|

市場調查報告書

商品編碼

1928882

可再生柴油市場機會、成長要素、產業趨勢分析及預測(2026-2035)Renewable Diesel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

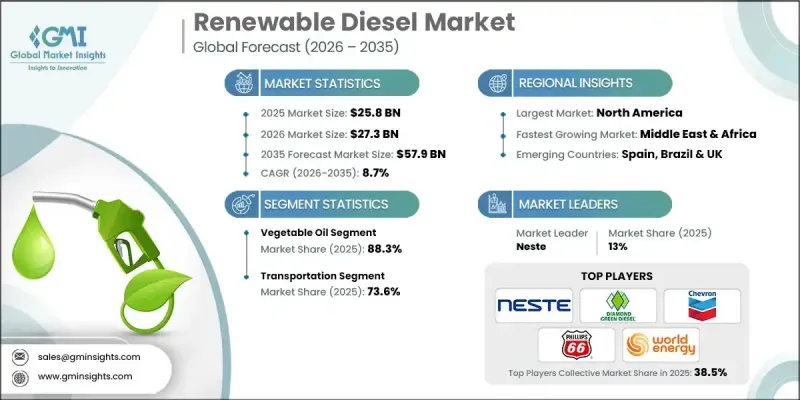

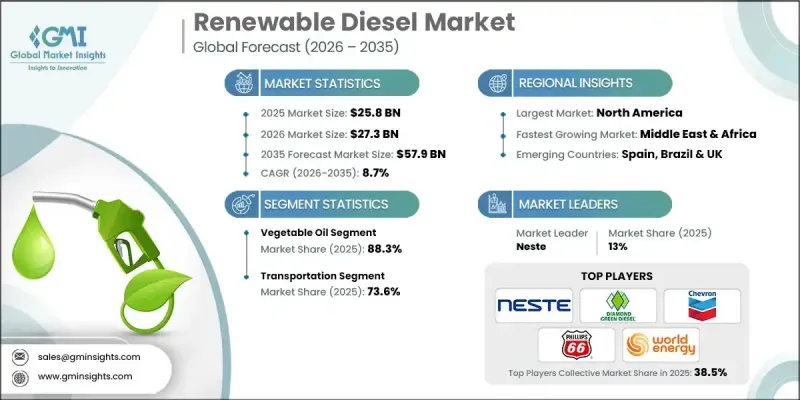

全球可再生柴油市場預計到 2025 年價值 258 億美元,到 2035 年將達到 579 億美元,年複合成長率為 8.7%。

全球對低生命週期溫室氣體排放燃料的需求不斷成長,並持續加速此類燃料的普及。可再生柴油因其與現有柴油引擎和燃料分配系統的兼容性而備受關注,無需大量資本投資即可實現平穩過渡。各國政府、各產業和車隊營運商日益重視兼顧排放和運作可靠性的能源解決方案。可再生柴油被視為增強燃料安全、應對氣候變遷的策略選擇。有利的法規結構,加上原油市場波動和地緣政治不確定性,進一步凸顯了對多元化、國產替代燃料的需求。可再生柴油卓越的性能特性以及在不犧牲效率的前提下滿足監管和企業永續性要求的能力,吸引了能源生產商的日益關注,進一步推動了市場發展。這些因素共同促成了可再生柴油在全球轉型為低碳能源系統的核心地位。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 258億美元 |

| 預測金額 | 579億美元 |

| 複合年成長率 | 8.7% |

可再生柴油是一種利用生質能資源生產的低碳燃料,其化學性質與傳統柴油相同。這使得現有基礎設施能夠立即投入使用,同時有助於實現排放和增強能源韌性的目標。政策支持和監管獎勵持續推動再生柴油在多個終端用戶領域的研發和應用,旨在減少對石油基燃料的依賴。

預計到2025年,植物油原料市佔率將達到88.3%,到2035年將以9.9%的複合年成長率成長。對可再生和永續原料日益成長的需求將支撐該領域的持續主導地位,因為這些原料符合脫碳目標,並且當採用先進的煉油技術加工時,其性能特徵可與傳統柴油燃料相媲美。

2025年,交通運輸領域佔73.6%的市場佔有率,預計2026年至2035年將以8.5%的複合年成長率成長。車隊營運商正擴大採用可再生柴油,以在滿足排放目標的同時,保持可靠性和性能標準。監管合規和企業永續性措施持續推動該應用領域的需求成長。

預計到 2025 年,美國可再生柴油市場將佔市場佔有率的 90.3%,到 2035 年將成長至 263 億美元。強力的政策支持和法規結構繼續推動多個行業採用低碳燃料,從而加強了可再生柴油作為石油基燃料可行替代品的地位。

目錄

第1章調查方法和範圍

- 初步研究和檢驗

- 部分原始資訊(但不限於此)

- 資料探勘資訊來源

- 付費資訊來源

- 區域資訊來源

- 調查過程和評估因素

- 研究軌跡的要素

- 評分組成部分

- 有關研究透明度的更多資訊

- 資訊來源歸屬框架

- 品質保證指標

- 對信任的承諾

- 市場定義

第2章執行摘要

第3章業界考察

- 產業生態系統

- 原物料供應及採購分析

- 製造能力評估

- 供應鏈韌性與風險因素

- 配電網路分析

- 監管環境

- 產業影響因素

- 促進要素

- 產業潛在風險與挑戰

- 成長潛力分析

- 成本結構分析

- 波特分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

- 新的機會與趨勢

- 數位化和物聯網整合

- 拓展新興市場

- 投資分析及未來展望

第4章 競爭情勢

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀錶板

- 策略舉措

- 企業標竿管理

- 創新與科技趨勢

第5章 市場規模及預測:依原料分類,2021-2034年

- 動物脂肪和油脂

- 植物油

- 其他

第6章 依應用領域分類的市場規模及預測(2021-2034年)

