|

市場調查報告書

商品編碼

1698510

介面 IC 市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Interface IC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

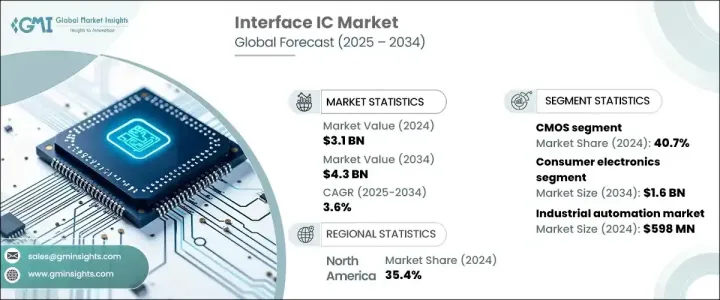

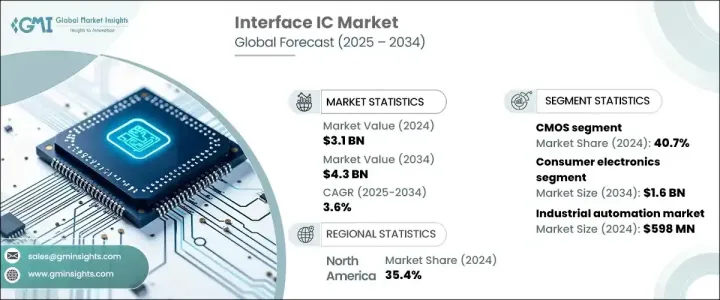

全球介面 IC 市場規模在 2024 年將持續達到 31 億美元的估值,預計在 2025 年至 2034 年期間的複合年成長率為 3.6%。對無縫連接、高速資料傳輸和節能電子系統的需求不斷成長,正在推動主要行業的擴張。隨著技術進步的加速,介面 IC 正在成為下一代設備中必不可少的組件,最佳化即時資料交換並提高整體系統效能。數位轉型、自動化和連網設備的日益普及進一步推動了對先進介面 IC 解決方案的需求。

介面 IC 在汽車應用中的滲透率不斷提高是一個重要的成長因素,尤其是隨著向電動車 (EV) 和自動駕駛技術的快速轉變。這些組件在管理電子通訊和安全系統方面發揮關鍵作用,確保車輛網路內可靠、高效的資料傳輸。先進駕駛輔助系統(ADAS)的擴展和高性能資訊娛樂解決方案的整合進一步凸顯了介面IC在汽車領域日益成長的重要性。此外,隨著企業尋求提高營運效率和降低能源消耗,工業自動化和智慧製造流程繼續推動需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 31億美元 |

| 預測值 | 43億美元 |

| 複合年成長率 | 3.6% |

影響介面 IC 市場的另一個主要促進因素是對高速資料傳輸技術的日益依賴。隨著智慧家庭自動化、物聯網 (IoT) 設備和高解析度顯示器的普及,對高效能訊號完整性和低功耗解決方案的需求也越來越大。電信、消費性電子和工業自動化等產業嚴重依賴介面 IC 來確保跨多個系統的資料順暢流動,從而實現先進的功能和增強的連接性。隨著產業向 5G 網路和人工智慧系統轉型,高效能介面 IC 的採用率將大幅上升。

從技術面來看,市場分為CMOS、雙極和BiCMOS介面IC。 CMOS 技術在 2024 年佔據該領域的首位,佔有 40.7% 的市場佔有率,這主要歸功於其在消費性電子、汽車和工業自動化領域的廣泛應用。該細分市場在 2023 年的價值達到 12 億美元,這得益於其成本效益、低功耗和高速資料傳輸能力。隨著製造商優先考慮能源效率和緊湊設計,對基於 CMOS 的介面 IC 的需求持續激增。

根據最終用戶,市場分為消費性電子、汽車、工業自動化、電信和其他。預計到 2034 年,消費性電子產品將創造 16 億美元的產值,並繼續保持其作為市場成長主要驅動力的強勁地位。 2024年,該細分市場佔全球介面IC市場的36.2%。智慧家庭自動化的日益普及、對高解析度 OLED 和 AMOLED 顯示器的需求不斷成長以及連網設備的廣泛使用促進了該領域的擴張。隨著穿戴式裝置、無線充電解決方案和下一代顯示技術的普及,介面 IC 在消費性電子產品中的作用仍然至關重要。

受配備 ADAS 的汽車和電動車強勁需求的推動,美國介面 IC 市場規模到 2024 年將達到 8.431 億美元。數位轉型和工業自動化領域的投資不斷增加,正在加速市場擴張。隨著電子系統的快速發展和對高效能資料傳輸的需求不斷成長,介面 IC 在多個行業的採用率持續上升。半導體製造商的強大影響力和通訊技術的不斷進步進一步加強了該地區市場的成長軌跡。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 消費性電子產品的擴張

- 汽車技術的進步

- 工業自動化的成長

- 電信基礎設施的擴展

- 產業陷阱與挑戰

- 科技快速進步

- 整合和相容性問題

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按介面類型,2021 年至 2034 年

- 主要趨勢

- 模擬

- 數位的

- 混合訊號

第6章:市場估計與預測:依介面標準,2021 年至 2034 年

- 主要趨勢

- 序列

- 平行線

- 高速

第7章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 互補金屬氧化物半導體

- 雙極

- BiCMOS

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 消費性電子產品

- 汽車

- 工業自動化

- 電信

- 其他

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Allegro Microsystems

- Analog Devices, Inc.

