|

市場調查報告書

商品編碼

1851387

合成潤滑油:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Synthetic Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

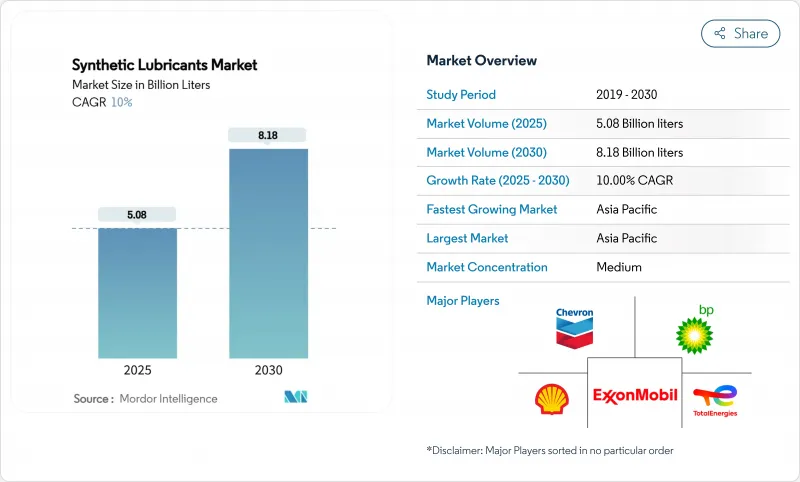

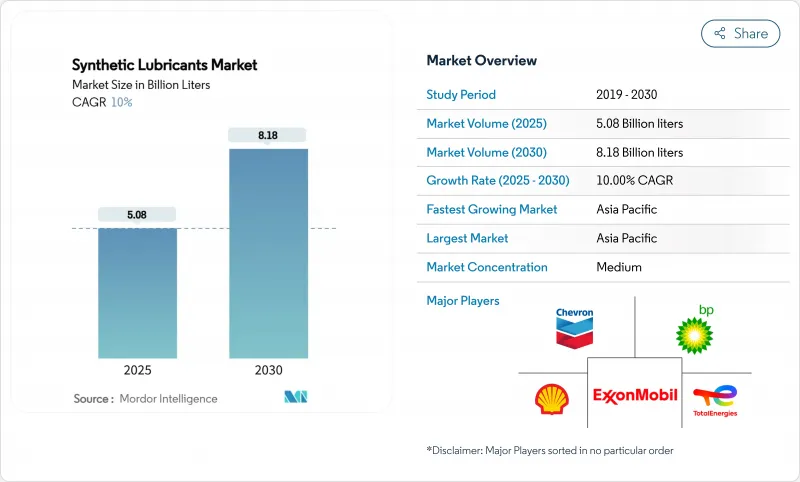

預計到 2025 年,合成潤滑油市場規模將達到 50.8 億公升,到 2030 年將達到 81.8 億公升,在預測期(2025-2030 年)內複合年成長率將達到 10%。

低黏度機油需求不斷成長、燃油經濟性監管壓力日益加大以及高性能潤滑油在自動化生產線上的快速應用,是推動合成潤滑油市場帶來了正面影響。對茂金屬聚環氧乙烷(PAO)產能的持續投資以及針對新的API和ACEA類別客製化產品的推出,正在增強供應安全並促進配方創新。同時,亞太地區在消費和成長方面均保持主導,這得益於中國龐大的製造地以及印度汽車保有量的復甦。

全球合成潤滑油市場趨勢及洞察

汽車售後市場對高性能合成機油的需求日益成長

隨著API SQ標準於2025年3月生效,2024年及以後售後市場向全合成機油的轉變已成定局。殼牌Helix Ultra系列填補了這個新類別,展現出卓越的動力保持能力和更佳的燃油經濟性,促使服務中心推薦優質合成機油作為預設加註機油。市場偏好正迅速轉向0W-20甚至0W-8黏度等級,因為更低的黏度可以改善冷啟動時的燃油經濟性。勝牌將於2024年底推出的優質全合成齒輪油,其磨損保護性能是傳統產品的四倍,其溢價也符合客戶在解釋總體擁有成本時的預期。由於更嚴格的法規和消費者意識提升的提高,北美和歐洲仍然處於領先地位,但隨著經銷商網路強調延長換油週期,這股勢頭正蔓延至亞太地區的城市市場。

