|

市場調查報告書

商品編碼

1913409

自行車變速器市場機會、成長要素、產業趨勢分析及預測(2026年至2035年)Bicycle Gear Shifter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

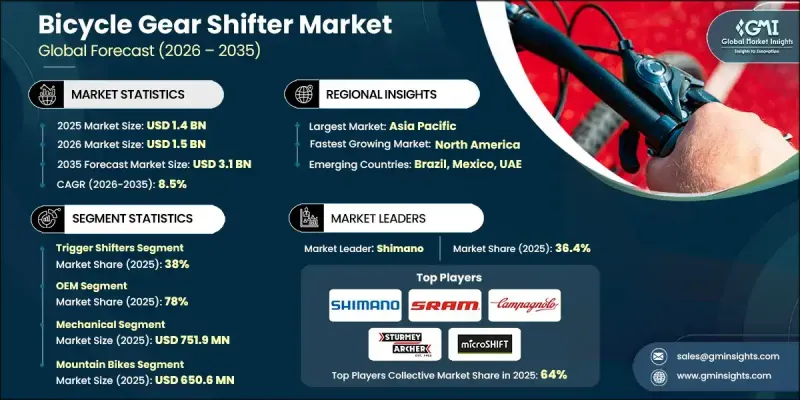

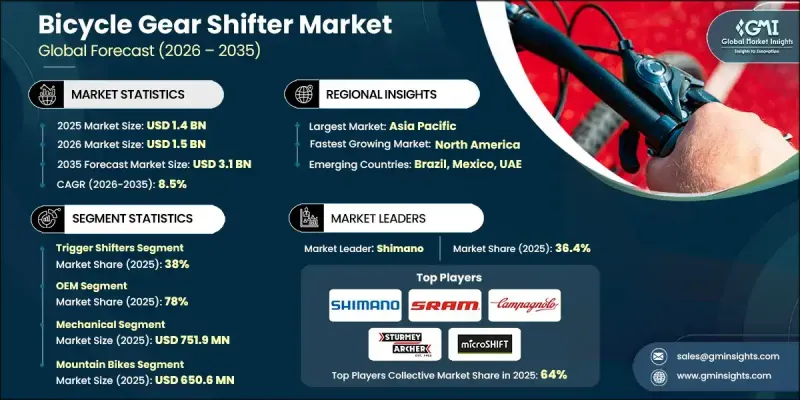

全球自行車變速器市場預計到 2025 年將達到 14 億美元,到 2035 年將達到 31 億美元,年複合成長率為 8.5%。

高性能客製化自行車的日益普及、電動自行車的廣泛應用以及休閒和通勤騎行需求的激增,共同推動了市場成長。隨著都市區和騎乘愛好者尋求高效、符合人體工學且可靠的交通工具,先進的變速器對於最佳化各種地形的舒適性、性能和安全性至關重要。電子變速系統、液壓變速器、智慧連接模組以及輕巧耐用的材料等技術創新正在改變現代自行車,使其換檔更順暢、騎行操控性更強、維護成本更低、能耗更低。競技自行車、山地自行車、城市旅行項目以及健身騎行等活動的日益普及也促進了市場擴張。此外,無線變速箱、符合人體工學的車把設計、多速飛輪相容性以及電子觸發系統等創新技術,正在提升易用性、零件耐用性和整體騎乘體驗,從而推動更廣泛的應用和市場成長。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 14億美元 |

| 預測金額 | 31億美元 |

| 複合年成長率 | 8.5% |

預計到 2025 年,指撥變速器市場佔有率將達到 38%,2026 年至 2035 年的複合年成長率將達到 7.9%。指撥變速器憑藉其精準的變速控制、符合人體工學的設計、與山地自行車、混合動力車和電動自行車的廣泛兼容性、快速響應和耐用性,在市場上佔據主導地位,成為競技自行車手和休閒自行車手的首選。

預計到2025年,OEM(整車製造商)市佔率將達到78%,並在2035年之前以8.2%的複合年成長率成長。 OEM通路透過將高品質的變速器整合到山地自行車、公路車、混合動力車和電動自行車等各種車型中,推動了市場成長。這確保了零件的正品性、最佳的傳動系統性能、無縫相容性和一致的騎乘體驗,從而鞏固了OEM作為大批量生產和高階自行車首選供應商的地位。

預計到2025年,中國自行車變速器市場將佔據33%的市場佔有率,市場規模達2.382億美元。該地區受益於快速的都市化、自行車使用量的成長、電動自行車保有量的擴大以及休閒、通勤和競技騎行需求的不斷成長。強大的製造能力、高效的分銷網路以及消費者意識的提升,都鞏固了該地區在全球市場的主導地位。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 成本結構

