|

市場調查報告書

商品編碼

1913276

消費品市場可程式物質的機會、成長促進因素、產業趨勢分析及預測(2026-2035)Programmable Matter for Consumer Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

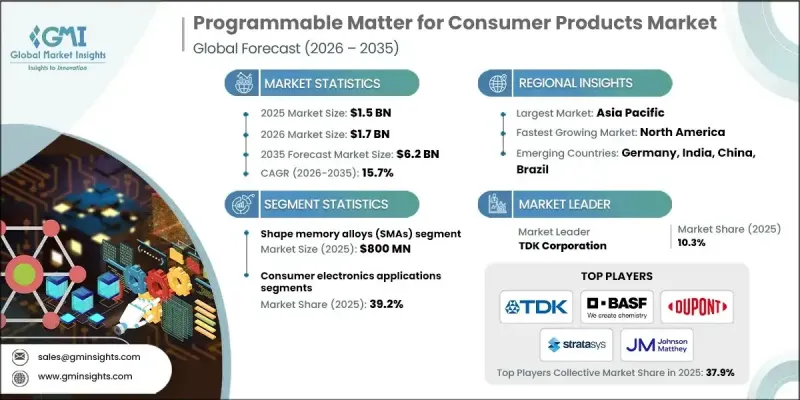

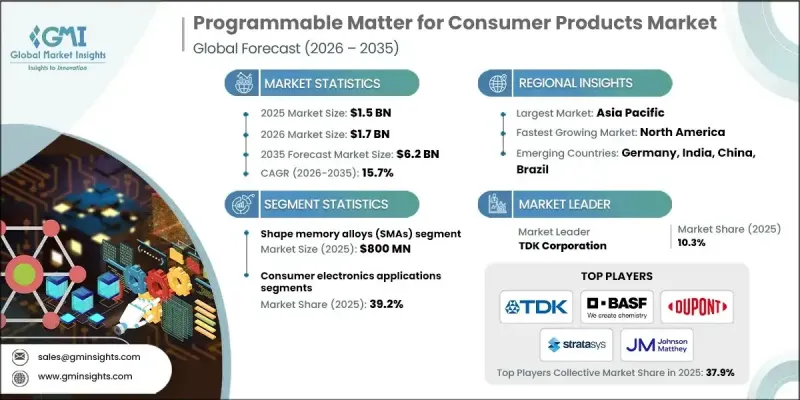

全球消費品可編程物質市場預計到 2025 年價值 15 億美元,到 2035 年達到 62 億美元,年複合成長率為 15.7%。

材料科學和響應技術的快速發展正在改變消費品的設計、製造和體驗方式。國防、航太和公共研究機構的大量資金投入正在加速創新,並逐步將這些技術轉化為消費應用。研究重點在於能夠回應外部刺激的材料,使其具備自調節、適應性和功能轉換等特性。隨著先進製造能力的不斷成熟,商業化門檻正在降低,規模化生產也變得越來越可行。消費者對智慧、適應性和個人化產品的興趣日益濃厚,推動了這類產品在各個終端應用領域的普及。企業正在利用材料科學、電子學和數位系統之間的跨學科合作,開拓新的應用場景。技術轉移框架在將創新成果從受控的研究環境推向消費市場方面發揮著至關重要的作用。資金、基礎設施和消費者需求的整合,正使可程式材料成為下一代消費品領域的一股變革力量。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 15億美元 |

| 預測金額 | 62億美元 |

| 複合年成長率 | 15.7% |

形狀記憶合金市場預計2025年將達到8億美元。政府對智慧材料研究的長期公共投資正在推動製造技術的進步,並加速其大規模商業化應用。政府支持的研究機構不斷拓展對熱和機械刺激有反應的合金的應用範圍,能源機構也認知到它們在支持環境高效技術方面的潛力。

到2025年,家用電器領域將佔據39.2%的市場。學術界和產業界的持續研究正在推動可重編程材料的創新,從而使電子消費品具備自適應功能。智慧紡織品和穿戴式解決方案正擴大整合可編程材料,以提高性能、舒適度和用戶互動。

