|

市場調查報告書

商品編碼

1892760

尼古丁袋市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Nicotine Pouches Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

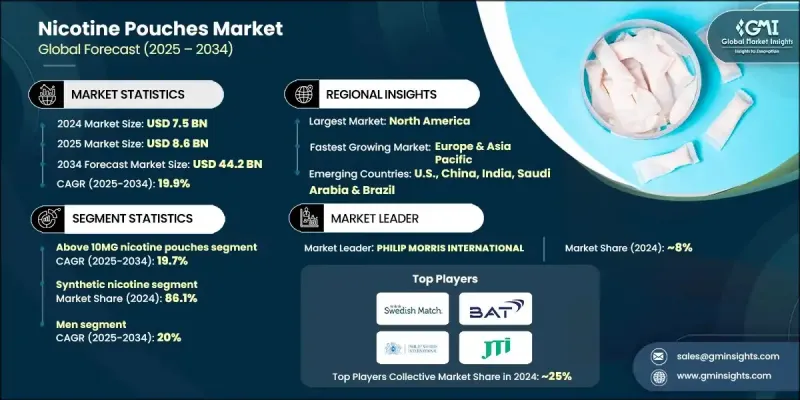

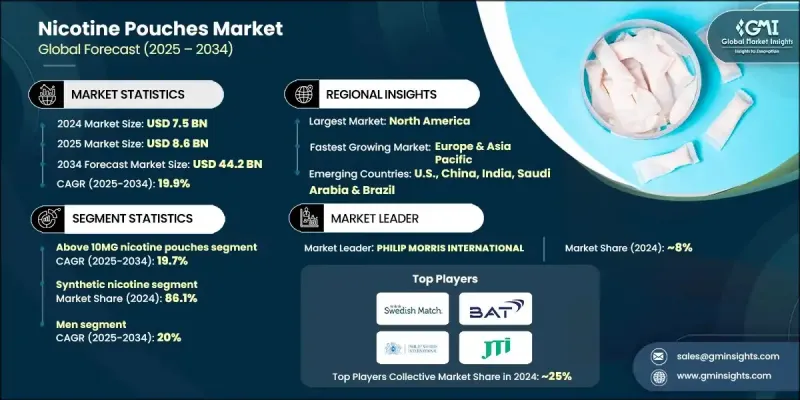

2024 年全球尼古丁袋市場價值為 75 億美元,預計到 2034 年將以 19.9% 的複合年成長率成長至 442 億美元。

隨著消費者擴大尋求傳統吸煙方式的替代品,尼古丁袋正日益受到歡迎。隨著人們健康意識的提高以及對肺癌和心臟病等吸煙相關疾病的日益關注,許多成年使用者開始使用尼古丁袋來滿足菸癮,同時避免燃燒帶來的有害影響。這些產品提供了一種隱密的選擇,符合無菸工作場所的規定,因此被廣泛接受。政府的措施、反吸煙運動以及更嚴格的菸草法規也在推動人們轉向減害替代品。與香菸或嚼煙相比,尼古丁袋的便利性、隱藏性以及較低的風險認知使其極具吸引力。口味創新、高濃度版本和緩釋技術進一步強化了這一趨勢,提升了使用者體驗,並促進了不同消費群體對尼古丁袋的接受度。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 75億美元 |

| 預測值 | 442億美元 |

| 複合年成長率 | 19.9% |

2024年,10毫克尼古丁袋市場規模達到24億美元,預計到2034年將以19.7%的複合年成長率成長。高濃度尼古丁袋能為從吸菸或其他無菸菸草產品過渡到尼古丁袋的消費者提供更強烈的尼古丁刺激。其隱密的設計和與無菸環境的兼容性提高了消費者的接受度,而口味和輸送方式的創新則進一步提升了消費者的滿意度。

2024年,男性消費者群體佔據了67.9%的市場佔有率,預計2025年至2034年將以20%的複合年成長率成長。男性吸菸率較高,且偏好高濃度尼古丁和濃郁口味,這使得他們成為尼古丁袋的主要消費群體。這些產品能夠完美融入禁煙的工作場所和社交環境,提供便利、隱密且令人滿意的體驗。

美國尼古丁袋市場在2024年創造了20億美元的收入,預計從2025年到2034年將以21.1%的複合年成長率成長。由於健康意識的提高和嚴格的禁煙政策,吸煙率下降,催生了龐大的無菸替代品消費群體。尼古丁袋提供了一個隱密、便利且符合法規的解決方案,滿足了這項需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 傳統菸草產品的無菸替代品越來越受歡迎。

- 健康意識提高。

- 口味多樣,強度各異

- 產業陷阱與挑戰

- 監管方面的不確定性

- 對青少年收養和公共衛生的擔憂

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL 分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依口味類型分類,2021-2034年

- 調味

- 薄荷

- 水果

- 草藥

- 其他成分(冬青油、咖啡、甜味劑等)

- 無味

第6章:市場估算與預測:依類型分類,2021-2034年

- 濕袋

- 乾袋

第7章:市場估計與預測:依尼古丁含量分類,2021-2034年

- 最高 5 毫克

- 5毫克 - 10毫克

- 10毫克以上

第8章:市場估算與預測:依產品形式分類,2021-2034年

- 小型的

- 苗條的

- 常規的

- 麥克西

第9章:市場估算與預測:依類別分類,2021-2034年

- 無菸環境

- 合成尼古丁

第10章:市場估計與預測:依價格分類,2021-2034年

- 低的

- 中等的

- 高的

第11章:市場估計與預測:依消費群體分類,2021-2034年

- 男人

- 女性

第12章:市場估算與預測:依配銷通路分類,2021-2034年

- 線上

- 電子商務

- 公司網站

- 離線

- 電子煙專賣店

- 其他零售店

第13章:市場估計與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第14章:公司簡介

- Moxy

- Black Buffalo

- Lyft

- White Fox

- Nordic Spirit

- Dryft

- Killa

- ZERO

- Rogue

- VELO

- On!

