|

市場調查報告書

商品編碼

1876631

汽車氫氣感測器市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Automotive Hydrogen Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

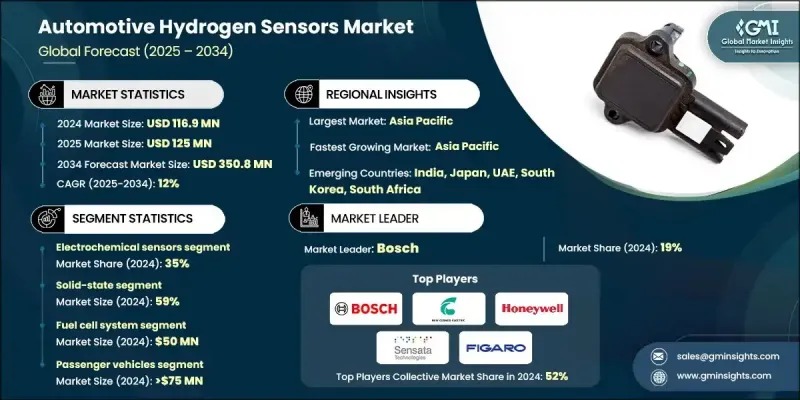

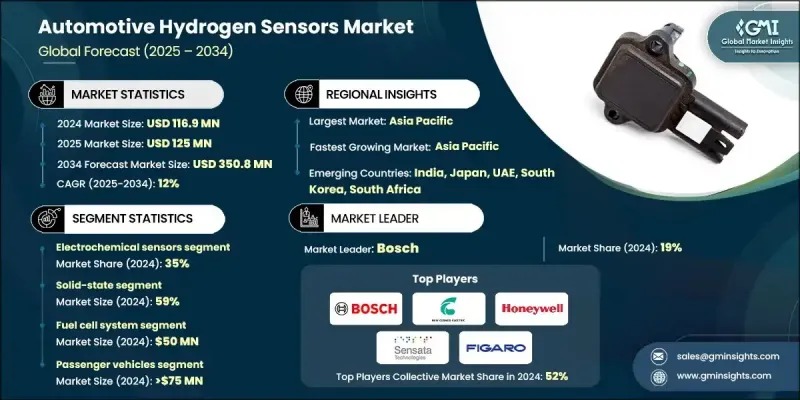

2024 年全球汽車氫氣感測器市場價值為 1.169 億美元,預計到 2034 年將以 12% 的複合年成長率成長至 3.508 億美元。

氫燃料電池汽車需求的不斷成長,以及日益嚴格的安全法規,正在加速汽車氫感測器產業的成長。這些感測器是關鍵部件,用於檢測氫氣洩漏、監測燃料電池性能,並確保氫動力車輛的整體安全。市場上有許多感測技術,例如電化學感測器、催化燃燒感測器、熱導率感測器和金屬氧化物半導體感測器,每種技術都滿足不同的汽車需求。氫燃料加註網路的持續發展,不僅推動了車輛氫感測器的應用,也促進了整個氫供應鏈中氫感測器的應用。對氫動力交通工具(尤其是商用車)投資的增加,進一步推動了市場擴張。儘管新冠疫情初期由於供應鏈受阻和工業活動減少,導致生產中斷和研發項目延誤,但最終卻成為支持氫能和安全發展的政策舉措的催化劑,從而為市場復甦和技術創新註入了新的動力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.169億美元 |

| 預測值 | 3.508億美元 |

| 複合年成長率 | 12% |

2024年,電化學感測器市佔率達到35%,預計2025年至2034年將以10.2%的複合年成長率成長。該細分市場持續佔據主導地位,主要得益於其高精度、高靈敏度和快速反應能力,這些特性對於安全至關重要的汽車系統而言必不可少。電化學感測器的工作原理是利用電解液中的鉑基電極,產生與環境中氫氣濃度成正比的電訊號。它們能夠在數秒內檢測到低至1 ppm的氫氣濃度,使其成為對精度和可靠性要求極高的監測應用的理想選擇。

