|

市場調查報告書

商品編碼

1892730

電動汽車電池健康監測市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)EV Battery Health Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

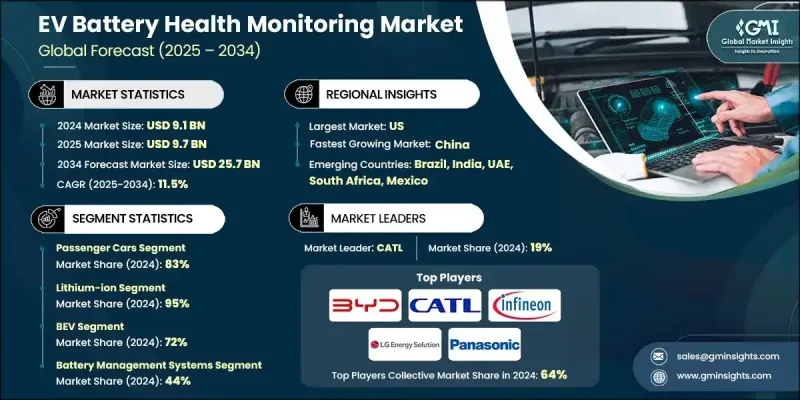

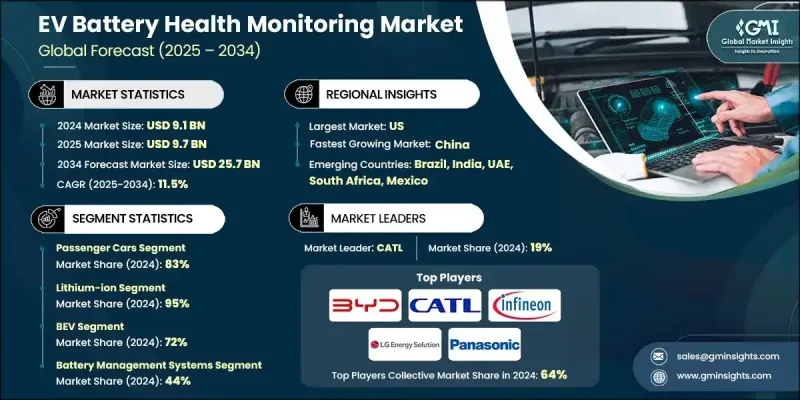

2024 年全球電動車電池健康監測市場價值為 91 億美元,預計到 2034 年將以 11.5% 的複合年成長率成長至 257 億美元。

電動車的快速普及催生了對精準、即時電池健康資料的迫切需求。電池成本幾乎佔電動車總成本的一半,因此,原始設備製造商 (OEM) 和車隊營運商密切監控電池的荷電狀態 (SOC) 和健康狀態 (SOH),以減少保固索賠、提升運行安全性並增強消費者信心。先進的電池監控系統正日益融合預測性維護、人工智慧和機器學習技術,以預測故障、最佳化充電模式並預防熱問題。這些創新技術能夠最大限度地減少停機時間、延長電池壽命並提高車隊可靠性。隨著軟體定義電池平台的興起,預測分析和數位孿生技術正成為高效電池管理的關鍵要素。政府法規以及對電池安全和回收利用的生命週期透明度要求,進一步推動了全球範圍內先進診斷和監控解決方案的部署,從而支撐了預測期內市場的強勁成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 91億美元 |

| 預測值 | 257億美元 |

| 複合年成長率 | 11.5% |

2024年乘用車市佔率達83%,預計2025年至2034年將以11%的複合年成長率成長。電動車在乘用車領域的普及推動了對精準即時電池資料的需求。更長的保固期、更高的安全性和可預測的性能促使製造商整合先進的SOH(電池健康狀態)和SOC(電池荷電狀態)演算法,從而增強消費者信任並實現車型差異化。

鋰離子電池在2024年佔據了95%的市場佔有率,預計2025年至2034年將以11.5%的複合年成長率成長。其在電動車中的廣泛應用凸顯了監測關鍵性能指標的必要性。高能量密度、對溫度波動的敏感度、電壓不平衡以及頻繁的充放電循環,都要求精密的診斷技術,以在各種駕駛條件下保持性能穩定、確保安全並延長電池壽命。

