|

市場調查報告書

商品編碼

1892743

工業電源裝置市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Industrial Power Supply Units Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

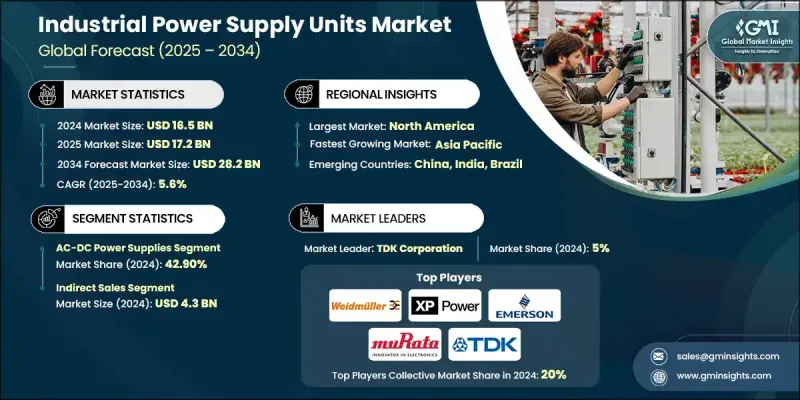

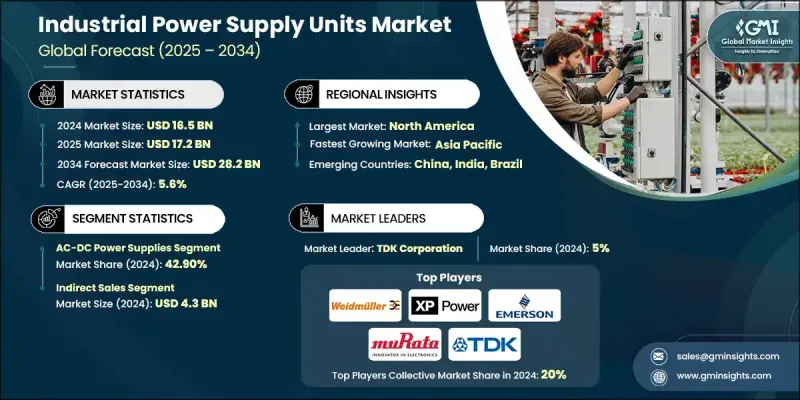

2024 年全球工業電源裝置市場價值為 165 億美元,預計到 2034 年將以 5.6% 的複合年成長率成長至 282 億美元。

隨著各行業擴大採用緊湊可靠的電源解決方案來支援製造、機器人和工業流程的自動化,市場正經歷成長。企業優先考慮效率、精度和降低勞動力成本,從而推動了對先進電源裝置的需求。此外,全球向包括風能和太陽能在內的再生能源轉型,也強化了對智慧電源管理系統的需求。雲端運算和巨量資料推動的資料中心快速成長,進一步加劇了對不間斷高效電源解決方案的需求。此外,全球向電動車和電動大眾運輸的轉型也擴大了對專用工業電源裝置的需求。改進的開關技術、與智慧電網的整合以及人工智慧的應用等技術進步,正在為提升能源分配、效率和運行可靠性創造新的機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 165億美元 |

| 預測值 | 282億美元 |

| 複合年成長率 | 5.6% |

交流-直流電源適配器市場佔有率為42.9%,預計到2034年將以5.3%的複合年成長率成長。這些適配器對於將市電交流電轉換為工業機械、工廠自動化和製程設備所需的穩定直流輸出至關重要。推動其市場普及的因素包括能源效率標準的提高、可靠性需求的增加以及PFC和LLC諧振轉換器等先進拓撲結構的應用。

2024年,間接銷售管道創造了43億美元的收入。在需要快速供貨、本地支援和標準配置的領域,這些通路仍然至關重要,尤其對於中小企業和區域整合商而言。經銷商通常提供增值服務,包括租賃、以舊換新和即時現場支持,但原始設備製造商(OEM)擴大直接參與其中,這也提高了對分銷商和經銷商業績的期望。

美國工業電源供應單元市場佔84.5%的市場佔有率,預計2024年市場規模將達35億美元。北美市場的成長主要得益於自動化技術的廣泛應用、雲端運算和資料儲存基礎設施的擴展以及電動車普及率的提高。完善的物流網路和先進技術的接受度也進一步支持了市場的持續成長。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 嚴格執行兒童安全法規

- 提高家長對兒童安全的意識和關注度

- 智慧座椅的技術整合

- 產業陷阱與挑戰

- 高初始成本和認證座椅系統

- 消費者困惑與安裝差距

- 機會

- 新興經濟體的成長。

- 輕量化和電商最佳化座椅的開發

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 交流-直流電源

- 直流-直流轉換器

- UPS(不斷電系統)

- 模組化冗餘電源

第6章:市場估算與預測、階段數、2021-2034年

- 單相

- 雙相

- 三個階段

第7章:市場估算與預測:依電壓等級分類,2021-2034年

- 最高 12 伏

- 12伏 - 24伏

- 24伏 - 48伏

- 高於 48 伏

第8章:市場估算與預測:依應用領域分類,2021-2034年

- 中央門鎖系統

- 門禁系統

- 自動門

- 照明控制系統

- 其他(警報和安防系統等)

第9章:市場估算與預測:依最終用途產業分類,2021-2034年

- 汽車

- 能源

- 醫療的

- 太陽能產業

- 電信

- 其他(物流等)

第10章:市場估價與預測:依配銷通路分類,2021-2034年

- 直銷

- 間接銷售

第11章:市場估計與預測:按地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- ABB

- Assa Abloy

- Berger Stromversorgungen

- Camtec Power Supplies

- Delta Electronics

- Emerson

- Gebruder Frei

- Mean Well

- Murata Manufacturing

- Murrelektronik

- Schneider Electric

- Siemens

- TDK Corporation

- Weidmueller Interface

- XP Power

The Global Industrial Power Supply Units Market was valued at USD 16.5 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 28.2 billion by 2034.

