|

市場調查報告書

商品編碼

1892901

工業車輛市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Industrial Trucks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

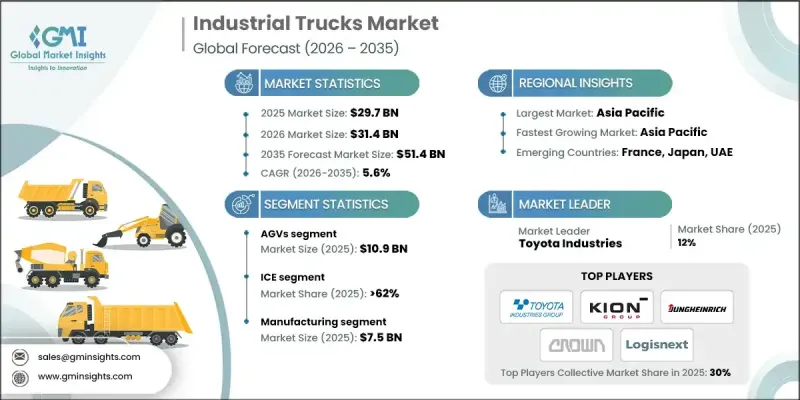

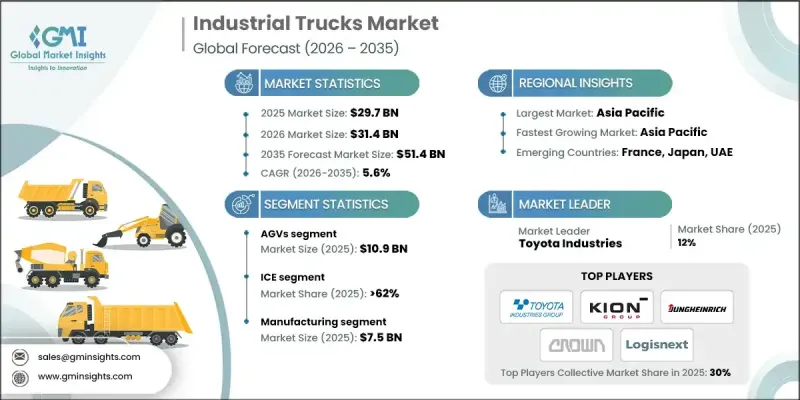

2025年全球工業車輛市場價值為297億美元,預計2035年將以5.6%的複合年成長率成長至514億美元。

電子商務的快速發展持續重塑供應鏈,促使企業採用更快、更有效率的物料搬運解決方案。不斷成長的線上訂單量推動企業投資建造大型配送中心和小型物流中心,以滿足消費者對快速交付的期望。這種日益成長的業務量提升了對堆高機、托盤搬運車和自動駕駛車輛的需求,這些設備能夠支援倉庫內貨物的高速搬運。隨著企業將快速內部運輸和提高吞吐量作為優先事項,工業車輛正成為物流環境中至關重要的競爭優勢。倉庫自動化技術的進步,包括機器人、基於感測器的系統和整合儲存技術,進一步推動了市場需求,因為企業希望最佳化勞動力、提高準確性並更好地利用寶貴的倉庫空間。這種轉變在人口密集的城市市場尤其明顯,自動化流程正在改善工作流程並提高生產效率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 297億美元 |

| 預測值 | 514億美元 |

| 複合年成長率 | 5.6% |

預計到2025年,AGV(自動導引車)市場規模將達到109億美元。 AGV利用雷射導航、感應系統和成像工具等技術獨立運作。這些車輛遵循預先設定的路線,並能即時調整路徑,無需人工操作即可在倉庫內安全高效地運輸物料。 AGV能夠穩定、精準地搬運托盤、貨櫃和其他貨物,使其成為現代物料搬運環境中不可或缺的一部分。

預計到2025年,內燃機卡車市佔率將達到62%。內燃機卡車在室內外各種高強度物料搬運作業中仍佔有重要地位。這些車輛以柴油、汽油或液化石油氣為動力,以其高扭矩和耐用性著稱,因此非常適合需要在嚴苛條件下進行重物起吊和運輸的行業。其卓越的性能在採礦、大型製造和建築等行業至關重要。

美國工業車輛市場佔75%的市場佔有率,預計2025年市場規模將達63億美元。倉儲設施的擴張以及自動化技術的加速應用,持續推動製造業、物流業和電子商務領域的強勁需求。對電動設備和先進搬運解決方案日益成長的興趣,反映了企業不斷推進的永續發展目標和安全合規要求。許多全球主要原始設備製造商的入駐,以及對下一代物料搬運技術的巨額投資,使美國成為工業車輛領域重要的創新中心。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 電子商務拓展與倉儲自動化

- 採用工業4.0技術

- 製造業、建築業和物流業的成長

- 已開發市場勞動力短缺

- 產業陷阱與挑戰

- 高昂的前期成本和維護費用

- 供應鏈中斷和零件短缺

- 機會

- 電動零排放卡車

- 自動導引車(AGV)和自動駕駛卡車

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依類型分類,2021-2034年

- AGV(自動導引車)

- 手動搬運車、平台搬運車和托盤搬運車

- 揀貨員

- 托盤搬運車

- 側裝式

- 步行式堆疊器

第6章:市場估算與預測:以推進方式分類,2021-2034年

- 冰

- 電的

第7章:市場估計與預測:依業者分類,2021-2034年

- 手動的

- 半自動

- 全自動

第8章:市場估算與預測:依最終用途產業分類,2021-2034年

- 餐飲

- 汽車

- 零售與電子商務

- 建築與採礦

- 製造業

- 製藥

- 物流與倉儲

- 其他

第9章:市場估計與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Anhui Heli

- BYD Company

- Clark Material Handling Company

- Combilift

- Crown Equipment

- Doosan Corporation Industrial Vehicle

- Hangcha Group

- Hyster-Yale Materials Handling

- Hyundai Heavy Industries

- Jungheinrich AG

- KION Group AG

- Komatsu

- Manitou Group

- Mitsubishi Logisnext

- Toyota Industries

The Global Industrial Trucks Market was valued at USD 29.7 billion in 2025 and is estimated to grow at a CAGR of 5.6% to reach USD 51.4 billion by 2035.

