|

市場調查報告書

商品編碼

1913343

冷卻塔市場機會、成長要素、產業趨勢分析及預測(2026年至2035年)Cooling Tower Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

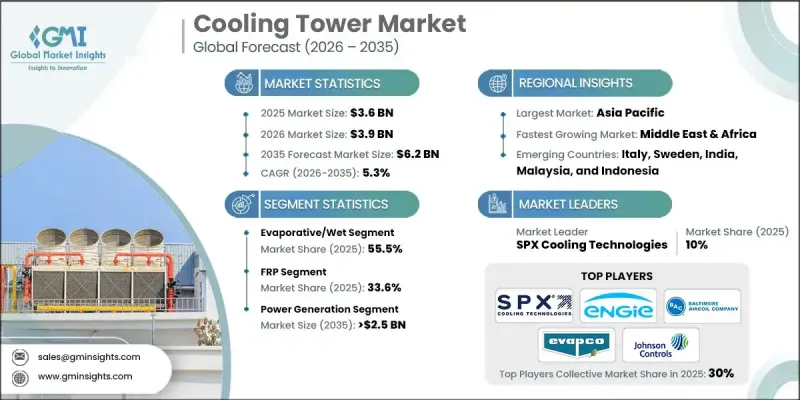

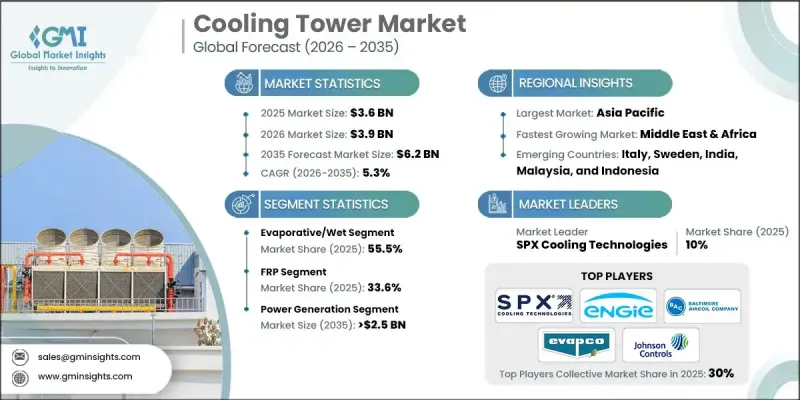

全球冷卻塔市場預計到 2025 年將價值 36 億美元,到 2035 年達到 62 億美元,年複合成長率為 5.3%。

市場成長的驅動力來自對節能型溫度控管系統日益成長的需求,以及各終端用戶產業日益嚴格的環境和排放法規。冷卻塔在散熱過程中發揮關鍵作用,它透過與空氣相互作用降低水溫,然後再循環利用,從而支持系統的持續運作和效率。智慧監控技術和預測性維護工具的日益普及,正在推動運行性能的提升、計劃外停機時間的減少以及生命週期成本的最佳化。對節水和環境合規性的日益重視,正加速向先進設計的轉變,這些設計在提高熱效率的同時,也能降低資源消耗。此外,市場也受益於耐用材料的轉變,這些材料具有更強的耐腐蝕性和更長的運作。隨著各行業尋求靈活的解決方案來滿足不斷成長的產能需求,擴充性和模組化配置也越來越受歡迎。永續性目標、技術創新和基礎設施升級的結合,持續增強全球工業和商業領域對現代化冷卻塔系統的需求。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 36億美元 |

| 預測金額 | 62億美元 |

| 複合年成長率 | 5.3% |

預計到2035年,乾式冷卻塔市場規模將達15億美元。由於乾式冷卻水塔不涉及水的蒸發,能夠大幅降低整體消費量,因此在面臨水資源短缺和環境法規嚴格限制的地區,此類系統越來越受歡迎。乾式冷卻塔完全依靠空氣散熱,符合永續性目標,並在對水資源高度敏感的市場中得到更廣泛的認可。

預計到2035年,混凝土冷卻塔市場將以5%的複合年成長率成長。由於其機械強度高、可靠性強,混凝土冷卻塔被廣泛應用於大規模工業和發電設施。混凝土冷卻水塔是需要穩定熱性能、結構穩定性和長使用壽命的永久性設施的理想選擇。

預計到 2025 年,北美冷卻塔市場將佔據 86.7% 的市場佔有率,價值 4.723 億美元。該地區的成長得益於強大的工業基礎、不斷擴展的數位基礎設施以及現有發電資產的持續更新,這些因素共同促成了對先進冷卻解決方案的穩定投資。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 原物料供應及採購分析