The market is witnessing growth as industries increasingly adopt compact and reliable power solutions to support automation in manufacturing, robotics, and industrial processes. Businesses are prioritizing efficiency, precision, and reduced labor costs, driving demand for advanced power supply units. Moreover, the global transition to renewable energy sources, including wind and solar, is reinforcing the need for intelligent power management systems. The rapid growth of data centers, fueled by cloud computing and big data, further intensifies the requirement for uninterrupted and efficient power solutions. Additionally, the global shift toward electric vehicles and electrified public transport is expanding the need for specialized industrial power units. Technological advances such as improved switching methods, integration with smart grids, and the adoption of artificial intelligence are creating new opportunities to enhance energy distribution, efficiency, and operational reliability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.5 Billion |

| Forecast Value | $28.2 Billion |

| CAGR | 5.6% |

The AC-DC power supply units segment held a 42.9% share, with a projected CAGR of 5.3% through 2034. These units are crucial for converting mains AC to stable DC outputs required by industrial machinery, factory automation, and process equipment. Adoption is driven by energy-efficiency standards, increasing reliability demands, and the use of advanced topologies such as PFC and LLC resonant converters.

The indirect sales channel generated USD 4.3 billion in 2024. These channels remain essential where rapid availability, local support, and standard configurations are critical, particularly for SMEs and regional integrators. Dealers often provide value-added services, including rentals, trade-ins, and immediate field support, although OEMs are increasingly engaging directly, raising expectations for distributor and dealer performance.

U.S Industrial Power Supply Units Market held 84.5% share, generating USD 3.5 billion in 2024. Market growth in North America is fueled by widespread adoption of automation, expansion of cloud computing and data storage infrastructure, and rising electric vehicle penetration. Established logistics networks and advanced technology acceptance further support sustained growth.

Key companies operating in the Industrial Power Supply Units Market include ABB, Assa Abloy, Berger Stromversorgungen, Camtec Power Supplies, Delta Electronics, Emerson, Gebruder Frei, Mean Well, Murata Manufacturing, Murrelektronik, Schneider Electric, Siemens, TDK Corporation, Weidmueller Interface, and XP Power. Companies in the Industrial Power Supply Units Market are employing multiple strategies to strengthen their position and expand market presence. They focus on continuous product innovation to meet advanced industrial needs, integrating smart features and AI-enabled capabilities. Strategic partnerships and collaborations with OEMs and industrial integrators enhance distribution reach and customer access. Businesses are also investing in regional expansions to tap into emerging markets and strengthen supply chain networks. Moreover, emphasis on energy-efficient and eco-friendly products helps align with global sustainability trends.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Number of Phases

- 2.2.4 Voltage

- 2.2.5 Application

- 2.2.6 End Use Industry

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Enforcement of Stringent Child Safety Regulation

- 3.2.1.2 Increased Parental Awareness and Focus on Child Safety

- 3.2.1.3 Technological Integration of Smart Seats

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Initial Cost and Certified Seat Systems

- 3.2.2.2 Consumer Confusion and Installation Gaps

- 3.2.3 Opportunities

- 3.2.3.1 Growth in Emerging Economies.

- 3.2.3.2 Development of Lightweight and E-commerce Optimized Seats

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Region

- 3.6.2 By Type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 AC-DC Power Supplies

- 5.3 DC-DC Converters

- 5.4 UPS (Uninterruptible Power Supply)

- 5.5 Modular & Redundant Power Supplies

Chapter 6 Market Estimates and Forecast, Number of Phases, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Dual phase

- 6.4 Three phases

Chapter 7 Market Estimates and Forecast, By Voltage, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Up to 12 V

- 7.3 12 V - 24 V

- 7.4 24 V - 48 V

- 7.5 Above 48 V

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Central locking systems

- 8.3 Access control systems

- 8.4 Automated doors

- 8.5 Lighting control systems

- 8.6 Others (alarm and security systems etc.)

Chapter 9 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Energy

- 9.4 Medical

- 9.5 Solar industry

- 9.6 Telecommunications

- 9.7 Others (logistics etc.)

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 ABB

- 12.2 Assa Abloy

- 12.3 Berger Stromversorgungen

- 12.4 Camtec Power Supplies

- 12.5 Delta Electronics

- 12.6 Emerson

- 12.7 Gebruder Frei

- 12.8 Mean Well

- 12.9 Murata Manufacturing

- 12.10 Murrelektronik

- 12.11 Schneider Electric

- 12.12 Siemens

- 12.13 TDK Corporation

- 12.14 Weidmueller Interface

- 12.15 XP Power