- 每個階段的附加價值

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 電動自行車和高性能自行車越來越受歡迎

- 技術創新

- 擴大休閒和通勤自行車出行

- 對客製化和性能的需求

- 產業潛在風險與挑戰

- 高級變速器高成本

- 新興市場認知度低

- 市場機遇

- 電動自行車領域的擴張

- 與原始設備製造商和智慧自行車平台合作

- 智慧型互聯變速器

- 高級可客製化變速器

- 促進要素

- 成長潛力分析

- 監管環境

- 北美洲

- 16 CFR 第 1512 部分 - 自行車安全要求;符合 ISO 標準

- CPSC 合規標準;ISO 4210 合規性;CAN/CSA 要求

- 歐洲

- EN ISO 4210(DIN協調標準);通用產品安全指令(GPSD);需要CE標誌

- 符合 EN ISO 4210 標準;符合 GPSD(通用產品安全指令)架構;符合型式核准要求

- EN ISO 4210:2023 GPSD 需求;英國脫歐後與 EN 標準的一致性

- 亞太地區

- 自行車零件的GB/T標準;變速機構的QC/T標準;政府指定的檢驗

- 符合印度標準 IS 2411 - 自行車(安全要求);符合 ISO 4210 標準;經印度標準局 (BIS) 認證

- 採用 ISO 4210 標準(JIS 自行車零件標準);對變速器的耐用性有嚴格的機械安全要求。

- 拉丁美洲

- ABNT(巴西技術標準協會)標準;ISO 4210;INMETRO市場進入認證要求

- 中東和非洲

- 符合海灣標準組織 (GSO) 標準;符合 ISO 4210 標準;符合當地安全認證要求

- 符合南非標準局 (SABS) 標準;符合 ISO 4210 標準;本地產品認證

- 北美洲

- 波特五力分析

- PESTEL 分析

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 生產統計

- 生產基地

- 消費基礎

- 進出口

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續努力

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 消費行為/趨勢分析

- 投資與資金籌措分析

- 主要企業研發投入

- 自行車技術領域的創業投資

- 併購活動

- 私募股權對零件製造商的興趣

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 企業擴張計畫和資金籌措

第5章 2022-2035年按產品分類的市場估算與預測

- 扳機式變速器

- 捻

- 把手末端

- 緊握

- 電子設備

- 其他

第6章 按技術分類的市場估計與預測,2022-2035年

- 機械的

- 電子的

- 油壓

第7章 按應用領域分類的市場估算與預測,2022-2035年

- 山地自行車

- 公路自行車

- 城市自行車

- 旅行自行車

- 其他

- 金屬底座

- 複合材料

第8章 按分銷管道分類的市場估算與預測,2022-2035年

- OEM

- 售後市場

第9章 2022-2035年各地區市場估算與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比利時

- 荷蘭

- 瑞典

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 新加坡

- 韓國

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Global Player

- Box Components

- Campagnolo

- FSA(Full Speed Ahead)

- Magura

- microSHIFT

- Rotor bike component

- Shimano

- SRAM

- SunRace Sturmey-Archer

- Tektro

- Rivendell Bicycle Works

- Regional Player

- Acros

- Blackspire

- Exustar

- KCNC

- KMC Chain

- PROWHEEL

- Reverse Components

- Syntace

- TruVativ

- Veloce

- 新興製造商

- BikeYoke

- Gevenalle

- JAGWIRE

- Pinion

The Global Bicycle Gear Shifter Market was valued at USD 1.4 billion in 2025 and is estimated to grow at a CAGR of 8.5% to reach USD 3.1 billion by 2035.

Market growth is fueled by the increasing popularity of high-performance and customized bicycles, the rising adoption of electric bikes, and a surge in recreational and commuter cycling. As urban populations and cycling enthusiasts seek efficient, ergonomic, and reliable mobility solutions, advanced gear shifters are becoming indispensable for optimizing comfort, performance, and safety across diverse terrains. Technological advancements such as electronic shifting systems, hydraulic shifters, smart connectivity modules, and lightweight, durable materials are transforming modern bicycles, providing smoother gear transitions, enhanced rider control, reduced maintenance, and energy-efficient operation. Market expansion is further supported by growing participation in competitive cycling, mountain biking, urban mobility programs, and fitness-oriented cycling. Additional innovations like wireless derailleurs, ergonomic handlebar designs, multi-speed cassette compatibility, and electronic trigger systems improve usability, component longevity, and overall riding satisfaction, driving broader adoption and market growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.4 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 8.5% |

The trigger shifters segment held 38% share in 2025 and is projected to grow at a CAGR of 7.9% from 2026 to 2035. Trigger shifters dominate the market due to their precise gear control, ergonomic design, broad compatibility with mountain, hybrid, and electric bikes, quick response, and durability, making them a preferred choice for both competitive and recreational cyclists.

The OEM segment held 78% share in 2025 and is expected to grow at a CAGR of 8.2% through 2035. OEM channels drive growth by integrating high-quality shifters with new bicycles across mountain, road, hybrid, and electric bike segments. This ensures component authenticity, optimal drivetrain performance, seamless compatibility, and consistent rider experience, solidifying OEM as the preferred choice for large-scale production and premium bicycles.

