|

市場調查報告書

商品編碼

1740911

數位紡織印花設備市場機會、成長動力、產業趨勢分析及2025-2034年預測Digital Textile Printing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

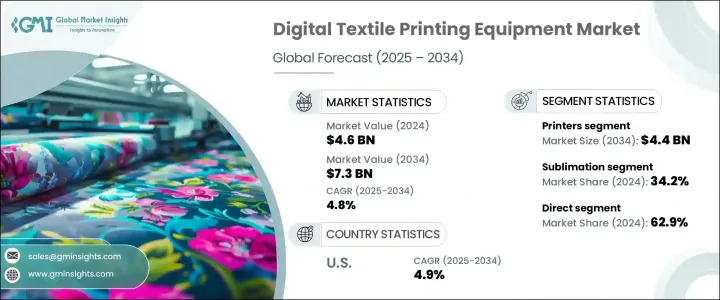

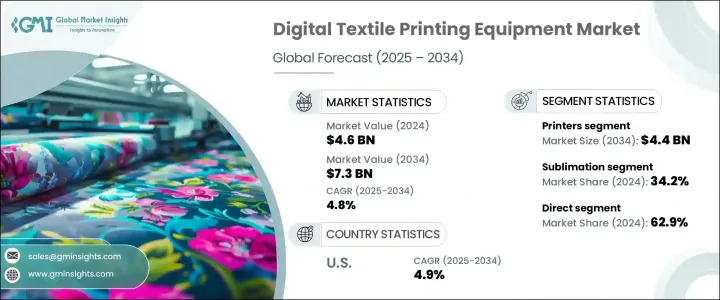

2024年,全球數位紡織印花設備市場規模達46億美元,預計2034年將以4.8%的複合年成長率成長,達到73億美元。這一成長主要源於個性化和短版紡織品生產需求的不斷成長。隨著消費者偏好轉向獨特的客製化商品,尤其是在時尚、家居和促銷商品領域,對靈活高效的生產方式的需求激增。數位紡織印花因其能夠快速交付原型、快速週轉和經濟高效的小批量生產而成為首選解決方案,而這些是傳統印花工藝無法比擬的。快時尚的興起和全球電子商務的蓬勃發展也做出了巨大貢獻,因為按需印刷有助於品牌保持敏捷,並能快速回應不斷變化的趨勢。小型品牌和獨立設計師尤其受益於能夠生產限量版設計,而無需過度投入大宗庫存,這與人們對永續和極簡主義消費模式日益成長的偏好相契合。

印花機在數位紡織印花設備領域中佔有最重要的佔有率。這些設備至關重要,因為它們能夠將數位圖案以高精度和高效率直接轉印到織物上。由於持續的技術創新,尤其是在列印頭設計、透過多程和單程配置實現的列印速度以及與各種紡織品的兼容性等方面,印花機的主導地位預計將持續下去。這些改進使企業能夠滿足服裝、室內裝潢和軟牌等各種應用領域日益成長的需求。隨著性能和輸出品質的提升,印花機越來越被視為新興和成熟紡織市場的策略投資。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 46億美元 |

| 預測值 | 73億美元 |

| 複合年成長率 | 4.8% |

就墨水類型而言,市場分為昇華墨水、活性墨水、酸性墨水、顏料墨水和包括分散墨水在內的其他類型墨水。其中,昇華墨水佔最大佔有率,2024 年約為 34.2%,預計到 2034 年將以 3.8% 的複合年成長率成長。昇華墨水因其能夠在聚酯纖維等合成纖維上呈現鮮豔持久的色彩而廣受歡迎。這些墨水是運動服、橫幅和促銷品的首選,這些產品對耐用性和耐洗性有很高的要求。它們也因其生態效率而受到認可,因為它們耗水量更少,幾乎不需要後處理。隨著產業持續向合成紡織品基料發展,昇華技術的使用也隨之擴大,鞏固了其在市場上的主導地位。