The rapid acceleration of e-commerce continues to reshape supply chains, pushing businesses to adopt faster and more efficient material-handling solutions. Rising online order volumes are driving companies to invest in large distribution hubs and smaller fulfillment sites to keep pace with expectations for rapid delivery. This increasing activity is elevating the need for forklifts, pallet trucks, and autonomous vehicles that support high-speed movement of goods throughout warehouse operations. As organizations prioritize quick internal transport and improved throughput, industrial trucks are becoming a vital competitive advantage in logistics environments. Advancements in warehouse automation including robotics, sensor-based systems, and integrated storage technologies are further propelling demand, as companies seek to optimize labor, maximize accuracy, and better utilize valuable warehouse space. This shift is particularly evident in dense urban markets, where automated processes are improving workflows and supporting higher productivity levels.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $29.7 Billion |

| Forecast Value | $51.4 Billion |

| CAGR | 5.6% |

The AGVs segment generated USD 10.9 billion in 2025. Automated guided vehicles operate independently using technologies such as laser-based navigation, induction systems, and imaging tools. These vehicles follow mapped routes and can modify their paths in real time, enabling safe and efficient transportation of materials throughout warehouses without the need for manual operation. Their ability to move pallets, containers, and other goods with consistency and precision has made them an integral part of modern material-handling environments.

The ICE segment held a 62% share in 2025. Internal combustion engine trucks remain heavily relied upon for demanding material-handling activities both indoors and outdoors. These vehicles, powered by diesel, gasoline, or LPG, are known for high torque and durability, making them suitable for industries that require lifting and transporting heavy loads under challenging conditions. Their performance capabilities are crucial in sectors including mining, large-scale manufacturing, and construction.

U.S. Industrial Trucks Market accounted for a 75% share and generated USD 6.3 billion in 2025. The expansion of warehouses, paired with the accelerated adoption of automation technologies, continues to drive strong demand across manufacturing, logistics, and e-commerce operations. Growing interest in electric-powered equipment and enhanced handling solutions reflects ongoing corporate sustainability goals and safety compliance requirements. The presence of major global original equipment manufacturers and significant investment in next-generation material-handling technologies positions the U.S. as a key center for innovation within the industrial trucks sector.

Major companies in the Industrial Trucks Market include Anhui Heli, BYD Company, Clark Material Handling Company, Combilift, Crown Equipment, Doosan Corporation Industrial Vehicle, Hangcha Group, Hyster-Yale Materials Handling, Hyundai Heavy Industries, Jungheinrich AG, KION Group AG, Komatsu, Manitou Group, Mitsubishi Logisnext, and Toyota Industries. Companies in the Industrial Trucks Market are strengthening their competitive position by expanding electric and automated product lines that support sustainability goals and reduce operating costs. Many manufacturers are integrating advanced telematics and fleet management systems to provide real-time data on performance, maintenance, and utilization. Continuous investment in autonomous technologies such as AGVs and semi-automated forklifts helps improve productivity and minimize reliance on manual labor. Firms are also diversifying their global production bases to improve supply stability and reduce lead times.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Propulsion

- 2.2.4 Operator type

- 2.2.5 End use industry

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 E-commerce expansion & warehouse automation

- 3.2.1.2 Adoption of Industry 4.0 technologies

- 3.2.1.3 Growth in manufacturing, construction, and logistics sectors

- 3.2.1.4 Labour shortages in developed markets

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High upfront costs & maintenance expenses

- 3.2.2.2 Supply chain disruptions & component shortages

- 3.2.3 Opportunities

- 3.2.3.1 Electric & zero-emission trucks

- 3.2.3.2 Automated guided vehicles (AGVs) & autonomous trucks

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 AGVs

- 5.3 Hand, platform and pallet trucks

- 5.4 Order pickers

- 5.5 Pallet jacks

- 5.6 Side-loaders

- 5.7 Walkie stackers

Chapter 6 Market Estimates and Forecast, By Propulsion, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 ICE

- 6.3 Electric

Chapter 7 Market Estimates and Forecast, By Operator, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Semi-automated

- 7.4 Fully automated

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Automotive

- 8.4 Retail & e-commerce

- 8.5 Construction & mining

- 8.6 Manufacturing

- 8.7 Pharmaceuticals

- 8.8 Logistics & warehousing

- 8.9 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Anhui Heli

- 10.2 BYD Company

- 10.3 Clark Material Handling Company

- 10.4 Combilift

- 10.5 Crown Equipment

- 10.6 Doosan Corporation Industrial Vehicle

- 10.7 Hangcha Group

- 10.8 Hyster-Yale Materials Handling

- 10.9 Hyundai Heavy Industries

- 10.10 Jungheinrich AG

- 10.11 KION Group AG

- 10.12 Komatsu

- 10.13 Manitou Group

- 10.14 Mitsubishi Logisnext

- 10.15 Toyota Industries