|

市場調查報告書

商品編碼

1913436

太陽能市場機會、成長要素、產業趨勢分析及2026年至2035年預測Solar Photovoltaic (PV) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

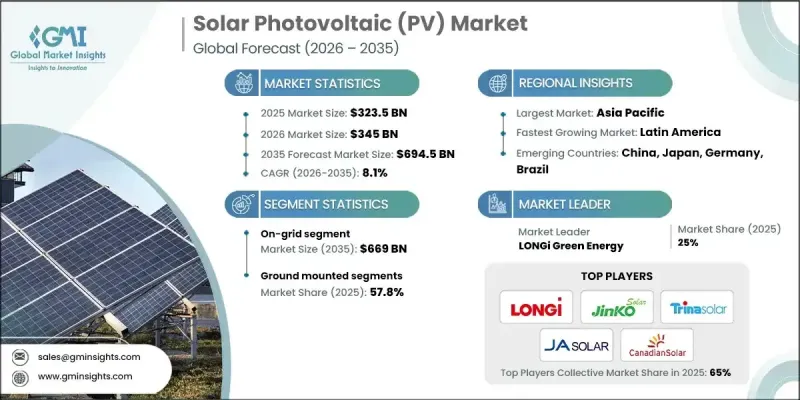

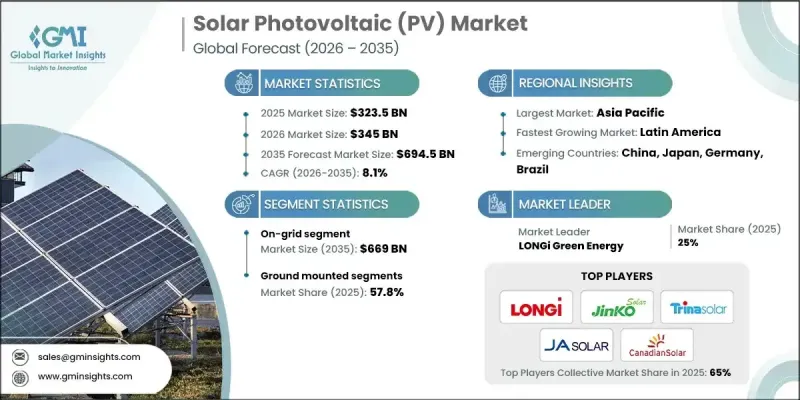

全球太陽能光電(PV)市場預計到 2025 年將達到 3,235 億美元,到 2035 年將達到 6,945 億美元,年複合成長率為 8.1%。

太陽能發電系統在農業和商業活動中的日益普及推動了市場需求,屋頂光電系統和農光互補系統在最佳化土地利用的同時,也提供了經濟高效的能源解決方案。這種雙用途模式不僅能發電,還能帶來經濟效益,促進了多個產業的應用。企業對太陽能光電製造業的投資增加和產能擴張正在推動該產業的發展。土地資源的充足、安裝成本的下降以及光伏組件效率和設計的改進,正在推動太陽能光伏的大規模部署。與傳統能源來源相比,太陽能的成本競爭力也促進了其進一步普及。此外,全球對區域太陽能光電生產的資金投入和策略性投資,以及能夠提升電網連接性、能源轉換效率和運作穩定性的新一代太陽能逆變器,都在增強市場動態,並推動太陽能在公共產業、商業和工業領域的應用。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 3235億美元 |

| 預測金額 | 6945億美元 |

| 複合年成長率 | 8.1% |

受偏遠地區電力需求成長的推動,預計2026年至2035年間,離網太陽能發電市場將以13%的複合年成長率成長。農村電氣化計畫的擴展、電池儲能技術的進步、太陽能組件成本的下降以及政府補貼等因素,都在加速離網太陽能發電的普及。此外,智慧型能源管理系統在最佳化電力使用方面的應用,也促進了離網地區的成長。

到2025年,地面光伏發電市場佔有率將達到57.8%,這得益於農業光伏一體化(AgriVolt)模式的推廣和高效土地利用策略的實施。光伏發電工程與農業的結合提高了資源利用效率,從而推動了該行業的成長。