嚴格的排放氣體和燃油經濟法規

歐洲7號排放標準計畫於2025年7月實施,而美國環保署(EPA)將於2026年發布更嚴格的重型車輛排放法規。這些法規強制要求使用黏度等級更低的潤滑油,例如5W-20和0W-20,迫使潤滑油配方商提高其抗氧化穩定性,以滿足新一代柴油引擎65萬英里(約105萬公里)的長期使用要求。 ILSAC GF-7規範增加了低速早燃(LSPI)保護和正時鏈條磨損控制功能,這些功能難以用礦物油實現,因此合成基料必不可少。中國正在推動的國六排放標準和印度的Bharat Stage VII排放標準也朝著相似的閾值邁進,有效地將最嚴格的要求全球化。標準的統一化有利於跨國供應商,他們可以在全球部署同一種配方,從而縮短檢驗週期並提高規模經濟效益。

合成潤滑油的初始成本較高

全合成機油的零售價通常是礦物油的兩到三倍,這一價格差異在對成本敏感的行業中仍然是一大障礙。在短週期使用情況下,延長換油週期的優勢並不明顯,這使得開發中國家的車隊管理者難以證明其溢價的合理性。加德士的數據證實,在低於5000公里的保養間隔下,很難實現投資報酬率。然而,原油價格的上漲導致礦物油價格上漲速度超過合成油,縮小了兩者之間的差距。同時,強調延長使用壽命的預測性維護工具逐漸降低商用車的吸引力。

細分市場分析

到2024年,機油將佔合成合成潤滑油市場34.58%的佔有率(按銷量計),這主要得益於內燃機車龐大的裝置量以及合成油優異的使用壽命。變速箱油和齒輪油仍是第二大品類,因為自動化生產線和風力發電機都需要在高負載下保持清潔運作。液壓油受益於建設業和機器人技術的融合,可在寬廣的溫度範圍內提供穩定的黏度。潤滑脂在需要無滴漏潤滑的領域仍然至關重要,例如航太產業的致動器和重型機械的接頭。金屬加工液雖然目前市佔率較小,但隨著精密加工和積層製造技術的成熟,其複合年成長率將達到11.15%,成為成長最快的品類。

此細分市場的前景受ILSAC GF-7和API SQ標準的影響。這項轉變有利於能夠延長換油週期、減少研討會次數和廢油處理的優質合成潤滑油。此外,低霧、高閃點的金屬加工液有助於降低工業事故的發生率,促使工廠轉向合成酯類和PAG系統。綜合來看,這些趨勢必將推動非引擎用合成潤滑油市場在2030年前保持穩定成長。

區域分析

預計到2024年,亞太地區將佔全球合成潤滑油市場佔有率的40.27%,複合年成長率(CAGR)為11.03%。中國先進製造業的復甦以及印度汽車銷售兩位數的成長,都支撐了該地區的消費。中國沿海地區新建的配方工廠,例如桂格霍頓公司計劃於2026年投產的張家港工廠,顯示供應商決心為高成長產業實現在地化供應。日本對高等級原廠潤滑油的需求依然旺盛,而東南亞經濟體則在擴大工業生產並拓展客戶群。

北美地區銷量位居第二,並持續保持技術領先地位。美國環保署 (EPA) 2026 年新規和美國石油學會 (API) 的產品線正推動配方師採用新一代添加劑化學品。美國憑藉其強大的丙烯基礎設施,在高黏度聚環氧乙烷 (PAO) 供應方面也佔據主導地位,但預計 2025 年年中丙烯供需將出現緊張,這可能會考驗淨利率。加拿大的油砂和採礦業以及墨西哥的汽車出口平台也構成了穩定的需求來源,這些地區依賴合成潤滑油來確保運作和保固。

