|

市場調查報告書

商品編碼

1892817

雙面太陽能模組市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Bifacial Solar Module Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

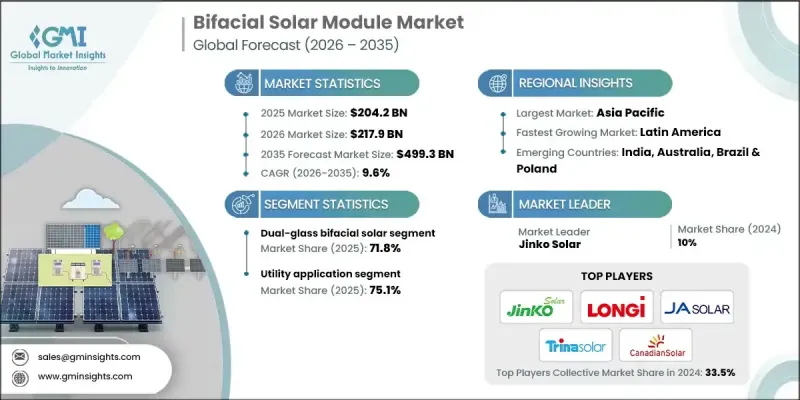

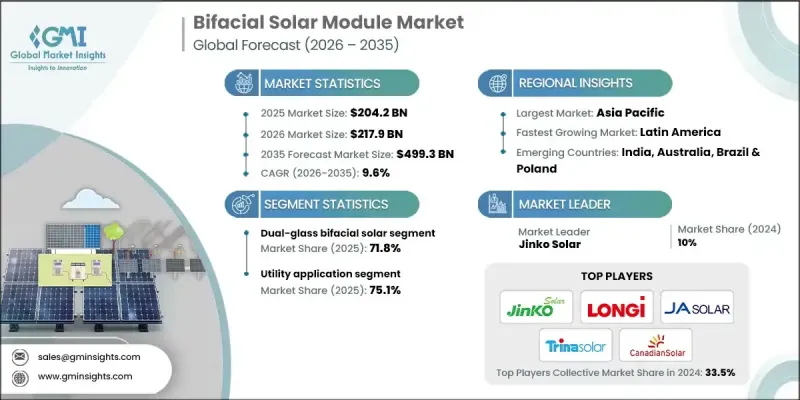

2025年全球雙面太陽能模組市場價值2,042億美元,預計2035年將以9.6%的複合年成長率成長至4,993億美元。

市場成長勢頭得益於對高容量太陽能解決方案日益成長的需求,尤其是在大型再生能源開發專案中,這些解決方案能夠在相同土地面積上提供更高的電力輸出。先進的電池架構,包括n型PERC、TOPCon和異質結技術,透過提高轉換效率、降低衰減和增強長期性能,正在加速其應用。雙面太陽能組件的設計使其能夠從面板的兩面捕獲太陽輻射,從而利用正面直射陽光和背面反射或散射光進行發電。與傳統的單面組件相比,這種配置提高了整體功率輸出。在嚴苛環境下的日益普及促使製造商設計出更具韌性的組件,以確保在更長的使用壽命內提供可靠的性能。電池效率和組件耐久性的不斷提升,正在鞏固雙面技術作為現代太陽能裝置中最大化能源產量首選解決方案的地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 2042億美元 |

| 預測值 | 4993億美元 |

| 複合年成長率 | 9.6% |

到2025年,雙面雙玻太陽能模組市佔率將達到71.8%,預計到2035年將以8.4%的複合年成長率成長。市場成長的主要驅動力是消費者對使用壽命更長、結構強度更高的組件的需求不斷成長。雙面雙玻結構能夠提高組件的抗環境壓力能力,增強長期可靠性,從而降低營運成本,並為公用事業規模和商業部署帶來更高的財務回報。

