|

市場調查報告書

商品編碼

1844318

尼古丁替代療法市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Nicotine Replacement Therapy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

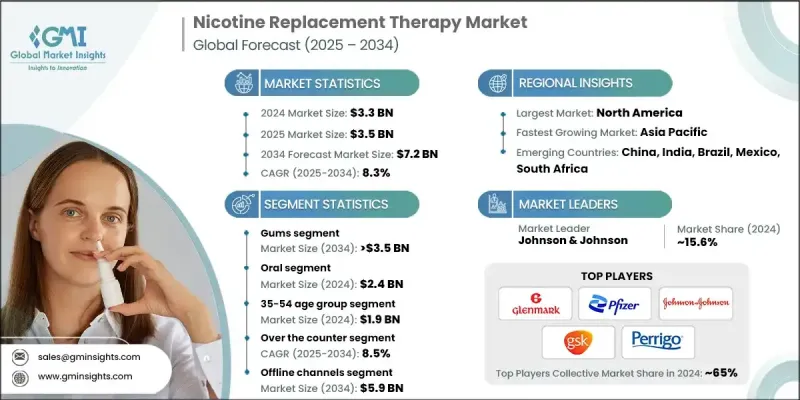

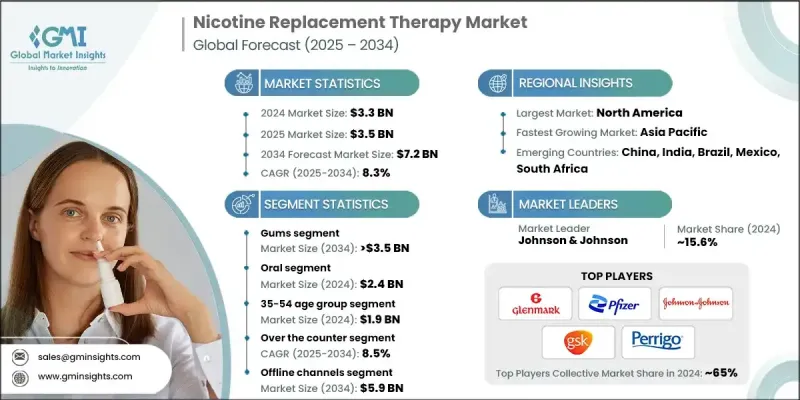

2024 年全球尼古丁替代療法市場價值為 33 億美元,預計到 2034 年將以 8.3% 的複合年成長率成長至 72 億美元。

這項成長的驅動力來自於全球吸菸率的上升、政府監管力度的加強、控煙措施的推進以及尼古丁替代療法(NRT)產品的技術進步。行動應用程式、遠距醫療和人工智慧平台等數位健康工具的整合,使得即時監測菸癮和戒斷症狀成為可能。這些創新有助於提高治療依從性,並允許醫療保健提供者遠端客製化治療方案,這在農村地區尤其重要。此類技術的日益普及正在進一步加速市場發展。尼古丁替代療法解決了吸菸者在戒菸過程中面臨的挑戰,因為突然戒菸通常會導致強烈的菸癮和戒斷症狀。公共衛生運動、稅收政策和禁煙令也推動了對NRT產品的需求。此外,具有反饋系統的藍牙吸入器、速溶口腔膜、合成尼古丁配方以及人工智慧驅動的戒菸應用程式等新設備正在透過提高生物利用度、用戶參與度和治療效果來徹底改變市場。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 33億美元 |

| 預測值 | 72億美元 |

| 複合年成長率 | 8.3% |

口香糖市場佔了49.6%的市場佔有率,預計到2034年將達到35億美元,複合年成長率為8.2%。尼古丁口香糖仍然是控制戒斷症狀的可靠且便捷的選擇,因此深受注重健康的消費者的青睞。隨著吸菸日益被視為一種慢性成癮,對尼古丁口香糖等長期戒菸輔助產品的需求持續成長。醫療保健專業人士經常推薦將尼古丁口香糖作為全面戒菸計畫的一部分,因為它吸收迅速,能夠有效緩解戒斷症狀。

