|

市場調查報告書

商品編碼

1892698

專業小型廚房電器市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Specialty Small Kitchen Appliances Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

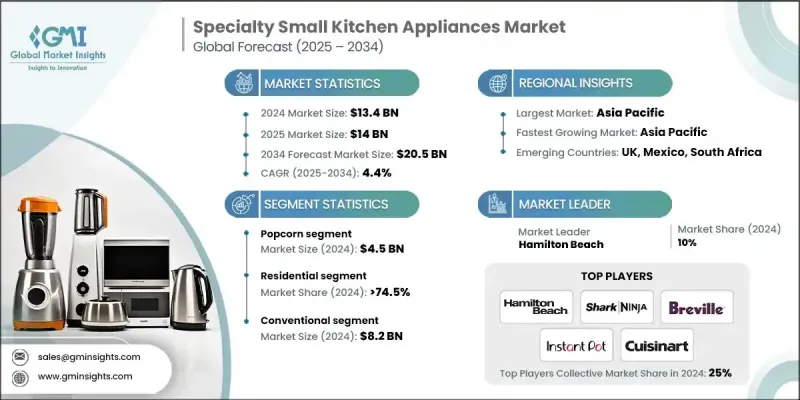

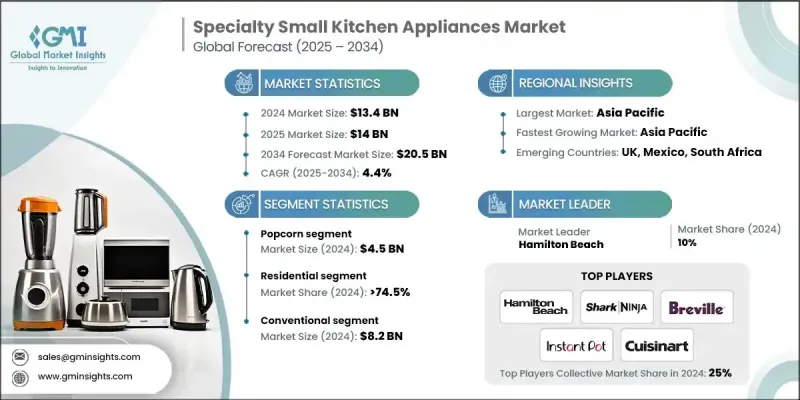

2024 年全球專業小型廚房電器市場價值為 134 億美元,預計到 2034 年將以 4.4% 的複合年成長率成長至 205 億美元。

隨著日常生活節奏加快,消費者越來越傾向選擇既能簡化烹飪流程又不影響品質的家電。現代緊湊型廚具的需求激增,人們希望在保證美味佳餚的同時,也能更快完成烹飪。許多家庭現在更青睞高效、易用、性能可靠的家電,以便用戶在繁忙的日程中輕鬆應對烹飪任務。這種趨勢與生活方式的轉變密切相關,尤其是在廚房空間和時間有限的城市地區和雙薪家庭。這種以便利性為導向的購買行為也反映出消費者越來越傾向於選擇永續、節能且能支持健康生活並能完美融入小型居住環境的電器。消費者優先考慮能夠讓他們輕鬆烹飪多種菜餚的解決方案,這也進一步推動了緊湊型多功能廚房設備的普及。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 134億美元 |

| 預測值 | 205億美元 |

| 複合年成長率 | 4.4% |

爆米花機市場預計在2024年將創造45億美元的收入。由於這類電器兼具實用性與娛樂性,市場需求持續成長。多樣化的設計和款式吸引著那些既想要功能齊全的電器,又希望其能與廚房美學相得益彰的消費者。

2024年,傳統廚具市場規模預計將達82億美元。這一品類依然具有市場意義,因為注重操作簡單性和可靠性的消費者往往會選擇不具備高階數位功能的設備。這些產品價格實惠,能夠滿足基本的烹飪需求,因此在消費者偏好簡單易用的市場中尤其重要。

美國專業小型廚房電器市場佔據84%的市場佔有率,預計2024年將創造34億美元的市場規模。消費者對便利、健康、高階小型電器的需求日益成長,推動了全國的銷售。家庭用戶正在採用各種專業工具來簡化備餐流程,並養成更健康的飲食習慣。此外,人們也越來越熱衷於使用適合製作飲品、零食和個人化餐點的專用電器,在家中打造高品質的用餐體驗。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 生活方式的改變和便利性的需求

- 健康與家庭烹飪趨勢

- 技術創新

- 產業陷阱與挑戰

- 競爭激烈,市場飽和

- 成本上升與經濟不穩定

- 機會

- 多功能且節省空間的設計

- 智慧互聯家電

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 爆米花機

- 冰淇淋機

- 華夫餅機

- 蘇打水機

- 其他(熱狗機等)

