|

市場調查報告書

商品編碼

1913379

血流動力學監測設備市場:市場機會、成長促進因素、產業趨勢分析及預測(2026-2035)Hemodynamic Monitoring Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

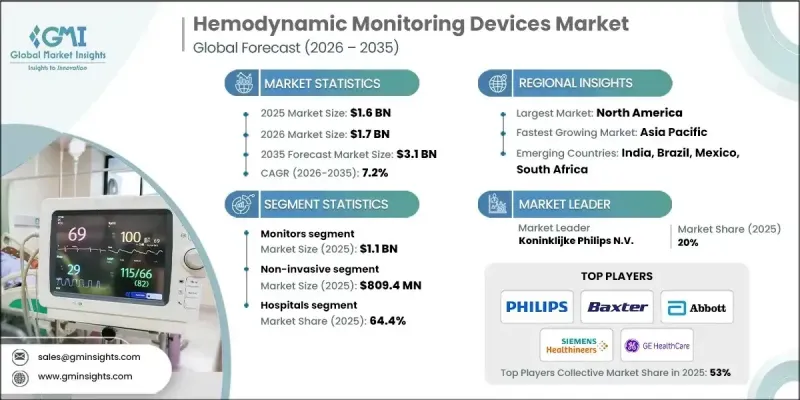

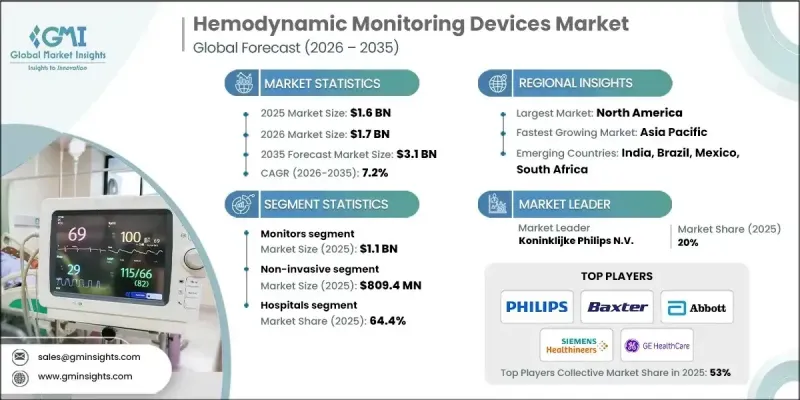

全球血液動力學監測設備市場預計到 2025 年將達到 16 億美元,到 2035 年將達到 31 億美元,年複合成長率為 7.2%。

全球慢性病盛行率上升、監測技術不斷創新、遠距醫療模式日益普及以及全球遠端醫療手術數量不斷增加,共同推動了血流動力學監測市場的成長。血流動力學監測設備是指透過即時追蹤血壓、血流和全身循環效率來評估心血管功能的系統。這些工具能夠持續提供心摶出量、血管阻力及相關生理指標的訊息,進而輔助臨床決策。它們在手術室、重症監護室和高依賴性醫院環境中發揮著尤為重要的作用。慢性病盛行率的不斷上升推動了對精準心血管評估工具的需求,尤其是在需要快速介入的情況下。與這些疾病相關的併發症促使醫療服務提供者採用先進的監測平台,以支持及時、準確的治療決策。隨著人工智慧 (AI) 和遠端連接功能更深入地整合到監測解決方案中,血流動力學監測有望成為現代臨床護理的核心組成部分,市場趨勢預計將進一步加速發展。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測期 | 2026-2035 |

| 初始市場規模 | 16億美元 |

| 市場規模預測 | 31億美元 |

| 複合年成長率 | 7.2% |

預計到2025年,監測領域的市場規模將達到11億美元。該領域包括先進的床邊系統、行動平台和整合監測解決方案,旨在提供連續的心血管數據,包括心摶出量、動脈壓和中心靜脈壓。這些監測系統被認為是維持病患病情穩定和發展嚴重臨床治療策略的重要工具。加護病房(ICU)的使用率最高,因為在ICU中,不間斷的心血管監測對於管理嚴重或病情不穩定的患者至關重要。