- ZYN

- UPROAR

The Global Nicotine Pouches Market was valued at USD 7.5 billion in 2024 and is estimated to grow at a CAGR of 19.9% to reach USD 44.2 billion by 2034.

Nicotine pouches are gaining popularity as consumers increasingly seek alternatives to traditional smoking. With heightened health awareness and rising concerns over smoking-related diseases such as lung cancer and heart disease, many adult users are turning to nicotine pouches to satisfy their cravings without exposure to the harmful effects of combustion. These products offer a discreet option that aligns with smoke-free workplace regulations, contributing to their widespread acceptance. Government initiatives, anti-smoking campaigns, and stricter tobacco regulations are also driving the shift toward harm-reduction alternatives. The convenience, discreet nature, and perception of reduced risk compared to cigarettes or chewing tobacco make nicotine pouches particularly appealing. This trend is further reinforced by flavor innovations, high-strength variants, and extended-release technologies that enhance the user experience and promote adoption across diverse consumer segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.5 billion |

| Forecast Value | $44.2 billion |

| CAGR | 19.9% |

The above 10MG nicotine pouch segment generated USD 2.4 billion in 2024 and is expected to grow at a CAGR of 19.7% through 2034. High-strength pouches provide a more intense nicotine hit for consumers transitioning from smoking or other smokeless tobacco products. Their discreet design and compatibility with smoke-free environments increase adoption, while innovations in flavor and delivery further enhance satisfaction.

The male consumers segment held a 67.9% share in 2024 and is projected to grow at a CAGR of 20% from 2025 to 2034. Higher smoking prevalence among men and a preference for stronger nicotine and bold flavors make them the primary adopters of nicotine pouches. These products fit seamlessly into workplaces and social environments where smoking is restricted, offering a convenient, discreet, and satisfying experience.

U.S. Nicotine Pouches Market generated USD 2 billion in 2024 and is anticipated to grow at a CAGR of 21.1% from 2025 to 2034. Declining cigarette smoking rates, driven by increased health awareness and strict anti-smoking policies, have created a large consumer base seeking smoke-free alternatives. Nicotine pouches fulfill this demand by providing a discreet, convenient, and regulation-compliant solution.

Key players in the Global Nicotine Pouches Market include UPROAR, Moxy, Nordic Spirit, Lyft, Rogue, ZYN, Black Buffalo, On!, ZERO, VELO, White Fox, Dryft, and Killa. Companies in the Nicotine Pouches Market are adopting several strategies to strengthen their market presence and foothold. They are investing heavily in research and development to introduce innovative flavors, extended-release technologies, and high-nicotine variants. Marketing campaigns target health-conscious consumers and emphasize the discreet, smoke-free nature of pouches. Firms are expanding their distribution networks across retail, e-commerce, and specialty stores to increase accessibility. Strategic collaborations with regulatory bodies and participation in anti-smoking initiatives enhance credibility and consumer trust. Additionally, companies focus on packaging innovations, subscription models, and loyalty programs to retain customers, drive repeat purchases, and reinforce brand loyalty in a highly competitive market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Flavour type

- 2.2.3 Type

- 2.2.4 Nicotine content

- 2.2.5 Format

- 2.2.6 Category

- 2.2.7 Price

- 2.2.8 Consumer group

- 2.2.9 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Smoke-free alternatives to traditional tobacco products gain traction.

- 3.2.1.2 Heightened health awareness.

- 3.2.1.3 Diverse flavors and varying strengths

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Uncertainty in regulations

- 3.2.2.2 Concerns over youth adoption & public health

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Flavour Type, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Flavored

- 5.2.1 Mint

- 5.2.2 Fruit

- 5.2.3 Herbal

- 5.2.4 Others (wintergreen, coffee, sweeteners, etc.)

- 5.3 Non-Flavored

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Moist pouches

- 6.3 Dry pouches

Chapter 7 Market Estimates & Forecast, By Nicotine Content, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Up to 5 MG

- 7.3 5MG - 10MG

- 7.4 Above 10MG

Chapter 8 Market Estimates & Forecast, By Format, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Mini

- 8.3 Slim

- 8.4 Regular

- 8.5 Maxi

Chapter 9 Market Estimates & Forecast, By Category, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Tobacco-free

- 9.3 Synthetic nicotine

Chapter 10 Market Estimates & Forecast, By Price, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Low

- 10.3 Medium

- 10.4 High

Chapter 11 Market Estimates & Forecast, By Consumer Group, 2021 - 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Men

- 11.3 Women

Chapter 12 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 Online

- 12.2.1 E-Commerce

- 12.2.2 Company website

- 12.3 Offline

- 12.3.1 Specialty vape shops

- 12.3.2 Other retail stores

Chapter 13 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 South Korea

- 13.4.5 Australia

- 13.4.6 Indonesia

- 13.4.7 Malaysia

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 MEA

- 13.6.1 Saudi Arabia

- 13.6.2 UAE

- 13.6.3 South Africa

Chapter 14 Company Profiles

- 14.1 Moxy

- 14.2 Black Buffalo

- 14.3 Lyft

- 14.4 White Fox

- 14.5 Nordic Spirit

- 14.6 Dryft

- 14.7 Killa

- 14.8 ZERO

- 14.9 Rogue

- 14.10 VELO

- 14.11 On!

- 14.12 ZYN

- 14.13 UPROAR