|

市場調查報告書

商品編碼

1892826

廚房小家電市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Kitchen Small Electronic Appliances Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

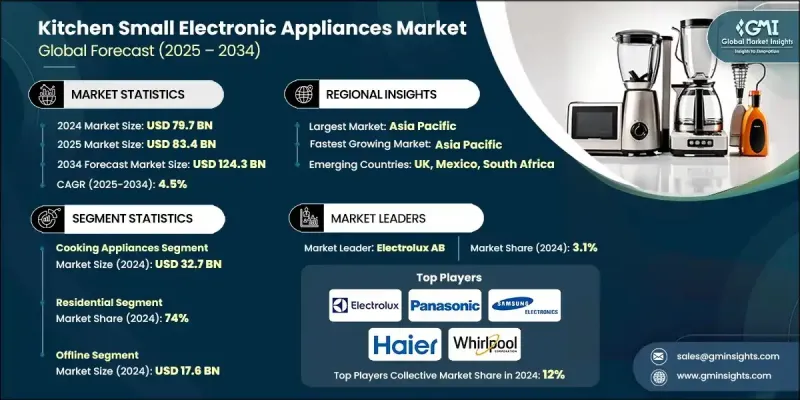

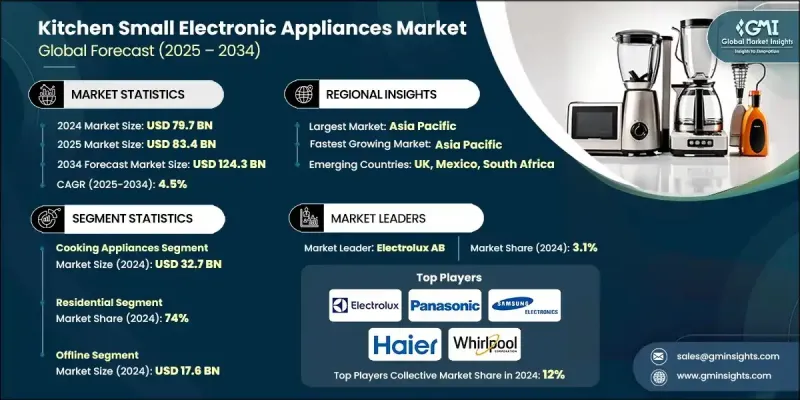

2024年全球廚房小家電市場價值為797億美元,預計2034年將以4.5%的複合年成長率成長至1,243億美元。

智慧科技正在改變消費者對小型廚房設備的認知,連結家電已成為現代生活不可或缺的一部分。配備 Wi-Fi 或其他連接功能的產品現在可以透過行動應用程式或語音系統進行遠端調節和個人化設置,使其成為智慧家庭的重要組成部分。商業用戶也看到了預測性維護和系統更新的優勢,這些功能可以延長產品壽命並提升整體效能。隨著智慧家庭的普及,這些設備正日益被視為必要的家庭投資。製造商正在整合人工智慧和增強型連接技術,打造能夠學習使用者習慣並幫助最佳化烹飪習慣的家電。這些發展有助於推動家庭數位化進程,並為市場長期擴張創造機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 797億美元 |

| 預測值 | 1243億美元 |

| 複合年成長率 | 4.5% |

預計到2024年,烹飪電器市場規模將達到327億美元,成為該類別中最大的產品組。該細分市場包括一些小巧的烹飪工具,它們不僅簡化了烹飪流程,還提高了精準度和能源效率。快節奏的生活方式和較小的居住空間對多功能產品的需求不斷成長,也推動了這類產品的流行。

2024年,住宅領域佔比高達74%。都市化進程加快、中產階級收入提高以及家庭生活習慣的改變,促使消費者投資購買便利實用的家用電器。家庭,尤其是居住在人口密集的城市地區的家庭,正在購買體積小巧、便於快速烹飪的廚具,以彌補廚房空間有限的不足。

