|

市場調查報告書

商品編碼

1911833

中東智慧家庭市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031年)Middle East Smart Home - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

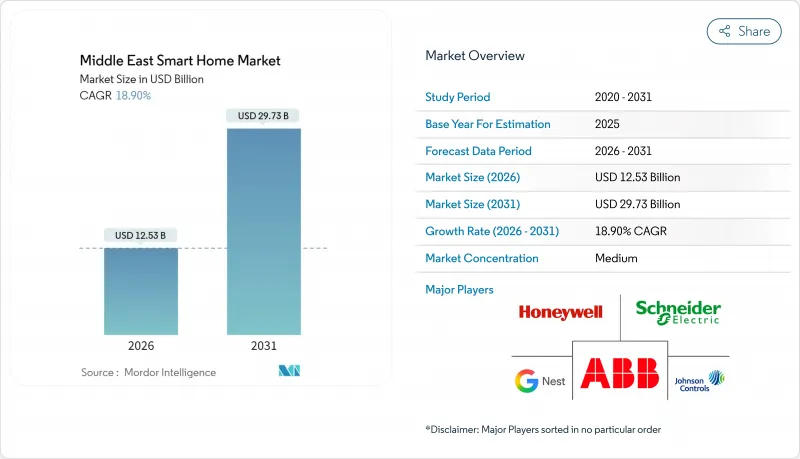

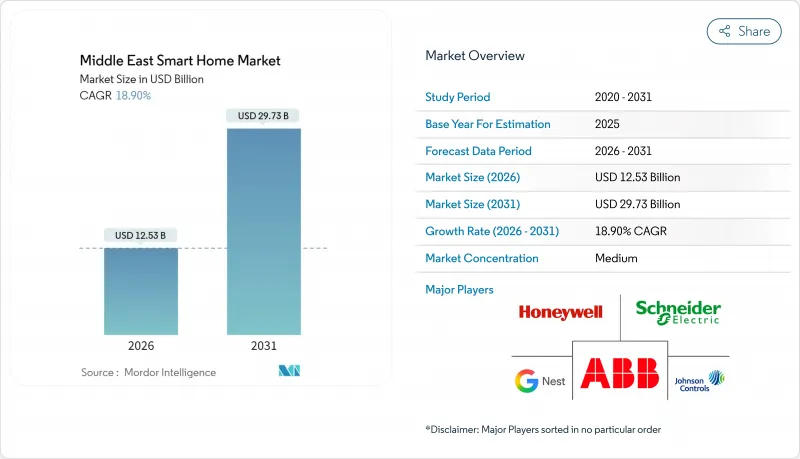

2025 年中東智慧家庭市場價值 105.4 億美元,預計將從 2026 年的 125.3 億美元成長到 2031 年的 297.3 億美元,在預測期(2026-2031 年)內,預計複合年成長率為 18.90%。

加速推進的數位化政府項目、高階消費群體以及大規模智慧城市計劃正在推動這一兩位數的成長。沙烏地阿拉伯的「2030願景」以及波灣合作理事會(GCC)其他國家類似的國家議程都強調永續城市發展,這使得供應商能夠從長遠角度看待住宅自動化需求。先進通訊服務的推廣,特別是全國光纖和5G網路的覆蓋,正在消除頻寬限制,並建立更豐富的互聯設備生態系統。沙烏地阿拉伯公民和外籍人士的高可支配收入支撐了高階產品的價格,而豪華房地產開發商也擴大將承包自動化解決方案打包出售,以使新計畫脫穎而出。同時,以安全為先的產品定位引起了注重資產保護的家庭的共鳴,推動監控和門禁解決方案成為首選購買清單上的項目,並隨著時間的推移促進生態系統的擴展。

中東智慧家庭市場趨勢與洞察

政府的「2030年智慧城市願景」計劃

長期國家計畫正將智慧家庭理念納入強制性住宅規劃要求。沙烏地阿拉伯的NEOM和阿拉伯聯合大公國的智慧城區計畫等旗艦計劃,都撥出專案預算用於高頻寬的最後一公里連線、本地物聯網閘道和需求面管理平台等基礎設施建設。這些公共投資透過標準化設備規格和安裝指南,簡化了供應商的進入流程,並透過增加採購量,推動了組件成本的快速下降。 2030願景框架中的永續性目標明確認可節能住宅設計,使設備製造商能夠將自動化產品作為合規工具而非奢侈品進行銷售。政府支持的示範區所取得的示範效應,正在加速住宅智慧家庭的接受度,並鞏固中東智慧家庭市場作為區域數位經濟計畫核心支柱的地位。

