|

市場調查報告書

商品編碼

1885874

菌絲體蛋白配料市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Mycelium-Based Protein Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

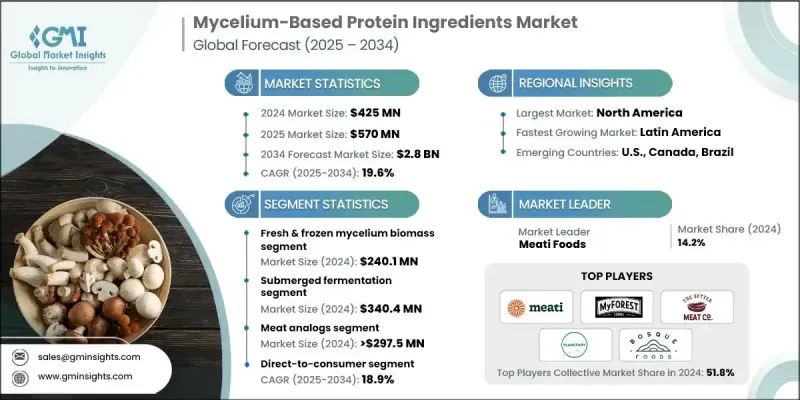

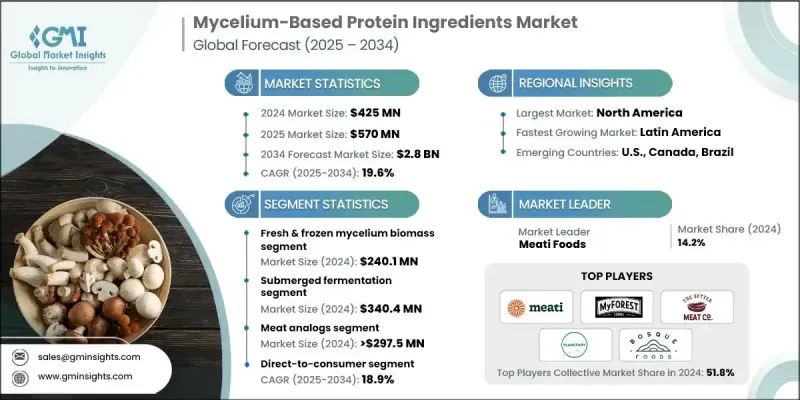

2024 年全球菌絲體蛋白配料市場價值為 4.25 億美元,預計到 2034 年將以 19.6% 的複合年成長率成長至 28 億美元。

消費者對環保蛋白質來源的需求不斷成長,持續推動著這一領域的擴張,越來越多的人尋求營養豐富且永續的替代品。這種日益成長的興趣促使零售商和餐飲服務公司推出更多種類的真菌衍生產品,從而加快了替代蛋白領域的產品開發速度,並擴大了生產能力。發酵科學和生物製程工程的進步正推動生產向大規模化方向發展,而工業生物反應器的設計旨在實現更高的控制精度、更高的產量和更穩定的品質。從試點營運到商業規模生產的轉變,得益於資金投入的增加和對新生產基地的大量投資,從而提高了食品製造商可獲得的菌絲體原料的供應量。來自公共和私營部門的財政支持正在加速工廠建設,並推動整個供應鏈的快速擴張。正如生產商和採購商所證實的那樣,資金的湧入縮短了商業化進程,透過規模效益降低了成本,並擴大了整體市場容量。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.25億美元 |

| 預測值 | 28億美元 |

| 複合年成長率 | 19.6% |

受全食品應用和清潔標籤偏好的推動,新鮮和冷凍菌絲體生質能市場預計在2024年達到2.401億美元。其天然的質地和豐富的膳食纖維使其無需深度加工即可製成整塊替代品、肉餅或即食食品。這種產品形式非常適合那些希望縮短成分錶、減少生產步驟、實現規模化生產並更快進入零售和餐飲通路的品牌。

2024年,液態發酵市場規模達3.404億美元,憑藉其高效性和可擴展性,仍是主要的生產方式。該技術利用大型工業生物反應器,能夠精確監控溫度、氧氣、營養液流量和pH值,從而支持生質能的持續成長和更可預測的產量。改進的製程控制提高了生產效率,而成本效益使其適用於為大型食品製造商和快餐企業供貨的公司。

