|

市場調查報告書

商品編碼

1892748

自行車變速箱市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Bicycle Derailleur Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

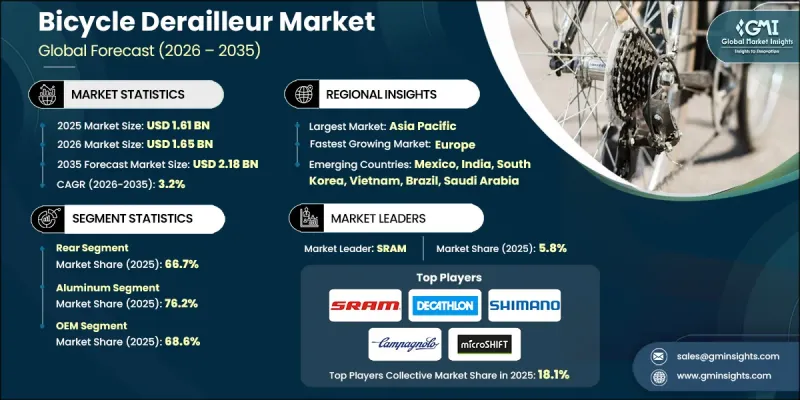

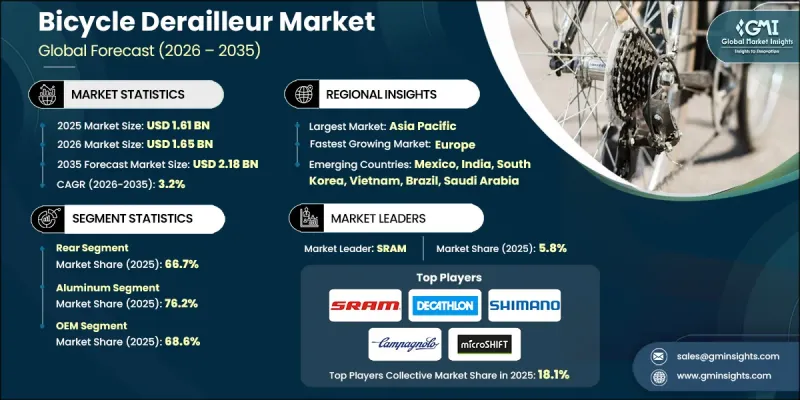

2025 年全球自行車變速箱市值為 16.1 億美元,預計到 2035 年將以 3.2% 的複合年成長率成長至 21.8 億美元。

自行車產業的蓬勃發展直接推動了對先進零件的需求,其中變速箱作為控制踩踏速度和檔位轉換的關鍵部件,發揮著至關重要的作用。製造商致力於研發更輕、更強、更精準的變速箱,以實現更順暢的變速、更少的維護和更優異的性能。電動自行車、礫石自行車和山地自行車的日益普及,也帶動了對能夠承受更高扭矩、更寬齒比範圍和應對複雜地形的變速器的需求。售後客製化是另一個主要促進因素,因為騎乘者越來越傾向於選擇能夠匹配自身騎乘風格並最佳化自行車性能的零件。同時,材料和設計的不斷創新也推動了這些趨勢的發展,旨在提高耐用性、輕量化和永續性,同時保持價格的合理性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 16.1億美元 |

| 預測值 | 21.8億美元 |

| 複合年成長率 | 3.2% |

成本和便利性在市場成長中起著至關重要的作用。變速箱製造商正在開發輕巧、耐用且價格實惠的組件。透過線上商店和自行車商店輕鬆購買,簡化了騎行者的購買和安裝流程。品牌競爭促使製造商提供鋁製、鋼製和複合材料變速器,以平衡性能、重量和成本。日益增強的環保意識也鼓勵使用回收材料,以吸引環保意識的消費者。

預計到2025年,後變速器將佔據66.7%的市場佔有率,這反映了其在多速傳動系統中的關鍵作用。大部分變速操作都發生在後飛輪上,因此後撥變速器成為公路車、山地車、混合動力車、礫石公路車和電動自行車中最廣泛使用的變速器,而前撥變速器則正在逐步被淘汰。

由於鋁材相比鋼或碳纖維具有成本效益高、耐腐蝕和耐用等優點,預計到2025年,鋁材市場佔有率將達到76.2%。然而,鋁材價格的波動有時會迫使製造商尋求替代材料。

2025年美國自行車變速箱市場規模達3.432億美元。 OEM銷售佔據市場主導地位,因為大多數變速箱都預先安裝在主要品牌和零售商銷售的新自行車上,尤其是在公路自行車、山地OEM和電動自行車領域。

