency, Technology, Regulation

- Analysis skewed but not exclusive to industrial oils, fluids and sectors/product categories with the greatest potential for synthetics penetration

- Rank and rate Industry 4.0, IoT, Robotics and the potential pull through effect for synthetics

- Assess suppliers most likely/capable to win in the space and why

OEM Influence & Impact

- Understand OEM influence, technology and recommendations (factory and service fill) and how it impacts the supply chain and end users' decision process

Channel/sector dynamics

- Examine synthetics' current/future penetration by channel/sector

- Rank and rate growth opportunities and potential disruptors/trends

Competitive Activity and Pressure

- Assess activity and pressure against factors such as pricing, branding, product features and benefits, distribution focus, feedstock sourcing and long-term success

Supplier Positioning -Market Share

- Review-compare-contrast global majors, regional independents, private label, OEM genuine and specialty suppliers' automotive and industrial synthetics product portfolio, tiering in PCMO/HDMO (value, flagship, premium), pricing, effectiveness, value proposition, strategies and long-term success

NEW for the 9th edition of the report will be an assessment and examination of the tiering of full synthetic PCMO in 5 key country markets

- Suppliers have been observed extending their full synthetic PCMO offer into two distinct tiers or categories: Flagship and Premium

- Objectives behind this trend can be viewed as (1) a means to maintain existing end user awareness and loyalty; (2) a hedge against growing competition from peers, private label, distributor house and OEM genuine oil brands among others; (3) protection against revenue and margins erosion as the full synthetic PCMO market skews towards commoditization

- Flagship can be viewed as a supplier existing or standard product offering featuring leading viscosity grades targeted to the specific needs of the vehicle parc and consumers, while meeting all OEM and industry specifications

- Premium aims to elevate the flagship offer through additional features and benefits such as extended performance and protection claims tied to higher mileage, e.g., 15K-20K miles / 24K-32K km, cleanliness, improved mileage/fuel economy, reduced friction, and sludge protection

- To convey Premium to end users, suppliers will use for example, distinct pac type graphics/colors/designs, elevated advertising, marketing and promotional efforts, and a price premium over their flagship offer

- The aim of this NEW content is to qualitatively and quantitatively explore the success of this tactic across 5 similar yet different country markets, identify which suppliers are currently active, how receptive are B2B participants and specifically, which trade classes (Installed / Retail) offer the most potential and opportunity for success and why

02-2729-4219

+886-2-2729-4219