預計到2025年,美國可程式物質消費品市場佔有率將達到74.9%。強大的研發生態系統、早期技術應用以及對先進製造技術的持續投資鞏固了其主導地位。材料科學、人工智慧和互聯技術領域的積極研發活動將繼續推動市場擴張。

目錄

第1章調查方法和範圍

第2章執行摘要

第3章業界考察

- 產業生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 對客製化和個人化的需求

- 材料科學和奈米技術的進展

- 與物聯網和人工智慧的整合

- 產業潛在風險與挑戰

- 高成本且製造流程複雜

- 能源消耗和控制系統

- 機會

- 下一代消費者介面

- 循環經濟與產品壽命

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 監管環境

- 標準和合規要求

- 區域法規結構

- 認證標準

- 差距分析

- 風險評估與緩解

- 波特分析

- PESTEL 分析

- 消費行為分析

- 購買模式

- 偏好分析

- 消費行為的區域差異

- 電子商務對購買決策的影響

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 企業矩陣分析

- 主要市場公司的競爭分析

- 競爭定位矩陣

- 重大進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 業務拓展計劃

第5章 依技術類型分類的市場估算與預測(2022-2035 年)

- 形狀記憶合金(SMA)

- 4D列印技術

- 智慧型自適應紡織品

- 電活性聚合物和材料

- 水凝膠和生物響應材料

- 相變材料(PCM)

第6章 市場估計與預測:依應用領域分類(2022-2035 年)

- 家用電器應用

- 整合到智慧型手機和行動裝置中

- 穿戴式科技及配件

- 自適應顯示技術

- 觸覺介面系統

- 智慧紡織品和服裝

- 適應性服裝和時尚應用

- 運動表現監測設備

- 健康監測服裝

- 互動娛樂紡織品

- 智慧家庭和家具

- 可重構家具系統

- 輔助設備

- 智慧表面技術

- 互動式介面整合

- 汽車消費功能

- 自適應內裝系統

- 舒適性和空調控制應用

- 保健和健康產品

- 穿戴式健康監測設備

- 自適應醫療設備

- 治療和復健系統

- 為老年人和身心障礙者提供輔助產品

- 食品/包裝應用

- 4D列印食品

- 智慧包裝技術

- 溫度和新鮮度指標

第7章 市場估計與預測:按地區分類(2022-2035 年)

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章 公司簡介

- AiQ Smart Clothing

- ATI

- BASF

- Cambridge Mechatronics

- DuPont

- Fort Wayne Metals

- Gentherm

- Interactive Wear

- Johnson Matthey

- Ohmatex

- Parker Hannifin

- Schoeller Textil

- Sensoria

- Stratasys

- TDK

The Global Programmable Matter for Consumer Products Market was valued at USD 1.5 billion in 2025 and is estimated to grow at a CAGR of 15.7% to reach USD 6.2 billion by 2035.

Rapid progress in material science and responsive technologies reshapes how consumer products are designed, manufactured, and experienced. Significant funding from defense, aerospace, and public research institutions accelerates innovation and gradually shifts these technologies toward consumer-ready applications. Research initiatives focus on materials capable of responding to external stimuli, enabling properties such as self-adjustment, adaptability, and functional transformation. As advanced manufacturing capabilities continue to mature, commercialization barriers decline, and scalable production becomes increasingly viable. Consumer interest in intelligent, adaptive, and personalized products supports adoption across multiple end-use categories. Companies leverage cross-disciplinary collaboration between material science, electronics, and digital systems to unlock new use cases. Technology transfer frameworks play a critical role in moving innovations from controlled research environments into consumer markets. This convergence of funding, infrastructure, and consumer demand positions programmable matter as a transformative force within next-generation consumer products.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.5 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 15.7% |

The shape memory alloys segment generated USD 800 million in 2025. Long-term public investment in smart materials research supports advancements in manufacturing techniques and accelerates readiness for large-scale commercial deployment. Government-backed research institutions continue to expand applications for alloys that respond to thermal and mechanical stimuli, while energy-focused agencies recognize their potential to support environmentally efficient technologies.

