|

市場調查報告書

商品編碼

1885923

舷外船市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Outboard Boats Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

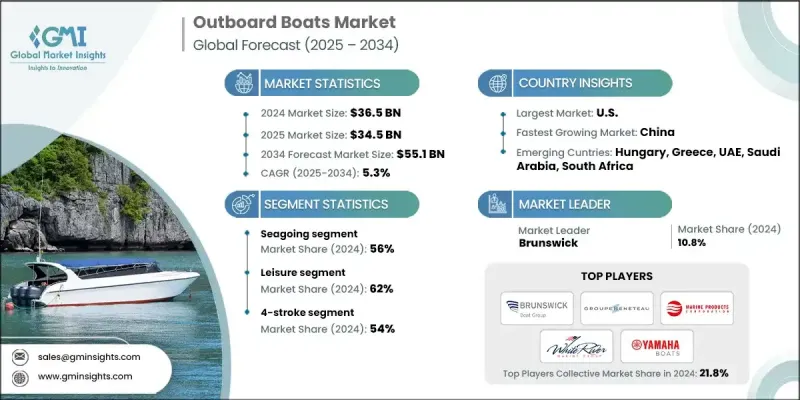

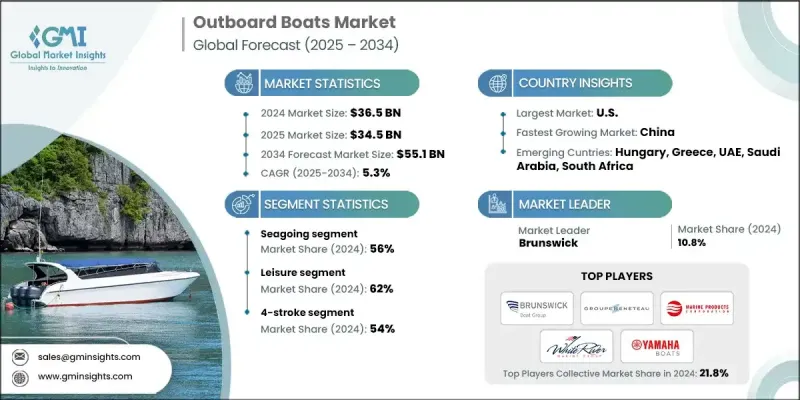

2024 年全球舷外船艇市場價值為 365 億美元,預計到 2034 年將以 5.3% 的複合年成長率成長至 551 億美元。

沿海和內陸地區休閒划船和水上運動參與度的不斷提高,持續支撐著對高性能引擎的需求。消費者在休閒活動上的支出不斷成長、碼頭網路的擴張以及旅遊業的穩步發展,都顯著推動了預測期內的市場成長動能。輕量化、燃油效率高、低排放引擎技術的進步,進一步促進了其在休閒和商業領域的應用。監管機構對清潔推進系統的推動,促使人們對四衝程和燃油直噴引擎產生濃厚興趣,這些引擎正日益被視為可靠的長期解決方案。沿海運輸活動、小型漁業和水產養殖業的蓬勃發展,也強化了對能夠支持連續運作的可靠舷外機的需求。對沿海基礎設施的持續投資,以及向混合動力和電動推進系統的快速轉型,預計將在未來十年為製造商創造巨大的成長機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 365億美元 |

| 預測值 | 551億美元 |

| 複合年成長率 | 5.3% |

2024年,遠洋船舶市場佔比達56%,預計2025年至2034年將以5.9%的複合年成長率成長。推動這一成長的因素包括沿海旅遊、近海旅行和海洋休閒活動的日益普及,這些活動都需要強勁且經久耐用的引擎。此外,由於遠洋船舶在嚴苛的海洋環境中展現出高效性和高可靠性,其在沿海運輸、巡邏船隊和救援行動中的重要性也日益凸顯。

