|

市場調查報告書

商品編碼

1473280

IC市場重點領域:人工智慧(AI)、5G、汽車、記憶體晶片市場分析Hot ICs: A Market Analysis of Artificial Intelligence (AI), 5G, Automotive and Memory Chips |

||||||

人工智慧(AI)、5G技術、汽車工業和儲存晶片的趨勢

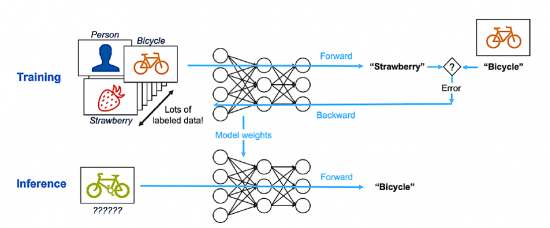

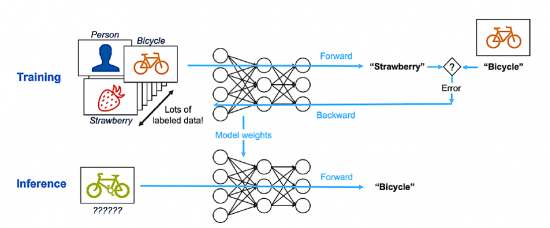

人工智慧(AI)領域正在出現幾個重要趨勢,包括人工智慧架構和演算法的進步、邊緣人工智慧的擴散以及人工智慧與各產業和應用的融合。人工智慧技術變得越來越複雜,可以實現自然語言處理、電腦視覺和自主決策等任務。

