|

市場調查報告書

商品編碼

1913407

可重複使用包裝市場機會、成長要素、產業趨勢分析及預測(2026年至2035年)Reusable Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

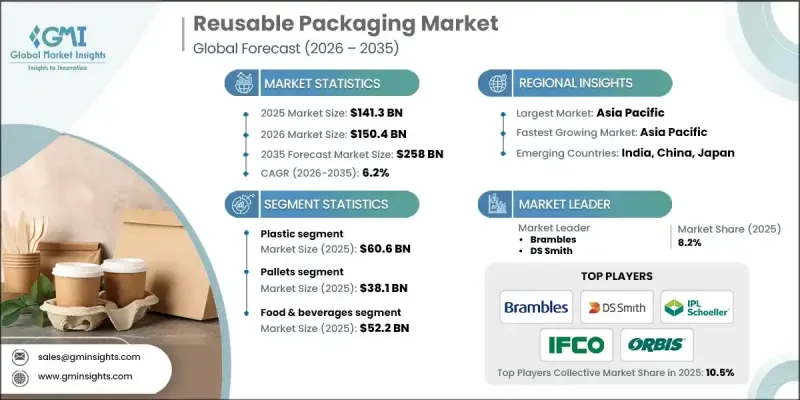

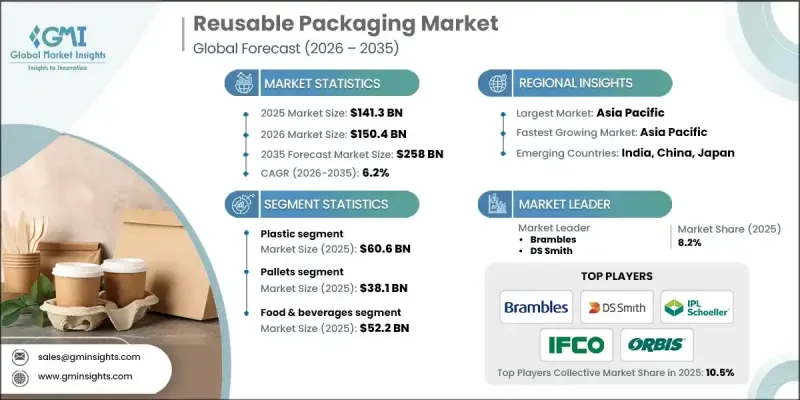

全球可重複使用包裝市場預計到 2025 年將達到 1,413 億美元,到 2035 年將達到 2,580 億美元,年複合成長率為 6.2%。

推動市場成長的因素包括:監管機構對永續措施的支持力度不斷加大、消費者對環保產品的偏好日益成長、可重複使用解決方案帶來的長期成本節約、電子商務的蓬勃發展以及包裝設計的持續創新。鼓勵採用可重複使用包裝的法規是主要的成長要素,因為企業越來越需要遵守有關塑膠、廢棄物和碳排放的法規。產業領導者意識到,遵守法規不僅可以減少對環境的影響,還可以提高營運效率、提升品牌聲譽,並促進各行業採用可重複使用包裝。電子商務的興起進一步加速了需求成長,隨著消費者和監管機構對線上零售和配送業務的永續包裝解決方案的需求日益成長,環保包裝已成為企業競爭力的關鍵因素。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 1413億美元 |

| 預測金額 | 2580億美元 |

| 複合年成長率 | 6.2% |

由於塑膠用途廣泛、成本效益高,且在食品、飲料和消費品等行業具有很強的適應性,預計到2025年,塑膠市場規模將達到606億美元。為了滿足日益成長的永續包裝解決方案需求,製造商正致力於開發可回收和環保的塑膠替代品,並最佳化生產流程。

預計到2025年,托盤市場規模將達到381億美元,這主要得益於全球貿易的成長、對耐用且可重複使用解決方案的需求,以及物流、零售和製造業領域對永續性重視。智慧追蹤技術和經濟高效的設計等創新是滿足日益成長的可重複使用托盤需求的關鍵因素。

美國可重複使用包裝市場預計2025年將達到315億美元。推動美國市場成長的因素包括:環保意識的增強、監管機構對廢棄物的要求、消費者對永續產品的需求,以及各行業對可重複使用解決方案的廣泛應用。企業在致力於創新設計、高效生產和遵守環境法規的同時,也著重提供符合消費者期望的耐用環保包裝。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 成本結構