固態感測器市場佔有率高達59%,預計在2025年至2034年間將維持14%的強勁複合年成長率。其市場主導地位歸功於其耐用性、緊湊的設計和免維護運行,這些特性符合現代汽車對可靠耐用組件的需求。這些感測器利用微機電系統(MEMS)和薄膜半導體技術,打造出整合先進訊號處理和通訊功能的微型感測元件。這種方法提高了燃料電池和排放監測系統中氫氣檢測的可靠性和效率。

亞太地區汽車氫氣感測器市場佔據51.6%的市場佔有率,預計到2034年將以13%的複合年成長率成長。該地區的成長主要得益於政府對氫能基礎設施的大規模公共投資、對零排放出行的強力政策支持以及氫動力汽車的快速商業化。預計該地區對氫燃料應用的戰略重點將使其在整個預測期內保持領先地位。

汽車氫氣感測器市場的主要參與者包括霍尼韋爾、博世、安費諾感測器、大陸集團、英飛凌科技、森薩塔科技、新宇宙電氣、菲加羅工程、日產FIS和森賽瑞恩。活躍於汽車氫氣感測器市場的企業正在實施創新驅動型策略,以加強其全球影響力。他們大力投資研發,致力於打造小型化、節能高效且經濟實惠的感測器解決方案,以滿足氫動力汽車的需求。汽車原始設備製造商 (OEM) 與感測器製造商之間的策略合作正在加速產品開發週期,並提升燃料電池系統中的技術整合。此外,各公司也正在拓展區域分銷網路和擴大生產能力,以滿足新興氫能經濟體日益成長的需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 專業氣體感測器製造商

- 多元化工業電子集團

- 汽車專用感測器供應商

- 化學及先進材料公司

- 專業的氫能和燃料電池技術專家

- 成本結構

- 利潤率

- 每個階段的價值增加

- 影響供應鏈的因素

- 顛覆者

- 供應商格局

- 對力的影響

- 成長促進因素

- 全球大力發展綠氫燃料電池電動車

- 擴大氫氣加註基礎設施

- 嚴格的安全標準和政府指令

- 感測器技術的進步

- 產業陷阱與挑戰

- 先進感測器技術成本高昂

- 技術和性能挑戰

- 市場機遇

- 與物聯網和預測性維護的整合

- 氫動力商用車的成長

- 成長促進因素

- 技術趨勢與創新生態系統

- 目前技術

- 量子點感測器

- 無線感測器網路

- 基於石墨烯的檢測

- 預測性維護系統

- 新興技術

- 機器學習整合

- 區塊鏈保障資料完整性

- 擴增實境介面

- 人工智慧驅動的智慧感測器

- 目前技術

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 成本細分分析

- 專利格局

- 專利組合分析

- 關鍵專利族

- 專利到期分析

- 智慧財產權策略與許可

- 價格趨勢

- 成本加成定價模式

- 獲利提升策略

- 製造費用

- 銷售與價格的關係

- 產品線及研發路線圖

- 技術開發時間表

- 短期發展規劃(2024-2026)

- 中期創新(2027-2030 年)

- 長期突破(2031-2034 年)

- 登月科技(2034)