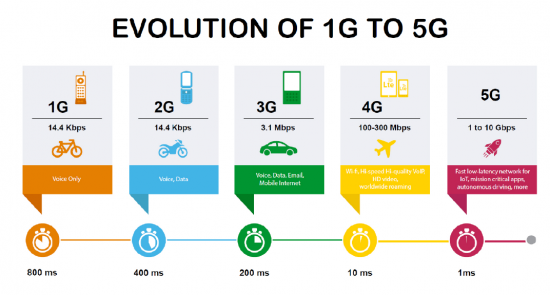

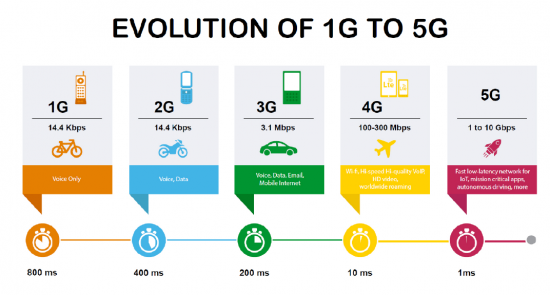

5G技術的廣泛採用將徹底改變整個產業,實現更快、更可靠的連接,支援物聯網(IoT)設備、擴增實境(AR)、虛擬實境(VR)、加速自我等領域的創新-駕駛汽車。

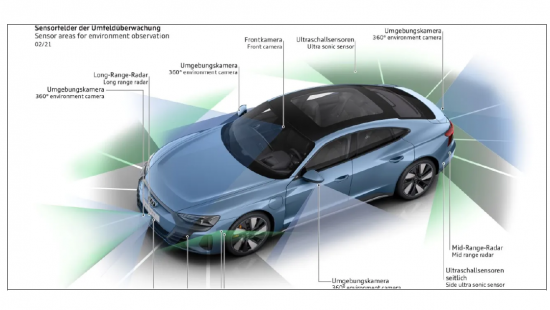

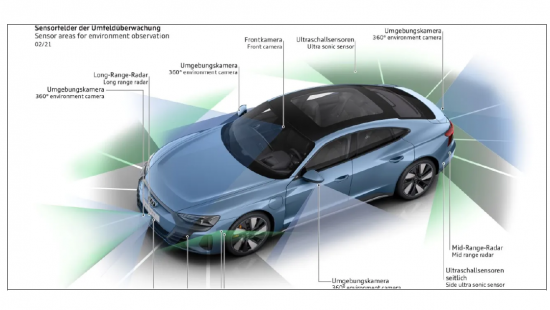

在汽車領域,人們越來越重視電氣化、連網化和自動化,從而促進了電動車(EV)、連網汽車和自動駕駛技術的發展。

最後,儲存晶片領域的重點是增加儲存容量、提高效能和降低功耗,以滿足雲端運算、人工智慧和大數據分析等資料密集型應用不斷增長的需求。

這些趨勢代表了當前人工智慧、5G、汽車和儲存晶片技術的演進和融合,正在推動創新和全球產業重組。

科技融合

人工智慧 (AI)、5G 技術、汽車產業以及儲存晶片技術進步的融合代表著全球技術格局的重大轉變,開啟了創新和連接的新時代。本報告揭示了這四個關鍵領域複雜的交叉動態,它們共同構成了現代 DX(數位轉型)的支柱,並為跨產業前所未有的成長機會奠定了基礎。

人工智慧處於這場技術革命的前沿,透過驅動更智慧、更有效率的系統來改變我們的生活、工作和互動方式。從提高運算能力到實現更複雜的數據分析和決策過程,人工智慧在塑造技術未來方面的作用至關重要。本報告探討了人工智慧跨產業的整合、其對智慧系統發展的影響,以及人工智慧如何徹底改變從消費性電子產品到複雜工業運作的一切。

同時,5G 技術的推出標誌著連接性、交付速度和可靠性方面的一個重要里程碑,遠遠超過了其前輩。5G 不僅僅是增強通訊能力;它將促進物聯網 (IoT)、自動駕駛汽車、遠距醫療服務等所需的即時資料傳輸。生態系統分析提供對 5G 生態系統的洞察,研究基礎設施課題、監管環境以及 5G 和人工智慧之間將促進技術進步的協同作用。

汽車產業正在經歷一場變革,電氣化、自動駕駛和連網汽車重新定義了移動出行的本質。本報告評估了人工智慧和 5G 將如何加速汽車創新,重點關注 ADAS(高級駕駛輔助系統)、車載資訊娛樂系統和 V2X(車聯網)通訊的整合。它還研究了對製造商、消費者和更廣泛的交通基礎設施的影響。

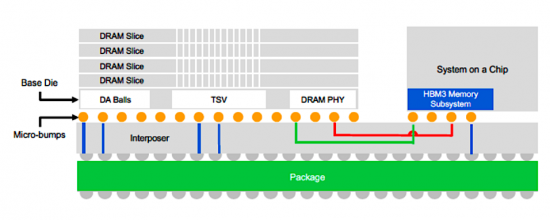

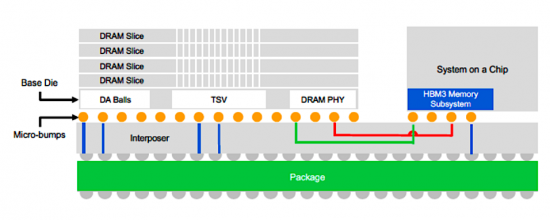

記憶體晶片是數位時代的無名英雄,在支援人工智慧、5G 和汽車技術的發展中發揮關鍵作用。隨著這些行業的快速成長,對更快、更有效率和更高容量的儲存解決方案的需求也在不斷增長。本節評估了記憶體晶片技術的最新趨勢,包括 DRAM、NAND 和新興的 NVRAM(非揮發性記憶體)技術,以及新興技術在支援資料密集需求方面所發揮的重要作用。

本報告分析了全球IC市場主要領域—人工智慧(AI)、5G、汽車和儲存晶片—的最新發展,並探討了各領域的基本市場結構和驅動因素,以及最新的技術發展和發展趨勢。

目錄

第一章執行摘要

第二章 汽車

- 汽車產業指標

- 汽車半導體產業

- 汽車記憶體半導體

- 汽車半導體:依類型

- 關鍵技術及零件供應商

- NXP

- STMicroelectronics

- Renesas Electronics

- Nvidia

- Intel (Mobileye and Moovit)