美國廚房小家電市場佔84%的市場佔有率,預計2024年市場規模將達200億美元。該地區的廚房小家電產業高度發達,隨著消費者從獨立設備轉向能夠完善現代家居生態系統的互聯多功能家電,其普及率持續上升。可支配收入的增加以及人們對健康飲食習慣日益成長的關注,進一步推高了全美對廚房小家電的需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 智慧互聯技術

- 健康與保健趨勢

- 可支配所得增加

- 生活方式的改變與都市化

- 產業陷阱與挑戰

- 競爭激烈

- 監理複雜性

- 機會

- 智慧廚房生態系統整合

- 節能環保家電

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 烹飪用具

- 咖啡機

- 滴濾咖啡機

- 義式咖啡機

- 單杯咖啡機

- 其他(法式濾壓壺等)

- 烤麵包機

- 雙槽烤麵包機

- 四片式烤麵包機

- 烤麵包機

- 微波爐

- Solo微波爐

- 微波爐烤肉架

- 其他

- 電熱板

- 單電熱板

- 雙電熱板

- 多功能電熱板

- 炊具

- 其他(電水壺等)

- 咖啡機

- 食品加工設備

- 油炸鍋

- 氣炸鍋

- 油炸鍋

- 其他

- 研磨機

- 攪拌機

- 榨汁機

- 食品加工機

- 其他(食物脫水機等)

- 油炸鍋

- 專業電器

- 爆米花機

- 冰淇淋機

- 華夫餅機

- 蘇打水機

- 其他(熱狗機等)

- 其他(暖氣設備等)

第6章:市場估計與預測:依功能分類,2021-2034年

- 傳統的

- 聰明的

- 無線上網

- 藍牙

- 其他技巧(例如 Zigbee 技術)

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 住宅

- 商業的

- HoReCa

- 機構

- 衛生保健

- 其他(娛樂中心、旅遊公司、運動中心等)

第8章:市場估算與預測:依配銷通路分類,2021-2034年

- 線上

- 電子商務

- 公司網站

- 離線

- 專賣店

- 獨立門市

- 其他

第9章:市場估計與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Bajaj Electricals

- Breville

- Daewoo

- Electrolux

- Haier Group

- Havells India

- Koninklijke Philips NV

- LG

- Morphy Richards

- Panasonic Group

- Robert Bosch

- Samsung Electronics

- V-Guard Industries

- Voltas

- Whirlpool

The Global Kitchen Small Electronic Appliances Market was valued at USD 79.7 billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 124.3 billion by 2034.

Smart technology is transforming how consumers perceive compact kitchen devices as connected appliances become an integral part of modern living. Products equipped with Wi-Fi or other connectivity features now offer remote adjustments and personalized settings through mobile apps or voice-enabled systems, making them an essential part of connected homes. Commercial users also see advantages in predictive maintenance and system updates that extend product longevity and improve overall performance. As smart homes become more common, these devices are increasingly being viewed as necessary household investments. Manufacturers are integrating artificial intelligence and enhanced connectivity to create appliances that learn from user routines and help optimize cooking habits. These developments contribute to broader digital adoption inside homes and create long-term opportunities for market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $79.7 Billion |

| Forecast Value | $124.3 Billion |

| CAGR | 4.5% |

The cooking appliances segment held USD 32.7 billion in 2024, making it the largest product group within the category. This segment includes compact tools that simplify meal preparation while offering improved precision and energy efficiency. Their popularity is boosted by growing demand for multifunctional products suitable for fast-paced lifestyles and smaller living spaces.

The residential sector accounted for a 74% share in 2024. Rising urbanization, higher middle-class incomes, and evolving home routines have encouraged consumers to invest in appliances that deliver convenience and versatility. Households, especially those in dense urban areas, are purchasing compact tools that support quicker meal preparation and help compensate for limited kitchen layouts.

U.S. Kitchen Small Electronic Appliances Market held 84% share and generated USD 20 billion in 2024. The industry in the region is highly advanced, and adoption continues to rise as consumers pivot from standalone devices to interconnected, multifunctional appliances that complement modern home ecosystems. Higher disposable income and increasing interest in healthier eating habits further elevate demand for small kitchen electronics across the country.