2024年,口服電子煙市場規模達24億美元。這類產品包括含片、口香糖和可溶解薄膜,它們為控制尼古丁渴望提供了隱藏便捷的解決方案。其便攜性和非侵入性使其在工作場所和社交場所等公共場所尤其受歡迎。這些產品的便利性提高了使用者的依從性,尤其受到那些偏好精細、按需選擇的年輕城市消費者的青睞。

2024年,北美尼古丁替代療法市場佔48.3%的市佔率。該地區知識淵博的民眾高度重視吸煙帶來的健康危害,包括癌症、心臟病和呼吸系統疾病。持續的公共衛生工作、教育計畫和媒體通報顯著影響了消費者行為,推動了對NRT等更安全戒菸方法的需求。北美菸草相關疾病的高負擔加劇了對有效戒菸解決方案的需求。此外,嚴格的政府政策,包括廣告限制、提高菸草稅和公共場所禁煙,也支持了市場的成長。

活躍於全球尼古丁替代療法市場的關鍵產業參與者包括 Glenmark、強生、西普拉、Fertin Pharma、雷迪博士實驗室、輝瑞、Rubicon Research、Sparsh Pharma、Niconovum、皮爾法伯集團、Perrigo Company、Rusan Pharma 和葛蘭素史克。為了鞏固其地位,尼古丁替代療法市場的公司正專注於創新,開發具有更高功效、更佳用戶體驗和更快緩解症狀的下一代產品。許多公司正在投資數位健康整合,例如行動應用程式和人工智慧工具,以提供個人化治療和遠端監控,從而提高患者的依從性。與醫療保健提供者和藥局的策略合作有助於拓寬分銷管道。行銷工作強調安全性和便利性,以吸引更廣泛的受眾,包括年輕用戶和農村人口。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 全球癌症病例不斷增加

- 加強戒菸舉措

- 提高健康意識和教育

- 擴大NRT產品的非處方藥(OTC)管道

- 產業陷阱與挑戰

- 相關副作用

- 嚴格的監管和限制

- 市場機會

- 與數位健康平台整合

- 全球老年人口不斷成長

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 北美洲

- 技術格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 定價分析

- 臨床試驗分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 牙齦

- 錠劑

- 透皮貼劑

- 吸入器

- 鼻噴劑

- 舌下片

第6章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 口服

- 透皮

- 鼻腔

第7章:市場估計與預測:按模式,2021 - 2034

- 主要趨勢

- 場外交易(OTC)

- 處方

第8章:市場估計與預測:按年齡層,2021 - 2034 年

- 主要趨勢

- 18-34

- 35-54

- 55歲以上

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 線下通路

- 醫院藥房

- 零售藥局

- 其他線下分銷通路

- 線上通路

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Cipla

- Dr. Reddy's Laboratories

- Fertin Pharma

- Glenmark

- GlaxoSmithKline

- Johnson & Johnson

- Niconovum

- Pfizer

- Rubicon Research

- Rusan Pharma

- Sparsh Pharma

- Perrigo Company

- Pierre Fabre Group

The Global Nicotine Replacement Therapy Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 7.2 billion by 2034.

The growth is driven by the increasing prevalence of smoking worldwide, stronger government regulations, tobacco control initiatives, and technological advancements in NRT products. The integration of digital health tools, including mobile applications, telemedicine, and AI-powered platforms, is enabling real-time monitoring of cravings and withdrawal symptoms. These innovations help improve treatment adherence and allow healthcare providers to tailor plans remotely, which is especially valuable in rural regions. The growing adoption of such technologies is further accelerating the market. Nicotine replacement therapy addresses the challenges smokers face when quitting, as abrupt cessation often causes intense cravings and withdrawal symptoms. Public health campaigns, taxation policies, and smoking bans are also propelling demand for NRT products. Additionally, new devices such as Bluetooth-enabled inhalers with feedback systems, fast-dissolving oral films, synthetic nicotine formulations, and AI-driven cessation apps are revolutionizing the market by enhancing bioavailability, user engagement, and treatment outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $7.2 Billion |

