|

市場調查報告書

商品編碼

1548970

A2A 支付的全球市場:2024-2029Global A2A Payments Market: 2024-2029 |

||||||

| 關鍵統計 | |

|---|---|

| 2024年 A2A 總交易數: | 600億 |

| 2029年 A2A 交易總數 | 1860億 |

| 2024年至2029年的市場成長率 | 209% |

| 預測週期 | 2024-2029 |

消費者取向的A2A 支付:到2029年,全球交易總數將達到 1,860億筆

研究套件對這個不斷發展的市場提供深入而深入的分析。開放銀行基礎設施和支付服務提供者、銀行和其他金融機構、電子商務平台和商家等利害關係人可以了解未來的成長、主要趨勢和競爭格局。

還可以存取反映 A2A(帳戶對帳戶)支付的採用情況和未來幾年市場成長的資料,以及揭示市場最新趨勢和機會的富有洞察力的研究。廣泛分析。

主要功能

- 市場動態:分析全球 A2A 支付市場的主要趨勢和市場擴張挑戰。分析了 A2A 支付市場的各個部分,包括詐欺風險帶來的挑戰、開放銀行的好處和加強即時支付的監管,以及 A2A 支付與傳統卡支付的比較。本報告還包括Juniper Research公司的國家就緒指數,該指數評估了 60個國家的市場就緒情況和成長情況,並提供了未來展望。

- 主要要點和策略建議:對全球 A2A 支付市場的主要成長機會和發現進行詳細分析,並為利害關係人提供策略建議。

- 產業預測基準:全球 A2A 支付資料集包括對各個細分市場的A2A 支付總數和價值的預測,包括店內支付、線上支付、P2P 支付和跨境支付。所有這些市場的大量預測,包括支付總數、金額和平均值。

- Juniper Research 競爭排行榜:Juniper Research 的競爭排行榜評估 19 家 A2A 支付供應商的能力,並致力於關鍵參與者的策略研發機會。

範例視圖

市場資料與預測報告:

Juniper Research的市場資料和預測報告透過數字了解現狀,並詳細解釋背後的原因和研究方法。

市場趨勢與策略報告:

全面分析當前市場狀況並提出策略建議。

市場資料與預測報告

檢查套件包括對由 49個表格和 22,000個資料點組成的完整預測資料集的存取。研究套件包括以下指標:

- 使用 A2A 付款的成年人數量

- 各細分領域進行支付的A2A 支付用戶數量

- 各細分領域的A2A 支付交易總數

- 各細分領域A2A支付總交易金額

競爭排行榜報告

競爭排行榜報告提供了全球 A2A 支付領域 19 家主要供應商的詳細評估和市場定位。

目錄

市場趨勢與策略

第1章 要點與策略建議

- 要點

- 策略建議

第2章 市場狀況

- 簡介

- A2A 付款類型

- 外圍技術

- 即時付款通道

- 開放式銀行業務和 A2A 支付

- 二維碼支付

- NFC

- A2A支付生態系與傳統卡支付生態系的比較

- 當前市場

- A2A支付系統

- 國家支付計劃

- 金融科技驅動的解決方案

- 要點

- A2A支付系統

- A2A 支付趨勢

- A2A 支付的主要驅動因素

- 技術開發

- 政府措施與監管環境

- 新趨勢

- VRP

- 付款請求和連結/代碼付款

- QR 碼已成為許多市場中 A2A 的代名詞

- 跨境 A2A 支付與支付互通性

- 詐欺偵測、反洗錢、制裁合規

- A2A 支付的主要驅動因素

- 優勢與挑戰

- 優點

- 更安全的即時付款

- 降低交易成本

- 改善客戶體驗

- 與其他金融服務直接集成

- 課題

- 在某些市場上品牌知名度有限

- 詐欺風險與安全問題

- 與現有支付基礎設施協調

- 缺乏理解

- 缺乏銀行報酬

- 優點

第3章 細分分析

- 零售/電子商務/其他服務

- 點對點

- 跨國支付

- 商業(B2B&B2C)