- 產品開發階段

- 概念和可行性研究

- 原型開發

- 試點測試與驗證

- 商業發布準備

- 研發投資分析

- 企業研發支出

- 政府資助項目

- 學術研究計劃

- 公私合營

- 技術準備度評估

- 技術成熟度等級(TRL)映射

- 商業化時程

- 可擴展性挑戰

- 市場准入壁壘

- 技術開發時間表

- 風險評估與緩解

- 技術性能下降

- 需求波動

- 供應鏈中斷

- 風險識別流程

- 緩解行動計劃

- 供應鏈韌性與本地化

- 全球供應鏈圖譜

- 供應鏈風險評估

- 在地化策略

- 政府激勵措施

- 市場採納與滲透分析

- 採用曲線分析

- 早期採用者的特徵

- 主流市場滲透率

- 後期採用者群體

- 市場飽和度預測

- 各細分市場的滲透率

- 車輛類型滲透率

- 地理滲透率

- 應用特定採用

- 技術遷移模式

- 市場成熟度評估

- 技術成熟度指標

- 市場發展階段

- 競爭強度演變

- 價值鏈最佳化

- 消費者行為與終端用戶洞察

- 基礎設施營運商的要求

- 使用者體驗分析

- 客戶之聲洞察

- 購買決策因素

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 催化燃燒感測器

- 電化學感測器

- 金屬氧化物半導體(MOS)感測器

- 熱導率感測器

- 其他

第6章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 微機電系統

- 固態感測器

第7章:市場估價與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 轎車

- 掀背車

- SUV

- 商用車輛

- 輕型商用車

- 中型商用車

- 重型商用車輛

第8章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 車載檢測

- 燃料電池系統監測

- 氫氣加註站

- 廢氣分析

- 碰撞後偵測

- 其他

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- OEM

- 售後市場

第10章:市場估計與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比利時

- 荷蘭

- 瑞典

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 新加坡

- 韓國

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- 全球參與者

- Bosch

- Continental

- Figaro Engineering

- Honeywell

- Nissha FIS

- Sensata Technologies

- Sensirion

- 區域玩家

- Amphenol Sensors

- Infineon Technologies

- New Cosmos Electric

- TE Connectivity

- Vitesco Technologies

- 新興玩家

- Custom Sensors Solutions

- NexTech Materials

- NGK Spark Plug

- Nuvoton Technology

- UST Umweltsensortechnik

- UTC Fuel Cells

- Winsen Sensor

- Xensor Integration

The Global Automotive Hydrogen Sensors Market was valued at USD 116.9 million in 2024 and is estimated to grow at a CAGR of 12% to reach USD 350.8 million by 2034.

The rising demand for hydrogen fuel cell vehicles, along with stringent safety regulations, is accelerating the growth of the automotive hydrogen sensors industry. These sensors are critical components designed to detect hydrogen leaks, monitor fuel cell performance, and ensure the overall safety of vehicles powered by hydrogen technology. The market features multiple sensing technologies such as electrochemical, catalytic combustion, thermal conductivity, and metal oxide semiconductor sensors, each catering to distinct automotive requirements. The ongoing development of hydrogen fueling networks is fueling the adoption of hydrogen sensors not only in vehicles but also across the broader hydrogen supply chain. Increasing investments in hydrogen-powered transport, particularly in commercial vehicles, are further driving market expansion. Although the COVID-19 pandemic initially disrupted production and delayed R&D projects due to supply chain constraints and reduced industrial activity, it ultimately acted as a catalyst for policy initiatives supporting hydrogen energy and safety advancements, leading to renewed momentum in market recovery and technological innovation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $116.9 Million |

| Forecast Value | $350.8 Million |

| CAGR | 12% |

The electrochemical sensors category captured a 35% share in 2024 and is expected to grow at a CAGR of 10.2% from 2025 to 2034. This segment continues to dominate due to its high precision, sensitivity, and fast response, which are essential in safety-critical automotive systems. Electrochemical sensors operate by using platinum-based electrodes within an electrolyte that produce electrical signals directly proportional to the hydrogen concentration in the environment. They are capable of detecting hydrogen concentrations as low as 1 ppm within seconds, making them ideal for monitoring applications that require accuracy and reliability.

The solid-state sensors segment held a 59% share and is projected to witness a robust CAGR of 14% during 2025-2034. Their dominance is attributed to their durability, compact design, and maintenance-free operation, which align with modern automotive preferences for reliable and long-lasting components. These sensors leverage MEMS and thin-film semiconductor technologies to create micro-scale sensing elements integrated with advanced signal processing and communication features. This approach enhances the robustness and efficiency of hydrogen detection in fuel cell and emission monitoring systems.