預計到2025年,非侵入性市場規模將達到8.094億美元,到2035年將以7.3%的複合年成長率成長。非侵入性血流動力學監測解決方案是一種無需破皮或插入導管即可評估心血管參數的技術。這些系統利用先進的生理測量方法來評估心摶出量和液體反應性,並專注於病人安全和營運效率。由於非侵入性方法能夠降低手術風險、縮短準備時間並提高成本效益,醫療機構正日益重視在手術全期和重症監護流程中採用這些方法。

預計到2025年,美國血流動力學監測設備市場規模將達到5.204億美元。由於美國心血管疾病發病率高且醫療基礎設施完善,預計美國將引領該市場。據悉,美國醫院和先進的醫療中心高度依賴各種監測解決方案,以支持接受複雜外科手術、創傷治療和高級心臟介入治療的患者。

目錄

第1章:分析方法和範圍

第2章執行摘要

第3章業界考察

- 產業生態系分析

- 產業影響因素

- 促進要素

- 全球慢性病發生率不斷上升

- 血流動力學監測設備的技術進步

- 人們對遠端醫療服務的偏好日益增強

- 手術數量增加

- 產業潛在風險與挑戰

- 病患監測設備高成本

- 嚴格的法規結構

- 市場機遇

- 擴大門診和居家醫療服務範圍

- 整合人工智慧和數據分析

- 促進要素

- 成長潛力分析

- 監管環境

- 技術進步

- 當前技術趨勢

- 新興技術

- 供應鏈分析

- 救贖方案

- 價格分析(2024)

- 未來市場趨勢

- 波特五力分析

- PESTEL 分析

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 企業矩陣分析

- 主要企業的競爭分析

- 競爭定位矩陣

- 主要趨勢

- 企業合併(M&A)

- 商業夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章 按產品分類的市場估算與預測(2022-2035 年)

- 一次性產品

- 監視器

第6章 依系統類型分類的市場估算與預測(2022-2035 年)

- 非侵入性

- 侵入性

- 微創

7. 依最終用途分類的市場估計與預測(2022-2035 年)

- 醫院

- 門診手術中心

- 居家醫療

- 其他用途

第8章 各地區市場估算與預測(2022-2035 年)

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott Laboratories

- Baxter International

- Becton, Dickinson and Company(BD)

- Canon Medical Systems Corporation

- Deltex Medical Group

- Edwards Lifesciences Corporation

- GE HealthCare Technologies

- Getinge

- ICU Medical

- Koninklijke Philips NV

- Masimo Corporation

- Mindray

- Nihon Kohden Corporation

- OSYPKA MEDICAL

- Siemens Healthineers.

The Global Hemodynamic Monitoring Devices Market was valued at USD 1.6 billion in 2025 and is estimated to grow at a CAGR of 7.2% to reach USD 3.1 billion by 2035.

The growth is explained by the rising global burden of long-term medical conditions, continuous innovation in monitoring technologies, wider acceptance of telehealth-based care models, and an increasing volume of surgical procedures worldwide. Hemodynamic monitoring devices are described as systems that assess cardiovascular performance by tracking blood pressure, blood flow, and overall circulatory efficiency in real time. These tools support clinical decision-making by delivering continuous insights into cardiac output, vascular resistance, and related physiological indicators. Their role is emphasized across surgical suites, intensive care environments, and high-dependency hospital settings. The expanding prevalence of chronic illnesses is said to be increasing demand for precise cardiovascular assessment tools, particularly where rapid intervention is required. Complications linked to these conditions are driving healthcare providers to adopt advanced monitoring platforms that support timely and accurate treatment decisions. Market momentum is expected to intensify as artificial intelligence and remote connectivity features become more deeply embedded in monitoring solutions, positioning hemodynamic monitoring as a core element of modern clinical care delivery.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.6 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 7.2% |