- Skyworks

- Qualcomm

- onsemi

- Texas Instruments

- Analog Devices

- 汽車/高級駕駛輔助系統 (ADAS)

- 與其他汽車AI晶片的競爭

- Intel-Mobileye

- Qualcomm

- Nvidia

- Huawei

- Horizon Robotics

- Black SesameTechnologies

- Xin Chi Technology

- Tesla

- 與其他汽車AI晶片的競爭

- 光達感測器

- 光達成本考慮

- 汽車應用

- 光達供應商

- Velodyne

- Luminar

- Aeva

- Ouster

- Innoviz

- Hesai

- Livox

- Innovusion

第三章 5G

- 5G晶片技術及趨勢

- 應用領域

- 手機

- 跨學科聯繫

- 市場分析

- 市場預測

- 適用於 5G 和 4G 的新組件

- 5G晶片供應商產品及簡介

- Analog Devices

- Anokiware

- Apple

- Broadcom

- Huawei

- Infineon

- Intel

- Inphi

- Microchip

- MediaTek

- Marvell

- M/A-Com

- NXP Semiconductor

- Onsemi

- Qualcomm

- Qorvo

- Samsung Electronics

- Sivers IMA

- Skyworks Solutions

- STMicroelectronics

- Teradyne

- Texas Instruments

- Win Semiconductors

- Xilinx

第四章 人工智慧(AI)

- AI科技及趨勢

- 雲端人工智慧運算

- 邊緣人工智慧運算

- 人工智慧的要素

- 市場分析

- AI晶片營收預測

- 應用領域

- 人工智慧的工業應用

- 人工智慧驅動的設備

- 軍事/國防應用

- AI晶片營收預測

- 人工智慧晶片技術

- GPU(影像處理單元)

- FPGA(現場可程式化閘陣列)

- ASIC(專用積體電路)

- 神經形態晶片

- DPU(資料處理單元)

- AI晶片供應商產品及簡介

- 積體電路供應商

- Achronix

- AMD

- Ampere

- Biren Technology

- Flex Logix

- IBM

- Intel

- MediaTek

- Nvidia

- NXP

- Qualcomm

- Rockchip

- Samsung Electronics

- STMicroelectronics

- Tentsorrent

- Xilinx

- 雲端提供者:技術領導者

- Alibaba

- Alibaba Cloud

- Amazon

- Apple

- Baidu

- Meta

- Fujitsu

- Huawei Cloud

- Microsoft

- Nokia

- Tencent Cloud

- Tesla

- 智慧財產權供應商

- ARM

- CEVA

- Imagination

- VeriSilicon

- Videantis

- 世界各地的新創公司

- Adapteva

- aiCTX

- AImotive

- AlphaICs

- Anari AI

- Blaize

- BrainChip

- Cerebras Systems

- Cornami

- DeepScale

- Anari AI

- Esperanto Technologies

- Graphcore

- GreenWaves Technology

- Groq

- Hailo AI

- KAIST

- Kalray

- Kneron

- Knowm

- Koniku

- Mythic

- SambaNova Systems

- Tachyum

- Via

- deantis

- Wave Computing

- 中國新創公司

- AISpeech

- Bitmain

- Cambricon

- Chipintelli

- DeePhi Tech

- Horizon Robotics

- NextVPU

- Rokid

- Thinkforce

- Unisound

- 積體電路供應商

第五章 記憶體晶片

- 記憶體技術及趨勢

- 記憶

- NAND

- NVRAM:MRAM、RRAM、FERAM

- 應用領域

- 記憶

- NAND

- 市場分析

- 記憶體晶片供應商產品和簡介

- CXMT

- Fujian

- GigaDevice Semiconductor

- Intel

- Micron Technology

- Nanya

- Powerchip Technology

- Samsung Electronics

- SK Hynix

- Toshiba (Kloxia)

- Tsinghua Chongqing

- Western Digital

- Winbond

- YMTC

Trends in Artificial Intelligence (AI), 5G technology, the automotive industry, and memory chips

In the realm of Artificial Intelligence (AI), several key trends are emerging, including advancements in AI architectures and algorithms, the proliferation of edge AI, and the integration of AI into various industries and applications. AI technologies are becoming more sophisticated, enabling tasks such as natural language processing, computer vision, and autonomous decision-making.

