|

市場調查報告書

商品編碼

1885818

威爾遜氏症治療市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Wilsons Disease Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

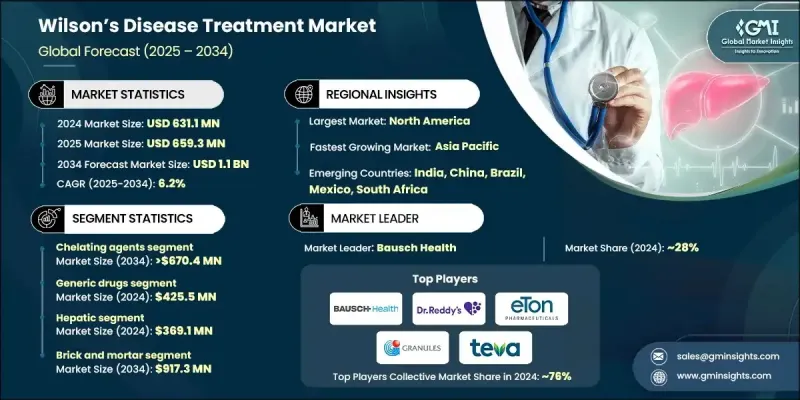

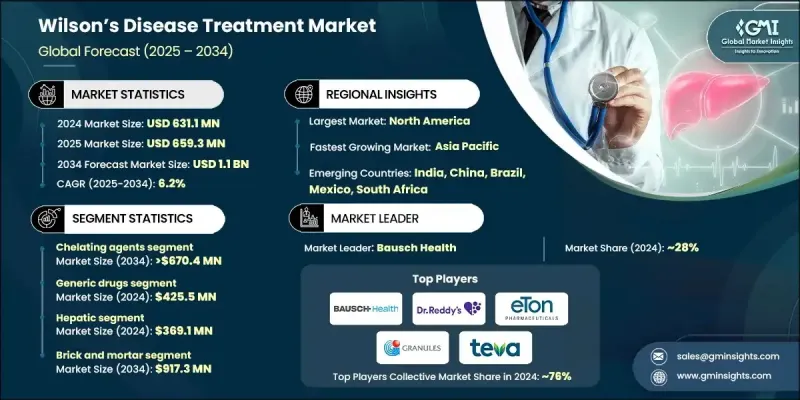

2024 年全球威爾遜氏症治療市場價值為 6.311 億美元,預計到 2034 年將以 6.2% 的複合年成長率成長至 11 億美元。

市場擴張持續受到疾病盛行率上升、臨床意識提高、螯合療法和鋅療法的廣泛應用以及藥物研發穩定進展的影響。專科護理和多學科治療中心的普及也促進了長期治療的推廣。威爾遜氏症治療的重點在於控制由遺傳性銅調節缺陷引起的銅過度積累,主要依靠螯合劑和鋅製劑來促進銅的排泄或減少吸收。這些療法旨在保護器官(尤其是肝臟和中樞神經系統),同時在患者一生中維持健康的銅水平。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.311億美元 |

| 預測值 | 11億美元 |

| 複合年成長率 | 6.2% |

由於螯合劑在指引中長期佔據重要地位,且能夠快速清除體內過量銅,預計到2024年,螯合劑將佔60%的市佔率。它們在治療神經系統和肝臟併發症方面的有效性,也使其在全球範圍內持續受到醫生的青睞。對三乙烯四胺和青黴胺等藥物的持續依賴,進一步鞏固了全球對螯合劑的強勁且穩定的需求。

2024年,學名藥市場規模達到4.255億美元,預計2034年將以6.3%的複合年成長率成長。常用螯合劑和鋅療法的低成本版本顯著降低了患者的用藥成本,有助於提高患者的治療依從性,因為這些療法需要終身服用。多種療法的專利到期使得更多生產商能夠進入市場,從而提高了對成本敏感的醫療保健系統的可及性。