Asia-Pacific Automotive Hydrogen Sensors Market held a 51.6% share and is forecasted to grow at a 13% CAGR through 2034. Regional growth is primarily supported by large-scale public investment in hydrogen infrastructure, strong policy backing for zero-emission mobility, and rapid commercialization of hydrogen-powered vehicles. The region's strategic focus on hydrogen fuel adoption is expected to sustain its leadership position throughout the forecast period.

Key Automotive Hydrogen Sensors Market participants include Honeywell, Bosch, Amphenol Sensors, Continental, Infineon Technologies, Sensata Technologies, New Cosmos Electric, Figaro Engineering, Nissha FIS, and Sensirion. Companies active in the Automotive Hydrogen Sensors Market are implementing innovation-driven strategies to strengthen their global presence. They are heavily investing in research and development to create miniaturized, energy-efficient, and cost-effective sensor solutions tailored for hydrogen-powered vehicles. Strategic collaborations between automotive OEMs and sensor manufacturers are accelerating product development cycles and improving technology integration within fuel cell systems. Firms are also expanding their regional distribution networks and manufacturing capacities to meet the growing demand across emerging hydrogen economies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast

- 1.4 Primary research and validation

- 1.5 Some of the primary sources

- 1.6 Data mining sources

- 1.6.1 Secondary

- 1.6.1.1 Paid Sources

- 1.6.1.2 Public Sources

- 1.6.1.3 Sources, by region

- 1.6.1 Secondary

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 Vehicle

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Specialized gas sensor manufacturers

- 3.1.1.2 Diversified industrial electronics conglomerates

- 3.1.1.3 Automotive-specific sensor suppliers

- 3.1.1.4 Chemical & advanced materials companies

- 3.1.1.5 Dedicated hydrogen & fuel cell technology specialists

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Global push for green hydrogen and fuel cell electric vehicles

- 3.2.1.2 Expansion of hydrogen refueling infrastructure

- 3.2.1.3 Stringent safety standards and government mandates

- 3.2.1.4 Advancements in sensor technology

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of advanced sensor technologies

- 3.2.2.2 Technical and performance challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with IoT and predictive maintenance

- 3.2.3.2 Growth of hydrogen-powered commercial vehicles

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.1.1 Quantum dot sensors

- 3.3.1.2 Wireless sensor networks

- 3.3.1.3 Graphene-based detection

- 3.3.1.4 Predictive maintenance systems

- 3.3.2 Emerging technologies

- 3.3.2.1 Machine learning integration

- 3.3.2.2 Blockchain for data integrity

- 3.3.2.3 Augmented reality interfaces

- 3.3.2.4 AI-powered smart sensors

- 3.3.1 Current technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Cost breakdown analysis

- 3.9 Patent landscape

- 3.9.1 Patent Portfolio Analysis

- 3.9.2 Key Patent Families

- 3.9.3 Patent Expiration Analysis

- 3.9.4 IP Strategy & Licensing

- 3.10 Price trends

- 3.10.1 Cost-plus pricing models

- 3.10.2 Margin enhancement strategies

- 3.10.3 Manufacturing expenses

- 3.10.4 Volume-price relationships

- 3.11 Product pipeline & R&D roadmap

- 3.11.1 Technology Development Timeline

- 3.11.1.1 Short-Term Developments (2024-2026)

- 3.11.1.2 Medium-Term Innovations (2027-2030)

- 3.11.1.3 Long-Term Breakthroughs (2031-2034)

- 3.11.1.4 Moonshot Technologies(Beyond 2034)