目錄

第1章:方法論

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 全球自行車參與人數成長

- 電動自行車市場擴張與整合

- 電子換檔技術進步

- 城市交通與通勤趨勢

- 產業陷阱與挑戰

- 高階電子系統成本高昂

- 材料成本上漲

- 市場機遇

- 新興市場發展

- 無線電子系統民主化

- 永續性與循環經濟的融合

- 直接面對消費者的分銷模式

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 技術路線圖與演進

- 技術採納生命週期分析

- 價格趨勢

- 按地區

- 依產品

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 專利分析

- 消費者洞察與行為智慧

- 客戶體驗地圖

- 用戶痛點

- 高階化趨勢

- 購買決策動機

- 永續發展與循環經濟機遇

- 材料的永續性

- 售後市場的回收和翻新機會

- 環保變速器設計框架

- 電動自行車馬達扭力對變速箱壽命和永續性的影響

- OEM合作夥伴格局及採購策略

- 自行車品牌採購模式

- OEM選擇標準

- 變速器品牌的策略採購機會

- OEM供應商依賴風險

- 市場中斷情境分析

- 改用皮帶傳動系統

- 材料短缺或碳價格波動

- 全球自行車補貼計畫的影響

- 地緣政治供給風險

- 產品更換及故障模式分析

- 不同類型自行車的更換率

- 磨損特性

- 維護頻率圖

- 影響早期失敗的因素

- 最佳情況

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

- 供應商選擇標準

第5章:市場估算與預測:依產品分類,2022-2035年

- 正面

- 後部

第6章:市場規模估算與預測(2022-2035年)

- 短的

- 中等的

- 長籠

第7章:市場估算與預測:依機制分類,2022-2035年

- 手動/機械

- 電子的

- 自動的

- 混合

第8章:市場估算與預測:依材料分類,2022-2035年

- 鋁

- 碳纖維

- 鋼

第9章:市場估價與預測:依自行車分類,2022-2035年

- 公路自行車

- 登山車

- 油電混合自行車

- 電動自行車

- 礫石自行車

第10章:市場估價與預測:依銷售管道分類,2022-2035年

- OEM

- 售後市場

第11章:市場估計與預測:依最終用途分類,2022-2035年

- 職業自行車手

- 愛好者

- 普通/通勤用戶

第12章:市場估算與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 比荷盧經濟聯盟

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 新加坡

- 馬來西亞

- 印尼

- 越南

- 泰國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第13章:公司簡介

- 全球公司

- Shimano

- SRAM

- Campagnolo

- MicroSHIFT

- Full Speed Ahead

- SunRace

- KMC Chain Industrial

- SR Suntour

- The Hive

- Decathlon

- 區域公司

- Box Components

- Cane Creek Cycling Components

- Paul Component Engineering

- Ritchey Design

- Gipiemme

- Garbaruk

- Wolf Tooth Components

- CeramicSpeed

- 新興公司

- ROTOR

- L-TWOO Sports Technology

- WHEELTOP

- Praxis Cycles

- Gevenalle

- Archer Components

- Sensah

- S-Ride

The Global Bicycle Derailleur Market was valued at USD 1.61 billion in 2025 and is estimated to grow at a CAGR of 3.2% to reach USD 2.18 billion by 2035.

The growth of the bicycle industry has directly fueled the demand for advanced components, with derailleurs being a critical element that manages pedal speed and gear transitions. Manufacturers are focusing on creating lighter, stronger, and more precise derailleurs to provide smoother shifting, reduced maintenance, and enhanced performance. Rising interest in e-bikes, gravel bikes, and mountain biking has increased demand for derailleurs that can handle higher torque, broader gear ranges, and challenging terrain. Aftermarket customization is another major driver, as cyclists increasingly seek components that match their riding style and optimize bike performance. These trends are complemented by the continuous innovation in materials and design to improve durability, weight efficiency, and sustainability while maintaining affordability.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.61 Billion |

| Forecast Value | $2.18 Billion |

| CAGR | 3.2% |

Cost and convenience play a pivotal role in market growth. Derailleur makers are developing components that are lightweight, long-lasting, and budget-friendly. Easy availability through online stores and bicycle shops simplifies purchase and installation for riders. Brand competition has pushed manufacturers to offer aluminum, steel, and composite derailleurs that balance performance, weight, and cost. Growing environmental awareness is encouraging the use of recycled materials to appeal to eco-conscious consumers.

The rear derailleur segment held 66.7% share in 2025, reflecting its essential role in multi-gear drivetrains. Most shifting occurs at the rear cassette, making rear derailleurs the most widely used across road, mountain, hybrid, gravel, and e-bikes, while front derailleurs are gradually being phased out.

The aluminum segment held a 76.2% share in 2025, due to its cost-effectiveness, corrosion resistance, and durability compared to steel or carbon fiber. However, fluctuations in aluminum pricing occasionally push manufacturers to explore alternative materials.

U.S. Bicycle Derailleur Market reached USD 343.2 million in 2025. OEM sales dominate the market, as most derailleurs are pre-installed on new bicycles sold by major brands and retailers, particularly in road, mountain, and e-bike segments.