China Bicycle Gear Shifter Market held 33% share, generating USD 238.2 million in 2025. The region benefits from rapid urbanization, widespread cycling adoption, expansion of e-bike fleets, and growing demand in recreational, commuter, and competitive cycling. Strong manufacturing capabilities, efficient distribution networks, and rising consumer awareness support the region's leadership in the global market.

Leading companies in the Global Bicycle Gear Shifter Market include microShift, SRAM, Campagnolo, Paul Components, Rivendell Bicycle Works, Shimano, Tektro, Pinion, SunRace, Sturmey Archer, and Box Components. To strengthen their presence, companies focus on continuous product innovation, introducing advanced electronic, hydraulic, and smart connectivity shifters for various bicycle segments. Strategic collaborations with OEMs and e-bike manufacturers ensure integration into new bicycles and fleet programs. Firms invest in lightweight, durable materials and ergonomic designs to enhance performance and customer satisfaction. Expanding distribution networks, strengthening after-sales support, and developing customizable solutions for competitive, commuter, and recreational riders further solidify market foothold.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of e-bikes and high-performance bicycles

- 3.2.1.2 Technological innovations

- 3.2.1.3 Growing recreational and commuter cycling

- 3.2.1.4 Demand for customization and performance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced shifters

- 3.2.2.2 Limited awareness in emerging markets

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in e-bike segment

- 3.2.3.2 Collaborations with OEMs and smart-bike platforms

- 3.2.3.3 Smart & Connected Shifters

- 3.2.3.4 Premium & Customizable Shifters

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 16 CFR Part 1512 - Bicycle Safety Requirements; ISO standards compliance

- 3.4.1.2 CPSC aligned standards; ISO 4210 compliance; CAN/CSA requirements

- 3.4.2 Europe

- 3.4.2.1 EN ISO 4210 (DIN harmonized); General Product Safety Directive (GPSD); CE marking required

- 3.4.2.2 EN ISO 4210 compliance; GPSD framework; Type approval requirements

- 3.4.2.3 EN ISO 4210:2023; GPSD requirements; Post-Brexit alignment with EN standards

- 3.4.3 Asia Pacific

- 3.4.3.1 GB/T standards for bicycle components; QC/T standards for gear mechanisms; Government-mandated inspections

- 3.4.3.2 IS (Indian Standards) 2411 - Cycles (Safety Requirements); ISO 4210 alignment; Bureau of Indian Standards (BIS) certification

- 3.4.3.3 JIS standards for bicycle components; ISO 4210 adoption; Strict mechanical safety requirements for shifter durability

- 3.4.4 Latin America

- 3.4.4.1 ABNT (Associacao Brasileira de Normas Tecnicas) standards; ISO 4210; INMETRO certification requirements for market entry

- 3.4.5 Middle East and Africa

- 3.4.5.1 GSO (Gulf Standardization Organization) standards; ISO 4210 compliance; Local safety certification requirements

- 3.4.5.2 SABS (South African Bureau of Standards) alignment; ISO 4210 compliance; Local product certification

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Consumer Behavior & Trends Analysis

- 3.14 Investment & Funding Analysis

- 3.14.1 R&D investment by major players

- 3.14.2 Venture capital in cycling technology

- 3.14.3 M&A activity

- 3.14.4 Private equity interest in component manufacturers

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2022 - 2035 ($ Bn, Units)

- 5.1 Key trends

- 5.2 Trigger shifters

- 5.3 Twist

- 5.4 Bar-end

- 5.5 Grip

- 5.6 Electronic

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2022 - 2035 ($ Bn, Units)

- 6.1 Key trends

- 6.2 Mechanical

- 6.3 Electronic

- 6.4 Hydraulic

Chapter 7 Market Estimates & Forecast, By Application, 2022 - 2035 ($ Bn, Units)

- 7.1 Key trends

- 7.2 Mountain bikes

- 7.3 Road bikes

- 7.4 Urban bikes

- 7.5 Touring bicycles

- 7.6 Others

- 7.7 Metal-based

- 7.8 Composite

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035 ($ Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global Player

- 10.1.1 Box Components

- 10.1.2 Campagnolo

- 10.1.3 FSA (Full Speed Ahead)

- 10.1.4 Magura

- 10.1.5 microSHIFT

- 10.1.6 Rotor bike component

- 10.1.7 Shimano

- 10.1.8 SRAM

- 10.1.9 SunRace Sturmey-Archer

- 10.1.10 Tektro

- 10.1.11 Rivendell Bicycle Works

- 10.2 Regional Player

- 10.2.1 Acros

- 10.2.2 Blackspire

- 10.2.3 Exustar

- 10.2.4 KCNC

- 10.2.5 KMC Chain

- 10.2.6 PROWHEEL

- 10.2.7 Reverse Components

- 10.2.8 Syntace

- 10.2.9 TruVativ

- 10.2.10 Veloce

- 10.3 Emerging Players

- 10.3.1 BikeYoke

- 10.3.2 Gevenalle

- 10.3.3 JAGWIRE

- 10.3.4 Pinion