|

市場調查報告書

商品編碼

1913385

氯化聚氯乙烯市場:市場機會、成長促進因素、產業趨勢分析及預測(2026-2035)Chlorinated Polyvinyl Chloride (CPVC) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

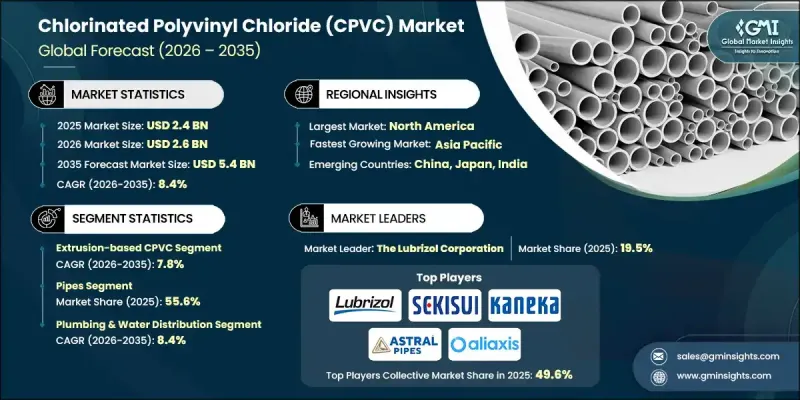

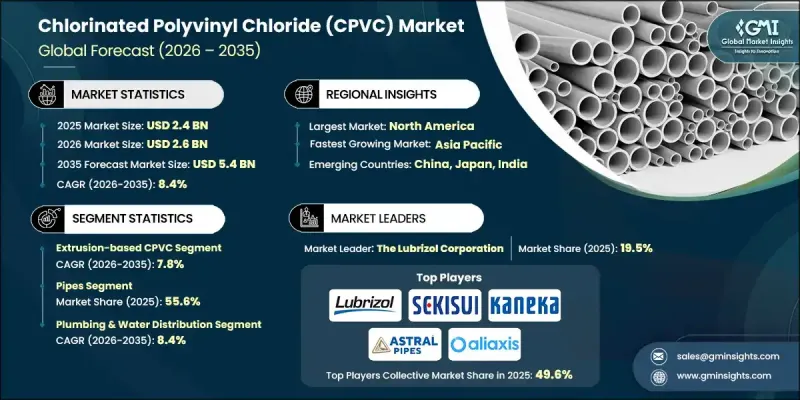

2025 年全球氯化聚氯乙烯(CPVC) 市值為 24 億美元,預計到 2035 年將達到 54 億美元,年複合成長率為 8.4%。

由於其卓越的性能和長使用壽命,CPVC在住宅、商業和工業建築中的應用日益廣泛,市場成長也反映了這一趨勢。對能夠承受高溫、內壓和化學腐蝕環境的耐用管道解決方案的需求不斷成長,並持續推動CPVC的普及。 CPVC正日益成為一種整合材料解決方案,它透過減少材料種類來簡化建設計畫,同時又能滿足安全性和性能標準。工程師和承包商看重CPVC的施工效率、可靠性和全生命週期成本優勢。持續的基礎設施建設、系統更新和現代化改造計劃進一步鞏固了其長期需求。材料配方技術的進步正在進一步提高其性能一致性和應用柔軟性。隨著建築規範的不斷完善和耐久性要求的日益嚴格,CPVC已鞏固其在全球建築和基礎設施市場中作為首選熱塑性材料的地位。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測期 | 2026-2035 |

| 初始市場規模 | 24億美元 |

| 市場規模預測 | 54億美元 |

| 複合年成長率 | 8.4% |

預計到2025年,擠壓成型製造領域將創造17億美元的收入,並將繼續引領市場,因為它能夠提供均勻尺寸的產品、實現高生產效率並有效控制成本。該工藝支援需要穩定品質和大批量生產的大型計劃。

