|

市場調查報告書

商品編碼

1913477

儲存槽市場機會、成長要素、產業趨勢分析及2026年至2035年預測Storage Tank Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

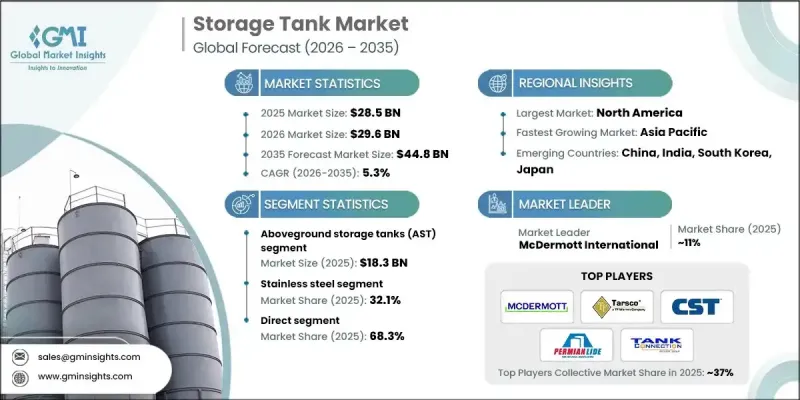

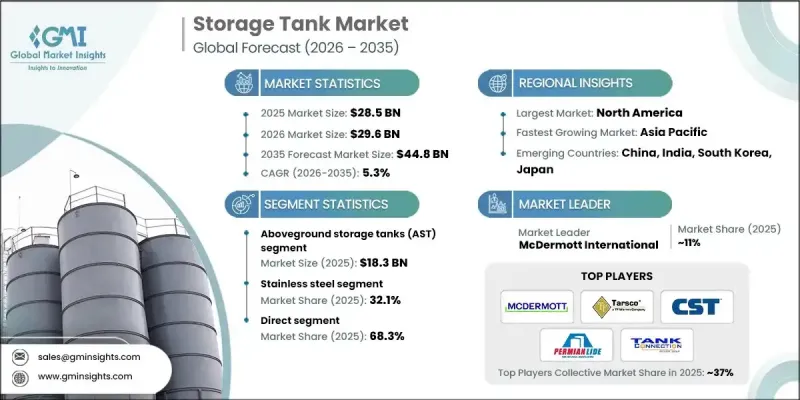

全球儲存槽市場預計到 2025 年將價值 285 億美元,到 2035 年將達到 448 億美元,年複合成長率為 5.3%。

全球能源和加工基礎設施的持續發展支撐著市場擴張。資源開採、加工和下游業務活動的活性化,持續推動對大型儲槽解決方案的需求,以確保安全儲存和營運連續性。工業運營商優先考慮耐用、耐腐蝕的儲罐系統,以確保資產可靠性和合規性。儲存槽在庫存管理、供應連續性和整體流程最佳化中發揮著至關重要的作用。煉油和加工設施能源消費量的成長和產能的擴張,推動了強勁的採購活動。先進工業園區的建造也增加了對適用於嚴苛運作條件的儲槽的需求。與能源相關發展同步,對基礎設施韌性和長期資產性能的日益重視,正在影響多個終端用戶行業的採購決策。隨著工業化進程的加快和環境監管標準的不斷完善,對高效、耐用且擴充性的儲罐系統的需求持續成長,這將推動儲存槽市場實現長期穩定的成長。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 285億美元 |

| 預測金額 | 448億美元 |

| 複合年成長率 | 5.3% |

污水處理和回收基礎設施的成長也推動了市場擴張。處理設施需要大容量儲槽來有效管理流體和處理原料。長期營運績效促使企業投資於具有強耐環境劣化的材料。有效的儲存解決方案有助於確保處理效果的穩定性,並幫助設施符合環境標準。同時,不斷擴大的回收活動也推動了對可回收材料安全儲存的需求。