- 運輸

- 發電

- 其他

第7章 2021-2034年各地區市場規模及預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 西班牙

- 英國

- 義大利

- 亞太地區

- 中國

- 印度

- 印尼

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- BP

- Cargill

- Carolina Renewable Products

- Chevron

- Diamond Green Diesel

- Eni

- Gevo

- HollyFrontier

- Imperial Oil

- LanzaJet

- Marathon Petroleum

- Neste

- Petrobras

- Phillips 66

- Preem AB

- Repsol

- Shell

- TotalEnergies

- Valero

- World Energy

The Global Renewable Diesel Market was valued at USD 25.8 billion in 2025 and is estimated to grow at a CAGR of 8.7% to reach USD 57.9 billion by 2035.

Rising global demand for fuels with lower lifecycle greenhouse gas emissions is continuing to accelerate their adoption. Renewable diesel gains strong momentum due to its compatibility with existing diesel engines and fuel distribution systems, which supports a smooth transition without requiring large capital investments. Governments, industries, and fleet operators increasingly prioritize energy solutions that balance emissions reduction with operational reliability. Renewable diesel is positioned as a strategic option for enhancing fuel security while addressing climate commitments. Supportive regulatory frameworks, combined with volatile crude oil markets and geopolitical uncertainty, reinforce the need for diversified and domestically sourced fuel alternatives. The market also benefits from growing interest among energy producers due to renewable diesel's strong performance characteristics and its ability to meet regulatory and corporate sustainability requirements without compromising efficiency. These combined factors establish renewable diesel as a central component of the global transition toward lower-carbon energy systems.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $25.8 Billion |

| Forecast Value | $57.9 Billion |

| CAGR | 8.7% |

Renewable diesel is described as a low-carbon fuel produced from biomass-based resources and offers chemical equivalence to conventional diesel. This allows immediate use across existing infrastructure while supporting emissions reduction and energy resilience goals. Policy support and regulatory incentives continue to strengthen development activity and encourage adoption across multiple end-use sectors seeking to reduce dependence on petroleum-based fuels.

The vegetable oil feedstock segment accounted for 88.3% share in 2025 and is projected to grow at a CAGR of 9.9% through 2035. Rising demand for renewable and sustainable inputs supports the continued dominance of this segment, as such feedstocks align with decarbonization objectives and deliver performance characteristics comparable to traditional diesel when processed through advanced refining technologies.

The transportation segment held 73.6% share in 2025 and is forecast to grow at a CAGR of 8.5% from 2026 to 2035. Fleet operators increasingly adopt renewable diesel to meet emissions targets while maintaining reliability and performance standards. Regulatory compliance and corporate sustainability commitments continue to strengthen demand within this application segment.

United States Renewable Diesel Market held 90.3% share in 2025 and is expected to generate USD 26.3 billion by 2035. Strong policy support and regulatory frameworks continue to incentivize low-carbon fuel adoption across multiple industries, reinforcing renewable diesel's role as a practical alternative to petroleum-based fuels.

Prominent companies active in the Global Renewable Diesel Market include Neste, Valero, Chevron, Shell, World Energy, TotalEnergies, BP, Phillips 66, Marathon Petroleum, Repsol, Diamond Green Diesel, Preem AB, Cargill, Eni, Gevo, Imperial Oil, Petrobras, LanzaJet, HollyFrontier, and Carolina Renewable Products. Companies operating in the Renewable Diesel Market strengthen their market position through capacity expansion, strategic partnerships, and investment in advanced refining technologies. Many players focus on securing long-term feedstock supply agreements to ensure production stability and cost control. Geographic expansion and integration across the value chain help improve market access and resilience. Firms also emphasize regulatory compliance and certification to align with evolving sustainability standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.1.1 Quantified market impact analysis

- 1.3.1.1.1 Mathematical impact of growth parameters on forecast

- 1.3.1.1 Quantified market impact analysis

- 1.3.2 Scenario analysis framework

- 1.3.1 Key trends for market estimates

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Feedstock trends

- 2.4 Application trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Cost structure analysis

- 3.6 Porter';s analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

- 3.8 Emerging opportunities & trends

- 3.8.1 Digitalization & IoT integration

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis and future outlook

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Feedstock, 2021 - 2034 (USD Billion & MT)

- 5.1 Key trends

- 5.2 Animal Fat

- 5.3 Vegetable Oil

- 5.4 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion & MT)

- 6.1 Key trends

- 6.2 Transportation

- 6.3 Power Generation

- 6.4 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion & MT)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Spain

- 7.3.4 UK

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Indonesia

- 7.4.4 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 BP

- 8.2 Cargill

- 8.3 Carolina Renewable Products

- 8.4 Chevron

- 8.5 Diamond Green Diesel

- 8.6 Eni

- 8.7 Gevo

- 8.8 HollyFrontier

- 8.9 Imperial Oil

- 8.10 LanzaJet

- 8.11 Marathon Petroleum

- 8.12 Neste

- 8.13 Petrobras

- 8.14 Phillips 66

- 8.15 Preem AB

- 8.16 Repsol

- 8.17 Shell

- 8.18 TotalEnergies

- 8.19 Valero

- 8.20 World Energy