預計到2035年,商業和工業領域的複合年成長率將達到10.8%。該領域的應用主要受安裝空間有限的情況下最大化發電量的需求所驅動。雙面組件能夠在不增加系統尺寸的情況下實現更高的輸出功率,從而提高能源經濟效益,並推動其在商業設施中的更廣泛應用。

2025年,美國雙面太陽能模組市佔率達95.8%,預計到2035年將達到390億美元。對先進太陽能技術的強勁需求,加上大型太陽能裝置的不斷擴張和聯邦政府的扶持性激勵政策,持續推動市場滲透率的提升。開發商越來越依賴雙面系統來提高專案收益,並最佳化現有土地資源的能源生產。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系統

- 原物料供應及採購分析

- 製造能力評估

- 供應鏈韌性與風險因素

- 配電網路分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 成本結構分析

- 波特的分析

- PESTEL 分析

- 新興機會與趨勢

- 數位化與物聯網整合

- 新興市場滲透

- 投資分析及未來展望

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 戰略儀錶板

- 策略舉措

- 公司標竿分析

- 創新與技術格局

第5章:市場規模及預測:依厚度分類,2022-2035年

- 小於 2 毫米

- 2毫米至3毫米

- > 3 毫米

第6章:市場規模及預測:依類型分類,2022-2035年

- 雙面玻璃太陽能

- 玻璃背板雙面太陽能電池

第7章:市場規模及預測:依應用領域分類,2022-2035年

- 住宅

- 商業及工業

- 公用事業

第8章:市場規模及預測:依技術分類,2022-2035年

- 鈍化射極背面接觸(PERC)

- 拓普康

- 異質結(HJT)

第9章:市場規模及預測:依鏡框類型分類,2022-2035年

- 框

- 無框

第10章:市場規模及預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 西班牙

- 荷蘭

- 波蘭

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 中東和非洲

- 阿拉伯聯合大公國

- 土耳其

- 埃及

- 拉丁美洲

- 巴西

- 智利

第11章:公司簡介

- 3Sun

- AE Solar

- Astronergy

- Axitec

- Bluesun Solar

- Boviet Solar

- Canadian Solar

- First Solar

- Hanwha Q CELLS

- JA Solar Technology

- Jinko Solar

- LONGi Green Energy Technology

- Primroot

- Seraphim Solar

- Sharp Corporation

- Silfab Solar

- Sunergy

- Trina Solar

- Vikram Solar

- Yingli Solar

The Global Bifacial Solar Module Market was valued at USD 204.2 billion in 2025 and is estimated to grow at a CAGR of 9.6% to reach USD 499.3 billion by 2035.

Market momentum is supported by rising demand for high-capacity solar solutions that deliver greater electricity output from the same land area, particularly in large-scale renewable energy developments. Advanced cell architectures, including n-type PERC, TOPCon, and heterojunction technologies, are accelerating adoption by improving conversion efficiency, reducing degradation, and enhancing long-term performance. Bifacial solar modules are designed to capture solar radiation from both sides of the panel, allowing energy generation from direct sunlight on the front surface and reflected or diffused light on the rear side. This configuration increases overall power output compared to conventional single-sided modules. Growing deployment in demanding environments has encouraged manufacturers to engineer more resilient module designs that deliver reliable performance over extended operating lifetimes. Continuous improvements in cell efficiency and module durability are strengthening the role of bifacial technology as a preferred solution for maximizing energy yield in modern solar installations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $204.2 Billion |

| Forecast Value | $499.3 Billion |

| CAGR | 9.6% |

The dual-glass bifacial solar modules segment accounted for 71.8% share in 2025 and is forecast to grow at a CAGR of 8.4% through 2035. Market growth is driven by increasing preference for modules with extended lifespan and higher structural strength. Dual-glass construction improves resistance to environmental stressors and enhances long-term reliability, which supports lower operating expenses and stronger financial returns for both utility-scale and commercial deployments.

The commercial and industrial segment is expected to register a CAGR of 10.8% through 2035. Adoption in this segment is driven by the need to maximize electricity generation where installation space is constrained. Bifacial modules enable higher output without expanding system size, which supports improved energy economics and drives wider use across business facilities.

