|

市場調查報告書

商品編碼

1913302

結構性黏著劑市場機會、成長要素、產業趨勢分析及2026年至2035年預測Structural Adhesive Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

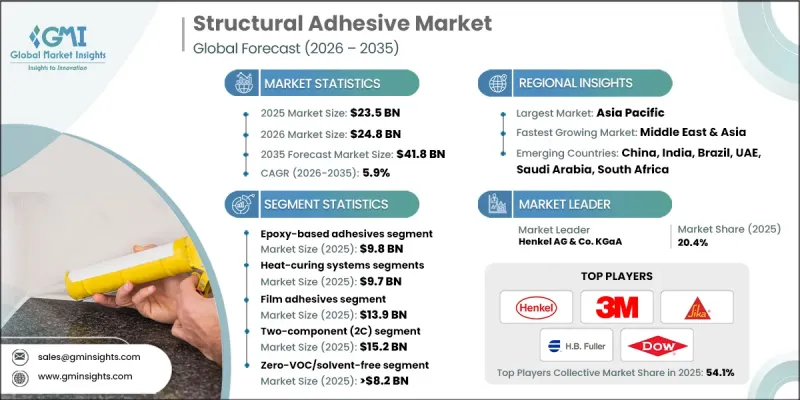

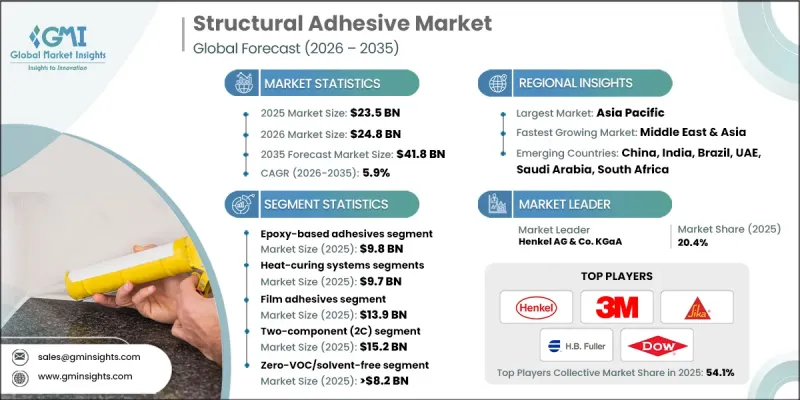

全球結構性黏著劑市場預計到 2025 年將達到 235 億美元,到 2035 年將達到 418 億美元,年複合成長率為 5.9%。

由於結構性黏著劑在汽車、航太、電子、船舶、風力發電和建築等各行業的應用日益廣泛,其市場正經歷顯著成長。在需要均勻應力分佈和輕量化組件的應用中,這些黏合劑正逐步取代焊接和機械緊固件。電動車產量的激增以及複合材料在飛機製造中的應用加速了這一轉變。此外,法規結構正引導市場轉向環保化學配方,例如水性、低VOC和零VOC配方,以符合永續性和合規性標準。大規模汽車生產推動了市場成長,增加了素車、玻璃安裝和電池組裝等領域對結構性黏著劑的需求。同時,嚴格的環境法規也推動了無溶劑和低排放替代品的趨勢。這些因素迫使製造商開發和創新配方,以在滿足合規性要求的同時,實現高性能和高效率。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 235億美元 |

| 預測金額 | 418億美元 |

| 複合年成長率 | 5.9% |

預計到2025年,環氧樹脂黏合劑市場規模將達到98億美元。環氧樹脂結構性黏著劑因其優異的拉伸強度和剪切強度,以及耐化學性和耐熱性而備受青睞。這些特性使其成為電動車電池組、航太複合材料和素車組裝等關鍵應用的理想選擇。增韌環氧樹脂黏合劑廣泛應用於增強和黏合領域,而高模量系統則有助於承受風力發電應用中的長跨度循環負荷。丙烯酸結構性黏著劑在各工業領域的應用也日益廣泛。

預計到2025年,熱固性系統市場規模將達到97億美元,這主要得益於對嚴苛運作系統需求的成長,例如航太複合材料和需要烘箱烘烤的汽車車體應用。這些系統由於其低交聯密度和優異的耐久性,非常適合長壽命應用。然而,雙組分室溫固化環氧樹脂和聚氨酯(PU)因其柔軟性、易於現場和生產線組裝以及無需人工安裝等優點而備受關注。這些系統兼具性能和便利性,日益廣泛應用於工業和建築計劃。

預計到2025年,美國結構性黏著劑市場規模將達到50億美元,主要驅動力來自航太領域的強勁成長以及汽車產業對電動車日益成長的接受度。美國的製造能力發揮主導作用,而加拿大則透過航太和建築應用做出貢獻。墨西哥汽車產量的成長也促進了區域市場的成長。不斷變化的監管環境正在推動低VOC和零VOC化學品的發展,進而推動結構玻璃和特殊黏合劑應用領域的創新。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 汽車和航太領域的減重