預計到2035年,歐洲光電市場規模將達到1,345億美元,主要得益於企業為實現可再生能源目標而進行的大力投資、智慧電網解決方案的普及以及儲能能力的提升。此外,核准流程的簡化和電網韌性的增強也進一步促進了光電發電在各種應用領域的大規模併網。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 產業生態系統

- 監管環境

- 產業影響因素

- 促進要素

- 產業潛在風險與挑戰

- 成長潛力分析

- 成本結構分析

- 價格趨勢分析

- 連結性別

- 按地區

- 波特五力分析

- PESTEL 分析

第4章 競爭情勢

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東

- 非洲

- 拉丁美洲

- 戰略儀錶板

- 策略舉措

- 創新與科技趨勢

第5章 依連結方式分類的市場規模及預測(2023-2035年)

- 併網

- 離網

6. 依安裝方式分類的市場規模及預測,2023-2035年

- 地面安裝

- 屋頂安裝類型

7. 依最終用途分類的市場規模及預測(2023-2035年)

- 住宅

- 商業和工業

- 公共產業

第8章 2023-2035年各地區市場規模及預測

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 奧地利

- 挪威

- 丹麥

- 芬蘭

- 法國

- 義大利

- 瑞士

- 西班牙

- 瑞典

- 英國

- 荷蘭

- 波蘭

- 比利時

- 愛爾蘭

- 波羅的海國家

- 葡萄牙

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 馬來西亞

- 新加坡

- 泰國

- 菲律賓

- 越南

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 約旦

- 阿曼

- 科威特

- 土耳其

- 非洲

- 南非

- 埃及

- 阿爾及利亞

- 奈及利亞

- 摩洛哥

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

- 秘魯

第9章:公司簡介

- Asun Trackers

- Canadian Solar

- CsunSolarTech

- Emmvee Solar

- First Solar

- GCL-SI

- Jinko Solar

- JA Solar Technology

- LONGi

- Q CELLS

- LG Electronics

- Motech Industries

- Renesola

- REC Solar Holdings

- Risen Energy

- Solar Frontier KK

- SunPower Corporation

- Solaria Corporation

- Shunfeng International Clean Energy

- Shenzhen Shine Solar

- Su-vastika Solar

- Trina Solar

- Vikram Solar

- Yingli Solar

The Global Solar Photovoltaic (PV) Market was valued at USD 323.5 billion in 2025 and is estimated to grow at a CAGR of 8.1% to reach USD 694.5 billion by 2035.

Rising integration of solar PV systems in agricultural and commercial operations is driving demand, as rooftop installations and agrivoltaic systems optimize land use while providing cost-effective energy solutions. This dual-use approach not only generates electricity but also delivers economic benefits, encouraging adoption across multiple sectors. Growing corporate investments and capacity expansion initiatives in solar PV manufacturing are fueling industry development. Favorable land availability, declining installation costs, and improvements in panel efficiency and design are promoting utility-scale solar deployments. The cost competitiveness of solar power versus traditional sources further supports widespread adoption. Additionally, global funding and strategic investments in local solar production, along with next-generation solar inverters that enhance grid integration, energy conversion efficiency, and operational stability, strengthen market dynamics and enabling applications across utility, commercial, and industrial segments.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $323.5 Billion |

| Forecast Value | $694.5 Billion |

| CAGR | 8.1% |

The off-grid solar PV segment is anticipated to grow at a CAGR of 13% from 2026 to 2035, driven by increasing electricity demand in remote areas. Expansion of rural electrification initiatives, advancements in battery storage technology, decreasing solar component costs, and supportive government subsidies are accelerating adoption. Integration of smart energy management systems is also optimizing power usage, supporting growth in off-grid communities.

The ground-mounted solar PV segment accounted for 57.8% share in 2025, benefiting from agrivoltaic adoption and efficient land utilization strategies. Combining solar projects with agriculture enhances resource efficiency, driving sector growth.

Europe Solar Photovoltaic (PV) Market is projected to reach USD 134.5 billion by 2035, fueled by strong corporate investment in renewable energy targets, adoption of smart grid solutions, and enhanced energy storage capabilities. Streamlined permitting processes and improved grid resilience are further enabling large-scale integration of solar power across diverse applications.

