|

市場調查報告書

商品編碼

1892864

STEM玩具市場機會、成長促進因素、產業趨勢分析及2025-2034年預測STEM Toys Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

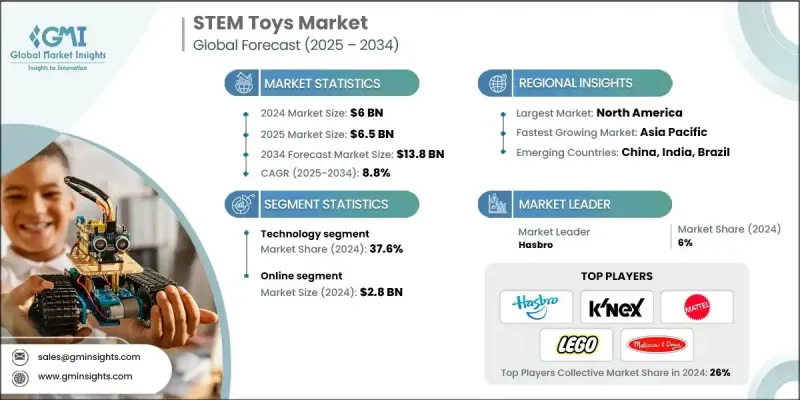

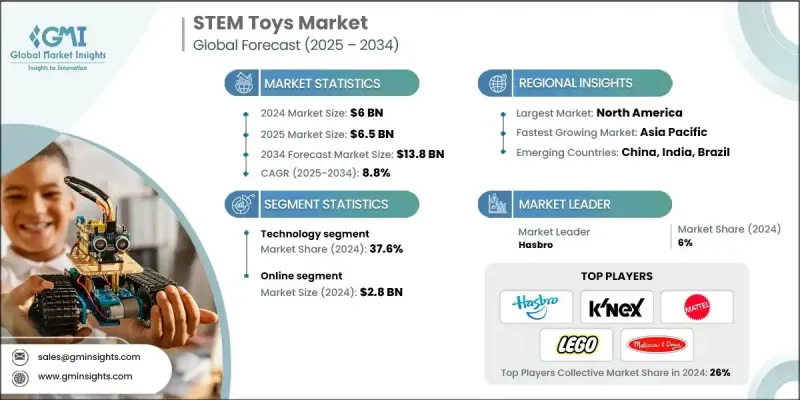

2024 年全球 STEM 玩具市場價值 60 億美元,預計到 2034 年將以 8.8% 的複合年成長率成長至 138 億美元。

市場擴張的驅動力在於家長和教育機構對能夠培養兒童批判性思維、創造力和問題解決能力的玩具日益成長的興趣。隨著STEM(科學、技術、工程和數學)類產品在全球廣泛認可,休閒玩具製造商正不斷拓展產品線,將教育性和互動性玩具納入其中。透過將傳統遊戲與STEM學習結合,企業可以兼顧娛樂和教育的雙重目的,吸引那些既重視技能培養又注重娛樂的家長。將STEM玩具與其他熱門兒童產品融合,也能提升產品感知價值,促使消費者做出明智的購買決策,並提高銷售量。教育與娛樂的融合催生了對兼具學習和休閒功能的創新互動玩具的強勁市場需求,使得STEM玩具成為全球製造商關注的重點。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 60億美元 |

| 預測值 | 138億美元 |

| 複合年成長率 | 8.8% |

預計到2024年,科技類玩具將佔37.6%的市佔率。工程類玩具能讓孩子積極創造、實驗和解決問題,提供動手實作、多感官的學習體驗。這些產品也能鼓勵合作遊戲,幫助孩子在完成搭建或工程挑戰的同時,培養溝通和團隊合作能力。

2024年,線上銷售額達28億美元。電子商務平台使製造商能夠與客戶保持直接聯繫,提供個人化方案和一體化服務。線上管道還使企業能夠收集寶貴的消費者洞察,改進售後支持,並透過服務合約和零件供應最大化客戶終身價值。

美國STEM玩具市場佔據84.5%的市場佔有率,預計到2024年將貢獻18億美元的市場規模。該地區完善的物流基礎設施、高度的技術普及以及消費者對創新教育玩具的強勁需求,使其成為全球領先的市場之一。政府措施和教育計畫持續推動STEM教育,進一步促進了市場成長。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 家長越來越重視早期教育

- 先進技術(人工智慧/機器學習/擴增實境)的整合

- 政府措施與課程銜接

- 產業陷阱與挑戰

- 先進機器人和編程套件價格昂貴

- 來自螢幕數位娛樂的競爭

- 機會

- 新興經濟體尚未開發的市場

- 實體遊戲與數位遊戲的整合(STEAM)

