|

市場調查報告書

商品編碼

1773317

電動汽車電池健康診斷系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測EV Battery Health Diagnostics System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

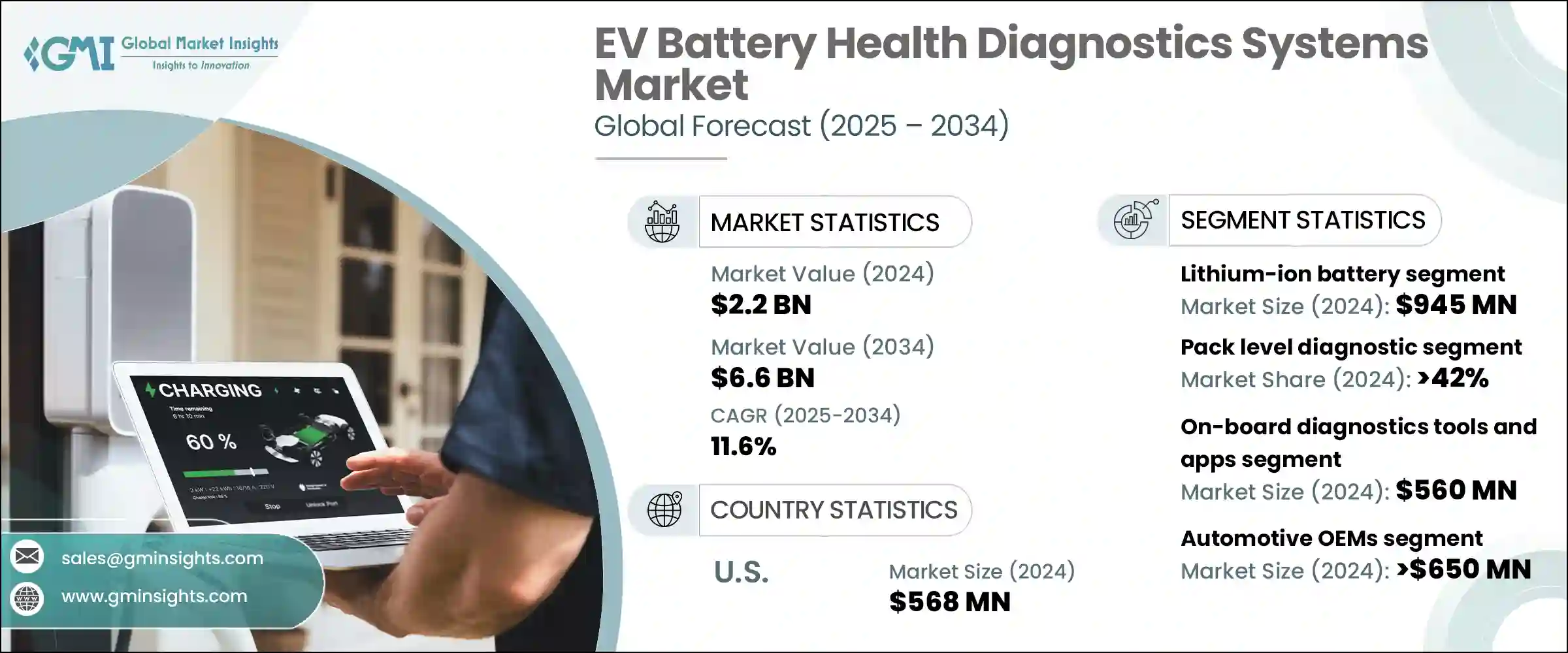

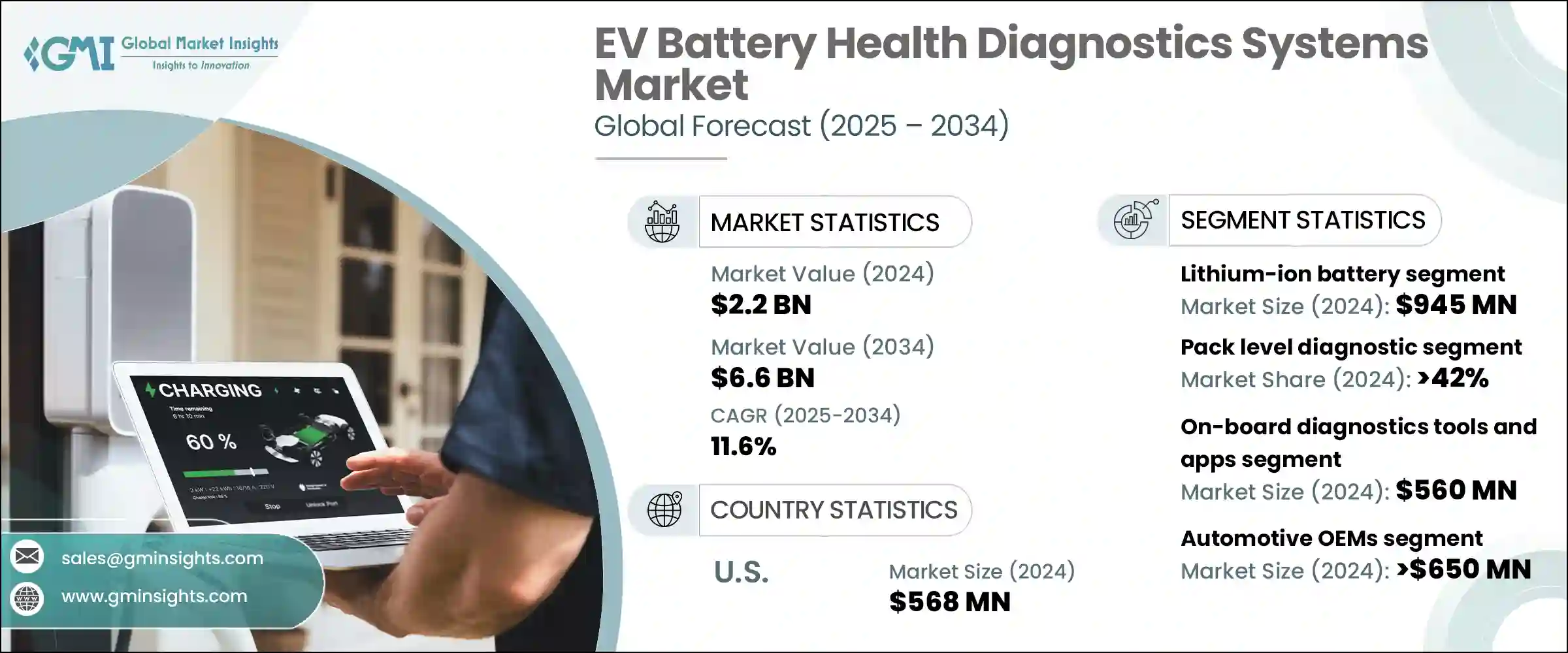

2024年,全球電動車電池健康診斷系統市場規模達22億美元,預計2034年將以11.6%的複合年成長率成長,達到66億美元。這一成長主要源於電動車在個人和商業運輸領域的快速擴張,以及人們對電池安全性、性能和使用壽命日益成長的擔憂。隨著電動車的普及,確保電池健康對汽車製造商、車隊營運商和消費者都至關重要。

由於電池成本高昂,對電動車來說是一筆不小的投資,因此即時診斷以監控電池的健康和性能至關重要。基於人工智慧和物聯網技術的先進診斷系統在降低電動車 (EV) 的整體維護成本方面發揮關鍵作用。這些系統能夠即時監控電池的健康狀況、性能和效率,以便及時進行干預和預測性維護。透過在潛在問題升級為重大問題之前將其檢測出來,這些診斷工具有助於最佳化電動車電池的使用壽命,從而減少昂貴的維修和更換費用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 22億美元 |

