|

市場調查報告書

商品編碼

1913314

航太密封劑市場機會、成長要素、產業趨勢分析及預測(2026年至2035年)Aerospace Sealants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

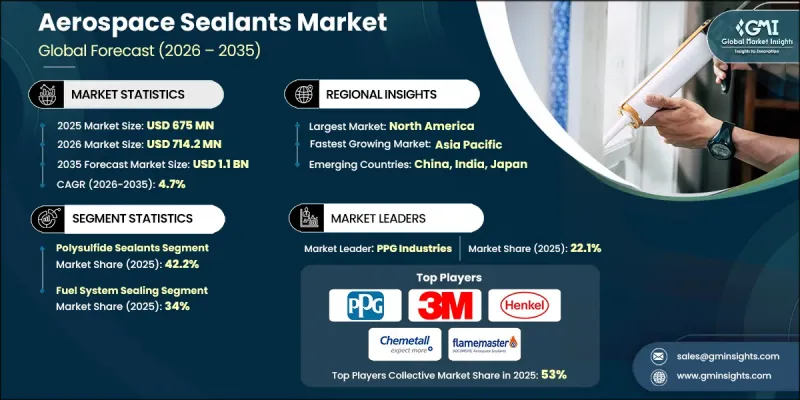

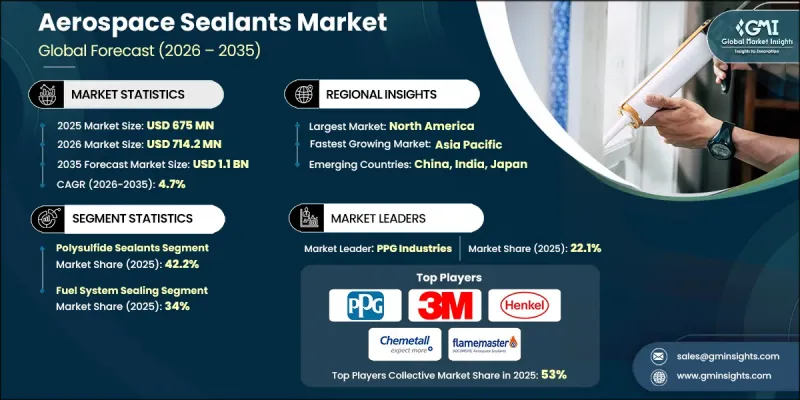

全球航太密封劑市場預計到 2025 年將達到 6.75 億美元,到 2035 年將達到 11 億美元,年複合成長率為 4.7%。

市場成長的驅動力在於飛機在極端溫度環境下運作對性能需求的不斷提高。航太密封劑必須能夠承受反覆的熱循環,從引擎周圍的高溫到巡航高度的低溫,同時保持黏合性、彈性和耐化學性。這項要求正在加速向先進化學技術的過渡,這些技術能夠提供長期耐久性、耐燃料性和機械穩定性。飛機製造商的輕量化目標也影響材料的選擇,促使密封劑配方朝著更低的密度、更好的施工性能和更薄的塗層厚度進行最佳化。即使密封劑最佳化帶來的微小重量減輕,也能在長期運作中顯著提高燃油效率。同時,日益嚴格的環境法規(專注於排放氣體和材料安全)迫使製造商轉向低VOC、高固態和無溶劑的解決方案。此外,維護活動的增加也使市場受益,業者尋求能夠更快固化、更易於操作且工作環境更安全的密封劑。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 6.75億美元 |

| 預測金額 | 11億美元 |

| 複合年成長率 | 4.7% |

截至2025年,聚硫化物基密封劑市佔率達42.2%。該細分市場持續領先,主要得益於其優異的耐燃料和液壓油性能,以及在長期暴露於溫度波動和主導應力下仍能保持性能的能力。這些特性使得聚硫化物基配方成為要求嚴苛的航太密封應用的首選材料。