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依類型分類,2021-2034年

- 科學

- 科技

- 工程

- 數學

第6章:市場估計與預測:依年齡層別分類,2021-2034年

- 0-3歲

- 3-8歲

- 8-12歲

- 12年以上

第7章:市場估計與預測:依配銷通路分類,2021-2034年

- 線上

- 離線

第8章:市場估算與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- BanBao

- Bandai

- Gigotoys

- Goldlok Toys

- Guangdong Loongon

- Guangdong Qman Culture Communication

- Hasbro

- K'NEX

- LEGO Group

- Mattel

- Melissa and Doug

- ShanTou LianHuan Toys and Crafts

- Spin Master

- TAKARA TOMY

- Vtech

The Global STEM Toys Market was valued at USD 6 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 13.8 billion by 2034.

The market expansion is driven by rising parental and educational interest in toys that develop children's critical thinking, creativity, and problem-solving skills. As STEM-based products gain global traction, recreational toy manufacturers are increasingly diversifying their portfolios to include educational and interactive toys. By combining traditional play with STEM learning, companies can cater to both fun and educational purposes, appealing to parents who prioritize skill-building alongside entertainment. Integrating STEM toys with other popular children's products also boosts perceived value, encourages informed purchasing decisions, and enhances sales volumes. This convergence of education and entertainment has created a strong market demand for innovative, engaging toys that provide both learning and leisure opportunities, making STEM toys a key focus for manufacturers worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6 Billion |

| Forecast Value | $13.8 Billion |

| CAGR | 8.8% |

The technology segment held a 37.6% share in 2024. Engineering-based toys allow children to actively create, experiment, and solve problems, providing hands-on, multi-sensory learning experiences. These products also encourage collaborative play, helping kids develop communication and teamwork skills while completing construction or engineering challenges.

The online sales segment generated USD 2.8 billion in 2024. E-commerce platforms allow manufacturers to maintain direct customer relationships, offer personalized packages, and provide integrated services. Online channels also enable companies to collect valuable consumer insights, improve after-sales support, and maximize customer lifetime value through service contracts and parts supply.

U.S. STEM Toys Market held 84.5% share, contributing USD 1.8 billion in 2024. The region's robust logistics infrastructure, high adoption of technology, and strong consumer demand for innovative educational toys have positioned it as a leading market globally. Government initiatives and educational programs continue to promote STEM learning, further supporting market growth.

Major players in the Global STEM Toys Market include BanBao, Bandai, Gigotoys, Goldlok Toys, Guangdong Loongon, Guangdong Qman Culture Communication, Hasbro, K'NEX, LEGO Group, Mattel, Melissa and Doug, ShanTou LianHuan Toys and Crafts, Spin Master, TAKARA TOMY, and VTech. STEM toy manufacturers focus on continuous innovation, designing interactive and technology-enabled toys that combine learning and entertainment. Companies invest in research and development to enhance product safety, educational value, and engagement. Strategic collaborations with educational institutions, after-school programs, and digital learning platforms help expand market reach. Firms also leverage online and omnichannel retail strategies to increase visibility, offer personalized customer experiences, and improve distribution efficiency. Marketing campaigns emphasizing skill development, creativity, and inclusivity help attract parents and educators.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Age group

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing parental emphasis on early education

- 3.2.1.2 Integration of advanced technology (AI/ML/AR)

- 3.2.1.3 Government initiatives and curriculum alignment

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of advanced robotics and coding kits

- 3.2.2.2 Competition from screen-based digital entertainment

- 3.2.3 Opportunities

- 3.2.3.1 Untapped markets in emerging economies

- 3.2.3.2 Convergence of physical and digital play (STEAM)

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Science

- 5.3 Technology

- 5.4 Engineering

- 5.5 Mathematics

Chapter 6 Market Estimates and Forecast, By Age Group, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 0-3 years

- 6.3 3-8 years

- 6.4 8-12 years

- 6.5 12+ years

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Online

- 7.3 Offline

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BanBao

- 9.2 Bandai

- 9.3 Gigotoys

- 9.4 Goldlok Toys

- 9.5 Guangdong Loongon

- 9.6 Guangdong Qman Culture Communication

- 9.7 Hasbro

- 9.8 K’NEX

- 9.9 LEGO Group

- 9.10 Mattel

- 9.11 Melissa and Doug

- 9.12 ShanTou LianHuan Toys and Crafts

- 9.13 Spin Master

- 9.14 TAKARA TOMY

- 9.15 Vtech