快速部署5G和光纖基礎設施

沿岸地區的通訊業者已部署光纖網路,幾乎涵蓋了所有家庭,目前正逐步推出低延遲的5G室內應用場景。固定無線接入方案正在將覆蓋範圍擴展到先前訊號較弱的郊區度假屋。這使得系統整合商能夠提案多房間監控系統和身臨其境型多媒體解決方案,而無需考慮品質保證方面的限制。網路切片測試正在為安全和生命安全設備提供獨立的虛擬通道,從而解決了風險規避型買家對可靠性的擔憂。結合由網路服務供應商提供的Wi-Fi 6E路由器,消費者可以操作密集的設備群而不會感受到明顯的延遲。隨著連接性不再是限制阻礙因素,競爭差異化正在轉向軟體功能的深度、數據分析儀表板和用戶體驗設計,從而推動了中東智慧家庭市場對加值服務的需求。

網路安全和資料隱私問題

物聯網相關安全漏洞的報告數量持續成長,提高了消費者的警覺性。沙烏地阿拉伯和阿拉伯聯合大公國的聯邦資料保護法都加強了使用者授權的核准流程,增加了供應商的合規成本。家庭用戶越來越需要本地資料儲存和多因素身份驗證,這使得即插即用的便利提案難以實現。曾經僅用於商業建築的企業級加密技術如今也開始應用於高階住宅,雖然延長了銷售週期,但提高了平均售價。儘管對安全性的重視可能會限制短期銷量,但也為值得信賴的品牌在中東智慧家庭市場獲得更高的利潤奠定了基礎。

細分市場分析

到2025年,安防系統將佔中東智慧家庭市場30.12%的佔有率,反映出該地區對資產保護和隱私的高度重視。市場需求主要集中在具備設備內建分析功能的智慧攝影機、可視門鈴和生物識別鎖上,這些產品符合當地居民對封閉式住宅的文化偏好。隨著家庭用戶在其網路中添加能源管理感測器,利用現有的基礎設施投資,追加提升銷售強勁。能源管理設備預計將以20.75%的複合年成長率(CAGR)實現最高成長,這主要得益於基於收費系統的投資回報率計算以及政府應對氣候變遷的承諾。同時,控制和連接中心正從單一功能的閘道器向人工智慧輔助的整合引擎發展,為第三方家用電器開闢了交叉銷售管道。娛樂套餐正受益於高清串流媒體的普及,但隨著消費者更加重視安全功能,其收入佔有率正在下降。隨著價格下降,中等收入的公寓居住者開始採用一體化入門套件,從而擴大了中東智慧家庭市場的潛在客戶群。

第二梯隊成長將來自高階品牌,這些品牌將健康感測器整合到產品中,用於監測室內空氣品質並與暖通空調控制設備整合。健康與舒適的結合使高階度假屋產品脫穎而出,並提高了單價。 Matter框架帶來的互通性進步消除了傳統生態系統的壁壘,使住宅能夠採用多品牌產品線,而無需擔心未來產品過時。這些協同效應創造了具有韌性的產品組合,使供應商免受任何單一類別需求波動的影響,從而保持中東智慧家居市場的高速成長。

到2025年,Wi-Fi將在中東智慧家庭市場佔據40.35%的佔有率,這主要得益於路由器的普及和簡易的設定體驗。網狀網路擴展技術消除了沿岸地區常見的多層住宅中的通訊盲區,並支援無需額外中心即可安裝攝影機和感測器。然而,Thread通訊協定預計將以20.56%的複合年成長率成長,這反映了全球範圍內採用節能型網狀網路(用於電池供電節點)的趨勢。經Matter認證的Thread邊界路由器將成為新型智慧音箱的標配,從而形成大規模的用戶群,並在未來重塑設備連接方式。低功耗藍牙(Bluetooth Low Energy)將在個人健康追蹤器和攜帶式語音助理領域繼續保持其獨特地位,而Zigbee仍將是商業整合商現有建築管理系統整合方案中的首選。 Z-Wave仍然受到頻譜分配規則的限制,這使其難以進入大眾市場零售領域。