| CAGR | 8.3% |

The gum segment held 49.6% share, and is anticipated to reach USD 3.5 billion by 2034, growing at an 8.2% CAGR. Nicotine gum remains a trusted and accessible option for managing withdrawal symptoms, making it highly favored by health-conscious consumers. As smoking is increasingly recognized as a chronic addiction, demand for long-term cessation aids like nicotine gum continues to rise. Healthcare professionals frequently recommend nicotine gum as part of comprehensive quitting plans due to its rapid absorption and effectiveness in easing withdrawal.

The oral segment generated USD 2.4 billion in 2024. This category includes lozenges, gums, and dissolvable films, which offer discreet and convenient solutions to control nicotine cravings. Their portability and non-invasive nature make them especially popular in public spaces such as workplaces and social environments. The convenience of these products enhances user compliance, particularly among younger and urban consumers who prefer subtle, on-demand options.

North America Nicotine Replacement Therapy Market held a 48.3% share in 2024. The region's well-informed population is highly aware of the health dangers related to smoking, including cancer, heart disease, and respiratory issues. Ongoing public health efforts, educational programs, and media coverage have significantly influenced consumer behavior, driving demand for safer quitting methods like NRT. The high burden of tobacco-related diseases in North America strengthens the need for effective cessation solutions. Additionally, strict government policies, including advertising restrictions, elevated tobacco taxes, and public smoking bans, support market growth.

Key industry players active in the Global Nicotine Replacement Therapy Market include Glenmark, Johnson & Johnson, Cipla, Fertin Pharma, Dr. Reddy's Laboratories, Pfizer, Rubicon Research, Sparsh Pharma, Niconovum, Pierre Fabre Group, Perrigo Company, Rusan Pharma, and GlaxoSmithKline. To fortify their presence, companies in the Nicotine Replacement Therapy Market are focusing on innovation by developing next-generation products that offer enhanced efficacy, improved user experience, and faster relief. Many are investing in digital health integrations such as mobile apps and AI tools to provide personalized treatment and remote monitoring, increasing patient adherence. Strategic collaborations with healthcare providers and pharmacies help broaden distribution channels. Marketing efforts highlight safety and convenience to appeal to a wider audience, including younger users and rural populations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Route of administration trends

- 2.2.4 Mode trends

- 2.2.5 Age group trends

- 2.2.6 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing cases of cancer globally

- 3.2.1.2 Increasing smoking cessation initiatives

- 3.2.1.3 Rising health awareness and education

- 3.2.1.4 Expansion of over the counter (OTC) access of NRT products

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Associated side-effects

- 3.2.2.2 Stringent regulation and restrictions

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with digital health platforms

- 3.2.3.2 Growing global aging population

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Clinical trial analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Gums

- 5.3 Lozenges

- 5.4 Transdermal patches

- 5.5 Inhaler

- 5.6 Nasal spray

- 5.7 Sublingual tablets

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Transdermal

- 6.4 Nasal

Chapter 7 Market Estimates and Forecast, By Mode, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Over the counter (OTC)

- 7.3 Prescription

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 18-34

- 8.3 35-54

- 8.4 55+

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Offline channels

- 9.2.1 Hospital pharmacies

- 9.2.2 Retail pharmacies

- 9.2.3 Other offline distribution channels

- 9.3 Online channels

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Cipla

- 11.2 Dr. Reddy’s Laboratories

- 11.3 Fertin Pharma

- 11.4 Glenmark

- 11.5 GlaxoSmithKline

- 11.6 Johnson & Johnson

- 11.7 Niconovum

- 11.8 Pfizer

- 11.9 Rubicon Research

- 11.10 Rusan Pharma

- 11.11 Sparsh Pharma

- 11.12 Perrigo Company

- 11.13 Pierre Fabre Group