- 供應鏈韌性與風險因素

- 配電網路分析

- 監管環境

- 產業影響因素

- 促進要素

- 產業潛在風險與挑戰

- 成長潛力分析

- 波特五力分析

- PESTEL 分析

- 冷卻塔成本結構分析

- 價格趨勢分析

- 按地區

- 新的機會與趨勢

- 數位化和物聯網整合

- 拓展新興市場

- 投資分析及未來展望

第4章 競爭情勢

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀錶板

- Key partnerships &collaborations

- Major M&A activities

- Product innovations &launches

- Market expansion strategies

- 策略舉措

- 競爭標竿分析

- 創新與科技趨勢

第5章 2022-2035年依產品分類的市場規模及預測

- 蒸發式/濕式

- 乾法

- 混合

第6章 依技術分類的市場規模及預測(2022-2035年)

- 開路

- 閉合電路

- 混合

第7章 依設計分類的市場規模及預測(2022-2035年)

- 機械的

- 自然的

第8章 依建築類型分類的市場規模及預測(2022-2035年)

- 現場組裝

- 包裹

第9章 建築材料市場規模及預測(2022-2035年)

- 具體的

- 鋼材

- FRP

- 木頭

- 其他

第10章 依流量分類的市場規模及預測,2022-2035年

- 交叉流

- 逆流

第11章 依應用領域分類的市場規模及預測(2022-2035年)

- 化學品/肥料

- 石油和天然氣

- 發電

- HVACR

- 其他

第12章 2022-2035年各地區市場規模及預測

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 瑞典

- 荷蘭

- 丹麥

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 馬來西亞

- 印尼

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 卡達

- 阿曼

- 科威特

- 埃及

- 南非

- 土耳其

- 拉丁美洲

- 巴西

- 阿根廷

- 智利/秘魯

第13章:公司簡介

- Advance Cooling Towers

- AEW Technik

- Aggreko

- Araco

- Baltimore Aircoil Company(BAC)

- Bellct

- Berg Chilling Systems

- Brentwood Industries

- Classik Cooling Towers

- CTP Engineering

- Delta Cooling Towers

- Enexio

- EVAPCO

- Faisal Jassim Trading

- Harrison Cooling Towers

- HCTC Cooling Equipment Trading

- John Cockerill

- Johnson Controls

- Konuk ISI

- Paharpur Cooling Towers

- SPX Cooling Tech

- Thermax

- Threcell Cooling Tower

- Tower Thermal

- VOLGA COOLING TECHNOLOGIES

The Global Cooling Tower Market was valued at USD 3.6 billion in 2025 and is estimated to grow at a CAGR of 5.3% to reach USD 6.2 billion by 2035.

Market growth is driven by rising demand for energy-efficient thermal management systems alongside tightening environmental and emission regulations across multiple end-use sectors. Cooling towers play a critical role in heat rejection by lowering water temperature through air interaction before recirculation, thereby supporting continuous operations and system efficiency. Growing adoption of smart monitoring technologies and predictive maintenance tools is enhancing operational performance, reducing unexpected shutdowns, and optimizing lifecycle costs. Increasing focus on water conservation and environmental compliance is accelerating the shift toward advanced designs that improve thermal efficiency while limiting resource consumption. The market is also benefiting from the transition toward durable materials that offer improved resistance to corrosion and longer operational life. In addition, scalable and modular configurations are gaining traction as industries seek flexible solutions that align with expanding capacity requirements. The combination of sustainability goals, technological innovation, and infrastructure upgrades continues to reinforce demand for modern cooling tower systems across global industrial and commercial landscapes.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.6 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 5.3% |

The dry cooling tower segment is anticipated to reach USD 1.5 billion by 2035. These systems are increasingly preferred in regions facing water availability constraints and strict environmental mandates, as they operate without water evaporation and significantly reduce overall consumption. By relying solely on air for heat dissipation, dry cooling towers align well with sustainability objectives and are gaining wider acceptance in water-sensitive markets.

The concrete-based cooling tower segment is expected to grow at a CAGR of 5% through 2035. These structures are extensively deployed in large industrial and power-related installations due to their high mechanical strength and long-term reliability. Concrete cooling towers are favored for permanent setups where consistent thermal performance, structural stability, and extended service life are essential.

North America Cooling Tower Market held 86.7% share in 2025, generating USD 472.3 million. Growth in the country is supported by a strong industrial base, expanding digital infrastructure, and ongoing upgrades of existing power generation assets, which collectively sustain steady investment in advanced cooling solutions.