由於嚴格的環境法規和先進的OEM技術標準,歐洲保持其領先地位。歐盟7排放標準要求更低的黏度和更強的後處理相容性,這推動了酯類增強配方在輕型和重型車輛中的應用。北海離岸風電走廊和伊比利亞半島新興的可再生叢集需要能夠耐受鹽溶液腐蝕的終身變速箱油,從而擴大了高價值PAG和PAO混合油的選擇範圍。隨著自動化投資的加速,東歐的工業基礎正進一步實現需求多元化。中東和非洲(程度稍輕)也正在經歷從礦物油到合成油的逐步轉變,因為海灣地區的石化中心和南非的礦場在嚴酷的氣候條件下追求更長的換油週期。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 汽車售後市場對高性能合成機油的需求日益成長

- 嚴格的排放氣體和燃油經濟法規

- 工業自動化的發展對先進的液壓油和齒輪油提出了更高的要求。

- 航太和國防領域的快速擴張對合成渦輪機油的需求

- 離岸風力發電激增帶動長效合成齒輪箱油需求成長

- 市場限制

- 與礦物油相比,初始成本較高。

- 由於電動車保有量增加,引擎機油需求下降。

- 聚α烯烴(PAO)原料供應的波動性;

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 機油

- 變速箱/齒輪油

- 油壓

- 金屬加工油

- 潤滑脂

- 其他產品類型(通用工業油等)

- 基油

- 聚α烯烴(PAO)

- 酯

- 聚亞烷基二醇(PAG)

- 第三類/GTL衍生合成油

- 其他(烷基甲醇烷基化等)

- 最終用戶

- 車

- 發電業務

- 重型機械

- 冶金與金屬加工

- 其他終端用戶產業(石油和天然氣、海運、資料中心等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 印尼

- 泰國

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 北歐國家

- 土耳其

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Shell plc

- Exxon Mobil Corporation

- BP plc(Castrol)

- Chevron Corporation

- TotalEnergies

- Valvoline Global Operations(Saudi Aramco)

- China Petrochemical Corporation(Sinopec)

- PETRONAS Lubricants International

- FUCHS SE

- ENEOS Corporation

- Indian Oil Corporation Ltd

- AMSOIL Inc.

- Idemitsu Kosan Co.,Ltd.

- Gazpromneft-Lubricants Ltd.

- LUKOIL

- Phillips 66 Company

- Suncor Energy Inc.

- Quaker Chemical Corporation

- Repsol

- Motul

第7章 市場機會與未來展望

The Synthetic Lubricants Market size is estimated at 5.08 Billion liters in 2025, and is expected to reach 8.18 Billion liters by 2030, at a CAGR of 10% during the forecast period (2025-2030).

Rising demand for lower-viscosity engine oils, accelerated regulatory pressure on fuel economy, and the rapid adoption of high-performance fluids across automated manufacturing lines are the principal growth engines. The synthetic lubricants market is also benefiting from the introduction of the ILSAC GF-7 specification, effective March 2025, which compels automakers and service networks to shift toward advanced PAO and PAG-based formulations. Continuous investments in metallocene PAO capacity, together with product launches tuned for new API and ACEA categories, reinforce supply security and spur formulation innovation. Against this backdrop, Asia-Pacific maintains leadership on both consumption and growth, aided by China's large manufacturing base and India's recovering vehicle parc.

Global Synthetic Lubricants Market Trends and Insights

Increasing Usage of High-Performance Synthetic Engine Oils in the Automotive Aftermarket

The post-2024 aftermarket pivot toward full-synthetic engine oils became pronounced once the API SQ standard entered force in March 2025. Shell's Helix Ultra line, which satisfies the new category, demonstrates full power retention and better fuel economy, convincing service centers to recommend premium synthetics as default fills . Market preference is shifting rapidly to 0W-20 and even 0W-8 grades because lower viscosity improves fuel efficiency during cold starts. Valvoline's premium full-synthetic gear oils, launched late 2024, provide four-fold wear protection over conventional products and command price premiums that customers accept when total cost of ownership is explained. North America and Europe remain at the forefront thanks to higher regulatory stringency and consumer awareness, yet momentum is spreading to urban markets in Asia-Pacific as dealership networks highlight extended drain intervals.