The adoption of 5G technology is driving significant transformations across industries, enabling faster and more reliable connectivity, supporting the proliferation of Internet of Things (IoT) devices, and facilitating innovations in areas like augmented reality (AR), virtual reality (VR), and autonomous vehicles.

In the automotive sector, there is a growing emphasis on electrification, connectivity, and autonomy, leading to the development of electric vehicles (EVs), connected cars, and selfdriving technologies.

Finally, in the realm of memory chips, there is a focus on increasing storage capacity, improving performance, and reducing power consumption to meet the growing demands of dataintensive applications such as cloud computing, artificial intelligence, and big data analytics.

These trends collectively represent the ongoing evolution and convergence of AI, 5G, automotive, and memory chip technologies, driving innovation and reshaping industries across the globe.

Convergence of Technology

The convergence of Artificial Intelligence (AI), 5G technology, the automotive industry, and advancements in memory chip technology represents a pivotal shift in the global technological landscape, heralding a new era of innovation and connectivity. This comprehensive report delves into the intricate dynamics at the intersection of these four critical sectors, unveiling how they collectively form the backbone of modern digital transformation and setting the stage for unprecedented growth opportunities across various industries.

Artificial Intelligence stands at the forefront of this technological revolution, driving smarter, more efficient systems that are transforming how we live, work, and interact. From enhancing computational power to enabling more sophisticated data analysis and decision-making processes, AI's role in shaping the future of technology cannot be overstated. This report explores AI's integration across industries, its impact on developing intelligent systems, and how it's revolutionizing everything from consumer electronics to complex industrial operations.

Parallelly, the rollout of 5G technology marks a significant milestone in connectivity, offering speeds and reliability that far surpass its predecessors. The implications of 5G extend beyond mere communication enhancements, facilitating the real-time data transmission necessary for the Internet of Things (IoT), autonomous vehicles, and remote healthcare services, among others. Our analysis provides insights into the 5G ecosystem, examining infrastructure challenges, regulatory landscapes, and the synergy between 5G and AI in catalyzing technological advancement.

The automotive sector is undergoing a transformative phase, with electrification, autonomous driving, and connected vehicles redefining the very essence of mobility. This report assesses how AI and 5G collectively accelerate automotive innovations, focusing on the integration of advanced driver-assistance systems (ADAS), in-vehicle infotainment, and vehicle-to-everything (V2X) communications. It also considers the implications for manufacturers, consumers, and the broader transportation infrastructure.

Memory chips, the unsung heroes of the digital age, play a crucial role in sustaining the growth of AI, 5G, and automotive technologies. As these sectors burgeon, so does the demand for faster, more efficient, and higher-capacity storage solutions. This section of the report evaluates the latest developments in memory chip technology, including DRAM, NAND, and emerging non-volatile memory technologies, highlighting their critical role in supporting the data-intensive needs of modern technologies.

In compiling this report, we aim to provide a holistic overview of how AI, 5G, the automotive sector, and advancements in memory chip technology are intricately linked, driving forward a new wave of innovation and industry growth. Through detailed market analysis, technological insights, and forward-looking projections, this report offers valuable intelligence for stakeholders across these sectors, enabling informed decision-making and strategic planning in an increasingly interconnected technological ecosystem.

About This Report

This report encompasses a broad spectrum of analyses, insights, and projections that illuminate the current state and future trajectory of these interlinked sectors. This report not only delves into individual technologies and their applications but also explores the synergies and intersections that are propelling innovation and market growth. Here's an expanded view of what such a report covers:

Artificial Intelligence (AI)

- Market Overview: Analysis of the global AI market, including size, growth trends, and forecasts. It examines key segments such as machine learning, natural language processing, and AI in robotics.