預計到2025年,燃油系統密封件市佔率將達到34%。此類別涵蓋燃油儲存和輸送部件的密封要求,其中長期化學穩定性以及在熱浸和浸沒條件下的性能保持仍然是關鍵的性能指標。對成熟密封化學品的持續依賴反映了應用於燃油相關航太部件的嚴格認證標準。

預計2025年,北美航太密封劑市佔率將達到38%。該地區憑藉其蓬勃發展的飛機製造活動、大規模的商用和國防機隊以及完善的維護和大修體系,保持著主導地位。機隊的持續擴張也持續支撐著生產和售後市場對高性能密封劑的強勁需求。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 產業潛在風險與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特五力分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 專利狀態

- 貿易統計(HS編碼)(註:僅提供主要國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續努力

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章 依化學品類型分類的市場規模及預測(2022-2035年)

- 聚硫密封劑

- 可固化多硫化物

- 未固化(未硫化)多硫化物

- 矽酮密封膠

- RTV矽膠(無腐蝕性)

- 低揮發性矽酮

- 高溫矽膠

- 氟矽酮密封劑

- 聚氨酯密封劑

- 聚醚聚氨酯

- 聚酯聚氨酯

- 聚丙烯酸酯密封劑

- 環氧密封劑

- 其他

第6章 依應用領域分類的市場規模及預測(2022-2035年)

- 燃油系統密封件

- 一體燃料箱密封處理

- 燃油管路和接頭密封件

- 飛機結構密封

- 機身密封

- 飛機擋風玻璃和座艙罩蓋密封

- 飛行線維修和現場維護

- 引擎和推進系統密封

- 液壓和氣動系統密封件

- 航空電子設備和電氣系統密封

- 環境控制系統(ECS)密封

- 天線和雷達罩密封

- 防腐蝕處理和接縫表面密封

- 其他

7. 依飛機類型分類的市場規模及預測,2022-2035年

- 民航機

- 窄體飛機

- 寬體飛機

- 支線飛機

- 公務及通用航空飛機

- 軍用機

- 戰鬥機和作戰飛機

- 運輸和加油飛機

- 旋翼機(直升機)

- 民用直升機

- 軍用直升機

- 無人駕駛飛行器(UAV)/無人無人機

- 軍用無人機

- 商用無人機(UAV)

- 其他

第8章 依最終用途產業分類的市場規模及預測(2022-2035年)

- 商業航空

- 軍事/國防

- 太空/衛星

- 其他

第9章 2022-2035年各地區市場規模及預測

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東和非洲地區

第10章:公司簡介

- 3M

- Chemetall

- Cytec Industries

- Dow Corning

- Flamemaster

- Henkel

- Master Bond

- Permatex

- PPG Industries

- Royal Adhesives &Sealants

The Global Aerospace Sealants Market was valued at USD 675 million in 2025 and is estimated to grow at a CAGR of 4.7% to reach USD 1.1 billion by 2035.

Market growth is driven by the increasing performance demands placed on aircraft operating across extreme temperature environments. Aerospace sealants must maintain adhesion, elasticity, and chemical resistance while withstanding repeated thermal cycling, ranging from high heat exposure in engine zones to subzero conditions at cruising altitudes. This requirement is accelerating the shift toward advanced chemistries delivering long-term durability, fuel resistance, and mechanical stability. Weight reduction targets set by aircraft manufacturers are also influencing material selection, with sealant formulations increasingly optimized for lower density, improved spreadability, and reduced application thickness. Even modest weight savings achieved through sealant optimization can generate measurable fuel efficiency gains over extended service periods. In parallel, tightening environmental regulations focused on emissions and material safety are pushing manufacturers toward low-VOC, high-solids, and solvent-free solutions. The market is also benefiting from rising maintenance activity, as operators seek sealants that support faster curing, improved handling, and safer working conditions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $675 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 4.7% |

The polysulfide sealants segment accounted for 42.2% share in 2025. This segment continues to lead due to its proven resistance to fuels and hydraulic fluids, combined with its ability to retain performance after prolonged exposure to temperature fluctuations and operational stress. These properties make polysulfide formulations a preferred choice across demanding aerospace sealing applications.

