|

市場調查報告書

商品編碼

1913391

輸送機系統市場:市場機會、成長促進因素、產業趨勢分析及預測(2026-2035 年)Conveyor System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

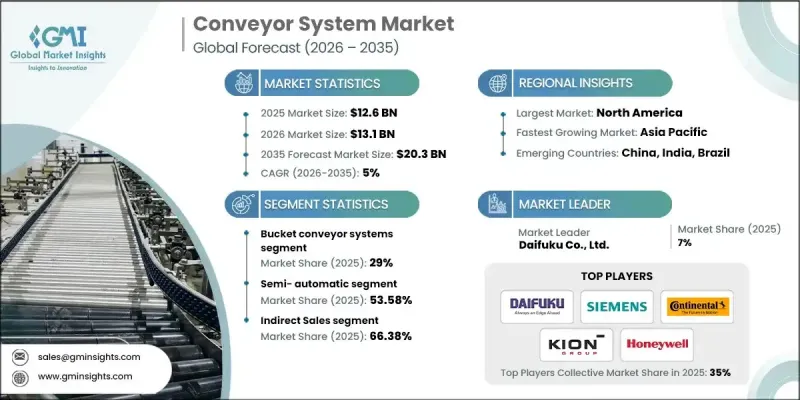

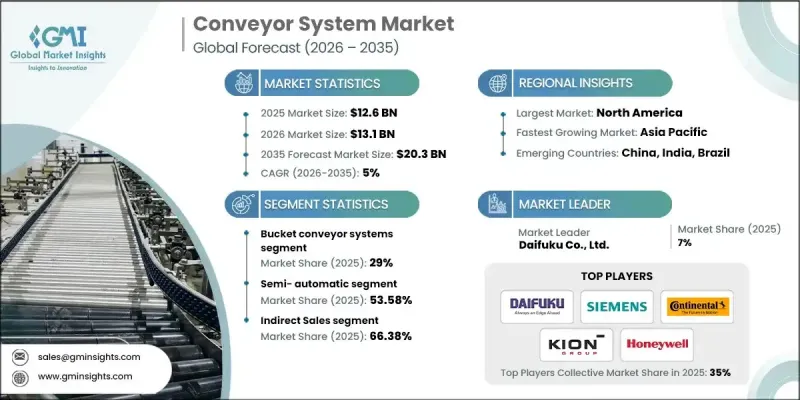

全球輸送機系統市場預計到 2025 年將達到 126 億美元,到 2035 年將達到 203 億美元,年複合成長率為 5%。

市場成長得益於工業供應鏈各環節對營運效率、成本最佳化和長期永續性重視。透過併購實現的產業整合正在加速技術進步並增強競爭優勢,從而促進系統的廣泛應用。隨著企業從勞力密集物料搬運轉向自動化、節能的解決方案,輸送機系統正日益受到青睞。現代系統設計優先考慮降低電力消耗量和減少營運排放,這與全球永續性目標一致。對環保製造和物流實踐的日益關注持續影響投資決策。工業營運中對穩定吞吐量、可靠性和擴充性的需求不斷成長,進一步推動了市場需求。隨著企業對其設施進行現代化改造以滿足不斷變化的配送和履約需求,輸送機系統正成為高效物料流策略的核心要素。預計這些趨勢將在預測期內推動市場穩步擴張。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測期 | 2026-2035 |

| 初始市場規模 | 126億美元 |

| 市場規模預測 | 203億美元 |

| 複合年成長率 | 5% |

北美地區對先進倉儲物流基礎設施的需求持續成長。同時,歐洲和亞太地區對工業和數位商務設施的投資不斷增加,推動了相關技術在商業領域的廣泛應用。企業越來越傾向於採用自動化、高效的系統來滿足其吞吐量需求,並逐步拋棄速度較慢、勞力密集的流程。

2025年,斗式輸送機系統市佔率佔比達29%。該細分市場持續保持強勁成長勢頭,這得益於其在有限的空間佈局內高效輸送大批量物料的能力。穩定的運作性能和物料處理能力也使其在散裝物料應用中廣泛應用。

預計到2025年,間接銷售通路將佔市場佔有率的66.38%,並在2035年之前保持強勁成長。系統整合商和專業經銷商透過提供客製化安裝、技術專長和持續的服務支援發揮關鍵作用。買家越來越依賴這些管道,以獲得快速的維護回應和在地化的支援。

受自動化設施持續投資和分銷網路不斷擴張的推動,美國輸送機系統市場預計到2034年將維持5.4%的複合年成長率。對職場安全、營運一致性和效率提升的高度重視也持續支撐著全國範圍內的需求。

目錄

第1章:分析方法和範圍

第2章執行摘要

第3章業界考察

- 產業生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 產業影響因素

- 促進要素

- 電子商務和履約的快速成長

- 工業4.0和智慧製造

- 永續性和能源效率

- 產業潛在風險與挑戰

- 初始投資額高,投資回收期長

- 對遺留網站維修的複雜性

- 市場機遇

- 物聯網與預測性維護的整合

- 模組化和靈活的輸送機設計

- 促進要素

- 成長潛力分析

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管環境

- 標準和合規要求

- 區域法規結構

- 認證標準

- 波特五力分析

- PESTEL 分析

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 企業矩陣分析

- 主要企業的競爭分析

- 競爭定位矩陣

- 主要趨勢

- 企業合併(M&A)

- 商業夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章 依產品類型分類的市場估算與預測(2022-2035 年)

- 斗式輸送機系統

- 皮帶輸送機系統

- 重力式滾筒輸送機

- 輸送機

- 鍊式輸送機

- 其他類型(天花板類型、地板類型、托盤類型等)

6. 按營運類型分類的市場估算與預測(2022-2035 年)

- 半自動

- 全自動

7. 依最終用途領域分類的市場估計與預測(2022-2035 年)

- 飛機場

- 零售

- 車

- 食品/飲料

- 其他

第8章 按分銷管道分類的市場估算和預測(2022-2035 年)

- 直接地

- 間接

第9章 各地區市場估算與預測(2022-2035 年)

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Beumer Group

- Continental AG

- Daifuku Co., Ltd.