2024年,休閒類產品市佔率達62%,預計2025年至2034年間將以5%的複合年成長率成長。人們對休閒巡航、家庭出遊和週末水上運動的興趣日益濃厚,持續推動中小型舷外機的銷售成長。可支配收入的增加、城市化生活方式的普及以及人們參與水上活動的增多,進一步刺激了市場需求。政府和私營部門對碼頭、海濱度假村和遊艇俱樂部的投資,也有助於加速休閒遊艇產業的長期發展。

美國舷外機船艇市場佔86%的市場佔有率,預計2024年市場規模將達35.7億美元。美國濃厚的航海文化,得益於廣泛的碼頭建設和消費者的高支出,持續推高了舷外機的需求。個人水上摩托車、漁船和休閒船艇仍然是市場持續成長的主要驅動力。美國領先的製造商正不斷推出先進的四衝程引擎和數位化增強型引擎,這些引擎具有排放更低、燃油經濟性更高、性能更平穩等優點。

參與舷外機船艇市場的主要公司包括 Brunswick、Cox Powertrain、Hidea Power、Honda、Oxe Marine、Parsun Power Machine、Suzuki Motor、Tohatsu、Volvo Penta 和 Yamaha。這些公司正透過拓展其燃油效率高、低排放和數位化控制的推進系統產品組合,來增強自身的競爭優勢。許多公司正大力投資混合動力和電動舷外機技術,以滿足未來的環保標準和不斷變化的客戶需求。與船舶製造商、碼頭營運商和技術公司建立策略合作夥伴關係,有助於實現下一代推進系統的無縫整合。此外,各公司也正在最佳化全球服務網路,以提升維護支援並增強客戶忠誠度。持續的研發投入專注於減輕引擎重量、提高功率輸出以及增強其在各種船舶應用中的耐用性。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 休閒划船和休閒旅遊的興起

- 舷外機的技術進步

- 沿海和內陸水利基礎設施的擴建

- 對輕型拖車船的需求日益成長

- OEM合作夥伴關係和產品多元化

- 產業陷阱與挑戰

- 高昂的初始成本和維修成本

- 季節性使用和氣候限制

- 環境法規

- 電動船充電基礎設施有限

- 市場機遇

- 亞太地區休閒海洋產業的成長

- 電氣化和混合動力推進系統

- 租賃和共享平台的擴張

- 售後服務和客製化

- 市場挑戰

- 電動舷外機電池續航里程限制

- 來自舷內機和舷外機替代方案的競爭

- 複雜的跨司法管轄區監理合規

- 供應鏈中斷和零件短缺

- 成長促進因素

- 成長潛力分析

- 主要市場趨勢和顛覆性因素

- 未來市場趨勢

- 監管環境

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 目前技術

- 先進燃油噴射系統

- 用於海水環境的耐腐蝕材料

- 數位引擎監控與智慧控制

- 新興技術

- 電動和混合動力舷外推進系統

- 輕質複合材料

- 模組化手提式電源裝置

- 聯網舷外機(物聯網整合)