The fuel system sealing segment held 34% share in 2025. This category includes sealing requirements across fuel containment and transfer components, where long-term chemical stability and property retention under thermal and immersion conditions remain critical performance criteria. The continued reliance on established sealing chemistries reflects the stringent qualification standards applied to fuel-related aerospace components.

North America Aerospace Sealants Market accounted for 38% share in 2025. The region maintains its leading position due to strong aircraft manufacturing activity, a large installed commercial and defense fleet, and a well-developed maintenance and overhaul ecosystem. Ongoing fleet expansion continues to support recurring demand for high-performance sealants across both production and aftermarket applications.

Key companies active in the Global Aerospace Sealants Market include Henkel, PPG Industries, 3M, Dow Corning, Flamemaster, Chemetall, Cytec Industries, Royal Adhesives & Sealants, Master Bond, and Permatex. Companies operating in the Global Aerospace Sealants Market are strengthening their competitive position through sustained investment in material innovation and regulatory compliance. Manufacturers are focusing on developing advanced formulations that meet evolving thermal, chemical, and mechanical performance requirements while aligning with stricter environmental standards. Portfolio optimization is a key strategy, with companies refining product lines to balance performance reliability and sustainability. Strategic collaboration with aircraft manufacturers and maintenance providers is supporting early adoption and long-term supply relationships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Chemistry type

- 2.2.2 Application

- 2.2.3 Aircraft type

- 2.2.4 End use industry

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Chemistry Type, 2022-2035 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Polysulfide sealants

- 5.2.1 Cured polysulfide

- 5.2.2 Non-cured (uncured) polysulfide

- 5.3 Silicone sealants

- 5.3.1 RTV silicone (non-corrosive)

- 5.3.2 Low-outgassing silicone

- 5.3.3 High-temperature silicone

- 5.4 Fluorosilicone sealants

- 5.5 Polyurethane sealants

- 5.5.1 Polyether polyurethane

- 5.5.2 Polyester polyurethane

- 5.6 Polyacrylate sealants

- 5.7 Epoxy sealants

- 5.8 Others

Chapter 6 Market Size and Forecast, By Application, 2022-2035 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Fuel system sealing

- 6.2.1 Integral fuel tank sealing

- 6.2.2 Fuel line & fitting sealing

- 6.3 Airframe structural sealing

- 6.4 Fuselage sealing

- 6.5 Aircraft windshield & canopy sealing

- 6.6 Flight line repair & field maintenance

- 6.7 Engine & propulsion system sealing

- 6.8 Hydraulic & pneumatic system sealing

- 6.9 Avionics & electrical system sealing

- 6.10 Environmental control system (ECS) sealing

- 6.11 Antenna & radome sealing

- 6.12 Corrosion protection & faying surface sealing

- 6.13 Others

Chapter 7 Market Size and Forecast, By Aircraft Type, 2022-2035 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Commercial aircraft

- 7.2.1 Narrow-body aircraft

- 7.2.2 Wide-body aircraft

- 7.3 Regional aircraft

- 7.4 Business & general aviation

- 7.5 Military aircraft

- 7.5.1 Fighter & combat aircraft

- 7.5.2 Transport & tanker aircraft

- 7.6 Rotorcraft (helicopters)

- 7.6.1 Civil helicopters

- 7.6.2 Military helicopters

- 7.7 Unmanned aerial vehicles (UAVs) / drones

- 7.7.1 Military UAVs

- 7.7.2 Commercial UAVs

- 7.8 Others

Chapter 8 Market Size and Forecast, By End Use Industry , 2022-2035 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Commercial aviation

- 8.3 Military & defense

- 8.4 Space & satellite

- 8.5 Others

Chapter 9 Market Size and Forecast, By Region, 2022-2035 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 3M

- 10.2 Chemetall

- 10.3 Cytec Industries

- 10.4 Dow Corning

- 10.5 Flamemaster

- 10.6 Henkel

- 10.7 Master Bond

- 10.8 Permatex

- 10.9 PPG Industries

- 10.10 Royal Adhesives & Sealants