- Technology Trends: Exploration of cutting-edge AI technologies and methodologies, including deep learning, computer vision, and AI chips. The report assesses how these technologies are transforming industries.

- Application Areas: Detailed review of AI applications across various sectors, including healthcare, finance, retail, and more, highlighting case studies of successful AI integration.

- Challenges and Opportunities: Discussion on ethical considerations, data privacy issues, and the talent gap in AI. It also explores funding trends and governmental policies affecting AI development and adoption.

5G Technology

- Infrastructure and Deployment: Examination of the global rollout of 5G, including infrastructure requirements, spectrum allocation, and deployment strategies. It evaluates the progress in major regions and the challenges faced.

- Use Cases and Applications: Insight into the transformative potential of 5G across industries such as entertainment, manufacturing, and agriculture, emphasizing enhanced connectivity and IoT.

- Market Dynamics: Analysis of the competitive landscape, key players, and partnerships shaping the 5G ecosystem. It includes investment trends and regulatory impacts on market evolution.

- Future Prospects: Projection of the future of 5G, including the integration with satellite communications, development of 6G, and its role in enabling smart cities and autonomous systems.

Automotive Industry

- Electrification and Autonomous Driving: Overview of trends in electric vehicles (EVs) and autonomous driving technologies. This section covers advancements in battery technology, ADAS, and regulatory frameworks impacting vehicle automation and connectivity.

- Connectivity Solutions: Examination of the role of 5G in transforming automotive connectivity, including vehicle-to-everything (V2X) communication, in-car infotainment systems, and telematics.

- Market Players and Innovations: Analysis of leading automotive manufacturers, technology companies, and startups driving innovation in connected and autonomous vehicles.

- Sustainability and Challenges: Discussion on the automotive industry's move towards sustainability, including challenges in adoption, infrastructure development, and the impact on urban mobility.

Memory Chips

- Technology Evolution: Deep dive into the developments in memory chip technology, including DRAM, NAND flash, and emerging technologies like 3D XPoint and MRAM. It assesses the impact of these advancements on storage capacity, speed, and power efficiency.

- Industry Applications: Exploration of how memory chips support the data needs of AI, 5G, and automotive technologies, facilitating advancements in edge computing, data centers, and consumer electronics.

- Market Analysis: Review of the global memory chip market, including supply and demand dynamics, key manufacturers, and pricing trends. It also considers the impact of geopolitical factors on the semiconductor supply chain.

- Future Directions: Projections for the memory chip market, focusing on innovations in semiconductor materials, manufacturing processes, and the integration of memory technologies in next-generation computing architectures.

Table of Contents

Chapter 1. Executive Summary

Chapter 2. Automotive

- 2.1. Automotive Industry Metrics

- 2.2. Automotive Semiconductor Industry

- 2.2.1. Automotive Memory Semiconductors

- 2.2.2. Automotive Semiconductors By Type

- 2.2.2.1. Microcontrollers

- 2.2.2.2. ASSP/ASICs

- 2.2.2.3. Analog

- 2.2.2.4. Discrete

- 2.3. Key Technology And Component Suppliers

- NXP

- STMicroelectronics

- Renesas Electronics

- Nvidia

- Intel (Mobileye and Moovit)

- Skyworks

- Qualcomm

- onsemi

- Texas Instruments

- Analog Devices

- 2.4. Automotive/ Advanced Driver Assistance Systems (ADAS)