預計到2025年,地上儲存槽市場規模將達到183億美元,並在2026年至2035年間以5.4%的複合年成長率成長。由於安裝流程簡便、易於檢查和維護,該細分市場持續受到歡迎。這些系統廣泛應用於工業、市政和商業環境,材料選擇主要考慮長期耐久性和環境適應性。

預計到2025年,銷售管道將佔據68.3%的市場佔有率,並在2035年之前以5.4%的複合年成長率成長。直接與製造商合作可獲得客製化的系統設計、高效的交貨時間和專業的技術支援。這種採購模式允許客戶根據自身俱體的營運和監管要求客製化儲罐規格。

美國儲存槽市場預計到2025年將達到69億美元。對製造、基礎設施和加工設施的持續投資正在支撐市場成長。對專為工業液體和受監管應用而設計的高級儲存系統的強勁需求預計將推動市場在2035年之前穩步擴張。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 產業影響因素

- 促進要素

- 石油天然氣和石化基礎設施計劃的擴建

- 污水處理和回收設施的成長

- 都市化和人口成長導致對儲水的需求不斷增加

- 挑戰與困難

- 大容量客製化儲存槽的初始投資成本很高

- 長期使用過程中發生的腐蝕和材料劣化

- 機會

- 對模組化和預製儲存槽解決方案的需求不斷成長

- 先進塗層和複合材料的廣泛應用

- 促進要素

- 成長潛力分析

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 監管環境

- 標準和合規要求

- 區域法規結構

- 認證標準

- 貿易統計(HS編碼-7309)

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL 分析

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章 依產品類型分類的市場估算與預測,2022-2035年

- 危險品儲存槽

- 非危險物質儲存槽

6. 按安裝類型分類的市場估算與預測,2022-2035 年

- 地上儲存槽(AST)

- 地下儲存槽(UST)

第7章 按材料分類的市場估算與預測,2022-2035年

- 不銹鋼

- 聚乙烯

- 玻璃纖維

- 具體的

- 其他

第8章 依最終用途產業分類的市場估算與預測,2022-2035年

- 石油和天然氣產業

- 化工

- 供水和污水處理

- 食品飲料業

- 製藥業

- 其他

9. 2022-2035年按分銷管道分類的市場估算與預測

- 直銷

- 間接

第10章 2022-2035年各地區市場估計與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第11章 公司簡介

- Caldwell Tanks

- CST Industries

- Fox Tank Company

- Highland Tank &Manufacturing Company

- McDermott International

- Motherwell Bridge Industries

- PermianLide

- Pfaudler Group

- Snyder Industries

- Superior Tank Co.

- Synalloy Corporation

- Tank Connection

- Tarsco

- Worthington Industries

- ZCL Composites

The Global Storage Tank Market was valued at USD 28.5 billion in 2025 and is estimated to grow at a CAGR of 5.3% to reach USD 44.8 billion by 2035.

Market expansion is supported by ongoing development of energy and processing infrastructure worldwide. Rising activity across resource extraction, processing, and downstream operations continues to create sustained demand for large-scale storage solutions designed for safe containment and operational continuity. Industrial operators are prioritizing long-lasting and corrosion-resistant tank systems to ensure asset reliability and regulatory compliance. Storage tanks play a critical role in inventory control, uninterrupted supply management, and overall process optimization. Increasing energy consumption and capacity additions across refining and processing facilities are generating consistent procurement activity. The construction of advanced industrial complexes is also supporting demand for engineered tanks suitable for challenging operating conditions. Alongside energy-related development, greater attention to infrastructure resilience and long-term asset performance is influencing purchasing decisions across multiple end-use sectors. As industrialization progresses and environmental compliance standards evolve, the need for efficient, durable, and scalable storage systems continues to rise, positioning the storage tank market for steady long-term growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $28.5 Billion |

| Forecast Value | $44.8 Billion |

| CAGR | 5.3% |

Growth in wastewater treatment and recycling infrastructure is also supporting market expansion. Treatment and processing facilities require large-capacity tanks to manage fluids and treatment inputs efficiently. Long-term operational performance is encouraging investment in materials that offer strong resistance to environmental degradation. Effective storage solutions support consistent processing outcomes and help facilities align with environmental standards, while expanded recycling initiatives are increasing the need for safe containment of reclaimed resources.

