|

市場調查報告書

商品編碼

1892812

射釘槍市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Nail Guns Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

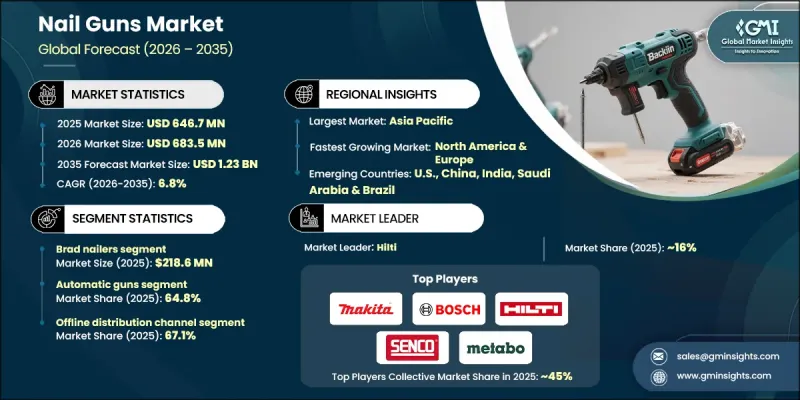

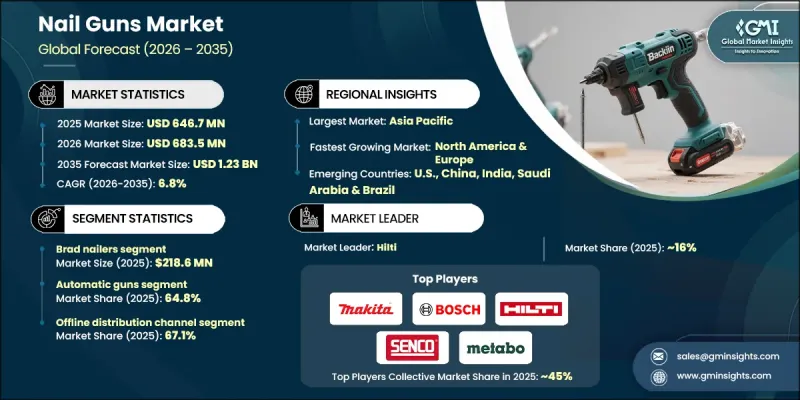

2025 年全球射釘槍市場價值為 6.467 億美元,預計到 2035 年將以 6.8% 的複合年成長率成長至 12.3 億美元。

隨著建築相關活動中對更快、更有效率的緊固解決方案的需求不斷成長,市場持續保持成長勢頭。建築活動的擴張、基礎設施投資的增加以及在控制勞動力成本的同時提高生產力的需求,都推動了市場成長。由於射釘槍能夠提供快速、均勻的緊固效果並減少體力消耗,因此越來越受到人們的青睞,優於手動緊固方法。承包商和專業用戶正在採用這些工具來滿足更緊迫的工期要求,並確保專案品質的一致性。同時,簡化的產品設計以及使用者認知度的提高,也促進了非專業使用者群體的廣泛採用。動力系統、人體工學和安全機制的持續進步也使市場受益,這些進步不斷提升了工具的性能和可靠性。隨著建築實踐的演變和效率的提升,射釘槍正從可選工具轉變為必備設備,從而增強了其在專業和消費領域的長期需求。人們對個人改造計畫的興趣日益濃厚,也進一步推動了市場擴張。消費者越來越依賴電動緊固工具,以最少的努力獲得乾淨、持久的緊固效果。製造商們正在積極回應,推出設計便利、安全、精準的用戶友善產品,這有助於該領域保持穩定成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 6.467億美元 |

| 預測值 | 12.3億美元 |

| 複合年成長率 | 6.8% |

2025年,射釘槍市場規模達2.186億美元,預計2026年至2035年將以7.3%的複合年成長率成長。此品類產品廣泛應用於需要精準安裝和表面保護的場合,較小的緊固件有助於維持材質的完整性。不斷成長的裝修活動和消費者對專業級飾面效果的追求,持續支撐著該品類的需求。

2025年,自動射釘槍市佔率達到64.8%,預計到2035年將以6.9%的複合年成長率成長。這些工具支援連續作業,因此非常適合效率和勞動力最佳化至關重要的高產量環境。自動化、數位整合以及與智慧型系統的兼容性方面的進步,正在提升其對專業用戶和工業用戶的吸引力。

2025年美國射釘槍市場規模達1.367億美元,預計2026年至2035年將以6.8%的複合年成長率成長。市場成長得益於持續的建築活動、房地產開發的不斷推進以及對提高生產效率工具的強勁需求。基礎設施投資和持續的翻新改造活動進一步強化了對高效緊固解決方案的需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 建築和基礎設施的快速擴張