預計到 2025 年,管道領域將佔 55.6% 的市場佔有率,到 2034 年將以 8.1% 的複合年成長率成長。與替代材料相比,管道在耐用性、熱穩定性和長期性能方面的優勢推動了強勁的需求。

預計2025年,北美氯化聚氯乙烯(CPVC)市場規模將達8.652億美元。美國和加拿大各地的基礎設施更新、更嚴格的安全標準以及老舊系統的更換,都推動了該地區市場的成長。 CPVC配方的不斷改進也進一步增強了市場的可靠性。

目錄

第1章:分析方法和範圍

第2章執行摘要

第3章業界考察

- 產業生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 對耐用且耐腐蝕的管道材料的需求不斷成長

- 住宅和商業基礎設施建設活動增加

- 對即使在高溫環境下也具有化學穩定性的塑膠材料的需求日益成長

- 產業潛在風險與挑戰

- 原物料供應和定價結構的波動

- 來自其他管道材料和技術的競爭

- 市場機遇

- 新興經濟體的快速都市化與基礎建設發展

- 提升CPVC性能特性的技術改進

- 促進要素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特五力分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 專利狀態

- 貿易統計(HS編碼)(註:僅提供主要國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續努力

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 考慮到碳足跡

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 企業矩陣分析

- 主要企業的競爭分析

- 競爭定位矩陣

- 主要趨勢

- 企業合併(M&A)

- 夥伴關係與合作

- 新產品發布

- 業務拓展計劃

第5章 依製造流程分類的市場估算與預測(2022-2035 年)

- 擠出成型CPVC

- 射出成型底座 CPVC

第6章 依產品類型分類的市場估算與預測(2022-2035 年)

- 樹脂/化合物

- 管道

- 管件和閥門

- 連接適配器

- 彎頭三通

- 聯合異徑接頭

- 閥門(球閥、閘閥、止回閥)

- 座椅面板輪廓

第7章 按應用領域分類的市場估算與預測(2022-2035 年)

- 管道和供水管道

- 熱水系統

- 冷凍水系統

- 循環系統

- 消防系統

- 住宅噴灌系統(NFPA 13D)

- 商用噴灌系統(NFPA 13)

- 多用戶住宅噴灌系統(NFPA 13R)

- 工業製程管道

- 化學加工與處理

- 水和污水處理

- 海水淡化廠

- 發電

- 石油和天然氣業務

- 礦物加工

- 空調和冷水系統

- 熱水暖氣

- 冷凍水管道

- 冷卻塔

第8章 各地區市場估算與預測(2022-2035 年)

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

第9章:公司簡介

- Aliaxis Group SA

- Astral Limited

- Charlotte Pipe and Foundry

- Georg Fischer Ltd.

- IPEX Inc.

- Kaneka Corporation

- Lubrizol Corporation

- Prince Pipes and Fittings

- Sekisui Chemical Co., Ltd.

- Supreme Industries Limited

The Global Chlorinated Polyvinyl Chloride (CPVC) Market was valued at USD 2.4 billion in 2025 and is estimated to grow at a CAGR of 8.4% to reach USD 5.4 billion by 2035.

Market growth reflects rising adoption of CPVC across residential, commercial, and industrial construction due to its strong performance characteristics and long service life. Increasing demand for durable piping solutions that can withstand elevated temperatures, internal pressure, and chemically aggressive environments continues to support widespread acceptance. CPVC is increasingly selected as a unified material solution that simplifies construction planning by reducing material variation while maintaining safety and performance standards. Engineers and contractors value CPVC for its installation efficiency, reliability, and lifecycle cost advantages. Ongoing infrastructure development, system upgrades, and modernization projects are reinforcing long-term demand. Advances in material formulation are further improving performance consistency and application flexibility. As building codes evolve and durability requirements become more stringent, CPVC remains well-positioned as a preferred thermoplastic material across global construction and infrastructure markets.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.4 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 8.4% |

The extrusion-based manufacturing segment generated USD 1.7 billion in 2025 and continues to lead the market due to its ability to deliver uniform dimensions, high production efficiency, and cost control. This process supports large-scale projects that require consistent quality and volume output.