Leading companies in the Bicycle Derailleur Market include SRAM, Decathlon, Shimano, Campagnolo, MicroSHIFT, SunRace, FSA, KMC Chain Industrial, SR Suntour, and The Hive. To strengthen their Bicycle Derailleur Market presence, companies are focusing on continuous product innovation by developing lighter, more precise, and durable derailleurs suited for high-performance cycling. Expanding distribution through online and retail channels improves accessibility, while investment in R&D ensures adaptation to evolving biking trends such as e-bikes and gravel/mountain riding. Brands also emphasize sustainability by using recycled and eco-friendly materials. Strategic partnerships and OEM collaborations help secure long-term contracts and visibility among global bicycle manufacturers. Additionally, aftermarket customization options cater to enthusiasts, increasing brand loyalty and driving repeat purchases.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Size

- 2.2.4 Mechanism

- 2.2.5 Material

- 2.2.6 Bicycle

- 2.2.7 Sales Channel

- 2.2.8 End Use

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Global cycling participation growth

- 3.2.1.2 E-bike market expansion & integration

- 3.2.1.3 Technology advancement in electronic shifting

- 3.2.1.4 Urban mobility & commuting trends

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of premium electronic systems

- 3.2.2.2 Material cost inflation

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets development

- 3.2.3.2 Wireless electronic system democratization

- 3.2.3.3 Sustainability & circular economy integration

- 3.2.3.4 Direct-to-consumer distribution models

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.7.3 Technology roadmaps & evolution

- 3.7.4 Technology adoption lifecycle analysis

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Patent analysis

- 3.11 Consumer insights & behavioral intelligence

- 3.11.1 Customer experience mapping

- 3.11.2 User pain points

- 3.11.3 Premiumization trend

- 3.11.4 Purchase decision motivators

- 3.12 Sustainability & circular economy opportunities

- 3.12.1 Material sustainability

- 3.12.2 Recycling & refurbishing opportunities in aftermarket

- 3.12.3 Eco-friendly derailleur design frameworks

- 3.12.4 Impact of e-bike motor torque on derailleur lifespan & sustainability

- 3.13 OEM partnership landscape & sourcing strategies

- 3.13.1 Bicycle brand sourcing patterns

- 3.13.2 OEM selection criteria

- 3.13.3 Strategic sourcing opportunities for derailleur brands

- 3.13.4 OEM-supplier dependency risks

- 3.14 Market disruption scenario analysis

- 3.14.1 Shift to belt-drive systems

- 3.14.2 Material shortage or carbon price volatility

- 3.14.3 Impact of global cycling subsidy programs

- 3.14.4 Geopolitical supply risk

- 3.15 Product replacement & failure pattern analysis

- 3.15.1 Replacement rates by bike type

- 3.15.2 Wear & tear characteristics

- 3.15.3 Maintenance frequency mapping

- 3.15.4 Factors influencing early failure

- 3.16 Best case scenarios

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Vendor selection criteria

Chapter 5 Market Estimates & Forecast, By Product, 2022 - 2035 ($Mn, Units)

- 5.1 Key trends

- 5.2 Front

- 5.3 Rear

Chapter 6 Market Estimates & Forecast, By Size, 2022 - 2035 ($Mn, Units)

- 6.1 Key trends

- 6.2 Short

- 6.3 Medium

- 6.4 Long Cage

Chapter 7 Market Estimates & Forecast, By Mechanism, 2022 - 2035 ($Mn, Units)

- 7.1 Key trends

- 7.2 Manual/Mechanical

- 7.3 Electronic

- 7.4 Automatic

- 7.5 Hybrid

Chapter 8 Market Estimates & Forecast, By Material, 2022 - 2035 ($Mn, Units)

- 8.1 Key trends

- 8.2 Aluminum

- 8.3 Carbon fiber

- 8.4 Steel

Chapter 9 Market Estimates & Forecast, By Bicycle, 2022 - 2035 ($Mn, Units)

- 9.1 Key trends

- 9.2 Road bikes

- 9.3 Mountain bikes

- 9.4 Hybrid bikes

- 9.5 E-bikes

- 9.6 Gravel Bikes

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Mn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Mn, Units)

- 11.1 Key trends

- 11.2 Professional Cyclists

- 11.3 Enthusiasts

- 11.4 General/Commuter Users

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn, Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 US

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Nordics

- 12.3.8 Benelux

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 ANZ

- 12.4.6 Singapore

- 12.4.7 Malaysia

- 12.4.8 Indonesia

- 12.4.9 Vietnam

- 12.4.10 Thailand

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Colombia

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Global companies

- 13.1.1 Shimano

- 13.1.2 SRAM

- 13.1.3 Campagnolo

- 13.1.4 MicroSHIFT

- 13.1.5 Full Speed Ahead

- 13.1.6 SunRace

- 13.1.7 KMC Chain Industrial

- 13.1.8 SR Suntour

- 13.1.9 The Hive

- 13.1.10 Decathlon

- 13.2 Regional companies

- 13.2.1 Box Components

- 13.2.2 Cane Creek Cycling Components

- 13.2.3 Paul Component Engineering

- 13.2.4 Ritchey Design

- 13.2.5 Gipiemme

- 13.2.6 Garbaruk

- 13.2.7 Wolf Tooth Components

- 13.2.8 CeramicSpeed

- 13.3 Emerging companies

- 13.3.1 ROTOR

- 13.3.2 L-TWOO Sports Technology

- 13.3.3 WHEELTOP

- 13.3.4 Praxis Cycles

- 13.3.5 Gevenalle

- 13.3.6 Archer Components

- 13.3.7 Sensah

- 13.3.8 S-Ride