Leading players operating in the Global Solar Photovoltaic (PV) Market include LONGi, First Solar, JA Solar Technology, Canadian Solar, Emmvee Solar, Jinko Solar, Q CELLS, Vikram Solar, LG Electronics, Trina Solar, Renesola, Motech Industries, SunPower Corporation, Solaria Corporation, Shunfeng International Clean Energy, CSunSolarTech, Solar Frontier, Risen Energy, Asun Trackers, Shenzhen Shine Solar, Su-vastika Solar, REC Solar Holdings, and GCL-SI. Companies in the Global Solar Photovoltaic (PV) Market are strengthening their presence by investing in advanced manufacturing technologies and improving panel efficiency and durability. Strategic collaborations with energy developers and government programs allow companies to expand regional footprints and accelerate project deployment. Firms are also focusing on R&D for next-generation inverters and smart grid-compatible solutions, optimizing system performance and reliability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2023 - 2035

- 2.2 Business trends

- 2.3 Connectivity trends

- 2.4 Mounting trends

- 2.5 End use trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Cost structure analysis

- 3.6 Price trend analysis

- 3.6.1 By connectivity

- 3.6.2 By region

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East

- 4.2.5 Africa

- 4.2.6 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Connectivity, 2023 - 2035 (USD Billion & MW)

- 5.1 Key trends

- 5.2 On grid

- 5.3 Off grid

Chapter 6 Market Size and Forecast, By Mounting, 2023 - 2035 (USD Billion & MW)

- 6.1 Key trends

- 6.2 Ground mounted

- 6.3 Roof top

Chapter 7 Market Size and Forecast, By End Use, 2023 - 2035 (USD Billion & MW)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial & industrial

- 7.4 Utility

Chapter 8 Market Size and Forecast, By Region, 2023 - 2035 (USD Billion & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Austria

- 8.3.2 Norway

- 8.3.3 Denmark

- 8.3.4 Finland

- 8.3.5 France

- 8.3.6 Italy

- 8.3.7 Switzerland

- 8.3.8 Spain

- 8.3.9 Sweden

- 8.3.10 UK

- 8.3.11 Netherlands

- 8.3.12 Poland

- 8.3.13 Belgium

- 8.3.14 Ireland

- 8.3.15 Baltics

- 8.3.16 Portugal

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 South Korea

- 8.4.4 India

- 8.4.5 Australia

- 8.4.6 Malaysia

- 8.4.7 Singapore

- 8.4.8 Thailand

- 8.4.9 Philippines

- 8.4.10 Vietnam

- 8.5 Middle East

- 8.5.1 Israel

- 8.5.2 Saudi Arabia

- 8.5.3 UAE

- 8.5.4 Jordan

- 8.5.5 Oman

- 8.5.6 Kuwait

- 8.5.7 Turkey

- 8.6 Africa

- 8.6.1 South Africa

- 8.6.2 Egypt

- 8.6.3 Algeria

- 8.6.4 Nigeria

- 8.6.5 Morocco

- 8.7 Latin America

- 8.7.1 Brazil

- 8.7.2 Argentina

- 8.7.3 Chile

- 8.7.4 Peru

Chapter 9 Company Profiles

- 9.1 Asun Trackers

- 9.2 Canadian Solar

- 9.3 CsunSolarTech

- 9.4 Emmvee Solar

- 9.5 First Solar

- 9.6 GCL-SI

- 9.7 Jinko Solar

- 9.8 JA Solar Technology

- 9.9 LONGi

- 9.10 Q CELLS

- 9.11 LG Electronics

- 9.12 Motech Industries

- 9.13 Renesola

- 9.14 REC Solar Holdings

- 9.15 Risen Energy

- 9.16 Solar Frontier KK

- 9.17 SunPower Corporation

- 9.18 Solaria Corporation

- 9.19 Shunfeng International Clean Energy

- 9.20 Shenzhen Shine Solar

- 9.21 Su-vastika Solar

- 9.22 Trina Solar

- 9.23 Vikram Solar

- 9.24 Yingli Solar