- 每個階段的附加價值

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 加強對永續做法的監管支持

- 消費者對環保解決方案的需求日益成長

- 可重複使用方案可實現長期成本節約

- 開發創新且可重複使用的包裝設計

- 電子商務和線上零售的成長

- 產業潛在風險與挑戰

- 遷移公司需要高額的初始投資

- 消費者對可重複使用包裝的抗拒情緒

- 市場機遇

- 提高消費者的環保意識

- 回收技術的進步

- 促進要素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特五力分析

- PESTEL 分析

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 新興經營模式

- 合規要求

- 永續性措施

- 消費者心理分析

- 地緣政治和貿易趨勢

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 市場集中度分析

- 主要企業的競爭標竿分析

- 財務績效比較

- 收入

- 利潤率

- 研究與開發

- 產品系列比較

- 產品線豐富

- 科技

- 創新

- 按地區分類的企業發展比較

- 全球擴張分析

- 服務網路覆蓋範圍

- 按地區分類的市場滲透率

- 競爭定位矩陣

- 領導企業

- 受讓人

- 追蹤者

- 小眾玩家

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年主要發展動態

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張與投資策略

- 永續發展計劃

- 數位轉型計劃

- 新興/Start-Ups競賽的趨勢

第5章 按材料分類的市場估算與預測,2022-2035年

- 塑膠

- HDPE

- PP

- PET

- LDPE

- 其他

- 金屬

- 鋼材

- 鋁

- 玻璃

- 木頭

第6章 2022-2035年按產品分類的市場估算與預測

- 容器

- 中型散貨箱(IBC)

- 折疊式容器

- 散裝箱

- 箱

- 可堆疊的箱子

- 折疊式板條箱

- 嵌套箱

- 瓶子

- 調色盤

- 塑膠托盤

- 木棧板

- 金屬托盤

- 鼓和桶

- 塑膠桶

- 金屬鼓

- 其他

7. 2022-2035年按最終用途產業分類的市場估算與預測

- 食品/飲料

- 生鮮食品

- 乳製品

- 肉類和水產品

- 飲料

- 麵包和糖果

- 其他

- 車

- 衛生保健

- 製藥

- 醫療設備

- 醫院供應鏈

- 物流/運輸

- 其他

第8章 2022-2035年各地區市場估算與預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- 主要企業

- Brambles

- DS Smith

- IFCO SYSTEMS

- Greif

- 按地區分類的主要企業

- 北美洲

- Buckhorn Inc

- IPL, Inc.

- Menasha Corporation

- Rehrig Pacific Company

- 歐洲

- GWP Group

- Schoeller Allibert

- Schutz GmbH &Co. KGaA

- SSI SCHAEFER

- Asia-Pacific

- Nefab Group

- Plasmix Private Ltd

- 北美洲

- 顛覆者/小眾玩家

- Kuehne+Nagel

- Packoorang AS

- noissue

- RePack

- RPP Containers

- Tri-Wall Limited

- Myers Industries

The Global Reusable Packaging Market was valued at USD 141.3 billion in 2025 and is estimated to grow at a CAGR of 6.2% to reach USD 258 billion by 2035.

The market growth is fueled by rising regulatory support for sustainable practices, increasing consumer preference for eco-friendly products, long-term cost savings from reusable solutions, the expansion of e-commerce, and continuous innovation in packaging designs. Regulations encouraging the adoption of reusable packaging are a key growth driver, with companies increasingly required to comply with restrictions on plastics, waste, and carbon emissions. Industry leaders recognize that compliance not only reduces environmental impact but also boosts operational efficiency, enhances brand reputation, and encourages wider adoption of reusable packaging across sectors. The rise of e-commerce is further accelerating demand, as consumers and regulators increasingly expect sustainable packaging solutions in online retail and delivery operations, making eco-conscious packaging a critical factor for business competitiveness.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $141.3 Billion |

| Forecast Value | $258 Billion |

| CAGR | 6.2% |

The plastic segment reached USD 60.6 billion in 2025, owing to its versatility, cost-effectiveness, and adaptability across industries such as food, beverage, and consumer goods. Manufacturers are focusing on developing recyclable, eco-friendly plastic alternatives and optimizing production processes to meet the growing need for sustainable packaging solutions.

The pallets segment generated USD 38.1 billion in 2025, driven by rising global trade, demand for durable reusable solutions, and increased sustainability initiatives in logistics, retail, and manufacturing. Innovations such as smart tracking technology and cost-efficient designs are key to meeting the expanding requirements for reusable pallets.

U.S. Reusable Packaging Market captured USD 31.5 billion in 2025. Growth in the U.S. is driven by strong environmental awareness, regulatory mandates on waste, consumer demand for sustainable products, and broad adoption of reusable solutions across industries. Companies are focusing on innovative designs, efficient production, and compliance with environmental regulations while delivering sturdy, eco-friendly packaging to meet consumer expectations.