第4章 國家儲備指數

- 國家儲備指數:簡介

- 優先市場

- 不斷成長的市場

- 新興市場

- 國家準備指數熱圖

競爭排行榜

第1章 A2A支付:競技排行榜

第2章 公司簡介

- 供應商簡介

- Aeropay

- Banked

- Brankas

- Brite Payments

- Dwolla

- Fiserv

- GoCardless

- kevin

- Mastercard

- Plaid

- Prometeo

- TrueLayer

- Trustly

- Token.io

- Visa

- Volt

- Vyne

- Worldline

- Yapily

- 排行榜評估研究方法

資料與預測

第1章 市場概述/研究方法

- A2A 支付:預測研究方法與假設

第2章 消費者 A2A:摘要

- 用戶總數

- 交易總數

- 總交易金額

第3章 店內支付

- 用戶總數

- 交易總數

- 總交易金額

第4章 電子商務A2A支付

- 用戶總數

- 交易總數

- 總交易金額

第5章 P2P支付

- 用戶總數

- 交易總數

- 總交易金額

第6章 跨國支付:消費者

- 用戶總數

- 交易總數

- 總交易金額

第7章 B2B 支付

- 國內B2B支付交易總數

- 國內B2B支付交易總額

- 跨國B2B支付交易總數

- 跨國B2B支付交易總額

| KEY STATISTICS | |

|---|---|

| Total A2A transaction volume in 2024: | 60bn |

| Total A2A transaction volume in 2029: | 186bn |

| 2024 to 2029 market growth: | 209% |

| Forecast period: | 2024-2029 |

'Consumer A2A Payments - 186 Billion Transactions Globally by 2029'

Overview

Our "Global A2A Payments" research suite provides detailed and perceptive analysis of this evolving market; enabling stakeholders such as Open Banking infrastructure and payment service providers, banks and other financial institutions, and eCommerce platforms and merchants to understand future growth, key trends, and the competitive environment.

The suite features several different options that can be purchased separately, including access to data mapping the A2A (Account-to-Account) payments adoption and market growth in the coming years, and an insightful study uncovering the latest trends and opportunities within the market. Additionally, the report contains an extensive analysis of the 19 market leaders in the A2A payments space. The coverage can also be purchased as a Full Research Suite, containing all of these elements, at a substantial discount.

Collectively, they provide a critical tool for understanding this rapidly emerging market; allowing all manner of A2A payment stakeholders to shape their future strategies. Its unparalleled coverage makes this research suite an incredibly useful resource for charting the future of such a crucially important and rapidly growing sector.

Key Features

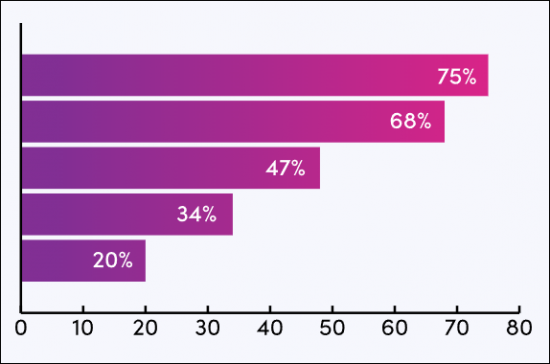

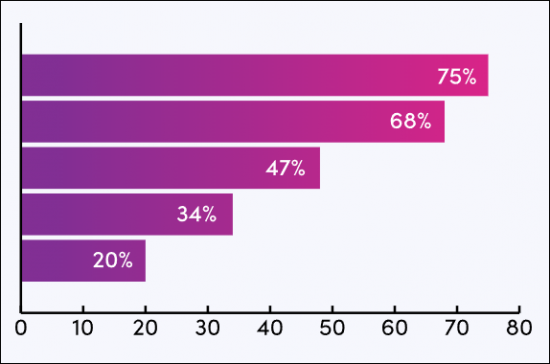

- Market Dynamics: Insights into key trends and market expansion challenges within the global A2A payments market. Specifically, the report addresses the challenges posed by the risk of fraud, the benefits of increasing regulatory involvement for Open Banking and instant payment rails, and how A2A payments compare to traditional card payments. The research also includes analysis of the various segments comprising the A2A payments market and a regional market growth analysis on the current and future of these segments. Finally, the report includes the Juniper Research Country Readiness Index which assesses the market readiness and growth across all 60 countries featured in our forecast, as well as providing a future outlook.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within the global A2A payments market; accompanied by strategic recommendations for stakeholders.

- Benchmark Industry Forecasts: The Global A2A Payments dataset includes forecasts for total volume and value of A2A payments across various segments, with a multitude of additional forecasts included for all of these markets, featuring total payment volumes, values, averages, and more, for in-store, online, P2P, and cross-border payments.

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 19 A2A payment vendors via the Juniper Research Competitor Leaderboard, featuring strategic development opportunities for key players in the global A2A payments market.