在檢視此類設備的銷售方式時,數位紡織印花設備市場可分為直接和間接分銷管道。 2024年,直銷通路的市佔率約為62.9%,預計到2034年將以4.6%的複合年成長率成長。這種方式之所以受到青睞,是因為它能讓製造商與最終用戶建立更牢固的關係,從而提供更優質的服務、培訓和技術支援。直接互動也能讓製造商獲得即時回饋,幫助他們改進產品和服務,更能滿足客戶需求。這種更緊密的客戶互動對於需要持續支援和客製化的複雜數位化營運系統尤其重要。

在美國,數位紡織印花設備市場規模在2024年超過6億美元,預計2034年將以4.9%的複合年成長率成長。由於注重技術創新以及訂製服裝和家居裝飾需求的不斷成長,美國已成為該市場的重要參與者。該市場受益於發達的時尚產業、較高的數位化普及率以及消費者對環保產品日益成長的興趣。先進的印花系統,尤其是支援直接成衣印花和捲對捲印花配置的系統,正受到尋求可擴展和永續解決方案的企業的青睞。

影響該領域競爭的關鍵因素包括列印速度、解析度、墨水靈活性、環境永續性以及整體擁有成本。設備製造商不斷改進自動化、多材料相容性和環保墨水配方等功能,以贏得競爭優勢。節水節能技術的發展也體現了對更永續營運的追求,這些技術不僅降低了營運成本,也吸引了具有環保意識的消費者和品牌。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 包裝和加工食品的需求不斷成長

- 技術進步

- 越來越重視永續包裝

- 產業陷阱與挑戰

- 初期投資及維護成本高

- 處理各種包裝材料的複雜性

- 成長動力

- 成長潛力分析

- 交易分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依組件類型,2021 - 2034 年

- 主要趨勢

- 印表機

- 預處理機

- 後處理機器

- 油墨供應和固化系統

第6章:市場估計與預測:依印刷製程類型,2021 - 2034 年

- 主要趨勢

- 直接織物(DTF)

- 直接成衣印花(DTG)

第7章:市場估計與預測:依油墨類型,2021 - 2034 年

- 主要趨勢

- 昇華

- 反應式

- 酸

- 顏料

- 其他(解散等)

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 服飾和服飾

- 家紡

- 技術紡織品

- 軟牌

- 旗幟和橫幅

- 工業應用

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直接的

- 間接

第10章:市場估計與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Atexco

- Brother Industries

- D.Gen

- Durst Phototechnik

- EFI (Electronics For Imaging)

- HP Inc.

- JTeck

- Klieverik

- Konica Minolta

- Kornit Digital

- Mimaki Engineering

- MS Printing Solutions

- Roland DG

- Seiko Epson

- Veika

The Global Digital Textile Printing Equipment Market was valued at USD 4.6 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 7.3 billion by 2034. This growth is largely fueled by an increasing demand for personalized and short-run textile production. As consumer preferences shift toward unique and tailored items, especially in fashion, home furnishings, and promotional merchandise, the need for flexible and efficient production methods has surged. Digital textile printing has become the go-to solution due to its ability to deliver quick prototypes, fast turnaround, and cost-effective small-batch runs-something that traditional printing processes cannot offer. The rise of fast fashion and the global e-commerce boom have also contributed significantly, as on-demand printing helps brands stay agile and responsive to changing trends. Smaller labels and independent designers, in particular, benefit from the ability to produce limited-edition designs without overcommitting to bulk inventory, which aligns with the growing preference for sustainable and minimalist consumption patterns.