- Broadcom Inc.

- Cirrus Logic, Inc.

- Diodes Incorporated

- Elmos Semiconductor SE

- IBS Electronic Group

- Ivelta

- Mouser Electronics, Inc.

- Nuvoton Technology Corporation

- NXP Semiconductors NV

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- ROHM Semiconductor

- SEIKO Epson Corporation

- Silicon Labs

- STMicroelectronics NV

- Symmetry Electronics

- Texas Instruments Incorporated

- Toshiba Corporation

The Global Interface IC Market continues to reach a valuation of USD 3.1 billion in 2024 and is projected to grow at a CAGR of 3.6% between 2025 and 2034. Increasing demand for seamless connectivity, high-speed data transmission, and energy-efficient electronic systems is driving expansion across key industries. As technological advancements accelerate, interface ICs are becoming essential components in next-generation devices, optimizing real-time data exchange and enhancing overall system performance. The increasing adoption of digital transformation, automation, and connected devices is further fueling the need for advanced interface IC solutions.

The rising penetration of interface ICs in automotive applications is a significant growth factor, particularly with the rapid shift toward electric vehicles (EVs) and autonomous driving technology. These components play a critical role in managing electronic communication and safety systems, ensuring reliable and efficient data transmission within vehicle networks. The expansion of advanced driver assistance systems (ADAS) and the integration of high-performance infotainment solutions further underscore the growing importance of interface ICs in the automotive sector. Additionally, industrial automation and smart manufacturing processes continue to drive demand as businesses seek to improve operational efficiency and reduce energy consumption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $4.3 Billion |

| CAGR | 3.6% |

Another major driver shaping the interface IC market is the increasing reliance on high-speed data transmission technologies. With the proliferation of smart home automation, Internet of Things (IoT) devices, and high-resolution displays, there is a greater need for efficient signal integrity and low-power consumption solutions. Industries such as telecommunications, consumer electronics, and industrial automation rely heavily on interface ICs to ensure smooth data flow across multiple systems, enabling advanced functionalities and enhanced connectivity. As industries transition toward 5G networks and AI-powered systems, the adoption of high-performance interface ICs is set to rise significantly.

In terms of technology, the market is segmented into CMOS, Bipolar, and BiCMOS interface ICs. CMOS technology led the segment in 2024, holding a 40.7% market share, primarily due to its widespread application in consumer electronics, automotive, and industrial automation. The segment accounted for USD 1.2 billion in 2023, driven by its cost-effectiveness, low power consumption, and high-speed data transfer capabilities. As manufacturers prioritize energy efficiency and compact design, the demand for CMOS-based interface ICs continues to surge.

By end-user, the market is categorized into consumer electronics, automotive, industrial automation, telecommunications, and others. Consumer electronics is anticipated to generate USD 1.6 billion by 2034, maintaining its strong position as a key driver of market growth. In 2024, this segment accounted for 36.2% of the global interface IC market. The increasing adoption of smart home automation, growing demand for high-resolution OLED and AMOLED displays, and the expanding use of connected devices contribute to the segment's expansion. With the proliferation of wearables, wireless charging solutions, and next-generation display technologies, the role of interface ICs in consumer electronics remains pivotal.

The United States interface IC market reached USD 843.1 million in 2024, driven by robust demand for ADAS-equipped vehicles and EVs. Increased investment in digital transformation and industrial automation is accelerating market expansion. With the rapid evolution of electronic systems and the growing need for efficient data transfer, the adoption of interface ICs continues to rise across multiple industries. The strong presence of semiconductor manufacturers and continuous advancements in communication technologies further reinforce the market growth trajectory in the region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of consumer electronics

- 3.2.1.2 Advancements in automotive technology

- 3.2.1.3 Growth in industrial automation

- 3.2.1.4 Expansion of telecommunication infrastructure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Rapid technological advancements

- 3.2.2.2 Integration and compatibility issues

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type of Interface, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Analog

- 5.3 Digital

- 5.4 Mixed-Signal

Chapter 6 Market Estimates and Forecast, By Interface Standard, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Serial

- 6.3 Parallel

- 6.4 High-Speed

Chapter 7 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 CMOS

- 7.3 Bipolar

- 7.4 BiCMOS

Chapter 8 Market Estimates and Forecast, By End-Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.3 Automotive

- 8.4 Industrial automation

- 8.5 Telecommunications

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.3.7 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Allegro Microsystems

- 10.2 Analog Devices, Inc.

- 10.3 Broadcom Inc.

- 10.4 Cirrus Logic, Inc.

- 10.5 Diodes Incorporated

- 10.6 Elmos Semiconductor SE

- 10.7 IBS Electronic Group

- 10.8 Ivelta

- 10.9 Mouser Electronics, Inc.

- 10.10 Nuvoton Technology Corporation

- 10.11 NXP Semiconductors N.V.

- 10.12 ON Semiconductor Corporation

- 10.13 Renesas Electronics Corporation

- 10.14 ROHM Semiconductor

- 10.15 SEIKO Epson Corporation

- 10.16 Silicon Labs

- 10.17 STMicroelectronics N.V.

- 10.18 Symmetry Electronics

- 10.19 Texas Instruments Incorporated

- 10.20 Toshiba Corporation