SAMPLE VIEW

Market Data & Forecasting Report:

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

Market Trends & Strategies Report:

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasting Report

The market-leading research suite for the global A2A payments market includes access to the full set of forecast data of 49 tables and 22,000 datapoints. Metrics in the research suite include:

- Number of Adults Making A2A Payments

- Number of A2A Payment Users Making Payments for Different Segments

- Total Transaction Volume of A2A Payments Across Different Segments

- Total Transaction Value of A2A Payments Across Different Segments

The segments of consumer A2A payments include in-person, online, P2P, and cross-border payments. Business A2A payments also feature in the forecast, split between domestic and cross-border payments.

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via five interactive scenarios

Market Trends & Strategies Report

This report examines the "Global A2A Payments" market landscape in detail; assessing market trends and factors shaping the evolution of this rapidly growing market. The report delivers comprehensive analysis of the strategic opportunities for A2A payment players; addressing key verticals and developing challenges, and suggesting how stakeholders should navigate these. It also includes evaluation of key country-level opportunities for A2A payment market growth, based on current A2A payment schemes and initiatives, Open Banking and instant payment rail infrastructure development, and more.

Competitor Leaderboard Report

The Competitor Leaderboard report provides a detailed evaluation and market positioning for 19 leading vendors in the "Global A2A Payments" space. The vendors are positioned as established leaders, leading challengers or disruptors and challengers, based on capacity and capability assessments:

|

|

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Market Landscape

- 2.1. Introduction

- 2.1.1. Types of A2A Payments

- 2.1.2. Surrounding Technologies

- i. Instant Payment Rails

- ii. Open Banking & A2A Payments

- Figure 2.1: How Open Banking Works

- Figure 2.2: Number of Open Banking Payment Users Globally (m), 2023-2028

- Figure 2.3: Proportion of Use Cases for APIs Globally (2023)

- iii. QR Code Payments

- iv. NFC

- 2.1.3. A2A Payment Ecosystem Versus Traditional Card-based Payment Ecosystem

- Figure 2.4: Card-based Payments vs A2A Payments Ecosystems

- 2.2. Current Market

- 2.2.1. A2A Payment Systems

- i. National Payment Schemes

- ii. Fintech-led Solutions

- iii. Key Takeaways

- 2.2.1. A2A Payment Systems

- 2.3. Trends for A2A Payments

- 2.3.1. Key Drivers of A2A Payments

- i. Technological Developments

- ii. Government Initiatives & Regulatory Environments

- 2.3.2. Emerging Trends

- i. VRPs

- ii. Request to Pay & Pay by Link/ Code

- iii. QR Codes Become Synonymous with A2A in Many Markets

- iv. Cross-border A2A Payments & Payment Interoperability

- v. Fraud Detection, AML, and Sanction Compliance

- 2.3.1. Key Drivers of A2A Payments

- 2.4. Benefits & Challenges

- 2.4.1. Benefits

- i. Instant Payments Made Safer

- ii. Reduced Transaction Costs

- iii. Improved Customer Experiences

- iv. Direct Integration with Other Financial Services

- 2.4.2. Challenges

- i. Limited Brand Recognition in Several Markets

- ii. Fraud Risks & Security Concerns

- iii. Interaction with Existing Payment Infrastructure

- iv. Lack of Understanding Stunts Growth

- v. Lack of Bank Remuneration

- 2.4.1. Benefits

3. Segment Analysis

- 3.1. Introduction

- 3.2. Retail, eCommerce, & Other Services

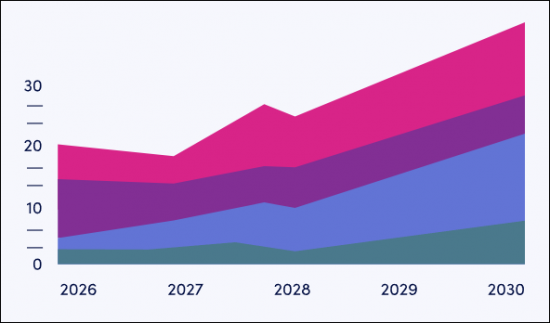

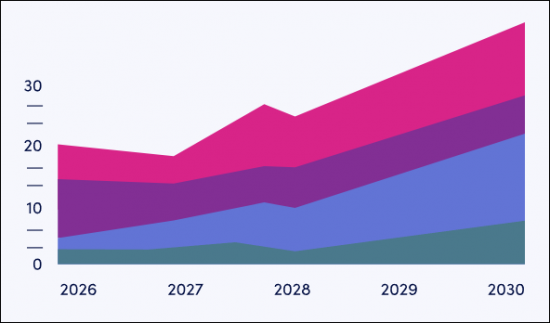

- Figure 3.2: Total Value of In-store & Online A2A Payments Globally ($), 2024-2029