- 3.11.2 Product Development Stages

- 3.11.2.1 Concept & Feasibility Studies

- 3.11.2.2 Prototype Development

- 3.11.2.3 Pilot Testing & Validation

- 3.11.2.4 Commercial Launch Readiness

- 3.11.3 R&D Investment Analysis

- 3.11.3.1 Corporate R&D Spending

- 3.11.3.2 Government Funding Programs

- 3.11.3.3 Academic Research Initiatives

- 3.11.3.4 Public-Private Partnerships

- 3.11.4 Technology Readiness Assessment

- 3.11.4.1 TRL Mapping by Technology

- 3.11.4.2 Commercialization Timelines

- 3.11.4.3 Scalability Challenges

- 3.11.4.4 Market Entry Barriers

- 3.11.1 Technology Development Timeline

- 3.12 Risk assessment & mitigation

- 3.12.1 Technology performance degradation

- 3.12.2 Demand volatility

- 3.12.3 Supply chain disruptions

- 3.12.4 Risk identification processes

- 3.12.5 Mitigation action plans

- 3.13 Supply chain resilience & localization

- 3.13.1 Global supply chain mapping

- 3.13.2 Supply chain risk assessment

- 3.13.3 Localization strategies

- 3.13.4 Government incentives

- 3.14 Market adoption & penetration analysis

- 3.14.1.1 Adoption Curve Analysis

- 3.14.1.2 Early Adopter Characteristics

- 3.14.1.3 Mainstream Market Penetration

- 3.14.1.4 Late Adopter Segments

- 3.14.1.5 Market Saturation Projections

- 3.14.2 Penetration Rate by Segment

- 3.14.2.1 Vehicle Type Penetration

- 3.14.2.2 Geographic Penetration Rates

- 3.14.2.3 Application-Specific Adoption

- 3.14.2.4 Technology Migration Patterns

- 3.14.3 Market Maturity Assessment

- 3.14.3.1 Technology Maturity Indicators

- 3.14.3.2 Market Development Stages

- 3.14.3.3 Competitive Intensity Evolution

- 3.14.3.4 Value Chain Optimization

- 3.15 Consumer behavior & end-user insights

- 3.15.1 Infrastructure operator demands

- 3.15.2 User experience analysis

- 3.15.3 Voice of customer insights

- 3.15.4 Purchase decision factors

- 3.16 Sustainability and environmental aspects

- 3.16.1 Sustainable practices

- 3.16.2 Waste reduction strategies

- 3.16.3 Energy efficiency in production

- 3.16.4 Eco-friendly initiatives

- 3.16.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Catalytic combustion Sensors

- 5.3 Electrochemical sensors

- 5.4 Metal Oxide Semiconductor (MOS) sensors

- 5.5 Thermal conductivity sensors

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Microelectromechanical system

- 6.3 Solid-State sensors

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger Vehicle

- 7.2.1 Sedan

- 7.2.2 Hatchback

- 7.2.3 SUV

- 7.3 Commercial Vehicle

- 7.3.1 Light commercial vehicle

- 7.3.2 Medium commercial vehicle

- 7.3.3 Heavy commercial vehicles

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Onboard vehicle detection

- 8.3 Fuel cell system monitoring

- 8.4 Hydrogen refueling stations

- 8.5 Exhaust gas analysis

- 8.6 Post-crash detection

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 North America

- 10.1.1 US

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Belgium

- 10.2.7 Netherlands

- 10.2.8 Sweden

- 10.2.9 Russia

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Vietnam

- 10.3.8 Indonesia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 Bosch

- 11.1.2 Continental

- 11.1.3 Figaro Engineering

- 11.1.4 Honeywell

- 11.1.5 Nissha FIS

- 11.1.6 Sensata Technologies

- 11.1.7 Sensirion

- 11.2 Regional players

- 11.2.1 Amphenol Sensors

- 11.2.2 Infineon Technologies

- 11.2.3 New Cosmos Electric

- 11.2.4 TE Connectivity

- 11.2.5 Vitesco Technologies

- 11.3 Emerging players

- 11.3.1 Custom Sensors Solutions

- 11.3.2 NexTech Materials

- 11.3.3 NGK Spark Plug

- 11.3.4 Nuvoton Technology

- 11.3.5 UST Umweltsensortechnik

- 11.3.6 UTC Fuel Cells

- 11.3.7 Winsen Sensor

- 11.3.8 Xensor Integration