|

市場調查報告書

商品編碼

1892757

罐裝鮪魚市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Canned Tuna Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

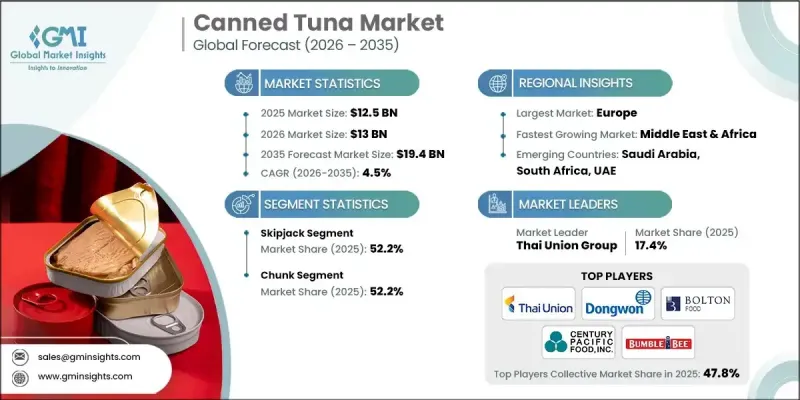

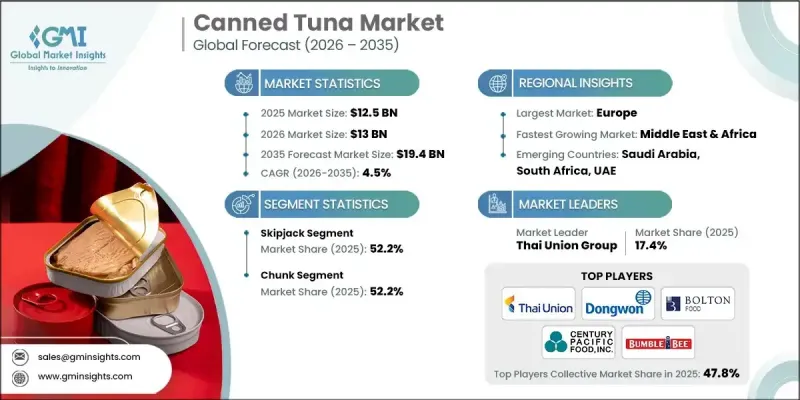

2025 年全球罐裝鮪魚市場價值為 125 億美元,預計到 2035 年將以 4.5% 的複合年成長率成長至 194 億美元。

罐裝鮪魚是一種經過加工的海鮮,將鮪魚與油、水或鹽水一起儲存在罐頭中,是一種方便且保存期限長的蛋白質來源。其價格實惠、營養豐富且易於烹飪,使其成為世界各地家庭的必備食品。消費者對高蛋白飲食和更健康食品的需求日益成長,推動了罐裝鮪魚的需求,因為它提供了一種優質的瘦蛋白來源,非常適合注重健身的人士。世界各國政府和衛生組織都鼓勵人們攝取蛋白質,尤其是在老年人和注重健康的年輕人群體中,並強調罐裝鮪魚在維持整體健康和支持飲食目標方面的重要作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 125億美元 |

| 預測值 | 194億美元 |

| 複合年成長率 | 4.5% |

鰹魚在2024年佔據了52.2%的市場佔有率,預計到2035年將以4.6%的複合年成長率成長。其廣泛的分佈、低廉的價格和清淡的口味是其主導市場的主要原因。熱帶海域為鰹魚提供了豐富的資源,降低了生產商的採購成本,使其能夠以更具競爭力的價格出售。穩定的供應鏈和消費者對清淡口味的偏好進一步鞏固了其市場地位。

2025年,塊狀鮪魚市佔率達到52.2%,並憑藉其誘人的口感和多功能性繼續保持領先地位。塊狀鮪魚深受消費者和食品生產商的喜愛,常用於沙拉、三明治和即食食品,使其成為零售和餐飲通路的熱門產品。

預計2026年至2035年間,北美罐裝鮪魚市場將以4.6%的複合年成長率成長,其中僅美國市場在2025年就將達到30億美元。消費者對健康和永續發展意識的不斷增強,推動了對來源可靠和有機罐裝鮪魚的需求。製造商正採用環保的捕撈方式,使用選擇性漁具和船舶追蹤技術,以確保永續捕撈。包裝創新,例如輕質和可回收材料,在滿足監管和行業永續發展標準的同時,也進一步吸引了具有環保意識的消費者。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 增加蛋白質飲食

- 食品業的擴張

- 便利性趨勢推動了風味包裝和袋裝產品的出現。

- 產業陷阱與挑戰

- 鮪魚價格波動

- 來自其他蛋白質的競爭

- 市場機遇

- 對即食蛋白質產品的需求不斷成長

- 人們對環保包裝的興趣日益濃厚

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 按類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依類型分類,2022-2035年

- 長鰭鮪魚

- 鰹魚

- 黃鰭鮪魚

- 大眼

- 藍鰭鮪魚

- Tongol/長尾

- 其他

第6章:市場估算與預測:依產品形式分類,2022-2035年

- 堅硬的

- 區塊

- 薄片

- 燻製

- 其他

第7章:市場估算與預測:依容器類型分類,2022-2035年

- 金屬罐

- 軟包裝袋(蒸煮袋)

- 玻璃罐

- 其他

第8章:市場估算與預測:依最終用途分類,2022-2035年

- 零售/家庭消費

- 餐飲服務(餐廳、飯店、餐飲承辦)

- 機構(學校、醫院、軍隊、企業)

- 食品加工與製造

- 寵物食品

- 其他

第9章:市場估算與預測:依配銷通路分類,2022-2035年

- 大型零售商(超商、大型超商、倉儲式會員店)

- 便利商店

- 線上零售與電子商務

- 特色食品健康食品店

- 餐飲服務分銷商

- 出口/國際分銷商

- 其他

第10章:市場估計與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第11章:公司簡介

- American Tuna

- Bumble Bee Foods

- Century Pacific Food

- Crown Prince

- Dongwon Group

- Nauterra

- Princes Food

- Safe Catch

- StarKist Co.