Stringent Emission and Fuel-Economy Regulations

July 2025 marked the planned start of Euro 7, while EPA 2026 tightens heavy-duty requirements in the United States. These rules mandate lower-viscosity grades such as 5W-20 and 0W-20, forcing lubricant formulators to boost oxidation stability to satisfy extended service limits of 650,000 miles for next-generation diesel engines. The ILSAC GF-7 specification adds LSPI protection and timing chain wear control that mineral oils struggle to achieve, making synthetic base stocks indispensable. China's evolving China VI and India's Bharat Stage VII frameworks are converging toward similar thresholds, which effectively globalize the most stringent requirements. Harmonized standards benefit multinational suppliers that can deploy one formulation worldwide, cutting validation cycles and strengthening economies of scale.

Higher Upfront Cost of Synthetic Lubricants

Full-synthetic products often sell at prices two to three times those of mineral oils, a differential that remains a stumbling block in cost-sensitive segments. In short duty cycles the benefit of extended drains is muted, preventing fleet managers in developing economies from justifying the premium. Caltex data confirm that where service intervals sit below 5,000 km, ROI is difficult to secure. Rising crude prices, however, are lifting the cost base of mineral oils faster than synthetics, narrowing the gap. Meanwhile, predictive maintenance tools underscore lifetime savings, gradually eroding resistance among commercial fleets.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Industrial Automation Demanding Advanced Hydraulic & Gear Oils

- Rapid Expansion in Aerospace, Defense and Offshore Renewables Demanding Synthetic Turbine & Gearbox Oils

- Growing Electric-Vehicle Fleet

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Engine oils captured 34.58% of the synthetic lubricants market in 2024 by volume, a position protected by the vast installed base of internal-combustion vehicles and the superior longevity synthetics deliver. Transmission and gear oils follow as the second-largest category because automated manufacturing lines and wind turbines both require high-load, clean-running formulations. Hydraulic fluids benefit from a construction upswing and robotics integration, supplying stable viscosity across wide temperature spreads. Greases remain indispensable in aerospace actuators and heavy machinery joints where drip-free lubrication is vital. Metalworking fluids, though holding a smaller volume share, advance at the fastest 11.15% CAGR as precision machining and additive manufacturing mature.

The segment outlook is shaped by ILSAC GF-7 and API SQ, both of which reduce permissible wear and LSPI occurrence. This shift favors premium synthetics that can sustain longer drains, reducing workshop visits, and oil disposal. Furthermore, metalworking fluids with low mist and high flash points mitigate occupational hazards, leading factories to migrate to synthetic ester-and-PAG systems. Together, these trends ensure that the synthetic lubricants market size for fluids beyond engine oils will expand steadily through 2030.

The Synthetic Lubricants Market Report Segments the Industry by Product Type (Engine Oils, Transmission and Gear Oils, Hydraulic Fluids, and More), by Base Oil (Polyalpha-Olefin (PAO), Esters, Polyalkylene Glycol (PAG), and More), by End User (Power Generation, Automotive, Heavy Equipment, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Volume (Liters).

Geography Analysis

Asia-Pacific held 40.27% of the synthetic lubricants market in 2024, with a 11.03% CAGR outlook. China's re-acceleration in advanced manufacturing, together with India's double-digit vehicle sales rebound, underpins regional consumption. New blending plants in coastal China, such as Quaker Houghton's Zhangjiagang facility scheduled for 2026, illustrate suppliers' determination to localize supply for high-growth sectors. Japan sustains demand for high-grade factory fills, while Southeast Asian economies ramp up industrial output, widening the customer base.

North America ranks second in volume and remains a technology bellwether. EPA 2026 rules and API's category pipeline push formulators into next-generation additive chemistry. The United States also dominates supply of high-viscosity PAO thanks to extensive propylene infrastructure, although propylene tightness predicted for mid-2025 could test margins. Canada's oil sands and mining fleets, plus Mexico's automotive export platforms, add stable demand pockets that rely on synthetic lubricants for uptime and warranty assurance.

