|

市場調查報告書

商品編碼

1907270

北美聚氯乙烯(PVC):市場佔有率分析、行業趨勢、統計數據和成長預測(2026-2031 年)North America Polyvinyl Chloride (PVC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

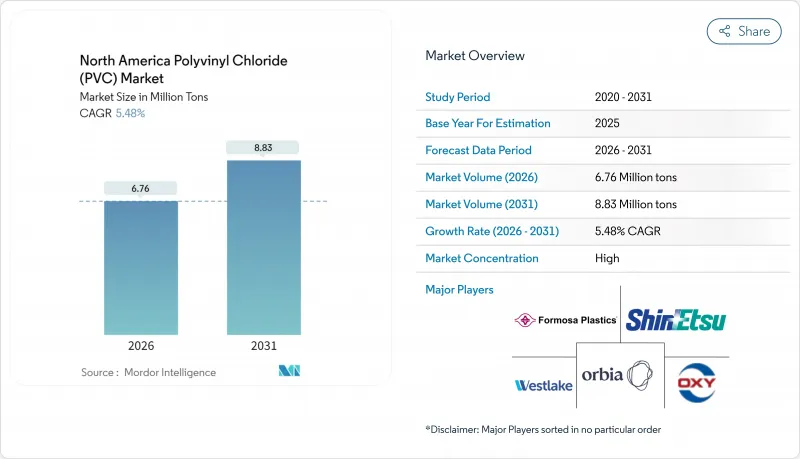

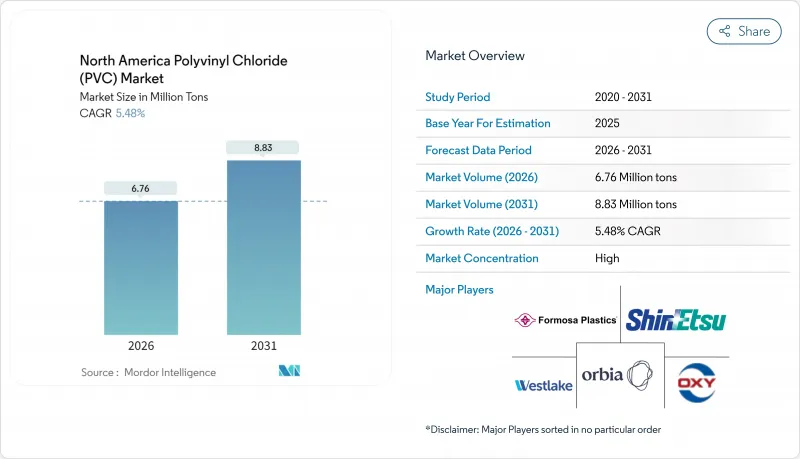

預計北美聚氯乙烯(PVC)市場將從2025年的641萬噸成長到2026年的676萬噸,到2031年將達到883萬噸,2026年至2031年的複合年成長率為5.48%。

儘管供應鏈持續波動,但基礎設施的持續現代化,特別是聯邦政府資助的鉛水管更換項目,支撐了這一成長。市政當局被要求在10年內完成鉛管的全面更換,這為市場提供了穩定的市場需求,並降低了管道採購受整體經濟波動的影響。美國是最大的PVC消費國,這得益於有利的乙烷價格,使生產商免受原料價格飆升的影響。醫療產業作為成長最快的終端用戶,其重要性日益凸顯,這主要受人口結構變化和醫療設備無鄰苯二甲酸酯化趨勢的推動。日益激烈的競爭集中在垂直整合、特殊配方和永續性創新方面,這些都有助於在全球樹脂供應過剩的市場中保護利潤空間。

北美聚氯乙烯(PVC)市場趨勢與洞察

建築和施工行業的需求不斷成長

建築業的PVC消費量與公共工程支出的復甦密切相關,其中管道和管件應用幾乎佔所有用途的一半。聯邦法規禁止延期,促使州和地方政府更換老化的管線網路。限制鉛含量的建築規範推動計劃轉向使用硬質PVC系統,而生產商則利用一體化的乙烯產業鏈來穩定成本。長期基礎設施規劃正在創造一個可預測的訂單基礎,該基礎不受私人住宅週期的影響,從而推動國內工廠產能擴張,並維持對PVC樹脂的需求。

醫療設備和輸液袋數量迅速增加

醫療產業的需求正以6.34%的複合年成長率成長,醫院指定使用不含鄰苯二甲酸二辛酯(DEHP)的化合物來生產血袋、輸液管和導管。材料配方商現在提供不含鄰苯二甲酸酯的添加劑,這些添加劑通過了FDA的測試,且不會影響透明度、柔軟性或耐滅菌性。不斷提高的監管門檻和驗證成本有利於成熟的供應商,使他們能夠收取溢價,從而抵消北美聚氯乙烯市場大宗商品利潤率面臨的壓力。人口老化和居家醫療的擴張為這一需求的成長提供了更大的空間。