第6章:市場估計與預測:依功能分類,2021-2034年

- 傳統的

- 聰明的

- 無線上網

- 藍牙

- 其他技巧(例如 Zigbee 技術)

第7章:市場估計與預測:依價格分類,2021-2034年

- 低的

- 中等的

- 高的

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 住宅

- 商業的

第9章:市場估算與預測:依配銷通路分類,2021-2034年

- 線上

- 電子商務

- 公司網站

- 離線

- 專賣店

- 獨立門市

- 其他

第10章:市場估計與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- Black+Decker

- Breville

- Chefman

- COSORI

- Cuisinart

- Dash

- De'Longhi

- Gourmia

- Hamilton Beach

- Instant Pot

- KitchenAid

- Le Creuset

- Miele

- SharkNinja

- Smeg

The Global Specialty Small Kitchen Appliances Market was valued at USD 13.4 billion in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 20.5 billion by 2034.

As daily routines become more demanding, consumers are increasingly looking for appliances that simplify meal preparation without compromising quality. The appeal of modern compact tools has surged as people seek ways to prepare meals faster while still enjoying flavorful results. Many households now favor appliances designed to deliver efficiency, ease of use, and reliable performance, enabling users to manage cooking tasks alongside their busy schedules. This rise is strongly connected to shifting lifestyles, particularly in urban areas and among dual-income households, where kitchen space and time are limited. Convenience-driven purchasing behavior also reflects a growing preference for sustainable, energy-efficient devices that support healthy living and integrate seamlessly into smaller living environments. Consumers are prioritizing solutions that allow them to prepare multiple types of meals with minimal effort, reinforcing widespread interest in compact, multipurpose kitchen equipment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.4 Billion |

| Forecast Value | $20.5 Billion |

| CAGR | 4.4% |

The popcorn segment generated USD 4.5 billion in 2024. Demand continues to rise as these appliances offer a blend of practicality and entertainment appeal. Varied designs and formats attract consumers who want functional devices that also complement their kitchen aesthetic.

The conventional segment produced USD 8.2 billion in 2024. This category remains relevant because shoppers who prioritize simplicity and dependable operation often choose devices without advanced digital capabilities. These products fulfill essential cooking needs at an affordable cost, making them especially important in markets where consumers prefer straightforward functionality.

U.S Specialty Small Kitchen Appliances Market held an 84% share and generated USD 3.4 billion in 2024. Growing interest in convenience-focused, wellness-oriented, and premium small appliances is fueling nationwide sales. Households are adopting specialized tools that help streamline meal preparation and support healthier food habits. Additionally, there is increasing enthusiasm for creating high-quality experiences at home using specialty appliances suited for beverages, snacks, and personalized meal preparation.

Major companies in the Global Specialty Small Kitchen Appliances Market include Black+Decker, Breville, Chefman, COSORI, Cuisinart, Dash, De'Longhi, Gourmia, Hamilton Beach, Instant Pot, KitchenAid, Le Creuset, Miele, SharkNinja, and Smeg. Companies in the specialty small kitchen appliances market are strengthening their competitive position by expanding product portfolios, incorporating advanced functionality, and improving design aesthetics to match evolving consumer lifestyles. Many brands are investing in energy-efficient technologies, user-friendly interfaces, and compact formats that appeal to urban households. Manufacturers are also prioritizing premium materials, enhanced durability, and multifunctional features to increase product value. Strategic partnerships with retailers, strong digital marketing campaigns, and direct-to-consumer sales channels help companies reach wider audiences.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Function

- 2.2.4 Price

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Changing lifestyles & convenience demand

- 3.2.1.2 Health & home-cooking trends

- 3.2.1.3 Technological innovation

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High competition & market saturation

- 3.2.2.2 Rising costs & economic instability

- 3.2.3 Opportunities

- 3.2.3.1 Multi-functional & space-saving designs

- 3.2.3.2 Smart & connected Appliances

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Popcorn machines

- 5.3 Ice cream makers

- 5.4 Waffle makers

- 5.5 Soda maker

- 5.6 Others (hot dog machines etc.)

Chapter 6 Market Estimates and Forecast, By Function, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Conventional

- 6.3 Smart

- 6.4 Wi-Fi

- 6.5 Bluetooth

- 6.5 Others (Zigbee technology, etc.)

Chapter 7 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Individual stores

- 9.3.3 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Black+Decker

- 11.2 Breville

- 11.3 Chefman

- 11.4 COSORI

- 11.5 Cuisinart

- 11.6 Dash

- 11.7 De'Longhi

- 11.8 Gourmia

- 11.9 Hamilton Beach

- 11.10 Instant Pot

- 11.11 KitchenAid

- 11.12 Le Creuset

- 11.13 Miele

- 11.14 SharkNinja

- 11.15 Smeg