2024年,美國威爾遜氏症治療市場規模達2.286億美元。北美地區擁有強大的診斷基礎設施,包括基因分析、生化檢測和影像學工具的廣泛應用,從而能夠更及時地發現該疾病。隨著早期診斷率的提高,治療啟動率也隨之提高,從而支撐了市場的持續成長。該地區品牌藥和學名藥的廣泛可及性,以及監管部門的批准和強大的供應鏈,也確保了治療的可靠性。

活躍於全球威爾遜氏症治療市場的主要公司包括Breckenridge Pharmaceutical、Nobelpharma、TAJ PHARMA、Dr. Reddy's Laboratories、TSUMURA、Teva Pharmaceutical、Zydus Group、Bausch Health、Eton Pharmaceuticals、Optimus Pharmaceutical、Zydus Group、Bausch Health、Eton Pharmaceuticals、Optimus Pharma、Biophore、Zyd這些公司正透過多種策略鞏固其市場地位。許多公司正在擴展其螯合劑和鋅基製劑的產品組合,以滿足不斷成長的治療需求並擴大患者的用藥範圍。對改善藥物輸送系統的投資旨在提高藥物的耐受性和長期依從性,尤其是在慢性病管理方面。製造商也強調成本效益高的生產方式,以支持品牌藥和學名藥的定價競爭力。與臨床研究團隊的合作有助於推動下一代療法的研發,並支持實證醫學的市場定位。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 螯合劑和鋅基療法的可及性日益提高

- 擴大孤兒藥認定範圍和監管支持

- 治療依從性和監測工具的進展

- 改進臨床指引和治療標準化

- 產業陷阱與挑戰

- 品牌藥和孤兒藥價格高昂

- 病患群體有限,商業吸引力低

- 市場機遇

- 引進新一代螯合劑和更安全的配方

- 日益關注基因療法和治癒性研究

- 成長促進因素

- 成長潛力分析

- 報銷方案

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 當前技術趨勢

- 新興技術

- 消費者洞察

- 管道分析

- 波特的分析

- PESTEL 分析

- 未來市場趨勢

- 臨床試驗場景

- 差距分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新型治療方案推出

- 擴張計劃

第5章:市場估計與預測:依治療類型分類,2021-2034年

- 主要趨勢

- 螯合劑

- D-青黴胺

- 鹽酸三乙烯四胺

- 鹽酸麴林

- 二巰基丙醇

- 鋅鹽

- 乙酸鋅

- 硫酸鋅

- 聯合療法

第6章:市場估算與預測:依藥物類型分類,2021-2034年

- 主要趨勢

- 學名藥

- 品牌藥物

第7章:市場估算與預測:依指示劑分類,2021-2034年

- 主要趨勢

- 肝臟

- 神經科和精神科

- 其他跡象

第8章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 磚瓦

- 電子商務

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Bausch Health

- Biophore

- Breckenridge Pharmaceutical

- Dr. Reddy's Laboratories

- Eton Pharmaceuticals

- GRANULES

- Invagen Pharmaceuticals

- Nobelpharma

- Optimus Pharma

- Orphalan

- TAJ PHARMA

- Teva Pharmaceutical

- TSUMURA

- Zydus Group

The Global Wilsons Disease Treatment Market was valued at USD 631.1 million in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 1.1 billion by 2034.

Market expansion continues to be shaped by rising disease prevalence, improved clinical awareness, broader use of chelation and zinc-based therapies, and steady advancements in drug development. Increasing access to specialty care and multidisciplinary treatment centers also supports stronger adoption of long-term therapy. Wilson's disease treatment focuses on managing excessive copper buildup caused by inherited defects in copper regulation, relying mainly on chelators and zinc formulations that enhance excretion or reduce absorption. These therapies aim to protect organs-most critically the liver and central nervous system-while sustaining healthy copper levels throughout a patient's lifetime.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $631.1 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 6.2% |

The chelating agents held a 60% share in 2024 owing to their longstanding role in guidelines and their ability to rapidly clear excess copper. Their effectiveness in addressing both neurological and hepatic complications supports ongoing physician preference worldwide. The continued reliance on agents such as trientine and penicillamine reinforces strong, consistent global demand.