Printers represent the most significant share within the digital textile printing equipment segment. These machines are essential because they directly transfer digital designs onto fabrics with high accuracy and efficiency. Their dominance is expected to continue, thanks to continuous technological innovation-especially in areas like printhead design, print speeds through multi-pass and single-pass configurations, and compatibility with a wide range of textiles. These improvements enable businesses to meet the increasing demand across diverse applications such as apparel, interior decor, and soft signage. As performance and output quality improve, printers are increasingly seen as a strategic investment across both emerging and established textile markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 4.8% |

In terms of ink types, the market is divided into sublimation, reactive, acid, pigment, and other varieties, including disperse inks. Among these, sublimation ink held the largest share at approximately 34.2% in 2024 and is forecasted to grow at a CAGR of 3.8% through 2034. Sublimation inks have gained popularity because they produce vivid, long-lasting colors on synthetic fabrics like polyester. These inks are preferred for sports apparel, banners, and promotional goods that demand high durability and wash resistance. They are also recognized for their eco-efficiency, as they use less water and require minimal post-processing. As the industry continues to move toward synthetic textile bases, the use of sublimation technology is expanding accordingly, reinforcing its dominant role in the market.

When examining how this equipment is sold, the digital textile printing equipment market is segmented into direct and indirect distribution channels. The direct sales channel held a market share of around 62.9% in 2024 and is anticipated to grow at a CAGR of 4.6% by 2034. This method is preferred because it allows manufacturers to build stronger relationships with end-users, providing better service, training, and technical support. Direct interactions also enable manufacturers to receive real-time feedback, helping them refine their products and services to better align with customer needs. This closer customer engagement is especially vital for complex, digitally operated systems that require ongoing support and customization.

In the United States, the digital textile printing equipment market exceeded USD 600 million in 2024 and is set to grow at a CAGR of 4.9% through 2034. The country has become a significant player due to its focus on technological innovation and the expanding demand for custom apparel and home decor. The market benefits from a well-developed fashion industry, high digital adoption rates, and increasing consumer interest in eco-conscious products. Advanced printing systems, particularly those that support direct-to-garment and roll-to-roll configurations, are gaining traction among businesses seeking scalable and sustainable solutions.

Key factors shaping competition in this sector include print speed, resolution, ink flexibility, environmental sustainability, and overall cost of ownership. Equipment manufacturers are continuously advancing features such as automation, multi-material compatibility, and eco-friendly ink formulations to gain a competitive edge. The push toward more sustainable operations is also evident in the development of water-efficient and energy-saving technologies, which not only reduce operational costs but also appeal to environmentally aware consumers and brands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.5 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.3 Supply-side impact (raw materials)

- 3.2.3.1 Price volatility in key materials

- 3.2.3.2 Supply chain restructuring

- 3.2.3.3 Production cost implications

- 3.2.3.4 Demand-side impact (selling price)

- 3.2.3.5 Price transmission to end markets

- 3.2.3.6 Market share dynamics

- 3.2.3.7 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for packaged and processed foods

- 3.7.1.2 Technological advancements

- 3.7.1.3 Increasing focus on sustainable packaging

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial investment and maintenance costs

- 3.7.2.2 Complexity in handling diverse packaging materials

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Trade analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Printers

- 5.3 Pre-Treatment machines

- 5.4 Post-Treatment machines

- 5.5 Ink supply & curing systems

Chapter 6 Market Estimates & Forecast, By Printing Process Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Direct-to-Fabric (DTF)

- 6.3 Direct-to-Garment (DTG)

Chapter 7 Market Estimates & Forecast, By Ink Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Sublimation

- 7.3 Reactive

- 7.4 Acid

- 7.5 Pigment

- 7.6 Others (disperse, etc.)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Clothing and apparel

- 8.3 Home textiles

- 8.4 Technical textiles

- 8.5 Soft aignage

- 8.6 Flags and banners

- 8.7 Industrial applications

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 -2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Atexco

- 11.2 Brother Industries

- 11.3 D.Gen

- 11.4 Durst Phototechnik

- 11.5 EFI (Electronics For Imaging)

- 11.6 HP Inc.

- 11.7 JTeck

- 11.8 Klieverik

- 11.9 Konica Minolta

- 11.10 Kornit Digital

- 11.11 Mimaki Engineering

- 11.12 MS Printing Solutions

- 11.13 Roland DG

- 11.14 Seiko Epson

- 11.15 Veika