- 3.3. P2P

- Figure 3.3: Total Transaction Volume of A2A-based P2P Payments (m), Split by Key Regions, 2024-2029

- 3.4. Cross-border

- Figure 3.4: Global Volume of Cross-border A2A Transactions (m), Split by 8 Key Regions, 2024

- 3.5. Businesses (B2B & B2C)

- Figure 3.5: Total Volume of A2A-based B2B Payments (m), Split by 8 Key Regions, 2024

4. Country Readiness Index

- 4.1. Introduction to Country Readiness Index

- Figure 4.1: Country Readiness Index Regional Definitions

- Table 4.2: Juniper Research's Country Readiness Index Scoring Criteria: A2A Payments

- Figure 4.3: Juniper Research's Country Readiness Index: A2A Payments

- Table 4.4: A2A Payments Country Readiness Index: Market Segments

- 4.1.1. Focus Markets

- i. National Payment Schemes

- Figure 4.5: Total Volume of Cross-border A2A Payments (m) Split by Focus Markets, 2024-2029

- ii. High Level of Open Banking Development

- iii. High Concentration of A2A Payment Vendors

- i. National Payment Schemes

- 4.1.2. Growth Markets

- i. Instant Payment Rails

- Figure 4.6: Total Volume of A2A-based B2B Transactions (m), Split by Growth Markets, 2024-2029

- ii. Emerging Initiatives for A2A Payments Nationally

- i. Instant Payment Rails

- 4.1.3. Developing Markets

- 4.1.4. Country Readiness Index Heatmaps

- i. North America

- Table 4.7: Juniper Research's A2A Payments Country Readiness Index Heatmap: North America

- ii. Latin America

- Table 4.8: Juniper Research's A2A Payments Country Readiness Index Heatmap: Latin America

- iii. West Europe

- Table 4.9: Juniper Research's A2A Payments Country Readiness Index Heatmap: West Europe

- iv. Central & East Europe

- Table 4.10: Juniper Research's A2A Payments Country Readiness Index Heatmap: Central & East Europe

- v. Far East & China

- Table 4.11: Juniper Research's A2A Payments Country Readiness Index Heatmap: Far East & China

- vi. Indian Subcontinent

- Table 4.12: Juniper Research's A2A Payments Country Readiness Index Heatmap: Indian Subcontinent

- vii. Rest of Asia Pacific

- Table 4.13: Juniper Research's A2A Payments Country Readiness Index Heatmap: Rest of Asia Pacific

- viii. Africa & Middle East

- Table 4.14: Juniper Research's A2A Payments Country Readiness Index Heatmap: Africa & Middle East

- i. North America

Competitor Leaderboard

1. A2A Payments Competitor Leaderboard

- 1.1. Why Read this Report?

- Table 1.1: Juniper Research Competitor Leaderboard: A2A Payment Vendors

- Figure 1.2: Juniper Research Competitor Leaderboard: A2A Payments

- Table 1.3: Juniper Research Competitor Leaderboard: A2A Payment Vendors & Positioning

- Table 1.4: : Juniper Research A2A Payments Competitor Leaderboard Heatmap

2. Company Profiles

- 2.1. Vendor Profiles

- 2.1.1. Aeropay

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.2. Banked

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.3. Brankas

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.4. Brite Payments

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.5. Dwolla

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.6. Fiserv

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.7. GoCardless

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.8. kevin

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.9. Mastercard

- i. Corporate Information

- Table 2.1: Mastercard's Financial Snapshot ($m), 2021-2023

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.2: Mastercard's Real-time Payments Solution

- Figure 2.3: Example of Mastercard's Pay by Bank Solution at Checkout

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.10. Plaid

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.11. Prometeo

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.12. TrueLayer

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.13. Trustly

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.14. Token.io

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.15. Visa

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.16. Volt

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.4: Example of a Volt Transformer Prompt

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.17. Vyne

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- Figure 2.5: How Vyne's Verified Payments Solution Works

- 2.1.18. Worldline

- i. Corporate Information

- Table 2.6: Worldline's Financial Snapshot ($m): 2022-2023

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.19. Yapily

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.1. Aeropay

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.2.1. Limitations & Interpretations

- Table 2.7: Juniper Research's Competitor Leaderboard Scoring Criteria - A2A Payments