The generic drugs category captured USD 425.5 million in 2024 and is expected to grow at a CAGR of 6.3% through 2034. Lower-cost versions of widely used chelators and zinc therapies provide significant affordability advantages, supporting sustained patient adherence since treatment must be maintained lifelong. Patent expirations across several therapies have enabled a broader range of manufacturers to enter the market, increasing availability within cost-sensitive healthcare systems.

U.S. Wilsons Disease Treatment Market generated USD 228.6 million in 2024. North America benefits from a strong diagnostic infrastructure, including widespread use of genetic analysis, biochemical testing, and imaging tools, enabling more timely detection of the condition. As early diagnosis rates rise, therapy initiation expands, supporting sustained market growth. Broad access to branded and generic medications across the region also ensures reliable treatment availability, supported by regulatory approvals and strong supply chains.

Prominent companies active in the Global Wilsons Disease Treatment Market include Breckenridge Pharmaceutical, Nobelpharma, TAJ PHARMA, Dr. Reddy's Laboratories, TSUMURA, Teva Pharmaceutical, Zydus Group, Bausch Health, Eton Pharmaceuticals, Optimus Pharma, Biophore, Granules, Invagen Pharmaceuticals, and Orphalan. Companies competing in the Global Wilsons Disease Treatment Market are strengthening their market foothold through multiple strategies. Many firms are expanding their portfolios of chelators and zinc-based formulations to meet increasing therapeutic demand and widen patient access. Investments in improved drug delivery systems aim to enhance tolerability and long-term adherence, especially for chronic management. Manufacturers are also emphasizing cost-efficient production to support competitive pricing in both branded and generic segments. Collaborations with clinical research groups help advance next-generation treatments and support evidence-based positioning.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Treatment type trends

- 2.2.3 Drug type trends

- 2.2.4 Indication trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising availability of chelating agents and zinc-based therapies

- 3.2.1.2 Expansion of orphan drug designations and regulatory support

- 3.2.1.3 Advancements in treatment adherence and monitoring tools

- 3.2.1.4 Improved clinical guidelines and treatment standardization

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of branded and orphan-designated drugs

- 3.2.2.2 Limited patient population and low commercial attractiveness

- 3.2.3 Market opportunities

- 3.2.3.1 Introduction of next-generation chelators and safer formulations

- 3.2.3.2 Growing focus on gene therapy and curative research

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Consumer insights

- 3.8 Pipeline analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

- 3.12 Clinical trial scenario

- 3.13 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New treatment type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Chelating agents

- 5.2.1 D-penicillamine

- 5.2.2 Trientine hydrochloride

- 5.2.3 Trientine tetrahydrochloride

- 5.2.4 Dimercaprol

- 5.3 Zinc salts

- 5.3.1 Zinc acetate

- 5.3.2 Zinc sulfate

- 5.4 Combination therapy

Chapter 6 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Generic drugs

- 6.3 Branded drugs

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hepatic

- 7.3 Neurological and psychiatric

- 7.4 Other indications

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Brick and mortar

- 8.3 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Bausch Health

- 10.2 Biophore

- 10.3 Breckenridge Pharmaceutical

- 10.4 Dr. Reddy’s Laboratories

- 10.5 Eton Pharmaceuticals

- 10.6 GRANULES

- 10.7 Invagen Pharmaceuticals

- 10.8 Nobelpharma

- 10.9 Optimus Pharma

- 10.10 Orphalan

- 10.11 TAJ PHARMA

- 10.12 Teva Pharmaceutical

- 10.13 TSUMURA

- 10.14 Zydus Group