Leading companies in the Kitchen Small Electronic Appliances Market include Bajaj Electricals, Breville, Daewoo, Electrolux, Haier Group, Havells India, Koninklijke Philips N.V., LG, Morphy Richards, Panasonic Group, Robert Bosch, Samsung Electronics, V-Guard Industries, Voltas, and Whirlpool. Manufacturers in the Kitchen Small Electronic Appliances Market are strengthening their competitive position by focusing on smart technology integration and enhancing energy efficiency across their product portfolios. Many brands are building interconnected ecosystems that link multiple household devices, improving convenience and encouraging customer loyalty. Companies are also prioritizing compact, multifunctional designs to meet the needs of urban households with limited space. Continuous investment in AI-driven personalization, predictive maintenance features, and improved safety technologies helps brands differentiate their offerings. Strategic expansion into e-commerce channels, along with strong retail partnerships, allows companies to reach wider audiences.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Function

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Smart & connected technology

- 3.2.1.2 Health & wellness trends

- 3.2.1.3 Rising disposable incomes

- 3.2.1.4 Changing lifestyles & urbanization

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High competition

- 3.2.2.2 Regulatory complexity

- 3.2.3 Opportunities

- 3.2.3.1 Smart kitchen ecosystem integration

- 3.2.3.2 Energy-efficient & eco-designed appliances

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Cooking Appliances

- 5.2.1 Coffee Makers

- 5.2.1.1 Drip coffee makers

- 5.2.1.2 Espresso machines

- 5.2.1.3 Single-Serve Coffee Makers

- 5.2.1.4 Others (French Press etc.)

- 5.2.2 Toasters

- 5.2.2.1 Two-slice toasters

- 5.2.2.2 Four-slice toasters

- 5.2.2.3 Toaster ovens

- 5.2.3 Microwaves

- 5.2.3.1 Solo microwaves

- 5.2.3.2 Grill microwaves

- 5.2.3.3 Others

- 5.2.4 Hot Plates

- 5.2.4.1 Single Hot Plate

- 5.2.4.2 Double Hot Plate

- 5.2.4.3 Multi Hot Plate

- 5.2.5 Cookers

- 5.2.6 Others (Electric Kettles etc.)

- 5.2.1 Coffee Makers

- 5.3 Food Preparation Appliances

- 5.3.1 Fryers

- 5.3.1.1 Air Fryers

- 5.3.1.2 Deep Fryers

- 5.3.1.3 Others

- 5.3.2 Grinders

- 5.3.3 Mixers

- 5.3.4 Juicers

- 5.3.5 Food Processors

- 5.3.6 Others (Food Dehydrators etc.)

- 5.3.1 Fryers

- 5.4 Specialty Appliances

- 5.4.1 Popcorn Machines

- 5.4.2 Ice Cream Makers

- 5.4.3 Waffle Makers

- 5.4.4 Soda Maker

- 5.4.5 Others (Hot Dog Machines etc.)

- 5.5 Others (Heating Appliances etc.)

Chapter 6 Market Estimates and Forecast, By Function, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Conventional

- 6.3 Smart

- 6.3.1 Wi-Fi

- 6.3.2 Bluetooth

- 6.3.3 Others (Zigbee technology, etc.)

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.3.1 HoReCa

- 7.3.2 Institutional

- 7.3.3 Healthcare

- 7.3.4 Others (Entertainment Centers, Tours & Travels, Sport Complex, etc.)

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce

- 8.2.2 Company websites

- 8.3 Offline

- 8.3.1 Specialty stores

- 8.3.2 Individual stores

- 8.3.3 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Bajaj Electricals

- 10.2 Breville

- 10.3 Daewoo

- 10.4 Electrolux

- 10.5 Haier Group

- 10.6 Havells India

- 10.7 Koninklijke Philips N.V.

- 10.8 LG

- 10.9 Morphy Richards

- 10.10 Panasonic Group

- 10.11 Robert Bosch

- 10.12 Samsung Electronics

- 10.13 V-Guard Industries

- 10.14 Voltas

- 10.15 Whirlpool