- 對效率和生產力的需求日益成長

- DIY與居家裝潢趨勢

- 技術進步

- 產業陷阱與挑戰

- 初始成本高,維修需求高

- 無線機型的電池續航時間限制

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2022-2035年

- 框架釘槍

- 布拉德釘槍

- 釘槍

- 屋頂釘槍

- 地板釘槍

- 其他

第6章:市場估算與預測:依電源類型分類,2022-2035年

- 氣動釘槍

- 瓦斯/汽油動力釘槍

- 電動釘槍

- 電池供電

第7章:市場估算與預測:依營運模式分類,2022-2035年

- 手持槍械

- 自動槍

第8章:市場估算與預測:依價格分類,2022-2035年

- 低的

- 中等的

- 高的

第9章:市場估算與預測:依最終用途分類,2022-2035年

- 建築與基礎設施

- 家具及家居裝修

- 汽車

- 包裝

- 其他

第10章:市場估價與預測:依配銷通路分類,2022-2035年

- 線上

- 電子商務平台

- 公司網站

- 離線

- 居家裝修中心

- 專業工具商店

- 其他

第11章:市場估計與預測:按地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第12章:公司簡介

- Bostitch

- DEWALT

- Freeman Tools

- Hilti Corporation

- Hitachi

- Makita Corporation

- Max Corporation

- Metabo

- Milwaukee Tool

- Paslode

- Ridgid

- Robert Bosch Tool Corporation

- Ryobi

- Senco

- Stanley Black & Decker

The Global Nail Guns Market was valued at USD 646.7 million in 2025 and is estimated to grow at a CAGR of 6.8% to reach USD 1.23 billion by 2035.

The market continues to gain momentum as demand rises for faster, more efficient fastening solutions across construction-related activities. Growth is supported by expanding building activity, rising investment in infrastructure, and the need to improve productivity while controlling labor expenses. Nail guns are increasingly preferred over manual fastening methods due to their ability to deliver speed, uniform results, and reduced physical effort. Contractors and professional users are adopting these tools to meet tighter schedules and ensure consistent quality across projects. At the same time, broader access to simplified product designs and better user awareness is supporting wider adoption among non-professional users. The market is also benefiting from ongoing advancements in power systems, ergonomics, and safety mechanisms, which continue to improve tool performance and reliability. As construction practices evolve and efficiency becomes a priority, nail guns are being positioned as essential equipment rather than optional tools, strengthening long-term demand across both professional and consumer segments. Growing interest in personal improvement projects is further supporting market expansion. Consumers increasingly rely on powered fastening tools to achieve clean, durable results with minimal effort. Manufacturers are responding by offering user-friendly models designed for convenience, safety, and precision, which is helping this segment sustain steady growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $646.7 Million |

| Forecast Value | $1.23 Billion |

| CAGR | 6.8% |

The brad nailers segment generated USD 218.6 million in 2025 and is forecast to grow at a CAGR of 7.3% from 2026 to 2035. This category is widely adopted for applications that require accuracy and surface protection, where smaller fasteners help preserve material integrity. Rising renovation activity and consumer preference for professional-quality finishes continue to support demand for this segment.

The automatic nail guns segment held 64.8% share in 2025 and is expected to grow at a CAGR of 6.9% through 2035. These tools support continuous operation, making them well-suited for high-output environments where efficiency and labor optimization are critical. Advancements in automation, digital integration, and compatibility with smart systems are enhancing their appeal among professional and industrial users.

US Nail Guns Market reached USD 136.7 million in 2025 and is projected to grow at a CAGR of 6.8% from 2026 to 2035. Market growth is supported by sustained construction activity, ongoing property development, and strong demand for productivity-enhancing tools. Investment in infrastructure and continued renovation activity further reinforces the need for efficient fastening solutions.

Major companies operating in the Global Nail Guns Market include DEWALT, Makita Corporation, Stanley Black & Decker, Milwaukee Tool, Bosch Tool Corporation, Hilti Corporation, Paslode, Ryobi, Metabo, Bostitch, Senco, Freeman Tools, Ridgid, Max Corporation, and Hitachi. Companies in the Nail Guns Market are strengthening their competitive position through continuous product innovation, expanded distribution channels, and targeted branding strategies. Manufacturers are investing in lightweight designs, improved power efficiency, and enhanced safety features to meet evolving user expectations. Strategic partnerships with retailers and professional networks are helping companies broaden market reach and improve customer access. Many players focus on differentiating their portfolios through specialized tools that address distinct user needs while maintaining durability and performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Power source

- 2.2.4 Operation

- 2.2.5 Price

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid expansion in construction & infrastructure

- 3.2.1.2 Rising demand for efficiency & productivity

- 3.2.1.3 DIY & home improvement trend

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial costs and maintenance requirements

- 3.2.2.2 Battery life limitations for cordless models

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022 - 2035, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Framing nailers

- 5.3 Brad nailers

- 5.4 Pin nailers

- 5.5 Roofing nailers

- 5.6 Flooring nailers

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Power Source, 2022 - 2035, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Pneumatic nail guns

- 6.3 Combustion-powered / gas nail guns

- 6.4 Electric nail guns

- 6.5 Battery operated

Chapter 7 Market Estimates & Forecast, By Operation, 2022 - 2035, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Handheld guns

- 7.3 Automatic guns

Chapter 8 Market Estimates & Forecast, By Price, 2022 - 2035, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By End Use, 2022 - 2035, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Construction & infrastructure

- 9.3 Furniture & home improvement

- 9.4 Automotive

- 9.5 Packaging

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce platforms

- 10.2.2 Company website

- 10.3 Offline

- 10.3.1 Home improvement centers

- 10.3.2 Specialty tool stores

- 10.3.3 Others

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Indonesia

- 11.4.7 Malaysia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Bostitch

- 12.2 DEWALT

- 12.3 Freeman Tools

- 12.4 Hilti Corporation

- 12.5 Hitachi

- 12.6 Makita Corporation

- 12.7 Max Corporation

- 12.8 Metabo

- 12.9 Milwaukee Tool

- 12.10 Paslode

- 12.11 Ridgid

- 12.12 Robert Bosch Tool Corporation

- 12.13 Ryobi

- 12.14 Senco

- 12.15 Stanley Black & Decker