氯乙烯單體和乙烯價格波動;

原料成本佔生產成本的70%之多,原料價格波動會對利潤率造成壓力。近期發生的鐵路事故凸顯了物流風險,而主要裂解裝置的計劃性停產導致區域供應緊張,加劇了現貨市場的波動。雖然一體化企業可以利用其有利的乙烷供應來緩解部分影響,但公司買家則面臨更快速的價格上漲,這使得北美PVC市場的庫存規劃更加複雜。

細分市場分析

到2025年,硬質PVC將佔總產量的59.65%,這充分體現了其在地下水基礎設施領域的優勢,因為在這些領域,管道的耐久性和成本穩定性至關重要。這一佔有率在北美PVC市場中佔據最大比例,主要得益於聯邦政府資助計劃對管道的需求。此外,硬質PVC也用於窗框和牆板,在公共工程之外也創造了穩定的需求。

受醫療設備、軟管和電線塗層等領域對特殊化合物的需求所推動,軟性材料品類正以5.82%的複合年成長率快速成長。製造商透過透明度、低溫柔柔軟性和不含鄰苯二甲酸酯的化學配方來區分產品。氯化聚氯乙烯(PVC)在熱水管道領域佔有一席之地,而低煙等級的PVC則符合運輸和高密度建築的防火安全標準。產品組合正持續向利潤率更高、對全球大宗商品週期依賴性更低的特種等級產品轉變。

北美聚氯乙烯(PVC) 市場報告按產品類型(硬質 PVC、軟質 PVC、低煙 PVC、氯化 PVC)、應用領域(管道及管件、薄膜及片材等)、終端用戶行業(建築、電氣電子、醫療、汽車等)和地區(美國、加拿大、墨西哥)進行細分。市場預測以噸為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 建築和施工行業的需求不斷成長

- 醫療設備和輸液袋使用量的快速成長

- 聯邦政府為水利基礎設施升級提供資金

- 無鉛管道監管勢頭強勁

- 生物基塑化劑開發高階利基市場

- 市場限制

- 氯乙烯單體和乙烯價格波動;

- 加強環境和健康監測

- 加強對鄰苯二甲酸酯類塑化劑的監管

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 進出口趨勢

第5章 市場規模及成長預測(以金額為準及數量)

- 依產品類型

- 硬質PVC

- 透明硬質PVC

- 不透明硬質聚氯乙烯

- 軟PVC

- 透明軟質PVC

- 不透明軟性PVC

- 低煙聚氯乙烯

- 氯化聚氯乙烯

- 硬質PVC

- 透過使用

- 管道和配件

- 薄膜和片材

- 電線電纜

- 瓶子

- 型材、軟管和管材

- 其他用途

- 按最終用戶行業分類

- 建築/施工

- 電氣和電子設備

- 衛生保健

- 車

- 包裝

- 鞋類

- 其他終端用戶產業

- 按國家/地區

- 美國

- 加拿大

- 墨西哥

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- AMCO International

- Aurora Material Solutions

- Braskem

- Formosa Plastics Corporation

- GEON

- INEOS

- Kem One

- LG Chem

- Lubrizol

- Occidental Petroleum Corporation

- Orbia Polymer Solutions(Vestolit)

- SABIC

- Shin-Etsu Chemical Co., Ltd.

- SIMONA AMERICA

- Teknor Apex

- Westlake Corporation

第7章 市場機會與未來展望

The North America Polyvinyl Chloride market is expected to grow from 6.41 million tons in 2025 to 6.76 million tons in 2026 and is forecast to reach 8.83 million tons by 2031 at 5.48% CAGR over 2026-2031.

Continued infrastructure modernization, especially the federally funded replacement of lead service lines, underpins this expansion even as supply-chain volatility persists. Demand visibility is strong because municipalities must comply with the ten-year mandate for full lead pipe replacement, insulating pipe purchases from broader economic swings. The United States accounts for the largest regional PVC consumption, supported by advantaged ethane costs that cushion producers from feedstock price shocks. Healthcare is gaining importance as the fastest-growing end user, propelled by demographic trends and the shift to phthalate-free medical devices. Competitive intensity centers on vertical integration, specialty compounding, and sustainability innovations that protect margins in a globally oversupplied resin market.

North America Polyvinyl Chloride (PVC) Market Trends and Insights

Rising Demand from Building and Construction

PVC consumption in construction tracks the recovery of public works spending, with pipes and fittings representing almost half of all applications. States and provinces are replacing aging distribution networks because federal rules prohibit deferrals. Building codes that cap lead content steer projects toward rigid vinyl systems, while producers leverage integrated ethylene chains to stabilize costs. Long-term infrastructure programs create predictable order books, encouraging capacity upgrades at domestic plants and sustaining resin uptake regardless of private housing cycles.