| 預測值 | 66億美元 |

| 複合年成長率 | 11.6% |

此外,這些智慧診斷系統透過提供電池健康和性能的精確資料,簡化了保固管理,使車隊營運商和製造商能夠更輕鬆地有效地管理保固索賠。遠端追蹤和診斷潛在問題的能力可確保更快的回應時間和更準確的索賠評估。

鋰離子電池市場佔40%的市場佔有率,2024年價值9.45億美元。鋰離子電池因其比其他化學電池更高的能量密度、更長的循環壽命和卓越的性能而得到了廣泛的應用。這種普及推動了先進診斷技術的廣泛應用,這些技術可以監測關鍵效能指標,例如充電狀態(SOC)、健康狀態(SOH)和熱性能。此外,鋰離子電池與基於人工智慧的雲端平台和無線(OTA)診斷的兼容性,鞏固了其在市場上的主導地位。

2024年,電池組級診斷市場佔據42%的佔有率,預計在2025-2034年期間將以10.5%的複合年成長率成長,這得益於面向大眾市場和商用電動車的經濟高效且可擴展的診斷解決方案。電池組級診斷可追蹤電壓、溫度和電流等關鍵參數,從而提供電池狀態的全面視圖。這種方法對於檢測早期故障(例如熱失控、電壓不平衡和能量濫用)至關重要,而這些故障對於車輛安全、效率和續航里程至關重要。