- 2.4.1. Competition from Alternative Automotive AI Chips

- Intel-Mobileye

- Qualcomm

- Nvidia

- Huawei

- Horizon Robotics

- Black SesameTechnologies

- Xin Chi Technology

- Tesla

- 2.4.1. Competition from Alternative Automotive AI Chips

- 2.5. LiDAR Sensors

- 2.5.1. LiDAR - Cost Considerations

- 2.5.2. Automotive Applications

- 2.5.3. LiDAR Suppliers

- Velodyne

- Luminar

- Aeva

- Ouster

- Innoviz

- Hesai

- Livox

- Innovusion

Chapter 3 5G

- 3.1 5G Chip Technology and Trends

- 3.2. Applications

- 3.2.1. Mobile Handsets

- 3.2.2. Interdisciplinary Connections

- 3.3. Market Analysis

- 3.3.1. Market Forecasts

- 3.3.2. New Components For 5G vs 4G

- 3.3.2.1. 5G Modem Chip Overview

- 3.3.2.2. 5G Chips

- 3.3.2.3. mmWave Modules

- 3.3.2.4. Traditional MIMO Antennas

- 3.4. 5G Chip Supplier Products and Profiles

- Analog Devices

- Anokiware

- Apple

- Broadcom

- Huawei

- Infineon

- Intel

- Inphi

- Microchip

- MediaTek

- Marvell

- M/A-Com

- NXP Semiconductor

- Onsemi

- Qualcomm

- Qorvo

- Samsung Electronics

- Sivers IMA

- Skyworks Solutions

- STMicroelectronics

- Teradyne

- Texas Instruments

- Win Semiconductors

- Xilinx

Chapter 4. Artificial Intelligence (AI)

- 4.1. AI Technology and Trends

- 4.1.1. Cloud AI Computing

- 4.1.2. Edge AI Computing

- 4.1.3. The Elements Of Artificial Intelligence

- 4.1.3.1. Importance Of Training And Inference

- 4.1.3.2. The Growing Importance Of Accelerators In Dc Spending

- 4.1.3.3. Training Costs

- 4.1.3.4. Generative AI

- 4.2. Market Analysis

- 4.2.1. AI Chip Revenue Forecast

- 4.3. Applications

- 4.3.1. Industry Applications of AI

- 4.3.1.1. Smart Healthcare

- 4.3.1.2. Smart Security

- 4.3.1.3. Smart Finance

- 4.3.1.4. Smart Grid

- 4.3.1.5. Smart Hone

- 4.3.2. AI-Powered Devices

- 4.3.2.1. Smart Speakers

- 4.3.2.2. Drones

- 4.3.2.3. Intelligent Robots

- 4.3.3. Military/Defense Applications

- 4.3.3.1. China's AI Plan

- 4.3.2.1. Driverless Vehicles

- 4.3.2.2. Computer Chips

- 4.3.2.3. Financial

- 4.3.2.4. Facial Recognition

- 4.3.2.5. Retail

- 4.3.2.6. Robots

- 4.3.3. AI Chip Revenue Forecast

- 4.3.1. Industry Applications of AI

- 4.4. AI Chip Technology

- 4.4.1. Graphics Processing Unit (GPU)

- 4.4.2. Field Programmable Gate Array (FPGA)

- 4.4.3. Application Specific Integrated Circuits (ASIC)

- 4.4.4. Neuromorphic Chips

- 4.4.5. Data Processing Units (DPUs)