- 2.2.1. Limitations & Interpretations

Data & Forecasting

1. Market Overview & Methodology

- 1.1. Introduction

- 1.2. A2A Payments: Forecast Methodology & Assumptions

- 1.2.1. Methodologies

- Figure 1.1: In-store A2A Payments Forecast Methodology

- Figure 1.2: eCommerce A2A Payments Forecast Methodology

- Figure 1.3: A2A-based P2P Payments Forecasts Methodology

- Figure 1.4: Consumer Cross-border A2A Payment Forecasts Methodology

- Figure 1.5: B2B Forecasts Methodology for the A2A Market

- 1.2.1. Methodologies

2. Consumer A2A: Summary

- 2.1. Total Number of A2A Payment Users

- Figure & Table 2.1: Total Number of A2A Payments Users (m), Split by 8 Key Regions, 2024-2029

- 2.2. Total Number of Consumer A2A Transactions

- Figure & Table 2.2: Total Volume of Consumer A2A Transactions (m), Split by 8 Key Regions, 2024-2029

- Table 2.3: Total Volume of Consumer A2A Transactions (m), Split by A2A Segment, 2024-2029

- 2.3. Total Value of Consumer A2A Transactions

- Figure & Table 2.4: Total Value of Consumer A2A Transactions ($m), Split by 8 Key Regions, 2024-2029

- Table 2.5: Total Value of Consumer A2A Transactions ($m), Split by A2A Segment, 2024-2029

3. In-store Payments

- 3.1. Total Number of In-store A2A Payment Users

- Figure & Table 3.1: Total Number of In-store A2A Payment Users (m), Split by Key Regions, 2024-2029

- 3.2. Total Number of In-store A2A Payments

- Figure & Table 3.2: Total Volume of In-store A2A Payments (m), Split by 8 Key Regions, 2024-2029

- 3.3. Total Value of In-store A2A Payments

- Figure & Table 3.3: Total Value of In-store A2A Payments ($m), Split by 8 Key Regions, 2024-2029

4. eCommerce Payments

- 4.1. Total Number of A2A eCommerce Payment Users

- Figure & Table 4.1: Total Number of Online A2A Payment Users (m), Split by 8 Key Regions, 2024-2029

- 4.2. Total Transaction Volume of A2A eCommerce Payments

- Figure & Table 4.2: Total Transaction Volume of A2A eCommerce Payments (m), Split by 8 Key Regions, 2024-2029

- 4.3. Total Value of A2A eCommerce Payments

- Figure & Table 4.3: Total Transaction Value of A2A eCommerce Payments ($m), Split by 8 Key Regions, 2024-2029

5. P2P Payments

- 5.1. Total Number of A2A Users Making P2P Payments

- Figure & Table 5.1: Total Number of A2A Users Making P2P Payments (m), Split by 8 Key Regions, 2024-2029

- 5.2. Total Volume of A2A-based P2P Payments

- Figure & Table 5.2: Total Volume of A2A-based P2P Payments (m), Split by 8 Key Regions, 2024-2029

- 5.3. Total Value of A2A-based P2P Payments

- Figure & Table 5.3: Total Value of A2A-based P2P Payments ($m), Split by 8 Key Regions, 2024-2029

6. Cross-border Payments: Consumer

- 6.1. Total Number of Cross-border A2A Payment Users

- Figure & Table .1: Total Number of Cross-border A2A Payment Users (m), Split by 8 Key Regions, 2024-2029

- 6.2. Total Volume of Consumer Cross-border A2A Payments

- Figure & Table .2: Total Volume of Consumer Cross-border A2A Payments (m), Split by 8 Key Regions, 2024-2029

- 6.3. Total Value of Consumer Cross-border A2A Payments

- Figure & Table .3: Total Value of Consumer Cross-border A2A Payments ($m), Split by 8 Key Regions, 2024-2029

7. B2B Payments

- 7.1. Total Number of Domestic B2B Payments Using A2A

- Figure & Table .1: Total Number of Domestic B2B Payments Using A2A (m), Split by 8 Key Regions, 2024-2029

- 7.2. Total Value of Domestic B2B Payments Using A2A

- Figure & Table .2: Total Value of Domestic B2B Payments Using A2A ($m), Split by 8 Key Regions, 2024-2029

- 7.3. Total Number of Cross-border B2B Payments Using A2A

- Figure & Table .3: Total Number of Cross-border B2B Payments Using A2A (m), Split by 8 Key Regions, 2024-2029

- 7.4. Total Value of Cross-border B2B Payments Using A2A

- Figure & Table .4: Total Value of Cross-border B2B Payments Using A2A ($m), Split by 8 Key Regions, 2024-2029