- Thai Union Group

- Wild Planet Foods

The Global Canned Tuna Market was valued at USD 12.5 billion in 2025 and is estimated to grow at a CAGR of 4.5% to reach USD 19.4 billion by 2035.

Canned tuna is a preserved seafood product where tuna is stored in cans with oil, water, or brine, offering a convenient and long-lasting source of protein. Its affordability, nutritional benefits, and ease of preparation make it a staple in households worldwide. Rising consumer interest in high-protein diets and healthier food options has fueled demand, as canned tuna provides a lean protein source ideal for fitness-conscious individuals. Governments and health organizations globally encourage protein consumption, particularly among the elderly and health-oriented younger populations, highlighting the role of canned tuna in maintaining overall wellness and supporting dietary goals.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $12.5 Billion |

| Forecast Value | $19.4 Billion |

| CAGR | 4.5% |

The skipjack tuna segment held a 52.2% share in 2024 and is expected to grow at a CAGR of 4.6% through 2035. Its widespread availability, low cost, and mild flavor contribute to its dominance. Tropical waters supply skipjack abundantly, reducing sourcing costs for manufacturers and enabling competitive pricing. Its steady supply chain and consumer preference for milder taste profiles further bolster its market position.

The chunk tuna segment accounted for a 52.2% share in 2025 and continues to lead due to its appealing texture and versatility. Chunk tuna is favored by consumers and food manufacturers alike for salads, sandwiches, and ready-to-eat meals, making it a highly sought-after product across retail and food service channels.

North America Canned Tuna Market is expected to grow at a CAGR of 4.6% between 2026 and 2035, with the U.S. alone accounting for USD 3 billion in 2025. Growing consumer awareness around health and sustainability is driving demand for responsibly sourced and organic canned tuna. Manufacturers are adopting eco-friendly fishing practices, using selective gear and vessel tracking technologies to ensure sustainable harvesting. Packaging innovations, including lightweight and recyclable materials, further appeal to environmentally conscious consumers while meeting regulatory and industry sustainability standards.

Key players in the Canned Tuna Market include American Tuna, Bumble Bee Foods, Century Pacific Food, Crown Prince, Dongwon Group, Nauterra, Princes Food, Safe Catch, StarKist Co., Thai Union Group, and Wild Planet Foods. Companies in the canned tuna market are enhancing their market foothold through strategies like sustainable sourcing and responsible fishing practices, which appeal to eco-conscious consumers and regulatory bodies. Investment in innovative, eco-friendly packaging reduces environmental impact while attracting premium buyers. Firms are also expanding their global distribution networks, forging strategic partnerships with retailers and food service providers to increase product availability. Marketing campaigns emphasizing health benefits, quality, and traceability help build brand loyalty. Additionally, companies focus on research and development to diversify product lines, including organic, low-sodium, and specialty flavored options, to cater to evolving consumer preferences and strengthen their competitive position.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Product form

- 2.2.4 Container type

- 2.2.5 End Use

- 2.2.6 Distribution channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing protein diet

- 3.2.1.2 Expansion of the food industry

- 3.2.1.3 Convenience trend driving flavored & pouch formats

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Price volatility of tuna

- 3.2.2.2 Competition from alternative proteins

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for ready-to-eat protein options

- 3.2.3.2 Rising interest in eco-friendly packaging

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Albacore

- 5.3 Skipjack

- 5.4 Yellowfin

- 5.5 Bigeye

- 5.6 Bluefin

- 5.7 Tongol/longtail

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Product Form, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Solid

- 6.3 Chunk

- 6.4 Flake

- 6.5 Smoked

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Container Type, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Metal cans

- 7.3 Flexible pouches (retort pouches)

- 7.4 Glass jars

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Retail/household consumption

- 8.3 Foodservice (restaurants, hotels, catering)

- 8.4 Institutional (schools, hospitals, military, corporate)

- 8.5 Food processing & manufacturing

- 8.6 Pet food

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Mass retailers (supermarkets, hypermarkets, warehouse clubs)

- 9.3 Convenience stores

- 9.4 Online retail & e-commerce

- 9.5 Specialty & health food stores

- 9.6 Foodservice distributors

- 9.7 Export/international distributors

- 9.8 Others

Chapter 10 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 American Tuna

- 11.2 Bumble Bee Foods

- 11.3 Century Pacific Food

- 11.4 Crown Prince

- 11.5 Dongwon Group

- 11.6 Nauterra

- 11.7 Princes Food

- 11.8 Safe Catch

- 11.9 StarKist Co.

- 11.10 Thai Union Group

- 11.11 Wild Planet Foods