Europe preserves its premium positioning through stringent environmental legislation and advanced OEM technical standards. Euro 7 compels lower viscosities and stronger aftertreatment compatibility, pushing adoption of ester-enhanced formulations in both light- and heavy-duty fleets. The North Sea offshore wind corridor and the Iberian Peninsula's emerging renewable clusters require fill-for-life gearbox oils that tolerate brine exposure, widening scope for high-value PAG and PAO blends. Eastern Europe's industrial base further diversifies demand as automation investments accelerate. The Middle East and Africa, while smaller, show a gradual shift from mineral to synthetic as Gulf petrochemical hubs and South African mines target longer drain intervals in harsh climates.

- Shell plc

- Exxon Mobil Corporation

- BP p.l.c. (Castrol)

- Chevron Corporation

- TotalEnergies

- Valvoline Global Operations (Saudi Aramco)

- China Petrochemical Corporation (Sinopec)

- PETRONAS Lubricants International

- FUCHS SE

- ENEOS Corporation

- Indian Oil Corporation Ltd

- AMSOIL Inc.

- Idemitsu Kosan Co.,Ltd.

- Gazpromneft-Lubricants Ltd.

- LUKOIL

- Phillips 66 Company

- Suncor Energy Inc.

- Quaker Chemical Corporation

- Repsol

- Motul

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Usage of High-Performance Synthetic Engine Oils in the Automotive Aftermarket

- 4.2.2 Stringent Emission & Fuel-Economy Regulations

- 4.2.3 Growth in Industrial Automation Demanding Advanced Hydraulic & Gear Oils

- 4.2.4 Rapid Expansion in Aerospace & Defence Requiring Synthetic Turbine Oils

- 4.2.5 Surge in Offshore Wind Installations Boosting Long-Drain Synthetic Gearbox Oils

- 4.3 Market Restraints

- 4.3.1 Higher Upfront Cost Versus Mineral Oils

- 4.3.2 Growing Electric-Vehicle Fleet Reducing Demand for Engine Oils

- 4.3.3 Volatility in Polyalphaolefin (PAO) Feed-Stock Supply

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Engine Oils

- 5.1.2 Transmission and Gear Oils

- 5.1.3 Hydraulic Fluids

- 5.1.4 Metalworking Fluids

- 5.1.5 Greases

- 5.1.6 Other Product Types (General Industrial Oils, etc.)

- 5.2 By Base Oil

- 5.2.1 Polyalpha-olefin (PAO)

- 5.2.2 Esters

- 5.2.3 Polyalkylene Glycol (PAG)

- 5.2.4 Group III / GTL-derived Synthetic

- 5.2.5 Others (Alkylated Naphthalene, etc.)

- 5.3 By End User

- 5.3.1 Automotive

- 5.3.2 Power Generation

- 5.3.3 Heavy Equipment

- 5.3.4 Metallurgy and Metalworking

- 5.3.5 Other End-user Industries (Oil and Gas, Marine, Data-centres, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Indonesia

- 5.4.1.7 Thailand

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 Egypt

- 5.4.5.5 South Africa

- 5.4.5.6 Nigeria

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Shell plc

- 6.4.2 Exxon Mobil Corporation

- 6.4.3 BP p.l.c. (Castrol)

- 6.4.4 Chevron Corporation

- 6.4.5 TotalEnergies

- 6.4.6 Valvoline Global Operations (Saudi Aramco)

- 6.4.7 China Petrochemical Corporation (Sinopec)

- 6.4.8 PETRONAS Lubricants International

- 6.4.9 FUCHS SE

- 6.4.10 ENEOS Corporation

- 6.4.11 Indian Oil Corporation Ltd

- 6.4.12 AMSOIL Inc.

- 6.4.13 Idemitsu Kosan Co.,Ltd.

- 6.4.14 Gazpromneft-Lubricants Ltd.

- 6.4.15 LUKOIL

- 6.4.16 Phillips 66 Company

- 6.4.17 Suncor Energy Inc.

- 6.4.18 Quaker Chemical Corporation

- 6.4.19 Repsol

- 6.4.20 Motul

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

- 7.2 Growing Adoption of Bio-lubricants