U.S. Bifacial Solar Module Market held 95.8% share in 2025 and is expected to reach USD 39 billion by 2035. Strong demand for advanced solar technologies, combined with expanding large-scale solar installations and supportive federal incentive structures, continues to boost market penetration. Developers increasingly rely on bifacial systems to enhance project returns and optimize energy production from available land resources.

Key companies active in the Global Bifacial Solar Module Market include Jinko Solar, Canadian Solar, LONGi Green Energy Technology, Trina Solar, JA Solar Technology, Hanwha Q CELLS, First Solar, Sharp Corporation, Vikram Solar, Silfab Solar, Astronergy, AE Solar, Axitec, Boviet Solar, Bluesun Solar, Seraphim Solar, Yingli Solar, Primroot, Sunergy, and 3Sun. Companies operating in the Global Bifacial Solar Module Market focus on multiple strategic initiatives to strengthen their competitive position. Manufacturers prioritize investments in research and development to enhance cell efficiency, reduce power loss, and extend product lifespan. Capacity expansion and vertical integration strategies are adopted to control production costs and ensure stable supply chains. Strategic partnerships with project developers and energy providers help accelerate market penetration and secure long-term contracts. Firms also emphasize geographic expansion to capture demand in high-growth regions while aligning product portfolios with local regulatory frameworks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.1.1 Quantified market impact analysis

- 1.3.2 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.3.1 Key trends for market estimates

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.2 Business trends

- 2.3 Thickness trends

- 2.4 Type trends

- 2.5 Application trends

- 2.6 Technology trends

- 2.7 Frame type trends

- 2.8 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Cost structure analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

- 3.8 Emerging opportunities & trends

- 3.8.1 Digitalization & IoT integration

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis and future outlook

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Thickness, 2022 - 2035 (USD Billion)

- 5.1 Key trends

- 5.2 < 2 mm

- 5.3 2 mm to 3 mm

- 5.4 > 3 mm

Chapter 6 Market Size and Forecast, By Type, 2022 - 2035 (USD Billion)

- 6.1 Key trends

- 6.2 Dual-Glass Bifacial Solar

- 6.3 Glass-Backsheet Bifacial Solar

Chapter 7 Market Size and Forecast, By Application, 2022 - 2035 (USD Billion)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial & Industrial

- 7.4 Utility

Chapter 8 Market Size and Forecast, By Technology, 2022 - 2035 (USD Billion)

- 8.1 Key trends

- 8.2 Passivated Emitter Rear Contact (PERC)

- 8.3 TOPCon

- 8.4 Heterojunction (HJT)

Chapter 9 Market Size and Forecast, By Frame Type, 2022 - 2035 (USD Billion)

- 9.1 Key trends

- 9.2 Framed

- 9.3 Frameless

Chapter 10 Market Size and Forecast, By Region, 2022 - 2035 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 Spain

- 10.3.3 Netherlands

- 10.3.4 Poland

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Australia

- 10.4.3 India

- 10.4.4 Japan

- 10.5 Middle East & Africa

- 10.5.1 UAE

- 10.5.2 Turkey

- 10.5.3 Egypt

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Chile

Chapter 11 Company Profiles

- 11.1 3Sun

- 11.2 AE Solar

- 11.3 Astronergy

- 11.4 Axitec

- 11.5 Bluesun Solar

- 11.6 Boviet Solar

- 11.7 Canadian Solar

- 11.8 First Solar

- 11.9 Hanwha Q CELLS

- 11.10 JA Solar Technology

- 11.11 Jinko Solar

- 11.12 LONGi Green Energy Technology

- 11.13 Primroot

- 11.14 Seraphim Solar

- 11.15 Sharp Corporation

- 11.16 Silfab Solar

- 11.17 Sunergy

- 11.18 Trina Solar

- 11.19 Vikram Solar

- 11.20 Yingli Solar