The pipes segment accounted for 55.6% share in 2025 and is expected to grow at a CAGR of 8.1% through 2034. Strong demand is driven by durability, thermal stability, and long-term performance advantages compared to alternative materials.

North America Chlorinated Polyvinyl Chloride (CPVC) Market reached USD 865.2 million in 2025. Regional growth is supported by infrastructure renewal, stricter safety standards, and replacement of aging systems across the U.S. and Canada. Continuous improvements in CPVC formulations are further strengthening market confidence.

Key companies operating in the Global Chlorinated Polyvinyl Chloride (CPVC) Market include Lubrizol Corporation, Aliaxis Group S.A., Kaneka Corporation, Georg Fischer Ltd., IPEX Inc., Astral Limited, Sekisui Chemical Co., Ltd., Prince Pipes and Fittings, Supreme Industries Limited, and Charlotte Pipe and Foundry. Companies in the Global Chlorinated Polyvinyl Chloride (CPVC) Market are strengthening their market position through capacity expansion, formulation innovation, and strategic partnerships. Manufacturers are investing in research to enhance thermal performance, pressure resistance, and long-term durability. Geographic expansion into high-growth construction markets is improving revenue diversification. Collaboration with contractors and system designers supports early-stage specification and repeat demand. Companies are also focusing on compliance with evolving safety and building regulations to reinforce product acceptance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Manufacturing Process

- 2.2.3 Product Form

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for durable and corrosion-resistant piping materials

- 3.2.1.2 Rising construction activity across residential and commercial infrastructure

- 3.2.1.3 Preference for high-temperature and chemically stable plastic materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Volatility in raw material availability and pricing structures

- 3.2.2.2 Competition from alternative piping materials and technologies

- 3.2.3 Market opportunities

- 3.2.3.1 Rapid urbanization and infrastructure development in emerging economies

- 3.2.3.2 Technological improvements enhancing CPVC performance characteristics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Manufacturing Process, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Extrusion-Based CPVC

- 5.3 Injection Molding-Based CPVC

Chapter 6 Market Estimates and Forecast, By Product Form, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Resin & Compound

- 6.3 Pipes

- 6.4 Fittings & Valves

- 6.4.1 Couplings & Adapters

- 6.4.2 Elbows & Tees

- 6.4.3 Unions & Reducers

- 6.4.4 Valves (Ball, Gate, Check)

- 6.5 Sheets, Panels & Profiles

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Plumbing & Water Distribution

- 7.2.1 Hot Water Systems

- 7.2.2 Cold Water Systems

- 7.2.3 Recirculation Systems

- 7.3 Fire Protection Systems

- 7.3.1 Residential Fire Sprinklers (NFPA 13D)

- 7.3.2 Commercial Fire Sprinklers (NFPA 13)

- 7.3.3 Multifamily Fire Sprinklers (NFPA 13R)

- 7.4 Industrial Process Piping

- 7.4.1 Chemical Processing & Handling

- 7.4.2 Water & Wastewater Treatment

- 7.4.3 Desalination Plants

- 7.4.4 Power Generation

- 7.4.5 Oil & Gas Operations

- 7.4.6 Mineral Processing

- 7.5 HVAC & Chilled Water Systems

- 7.5.1 Hydronic Heating

- 7.5.2 Chilled Water Distribution

- 7.5.3 Cooling Towers

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Aliaxis Group S.A.

- 9.2 Astral Limited

- 9.3 Charlotte Pipe and Foundry

- 9.4 Georg Fischer Ltd.

- 9.5 IPEX Inc.

- 9.6 Kaneka Corporation

- 9.7 Lubrizol Corporation

- 9.8 Prince Pipes and Fittings

- 9.9 Sekisui Chemical Co., Ltd.

- 9.10 Supreme Industries Limited