目前,產業聯盟正在推廣韌體更新,以實現雙通訊協定運行,從而緩解消費者在初始技術選擇上的不確定性。這種整合將使零售商受益,因為他們可以減少庫存的不同SKU數量,降低庫存風險。隨著具有確定性延遲保證的Wi-Fi 7的到來,8K安防視訊串流和身臨其境型虛擬實境等高頻寬應用將獲得更佳的效能。因此,增強Wi-Fi骨幹網路和Thread邊緣設備的共存將引領中東智慧家庭市場邁向無縫的混合網路架構。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 政府2030年願景智慧城市計劃

- 快速部署5G和光纖基礎設施

- 電費上漲推動能源管理技術的普及

- 房地產開發商提供智慧家庭捆綁解決方案

- 精通科技的外籍人士群體日益壯大

- 氣候變遷要求最佳化暖通空調系統。

- 市場限制

- 網路安全和資料隱私問題

- 技術標準分散

- 熟練安裝人員的生態系統有限

- 補貼降低了公用事業費率,從而降低了投資收益(ROI)。

- 產業價值鏈分析

- 監管環境

- 技術展望

- 宏觀經濟因素的影響

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品

- 舒適度和照明

- 控制與連接

- 能源管理

- 家庭娛樂

- 安全

- 智慧家庭設備

- 透過連接技術

- Wi-Fi

- Bluetooth

- Zigbee

- Z-Wave

- 線

- 其他技術

- 按住宅類型

- 豪華別墅

- 高所得公寓

- 中等收入公寓

- 低收入住宅

- 按銷售管道

- 直接面對消費者(線上)

- 零售店(實體店面)

- 建築承包商

- 系統整合商

- 按國家/地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 土耳其

- 科威特

- 巴林

- 其他中東地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Schneider Electric SE

- Honeywell International Inc.

- ABB Ltd.

- Johnson Controls International plc

- Google LLC(Nest)

- Amazon.com Inc.(Ring LLC)

- Samsung Electronics Co. Ltd.

- Huawei Technologies Co. Ltd.

- Legrand SA

- Siemens AG

- LG Electronics Inc.

- Lutron Electronics Co. Inc.

- Bosch Security Systems GmbH

- Cisco Systems Inc.

- TP-Link Technologies Co. Ltd.

- Resideo Technologies Inc.

- Fibaro Group SA

- Aqara(Lumi United Technology Co. Ltd.)

- Dahua Technology Co. Ltd.

- Etisalat by e&

第7章 市場機會與未來展望

The Middle East smart home market was valued at USD 10.54 billion in 2025 and estimated to grow from USD 12.53 billion in 2026 to reach USD 29.73 billion by 2031, at a CAGR of 18.90% during the forecast period (2026-2031).

Accelerating digital-government programs, premium-focused consumer segments, and large-scale smart-city projects collectively underpin this double-digit expansion. Saudi Vision 2030 and comparable national agendas across the Gulf Cooperation Council emphasize sustainable urban development, giving vendors long-range visibility into residential automation demand. Advanced telecommunications rollouts, especially nationwide fiber and 5G coverage, remove bandwidth constraints and enable richer connected-device ecosystems. High disposable incomes among both nationals and expatriates support premium price points, while luxury real-estate developers increasingly bundle turnkey automation packages to differentiate new projects. Meanwhile, security-first product positioning resonates with households concerned about property protection, pushing surveillance and access-control solutions to the top of initial purchase lists and encouraging ecosystem expansion over time.

Middle East Smart Home Market Trends and Insights

Government Vision 2030 Smart-City Initiatives

Long-range national programs have hard-wired smart-home considerations into residential planning mandates. Flagship projects such as Saudi Arabia's NEOM and the UAE's smart-district blueprints allocate infrastructure budgets for high-bandwidth last-mile connectivity, on-premises IoT gateways, and demand-side management platforms. These public investments ease vendor entry by standardizing device specifications and installation guidelines while unlocking procurement volumes that quickly shift component costs downward. Sustainability targets inside Vision 2030 frameworks explicitly reward energy-efficient dwelling designs, allowing device makers to market automation not as a luxury but as a compliance aid. The demonstration effect of government-backed model neighborhoods accelerates homeowner awareness, reinforcing the Middle East smart home market as a core pillar of regional digital-economy plans.