2024年,北美菌絲體蛋白配料市佔率將達到36.4%,其中美國市場表現強勁。該地區受益於成熟的發酵設施、經驗豐富的配套設施以及對真菌蛋白研發企業的早期投資。大量的創投加速了產能擴張,並支持了零售和餐飲服務業的快速商業化。消費者對高蛋白、清潔標章和環保產品的日益關注,也推動了零售商對菌絲體產品的需求,從而促進了產品多元化。

菌絲體蛋白配料市場的主要企業包括Maia Farms、My Forest Foods、Meati Foods、Bosque Foods、Optimized Foods、Cargill、Planetary、Better Meat Co.和Esencia Foods。這些企業運用多種策略來提升自身的競爭力。許多企業專注於擴大發酵產能和最佳化生物程序,以提高產量並降低生產成本。研發投入有助於企業改善產品的質地、風味和營養成分,從而滿足食品生產商和消費者的期望。與零售商、配料供應商和餐飲服務業者建立策略合作夥伴關係,可拓展分銷網路,並加速市場整合。此外,各品牌也強調清潔標籤定位和永續發展概念,以增強消費者信任。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 消費者對永續蛋白質來源的需求不斷成長

- 與畜牧業相比,環境效益較佳

- 發酵技術的進步

- 加大對替代蛋白的投資

- 產業陷阱與挑戰

- 與植物性蛋白質相比,生產成本較高

- 消費者認知和接受度有限

- 市場機遇

- 臨床營養應用的發展

- 與食物垃圾資源化利用結合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 產品

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品形式分類,2021-2034年

- 主要趨勢

- 新鮮和冷凍菌絲生質能

- 乾燥菌絲體

- 菌絲粉和麵粉

- 蛋白質分離物和濃縮物

- 整片式

第6章:市場估算與預測:依生產技術分類,2021-2034年

- 主要趨勢

- 深層發酵

- 固態發酵

- 連續好氧發酵

- 分批式和補料分批式發酵

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 肉類替代品

- 漢堡和碎肉

- 整塊牛排和肉排

- 培根和香腸

- 雞塊和加工肉類

- 乳製品替代品

- 牛奶和奶油替代品

- 優格及發酵產品

- 起司替代品

- 冰淇淋和冷凍甜點

- 烘焙食品

- 飲料

- 零食和加工食品

- 運動營養與補劑

- 臨床營養

- 動物飼料

第8章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- B2B原料供應商

- 直接面對消費者

- 零售(現代貿易)

- 超市和大型超市

- 便利商店

- 專業健康食品店

- 線上及電子商務

- 傳統市集和街頭小販

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Bosque Foods

- Maia Farms

- Planetary

- Meati Foods

- Cargill

- My Forest Foods

- Optimized Foods

- Esencia Foods

- Better Meat Co

The Global Mycelium-Based Protein Ingredients Market was valued at USD 425 million in 2024 and is estimated to grow at a CAGR of 19.6% to reach USD 2.8 billion by 2034.

Rising consumer demand for environmentally conscious protein sources continues to help in this expansion, as more individuals seek nutrient-dense, sustainable alternatives. This growing interest has encouraged retailers and foodservice companies to introduce a wider range of fungi-derived offerings, prompting faster product development and broader manufacturing capabilities across the alternative-protein landscape. Advancements in fermentation science and bioprocess engineering are pushing production toward large-scale capabilities, supported by industrial bioreactors designed to deliver greater control, higher yields, and consistent quality. The shift from pilot operations to commercial-scale facilities is reinforced by increased funding activities and significant investments in new production sites, boosting the availability of mycelium ingredients for food manufacturers. Financial support from both private and public sectors is accelerating the construction of factories and driving rapid expansion across the supply chain. This surge in capital flow shortens commercialization timelines, reduces costs through scale efficiencies, and expands overall market capacity as documented by producers and purchasers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $425 Million |

| Forecast Value | $2.8 Billion |

| CAGR | 19.6% |

The fresh and frozen mycelium biomass segment reached USD 240.1 million in 2024, driven by alignment with whole-food applications and clean-label preferences. Its natural texture and fiber-rich profile allow producers to create whole-cut alternatives, patties, or ready-made meals without heavy processing. This format is ideal for brands looking for shorter ingredient lists, reduced production steps, scalable volume, and quicker entry into retail and foodservice channels.