- 目前技術

- 專利分析

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 價格趨勢

- 按地區

- 透過推進

- 定價分析與價值鏈經濟學

- 按馬力分類的舷外機價格趨勢

- 高馬力車型的溢價策略

- 成本結構細分

- 區域價格敏感性

- 成本細分分析

- 組件級成本結構分析

- 製造成本促進因素和最佳化

- 區域成本差異及其對競爭的影響

- 成本管理策略與競爭定位

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 全球貿易與進出口分析

- 按區域導入相依性

- 貿易法規和關稅的影響

- 產品生命週期分析

- 舷外機船生命週期階段

- 舷外機生命週期分析

- 維護計劃和服務要求

- 關鍵產業缺口及公司因應策略

- 已識別的關鍵差距

- 電動舷外機續航里程及充電基礎設施有限

- 合格船舶技術人員短缺

- 智慧船舶技術缺乏標準化

- 報廢船舶處置及回收基礎設施

- 公司因應策略

- 電力推進領導夥伴關係

- 培訓計畫及服務網拓展

- 充電基礎設施的合作

- 回收利用計劃

- 已識別的關鍵差距

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

- 高階定位策略

- 策略性OEM合作夥伴機會

- 技術標準和認證要求

- 策略市場機遇

第5章:市場估算與預測:依水路分類,2021-2034年

- 主要趨勢

- 遠洋

- 閒暇

- 貨物運輸

- 人員運輸

- 釣魚

- 政府用途

- 內陸

- 閒暇

- 貨物運輸

- 人員運輸

- 釣魚

- 政府用途

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 閒暇

- 貨物運輸

- 人員運輸

- 釣魚

- 政府用途

第7章:市場估算與預測:以推進方式分類,2021-2034年

- 主要趨勢

- 汽油

- 柴油引擎

- 電的

第8章:市場估算與預測:依引擎類型分類,2021-2034年

- 主要趨勢

- 二衝程

- 四衝程

- 電的

第9章:市場估計與預測:依馬力分類,2021-2034年

- 主要趨勢

- 低於200馬力

- 201至500馬力

- 501至1000馬力

- 超過1000馬力

第10章:市場估價與預測:依船舶分類,2021-2034年

- 主要趨勢

- 中央控制台

- 快艇

- 浮橋

- 快艇弓形艇

- 其他

第11章:市場估計與預測:按地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 匈牙利

- 希臘

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- 全球參與者

- Bennington Marine

- Brunswick

- Grady-White Boats

- Malibu Boats

- White River Marine

- Regional Champions

- Albemarle Boats

- Blackfin Boats

- Boston Whaler

- Carolina Skiff

- Contender Boats

- Everglades Boats

- Fountain Powerboats

- NauticStar Boats

- Pathfinder Boats

- Robalo Boats

- Sailfish Boats

- Scout Boats

- Sea Fox Boats

- Sea Hunt Boats

- Tidewater Boats

- Wellcraft Boats

- World Cat

- 新興參與者和顛覆者

- Avalon Pontoons

- Barletta Pontoon Boats

- Harris Pontoons

- Lowe Boats

- Manitou Pontoons

- Premier Pontoons

- Ranger Boats

- Tracker Boats

The Global Outboard Boats Market was valued at USD 36.5 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 55.1 billion by 2034.

Increasing participation in recreational boating and water sports across coastal and inland regions continues to support demand for high-performance engines. Rising consumer spending on leisure activities, expansion of marina networks, and the steady growth of tourism contribute significantly to market momentum throughout the forecast period. Advancements in lightweight, fuel-efficient, and low-emission engine technology are further strengthening adoption across both recreational and commercial sectors. Regulatory pressure favoring cleaner propulsion systems is driving interest in four-stroke and direct fuel injection engines, which are increasingly viewed as reliable, long-term solutions. Expanding coastal transport activities, artisanal fishing, and aquaculture development are also reinforcing the need for dependable outboard engines capable of supporting continuous operations. Ongoing investments in coastal infrastructure, paired with the rapid transition toward hybrid and electric propulsion, are expected to create substantial growth opportunities for manufacturers over the coming decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $36.5 Billion |

| Forecast Value | $55.1 Billion |

| CAGR | 5.3% |

The seagoing segment accounted for a 56% share in 2024 and is anticipated to grow at a CAGR of 5.9% from 2025 to 2034. Demand is being driven by rising interest in coastal tourism, offshore travel, and marine recreation, all of which require powerful and durable engines. The seagoing category is also gaining importance within coastal transport, patrol fleets, and rescue operations due to its efficiency and high reliability in demanding maritime environments.

The leisure category segment held a 62% share in 2024 and is forecast to grow at a CAGR of 5% between 2025 and 2034. Growing interest in recreational cruising, family outings, and weekend marine sports continues to increase sales of small and mid-range outboard engines. Higher disposable incomes, urbanized lifestyles, and greater participation in marine activities are further stimulating demand. Government and private-sector investments in marinas, waterfront resorts, and boating clubs are helping accelerate the long-term expansion of the leisure boating sector.