Key companies active in the Global Cooling Tower Market include SPX Cooling Tech, EVAPCO, Baltimore Aircoil Company (BAC), Thermax, Paharpur Cooling Towers, Enexio, Johnson Controls, Aggreko, Delta Cooling Towers, Brentwood Industries, John Cockerill, Advance Cooling Towers, Berg Chilling Systems, Araco, AEW Technik, VOLGA COOLING TECHNOLOGIES, Tower Thermal, Classik Cooling Towers, Faisal Jassim Trading, Konuk ISI, HCTC Cooling Equipment Trading, Harrison Cooling Towers, Threcell Cooling Tower, Bellct, and CTP Engineering. Companies operating in the Cooling Tower Market are strengthening their competitive position through a combination of product innovation, strategic partnerships, and geographic expansion. Manufacturers are focusing on developing energy-efficient and environmentally compliant solutions that address water conservation and emission reduction requirements. Investment in digital technologies such as remote monitoring, automation, and predictive maintenance is being prioritized to enhance system reliability and customer value. Many players are expanding manufacturing capabilities and service networks to improve regional presence and shorten delivery timelines.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Technology trends

- 2.5 Design trends

- 2.6 Build trends

- 2.7 Construction material trends

- 2.8 Flow trends

- 2.9 Application trends

- 2.10 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Supply chain resilience & risk factors

- 3.1.3 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of cooling tower

- 3.8 Price trend analysis

- 3.8.1 By region

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization and IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Evaporative/wet

- 5.3 Dry

- 5.4 Hybrid

Chapter 6 Market Size and Forecast, By Technology, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Open circuit

- 6.3 Closed circuit

- 6.4 Hybrid

Chapter 7 Market Size and Forecast, By Design, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Mechanical

- 7.3 Natural

Chapter 8 Market Size and Forecast, By Build, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 Field erection

- 8.3 Package

Chapter 9 Market Size and Forecast, By Construction Material, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 Concrete

- 9.3 Steel

- 9.4 FRP

- 9.5 Wood

- 9.6 Others

Chapter 10 Market Size and Forecast, By Flow, 2022 - 2035 (USD Million)

- 10.1 Key trends

- 10.2 Cross flow

- 10.3 Counter flow

Chapter 11 Market Size and Forecast, By Application, 2022 - 2035 (USD Million)

- 11.1 Key trends

- 11.2 Chemicals & fertilizers

- 11.3 Oil & gas

- 11.4 Power generation

- 11.5 HVACR

- 11.6 Others

Chapter 12 Market Size and Forecast, By Region, 2022 - 2035 (USD Million)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.2.3 Mexico

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 France

- 12.3.3 Germany

- 12.3.4 Italy

- 12.3.5 Sweden

- 12.3.6 Netherlands

- 12.3.7 Denmark

- 12.3.8 Spain

- 12.3.9 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 South Korea

- 12.4.4 India

- 12.4.5 Australia

- 12.4.6 Malaysia

- 12.4.7 Indonesia

- 12.5 Middle East & Africa

- 12.5.1 UAE

- 12.5.2 Saudi Arabia

- 12.5.3 Qatar

- 12.5.4 Oman

- 12.5.5 Kuwait

- 12.5.6 Egypt

- 12.5.7 South Africa

- 12.5.8 Turkey

- 12.6 Latin America

- 12.6.1 Brazil

- 12.6.2 Argentina

- 12.6.3 Chile Peru

Chapter 13 Company Profiles

- 13.1 Advance Cooling Towers

- 13.2 AEW Technik

- 13.3 Aggreko

- 13.4 Araco

- 13.5 Baltimore Aircoil Company (BAC)

- 13.6 Bellct

- 13.7 Berg Chilling Systems

- 13.8 Brentwood Industries

- 13.9 Classik Cooling Towers

- 13.10 CTP Engineering

- 13.11 Delta Cooling Towers

- 13.12 Enexio

- 13.13 EVAPCO

- 13.14 Faisal Jassim Trading

- 13.15 Harrison Cooling Towers

- 13.16 HCTC Cooling Equipment Trading

- 13.17 John Cockerill

- 13.18 Johnson Controls

- 13.19 Konuk ISI

- 13.20 Paharpur Cooling Towers

- 13.21 SPX Cooling Tech

- 13.22 Thermax

- 13.23 Threcell Cooling Tower

- 13.24 Tower Thermal

- 13.25 VOLGA COOLING TECHNOLOGIES