- 4.5. AI Chip Supplier Products and Profiles

- 4.5.1. IC Vendors

- Achronix

- AMD

- Ampere

- Biren Technology

- Flex Logix

- IBM

- Intel

- MediaTek

- Nvidia

- NXP

- Qualcomm

- Rockchip

- Samsung Electronics

- STMicroelectronics

- Tentsorrent

- Xilinx

- 4.5.2. Cloud Providers - Tech Leaders

- Alibaba

- Alibaba Cloud

- Amazon

- Apple

- Baidu

- Meta

- Fujitsu

- Huawei Cloud

- Microsoft

- Nokia

- Tencent Cloud

- Tesla

- 4.5.3. IP Vendors

- ARM

- CEVA

- Imagination

- VeriSilicon

- Videantis

- 4.5.4. Startups Worldwide

- Adapteva

- aiCTX

- AImotive

- AlphaICs

- Anari AI

- Blaize

- BrainChip

- Cerebras Systems

- Cornami

- DeepScale

- Anari AI

- Esperanto Technologies

- Graphcore

- GreenWaves Technology

- Groq

- Hailo AI

- KAIST

- Kalray

- Kneron

- Knowm

- Koniku

- Mythic

- SambaNova Systems

- Tachyum

- Via

- deantis

- Wave Computing

- 4.5.5. Startups in China

- AISpeech

- Bitmain

- Cambricon

- Chipintelli

- DeePhi Tech

- Horizon Robotics

- NextVPU

- Rokid

- Thinkforce

- Unisound

- 4.5.1. IC Vendors

Chapter 5. Memory Chips

- 5.1. Memory Technology and Trends

- 5.1.1. DRAM

- 5.1.2. NAND

- 5.1.3. NVRAM - MRAM, RRAM, and FERAM

- 5.2. Applications

- 5.2.1. DRAM

- 5.2.1.1. Server

- 5.2.1.2. PC

- 5.2.1.3. Graphics

- 5.2.1.4. Mobile

- 5.2.1.5. Consumer

- 5.2.2. NAND

- 5.2.2.1. SSD

- 5.2.2.2. PC

- 5.2.2.3. TV

- 5.2.2.4. Mobile

- 5.2.2.5. USB

- 5.2.1. DRAM

- 5.3. Market Analysis

- 5.4. Memory Chip Supplier Products and Profiles

- CXMT

- Fujian

- GigaDevice Semiconductor

- Intel

- Micron Technology

- Nanya

- Powerchip Technology

- Samsung Electronics

- SK Hynix

- Toshiba (Kloxia)