U.S. Outboard Boats Market held 86% share, generating USD 3.57 billion in 2024. The strong boating culture in the country, supported by widespread marina development and high consumer spending, continues to elevate demand for outboard engines. Personal watercraft, fishing boats, and recreational vessels remain key contributors to ongoing sales. Leading U.S. manufacturers are increasingly introducing advanced four-stroke and digitally enhanced engines that offer reduced emissions, improved fuel economy, and smoother performance.

Major companies participating in the Outboard Boats Market include Brunswick, Cox Powertrain, Hidea Power, Honda, Oxe Marine, Parsun Power Machine, Suzuki Motor, Tohatsu, Volvo Penta, and Yamaha. Companies in the Outboard Boats Market are strengthening their competitive edge by expanding their portfolios of fuel-efficient, low-emission, and digitally controlled propulsion systems. Many are investing heavily in hybrid and electric outboard technologies to meet future environmental standards and evolving customer preferences. Strategic partnerships with boat manufacturers, marina operators, and technology firms enable seamless integration of next-generation propulsion systems. Firms are also optimizing global service networks to improve maintenance support and enhance customer loyalty. Continuous R&D investments focus on reducing engine weight, boosting power output, and improving durability for varied marine applications.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Waterways

- 2.2.3 Application

- 2.2.4 Propulsion

- 2.2.5 Engine

- 2.2.6 Horsepower

- 2.2.7 Boat

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in recreational boating and leisure tourism

- 3.2.1.2 Technological advancements in outboard engines

- 3.2.1.3 Expansion of coastal and inland water infrastructure

- 3.2.1.4 Growing demand for lightweight, trailer boats

- 3.2.1.5 OEM partnerships and product diversification

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial and maintenance costs

- 3.2.2.2 Seasonal usage and climatic limitations

- 3.2.2.3 Environmental regulations

- 3.2.2.4 Limited charging infrastructure for electric boats

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in Asia Pacific recreational marine sector

- 3.2.3.2 Electrification and hybrid propulsion systems

- 3.2.3.3 Expansion of rental and sharing platforms

- 3.2.3.4 Aftermarket services and customization

- 3.2.4 Market Challenges

- 3.2.4.1 Battery Range Limitations for Electric Outboards

- 3.2.4.2 Competition from Inboard & Stern-Drive Alternatives

- 3.2.4.3 Complex Multi-Jurisdictional Regulatory Compliance

- 3.2.4.4 Supply Chain Disruptions & Component Shortages

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and disruptions

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current Technologies

- 3.9.1.1 Advanced Fuel Injection Systems

- 3.9.1.2 Corrosion-Resistant Materials for Saltwater Use

- 3.9.1.3 Digital Engine Monitoring & Smart Controls

- 3.9.2 Emerging Technologies

- 3.9.2.1 Electric & Hybrid Outboard Propulsion

- 3.9.2.2 Lightweight Composite Materials

- 3.9.2.3 Modular & Portable Power Units

- 3.9.2.4 Connected Outboards (IoT Integration)

- 3.9.1 Current Technologies

- 3.10 Patent analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Price trends