The monitors segment generated USD 1.1 billion in 2025. This category includes advanced bedside systems, mobile platforms, and integrated monitoring solutions designed to deliver continuous cardiovascular data, including cardiac output, arterial pressure, and central venous pressure. These monitoring systems are regarded as critical tools for maintaining patient stability and guiding therapeutic actions in high-acuity clinical settings. Utilization levels are highest in intensive care units, where uninterrupted cardiovascular monitoring is essential for managing patients with severe or unstable conditions.

The non-invasive segment reached USD 809.4 million in 2025 and is projected to grow at a CAGR of 7.3% throughout 2035. Non-invasive hemodynamic monitoring solutions are positioned as technologies that evaluate cardiovascular parameters without breaching the skin or requiring catheter placement. These systems rely on advanced physiological measurement methods to assess cardiac output and fluid responsiveness with a focus on patient safety and operational efficiency. Healthcare facilities are increasingly favoring non-invasive approaches due to reduced procedural risks, faster setup times, and improved cost efficiency across perioperative and critical care workflows.

U.S. Hemodynamic Monitoring Devices Market captured USD 520.4 million in 2025. The United States is described as leading the market due to a high incidence of cardiovascular disorders and a well-established healthcare infrastructure. Hospitals and advanced care centers across the country are said to rely heavily on a broad range of monitoring solutions to support patients undergoing complex surgical procedures, trauma management, and advanced cardiac interventions.

Key participants active in the Global Hemodynamic Monitoring Devices Market include Siemens Healthineers, Koninklijke Philips N.V., Edwards Lifesciences Corporation, GE HealthCare Technologies, Abbott Laboratories, Masimo Corporation, Mindray, Baxter International, Getinge, Nihon Kohden Corporation, Canon Medical Systems Corporation, Becton, Dickinson and Company, ICU Medical, Deltex Medical Group, and OSYPKA MEDICAL. Companies operating in the Global Hemodynamic Monitoring Devices Market are described as strengthening their market position through a combination of innovation, strategic partnerships, and geographic expansion. Product development efforts are focused on improving accuracy, usability, and data integration to support real-time clinical decision-making. Many players are investing in digital health capabilities, including remote monitoring and intelligent analytics, to align with evolving care models. Strategic collaborations with hospitals and research institutions help companies validate technologies and accelerate adoption.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 System type trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of chronic diseases across the globe

- 3.2.1.2 Technological advancements in hemodynamic monitoring devices

- 3.2.1.3 Increasing preference for telehealth services

- 3.2.1.4 Growing number of surgeries

- 3.2.2 Industry Pitfalls and Challenges

- 3.2.2.1 High cost of patient monitoring devices

- 3.2.2.2 Stringent regulatory framework

- 3.2.3 Market Opportunities

- 3.2.3.1 Expansion in ambulatory and homecare settings

- 3.2.3.2 Integration of AI and data analytics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Disposables

- 5.3 Monitors

Chapter 6 Market Estimates and Forecast, By System Type, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Non-invasive

- 6.3 Invasive

- 6.4 Minimally invasive

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Homecare settings

- 7.5 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Baxter International

- 9.3 Becton, Dickinson and Company (BD)

- 9.4 Canon Medical Systems Corporation

- 9.5 Deltex Medical Group

- 9.6 Edwards Lifesciences Corporation

- 9.7 GE HealthCare Technologies

- 9.8 Getinge

- 9.9 ICU Medical

- 9.10 Koninklijke Philips N.V.

- 9.11 Masimo Corporation

- 9.12 Mindray

- 9.13 Nihon Kohden Corporation

- 9.14 OSYPKA MEDICAL

- 9.15 Siemens Healthineers.