- Tsinghua Chongqing

- Western Digital

- Winbond

- YMTC

List of Figures

- 1.1. IC Market By Revenue By Type By Quarter 2019-2023

- 1.2. IC Market By Units By Type By Quarter 2019-2023

- 1.3. IC Market By Asps By Type By Quarter 2019-2023

- 1.4. Smartphone And PC Unit Shipments By Quarter 2022-2023

- 1.5. Smartphone And PC Unit Shipments By Year 2021-2024

- 1.6. PC Semiconductor Market Forecast 2015-2026

- 1.7. Logic Revenues By Quarter 2019-2023

- 1.8. Memory Revenues By Quarter 2019-2023

- 1.9. Memory Units By Quarter 2019-2023

- 1.10. Memory ASPs By Quarter 2019-2023

- 2.1. Semiconductor Content Per Vehicle Forecast

- 2.2. Key Applications Of Semiconductors In An Automobile

- 2.3. Diagram Of Automotive Memory Needs

- 2.4. Automotive Memory Market Share

- 2.5. Automotive Semiconductor Market Share

- 2.6. Average Semiconductor Content Per Car By Level Of Automation

- 2.7. Automotive Imaging Segments

- 2.8. Five Levels Of Autonomous Driving

- 3.1. RF Chip Market Forecast By Network Generation

- 4.1. Performance Comparison Of TPU, GPU, And CPU

- 4.2. Artificial Intelligence Market Share by Chip Type 2022 and 2023

- 4.3. AI Training And Inference

- 4.4. AI Training And Inference Chip Forecast

- 4.5. AI Training And Inference Chip Forecast By Type

- 4.6. Total Top Global Defense Company M&A 2013-2020

- 5.1. DRAM Scaling

- 5.2. DRAM Memory Shrink Roadmap

- 5.3. 3D-NAND Memory Shrink Roadmap

- 5.4. Transition From SLC To QLC

- 5.5. Comparison Of Non-Volatile Ram Write Times

- 5.6. Competition In Dissipation Speed And Memory Capacity

- 5.7. DRAM Content Of Chinese Smartphones

- 5.8. NAND Content Of Chinese Smartphones

- 5.9. Total Available Market For SST MRAM

- 5.10. Total Available Market For Toggle MRAM

List of Tables

- 1.2. Smartphone Unit Shipment Forecast 2019-2026

- 1.3. Smartphone Semiconductor Content Forecast 2019-2026

- 1.4. Smartphone Semiconductor Market By Revenue 2019-2026

- 1.5. Smartphone Semiconductor Revenue Content 2019-2026

- 1.6. Smartphone Dram ASPs Forecast 2019-2026

- 1.7. Smartphone Nand ASPs Forecast 2019-2026

- 1.8. PC Market Forecast By Type 2019-2026

- 1.9. PC Semiconductor Market Forecast 2019-2026

- 1.10. PC Memory Revenue Market Forecast 2019-2026

- 1.11. PC Memory Gb Market Forecast By Type 2019-2026

- 1.12. Server Market Forecast 2019-2026

- 1.13. Server Semiconductor Market Forecast 2019-2026

- 1.14. Server Memory Revenue Market Forecast 2019-2026

- 1.15. Server GPU Revenue Market Forecast 2019-2026

- 2.1. EV Shipment Forecast By Region 2018-2025

- 2.2. ICE Auto Shipment Forecast By Region 2018-2025

- 2.3. Automotive Semiconductor Sales Forecast 2019-2025

- 2.4. Automotive Semiconductor Sales By Company 2022-2024

- 2.5. Top Automotive Semiconductor Sales By Customer 2021-2022

- 2.6. SOC Autopilot Chip Versions

- 2.7. Functionality Comparison Of Sensor Modalities

- 2.8. Differences Among Lidar Devices

- 2.9. Major Lidar Companies

- 3.1. Feature Comparison Of Smartphone PAs By Generation

- 3.2. 5G Subscriptions

- 3.3. Smartphone Forecast By Geographic Region

- 3.4. Smartphone Subscription Forecast By Technology

- 3.5. 5G Smartphone Forecast By Geographic Region

- 3.6. 5G Smartphone Mobile Semiconductor Forecast

- 3.7. 5G Semiconductor Total Available Market Forecast

- 3.8. 5G Smartphone Shipment By Major OEMs

- 3.9. 5G Smartphone Penetration By Country

- 3.10. Mobile Subscriptions By Region

- 3.11. Smartphone Subscriptions By Region

- 3.12. LTE Subscriptions By Region

- 3.13. 5G Subscriptions By Region

- 3.14. Data Traffic Per Smartphone By Region

- 3.15. Mobile Data Traffic By Region

- 4.1. Artificial Intelligence Market Forecast By Chip Type 2019-2026

- 4.2. AI Training And Inference Chip Forecast

- 4.3. AI Chip Forecast By Chip Type

- 4.4. Characteristics Of CPU, FPGA, CCPU, and ASIC

- 4.5. Characteristics Of CPU, FPGA, CCPU, and ASIC

- 4.6. Smart Speaker Products

- 5.1. Comparison Of Non-Volatile RAM Technology

- 5.2. Total DRAM Industry Revenue Forecast 2019-2026

- 5.3. Total DRAM Bit Shipment Revenue Forecast 2019-2026

- 5.4. Total DRAM Blended ASP ($/GB) Revenue Forecast 2015-2026

- 5.5. Total DRAM Bit Supply Forecast 2019-2026

- 5.6. DRAM Revenue By End Market Forecast 2019-2026

- 5.7. DRAM Capacity By Company Forecast 2018-2024

- 5.8. DRAM Revenue By Company Forecast 2018-2024

- 5.9. Total NAND Industry Revenue Forecast 2019-2026

- 5.10. Total NAND Bit Shipment Revenue Forecast 2019-2026

- 5.11. Total NAND Blended ASP ($/Gb) Revenue Forecast 2019-2026

- 5.12. Total NAND Bit Supply Forecast 2019-2026

- 5.13. NAND Revenue By End Market Forecast 2019-2026

- 5.14. NAND Capacity By Company Forecast 2018-2024

- 5.15. NAND Revenue By Company Forecast 2018-2024