Rapid Deployment of 5G and Fiber Infrastructure

Operators in the Gulf have achieved near-ubiquitous household fiber coverage and are now layering low-latency 5G for indoor use-cases. Fixed-wireless access options widen reach to suburban villas that previously suffered from signal drop-offs, letting integrators pitch multi-room surveillance and immersive multimedia without quality-of-service caveats. Network slicing pilots provide isolated virtual channels for security and life-safety devices, addressing reliability fears among risk-averse buyers. Combined with Wi-Fi-6E routers bundled by internet-service providers, consumers can run dense device clusters without perceivable lag. As connectivity ceases to be a limiting factor, competitive differentiation shifts toward software feature depth, data analytics dashboards, and user-experience design, reinforcing premium service willingness across the Middle East smart home market.

Cybersecurity and Data-Privacy Concerns

A steady rise in IoT-related breach headlines has elevated consumer caution. Federal data-protection statutes in both Saudi Arabia and the UAE impose stricter consent rules, heightening vendor compliance costs. Households increasingly request on-premises data storage and multi-factor authentication, complicating quick plug-and-play proposals. Enterprise-grade encryption, once aimed at commercial buildings, is now marketed for high-net-worth residences, lengthening sales cycles but also raising average selling prices. While the security narrative restrains short-term volumes, it simultaneously positions trusted brands to command higher margins within the Middle East smart home market.

Other drivers and restraints analyzed in the detailed report include:

- High Electricity Tariffs Driving Energy-Management Adoption

- Real-Estate Developers Bundling Smart-Home Solutions

- Fragmented Technology Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Security systems captured 30.12% of the Middle East smart home market size in 2025, underscoring the region's priority on property protection and privacy safeguards. Demand centers on smart cameras with on-device analytics, video doorbells, and biometric locks that align with cultural preferences for gated living. Upsell momentum builds as households layer energy-management sensors onto the same network, leveraging sunk infrastructure costs. Energy-management devices exhibit the strongest 20.75% CAGR outlook, propelled by tariff-driven return-on-investment calculations and government climate commitments. Meanwhile, control and connectivity hubs evolve from single-purpose gateways into AI-assisted orchestration engines, opening cross-selling pathways for third-party appliances. Entertainment bundles ride high-definition streaming adoption, yet their revenue share lags because consumers often prioritize core safety features before discretionary upgrades. As price points descend, some middle-income apartment dwellers begin installing all-in-one starter kits, broadening addressable volume within the Middle East smart home market.

A second growth layer emerges from premium brands packaging wellness sensors that monitor indoor air quality and integrate with HVAC controllers. This convergence of health and comfort differentiates offerings in upscale villas, raising per-unit revenue. Interoperability progress under the Matter framework removes earlier ecosystem barriers, letting homeowners adopt multi-brand product stacks without fear of future obsolescence. The combined effect is a more resilient product mix that buffers vendors from single-category demand shocks and keeps the Middle East smart home market on its high-growth trajectory.

Wi-Fi supported 40.35% of the Middle East smart home market share in 2025, buoyed by near-universal router penetration and straightforward setup experiences. Mesh extensions eliminate dead zones in multi-story properties common across the Gulf, letting homeowners deploy cameras and sensors without additional hubs. Nevertheless, Thread protocol is projected to log a 20.56% CAGR, mirroring global momentum toward energy-efficient mesh networks for battery-powered nodes. Matter-certified Thread border routers ship as standard in new smart speakers, creating a large installed base that will redirect future device attach rates. Bluetooth Low Energy retains niche roles in personal health trackers and portable voice assistants, while Zigbee persists in commercial integrator portfolios for legacy building-management integrations. Z-Wave remains constrained by spectrum allocation rules that complicate mass-market retail.

Industry alliances now push firmware updates enabling dual-protocol operation, reducing consumer anxiety over early technology bets. This convergence benefits retailers who can stock fewer distinct SKUs, lowering inventory risk. As Wi-Fi 7 arrives with deterministic latency guarantees, high-bandwidth applications such as 8K security feeds and immersive virtual reality receive a performance boost. The coexistence of upgraded Wi-Fi backbones and Thread edge devices thus positions the Middle East smart home market for seamless hybrid networking architectures.

The Middle East Smart Home Market Report is Segmented by Product (Comfort and Lighting, Control and Connectivity, and More), Connectivity Technology (Wi-Fi, Bluetooth, and More), Residential Type (Luxury Villas, High-Income Apartments, and More), Sales Channel (Direct-To-Consumer, Retail, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Schneider Electric SE

- Honeywell International Inc.

- ABB Ltd.

- Johnson Controls International plc

- Google LLC (Nest)

- Amazon.com Inc. (Ring LLC)

- Samsung Electronics Co. Ltd.

- Huawei Technologies Co. Ltd.

- Legrand SA

- Siemens AG

- LG Electronics Inc.

- Lutron Electronics Co. Inc.

- Bosch Security Systems GmbH

- Cisco Systems Inc.

- TP-Link Technologies Co. Ltd.

- Resideo Technologies Inc.

- Fibaro Group S.A.

- Aqara (Lumi United Technology Co. Ltd.)

- Dahua Technology Co. Ltd.

- Etisalat by e&

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Vision 2030 smart-city initiatives

- 4.2.2 Rapid deployment of 5G and fibre infrastructure

- 4.2.3 High electricity tariffs driving energy-management adoption

- 4.2.4 Real-estate developers bundling smart-home solutions

- 4.2.5 Expatriate tech-savvy population growth

- 4.2.6 Climate-driven demand for HVAC optimisation

- 4.3 Market Restraints

- 4.3.1 Cybersecurity and data-privacy concerns

- 4.3.2 Fragmented technology standards

- 4.3.3 Limited skilled-installer ecosystem

- 4.3.4 Subsidised utility prices reducing ROI

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Product

- 5.1.1 Comfort and Lighting

- 5.1.2 Control and Connectivity

- 5.1.3 Energy Management

- 5.1.4 Home Entertainment

- 5.1.5 Security

- 5.1.6 Smart Appliances

- 5.2 By Connectivity Technology

- 5.2.1 Wi-Fi

- 5.2.2 Bluetooth

- 5.2.3 Zigbee

- 5.2.4 Z-Wave

- 5.2.5 Thread

- 5.2.6 Other Technologies

- 5.3 By Residential Type

- 5.3.1 Luxury Villas

- 5.3.2 High-income Apartments

- 5.3.3 Middle-income Apartments

- 5.3.4 Low-income Housing

- 5.4 By Sales Channel

- 5.4.1 Direct-to-Consumer (Online)

- 5.4.2 Retail (Brick-and-Mortar)

- 5.4.3 Contractors and Installers

- 5.4.4 System Integrators

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Qatar

- 5.5.4 Turkey

- 5.5.5 Kuwait

- 5.5.6 Bahrain

- 5.5.7 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schneider Electric SE

- 6.4.2 Honeywell International Inc.

- 6.4.3 ABB Ltd.

- 6.4.4 Johnson Controls International plc

- 6.4.5 Google LLC (Nest)

- 6.4.6 Amazon.com Inc. (Ring LLC)

- 6.4.7 Samsung Electronics Co. Ltd.

- 6.4.8 Huawei Technologies Co. Ltd.

- 6.4.9 Legrand SA

- 6.4.10 Siemens AG

- 6.4.11 LG Electronics Inc.

- 6.4.12 Lutron Electronics Co. Inc.

- 6.4.13 Bosch Security Systems GmbH

- 6.4.14 Cisco Systems Inc.

- 6.4.15 TP-Link Technologies Co. Ltd.

- 6.4.16 Resideo Technologies Inc.

- 6.4.17 Fibaro Group S.A.

- 6.4.18 Aqara (Lumi United Technology Co. Ltd.)

- 6.4.19 Dahua Technology Co. Ltd.

- 6.4.20 Etisalat by e&

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need assessment