美國電動車電池健康診斷系統市場佔75%的市場佔有率,2024年市場規模達5.68億美元。隨著電動車生態系統的快速發展以及聯邦政府對電動車隊的支持,美國市場有望進一步成長。消費者對電池效能透明度、安全性和可靠性的需求,推動了對準確及時診斷的需求。美國政府的激勵措施,例如《通膨削減法案》,加上對電池生產和二次利用應用的資助,進一步推動了診斷系統創新,尤其是基於雲端和人工智慧的技術。

電動車電池健康診斷系統市場的頂級公司包括 AVL、Mahle、Exide Technologies、Forvia Hella、Cox Automotive、LG Energy Solutions 和 Delphi。為了鞏固其在電動車電池診斷市場的地位,各公司正專注於將人工智慧、物聯網和雲端平台等先進技術整合到其解決方案中。這有助於提供即時、精確的診斷,從而提高電池效能和使用壽命。各公司也在擴展其產品線,包括先進的電池組級和電池單元級診斷,以滿足原始設備製造商 (OEM) 和車隊營運商不斷變化的需求。

與汽車製造商和車隊管理公司合作,使這些企業能夠根據特定客戶需求開發客製化解決方案。此外,各公司正大力投資研發,以創新電池診斷技術,提升系統的準確性、可擴展性和效率。最後,提供全面的售後服務並透過直銷管道建立穩固的客戶關係已成為鞏固市場地位的重要策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 成本結構

- 利潤率

- 每個階段的增值

- 影響供應鏈的因素

- 破壞者

- 對部隊的影響

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 技術與創新格局

- 現有技術

- 新興技術

- 專利分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 生產統計

- 生產中心

- 消費中心

- 匯出和匯入

- 成本細分分析

- 永續性分析

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按電池,2021 - 2034 年

- 主要趨勢

- 鋰離子電池

- 鉛酸電池

- 鎳氫電池

- 固態電池

- 其他

第6章:市場估計與預測:按診斷,2021 - 2034 年

- 主要趨勢

- 細胞水平診斷

- 模組級診斷

- 電池組級診斷

第7章:市場估計與預測:依服務模式,2021 - 2034 年

- 主要趨勢

- 內部診斷系統

- 第三方實驗室測試服務

- 基於雲端的平台/API

- 其他

第8章:市場估計與預測:依診斷方法,2021 - 2034 年

- 主要趨勢

- 電化學阻抗譜

- 電壓和電流監控

- 熱成像/感測器

- 基於人工智慧的預測分析

- 車載診斷工具和應用程式

- 其他

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 汽車OEM

- 電池製造商

- 車隊營運商

- 電動車服務站

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Accure Battery Intelligence

- Autel

- Aviloo

- AVL

- Battery OK Technologies

- Cellife Technologies

- Cox Automotive

- Delphi

- Exide Technologies

- Forvia Hella

- HEI Corporation

- Infinitev

- LG Energy Solutions

- Mahle

- Midtronics

- My Battery Health

- SG Software GmbH

- SK On

- Twaice

- Volytica Diagnostics

The Global EV Battery Health Diagnostics System Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 11.6% to reach USD 6.6 billion by 2034. This growth is primarily driven by the rapid expansion of electric vehicles (EVs) across personal and commercial transport sectors, alongside growing concerns about battery safety, performance, and longevity. As EV adoption accelerates, the importance of ensuring battery health has become critical for automotive manufacturers, fleet operators, and consumers alike.

With the high cost of batteries being a significant investment for EVs, real-time diagnostics to monitor battery health and performance is essential. Advanced diagnostic systems, powered by AI and IoT technologies, play a pivotal role in reducing the overall maintenance costs associated with electric vehicles (EVs). These systems enable real-time monitoring of battery health, performance, and efficiency, allowing for timely interventions and predictive maintenance. By detecting potential issues before they escalate into major problems, these diagnostic tools help optimize the longevity of EV batteries, thereby cutting down on expensive repairs and replacements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $6.6 Billion |

| CAGR | 11.6% |

Moreover, these smart diagnostics systems streamline warranty management by providing precise data on battery health and performance, making it easier for fleet operators and manufacturers to manage warranty claims effectively. The ability to track and diagnose potential issues remotely ensures faster response times and more accurate claim assessments.