美國電動車電池健康監測市場佔 86% 的市場佔有率,預計到 2024 年將創造 31 億美元的收入。政府激勵措施、稅收優惠和清潔旅行計畫的大力支持,推動了電動車的普及,促使汽車製造商和車隊營運商尋求先進的電池健康管理系統,以確保安全、最佳化保修,並在各種條件下實現可靠的長期運作。

目錄

第1章:方法論

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 互聯電動車平台的日益普及

- 向人工智慧驅動的電池診斷轉型

- 電池安全法規和透明度要求

- 電動商用車隊的成長

- 產業陷阱與挑戰

- 先進監控硬體成本高昂

- 電池化學成分和設計的多樣性

- 熱安全問題

- 資料安全和隱私問題

- 市場機遇

- 二次利用和回收市場的擴張

- 亞太地區電動汽車製造業務成長

- 充電基礎設施整合

- 車隊預測性維修服務

- 成長促進因素

- 成長潛力分析

- 監管環境

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 目前技術

- 先進的電池管理系統

- 車載電池診斷與嵌入式感測

- 雲端電池分析平台

- 車輛遠程資訊處理和基於 CAN 的資料整合

- 新興技術

- 基於人工智慧的電池健康預測和剩餘使用壽命建模

- 數位孿生電池建模

- 基於區塊鏈的電池可追溯性和生命週期完整性

- 支援 5G 的低延遲電池遙測和 V2X 整合

- 目前技術

- 專利分析

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 價格趨勢

- 按地區

- 透過電池

- 定價分析與成本結構

- BMS硬體成本明細

- 軟體授權和訂閱模式

- 車隊營運商的總擁有成本

- 價格侵蝕趨勢與商品化風險

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 電池化學多樣性及監測複雜性

- 鋰離子化學變異體

- 固態電池監控挑戰

- 熱管理和熱失控預防架構

- 熱失控機制及檢測階段

- 多點溫度感測策略

- 熱傳播監測與預警系統

- 主動式與被動式熱管理整合

- V2G 整合與電池損耗統計

- ISO 15118-20 雙向功率傳輸協議

- V2G運作中的電池衰減機制

- V2 G 特定 SOH 追蹤和報告

- 網格服務最佳化演算法

- 二次電池評估及循環經濟可行性

- 首次生命終結標準與健康閾值

- 二次利用適用性分析

- 第二生命認證的健康監測

- 車隊遠端資訊處理整合及整體擁有成本最佳化

- 車隊管理平台架構

- 電池健康監測輔助車隊降低總擁有成本

- 多車電池健康基準測試

- 車隊電氣化投資報酬率建模

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估價與預測:依電池類型分類,2021-2034年

- 鋰離子

- 鉛酸

- 鎳氫

- 其他

第6章:市場估算與預測:以推進方式分類,2021-2034年

- 純電動車

- 插電式混合動力汽車

- 戊型肝炎病毒

第7章:市場估價與預測:依車輛類型分類,2021-2034年

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 輕型

- 中型

- 重負

第8章:市場估算與預測:依技術分類,2021-2034年

- 電池管理系統

- 監測與診斷

- 人工智慧/機器學習和雲端分析

- 車隊遠端資訊處理和遠端監控

- 售後診斷解決方案

- 其他

第9章:市場估計與預測:依應用領域分類,2021-2034年

- 首次車輛營運

- 車隊管理

- 充電基礎設施整合

- 車網互動服務

- 其他

第10章:市場估計與預測:依最終用途分類,2021-2034年

- 汽車原廠設備製造商

- 車隊營運商

- 電池製造商和供應商

- 充電基礎設施供應商

- 售後服務提供者

- 其他

第11章:市場估計與預測:按地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- 全球參與者

- Continental

- LG Energy Solution

- Panasonic

- CATL

- BYD

- Analog Devices

- Samsung SDI

- Texas Instruments

- Infineon

- LEM International

- 區域玩家

- Samsara

- Geotab

- NXP Semiconductors

- Denso

- Valeo

- Renesas Electronics

- STMicroelectronics

- 新興參與者:

- Qnovo

- Teltonika

- Twaice Technologies

- Breathe Battery Technologies

- Voltaiq

- Brill Power

The Global EV Battery Health Monitoring Market was valued at USD 9.1 billion in 2024 and is estimated to grow at a CAGR of 11.5% to reach USD 25.7 billion by 2034.

The accelerating adoption of electric vehicles has created a critical demand for accurate, real-time battery health data. Batteries account for nearly half of an EV's total cost, prompting OEMs and fleet operators to closely monitor state-of-charge (SOC) and state-of-health (SOH) to reduce warranty claims, enhance operational safety, and strengthen consumer confidence. Advanced battery monitoring systems are increasingly incorporating predictive maintenance, artificial intelligence, and machine learning to anticipate failures, optimize charging patterns, and prevent thermal issues. These innovations minimize downtime, extend battery longevity, and improve fleet reliability. With the rise of software-defined battery platforms, predictive analytics, and digital twins are becoming essential for efficient battery management. Government regulations and lifecycle transparency requirements for battery safety and recycling further drive the deployment of sophisticated diagnostic and monitoring solutions worldwide, supporting robust market growth over the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.1 Billion |

| Forecast Value | $25.7 Billion |

| CAGR | 11.5% |

The passenger car segment held an 83% share in 2024 and is expected to grow at a CAGR of 11% from 2025 to 2034. Increasing EV adoption in passenger vehicles is fueling the demand for precise, real-time battery data. Longer warranty terms, improved safety, and predictable performance compel manufacturers to integrate advanced SOH and SOC algorithms, enhancing consumer trust and differentiating models.

The lithium-ion batteries segment held a 95% share in 2024, expected to grow at a CAGR of 11.5% from 2025 to 2034. Their widespread use in EVs underscores the necessity of monitoring key performance metrics. High energy density, sensitivity to temperature fluctuations, voltage imbalance, and frequent charge cycles require sophisticated diagnostics to maintain uniform performance, ensure safety, and extend battery life under diverse driving conditions.

US EV Battery Health Monitoring Market held an 86% share, generating USD 3.1 billion in 2024. Strong EV adoption supported by government incentives, tax benefits, and clean mobility initiatives has driven OEMs and fleet operators to seek advanced battery health management systems for safety, warranty optimization, and reliable long-term operation across varying conditions.

Major players in the EV Battery Health Monitoring Market include LG Energy Solution, Analog Devices, BYD, CATL, Continental, Infineon, LEM International, Panasonic, Samsung SDI, and Texas Instruments. Market leaders in EV battery health monitoring are focusing on developing advanced chipsets and sensor solutions to enhance real-time monitoring capabilities. Companies are investing heavily in AI-driven predictive maintenance platforms and machine learning algorithms to anticipate failures, optimize charging cycles, and improve safety. Strategic partnerships with EV manufacturers and fleet operators ensure widespread integration of monitoring systems. Firms are also expanding their global distribution networks and local service capabilities to support diverse regional requirements. Continuous research and development efforts are driving innovation in software-defined battery management and digital twin technologies. Regulatory compliance, product customization, and technology differentiation remain central to maintaining competitive advantage and securing long-term market presence.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Battery

- 2.2.3 Technology

- 2.2.4 Propulsion

- 2.2.5 Vehicle

- 2.2.6 Application

- 2.2.7 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing adoption of connected EV platforms

- 3.2.1.2 Shift toward AI-driven battery diagnostics

- 3.2.1.3 Battery safety regulations and transparency mandates

- 3.2.1.4 Growth of electrified commercial fleets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced monitoring hardware

- 3.2.2.2 Variability in battery chemistries and designs

- 3.2.2.3 Thermal safety concerns

- 3.2.2.4 Data security and privacy issues

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of second-life and recycling markets

- 3.2.3.2 Growth in APAC EV manufacturing

- 3.2.3.3 Charging infrastructure integration

- 3.2.3.4 Predictive maintenance services for fleets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current Technologies

- 3.7.1.1 Advanced battery management systems

- 3.7.1.2 On-board battery diagnostics & embedded sensing

- 3.7.1.3 Cloud-connected battery analytics platforms

- 3.7.1.4 Vehicle telematics & can-based data integration

- 3.7.2 Emerging Technologies

- 3.7.2.1 AI-powered predictive battery health & RUL modeling

- 3.7.2.2 Digital twin battery modeling

- 3.7.2.3 Blockchain-Enabled Battery Traceability & Lifecycle Integrity

- 3.7.2.4 5G-enabled low-latency battery telemetry & V2X integration

- 3.7.1 Current Technologies

- 3.8 Patent analysis

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By battery

- 3.11 Pricing analysis & cost structure

- 3.11.1 BMS hardware cost breakdown

- 3.11.2 Software licensing & subscription models

- 3.11.3 Total cost of ownership for fleet operators

- 3.11.4 Price erosion trends & commoditization risk

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Battery chemistry diversity & monitoring complexity

- 3.13.1 Lithium-ion chemistry variants

- 3.13.2 Solid-state battery monitoring challenges

- 3.14 Thermal management & thermal runaway prevention architecture

- 3.14.1 Thermal runaway mechanism & detection stages

- 3.14.2 Multi-point temperature sensing strategies

- 3.14.3 Thermal propagation monitoring & early warning systems

- 3.14.4 Active vs. Passive thermal management integration

- 3.15 V2G integration & battery wear accounting

- 3.15.1 ISO 15118-20 bidirectional power transfer protocol

- 3.15.2. Battery degradation mechanisms in V2 G operation

- 3.15.3. V2 G-specific SOH tracking & reporting

- 3.15.4 Grid service optimization algorithms

- 3.16 Second-life battery assessment & circular economy viability

- 3.16.1 End-of-first-life criteria & health thresholds

- 3.16.2 Second-life application suitability analysis

- 3.16.3 Health monitoring for second-life certification

- 3.17 Fleet telematics integration & total cost of ownership optimization

- 3.17.1 Fleet management platform architecture

- 3.17.2 Battery health monitoring for fleet tco reduction

- 3.17.3 Multi-vehicle battery health benchmarking

- 3.17.4 Fleet electrification roi modeling

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Lithium-ion

- 5.3 Lead-acid

- 5.4 NiMH

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 BEV

- 6.3 PHEV

- 6.4 HEV

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger car

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicle

- 7.3.1 Light duty

- 7.3.2 Medium duty

- 7.3.3 Heavy duty

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Battery management systems

- 8.3 Monitoring & diagnostic

- 8.4 AI/ML & cloud-based analytics

- 8.5 Fleet telematics & remote monitoring

- 8.6 Aftermarket diagnostic solutions

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 First-life vehicle operation

- 9.3 Fleet management

- 9.4 Charging infrastructure integration

- 9.5 Vehicle-to-grid services

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Automotive OEMs

- 10.3 Fleet operators

- 10.4 Battery manufacturers & suppliers

- 10.5 Charging infrastructure providers

- 10.6 Aftermarket service providers

- 10.7 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global players

- 12.1.1 Continental

- 12.1.2 LG Energy Solution

- 12.1.3 Panasonic

- 12.1.4 CATL

- 12.1.5 BYD

- 12.1.6 Analog Devices

- 12.1.7 Samsung SDI

- 12.1.8 Texas Instruments

- 12.1.9 Infineon

- 12.1.10 LEM International

- 12.2 Regional players

- 12.2.1 Samsara

- 12.2.2 Geotab

- 12.2.3 NXP Semiconductors

- 12.2.4 Denso

- 12.2.5 Valeo

- 12.2.6 Renesas Electronics

- 12.2.7 STMicroelectronics

- 12.3 Emerging Players:

- 12.3.1 Qnovo

- 12.3.2 Teltonika

- 12.3.3 Twaice Technologies

- 12.3.4 Breathe Battery Technologies

- 12.3.5 Voltaiq

- 12.3.6 Brill Power