The submerged fermentation segment was valued at USD 340.4 million in 2024 and continues to serve as the primary production method due to its efficiency and scalability. This technique leverages large industrial bioreactors that allow precise monitoring of temperature, oxygen, nutrient flow, and pH, supporting continuous biomass growth and more predictable output. Improved process control results in higher productivity, while cost efficiencies make it suitable for companies supplying large food manufacturers and quick-service businesses.

North America Mycelium-Based Protein Ingredients Market held a 36.4% share in 2024, led by strong activity in the United States. The region benefits from established fermentation facilities, experienced infrastructure, and early investments in companies developing fungal proteins. Substantial venture funding accelerates capacity growth and supports rapid commercialization in both retail and foodservice sectors. Rising consumer interest in high-protein, clean-label, and environmentally friendly options strengthens the demand for mycelium-based products as retailers seek to diversify their product offerings.

Major companies active in the Mycelium-Based Protein Ingredients Market include Maia Farms, My Forest Foods, Meati Foods, Bosque Foods, Optimized Foods, Cargill, Planetary, Better Meat Co., and Esencia Foods. Companies in the Mycelium-Based Protein Ingredients Market use multiple strategies to enhance their competitive position. Many focus on expanding fermentation capacity and optimizing bioprocesses to increase output while lowering production costs. Investments in R&D help firms improve texture, flavor, and nutritional profiles to meet the expectations of food manufacturers and consumers. Strategic partnerships with retailers, ingredient suppliers, and foodservice operators expand distribution networks and support quicker market integration. Brands also emphasize clean-label positioning and sustainability messaging to strengthen consumer trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Form

- 2.2.3 Production Technology

- 2.2.4 Application

- 2.2.5 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer demand for sustainable protein sources

- 3.2.1.2 Environmental benefits over animal agriculture

- 3.2.1.3 Technological advancements in fermentation

- 3.2.1.4 Increasing investment in alternative proteins

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs compared to plant proteins

- 3.2.2.2 Limited consumer awareness & acceptance

- 3.2.3 Market opportunities

- 3.2.3.1 Development of clinical nutrition applications

- 3.2.3.2 Integration with food waste valorization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Form, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fresh & frozen mycelium biomass

- 5.3 Dried mycelium

- 5.4 Mycelium powder & flour

- 5.5 Protein isolates & concentrates

- 5.6 Whole-cut formats

Chapter 6 Market Estimates and Forecast, By Production Technology, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Submerged fermentation

- 6.3 Solid-state fermentation

- 6.4 Continuous aerobic fermentation

- 6.5 Batch & fed-batch fermentation

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Meat analogs

- 7.2.1 Burgers & ground meat

- 7.2.2 Whole-cut steaks & cutlets

- 7.2.3 Bacon & sausages

- 7.2.4 Nuggets & processed meats

- 7.3 Dairy analogs

- 7.3.1 Milk & cream alternatives

- 7.3.2 Yogurt & fermented products

- 7.3.3 Cheese alternatives

- 7.3.4 Ice cream & frozen desserts

- 7.4 Baked goods

- 7.5 Beverages

- 7.6 Snacks & processed foods

- 7.7 Sports nutrition & supplements

- 7.8 Clinical nutrition

- 7.9 Animal feed

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD million) (Kilo Tons)

- 8.1 Key trends

- 8.2 B2B ingredient suppliers

- 8.3 Direct-to-consumer

- 8.4 Retail (modern trade)

- 8.4.1 Supermarkets & hypermarkets

- 8.4.2 Convenience stores

- 8.4.3 Specialty health food stores

- 8.5 Online & e-commerce

- 8.6 Traditional markets & street vendors

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Bosque Foods

- 10.2 Maia Farms

- 10.3 Planetary

- 10.4 Meati Foods

- 10.5 Cargill

- 10.6 My Forest Foods

- 10.7 Optimized Foods

- 10.8 Esencia Foods

- 10.9 Better Meat Co