The lithium-ion battery segment held a 40% share and was valued at USD 945 million in 2024. Lithium-ion batteries have gained widespread use due to their superior energy density, longer cycle life, and exceptional performance compared to other battery chemistries. This popularity has led to the increased adoption of advanced diagnostics technologies that monitor key performance metrics like state of charge (SOC), state of health (SOH), and thermal performance. Additionally, their compatibility with AI-based cloud platforms and over-the-air (OTA) diagnostics has strengthened their dominance in the market.

The pack-level diagnostics segment held a 42% share in 2024 and is expected to grow at a CAGR of 10.5% during 2025-2034, driven by the cost-effective and scalable diagnostic solutions for both mass-market and commercial EVs. Pack-level diagnostics track critical parameters such as voltage, temperature, and current flow, offering an overall view of the battery's condition. This approach is vital for detecting early-stage failures, such as thermal runaway, voltage imbalances, and energy misuse, all of which are crucial for vehicle safety, efficiency, and range.

U.S. EV Battery Health Diagnostics System Market held a 75% share and generated USD 568 million in 2024. With rapid developments in the EV ecosystem and federal support aimed at electrifying fleets, the U.S. market is poised for further growth. Consumer demand for transparency in battery performance, as well as safety and reliability, is driving the need for accurate and timely diagnostics. The U.S. government's incentives, such as The Inflation Reduction Act, combined with funding for battery production and secondary use applications, have further fueled the push for innovation in diagnostics systems, especially cloud-based and AI-powered technologies.

The top companies in the EV Battery Health Diagnostics System Market include AVL, Mahle, Exide Technologies, Forvia Hella, Cox Automotive, LG Energy Solutions, and Delphi. To strengthen their position in the EV battery diagnostics market, companies are focusing on integrating advanced technologies such as AI, IoT, and cloud-based platforms into their solutions. This helps to provide real-time, precise diagnostics that enhance battery performance and lifespan. Companies are also expanding their product offerings, including advanced pack-level and cell-level diagnostics, to meet the evolving needs of OEMs and fleet operators.

Partnerships with automakers and fleet management companies allow these players to develop customized solutions tailored to specific customer needs. Furthermore, companies are investing heavily in R&D to innovate in battery diagnostics and improve system accuracy, scalability, and efficiency. Finally, offering comprehensive after-sales services and building strong customer relationships through direct sales channels have become essential strategies for strengthening the market foothold.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Battery type

- 2.2.3 Diagnostic type

- 2.2.4 Service model

- 2.2.5 Diagnostic model

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Market Opportunities

- 3.3 Growth potential analysis

- 3.4 Porter's analysis

- 3.5 PESTEL analysis

- 3.6 Technology & innovation landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 Latin America

- 3.8.5 Middle East & Africa

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Sustainability analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New Product Launches

- 4.5.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Lithium-ion battery

- 5.3 Lead-acid battery

- 5.4 Nickel-metal hydride battery

- 5.5 Solid-state battery

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Diagnostic, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cell-level diagnostic

- 6.3 Module-level diagnostic

- 6.4 Pack-level diagnostic

Chapter 7 Market Estimates & Forecast, By Service Model, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 In-house diagnostic systems

- 7.3 Third-party lab testing services

- 7.4 Cloud-based platform/APIs

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Diagnostic Method, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Electrochemical impedance spectroscopy

- 8.3 Voltage and current monitoring

- 8.4 Thermal imaging/sensors

- 8.5 AI-based predictive analytics

- 8.6 On-board diagnostics tools and apps

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Automotive OEM

- 9.3 Battery manufacturers

- 9.4 Fleet operators

- 9.5 EV service stations

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 North America

- 10.1.1 U.S.

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Russia

- 10.2.7 Nordics

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 South Korea

- 10.3.5 Australia

- 10.3.6 Southeast Asia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Accure Battery Intelligence

- 11.2 Autel

- 11.3 Aviloo

- 11.4 AVL

- 11.5 Battery OK Technologies

- 11.6 Cellife Technologies

- 11.7 Cox Automotive

- 11.8 Delphi

- 11.9 Exide Technologies

- 11.10 Forvia Hella

- 11.11 HEI Corporation

- 11.12 Infinitev

- 11.13 LG Energy Solutions

- 11.14 Mahle

- 11.15 Midtronics

- 11.16 My Battery Health

- 11.17 SG Software GmbH

- 11.18 SK On

- 11.19 Twaice

- 11.20 Volytica Diagnostics