- 不斷增加的建築和基礎設施計劃

- 技術進步

- 產業潛在風險與挑戰

- 較長的固化時間

- 與拉鍊相比,高成本

- 市場機遇

- 電動車(EV)的擴張

- 3D列印與積層製造

- 維修/保養用途

- 促進要素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特五力分析

- PESTEL 分析

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 透過技術平台

- 未來市場趨勢

- 專利狀態

- 貿易統計(HS編碼)(註:僅提供主要國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續努力

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 考慮到碳足跡

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章 依技術平台分類的市場估算與預測,2022-2035年

- 環氧樹脂黏合劑

- 聚氨酯(PU)黏合劑

- 丙烯酸黏合劑

- 氰基丙烯酸黏合劑

- 矽膠黏合劑

- 其他技術

第6章 依固化機制分類的市場估算與預測,2022-2035年

- 熱固化系統

- 高溫固化(150 度C以上)

- 中溫固化(120-150 度C)

- 低溫固化(70-120 度C)

- 室溫固化系統

- 濕固化系統

- 紫外線/輻射固化系統

- 雙重固化系統

第7章 按類型分類的市場估計與預測,2022-2035年

- 薄膜黏合劑

- 貼上式黏合劑

- 液態、低黏度黏合劑

第8章 按組件系統分類的市場估算與預測,2022-2035年

- 單一成分(1C)系統

- 雙組分(2C)系統

9. 按揮發性有機化合物 (VOC) 含量分類的市場估算和預測,2022-2035 年

- 低VOC黏合劑(低於50克/公升)

- 零VOC/無溶劑黏合劑

- 水性黏合劑

- 生物基/可再生成分

第10章 依應用領域分類的市場估計與預測,2022-2035年

- 金屬與金屬的黏合

- 複合材料黏合

- 複合材料黏合

- 塑膠黏合劑

- 木材/加工木材黏合劑

- 混凝土和砌體粘結

- 玻璃黏合劑

- 其他

第11章 依最終用途產業分類的市場估計與預測,2022-2035年

- 車

- 航空航太太空產業

- 風力發電

- 船舶/造船

- 建築和基礎設施

- 電學

- 用水和污水

- 其他

第12章 2022-2035年各地區市場估算與預測

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

第13章:公司簡介

- 3M Company

- Arkema SA

- Ashland Global Holdings Inc.

- Bostik(Arkema)

- Cemedine Co., Ltd.

- Dow Inc.

- Dymax Corporation

- Henkel AG &Co. KGaA

- HB Fuller Company

- Huntsman Corporation

- Kangda New Materials

- Kisling AG

- Master Bond Inc.

- Panacol-Elosol GmbH

- Parson Adhesives

- PPG Industries

- Sika AG

- ThreeBond Holdings Co., Ltd.

- Toagosei Co., Ltd.

- Weiss Chemie+Technik GmbH &Co. KG

The Global Structural Adhesive Market was valued at USD 23.5 billion in 2025 and is estimated to grow at a CAGR of 5.9% to reach USD 41.8 billion by 2035.

Structural adhesives are experiencing significant growth as multiple industries, including automotive, aerospace, electronics, marine, wind energy, and construction, increasingly adopt them. These adhesives are gradually replacing welding and mechanical fasteners in applications that require evenly distributed stresses and lightweight assemblies. The surge in electric vehicle production and the integration of composite materials in aircraft have accelerated this transition. Additionally, regulatory frameworks are steering the market toward environmentally friendly chemistries, such as water-based, low-VOC, and zero-VOC formulations, aligning with sustainability and compliance standards. Market growth is driven by large-scale vehicle production, creating high demand for structural adhesives in body-in-white, glazing, and battery assembly, alongside stringent environmental regulations encouraging solvent-free and low-emission alternatives. These factors compel manufacturers to innovate and develop formulations that meet compliance while delivering high performance and efficiency.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $23.5 Billion |

| Forecast Value | $41.8 Billion |

| CAGR | 5.9% |

The epoxy-based adhesives segment generated USD 9.8 billion in 2025. Epoxy structural adhesives are highly valued for their exceptional tensile and shear strength, as well as chemical and thermal resistance. These properties make them ideal for critical applications, including electric vehicle battery packs, aerospace composites, and body-in-white assemblies. Toughened epoxy adhesives are widely used for reinforcement and bonding applications, while high-modulus systems in wind energy applications help withstand cyclic loads across long spans. The acrylic structural adhesives segment is also witnessing growing adoption across various industries.

The heat-curing systems segment was valued at USD 9.7 billion in 2025 and is seeing rising demand in challenging operating environments, such as aerospace composites and automotive body-in-white applications that require oven baking. These systems offer lower cross-link density and high durability, making them suitable for long-lasting applications. However, two-component, room-temperature curing epoxies and polyurethanes (PUs) are gaining traction due to their flexibility, ease of field and line assembly, and elimination of labor-intensive installations. These systems are increasingly used in industrial and construction projects, providing a balance between performance and convenience.

U.S. Structural Adhesive Market reached USD 5 billion in 2025, owing to a strong aerospace sector and growing adoption of electric vehicles in the automotive industry. Manufacturing capabilities in the U.S. play a leading role, while Canada contributes through aerospace and construction applications. Mexico's growing automotive production also supports regional market expansion. The evolving regulatory landscape promotes low and zero-VOC chemistries, driving innovation in structural glazing and specialty adhesive applications.

Key players in the Global Structural Adhesive Market include 3M, Arkema S.A., Ashland Global Holdings Inc., Dow Inc., Bostik (Arkema), Dymax Corporation, Henkel AG & Co. KGaA, H.B. Fuller Company, Huntsman Corporation, Kangda New Materials, Kisling AG, Master Bond Inc., Panacol-Elosol GmbH, Parson Adhesives, PPG Industries, Sika AG, ThreeBond Holdings Co., Ltd., Toagosei Co., Ltd., and Weiss Chemie + Technik GmbH & Co. KG. Companies in the Global Structural Adhesive Market are implementing several strategies to strengthen their market presence and enhance competitiveness. Investments in research and development focus on creating high-performance, environmentally friendly formulations, including low- and zero-VOC adhesives. Strategic partnerships with automotive, aerospace, and electronics manufacturers facilitate product integration into large-scale production. Firms are expanding regional manufacturing capacities to serve emerging markets and enhance supply chain resilience. Emphasis on sustainability, regulatory compliance, and innovative product design helps companies differentiate their offerings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Technology platform

- 2.2.2 Curing mechanism

- 2.2.3 Form

- 2.2.4 Component system

- 2.2.5 VOC content

- 2.2.6 Application

- 2.2.7 End use industry

- 2.2.8 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Lightweighting in automotive & aerospace

- 3.2.1.2 Rising construction & infrastructure projects

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Long curing times

- 3.2.2.2 High cost compared to fasteners

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in electric vehicles (EVS)

- 3.2.3.2 3D printing & additive manufacturing

- 3.2.3.3 Repair & maintenance applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By technology platform

- 3.9 Future market trends

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology Platform, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Epoxy-based adhesives

- 5.3 Polyurethane (PU) adhesives

- 5.4 Acrylic adhesives

- 5.5 Cyanoacrylate adhesives

- 5.6 Silicone adhesives

- 5.7 Other technologies

Chapter 6 Market Estimates and Forecast, By Curing Mechanism, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Heat-curing systems

- 6.2.1 High-temperature cure (>150°C)

- 6.2.2 Medium-temperature cure (120-150°C)

- 6.2.3 Low-temperature cure (70-120°C)

- 6.3 Room-temperature curing systems

- 6.4 Moisture-curing systems

- 6.5 UV & radiation-curing systems

- 6.6 Dual-cure systems

Chapter 7 Market Estimates and Forecast, By Form, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Film adhesives

- 7.3 Paste adhesives

- 7.4 Liquid & low-viscosity adhesives

Chapter 8 Market Estimates and Forecast, By Component System, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Single-component (1C) systems

- 8.3 Two-component (2C) systems

Chapter 9 Market Estimates and Forecast, By VOC Content, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Low-VOC adhesives (<50 g/L)

- 9.3 Zero-VOC/solvent-free adhesives

- 9.4 Water-based adhesives

- 9.5 Bio-based/renewable content

Chapter 10 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Metal-to-metal bonding

- 10.3 Composite bonding

- 10.4 Mixed-material bonding

- 10.5 Plastic bonding

- 10.6 Wood & engineered wood bonding

- 10.7 Concrete & masonry bonding

- 10.8 Glass bonding

- 10.9 Others

Chapter 11 Market Estimates and Forecast, By End Use Industry, 2022-2035 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 Automotive

- 11.3 Aviation & aerospace

- 11.4 Wind energy

- 11.5 Marine & shipbuilding

- 11.6 Construction & infrastructure

- 11.7 Electronics & electrical

- 11.8 Water & wastewater

- 11.9 Others

Chapter 12 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.2.3 Mexico

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Rest of Europe

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Rest of Asia Pacific

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Rest of Latin America

- 12.6 Middle East and Africa

- 12.6.1 Saudi Arabia

- 12.6.2 South Africa

- 12.6.3 UAE

- 12.6.4 Rest of Middle East and Africa

Chapter 13 Company Profiles

- 13.1 3M Company

- 13.2 Arkema S.A.

- 13.3 Ashland Global Holdings Inc.

- 13.4 Bostik (Arkema)

- 13.5 Cemedine Co., Ltd.

- 13.6 Dow Inc.

- 13.7 Dymax Corporation

- 13.8 Henkel AG & Co. KGaA

- 13.9 H.B. Fuller Company

- 13.10 Huntsman Corporation

- 13.11 Kangda New Materials

- 13.12 Kisling AG

- 13.13 Master Bond Inc.

- 13.14 Panacol-Elosol GmbH

- 13.15 Parson Adhesives

- 13.16 PPG Industries

- 13.17 Sika AG

- 13.18 ThreeBond Holdings Co., Ltd.

- 13.19 Toagosei Co., Ltd.

- 13.20 Weiss Chemie + Technik GmbH & Co. KG