The consumer electronics segment held 39.2% share in 2025. Ongoing academic and industrial research drives innovation in reprogrammable materials that enable adaptive functionality within electronic consumer goods. Smart textiles and wearable solutions increasingly integrate programmable matter to enhance performance, comfort, and user interaction.

U.S. Programmable Matter for Consumer Products Market held a 74.9% share in 2025. Strong research ecosystems, early technology adoption, and sustained investment in advanced manufacturing reinforce this leadership position. Robust development activity across materials science, artificial intelligence, and connected technologies continues to fuel market expansion.

Key companies operating in the Global Programmable Matter for Consumer Products Market include BASF, Stratasys, DuPont, TDK, Johnson Matthey, Parker Hannifin, Gentherm, ATI, Fort Wayne Metals, Cambridge Mechatronics, Sensoria, AiQ Smart Clothing, Ohmatex, Interactive Wear, and Schoeller Textil. Companies strengthen their position by prioritizing research-driven innovation, strategic partnerships, and scalable manufacturing capabilities. Many firms invest heavily in proprietary materials and process optimization to accelerate commercialization timelines. Collaboration with research institutions and technology developers supports access to emerging breakthroughs while reducing development risk. Businesses also focus on integrating programmable matter with digital platforms to enable smarter, connected consumer products. Expanding production capacity and improving material reliability help address cost and performance expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Demand for customization and personalization

- 3.2.1.2 Advances in material science and nanotechnology

- 3.2.1.3 Integration with IoT and AI

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost and manufacturing complexity

- 3.2.2.2 Energy consumption and control systems

- 3.2.3 Opportunities

- 3.2.3.1 Next-gen consumer interfaces

- 3.2.3.2 Circular economy and product longevity

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Regulatory landscape

- 3.6.1 Standards and compliance requirements

- 3.6.2 Regional regulatory frameworks

- 3.6.3 Certification standards

- 3.7 Gap analysis

- 3.8 Risk assessment and mitigation

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Technology Type, 2022-2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Shape memory alloys (SMAs)

- 5.3 4d printing technologies

- 5.4 Smart and adaptive textiles

- 5.5 Electroactive polymers and materials

- 5.6 Hydrogels and bio-responsive materials

- 5.7 Phase change materials (PCMS)

Chapter 6 Market Estimates & Forecast, By Application Type, 2022-2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Consumer Electronics Applications

- 6.2.1 Integration in smartphones and mobile devices integration

- 6.2.2 Wearable technology & accessories

- 6.2.3 Adaptive display technologies

- 6.2.4 Haptic interface systems

- 6.3 Smart textiles & apparel

- 6.3.1 Adaptive clothing & fashion applications

- 6.3.2 Sports & performance monitoring gear

- 6.3.3 Health monitoring garments

- 6.3.4 Interactive & entertainment textiles

- 6.4 Home automation & furniture

- 6.4.1 Reconfigurable furniture systems

- 6.4.2 Adaptive home appliances

- 6.4.3 Smart surface technologies

- 6.4.4 Interactive interface integration

- 6.5 Automotive consumer features

- 6.5.1 Adaptive interior systems

- 6.5.2 Comfort & climate control applications

- 6.6 Healthcare & wellness products

- 6.6.1 Wearable health monitoring devices

- 6.6.2 Adaptive medical equipment

- 6.6.3 Therapeutic & rehabilitation systems

- 6.6.4 Products for elderly & disability assistance

- 6.7 Food & packaging applications

- 6.7.1 4D printed food products

- 6.7.2 Smart packaging technologies

- 6.7.3 Temperature & freshness indicators

Chapter 7 Market Estimates & Forecast, By Region, 2022-2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 UK

- 7.3.4 Italy

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 AiQ Smart Clothing

- 8.2 ATI

- 8.3 BASF

- 8.4 Cambridge Mechatronics

- 8.5 DuPont

- 8.6 Fort Wayne Metals

- 8.7 Gentherm

- 8.8 Interactive Wear

- 8.9 Johnson Matthey

- 8.10 Ohmatex

- 8.11 Parker Hannifin

- 8.12 Schoeller Textil

- 8.13 Sensoria

- 8.14 Stratasys

- 8.15 TDK