Surging Use in Medical-Grade Devices and IV Bags

Healthcare demand expands at 6.34% CAGR as hospitals specify non-DEHP compounds for blood bags, tubing, and catheters. Material formulators now offer phthalate-free additives that pass FDA tests without trade-offs in clarity, flexibility, or sterilization resistance. Higher regulatory barriers and validation costs favor established suppliers, enabling premium pricing that offsets commodity margin pressure in the North America Polyvinyl Chloride market. An aging population and the growth of home-based care further extend this demand runway.

Volatile Vinyl Chloride Monomer and Ethylene Prices

Feedstock swings erode margins because raw materials represent up to 70% of production cost. Recent rail incidents underscore logistical risk, while planned shutdowns at major crackers tighten regional availability and amplify spot volatility. Integrated firms cushion some of the impact through advantaged ethane, but merchant buyers face sharper price spikes, complicating inventory planning across the North America Polyvinyl Chloride market.

Other drivers and restraints analyzed in the detailed report include:

- Federal Funding for Replacement Water Infrastructure

- Regulatory Tailwinds for Lead-Free Plumbing

- Intensifying Environmental and Health Scrutiny

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rigid PVC accounted for 59.65% of total volume in 2025, underscoring its strength in underground water infrastructure, where lifespan and cost stability prevail. That share translates to the largest slice of the North America Polyvinyl Chloride market size, anchored by pipes mandated in federally funded projects. Rigid formulations also serve window profiles and siding, adding steady demand outside public works.

The flexible category advances at a 5.82% CAGR as medical devices, hoses, and wire coatings adopt specialized compounds. Manufacturers differentiate through clarity, low-temperature flexibility, and phthalate-free chemistries. Chlorinated PVC retains a niche in hot-water lines, while low-smoke grades address fire-safety codes in transit and high-occupancy buildings. Product mix continues shifting toward specialty grades that command higher margins and reduce exposure to global commodity cycles.

The North America Polyvinyl Chloride (PVC) Market Report is Segmented by Product Type (Rigid PVC, Flexible PVC, Low-Smoke PVC, and Chlorinated PVC), Application (Pipes and Fittings, Films and Sheets, and More), End-User Industry (Building and Construction, Electrical and Electronics, Healthcare, Automotive, and More), and Geography (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Volume (Tons).

List of Companies Covered in this Report:

- AMCO International

- Aurora Material Solutions

- Braskem

- Formosa Plastics Corporation

- GEON

- INEOS

- Kem One

- LG Chem

- Lubrizol

- Occidental Petroleum Corporation

- Orbia Polymer Solutions (Vestolit)

- SABIC

- Shin-Etsu Chemical Co., Ltd.

- SIMONA AMERICA

- Teknor Apex

- Westlake Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand from building and construction

- 4.2.2 Surging use in medical-grade devices and IV bags

- 4.2.3 Federal funding for replacement water infrastructure

- 4.2.4 Regulatory tailwinds for lead-free plumbing

- 4.2.5 Bio-based plasticizers unlocking premium niches

- 4.3 Market Restraints

- 4.3.1 Volatile vinyl chloride monomer and ethylene prices

- 4.3.2 Intensifying environmental and health scrutiny

- 4.3.3 Tightening limits on phthalate plasticizers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Import-Export Trends

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Product Type

- 5.1.1 Rigid PVC

- 5.1.1.1 Clear Rigid PVC

- 5.1.1.2 Non-clear Rigid PVC

- 5.1.2 Flexible PVC

- 5.1.2.1 Clear Flexible PVC

- 5.1.2.2 Non-clear Flexible PVC

- 5.1.3 Low-smoke PVC

- 5.1.4 Chlorinated PVC

- 5.1.1 Rigid PVC

- 5.2 By Application

- 5.2.1 Pipes and Fittings

- 5.2.2 Films and Sheets

- 5.2.3 Wires and Cables

- 5.2.4 Bottles

- 5.2.5 Profiles, Hoses and Tubing

- 5.2.6 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Electrical and Electronics

- 5.3.3 Healthcare

- 5.3.4 Automotive

- 5.3.5 Packaging

- 5.3.6 Footwear

- 5.3.7 Other End-user Industries

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AMCO International

- 6.4.2 Aurora Material Solutions

- 6.4.3 Braskem

- 6.4.4 Formosa Plastics Corporation

- 6.4.5 GEON

- 6.4.6 INEOS

- 6.4.7 Kem One

- 6.4.8 LG Chem

- 6.4.9 Lubrizol

- 6.4.10 Occidental Petroleum Corporation

- 6.4.11 Orbia Polymer Solutions (Vestolit)

- 6.4.12 SABIC

- 6.4.13 Shin-Etsu Chemical Co., Ltd.

- 6.4.14 SIMONA AMERICA

- 6.4.15 Teknor Apex

- 6.4.16 Westlake Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment