|

市場調查報告書

商品編碼

1892918

汽車感測器市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Automotive Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

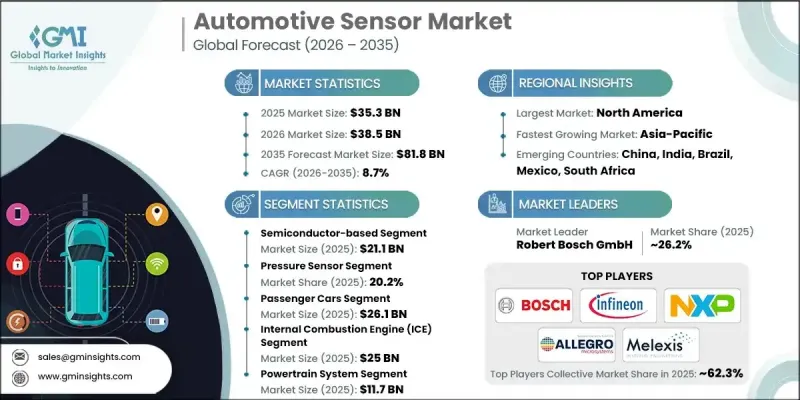

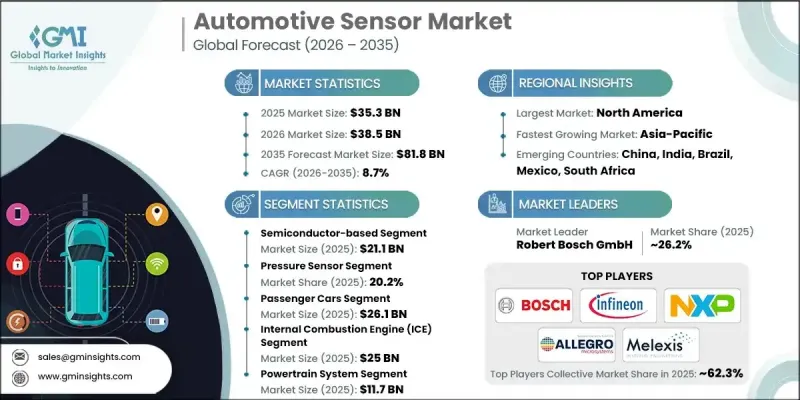

2025年全球汽車感測器市場價值為353億美元,預計到2035年將以8.7%的複合年成長率成長至818億美元。

市場成長的驅動力來自先進駕駛輔助系統(ADAS) 的日益普及、互聯自動駕駛汽車的日益流行,以及能夠提升安全性、效率和整體車輛性能的智慧感測器的部署。自適應巡航控制、車道偏離預警、自動煞車和盲點監測等功能推動了雷達、LiDAR、攝影機和超音波感測器的整合,從而實現即時態勢感知。此外,向電動車的轉型也帶動了對用於管理電池性能、熱調節、馬達控制和能源效率的感測器的需求。政府為促進安全、減少排放和提高燃油效率而製定的強制性規定,進一步加速了各細分市場感測器的應用。電動車產量的成長和清潔交通誘因也促進了全球市場的成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 353億美元 |

| 預測值 | 818億美元 |

| 複合年成長率 | 8.7% |

預計到2024年,半導體感測器市場規模將達211億美元。這些感測器精度高、可靠性強,並且能夠在單一晶片上整合多種功能。它們結構緊湊、功耗低、成本效益高,並且與先進的汽車電子設備相容,使其成為電動車、自動駕駛汽車和智慧網聯汽車不可或缺的組件。這些感測器廣泛應用於高階駕駛輔助系統(ADAS)、動力系統、電池管理、資訊娛樂系統和安全系統等領域,在全球市場保持強勁的需求。

預計到2025年,壓力感測器市場規模將達到71億美元。其廣泛應用源自於引擎管理、變速箱系統、輪胎壓力監測、煞車系統和電動車電池管理等領域。對車輛安全、法規遵循、排放控制和燃油效率的日益重視,持續推動全球乘用車和商用車對這類感測器的需求。

預計到2025年,北美汽車感測器市場佔有率將達到37.1%。該地區的領先地位歸功於其強大的汽車製造業基礎、對先進汽車技術的早期應用以及對安全性、燃油效率和排放合規車輛日益成長的需求。對電氣化、連網汽車和自動駕駛解決方案的日益重視推動了高級駕駛輔助系統(ADAS)和動力總成系統中感測器的部署。此外,嚴格的政府法規和消費者對創新汽車技術的偏好也鞏固了北美在全球市場的領先地位。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 電動車和自動駕駛汽車的普及

- 嚴格的安全和排放法規

- 消費者對提升車內體驗的需求

- 技術進步和成本降低

- 高級駕駛輔助系統(ADAS)的需求不斷成長

- 產業陷阱與挑戰

- 高昂的開發和生產成本

- 整合和相容性問題的複雜性

- 市場機遇

- 電動車(EV)的擴張

- 高級駕駛輔助系統(ADAS)和自動駕駛汽車

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 定價策略

- 新興商業模式

- 合規要求

- 永續性措施

- 消費者情緒分析

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 公司市佔率分析簡介

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 市場集中度分析

- 主要參與者的競爭基準化分析

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理分佈比較

- 全球足跡分析

- 服務網路覆蓋範圍

- 按地區分類的市場滲透率

- 競爭定位矩陣

- 領導人

- 挑戰者

- 追蹤者

- 小眾玩家

- 戰略展望矩陣

- 財務績效比較

- 2022-2025 年主要發展動態

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 永續發展計劃

- 數位轉型計劃

- 新興/新創企業競爭對手格局

第5章:市場估算與預測:依感測器類型分類,2022-2035年

- 壓力感測器

- 燃油軌道壓力感知器

- 歧管絕對壓力(MAP)感知器

- 差壓感知器(GPF/DPF)

- 輪胎壓力監測感知器

- 煞車壓力感知器

- 其他

- 氣體感測器

- 顆粒物(PM)感測器

- 氮氧化物(NOx)感測器

- 氧氣(λ)感測器

- 二氧化碳感測器

- 碳氫化合物(HC)感測器

- 其他

- 溫度感測器

- 排氣溫度(EGT)感知器

- 引擎冷卻液溫度感知器

- 電池溫度感測器(電動車)

- 環境溫度感測器

- 油溫感知器

- 其他

- 電流和電壓感測器

- 電池電流感測器(電動車)

- 電池電壓感測器(電動車)

- 高壓聯鎖迴路(HVIL)感測器

- 充電電流感測器

- 其他

- 位置和速度感測器

- 凸輪軸位置感知器

- 曲軸位置感知器

- 車輪速度感測器

- 轉向角感測器

- 節氣門位置感知器

- 其他

- 光學感測器

- 相機/影像感光元件

- LiDAR感測器

- 紅外線感測器

- 雨量/光線感應器

- 其他

- 雷達感測器

- 24 GHz 雷達感測器

- 77 GHz 雷達感測器

- 79 GHz 雷達感測器

- 其他

- 超音波感測器

- 停車輔助感應器

- 人體感應感應器

- 其他

- 慣性感測器

- 加速度計

- 陀螺儀

- 慣性測量單元(IMU)

- 其他

- 其他

第6章:市場估算與預測:依技術分類,2022-2035年

- 基於半導體的感測器

- 矽基感測器

- 陶瓷基感測器

- 微機電系統(MEMS)

- 磁性感應器

- 霍爾效應感測器

- 磁阻感測器

- 光學感測器

- 電化學感測器

第7章:市場估價與預測:依車輛類型分類,2022-2035年

- 搭乘用車

- 小型車

- 中型轎車

- 豪華轎車

- SUV

- 輕型商用車

- 重型商用車輛

- 中型卡車

- 重型卡車

- 公車

第8章:市場估算與預測:依推進類型分類,2022-2035年

- 內燃機(ICE)

- 汽油

- 柴油引擎

- 替代燃料(壓縮天然氣、液化石油氣)

- 電動車

- 混合動力電動車(HEV)

- 插電式混合動力電動車(PHEV)

- 電池電動車(BEV)

- 燃料電池電動車(FCEV)

第9章:市場估算與預測:依應用領域分類,2022-2035年

- 動力總成系統

- 引擎管理系統

- 變速箱控制系統

- 燃油輸送系統

- 廢氣後處理系統

- 電氣化系統

- 電池管理系統

- 馬達控制系統

- 充電系統

- 熱管理系統(電動車)

- 高壓安全系統

- 安全與ADAS系統

- 防碰撞系統

- 車道維持輔助系統

- 自適應巡航控制系統

- 停車輔助系統

- 盲點偵測系統

- 車身及底盤系統

- 轉向系統

- 懸吊系統

- 煞車系統

- 氣候控制系統

- 照明系統

- 舒適便利系統

- 資訊娛樂系統

- 座椅控制系統

- 門禁系統

- 其他

第10章:市場估價與預測:依銷售管道分類,2022-2035年

- 原始設備製造商(OEM)

- 售後市場

第11章:市場估計與預測:按地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第12章:公司簡介

- Allegro MicroSystems LLC

- Analog Devices Inc.

- Aptiv PLC

- BorgWarner Inc.

- Continental AG

- Denso Corporation

- First Sensor AG

- Hitachi Astemo Americas Inc.

- Honeywell International Inc.

- Infineon Technologies AG

- Melexis NV

- Microchip Technology Inc.

- NXP Semiconductors

- OMNIVISION Technologies Inc.

- ON Semiconductor

- Panasonic Corporation

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Sensata Technologies Inc.

- STMicroelectronics NV

- TE Connectivity Ltd.

- Valeo SA

The Global Automotive Sensor Market was valued at USD 35.3 billion in 2025 and is estimated to grow at a CAGR of 8.7% to reach USD 81.8 billion by 2035.

The market's growth is fueled by the rising adoption of advanced driver assistance systems (ADAS), the increasing popularity of connected and autonomous vehicles, and the deployment of smart sensors that enhance safety, efficiency, and overall vehicle performance. Features such as adaptive cruise control, lane departure warning, automatic braking, and blind-spot monitoring are driving the integration of radar, lidar, camera, and ultrasonic sensors, enabling real-time situational awareness. Additionally, the transition to electric vehicles is supporting demand for sensors that manage battery performance, thermal regulation, motor control, and energy efficiency. Government mandates promoting safety, emission reduction, and fuel efficiency further accelerate sensor adoption across all vehicle segments. Rising production of EVs and incentives for cleaner transportation are also contributing to market growth globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $35.3 Billion |

| Forecast Value | $81.8 Billion |

| CAGR | 8.7% |

The semiconductor-based sensors segment reached USD 21.1 billion in 2024. These sensors are highly accurate, reliable, and capable of integrating multiple functions on a single chip. Their compact design, low power requirements, cost-effectiveness, and compatibility with advanced automotive electronics make them indispensable in electric, autonomous, and connected vehicles. They are widely utilized across ADAS, powertrain, battery management, infotainment, and safety systems, sustaining strong demand across global markets.

The pressure sensor segment was valued at USD 7.1 billion in 2025. Their widespread adoption stems from applications in engine management, transmission systems, tire pressure monitoring, braking systems, and electric vehicle battery management. Rising emphasis on vehicle safety, regulatory compliance, emission control, and fuel efficiency continues to drive demand for these sensors across passenger and commercial vehicles worldwide.

North America Automotive Sensor Market held a 37.1% share in 2025. The region's dominance is attributed to its strong automotive manufacturing base, early adoption of advanced vehicle technologies, and increasing demand for safety, fuel efficiency, and emission-compliant vehicles. Growing focus on electrification, connected vehicles, and autonomous driving solutions has driven sensor deployment in ADAS and powertrain systems. Additionally, stringent government regulations and consumer preference for innovative automotive technologies support North America's leadership in the global market.

Key players operating in Global Automotive Sensor Market include Infineon Technologies AG, Denso Corporation, Panasonic Corporation, Melexis NV, Analog Devices Inc., Microchip Technology Inc., TE Connectivity Ltd., NXP Semiconductors, Honeywell International Inc., Allegro MicroSystems LLC, Renesas Electronics Corporation, Robert Bosch GmbH, BorgWarner Inc., ON Semiconductor, Aptiv PLC, Hitachi Astemo Americas Inc., Continental AG, Sensata Technologies Inc., First Sensor AG, Valeo SA, STMicroelectronics NV, and OMNIVISION Technologies Inc. Companies in the Global Automotive Sensor Market are employing diverse strategies to strengthen their presence and expand their market foothold. They are investing heavily in research and development to deliver innovative, high-precision sensors for ADAS, autonomous, and electric vehicles. Strategic partnerships, mergers, and acquisitions are being pursued to expand technological capabilities, geographic reach, and production capacity. Firms are also focusing on product differentiation through miniaturization, multi-function integration, and energy-efficient designs. Additionally, companies are enhancing customer support, providing software-enabled solutions, and targeting emerging markets to capture growth opportunities, strengthen distribution networks, and maintain a competitive edge in the rapidly evolving automotive sensor landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Sensor type trends

- 2.2.3 Technology type trends

- 2.2.4 Vehicle type trends

- 2.2.5 Propulsion type trends

- 2.2.6 Application trends

- 2.2.7 Sales channel trends

- 2.2.8 Regional trends

- 2.3 TAM Analysis, 2026-2035 (USD Million)

- 2.4 CXO Perspectives: Strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical Success Factors

- 2.7 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Proliferation of electric and autonomous vehicles

- 3.2.1.2 Stringent safety and emission regulations

- 3.2.1.3 Consumer demand for enhanced in-vehicle experience

- 3.2.1.4 Technological advancements and cost reduction

- 3.2.1.5 Increasing Demand for Advanced Driver Assistance Systems (ADAS)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and production costs

- 3.2.2.2 Complexity of integration and compatibility issues

- 3.2.3 Market Opportunities

- 3.2.3.1 Expansion of Electric Vehicles (EVs)

- 3.2.3.2 Advanced Driver Assistance Systems (ADAS) and Autonomous Vehicles

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technological and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price Trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction Company market share analysis

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1. North America

- 4.2.2. Europe

- 4.2.3. Asia Pacific

- 4.2.2 Market concentration analysis

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1. Revenue

- 4.3.1.2. Profit Margin

- 4.3.1.3. R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1. Product Range Breadth

- 4.3.2.2. Technology

- 4.3.2.3. Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1. Global Footprint Analysis

- 4.3.3.2. Service Network Coverage

- 4.3.3.3. Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1. Leaders

- 4.3.4.2. Challengers

- 4.3.4.3. Followers

- 4.3.4.4. Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2022-2025

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Sensor Type, 2022 - 2035 (USD Million & Units)

- 5.1 Key trends

- 5.2 Pressure Sensors

- 5.2.1 Fuel Rail Pressure Sensors

- 5.2.2 Manifold Absolute Pressure (MAP) Sensors

- 5.2.3 Differential Pressure Sensors (GPF/DPF)

- 5.2.4 Tire Pressure Monitoring Sensors

- 5.2.5 Brake Pressure Sensors

- 5.2.6 Others

- 5.3 Gas Sensors

- 5.3.1 Particulate Matter (PM) Sensors

- 5.3.2 NOx (Nitrogen Oxide) Sensors

- 5.3.3 Oxygen (Lambda) Sensors

- 5.3.4 CO2 Sensors

- 5.3.5 Hydrocarbon (HC) Sensors

- 5.3.6 Others

- 5.4 Temperature Sensors

- 5.4.1 Exhaust Gas Temperature (EGT) Sensors

- 5.4.2 Engine Coolant Temperature Sensors

- 5.4.3 Battery Temperature Sensors (EV)

- 5.4.4 Ambient Temperature Sensors

- 5.4.5 Oil Temperature Sensors

- 5.4.6 Others

- 5.5 Current & Voltage Sensors

- 5.5.1 Battery Current Sensors (EV)

- 5.5.2 Battery Voltage Sensors (EV)

- 5.5.3 High Voltage Interlock Loop (HVIL) Sensors

- 5.5.4 Charging Current Sensors

- 5.5.5 Others

- 5.6 Position & Speed Sensors

- 5.6.1 Camshaft Position Sensors

- 5.6.2 Crankshaft Position Sensors

- 5.6.3 Wheel Speed Sensors

- 5.6.4 Steering Angle Sensors

- 5.6.5 Throttle Position Sensors

- 5.6.6 Others

- 5.7 Optical Sensors

- 5.7.1 Camera/Image Sensors

- 5.7.2 LiDAR Sensors

- 5.7.3 Infrared Sensors

- 5.7.4 Rain/Light Sensors

- 5.7.5 Others

- 5.8 Radar Sensors

- 5.8.1 24 GHz Radar Sensors

- 5.8.2 77 GHz Radar Sensors

- 5.8.3 79 GHz Radar Sensors

- 5.8.4 Others

- 5.9 Ultrasonic Sensors

- 5.9.1 Parking Assistance Sensors

- 5.9.2 Occupancy Detection Sensors

- 5.9.3 Others

- 5.10 Inertial Sensors

- 5.10.1 Accelerometers

- 5.10.2 Gyroscopes

- 5.10.3 Inertial Measurement Units (IMU)

- 5.10.4 Others

- 5.11 Others

Chapter 6 Market estimates & forecast, By Technology, 2022 - 2035 (USD Million & Units)

- 6.1 Key trends

- 6.2 Semiconductor-based Sensors

- 6.2.1 Silicon-based Sensors

- 6.2.2 Ceramic-based Sensors

- 6.3 MEMS (Micro-Electro-Mechanical Systems)

- 6.4 Magnetic Sensors

- 6.4.1 Hall-Effect Sensors

- 6.4.2 Magneto-Resistive Sensors

- 6.5 Optical Sensors

- 6.6 Electrochemical Sensors

Chapter 7 Market estimates & forecast, By Vehicle Type, 2022 - 2035 (USD Million & Units)

- 7.1 Key trends

- 7.2 Passenger Cars

- 7.2.1 Compact Cars

- 7.2.2 Mid-size Cars

- 7.2.3 Luxury Cars

- 7.2.4 SUVs

- 7.3 Light Commercial Vehicles

- 7.4 Heavy Commercial Vehicles

- 7.4.1 Medium-duty Trucks

- 7.4.2 Heavy-duty Trucks

- 7.4.3 Buses

Chapter 8 Market estimates & forecast, By Propulsion Type, 2022-2035 (USD Million & Units)

- 8.1 Key trends

- 8.2 Internal Combustion Engine (ICE)

- 8.1.1 Gasoline

- 8.1.2 Diesel

- 8.3 Alternative Fuels (CNG, LPG)

- 8.1.3 Electrified Vehicles

- 8.1.4 Hybrid Electric Vehicle (HEV)

- 8.1.5 Plug-in Hybrid Electric Vehicle (PHEV)

- 8.1.6 Battery Electric Vehicle (BEV)

- 8.1.7 Fuel Cell Electric Vehicle (FCEV)

Chapter 9 Market estimates & forecast, By Application, 2022-2035 (USD Million & Units)

- 9.1 Key trends

- 9.2 Powertrain Systems

- 9.2.1 Engine Management Systems

- 9.2.2 Transmission Control Systems

- 9.2.3 Fuel Delivery Systems

- 9.2.4 Emissions After-treatment Systems

- 9.3 Electrification Systems

- 9.3.1 Battery Management Systems

- 9.3.2 Electric Motor Control Systems

- 9.3.3 Charging Systems

- 9.3.4 Thermal Management Systems (EV)

- 9.3.5 High Voltage Safety Systems

- 9.4 Safety & ADAS Systems

- 9.4.1 Collision Avoidance Systems

- 9.4.2 Lane Keeping Assistance Systems

- 9.4.3 Adaptive Cruise Control Systems

- 9.4.4 Parking Assistance Systems

- 9.4.5 Blind Spot Detection Systems

- 9.5 Body & Chassis Systems

- 9.5.1 Steering Systems

- 9.5.2 Suspension Systems

- 9.5.3 Braking Systems

- 9.5.4 Climate Control Systems

- 9.5.5 Lighting Systems

- 9.6 Comfort & Convenience Systems

- 9.6.1 Infotainment Systems

- 9.6.2 Seat Control Systems

- 9.6.3 Access Control Systems

- 9.6.4 Others

Chapter 10 Market estimates & forecast, By Sales channel, 2022-2035 (USD Million & Units)

- 10.1 Key trends

- 10.2 Original Equipment Manufacturer (OEM)

- 10.3 Aftermarket

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million & Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 U.K.

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East & Africa

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profile

- 12.1 Allegro MicroSystems LLC

- 12.2 Analog Devices Inc.

- 12.3 Aptiv PLC

- 12.4 BorgWarner Inc.

- 12.5 Continental AG

- 12.6 Denso Corporation

- 12.7 First Sensor AG

- 12.8 Hitachi Astemo Americas Inc.

- 12.9 Honeywell International Inc.

- 12.10 Infineon Technologies AG

- 12.11 Melexis NV

- 12.12 Microchip Technology Inc.

- 12.13 NXP Semiconductors

- 12.14 OMNIVISION Technologies Inc.

- 12.15 ON Semiconductor

- 12.16 Panasonic Corporation

- 12.17 Renesas Electronics Corporation

- 12.18 Robert Bosch GmbH

- 12.19 Sensata Technologies Inc.

- 12.20 STMicroelectronics NV

- 12.21 TE Connectivity Ltd.

- 12.22 Valeo SA