- FlexLink AB(Coesia Group)

- Fives Group

- KION Group

- Honeywell Intelligrated

- Interroll Holding AG

- Hytrol Conveyor Company, Inc.

- Siemens Logistics

- Intralox, LLC(part of Laitram, LLC)

- Rexnord Corporation

- Shuttleworth, LLC(ProMach)

- Viastore Systems GmbH

- Swisslog Holding AG(KUKA AG)

- WAMGROUP SpA

The Global Conveyor System Market was valued at USD 12.6 billion in 2025 and is estimated to grow at a CAGR of 5% to reach USD 20.3 billion by 2035.

Market growth is supported by increasing focus on operational productivity, cost optimization, and long-term sustainability across industrial supply chains. Industry consolidation through mergers and acquisitions is accelerating technological advancement and strengthening competitive positioning, which is contributing to broader system adoption. Conveyor systems are increasingly preferred as organizations transition away from labor-intensive material movement toward automated and energy-conscious solutions. Modern system designs prioritize reduced power consumption and lower operational emissions, aligning with global sustainability objectives. Growing commitment to environmentally responsible manufacturing and logistics practices continues to influence investment decisions. The rising need for consistent throughput, reliability, and scalability across industrial operations further supports demand. As companies modernize facilities to meet evolving distribution and fulfillment requirements, conveyor systems are becoming a core component of efficient material flow strategies. These trends collectively position the market for steady expansion over the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $12.6 Billion |

| Forecast Value | $20.3 Billion |

| CAGR | 5% |

Demand for advanced warehousing and logistics infrastructure is increasing steadily across North America. At the same time, rising investment in industrial and digital commerce facilities across Europe and the Asia-Pacific region is supporting strong commercial adoption. Businesses are increasingly favoring automated, high-efficiency systems to meet throughput requirements, moving away from slower and labor-dependent processes.

The bucket conveyor systems segment held 29% share in 2025. This segment continues to perform strongly due to its ability to transport high volumes efficiently within limited spatial layouts. Consistent operational performance and load-handling capability support continued adoption across bulk material applications.

The indirect sales segment held 66.38% share in 2025 and is expected to maintain strong growth through 2035. System integrators and specialized distributors play a key role by delivering customized installations, technical expertise, and ongoing service support. Buyers increasingly rely on these channels for maintenance responsiveness and localized assistance.

U.S. Conveyor System Market held a CAGR of 5.4% through 2034, driven by sustained investment in automated facilities and expanding distribution networks. Emphasis on workplace safety, operational consistency, and efficiency improvement continues to support demand nationwide.

Key companies active in the Global Conveyor System Market include Daifuku Co., Ltd., Interroll Holding AG, Honeywell Intelligrated, KION Group, Beumer Group, Swisslog Holding AG (KUKA AG), Hytrol Conveyor Company, Inc., Siemens Logistics, Continental AG, Intralox, L.L.C., Fives Group, Rexnord Corporation, Viastore Systems GmbH, FlexLink AB (Coesia Group), Shuttleworth, LLC, and WAMGROUP S.p.A. Companies operating in the Global Conveyor System Market are reinforcing their market position through product innovation, automation integration, and strategic expansion. Manufacturers are investing in modular and scalable system designs to meet diverse customer requirements. Partnerships with logistics providers and system integrators are helping expand market reach and improve solution customization. Firms are also enhancing digital capabilities, including smart monitoring and predictive maintenance features, to increase system reliability and lifecycle value.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Operation

- 2.2.4 End- Use Vertical

- 2.2.5 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid E-commerce & Fulfillment Growth

- 3.2.1.2 Industry 4.0 & Smart Manufacturing

- 3.2.1.3 Sustainability & Energy Efficiency

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Initial CAPEX & Long ROI

- 3.2.2.2 Complexity of Retrofitting Legacy Sites

- 3.2.3 Opportunities

- 3.2.3.1 IoT & Predictive Maintenance Integration

- 3.2.3.2 Modular & Flexible Conveyor Design

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022 - 2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Bucket Conveyor Systems

- 5.3 Belt Conveyor System

- 5.4 Gravity Roller Conveyor

- 5.5 Screw (Auger) Conveyors

- 5.6 Chain Conveyors

- 5.7 Others (Overhead, Floor, Pallet, etc)

Chapter 6 Market Estimates and Forecast, By Operation, 2022 - 2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Automatic

Chapter 7 Market Estimates and Forecast, By End Use Vertical, 2022 - 2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Airport

- 7.3 Retail

- 7.4 Automotive

- 7.5 Food & Beverages

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2022 - 2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Beumer Group

- 10.2 Continental AG

- 10.3 Daifuku Co., Ltd.

- 10.4 FlexLink AB (Coesia Group)

- 10.5 Fives Group

- 10.6 KION Group

- 10.7 Honeywell Intelligrated

- 10.8 Interroll Holding AG

- 10.9 Hytrol Conveyor Company, Inc.

- 10.10 Siemens Logistics

- 10.11 Intralox, L.L.C. (part of Laitram, L.L.C.)

- 10.12 Rexnord Corporation

- 10.13 Shuttleworth, LLC (ProMach)

- 10.14 Viastore Systems GmbH

- 10.15 Swisslog Holding AG (KUKA AG)

- 10.16 WAMGROUP S.p.A.