- 3.12.1 By region

- 3.12.2 By propulsion

- 3.13 Pricing analysis and value chain economics

- 3.13.1 Outboard pricing trends by hp segment

- 3.13.2 Premium pricing strategies in high-hp models

- 3.13.3 Cost structure breakdown

- 3.13.4 Regional price sensitivity

- 3.14 Cost breakdown analysis

- 3.14.1 Component-level cost structure analysis

- 3.14.2 Manufacturing cost drivers and optimization

- 3.14.3 Regional cost variations and competitive implications

- 3.14.4 Cost management strategies and competitive positioning

- 3.15 Sustainability and environmental aspects

- 3.15.1 Sustainable practices

- 3.15.2 Waste reduction strategies

- 3.15.3 Energy efficiency in production

- 3.15.4 Eco-friendly initiatives

- 3.15.5 Carbon footprint considerations

- 3.16 Global trade and import/export analysis

- 3.16.1 Import dependencies by region

- 3.16.2 Trade regulations and tariff impact

- 3.17 Product lifecycle analysis

- 3.17.1 Outboard boat lifecycle stages

- 3.17.2 Outboard engine lifecycle analysis

- 3.17.3 Maintenance schedules & service requirements

- 3.18 Critical industry gaps & company response strategies

- 3.18.1 Identified critical gaps

- 3.18.1.1 Limited electric outboard range & charging infrastructure

- 3.18.1.2 Shortage of certified marine technicians

- 3.18.1.3 Lack of standardization in smart boat technology

- 3.18.1.4 End-of-life boat disposal & recycling infrastructure

- 3.18.2 Company response strategies

- 3.18.2.1 Partnership for electric propulsion leadership

- 3.18.2.2 Training programs & service network expansion

- 3.18.2.3 Collaboration on charging infrastructure

- 3.18.2.4 Recycling initiatives

- 3.18.1 Identified critical gaps

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Premium Positioning Strategies

- 4.8 Strategic OEM Partnership Opportunities

- 4.9 Technical Standards and Certification Requirements

- 4.10 Strategic Market Opportunities

Chapter 5 Market Estimates & Forecast, By Waterways, 2021 - 2034 ($Bn, Units, Fleet Size)

- 5.1 Key trends

- 5.2 Seagoing

- 5.2.1 Leisure

- 5.2.2 Transport Of goods

- 5.2.3 Transport Of people

- 5.2.4 Fishing

- 5.2.5 Government use

- 5.3 Inland

- 5.3.1 Leisure

- 5.3.2 Transport Of goods

- 5.3.3 Transport Of people

- 5.3.4 Fishing

- 5.3.5 Government use

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units, Fleet Size)

- 6.1 Leisure

- 6.2 Transport Of goods

- 6.3 Transport Of people

- 6.4 Fishing

- 6.5 Government use

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units, Fleet Size)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Diesel

- 7.4 Electric

Chapter 8 Market Estimates & Forecast, By Engine, 2021 - 2034 ($Bn, Units, Fleet Size)

- 8.1 Key trends

- 8.2 2-stroke

- 8.3 4-stroke

- 8.4 Electric

Chapter 9 Market Estimates & Forecast, By Horsepower, 2021 - 2034 ($Bn, Units, Fleet Size)

- 9.1 Key trends

- 9.2 Below 200 hp

- 9.3 201 to 500 hp

- 9.4 501 to 1000 hp

- 9.5 Above 1000 hp

Chapter 10 Market Estimates & Forecast, By Boat, 2021 - 2034 ($Bn, Units, Fleet Size)

- 10.1 Key trends

- 10.2 Center console

- 10.3 Express cruiser

- 10.4 Pontoon

- 10.5 Runabout bowrider

- 10.6 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 ($Bn, Units, Fleet Size)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Hungary

- 11.3.9 Greece

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Bennington Marine

- 12.1.2 Brunswick

- 12.1.3 Grady-White Boats

- 12.1.4 Malibu Boats

- 12.1.5 White River Marine

- 12.2 Regional Champions

- 12.2.1 Albemarle Boats

- 12.2.2 Blackfin Boats

- 12.2.3 Boston Whaler

- 12.2.4 Carolina Skiff

- 12.2.5 Contender Boats

- 12.2.6 Everglades Boats

- 12.2.7 Fountain Powerboats

- 12.2.8 NauticStar Boats

- 12.2.9 Pathfinder Boats

- 12.2.10 Robalo Boats

- 12.2.11 Sailfish Boats

- 12.2.12 Scout Boats

- 12.2.13 Sea Fox Boats

- 12.2.14 Sea Hunt Boats

- 12.2.15 Tidewater Boats

- 12.2.16 Wellcraft Boats

- 12.2.17 World Cat

- 12.3 Emerging Players & Disruptors

- 12.3.1 Avalon Pontoons

- 12.3.2 Barletta Pontoon Boats

- 12.3.3 Harris Pontoons

- 12.3.4 Lowe Boats

- 12.3.5 Manitou Pontoons

- 12.3.6 Premier Pontoons

- 12.3.7 Ranger Boats

- 12.3.8 Tracker Boats