The aboveground storage tanks generated USD 18.3 billion in 2025 and is expected to grow at a CAGR of 5.4% between 2026 and 2035. This segment continues to attract demand due to simplified installation processes, accessibility for inspection, and ease of ongoing maintenance. These systems are widely adopted across industrial, municipal, and commercial environments, with material selection focused on long-term durability and environmental resistance.

The direct distribution channel held a 68.3% share in 2025 and is forecast to grow at a CAGR of 5.4% through 2035. Direct engagement with manufacturers enables tailored system design, efficient delivery schedules, and access to technical expertise. This purchasing model allows customers to align tank specifications closely with operational and regulatory requirements.

U.S. Storage Tank Market accounted for USD 6.9 billion in 2025. Growth is supported by continued investment across processing, infrastructure, and treatment facilities. Demand remains strong for advanced storage systems designed for industrial liquids and regulated applications, reinforcing steady market expansion through 2035.

Major companies active in the Global Storage Tank Market include CST Industries, Worthington Industries, Caldwell Tanks, McDermott International, Tank Connection, ZCL Composites, Superior Tank Co., Pfaudler Group, Synalloy Corporation, Fox Tank Company, Tarsco, Snyder Industries, PermianLide, Motherwell Bridge Industries, and Highland Tank & Manufacturing Company. Companies in the Storage Tank Market are strengthening their competitive position through capacity expansion, product customization, and material innovation. Manufacturers are investing in advanced fabrication technologies to improve durability, corrosion resistance, and lifecycle performance. Strategic partnerships with industrial clients support long-term supply agreements and repeat business. Geographic expansion and localized manufacturing are being used to reduce delivery timelines and enhance customer responsiveness. Firms are also focusing on compliance-driven designs to meet evolving safety and environmental standards. Enhanced aftersales support, including maintenance and inspection services, is improving customer retention.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Installation type

- 2.2.4 Material

- 2.2.5 End Use industry

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of oil and gas and petrochemical infrastructure projects

- 3.2.1.2 Growth of wastewater treatment and recycling facilities

- 3.2.1.3 Rising demand for water storage due to urbanization and population growth

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 High capital cost of large-capacity and customized storage tanks

- 3.2.2.2 Corrosion and material degradation over long service periods

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand for modular and prefabricated storage tank solutions

- 3.2.3.2 Growing use of advanced coatings and composite materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS Code - 7309)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Hazardous Storage Tanks

- 5.3 Non-Hazardous Storage Tanks

Chapter 6 Market Estimates & Forecast, By Installation Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Aboveground storage tanks (AST)

- 6.3 Underground storage tanks (UST)

Chapter 7 Market Estimates & Forecast, By Material, 2022 - 2035, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Stainless Steel

- 7.3 Polyethylene

- 7.4 Fiberglass

- 7.5 Concrete

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2022 - 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Oil & Gas Industry

- 8.3 Chemical Industry

- 8.4 Water and Wastewater Treatment

- 8.5 Food and Beverage Industry

- 8.6 Pharmaceutical Industry

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Caldwell Tanks

- 11.2 CST Industries

- 11.3 Fox Tank Company

- 11.4 Highland Tank & Manufacturing Company

- 11.5 McDermott International

- 11.6 Motherwell Bridge Industries

- 11.7 PermianLide

- 11.8 Pfaudler Group

- 11.9 Snyder Industries

- 11.10 Superior Tank Co.

- 11.11 Synalloy Corporation

- 11.12 Tank Connection

- 11.13 Tarsco

- 11.14 Worthington Industries

- 11.15 ZCL Composites