Prominent companies operating in the Global Reusable Packaging Market include IFCO SYSTEMS, DS Smith, Tri-Wall Limited, RePack, Buckhorn Inc, Nefab Group, Greif, Brambles, Schutz GmbH & Co. KGaA, Packoorang AS, SSI SCHAEFER, RPP Containers, Plasmix Private Ltd, Rehrig Pacific Company, Myers Industries, GWP Group, Kuehne + Nagel, Menasha Corporation, noissue, and Schoeller Allibert. To strengthen their foothold, companies in the Reusable Packaging Market are adopting strategies such as continuous product innovation to enhance durability, eco-friendliness, and efficiency. Firms are integrating smart technologies like RFID and IoT tracking to optimize supply chain visibility and sustainability. Strategic partnerships with retailers, logistics providers, and e-commerce platforms expand market reach, while cost optimization and modular designs reduce operational expenses.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Material trends

- 2.2.2 Product trends

- 2.2.3 End use industry trends

- 2.2.4 Regional trends

- 2.3 TAM analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing regulatory support for sustainable practices

- 3.2.1.2 Rising consumer demand for eco-friendly solutions

- 3.2.1.3 Long-term cost savings from reusable options

- 3.2.1.4 Development of innovative reusable packaging designs

- 3.2.1.5 Growth of E-commerce & online retail

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment for transitioning businesses

- 3.2.2.2 Consumer behavior resistance to reusable packaging

- 3.2.3 Market Opportunities

- 3.2.3.1 Rise in consumer environmental awareness

- 3.2.3.2 Advancements in recycling technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Sustainability measures

- 3.11 Consumer sentiment analysis

- 3.12 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit Margin

- 4.3.1.3 R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1 Product Range Breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1 Global Footprint Analysis

- 4.3.3.2 Service Network Coverage

- 4.3.3.3 Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates and Forecast, By Material, 2022 - 2035 (USD Billion)

- 5.1 Key trends

- 5.2 Plastic

- 5.2.1 HDPE

- 5.2.2 PP

- 5.2.3 PET

- 5.2.4 LDPE

- 5.2.5 Others

- 5.3 Metal

- 5.3.1 Steel

- 5.3.2 Aluminum

- 5.4 Glass

- 5.5 Wood

Chapter 6 Market Estimates and Forecast, By Product, 2022 - 2035 (USD Billion)

- 6.1 Key trends

- 6.2 Containers

- 6.2.1 Intermediate bulk containers (IBCs)

- 6.2.2 Foldable/collapsible containers

- 6.2.3 Bulk boxes

- 6.3 Crates

- 6.3.1 Stackable crates

- 6.3.2 Foldable crates

- 6.3.3 Nestable crates

- 6.4 Bottles

- 6.5 Pallets

- 6.5.1 Plastic pallets

- 6.5.2 Wooden pallets

- 6.5.3 Metal pallets

- 6.6 Drums & barrels

- 6.6.1 Plastic drums

- 6.6.2 Metal drums

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2022 - 2035 (USD Billion)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.2.1 Fresh produce

- 7.2.2 Dairy

- 7.2.3 Meat & seafood

- 7.2.4 Beverages

- 7.2.5 Bakery & confectionery

- 7.2.6 Others

- 7.3 Automotive

- 7.4 Healthcare

- 7.4.1 Pharmaceuticals

- 7.4.2 Medical devices

- 7.4.3 Hospital supply chains

- 7.5 Logistics & transportation

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Uk

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company profiles

- 9.1 Global Key Players

- 9.1.1 Brambles

- 9.1.2 DS Smith

- 9.1.3 IFCO SYSTEMS

- 9.1.4 Greif

- 9.2 Regional Key Players

- 9.2.1 North America

- 9.2.1.1 Buckhorn Inc

- 9.2.1.2 IPL, Inc.

- 9.2.1.3 Menasha Corporation

- 9.2.1.4 Rehrig Pacific Company

- 9.2.2 Europe

- 9.2.2.1 GWP Group

- 9.2.2.2 Schoeller Allibert

- 9.2.2.3 Schutz GmbH & Co. KGaA

- 9.2.2.4 SSI SCHAEFER

- 9.2.3 Asia-Pacific

- 9.2.3.1 Nefab Group

- 9.2.3.2 Plasmix Private Ltd

- 9.2.1 North America

- 9.3 Disruptors / Niche Players

- 9.3.1 Kuehne + Nagel

- 9.3.2 Packoorang AS

- 9.3.3 noissue

- 9.3.4 RePack

- 9.3.5 RPP Containers

- 9.3.6 Tri-Wall Limited

- 9.3.7 Myers Industries